What is and why is the BG registry needed?

Until mid-2021, anyone had the opportunity to check a bank guarantee in the register of bank guarantees located on the official website of the EIS Procurement. Currently, the information contained therein is available exclusively to customers and banks.

The need to create such a federal database is beyond doubt. It is explained by the large number of government procurements being carried out, which is steadily growing every year, as well as the appearance of scammers on the market offering fictitious bank guarantees.

The formation of the register made it possible to quickly solve this problem and restore order with the issuance of financial guarantees. After this, it was decided to close the information to ordinary users, since if used correctly, it provided them with information that could be classified as a trade secret.

How to check a bank guarantee under 44-FZ

Today, there are several ways to check the guarantee received from the bank. Let's look at the most popular and effective ones.

Registry check

The first and most obvious way to verify the received financial guarantee still involves contacting the register of bank guarantees under No. 44-FZ. Despite limited access to the database, with some effort it is still possible to obtain it, for example, by contacting a partner bank. Such institutions receive the necessary information without any problems.

Sending a request to the guarantor bank

An alternative verification option involves sending an official request to the guarantor bank that issued the guarantee. It must indicate the details of the document, including the number, TIN of the beneficiary and the principal. In relation to government procurement under No. 44-FZ, the customer is the first, and the supplier or contractor is the second.

Current legislation obliges the bank to provide an extract from the bank register within one business day. It must include the following information:

- number of the register entry of the bank guarantee and the date of its placement in the register;

- details of all participants in the financial transaction (name, tax identification number, legal address), including the guarantor, beneficiary and principal;

- government procurement code;

- conditions for providing BG (duration, amount, etc.).

Sending a request to the Treasury

The scheme for checking a bank's financial guarantee described above is suitable for open procurement. If we are talking about closed tenders, it is necessary to contact not the guarantor, but the Federal Treasury. The easiest way to do this is provided by the official website of the department, which contains a special request form that looks like this. To send an application to the FC, you need to sign a document with a qualified digital signature. You can download the form in a special section of one of the territorial bodies of the FC.

Bank guarantor

One of the mandatory conditions for issuing a bank guarantee within the framework of government procurement under No. 44-FZ is the inclusion of the bank in the list of credit institutions accredited by the Ministry of Finance. The latter is also posted on the official website of the federal department, and the information is freely available. All that is required from the inspector is to verify the data specified on the Internet resource and directly in the bank guarantee.

Warranty agreement

Another basic verification criterion is the compliance of the BG agreement with the rules of execution established at the legislative level. The first of these is drafting it on the letterhead of the guarantor bank. The second - already mentioned above - is the complete identity of the details on the document and in the list of the Ministry of Finance. It is also necessary to check the conditions and validity period of the financial guarantee.

BG conditions

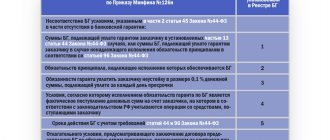

There are increased requirements for financial guarantees within the framework of public procurement. They are expressed in several standard and additional conditions that must be present in the text of the document. These include:

- irrevocable nature of the bank's guarantee obligations;

- guarantee amount;

- obligations on the part of the principal, the fulfillment of which is ensured by the BG;

- additional obligations of the bank to pay the beneficiary 0.1% of the BG amount in the form of a penalty, which is accrued per day of delay;

- instructions on the rules for determining the date of fulfillment of the guarantor’s obligations at the time the money arrives in the beneficiary’s current account;

- validity period of the BG;

- conditions for the bank to have an obligation to pay off the guarantee.

An important additional condition is the placement in the text of the document of a list of documents provided by the beneficiary to the bank simultaneously with the request for payment. Failure to comply with any of the above requirements may become grounds for invalidating the bank guarantee.

Validity period of the bank guarantee

One of the key points of the financial guarantee deserves special consideration – the validity period of the BG. It is strictly regulated by the provisions of No. 44-FZ and is determined by the type of warranty:

- if we are talking about securing an application for participation in an auction, the period should be 2 months longer than the time for submitting applications;

- when securing a government contract, the BG must be at least a month longer than the period for fulfilling obligations under it;

- when the bank guarantees the quality of the goods supplied or the work performed, the BG must be valid for at least a month longer than the guarantee obligations specified in the contract.

