Contract price and what is the delivery basis?

In international trade, when concluding contracts, it is usually clearly stated who will bear certain costs and, accordingly, what the price of the goods will be. Thus, the contract price is the price fixed in the purchase and sale document (contract). The very distribution of responsibilities of the parties for insurance and payment of transportation costs, determination of the moments of transfer of risks and property rights from the seller to the buyer is called the delivery basis .

Basic delivery terms CIF and FOB: differences in the responsibilities of the parties

What are fob delivery terms or cif delivery terms? It would seem that clearly state in the contract who is responsible for what and until when - and there will be no problems. But no! The main problem is the completely different, sometimes even opposite, interpretation of some trade terms by the legislation of individual countries. This leads to misunderstandings, disagreements, disputes, loss of time and money, and litigation. In order for terms and conditions to be interpreted equally and problems of unambiguous interpretation to arise as rarely as possible, the International Chamber of Commerce (International Chamber of Commerce - The World Business Organization https://www.iccwbo.org) developed and published uniform standardized rules - Incoterms (international commercial terms), also called basic terms of delivery - Basis terms of delivery. They make it possible to simplify the wording as much as possible when concluding a purchase and sale agreement, clearly indicate the obligations assumed by the parties, and greatly facilitate the choice of transport conditions . If you have expensive cargo or it needs to be delivered to several customs offices, then in Russia the simplest and least expensive option is to hire a customs carrier .

The purpose of Incoterms is to clearly regulate the following issues:

- Which party is responsible for providing the means of transport to ship the goods?

- Which party bears the costs of customs clearance, certification and licensing of imported/exported goods.

- The exact place, and sometimes even the position of the goods, where the seller’s transportation costs end and the buyer’s begin.

- The point at which the risk of damage or loss of cargo passes from the seller to the buyer.

- The point in time before which the seller must fulfill his obligations and transfer the goods to the buyer (or transport company). In other words, delivery times.

In the new edition of Incoterms, the obligations of the parties are grouped into 13 sections. Below we will briefly describe each of the sections, but now let's look at these responsibilities using the example of the two most popular terms - FOB and CIF. For us, these conditions are also close in that they relate exclusively to sea cargo transportation.

Questions about INCOTERMS: legal practitioners answer

Malakhova Anastasia

lawyer, partner of the law office "Sysuev, Bondar and SBBH Partners"

Soltanovich Anna

assistant lawyer, law office "Sysuev, Bondar and SBBH partners"

Where can I find the official text of Incoterms in Russian?

International trade terms Incoterms have been published by the International Chamber of Commerce (ICC) since 1936. They are regularly updated and improved by a working group of experts and legal practitioners brought together under the auspices of the ICC. The official translation into Russian is carried out by the Russian National Committee of the International Chamber of Commerce - World Business Organization (ICC Russia). The introduction to Incoterms 2010 can be found on the ICC Russia website and the bilingual Russian-English official version of the publication can be ordered there.

The ICC is currently preparing for publication a new version of Incoterms - Incoterms 2021. It is expected that the new edition will come into force on January 1, 2021. The main features of the new Incoterms will be the abandonment of the term FAS, the presentation of the term FCA in two versions - for land and water transport, as well as the introduction of new terms CNI (Cost and Insurance), DTP (Delivered at Terminal Paid) and DPP (Delivered at Place Paid).

What should you consider when choosing a particular Incoterm?

First, the parties to the transaction need to remember that Incoterms apply only to relations of purchase and sale (supply) of goods. Incoterms do not define the rights and obligations in relation to the carrier, shipper and consignee (participants in transportation). If the contract of carriage presented by a foreign counterparty includes the Incoterms basis when describing the carriage, then the terms of the contract must define its content through the rights and obligations of the participants in the carriage.

Secondly, it is necessary to take into account which party assumes the responsibility for transporting the goods, what type of transport will be used to deliver the goods, and the agreed delivery point.

For example, if the seller supplies the buyer with perishable products and the seller has all the necessary equipment and resources for transporting such products over long distances (specially equipped trucks, refrigeration units, etc.), but the buyer does not have such resources, it would be reasonable to carry out the transportation funds of the seller, for example, on DAP terms (delivery at destination).

