- RusTender

- Question answer

- Bank guarantee

- Customs bank guarantee

Obtaining a bank guarantee for customs payments may be necessary when importing excisable goods, carrying out internal transit, as well as when owning a customs warehouse or storing goods.

The obligations that the participant bears to the customs authorities (for example, payment of duties, compliance with all rules for the import and export of goods) can be ensured not only with his own funds, but also with a bank guarantee.

Banks issuing customs bank guarantee

Customs authorities, as security for obligations, accept a guarantee only from registered banks approved by the Federal Customs Service of Russia, VEB.RF or from the Eurasian Development Bank. In addition to the fact that the guarantee must be issued by one of these institutions, it must comply with the requirements specified in Art. 61 of the Federal Law of August 3, 2018 N 289-FZ.

If the principal violates his obligations to the customs authorities, the guarantor bank will pay the entire amount of money at the request of the beneficiary.

Customs bank guarantee in a short time

only registered banks

Calculate and issue

Why do you need a customs payment guarantee?

A customs guarantee is a way of ensuring a company’s obligations to the customs authority. When it is concluded, another participant appears in the operation of importing or exporting products across the border of the Russian Federation - a guarantor bank. In case of violation of obligations - for example, failure to pay duties on time - the guarantor pays compensation to the customs authorities, the amount of which is specified in the contract. The company, in turn, will be obliged to return the amount of this compensation to the bank.

In addition to guarantees, the Customs Code of the Russian Federation provides for other types of security for obligations - a pledge of property or money, a surety or an insurance contract.

Customs guarantee may be required:

- When applying for an installment plan or deferment of customs duties

- When performing the functions of a customs warehouse, carrier or broker

- When importing or exporting excisable products (for example, alcohol or tobacco)

- When placing goods under the customs regime of processing, re-export or temporary import

- During internal customs transit of goods

In all these situations, the customs service wants to make sure that the company that wants to transport goods across the border or organizes the transport process will fulfill its obligations to the state. Violations of these obligations can lead to various problems, including criminal prosecution. A bank guarantee will allow the company to cope with non-payment of payments, and the customs service to receive the required duties.

Only banks that are included in the relevant register of the Federal Customs Service have the right to issue customs guarantees. The total amount of guarantees of this type that a bank can issue simultaneously is limited by the Ministry of Finance and depends on the size of its own funds.

Requirements for a customs bank guarantee

The bank guarantee must be provided either in printed or electronic form.

It must contain the following information:

- The condition under which the fulfillment of the guarantor’s obligations under the BG is the actual receipt of funds to the account of the Federal Treasury.

- On reducing the guarantor's obligations by the amount paid under the bank guarantee.

- On the penalty for late payment under the guarantee 0.1 percent of the amount payable for each calendar day of delay in fulfilling obligations under the bank guarantee.

- On the application by the customs authority of measures to collect from the guarantor amounts, the obligation to pay which is secured by a bank guarantee (indisputable collection of Article 75 N 289-FZ)

- On the irrevocability of a bank guarantee

At the moment when the bank guarantee reaches the customs authority, it must already be in force (unless otherwise provided for in the BG agreement). The guarantee can be provided either to the customs authority or to the federal executive body, depending on the obligations secured.

The operating procedure of customs control points to ensure customs transit

The checkpoint on the territory of the Customs Union, where the cargo arrives for customs transit, becomes the starting point of the procedure. Customs issues permission to transport foreign goods in transit.

Documents must be submitted within 1 (maximum 2) hours from the moment the consignment of goods arrives at the checkpoint (during business hours). The control department is given 1 hour to register submitted documents and no more than 24 hours to process them and issue a permit for customs transit (subject to observance of mandatory conditions by the sender and transporter).

Customs escort is a mandatory condition for the legitimate passage of cargo through the territory of the Customs Union countries. Customs service employees or other officials who have the right to monitor customs transit in the territories of the CU member countries are authorized to accompany transit across Russia.

Changes to a predetermined route can only be made with the permission of the escort service. Such an order must be issued to the carrier in writing.

The procedure for the transit of foreign goods is considered completed after the actual delivery of the cargo to the destination and documentary approval of the fact of acceptance of the goods, as well as the transfer of a package of documents for them (transit declaration, etc.).

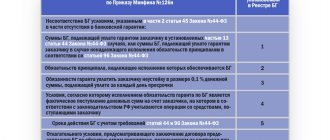

Refusal to accept a customs bank guarantee

A bank guarantee issued electronically may be rejected for one of the following reasons:

- Revocation of the license of the bank that issued the bank account.