Issuing a guarantee for a shorter period means failure to comply with legal requirements. The result is a justified rejection of the document by the decision of the customer conducting the public procurement.

Latest revision of the list

You can view the register of banks in a convenient form below. The list is updated automatically online from the official website of the Ministry of Finance. The last check was recorded on December 14, 2021.

| № | Name of the bank | Capital (RUB million) | ACRA rating | Rating Expert RA |

| 1 | JSC UniCredit Bank License No. 1 | 202 019 11th place | AAA(RU) | ruAAA |

| 2 | PJSC Bank "ALEXANDROVSKY" License No. 53 | 2 061 139th place | — | ruB |

| 3 | JSCB "Energobank" (JSC) License No. 67 | 6 113 94th place | BB-(RU) | — |

| 4 | SEA BANK (JSC) License No. 77 | 1 930 143rd place | B+(RU) | — |

| 5 | JSC "BCS Bank" License No. 101 | 7 381 87th place | — | ruA- |

| 6 | JSC JSCB RN Bank License No. 170 | 26 594 37th place | AAA(RU) | — |

| 8 | Prio-Vneshtorgbank (PJSC) License No. 212 | 1 715 150th place | — | ruBB |

| 9 | JSC KB "Khlynov" License No. 254 | 4 091 111th place | — | ruBBB |

| 10 | JSC "GUTA-BANK" License No. 256 | 2 950 128th place | — | ruB+ |

| 11 | LLC "HKF Bank" License No. 316 | 58 034 26th place | A(RU) | ruA- |

| 12 | JSC AB RUSSIA License No. 328 | 106 839 16th place | A+(RU) | ruAA |

| 13 | Bank GPB (JSC) License No. 354 | 837 310 3rd place | AA+(RU) | ruAA+ |

| 14 | LLC Bank "Avers" License No. 415 | 24 974 39th place | A(RU) | — |

| 15 | PJSC "Best Efforts Bank" License No. 435 | 1 933 142nd place | — | ruA- |

| 16 | PJSC "Bank" Saint-Petersburg" License No. 436 | 95 727 17th place | A(RU) | ruA |

| 17 | Kamkombank LLC License No. 438 | 801 171 places | — | ruBB- |

| 18 | JSC "TATSOTSBANK" License No. 480 | 9 587 78th place | BB+(RU) | ruBBB- |

| 19 | PJSC "CHELINDBANK" License No. 485 | 9 877 75th place | — | ruA |

| 20 | PJSC "CHELYABINVESTBANK" License No. 493 | 9 954 74th place | — | ruA |

| 21 | JSC Bank "Venets" License No. 524 | 1 044 168th place | B-(RU) | — |

| 22 | Promselkhozbank LLC License No. 538 | 363 185th place | — | ruB |

| 23 | JSC KB "Solidarity" License No. 554 | 18 626 50th place | BB-(RU) | — |

| 24 | JSC "Bank Acceptance" License No. 567 | 2 916 129th place | — | ruBBB+ |

| 25 | JSC BANK "SNGB" License No. 588 | 15 061 61st place | — | ruA+ |

| 26 | JSC "First Investment Bank" License No. 604 | 1 054 166th place | — | ruB+ |

| 27 | PJSC Bank "Kuznetsky" License No. 609 | 631 177th place | B+(RU) | — |

| 28 | JSC "Databank" License No. 646 | 1 433 156th place | — | ruBB- |

| 29 | JSC "Pochta Bank" License No. 650 | 86 673 19th place | A-(RU) | — |

| 30 | LLC CB "GT Bank" License No. 665 | 1 916 144th place | BB-(RU) | — |

| 31 | PJSC "NIKO-BANK" License No. 702 | 2 085 138th place | — | ruBB+ |

| 32 | PJSC "SKB-bank" License No. 705 | 7 980 84th place | — | ruB+ |

| 33 | LLC KBER "Bank of Kazan" License No. 708 | 2 105 136th place | BB+(RU) | — |

| 34 | JSC UKB "Belgorodsotsbank" License No. 760 | 1 335 158th place | — | ruBB+ |