When agreeing on the terms CFR (cost and freight) or CIF (cost, insurance and freight), the seller is obliged to deliver the goods by sea or river transport, because upon delivery he will be required to present a bill of lading or other maritime transport document.

Thirdly, you need to know whether the seller is obligated to insure the goods, and if so, under what conditions (against what risks).

Fourthly, in international trade, it is necessary to take into account how obligations are distributed between the seller and the buyer to fulfill customs formalities along the entire route of the goods from the point of shipment to the point of delivery, to obtain permits (licenses) necessary for exporting goods from the territory of one state and import into the territory of another.

How to correctly agree on the use of Incoterms in a contract?

To apply Incoterms, the parties must include the appropriate condition in the purchase and sale agreement by specifying the Incoterms in the desired edition.

The 2010 edition of Incoterms is currently in effect. However, the parties have the right to be guided by previously valid editions.

In addition to indicating the Incoterms in a certain edition, the parties need to determine the agreed delivery basis with the obligatory designation of the point or port of destination. The more precisely the location is specified in the contract, the less likely it is that misunderstandings will arise in the future. For example: "DAP Barnards Inn, 86 Fetter Lane, London, United Kingdom."

When indicating the destination, it is advisable to indicate not only the locality, but also the address within the locality. In the absence of such a designation, delivery of the goods to any place within the specified point (to any port - if there are several ports) will be the proper fulfillment of the obligation.

If the use of Incoterms is incorrectly agreed upon, the following situations are possible:

— the parties referred to the use of Incoterms without indicating their edition;

— the parties indicated the edition of Incoterms (for example, Incoterms 2000) and the delivery basis, which is not provided for in the corresponding editions (for example, DAP).

In this case, when considering a dispute, the court must determine the terms of the agreement by ascertaining the will of the parties, taking into account the purpose of the agreement, as provided for in Part 2 of Art. 401 Civil Code.

What delivery terms are not regulated by Incoterms?

Incoterms themselves are not a sales contract. They only regulate those conditions that relate to the transportation and insurance of goods, compliance with customs formalities, as well as what costs each party bears. The remaining terms of the contract, such as the price of the goods, payment procedure, liability of the parties for violation of the contract, etc., do not provide for Incoterms. Therefore, with regard to other terms of the contract, the parties should rely on the law and their own terms.

In particular, Incoterms do not regulate:

1. The moment of transfer of ownership of the goods. In practice, cases may arise when parties confuse the concepts of “moment of risk transfer” and “moment of transfer of ownership”. This is explained by the fact that often at the moment of the actual transfer of the goods themselves from the seller to the buyer, both risks and ownership rights are transferred along with the goods. The Civil Code determines that the right of ownership of the acquirer of a thing under a contract arises from the moment of its transfer, unless otherwise provided by law or the contract <*>. However, such a rule may not apply to the transfer of the risk of loss or damage to a thing.

So, for example, the delivery basis may provide that the delivery of goods is carried out after the seller provides notice to the buyer that the goods are ready for acceptance and the buyer provides the corresponding notice to the seller about the time and place of receipt of the goods. Moreover, if the buyer does not fulfill his obligation to notify the seller and does not accept the goods on time, he bears all risks of loss or damage to the goods starting from the agreed date or from the date on which the agreed delivery period has expired. If such a situation arises, only the risks of loss or damage to the goods will pass to the buyer, but not the ownership, because the transfer of goods may not have taken place.

2. Exemption from fulfillment of obligations and liability in the event of unforeseen circumstances (difficulty or force majeure). The Incoterms rules governing the conditions of transportation and insurance of goods do not provide for cases of exemption of parties from liability upon the occurrence of certain circumstances. If the parties wish to agree on specific conditions and cases of exemption from liability for failure to fulfill contractual obligations, it is necessary to directly stipulate them in the contract or rely on the norms of the current legislation applicable to the legal relations of the parties.

3. Consequences of failure by the parties to fulfill the terms of the agreement. By analogy with the previous paragraph, Incoterms do not regulate the parties’ liability for failure to fulfill contractual obligations. The parties to the transaction have the right to establish agreed upon measures of liability that do not contradict applicable law.