- Absence from the register of the bank that issued the guarantee.

- The warranty does not include some of the information we listed above.

- The guarantee contains false information about the guarantor, beneficiary or principal.

- The size of the bank guarantee or the limit of all existing BGs has been exceeded. The amount of each and all guarantees is indicated in the register of customs bank guarantees.

- The requirements specified in the guarantee to provide the customs authority to the bank with documents not provided for in Art. 61 289-FZ

- The validity period of the BG is less than 3 months, after the completion of fulfillment of obligations to the customs authorities

If the guarantee was issued in printed form, then several more reasons are added to the above:

- Lack of information about the bank account from the executive authority, which must be provided by the bank issuing the document.

- The guarantee was signed by unauthorized persons.

- The seal impression or signature on the BG does not match the sample.

Guarantees in favor of the Federal Customs Service and the Federal Tax Service

Customs guarantee

UBRD is included in the Register of banks and other credit organizations that have the right to provide guarantees for the payment of customs duties.

The use of the guarantee will allow:

- Speed up customs procedures and receive goods before paying customs duties, taxes / paperwork

- Take advantage of the right to receive a deferment or installment payment of customs duties and taxes. This allows you to optimize the company’s cash flows and not withdraw funds from circulation.

- Comply with legal requirements when carrying out activities in the field of customs/using excise stamps

More details

Hide More details

Customs guarantee

| Subject of guarantees |

|

| Rationale | Documents for the guaranteed operation. |

| Guarantee period | Up to 14 months. |

| Guarantee amount | Individually. |

| Security: | |

| Any liquid property (real estate, equipment, vehicles, goods in circulation, securities, including bills); pledge of rights; insurance of financial risks / borrower liability. |

|

|

In favor of Rosalkogolregulirovanie

UBRD provides bank guarantees in favor of the Federal Service for Regulation of the Alcohol Market and/or its territorial bodies (hereinafter referred to as Rosalkogolregulirovanie). The Bank provides corporate clients with guarantees that ensure the proper fulfillment of clients' obligations to Rosalkogolregulirovanie to use purchased federal special brands in accordance with their purpose. The amount of guarantees in favor of Rosalkogolregulirovanie provided by the bank is regulated by Order of Rosalkogolregulirovanie dated January 15, 2014 No. 4 “On approval of the maximum amount of one bank guarantee and all simultaneously valid bank guarantees issued by one guarantor.”

More details

Hide More details

Guarantee in favor of the Federal Service for Regulation of the Alcohol Market and/or its territorial bodies

| Subject of guarantees | Fulfillment of obligations to use purchased federal special stamps in accordance with their purpose, including application to alcoholic products, destruction of damaged and unused stamps, provision of a report on previously issued federal special stamps. |

| Rationale | Documents for the guaranteed operation, including:

|

| Guarantee period | Up to 1 year |

| Guarantee amount | Individually |

| Security: | |

| Any liquid property (real estate, equipment, vehicles, goods in circulation, securities, including bills); pledge of rights; insurance of financial risks / borrower liability. |

| A guarantee is required from the actual owners of the business who can have a significant impact on the activities of the business and/or related solvent legal entities. When pledging the Bank's bill for the entire amount of the guarantee, a guarantee is not required. |

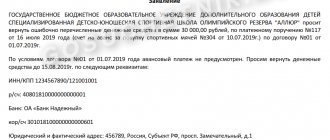

Guarantee in favor of the tax authorities (FTS), including a guarantee of VAT refund

UBRD is included in the list of financial and credit institutions that can provide their clients with guarantees giving the right to a declarative procedure for reimbursement of value added tax, in accordance with Art. 176.1 of the Tax Code of the Russian Federation.

The guarantee provides for the bank's obligation, at the request of the tax inspectorate, to pay to the budget on behalf of the taxpayer the excess amounts of tax received by him (or credited to him) as a result of a tax refund in a declarative manner. This happens when the tax inspectorate cancels the decision to refund the tax based on the results of a desk tax audit.

A bank guarantee from UBRD will allow the taxpayer to exercise the right to an accelerated refund of VAT declared in the return before the completion of the tax audit.