| 35 | LLC KB "Ketovsky" License No. 842 | 553 180th place | — | ruB- |

| 36 | JSC Far Eastern Bank License No. 843 | 9 694 77th place | — | ruBBB- |

| 37 | Bank Perm (JSC) License No. 875 | 577 179th place | — | ruB |

| 38 | PJSC "Norvik Bank" License No. 902 | 1 940 141 places | — | ruB+ |

| 39 | JSC "VLADBUSINESSBANK" License No. 903 | 1 128 164th place | — | ruBB+ |

| 40 | JSC "MinBank" License No. 912 | 6 088 95th place | BBB(RU) | — |

| 41 | PJSC "Sovcombank" License No. 963 | 224 937 9th place | AA-(RU) | ruAA |

| 42 | JSC "PERVURALSBANK" License No. 965 | 536 181 places | — | ruB+ |

| 43 | VTB Bank (PJSC) License No. 1000 | 1 844 838 2nd place | AAA(RU) | ruAAA |

| 44 | LLC "Khakassian Municipal Bank" License No. 1049 | 1 515 154th place | — | ruBB |

| 45 | JSC "MIT Bank" License No. 1052 | 640 176th place | — | ruB |

| 46 | JSC "REALIST BANK" License No. 1067 | 4 136 110th place | B(RU) | — |

| 47 | "Brotherly ANKB" JSC License No. 1144 | 528 182nd place | — | ruBB |

| 48 | JSC Kuznetskbusinessbank License No. 1158 | 1 754 147th place | — | ruBB |

| 49 | PJSC Stavropolpromstroybank License No. 1288 | 803 170th place | — | ruB |

| 50 | CB "ENERGOTRANSBANK" (JSC) License No. 1307 | 5 703 98th place | — | ruBBB- |

| 51 | JSC "ALFA-BANK" License No. 1326 | 702 894 4th place | AA+(RU) | ruAA+ |

| 52 | JSC "Solid Bank" License No. 1329 | 1 751 148th place | — | ruB |

| 53 | Bank "Levoberezhny" (PJSC) License No. 1343 | 11 907 68th place | — | ruA- |

| 54 | RNKB Bank (PJSC) License No. 1354 | 59 944 25th place | A+(RU) | ruA |

| 55 | LLC Bank "Elite" License No. 1399 | 463 183rd place | — | ruB+ |

| 56 | PJSC Sberbank License No. 1481 | 5 030 416 1 place | AAA(RU) | — |

| 57 | PJSC "RosDorBank" License No. 1573 | 2 719 130th place | BB-(RU) | — |

| 58 | "SDM-Bank" (PJSC) License No. 1637 | 9 130 81st place | BBB+(RU) | ruA- |

| 59 | Credit Agricole CIB JSC License No. 1680 | 13 091 64th place | AAA(RU) | — |

| 60 | PJSC "BystroBank" License No. 1745 | 4 203 109th place | — | ruBB |

| 61 | "Asian-Pacific Bank" (JSC) License No. 1810 | 17 487 53rd place | BBB(RU) | — |

| 62 | LLC "Inbank" License No. 1829 | 4 671 106th place | — | ruBB |

| 63 | JSCB FORA-BANK (JSC) License No. 1885 | 9 480 80th place | B+(RU) | ruB |

| 64 | JSCB "Lanta-Bank" (JSC) License No. 1920 | 2 335 132nd place | B-(RU) | — |

| 65 | JSC CB "Modulbank" License No. 1927 | 3 349 119th place | BB-(RU) | — |

| 66 | LLC MIB "DALENA" License No. 1948 | 777 172nd place | BB+(RU) | — |

| 67 | PJSC "NBD-Bank" License No. 1966 | 5 755 97th place | — | ruBBB+ |

| 68 | PJSC "CREDIT BANK OF MOSCOW" License No. 1978 | 315 623 8th place | A(RU) | ruA+ |

| 69 | "SIBSOCBANK" LLC License No. 2015 | 1 483 155th place | — | ruBB+ |

| 70 | Municipal Kamchatprofitbank (JSC) License No. 2103 | 736 174th place | — | ruB- |

| 71 | JSCB PERESVET (PJSC) License No. 2110 | 88 686 18th place | — | ruBBB- |

| 72 | JSC JSCB "Alef-Bank" License No. 2119 | 4 760 105th place | — | ruB+ |

| 73 | JSCB "NRBank" (JSC) License No. 2170 | 5 050 103rd place | — | ruBB |

| 74 | JSCB Forshtadt (JSC) License No. 2208 | 3 339 120th place | — | ruBB+ |

| 75 | PJSC Bank "FC Otkritie" License No. 2209 | 360 382 6th place | AA(RU) | ruAA |