4. Conditions under which the contract will be considered concluded. Requirements for the form of the agreement, a list of essential conditions, and whether the representatives of the parties have the authority to sign the purchase and sale agreement are not enshrined in Incoterms and are determined by the norms of national legislation.

5. Product quality. Requirements for the quality of goods are established by the parties in the purchase and sale agreement, and in the absence of such requirements in the agreement, the relevant norms of civil legislation are subject to application, in particular, Art. 439 of the Civil Code, Regulations on the acceptance of goods by quantity and quality, etc. Incoterms do not regulate this aspect of the contract.

Is it possible to use Incoterms when concluding an agreement between residents of Belarus?

Participants in civil legal relations acquire and exercise their civil rights of their own will and in their own interests. They are free to establish their rights and obligations on the basis of the contract and to determine any terms of the contract that do not contradict the law <*>.

Citizens and legal entities are free to enter into an agreement. In this case, the terms of the agreement are determined at the discretion of the parties in the manner and within the limits provided by law <*>. The contract must comply with the rules obligatory for the parties established by law <*>.

Due to the principle of freedom of contract, the parties may provide in the contract for the application of certain Incoterms conditions to the legal relationship of the parties under the contract (indicate delivery on a certain basis). In this case, the Incoterms rules will be applicable to the extent that they do not contradict the law.

For example, responsibilities A2 and B2 “Licenses, permits, security controls and other formalities” will not apply when making deliveries within the Republic of Belarus.

The chosen Incoterm contradicts the terms of the contract. What should be used in this case?

When interpreting the terms of a contract, the court takes into account the literal meaning of the words and expressions contained in it. The literal meaning of the terms of the contract in case of ambiguity is established by comparison with other conditions and the meaning of the contract as a whole. If this rule does not allow determining the content of the contract, then the actual common will of the parties must be clarified, taking into account the purpose of the contract. In this case, all relevant circumstances are taken into account, including negotiations and correspondence preceding the contract, the practice established in the mutual relations of the parties, and the subsequent behavior of the parties <*>.

Incoterms provide for the right of the parties to the contract, by mutual agreement, to change the content of the basic terms of delivery. In such a situation, the terms of the contract will apply. A similar position is reflected in the UNIDROIT Principles: Art. 2.21 establishes the advantage of non-standard contract terms over standard ones.

Thus, if there is a discrepancy between the terms of the contract and the delivery basis included in the contract according to Incoterms, the terms of the contract will take precedence. If a dispute arises between the parties regarding the terms of the contract, taking into account the selected Incoterms basis, the court will interpret the contract.

What mistakes are most often made when choosing a particular Incoterm?

The first mistake: the contract and the documents attached to it contain different delivery bases.

For example, the contract contains the delivery basis EXW, and the invoice indicates CIP, while the contract does not stipulate that the invoice may establish other conditions for delivery and pricing of the goods. In this case, questions may arise with determining the customs value of the goods in terms of additional inclusion in the cost of the goods of the costs of transporting the goods to the destination.

Mistake two: the parties have an incorrect understanding of the content of rights and obligations in the chosen delivery basis.

For example, EXW and FCA. In accordance with the FCA rules, the seller transfers the goods to the carrier or other person nominated by the buyer at its premises or at another designated place. Article B. 7 FCA Incoterms 2010 establishes that the buyer is obliged to inform the seller:

- the name of the carrier or any other person nominated as provided in paragraph A. 4, for a sufficient period to enable the seller to deliver the goods in accordance with the said paragraph;

- if necessary, the date within the period agreed for delivery when the carrier or nominated person can pick up the goods;

- the method of transportation to be used by the nominated person and the point of acceptance of delivery at the named place.

At the same time, the FCA does not establish the seller’s obligation to notify the buyer that the goods are ready for delivery, in contrast to the seemingly similar term EXW. In this situation, the buyer’s arguments that the seller is obliged to notify that the goods are ready for shipment, as provided for by the EXW term, will be unfounded. The seller, in turn, did not send such a notice, because this was not included in the selected delivery basis.

Error three: choosing a transport when agreeing on the terms CIF and CIP.

The CIF basis implies the seller's obligation to enter into a contract and pay all costs and freight necessary to deliver the goods to the specified port of destination. In this case, the port can be both river and sea.

