The Commodity Nomenclature of Foreign Economic Activity of the EAEU is a large classifier of goods. The commodity nomenclature of foreign economic activity of the Eurasian Economic Union is used in their work by customs officials and companies that are engaged in foreign economic activity.

Using HS codes, process participants identify the product and perform customs operations. Simply put, thanks to the code, both customs and companies quickly understand what the amount of duty and excise tax will be, and find out whether the product requires permits. In addition, according to the Commodity Nomenclature of Foreign Economic Activity, customs monitors foreign trade statistics.

For customs authorities, the ten-digit code simplifies the processing of declarations. But for companies without special knowledge, correctly assigning a HS code is an extremely difficult task.

What is HSDD? Structure of the HS code. Application of HS in practice.

Commodity Nomenclature of Foreign Economic Activity (TN FEA) is a classifier of goods created for use by customs and participants in foreign trade activities. The Commodity Nomenclature of Foreign Economic Activity of the Russian Federation is a more complete Russian version of the Harmonized System, developed by the world customs organization and adopted as the basis for commodity classification in European and some other countries. The essence of the classifier is that each product or group of goods is assigned its own unique code and a customs duty is assigned. This classifier is used to ensure unambiguous identification of goods, collection of customs duties and to simplify automated processing of customs declarations.

Definition and purpose

In accordance with the decoding of the abbreviation, the Commodity Nomenclature of Foreign Economic Activity of the EAEU is a commodity nomenclature for foreign economic activity of the Eurasian Economic Union, that is, a unified list of codes designed to simplify the procedure for processing declarations and accompanying documents.

Competent and correct completion of documentation is an important factor in avoiding difficulties associated with passing inspections when transporting goods. Supervisory authorities strictly monitor compliance with established regulatory requirements and are willing to impose penalties on violators. Penalties provided for by legislative provisions include both administrative forms of penalties, with fines reaching up to 200% of the amount of unpaid duties, and criminal prosecution.

SEA BANK has favorable conditions for obtaining services for foreign economic activity (foreign economic activity), cash settlement services (cash settlement services), and it is also possible to issue a bank guarantee.

Why is it important to determine the HS code?

All goods crossing the customs border of the Russian Federation are assigned a ten-digit HS code; this code is written in the international consignment note (CMR) that comes along with the cargo. Determining and assigning a code to a product is called classification . At the customs clearance site, the declarant must enter this code in the cargo customs declaration. The size of customs duties and the application of non-tariff regulation measures depend on what specific HS code appears in the declaration. Also, for customs clearance of different HS codes (goods), certain additional documents are required. Very often, customs has a different opinion than that chosen by the declarant and makes its own classification decision. At the same time, the amount of customs duties required for payment may not be at all what the foreign trade participant expected. To resolve such disagreements, you have to contact a higher customs authority or court, the outcome of which does not always end in favor of the declarant. Such litigation significantly increases the time required for customs clearance. Example: We have the following description of a product: “a product made of silicate glass in the form of a glass, height 6 cm, intended for setting candles.” You think that this product should be classified with code 7013990000 (TOILET AND STATIONERY ACCESSORIES, GLASS PRODUCTS FOR HOME DECORATION OR SIMILAR PURPOSES NOT FROM GLASS CERAMICS AND NOT FROM LEAD CRYSTAL, duty 15% , VAT 18%). Or maybe the correct code for the product “Candlestick” is 9405500000? (NON-ELECTRIC LAMPS AND LIGHTING EQUIPMENT, duty 20% , VAT 18%)

HS codes for labeled clothing: table

| Articles of clothing and clothing accessories, made of genuine leather or composition leather: | 4203 10 000 - items of clothing | 4203 10 000 1 - made of genuine leather | ||

| Articles of clothing and clothing accessories, made of genuine leather or composition leather: | 4203 10 000 - items of clothing | 4203 10 000 9 - other | ||

| 6106 - Blouses, blouses and blouses, knitted or crocheted, for women or girls: | 6106 10 000 0 - from cotton yarn | |||

| 6106 - Blouses, blouses and blouses, knitted or crocheted, for women or girls: | 6106 20 000 0 - from chemical threads | |||

| 6106 - Blouses, blouses and blouses, knitted or crocheted, for women or girls: | 6106 90 - from other textile materials: | 6106 90 100 0 - from wool yarn or yarn from fine animal hair | ||