| 76 | TKB BANK PJSC License No. 2210 | 26 053 38th place | — | ruBB+ |

| 77 | JSC Banca Intesa License No. 2216 | 14 580 62nd place | — | ruA+ |

| 78 | PJSC CB "TENDER-BANK" (JSC) License No. 2252 | 1 302 159th place | — | ruB- |

| 81 | PJSC "MTS-Bank" License No. 2268 | 53 243 28th place | — | ruA- |

| 82 | PJSC ROSBANK License No. 2272 | 203 737 10th place | AAA(RU) | ruAAA |

| 83 | PJSC "BANK URALSIB" License No. 2275 | 70 007 22nd place | BBB(RU) | — |

| 84 | JSC Russian Standard Bank License No. 2289 | 27 651 35th place | — | ruBB- |

| 85 | JSCB "Absolut Bank" (PJSC) License No. 2306 | 32 577 30th place | — | ruBBB |

| 86 | Bank SOYUZ (JSC) License No. 2307 | 11 852 70th place | BBB-(RU) | — |

| 87 | JSCB "BANK OF CHINA" (JSC) License No. 2309 | 17 022 54th place | — | ruAA |

| 88 | JSC "Bank DOM.RF" License No. 2312 | 123 298 15th place | AA-(RU) | ruAA- |

| 89 | LLC "Blank Bank" License No. 2368 | 759 173rd place | — | — |

| 90 | Bank "ITURUP" (LLC) License No. 2390 | 1 698 151 places | BB-(RU) | — |

| 91 | JSC JSCB "EVROFINANCE MOSNARBANK" License No. 2402 | 10 844 72nd place | — | ruBB+ |

| 92 | PJSC JSCB "Metallinvestbank" License No. 2440 | 20 619 44th place | A-(RU) | — |

| 93 | PJSC "METCOMBANK" License No. 2443 | 18 624 51st place | BBB-(RU) | ruBBB- |

| 94 | ING BANK (EURASIA) JSC License No. 2495 | 19 864 45th place | AAA(RU) | — |

| 95 | CB "Kuban Credit" LLC License No. 2518 | 15 479 59th place | BBB-(RU) | — |

| 96 | JSC KB "Let's go!" License No. 2534 | 3 979 113 place | BB+(RU) | — |

| 97 | JSC JSCB "NOVIKOMBANK" License No. 2546 | 66 670 23rd place | A+(RU) | ruA |

| 98 | JSC Bank "PSKB" License No. 2551 | 3 114 125th place | — | ruBB+ |

| 99 | JSC CB "Citibank" License No. 2557 | 63 750 24th place | AAA(RU) | — |

| 100 | "ZIRAAT BANK (MOSCOW)" (JSC) License No. 2559 | 3 712 117th place | — | ruBBB |

| 101 | Bank "KUB" (JSC) License No. 2584 | 5 208 102nd place | — | ruA |

| 102 | PJSC "AKIBANK" License No. 2587 | 5 405 99th place | BB(RU) | — |

| 103 | PJSC "AK BARS" BANK License No. 2590 | 76 411 21st place | A-(RU) | ruA- |

| 104 | JSCB "Almazergienbank" JSC License No. 2602 | 4 456 108th place | — | ruBB |

| 105 | JSC Bank "United Capital" License No. 2611 | 7 912 85th place | — | ruBB |

| 106 | JSC JSCB "INTERNATIONAL FINANCIAL CLUB" License No. 2618 | 7 899 86th place | — | ruBB+ |

| 107 | KB "J.P. Morgan Bank International" (LLC) License No. 2629 | 31 895 33rd place | AAA(RU) | — |

| 108 | JSCB "NOOSPHERE" (JSC) License No. 2650 | 417 184th place | — | ruB- |

| 109 | LLC CB "Altaicapitalbank" License No. 2659 | 658 175th place | — | ruBB- |

| 110 | JSC Tinkoff Bank License No. 2673 | 146 837 14th place | A(RU) | ruA |

| 111 | CB "LOKO-Bank" (JSC) License No. 2707 | 19 470 46th place | BBB+(RU) | — |