In turn, CIP implies the obligation of the carrier to enter into a contract of carriage and bear the costs of transportation necessary for delivery to the destination.

When concluding a supply contract on CIF terms, the destination implies the supplier’s obligation to enter into a contract of carriage and pay for the delivery of goods to the port available at the corresponding destination. Delivery of goods by road to a warehouse within a populated area may be considered improper fulfillment of the delivery obligation, because, perhaps, removal of the goods from the port was optimal for the buyer. The situation will be different when the parties made a mistake and indicated the CIF condition and the delivery point in which there is no port. In this case, a condition may be set on non-agreed basis of supply, and the procedure for fulfillment by the supplier of the delivery obligation will be determined in accordance with the legislation applicable to the contract.

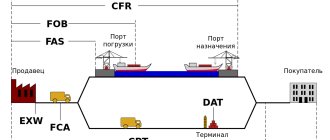

FOB delivery terms

When concluding a contract on FOB terms , the seller is obliged to organize and pay for the delivery of the cargo to the port of shipment and its loading onto the ship chosen by the buyer . When exported , he also carries out customs clearance of the goods. Risks associated with damage or loss of goods are transferred to the buyer at the moment the cargo crosses the side of the ship at the port of loading . The conditions FOB STOWED (FOB with placement) and FOB STOWED AND TRIMMED (FOB with placement and trimming) are used in sales contracts to clarify the seller’s obligation to stow and correctly distribute the goods loaded on the ship in the hold. The second option is used exclusively for bulk cargo. When adding such terms to a purchase agreement, it is necessary to clarify who bears the costs of these additional responsibilities and at what point the risk passes to the buyer in order to clearly define the FOB price.

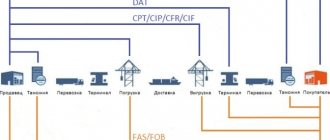

Incoterms 2010 classification

Terms of delivery of goods for any type of transport

EXW / Ex Works – Ex-factory

FCA / Free Carrier - Free carrier

CPT / Carriage Paid to - Carriage paid to

CIP / Carriage and Insurance Paid to - Transportation and insurance paid to

DAT / Delivered at Terminal

DAP / Delivered at Place

DDP / Delivered Duty Paid

Terms of delivery of goods for sea and inland water transport

FAS / Free Alongside Ship - Free along the side of the ship

FOB / Free on Board - Free on board

CFR / Cost and Freight - Cost and freight

CIF / Cost Insurance and Freight - Cost, insurance and freight

CIF delivery terms

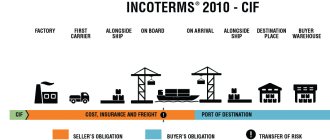

According to the CIF , the terms of delivery impose responsibility on the seller for delivery of the cargo to the port of destination , its insurance, export customs clearance, loading on the ship chosen by the seller and the freight of this ship. Although the seller pays for all of the above, his delivery obligations are considered fulfilled after the goods are loaded onto the ship at the port of departure. Accordingly, risk transfer also occurs there.

Thus, the main difference CIF and FOB delivery terms is the transport component : who chooses the carrier and pays transport costs - the seller or the buyer. CIF and FOB prices depends on the transport component .

Without going into details, CIF means the seller pays for transport; if FOB , the buyer pays for transport. The difference between the CIF and the FOB is equal to the cost of delivery to the destination port.

Advantages and disadvantages of applying the FOB rule

The obvious advantage to the seller of using the FOB rule is that, since the seller is required to load the goods on board the ship, the transport document, usually the bill of lading, will indicate the seller as the shipper.

The advantage for the buyer of using the FOB trade term is that he controls the goods and costs on the vessel he has ordered, because he pays the freight.

FOB Incoterms 2021 delivery terms are to be used only for sea or inland waterway transport where the parties intend to deliver the goods by stowing the goods on board the vessel (reference to the ship's rail is excluded). Thus, the FOB rule is not appropriate when the goods are handed over to the ocean carrier before they are on board the vessel, for example when the goods are handed over to the carrier at a container terminal. According to Incoterms 2020, the FOB basis is not suitable for container transport, since the cargo is transferred to the sea carrier not on board, but at a place located some distance from the port, for example, at a container yard or even at the seller's premises, where the goods are packed (loaded) in container provided by the buyer's carrier. In this case, parties should consider using the FCA Incoterms 2021 rule.