| 6106 - Blouses, blouses and blouses, knitted or crocheted, for women or girls: | 6106 90 - from other textile materials: | 6106 90 300 0 - from silk threads or from yarn from silk waste | ||

| 6106 - Blouses, blouses and blouses, knitted or crocheted, for women or girls: | 6106 90 - from other textile materials: | 6106 90 500 0 - from flax fibers or ramie fibers | ||

| 6106 - Blouses, blouses and blouses, knitted or crocheted, for women or girls: | 6106 90 - from other textile materials: | 6106 90 900 0 - from other textile materials | ||

| 6201 - Coats, short coats, capes, raincoats, jackets (including ski jackets), windbreakers, windbreakers and similar articles for men or boys, other than articles of heading 6203: | coats, short coats, capes, raincoats and similar products: | 6201 11 000 0 - from wool yarn or yarn from fine animal hair | ||

| 6201 - Coats, short coats, capes, raincoats, jackets (including ski jackets), windbreakers, windbreakers and similar articles for men or boys, other than articles of heading 6203: | coats, short coats, capes, raincoats and similar products: | 6201 12 - from cotton yarn: | 6201 12 100 0 - with a weight of one product not exceeding 1 kg | |

| 6201 - Coats, short coats, capes, raincoats, jackets (including ski jackets), windbreakers, windbreakers and similar articles for men or boys, other than articles of heading 6203: | coats, short coats, capes, raincoats and similar products: | 6201 12 - from cotton yarn: | 6201 12 900 0 - with a single product weighing more than 1 kg | |

| 6201 - Coats, short coats, capes, raincoats, jackets (including ski jackets), windbreakers, windbreakers and similar articles for men or boys, other than articles of heading 6203: | coats, short coats, capes, raincoats and similar products: | 6201 13 - from chemical threads: | 6201 13 100 0 - with a weight of one product not exceeding 1 kg | |

| 6201 - Coats, short coats, capes, raincoats, jackets (including ski jackets), windbreakers, windbreakers and similar articles for men or boys, other than articles of heading 6203: | coats, short coats, capes, raincoats and similar products: | 6201 13 - from chemical threads: | 6201 13 900 0 - with a weight of one product more than 1 kg | |

| 6201 - Coats, short coats, capes, raincoats, jackets (including ski jackets), windbreakers, windbreakers and similar articles for men or boys, other than articles of heading 6203: | coats, short coats, capes, raincoats and similar products: | 6201 19 000 0 - from other textile materials | ||

| 6201 - Coats, short coats, capes, raincoats, jackets (including ski jackets), windbreakers, windbreakers and similar articles for men or boys, other than articles of heading 6203: | others: | 6201 91 000 0 - from wool yarn or yarn from fine animal hair | ||

| 6201 - Coats, short coats, capes, raincoats, jackets (including ski jackets), windbreakers, windbreakers and similar articles for men or boys, other than articles of heading 6203: | others: | 6201 92 000 0 - from cotton yarn | ||

| 6201 - Coats, short coats, capes, raincoats, jackets (including ski jackets), windbreakers, windbreakers and similar articles for men or boys, other than articles of heading 6203: | others: | 6201 93 000 0 - from chemical threads | ||

| 6201 - Coats, short coats, capes, raincoats, jackets (including ski jackets), windbreakers, windbreakers and similar articles for men or boys, other than articles of heading 6203: | others: | 6201 99 000 0 - from other textile materials | ||

| 6202 - Coats, short coats, capes, raincoats, jackets (including ski jackets), windbreakers, windbreakers and similar articles for women or girls, other than articles of heading 6204: | coats, short coats, capes, raincoats and similar products: | 6202 11 000 0 - from wool yarn or yarn from fine animal hair | ||

| 6202 - Coats, short coats, capes, raincoats, jackets (including ski jackets), windbreakers, windbreakers and similar articles for women or girls, other than articles of heading 6204: | coats, short coats, capes, raincoats and similar products: | 6202 12 - from cotton yarn: | 6202 12 100 0 - with a weight of one product not exceeding 1 kg | |

| 6202 - Coats, short coats, capes, raincoats, jackets (including ski jackets), windbreakers, windbreakers and similar articles for women or girls, other than articles of heading 6204: | coats, short coats, capes, raincoats and similar products: | 6202 12 - from cotton yarn: | 6202 12 900 0 - with a weight of one product more than 1 kg | |