| 112 | "Northern People's Bank" (JSC) License No. 2721 | 1 120 165th place | — | ruB+ |

| 113 | PJSC SKB Primorye "Primsotsbank" License No. 2733 | 11 066 71st place | — | ruBBB+ |

| 114 | JSCB "Derzhava" PJSC License No. 2738 | 9 493 79th place | BBB-(RU) | — |

| 115 | JSC "BM-Bank" License No. 2748 | 80 747 20th place | — | ruA- |

| 116 | JSC "NK Bank" License No. 2755 | 3 101 126th place | B+(RU) | ruB+ |

| 117 | JSC "OTP Bank" License No. 2766 | 31 690 34th place | A+(RU) | ruA |

| 118 | LLC "ATB" Bank License No. 2776 | 3 908 114th place | — | ruBB |

| 119 | JSC MS Bank Rus License No. 2789 | 4 641 107th place | — | ruA- |

| 120 | JSC ROSEXIMBANK License No. 2790 | 32 035 32nd place | AA(RU) | ruAA |

| 121 | JSCB "Transstroybank" (JSC) License No. 2807 | 1 179 163rd place | — | ruB- |

| 122 | JSC "BANK SGB" License No. 2816 | 5 287 101st place | — | ruA- |

| 123 | LLC CB "SINKO-BANK" License No. 2838 | 1 292 160th place | — | ruB |

| 124 | LLC CB "Stolichny Credit" License No. 2853 | 354 186th place | — | ruB- |

| 125 | PJSC JSCB "AVANGARD" License No. 2879 | 21 039 43rd place | BB+(RU) | — |

| 126 | JSC CB "AGROPROMKREDIT" License No. 2880 | 2 685 131 places | — | ruB+ |

| 127 | "Bank Kremlevsky" LLC License No. 2905 | 2 164 135th place | — | ruB |

| 128 | LLC CB "ARESBANK" License No. 2914 | 3 905 115th place | — | ruBB- |

| 129 | JSC "GORBANK" License No. 2982 | 3 274 122nd place | — | ruB |

| 130 | JSC "Uglemetbank" License No. 2997 | 1 427 157th place | — | ruBB |

| 131 | JSC Expobank License No. 2998 | 23 171 40th place | — | ruA- |

| 132 | PJSC JSCB "Primorye" License No. 3001 | 3 314 121 places | — | ruB+ |

| 133 | JSC Bank "Development-Capital" License No. 3013 | 3 782 116th place | — | ruB- |

| 134 | "Republican Credit Alliance" LLC License No. 3017 | 601 178th place | — | ruB |

| 135 | J&T Bank (JSC) License No. 3061 | 7 297 89th place | — | ruBBB- |

| 136 | PJSC "RGS Bank" License No. 3073 | 22 322 42nd place | — | ruBBB+ |

| 137 | JSC "RFK-Bank" License No. 3099 | 1 901 145th place | — | ruBB+ |

| 138 | JSC "NS Bank" License No. 3124 | 5 377 100th place | B(RU) | — |

| 139 | JSC "Bank BZhF" License No. 3138 | 2 295 133rd place | — | ruB |

| 140 | PJSC Bank Ekaterinburg License No. 3161 | 1 552 152nd place | — | ruBB+ |

| 141 | JSC MOSCOMBANK License No. 3172 | 1 190 162nd place | — | ruBB- |

| 142 | LLC CB "VNESHFINBANK" License No. 3173 | 1 021 169th place | — | ruB+ |

| 143 | JSC CB "IS Bank" License No. 3175 | 1 050 167th place | B(RU) | — |

| 144 | SBI Bank LLC License No. 3185 | 6 711 92nd place | BBB(RU) | — |

| 145 | JSC NOKSSBANK License No. 3202 | 3 032 127th place | BB-(RU) | ruBB |

| 146 | JSC SEB Bank License No. 3235 | 9 730 76th place | AAA(RU) | — |

| 147 | JSC BANK "MOSCOW-CITY" License No. 3247 | 1 534 153rd place | — | ruB+ |

| 148 | PJSC Promsvyazbank License No. 3251 | 328 632 7th place | AA+(RU) | ruAA+ |