When applying for a bank letter of credit, many banks insist on using FOB delivery terms instead of FCA Incoterms 2021, even if the goods are in sea containers or transported by air, because: “We have always done it this way” or “This is our standard form of transaction”!

Transport conditions and commercial risks

It should be noted that Incoterms govern the relations of the parties exclusively within the framework of the purchase and sale agreement. Therefore, the transportation contract should be concluded separately, and it should already stipulate all the transport conditions . For sea transportation, this section of the sales contract stipulates:

- port of loading and unloading of goods;

- point of transfer or transshipment of cargo;

- type of charter or bill of lading;

- the procedure for informing the parties about the vessel’s arrival at the port and its readiness for loading and unloading operations;

- procedure for determining lay time;

- loading and unloading standards;

- conditions and procedure for paying fines (demurrage and dispatch) to the carrier.

Incoterms also do not stipulate who assumes the commercial risks for possible maritime surcharges. For example, BAF (fuel surcharge), ERS (contingency transport charges) or CAF (currency surcharge). Commercial risks may also include sudden increases in port or insurance rates, increases in wages or carrier tariffs. Unfortunately, there are many such “pitfalls” hidden in Incoterms.

All these risks can be additionally reinsured. However, in this case, insurance costs will increase.

Which terminals and transport are suitable for DAT

Transportation of cargo under DAT delivery conditions can be carried out by any means of transport, including multimodal transportation.

The terminal can be a seaport, a pier, a warehouse, a container yard, a cargo complex at the airport, a road or railway terminal, etc. For example, delivery of products to Russia can be carried out to the following places:

- Novorossiysk sea trade port for goods transported by sea;

- cargo terminal at Sheremetyevo airport for transportation by aircraft;

- customs and logistics terminal in the village. Kozinka, Grayvoronovo district, Belgorod region, for road transport;

- customs and logistics terminal in Formachevo village, Uvelsky district, Chelyabinsk region for delivery by rail.

The list of operating customs and logistics terminals near the borders of Russia is available for review on the website of the Customs Service in the open data register. TLT from the specified list can also be designated as the agreed destination for the delivery of goods.

Please help make this article better. Answer just 3 questions.

It is recommended to indicate the destination in more detail in the contract, for example: “The cargo is transferred at the Bagrationovsky terminal at the transfer point of the temporary storage warehouse of Inmar CJSC at the address: Russian Federation, Kaliningrad region, Guryevsky district, Druzhny village, st. Dzerzhinsky, 248.” There is another option for formatting the same clause in the contract: “Point of delivery of the Goods: DAT, 248, st. Dzerzhinsky, terminal “Bagrationovsky”, Druzhny village, Guryevsky district, Kaliningrad region, Russian Federation, Incoterms 2010.”

Distribution of costs and risks between the carrier and the cargo owner

One of the biggest risks for contracting parties is the choice of delivery terms. Specifically, who, when and how much will pay for transportation.

It should be recalled here that contracts are most often concluded long before the cargo is sent. And at the time of shipment, the transportation price may differ significantly from that specified in the contract. The carrier himself also takes risks by stipulating the cost of his services long before the start of transportation.

Ideally, the amount of freight due to the carrier should cover all future expenses (fuel, crew salaries, loading and unloading, repairs and maintenance of the vessel, port duties) and the risks of the carrier. However, in a competitive environment, the carrier has to indicate a deliberately lower price. Thus, the freight amount may not reimburse the shipowner for all costs.

Outsourcing of foreign trade activities

There are companies that provide outsourcing services for export to foreign trade activities - from selecting a buyer or supplier to full support of the transaction. Outsourcing will require additional costs from you, but will save your time. Often such services help save money on fines, thereby justifying the costs. If you are not confident in your abilities, contact outsourcing specialists.

Keep separate records of export and domestic transactions on the simplified tax system in the cloud service Kontur.Accounting. This will help you avoid errors in calculating customs duties, excise duties and taxes. The first 14 days of using the service are free.

Try for free