More details

Hide More details

Guarantee in favor of tax authorities (FTS)

| Subject of the guarantee | To apply the application procedure for VAT refund | To appeal decisions of the Federal Tax Service | For transactions with excisable goods

|

| Rationale | Tax return confirming the amount of VAT to be refunded | 1) Tax return confirming the amount of tax based on the results of the tax period (calculations) 2) Applications to suspend the execution of the appealed decision 3) Acts of the tax authority, signed by the head (deputy head) of the tax authority: - requirement to pay taxes; — decision to collect taxes; — decision to refuse, in whole or in part, VAT refund, etc. | Excise tax return for the tax period in which the date of transactions with excisable goods falls Contract (copy of contract) of the taxpayer with the counterparty for transactions with excisable goods |

| Guarantee period | Up to 1 year | ||

| Guarantee amount | Individually | ||

| Security: | |||

| Any liquid property (real estate, equipment, vehicles, goods in circulation, securities, including bills); pledge of rights; insurance of financial risks / borrower liability. | ||

| A guarantee is required from the actual owners of the business who can have a significant impact on the activities of the business and/or related solvent legal entities. When pledging the Bank's bill for the entire amount of the guarantee, a guarantee is not required. | ||

List of banks where you can obtain a customs guarantee

To obtain a customs guarantee, you must contact one of the registered banks , VEB.RF or the Eurasian Development Bank and submit an application.

Sometimes, to obtain it, you may need to provide security, which can be a pledge of property, securities or a surety.

Our specialists will help you choose a bank with the most suitable conditions and will handle all the paperwork, so to save time you can contact our company.

© RusTender LLC

The material is the property of tender-rus.ru. Any use of an article without indicating the source - tender-rus.ru is prohibited in accordance with Article 1259 of the Civil Code of the Russian Federation

Responsibilities of a transit cargo carrier

According to Article 223 of the Customs Code of the Customs Union, the customs transit transportation service is responsible for the safety of cargo, seals, locking devices and elements of identification of goods.

The carrier is obliged:

- ensure the integrity of the container packaging of the cargo and the safety of the goods;

- eliminate the risk of unauthorized access to the contents of sealed containers, as well as unplanned unloading of goods in transit;

- strictly follow the planned route.

Circumstances of force majeure or a car accident not due to the transiter’s fault release the transporter from the obligation to compensate for losses caused by the loss of cargo. However, the transportation service is obliged to do everything possible to ensure the safety of goods in customs transit in the event of a threatening situation.

Transshipment (transshipment), partial unloading of goods in transit

Any actions with customs transit cargo must be carried out:

- subject to the maximum possible safety of seals and seals on the container;

- only after written notification and obtaining the consent of the customs services of the region where the cargo is traveling.

Who can handle the paperwork?

As a rule, it is difficult for the declarant or there is no time to delve into the nuances of customs transit registration. Meanwhile, with the right approach, the procedure can be done:

- effectively organized;

- operational;

- economical.

Seeking help from a specialized company - a customs broker - allows you to save transported goods from being placed in temporary storage warehouses due to incorrectly completed documents, as well as avoid unwanted costs for paying for the storage of detained goods.

provides a full range of services for transit and other types of cargo transportation across the territory of Russia, the Customs Union and other states. The team’s work experience in this area exceeds 10 years, all activities are certified, and the staff consists of only professionally trained employees.

For questions about organizing customs transit and escorting goods across the territory of the Customs Union, contact the company in person, by phone +7 or online.

Advantages of working with the Bank in the area of documentary operations:

- an extensive network of counterparty banks around the world;

- advantages of the international banking group Intesa Sanpaolo: attractive rates, wide geographical presence (more than 40 countries), high standards of customer service;

- the stability and reliability of Banca Intesa has been confirmed by the international auditing company KPMG;

- a wide network of regional branches of Banca Intesa from Kaliningrad to Vladivostok;

- the ability to attract resources from first-class banks on favorable terms and develop flexible schemes for their optimal use in order to reduce costs when fulfilling contractual obligations;

- Individual approach to each client. Consulting on optimization of payment terms of foreign trade contracts for the use of documentary instruments;

- significant experience in the field of trade finance and documentary banking operations;

- availability of certified specialists in the field of trade finance and documentary banking operations (certificates of the International Chamber of Commerce).

Check warranty

Ask a Question

| Memo “On measures to safely obtain bank guarantees” (PDF, 62 KB) |

| Universal tariffs for servicing SME Clients, legal entities and individual entrepreneurs for transactions in Russian rubles on the territory of the Russian Federation |

| Universal tariffs for servicing SME Clients, legal entities and individual entrepreneurs for transactions carried out in foreign currency and for international transactions in Russian currency |

| Universal tariffs for the provision and servicing of loans and overdrafts, bank guarantees and letters of credit with credit risk to SME clients |