| 149 | PJSC Bank ZENIT License No. 3255 | 35 370 29th place | — | ruA- |

| 150 | JSC "BANK ORENBURG" License No. 3269 | 3 216 123rd place | — | ruBB+ |

| 151 | Bank "RRB" (JSC) License No. 3287 | 150 718 13th place | AA(RU) | ruAA |

| 152 | LLC "HSBC Bank (RR)" License No. 3290 | 10 400 73rd place | AAA(RU) | — |

| 153 | JSC Raiffeisenbank License No. 3292 | 186 596 12th place | AAA(RU) | ruAAA |

| 154 | "Rusuniversalbank" (LLC) License No. 3293 | 7 321 88th place | — | ruBB |

| 155 | JSC "KOSHELEV-BANK" License No. 3300 | 1 963 140th place | B+(RU) | — |

| 156 | JSC "Credit Europe Bank (Russia)" License No. 3311 | 18 308 52nd place | BBB(RU) | — |

| 157 | Deutsche Bank LLC License No. 3328 | 16 749 55th place | AAA(RU) | — |

| 158 | JSC Denizbank Moscow License No. 3330 | 6 715 91st place | A-(RU) | — |

| 159 | JSC "COMMERZBANK (EURASIA)" License No. 3333 | 12 851 65th place | AAA(RU) | — |

| 160 | JSC Mizuho Bank (Moscow) License No. 3337 | 18 829 47th place | AAA(RU) | — |

| 161 | JSC "SME Bank" License No. 3340 | 18 680 48th place | BBB(RU) | ruBB+ |

| 162 | JSC Rosselkhozbank License No. 3349 | 516 605 5th place | AA(RU) | — |

| 163 | CB "Renaissance Credit" (LLC) License No. 3354 | 27 452 36th place | BBB(RU) | — |

| 164 | CB "Moskommertsbank" (JSC) License No. 3365 | 8 784 83rd place | — | ruB+ |

| 165 | JSC "SMP Bank" License No. 3368 | 55 076 27th place | — | ruA |

| 166 | JSC "Bank Finservice" License No. 3388 | 11 868 69th place | — | ruBBB- |

| 167 | Natixis Bank JSC License No. 3390 | 5 935 96th place | AAA(RU) | — |

| 168 | "Bank "IBA-MOSCOW" LLC License No. 3395 | 7 293 90th place | — | ruBB |

| 169 | JSC "MB Bank" License No. 3396 | 12 420 66th place | — | ruBB+ |

| 170 | JSC CB "RUSNARBANK" License No. 3403 | 3 514 118th place | — | ruBBB |

| 171 | "BNP PARIBAS BANK" JSC License No. 3407 | 12 143 67th place | AAA(RU) | — |

| 172 | CB "RBA" (LLC) License No. 3413 | 1 809 146th place | — | ruB- |

| 173 | Unifondbank LLC License No. 3416 | 2 102 137th place | — | ruB |

| 174 | KB "Novy Vek" (LLC) License No. 3417 | 1 213 161 places | — | ruB+ |

| 175 | JSC Bank "National Standard" License No. 3421 | 9 047 82nd place | — | ruBB+ |

| 176 | LLC "First Client Bank" License No. 3436 | 1 721 149th place | — | ruB- |

| 177 | Bank NFK (JSC) License No. 3437 | 3 209 124th place | — | ruBBB+ |

| 178 | "Commercial Indo Bank" LLC License No. 3446 | 2 241 134th place | A(RU) | — |

| 179 | Bank "RESO Credit" (JSC) License No. 3450 | 4 007 112th place | — | ruBBB |

| 180 | JSC "MG Bank (Eurasia)" License No. 3465 | 23 028 41st place | AAA(RU) | — |

| 181 | JSC "Toyota Bank" License No. 3470 | 13 709 63rd place | AAA(RU) | — |

| 182 | Mercedes-Benz Bank Rus LLC License No. 3473 | 4 867 104th place | AAA(RU) | — |

| 183 | ICBC Bank (JSC) License No. 3475 | 18 643 49th place | — | ruAA |

| 184 | JSC "SMBSR Bank" License No. 3494 | 16 098 57th place | AAA(RU) | — |

| 185 | Volkswagen Bank RUS LLC License No. 3500 | 16 430 56th place | AAA(RU) | — |

| 186 | China Construction Bank LLC License No. 3515 | 6 462 93rd place | AAA(RU) | — |

Total 186 banks

If you think that the functioning of the service could be improved, please let us know via the contact form. We will try to take this into account.