| 6202 - Coats, short coats, capes, raincoats, jackets (including ski jackets), windbreakers, windbreakers and similar articles for women or girls, other than articles of heading 6204: | coats, short coats, capes, raincoats and similar products: | 6202 13 - from chemical threads: | 6202 13 100 0 - with a weight of one product not exceeding 1 kg | |

| 6202 - Coats, short coats, capes, raincoats, jackets (including ski jackets), windbreakers, windbreakers and similar articles for women or girls, other than articles of heading 6204: | coats, short coats, capes, raincoats and similar products: | 6202 13 - from chemical threads: | 6202 13 900 0 - with a weight of one product more than 1 kg | |

| 6202 - Coats, short coats, capes, raincoats, jackets (including ski jackets), windbreakers, windbreakers and similar articles for women or girls, other than articles of heading 6204: | coats, short coats, capes, raincoats and similar products: | 6202 19 000 0 - from other textile materials | ||

| 6202 - Coats, short coats, capes, raincoats, jackets (including ski jackets), windbreakers, windbreakers and similar articles for women or girls, other than articles of heading 6204: | others: | 6202 91 000 0 - from wool yarn or yarn from fine animal hair | ||

| 6202 - Coats, short coats, capes, raincoats, jackets (including ski jackets), windbreakers, windbreakers and similar articles for women or girls, other than articles of heading 6204: | others: | 6202 92 000 0 - from cotton yarn | ||

| 6202 - Coats, short coats, capes, raincoats, jackets (including ski jackets), windbreakers, windbreakers and similar articles for women or girls, other than articles of heading 6204: | others: | 6202 93 000 0 - from chemical threads | ||

| 6202 - Coats, short coats, capes, raincoats, jackets (including ski jackets), windbreakers, windbreakers and similar articles for women or girls, other than articles of heading 6204: | others: | 6202 99 000 0 - from other textile materials | ||

| 6302 — Bed, table, toilet and kitchen linen: | 6302 10 - knitted bed linen, machine or hand knitted: | 6302 10 000 1 - from cotton yarn | ||

| 6302 — Bed, table, toilet and kitchen linen: | 6302 10 - knitted bed linen, machine or hand knitted: | 6302 10 000 9 - from other textile materials | ||

| 6302 — Bed, table, toilet and kitchen linen: | other printed bed linen: | 6302 21 000 0 - from cotton yarn | ||

| 6302 — Bed, table, toilet and kitchen linen: | other printed bed linen: | 6302 22 - from chemical threads: | 6302 22 100 0 - from non-woven materials | |

| 6302 — Bed, table, toilet and kitchen linen: | other printed bed linen: | 6302 22 - from chemical threads: | 6302 22 900 0 — other | |

| 6302 — Bed, table, toilet and kitchen linen: | other printed bed linen: | 6302 29 - from other textile materials: | 6302 29 100 0 - from linen yarn or ramie fiber | |

| 6302 — Bed, table, toilet and kitchen linen: | other printed bed linen: | 6302 29 - from other textile materials: | 6302 29 900 0 - from other textile materials | |

| 6302 — Bed, table, toilet and kitchen linen: | other bed linen: | 6302 31 - from cotton yarn: | 6302 31 000 1 - mixed with flax | |

| 6302 — Bed, table, toilet and kitchen linen: | other bed linen: | 6302 31 - from cotton yarn: | 6302 31 000 9 — other | |

| 6302 — Bed, table, toilet and kitchen linen: | other bed linen: | 6302 32 - from chemical threads: | 6302 32 100 0 - from non-woven materials | |

| 6302 — Bed, table, toilet and kitchen linen: | other bed linen:: | 6302 32 - from chemical threads: | 6302 32 900 0 — other | |

| 6302 — Bed, table, toilet and kitchen linen: | other bed linen: | 6302 39 - from other textile materials: | 6302 39 200 - from linen yarn or ramie fiber: | |

| 6302 — Bed, table, toilet and kitchen linen: | other bed linen: | 6302 39 - from other textile materials: | 6302 39 200 - from linen yarn or ramie fiber: | 6302 39 200 1 - from linen yarn |

| 6302 — Bed, table, toilet and kitchen linen: | other bed linen: | 6302 39 - from other textile materials: | 6302 39 200 - from linen yarn or ramie fiber: | 6302 39 200 9 - made of ramie fiber |

| 6302 — Bed, table, toilet and kitchen linen: | other bed linen: | 6302 39 - from other textile materials: | 6302 39 900 0 - from other textile materials | |