The trend shows that the list of accredited banks is becoming smaller over time. The movement towards reduction is caused by the fact that the conditions for authorized banks are becoming tougher every year.

This fact once again proves that it is advisable for suppliers who actively participate in tenders and use the guarantees of 44-FZ to refer to the list as often as possible.

How to check BG according to 223-FZ

Provisions No. 223-FZ regulate procurements carried out by companies and corporations with state participation in ownership. Such tender procedures are regulated less strictly than government procurement, but must also comply with certain rules. One of them is the provision of security for the obligations of the bidder in the form of a bank guarantee. The authenticity of the latter is verified by two key criteria - the guarantor bank and the terms of the financial guarantee. They become even more relevant if we consider that a federal register of bank guarantees under No. 223-FZ is not maintained.

Bank guarantor

The list of banks that have the right to provide financial statements within the framework of procurement procedures under No. 223-FZ is not limited. But some state corporations acting as customers, for example, Russian Railways or Gazprom, accept guarantees only from financial organizations specially accredited by them. This possibility is allowed by the provisions of No. 223-FZ. A mandatory additional requirement for the bank is the presence of a valid license issued by the market regulator - the Central Bank of the Russian Federation.

Bank guarantee agreement

The requirements for a bank guarantee agreement under No. 223-FZ are similar to those under No. 44-FZ, although they are somewhat more loyal to the guarantor. The first and main condition is registration on the letterhead of a credit institution. The conditions and validity period of the BG are checked separately.

Bank guarantee conditions

The mandatory conditions of a guarantee for the principal’s obligations within the framework of procurement under No. 223-FZ include the following:

- date and title of the document;

- the name of the participants in the financial transaction - guarantor, beneficiary, principal - indicating the details;

- the amount of the guarantee or the rules for calculating it;

- an obligation the fulfillment of which is guaranteed by the bank;

- conditions for the obligation to pay the guarantee amount.

The current edition of No. 223-FZ gives customers the right to supplement the list of mandatory conditions with additional ones at their own discretion. Therefore, often the list of requirements for BG coincides with those provided for by the provisions of No. 44-FZ.

Validity period of the bank guarantee

The minimum duration of the guarantor bank's obligations is set by the customer. Usually it is guided by the requirements of No. 44-FZ, which become mandatory when included in the tender documentation.

Information displayed in the state register

The data that the bank must provide for inclusion in the state register is strictly regulated by Federal Law 44-FZ “On the contract system in the field of procurement of goods, works, services to meet state and municipal needs.” It provides for displaying the following information and documents in the register:

- information about the financial institution that issued the guarantee: name, address, individual taxpayer number;

- information about the procurement participant (principal): name, address, individual taxpayer number;

- the guarantee amount that the bank is obliged to pay to the beneficiary in the event of failure by the principal to fulfill its obligations;

- validity period of the issued document;

- a copy of the issued guarantee (with the exception of BGs included in the closed list);

- other information and copies of documents, the provision of which is regulated by the Government of the Russian Federation.

The main signs of an invalid BG

For a long time, there were many fictitious bank guarantees on the Russian financial market. Today this problem has become much less pressing, but the possibility of receiving an invalid guarantee cannot be completely excluded. Therefore, it is advisable to always check the BG for authenticity. In this sense, it is useful to know the three main signs that cast doubt on the validity of a bank guarantee.

Debts of the guarantor organization

The first and main problem is the unstable financial position of the banking institution. Not all domestic banks operate successfully and efficiently, which is confirmed by the annual revocation of a considerable number of banking licenses by the market regulator.

Therefore, before starting cooperation on issuing a guarantee, it makes sense to study the financial statements of the credit institution, the list of legal proceedings in which it is involved, as well as look at its ratings on thematic sites and other similar information. This approach will allow you to avoid business relationships with a counterparty with a dubious reputation.

Low cost bank guarantee

Dumping prices for services provided is another obvious and very clear indicator of the bank’s unstable financial position. The standard commission for issuing a bank guarantee is 5-10%. Large and well-known banks offer some discount for regular customers, reducing the rate to 3-4% or even 2%.