| 6302 — Bed, table, toilet and kitchen linen: | 6302 40 000 0 - knitted table linen, machine or hand knitted | |||

| 6302 — Bed, table, toilet and kitchen linen: | other table linen: | 6302 51 - from cotton yarn: | 6302 51 000 1 - mixed with flax | |

| 6302 — Bed, table, toilet and kitchen linen: | other table linen: | 6302 51 - from cotton yarn: | 6302 51 000 9 - other | |

| 6302 — Bed, table, toilet and kitchen linen: | other table linen: | 6302 53 - from chemical threads: | 6302 53 100 0 - from non-woven materials | |

| 6302 — Bed, table, toilet and kitchen linen: | other table linen: | 6302 53 - from chemical threads: | 6302 53 900 0 - other | |

| 6302 — Bed, table, toilet and kitchen linen: | other table linen: | 6302 59 - from other textile materials: | 6302 59 100 0 - from linen yarn | |

| 6302 — Bed, table, toilet and kitchen linen: | other table linen: | 6302 59 - from other textile materials: | 6302 59 900 0 - other | |

| 6302 — Bed, table, toilet and kitchen linen: | 6302 60 000 0 - toiletry and kitchen linen, made from terry toweling fabrics or similar woven terry materials, from cotton yarn | |||

| 6302 — Bed, table, toilet and kitchen linen: | other: | 6302 91 000 0 - from cotton yarn | ||

| 6302 — Bed, table, toilet and kitchen linen: | other: | 6302 93 - from chemical threads: | 6302 93 100 0 - from non-woven materials | |

| 6302 — Bed, table, toilet and kitchen linen: | other: | 6302 93 - from chemical threads: | 6302 93 9 000 - other | |

| 6302 — Bed, table, toilet and kitchen linen: | other: | 6302 99 - from other textile materials: | 6302 99 100 0 - from linen yarn | |

| 6302 — Bed, table, toilet and kitchen linen: | other: | 6302 99 - from other textile materials: | 6302 99 900 0 - other |

How to determine the customs code of a product?

For foreign trade participants it is very important to determine the product code correctly! An error in determining the HS code can result in a serious problem, the solution of which will require a lot of effort and resources.

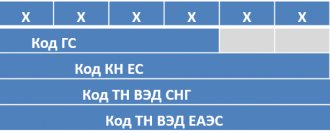

The catalog or directory of HS codes has a tree structure. HS codes consist of 10 characters and are divided into 21 sections and 97 groups XXXX XX XXX X. Each of the 10 characters corresponds to a group of homogeneous products.

Now the customs authorities of the Russian Federation use the Commodity Nomenclature of Foreign Economic Activity of the Customs Union (CU), which includes Russia, Belarus and Kazakhstan. The Unified Customs Tariff (UCT) of the customs union is a classifier of goods approved by the heads of the three states on November 27, 2009 and put into effect on January 1, 2010. The HS codes strictly adhere to the principles of unambiguous assignment of goods to one or another group. Correct identification of goods and their classification is crucial in determining duty rates and establishing customs regimes.

If you have difficulties in independently determining the HS code, you can contact the local Chamber of Commerce and Industry (CCI), they will examine the samples you submitted, classify your samples, charge you money and issue a conclusion. Details can be found on the website of the Russian Chamber of Commerce and Industry. It is important to understand that the final decision to accept or not accept the goods code according to the Commodity Classification of Foreign Economic Activity that you have selected always remains with the customs authorities.

What is a preliminary classification decision?

A more reliable option for determining the HS code is to contact the Federal Customs Service (FCS) for a preliminary classification decision , in jargon called a class decision (CR). High-tech and large equipment is usually supplied in parts and disassembled and is submitted for customs clearance in batches and at different times. The Federal Customs Service of Russia has a special procedure for moving such equipment. In accordance with this procedure, classification decisions are issued for such goods and a single HS code for the entire equipment is assigned. If the Federal Customs Service has issued a classification decision for your goods, this will allow you to avoid controversial issues during customs clearance. The classification decision of the Federal Customs Service is mandatory for adoption by any customs authority on the territory of Russia in accordance with paragraph 6 of Article 52 of the Customs Code of the Customs Union. In practice, this means that when contacting customs to clear the cargo, the declarant has a ready-made class solution in hand and completely avoids the risks associated with possible ambiguous interpretation of the coding of goods. The customs authority that carries out cargo clearance, based on the class decision, no longer checks the classification according to the Commodity Nomenclature of Foreign Economic Activity. To obtain a preliminary classification decision, you must contact the Commodity Nomenclature Department of the Federal Customs Service with a written request and provide a package of documents required for this. The Federal Customs Service considers requests for a classification decision within 90 days. In practice, it often turns out that the package of documents is not complete or there is not enough information, the period for consideration of the application may be extended indefinitely, or the Federal Customs Service may completely refuse to issue a preliminary decision on the classification of your product. There are many assistance companies that, for selfish purposes, will study the issue, draw up an application and help collect documents.