But such concessions must be justified by an interest in further mutually beneficial cooperation, and not by the desire to get a client in any way in order to at least slightly improve the financial situation. The need to carefully study the details where the commission payment is transferred deserves special mention. They must belong to the guarantor bank, and not to a third party used to withdraw the assets of a problem credit institution.

A small list of required documents

In fact, a bank guarantee is a service similar to lending, albeit in a somewhat simplified form and without unnecessary formalities. Therefore, the bank must check the potential client, for which a standard set of documents is requested in such situations. It includes:

- IP passport or LLC constituent documentation;

- registration documents;

- data and passport details of the founders of the legal entity;

- tax and accounting reporting for at least one, and sometimes two or three years;

- certificates of absence of debts on taxes and mandatory fees;

- other documents, the list of which is determined by the internal regulations of the bank.

If a request for the provision of the listed documentation has not been received, and the banking institution is ready to issue a guarantee, this becomes a serious signal about the dubious value of such a guarantee. There is a high probability that the document will be invalidated.

Participants in the process

There are three parties involved in a bank guarantee: the principal, the beneficiary and the guarantor.

Principal

- the one who asks the bank for a guarantee and pays money to receive it. For example, a construction company won a tender to build a university building. When concluding a contract, she must provide a guarantee that she will complete the work efficiently and on time. She buys such a guarantee from the bank and becomes the principal.

Beneficiary

- the one who will receive money from the bank if the principal does not fulfill his obligations. In our example, this is a university. In government procurement, the beneficiary is always the customer. But sometimes it can also be a seller, contractor and executor.

For example, a contractor and a customer entered into an agreement to renovate an office. But the buyer does not have the money to pay for the work right away, and he promises to pay three months after the repairs are completed. The contractor demanded a bank guarantee - if after three months the customer is unable to pay for the work, the contractor will receive money from the bank. In this case, the contractor is the beneficiary.

Guarantee

- the one who issues a bank guarantee, that is, a bank or other commercial organization that gives a written undertaking to pay the beneficiary if the principal fails to fulfill his obligations. In government procurement, only a bank can be a guarantor; in commercial procurement, any commercial organization can be a guarantor.

FAQ

Why is a bank guarantee provided as part of procurements under No. 44-FZ and No. 223-FZ?

A bank guarantee is provided by a government procurement participant for one of two purposes: the first is to secure the application (required for all potential suppliers and performers), the second is to secure obligations to fulfill the government contract (required only by the winner of the electronic auction).

How to find out the registration number of a bank guarantee?

To do this, you must submit an official request either to the bank that issued the guarantee or to the Federal Treasury. The first option is used for open procurement, the second - for closed bidding.

What are the main ways to verify the authenticity of a financial guarantee?

The simplest and most reliable method of verification involves contacting the bank that issued the guarantee. Alternative options include careful study of the terms of the guarantee, including the availability of all necessary details and information, as well as the correct validity period of the document.

How the guarantee works

By concluding an agreement with the guarantor bank, the principal undertakes obligations for the conscientious execution of the contract, and the beneficiary receives confidence that he will receive high-quality work or monetary compensation for poor-quality work.

If the principal fails to fulfill the obligation, the beneficiary will require the bank to pay the guarantee. To do this, you need to send a request to the bank to make a payment and attach to it the documents specified in the guarantee, for example, a debt calculation and a power of attorney.

The bank has no right to refuse to pay the guarantee, even if the obligation has been fulfilled.

Having received a request for payment of a guarantee, the bank is obliged to immediately notify the principal about this and give him a copy of the request and the documents attached to it.

The bank does not care whether the principal actually failed to fulfill his obligations. The main thing is that the documents are drawn up correctly. For example, a bank may refuse to pay if the beneficiary has not signed the debt settlement.

The principal is obliged to reimburse the bank for the amounts paid to the beneficiary under the guarantee. But if the bank paid for the guarantee with an incomplete set of documents, then the principal may not reimburse his expenses.

The following situation may occur: the beneficiary demands payment of the guarantee, although the principal has fulfilled his obligation. The bank paid the guarantee and received compensation from the principal. In this case, the principal may require the beneficiary to reimburse him for this amount.