You can choose the code yourself using the HS codes directory, this is not a secret. The code can be requested from the sender of the goods. But we don’t advise you to be tricky by choosing a HS code with a small duty; you will have to defend your code at customs. Consult your customs broker; he will paint a clear picture of how customs accepts value and classification.

Article 16.2 of the Code of Administrative Offenses of the Russian Federation provides for administrative liability for declaring false information when declaring goods, if this served as the basis for exemption from customs duties, taxes, or for underestimating their amount, or for non-application of state prohibitions and restrictions.

Article 40 of the Customs Code of the Russian Federation states that all goods are subject to classification when declared. The rates of customs duties, taxes, the application of non-tariff regulation measures, and obtaining permits from various regulatory authorities depend on the product code. The first six characters should be the same in most countries of the world. Therefore, when importing, it is important to ask your foreign partner what codes he uses to send this or that product for export.

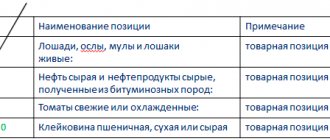

The product nomenclature provides for 5 levels of product detail:

- section level (take the agricultural sector);

- group level (cereals);

- level of commodity items (cereals are divided into rye, wheat);

- Levels 4 and 5, lower levels of detail (durum wheat)

The main criteria used for classification: 1 - the material from which the product is made; 2 - the functions it performs; 3 - degree of processing (manufacturing).

In total, HS codes consist of 97 groups and 21 sections.

The basic unit of measurement of goods according to the Commodity Classification of Foreign Economic Activity is weight in kg.

For example: GROUP 10, CEREALS

General provisions This group includes only grains, including those in sheaves or ears. Grain of this group, cut before ripening and not threshed, is classified with simple grain. Fresh grains (other than sweet corn of Chapter 07), whether or not suitable for use as vegetables, are classified in this chapter. Rice is classified in heading 1006 even if threshed, bleached, polished, dried or milled, provided that it is not otherwise processed. Any other grains, if threshed or otherwise processed, are excluded from this chapter, such as those described in heading 1104 (see relevant HS Explanations).

Explanation of subheadings Dried ears (cobs) of cereal crops (for example, corn), bleached, dyed, impregnated or otherwise processed for decorative purposes, are classified in subheading 0604 99 900 0. Cereals remain in this group, even if they have undergone heat treatment for storage purposes, which may cause the grains to partially gel and sometimes cause them to explode. Partial gelatinization (pre-gelatinization) occurs during the drying process and involves only a small portion of the grains. This transformation of starch is not the purpose of heat treatment, but is only a side effect. A product processed in this way shall not be considered to be “otherwise processed” within the meaning of Note 1(B) to Chapter 10.

Note: 1.(A) Headings in this Chapter are to cover only grains, including those not separated from ears or stems. (B) This chapter does not include grains that have been shelled or otherwise processed. However, rice whether husked, hulled, polished, glazed, parboiled or broken is classified in heading 1006. 2. Heading 1005 excludes sweet corn (Chapter 07).

Note on subitems. 1. The term “drum wheat” means wheat of the species Triticum durum and hybrids obtained as a result of interspecific crossing of Triticum durum with other species having the same number of chromosomes (28).

The easiest and least expensive option to deliver cargo without surprises with customs is to hire a customs carrier .

Documents for confirmation

In accordance with the current regulations, the entity acting in the status of the declarant is obliged to provide a set of documentation certifying the validity of the choice of a specific codifier for the transported products. In this capacity, a variety of acts, certificates and forms can be used, the list of which depends on the specifics of the product.

In cases where the basic feature of differentiation is the presence of certain substances, including those potentially dangerous to humans, a prerequisite is the presentation of research results confirming the physical and chemical composition of the product. A similar principle applies to other codified objects, for example, those allocated to a homogeneous group on the basis of a single process of technical processing. For such situations, it is important to have applications in the form of technological diagrams, drawings, descriptions, etc.