Rules for the classification of goods in accordance with the Commodity Nomenclature of Foreign Economic Activity

- Systematization of trade items according to technical specifications is the most important task for parties to foreign economic relations.

- Codification according to the TN code of products involves the establishment of FCS tariffs and the amounts of contributions and duties.

- To assign trade items to the appropriate TN coding, you need special knowledge and various types of examinations in order to establish the characteristic features of products and manufacturing methods.

- The accuracy of code assignment is needed for analytical and statistical observations in the field of foreign trade.

- According to the requirements of the Customs Code, parties to foreign trade activities must themselves determine the coding of goods passing through customs. If an incorrect classification as a TN is revealed, the customs itself will systematize the items of trade (clause 3 of Article 52 of the Customs Code of the Customs Union).

- The Federal Customs Service has the right to provide explanations on the systematization of certain samples of goods, with the possibility of publishing such information (clause 6 of Article 52 of the Customs Code of the Customs Union).

- Systematization occurs according to certain rules. There are six of them in total. They are used in strict sequence.

From 1st to 5th, the rules apply like this:

- if the 1st is not suitable, look at the 2nd;

- the 2nd does not fit, then we check the 3rd;

- if not 3rd, then look at 4th;

- etc.

This will find the 4-digit position of the item. The 6th Rule allows you to find a 6-digit subposition, and a subposition under it. It is used in 4-digit encoding.

Rule 1

Its essence is that the names of sections, groups and subgroups are designated for the practical use of TN; For legal purposes, the systematization of trade items in TN is used based on the textual designation of commodity provisions.

Thus, from 1 it follows that if the position of the item of trade truly describes a certain product, then it belongs to this series of goods.

Example

Apples are classified according to the code 08.08 “fresh apples, pears and quinces”.

Rule 2

Rule 2 (a) Any reference in the item of trade to any product will be interpreted as an indication of this product in an incomplete or unfinished form, provided that, being served in these types, this product has the main quality of a completed or completed item.

Example

The complete set of slats made of wood, which have undergone processing, for the manufacture of a hanger, but in the absence of a hook, will be regarded as a hanger product, because absorbs its characteristic features.

Rule 2(b)

Any mention in the name of a commodity provision for any matter or substance must also be interpreted as a reference to the mixing of such a substance with other matters.

Any mention of products made from specified material must be interpreted as a mention of goods that fully or partially include the designated material.

Systematization of objects that include more than one type of matter is carried out according to the 3rd Rule.

Example

- Product 4503 “Natural products. plugs” contains cork plugs with linings made from other components (plastic, etc.).

- Products made from nature. leathers have the code “4203”, but this coding also contains other components: plastic locks, buttons, lining made of various types of fabric (textile, fur, padding polyester, etc.).

The peculiarity of such a Rule is the extension of any provision of goods which relate to it, made of the specified matter, to include articles of trade made in part from such matter or substance.

But, nevertheless, it does not greatly increase the position for the inclusion of trade items in it, which, according to the 1st Rule, cannot be considered as suitable for the definition of the specified position of the goods.

That is, if the addition of another material changes the characteristics of the product, then it ceases to fit the specified position.

Simply put, rule 2 (6) does not apply if the presence of additions by other matter cannot be ignored. Here you need to use the 3rd Rule.

Rule 2(6) cannot be taken even when the characteristics of the product contain a clause stating that it is 100% impossible to include other substances, for example, “2940” - “Sugar chemical...”.

Rule 3

It embodies three methods of product coding, which can be attributed to several provisions of the product, either in accordance with norm 2 (6) or for any other possible reason.

It consists of 3 parts: 3 (a), 3 (6) and 3 (c).

Their use occurs in the algorithm in which they are enshrined in the above-mentioned Rule: 3 (6) only when 3 (a) does not assist in systematizing the product, moreover, if both 3 (a) and 3 (6) do not provide effect, then 3 (c) must be used.

Standard 3 applies only if the title of product provisions and notes to sections and groups do not require any other interpretation.

Example

Comment 4 (6) to Group 97 states that product code 9706 “Antiques over 100 years old” does not belong to items included in the previous headings of Group 97, that is, the original painting of 120 years ago will be codified in 9702 “Originals” engravings..."

Rule 3(a)

According to 3 (a), first you need to try to systematize the product according to the description of that item of the product, according to which we see the most specific display of the desired product.

If no such position is found, 3(a) cannot be used.

Example

Automotive textile mats should be codified not as an attribute for a car in position “8708”, but in “5703” - “Carpets and other text. floor coverings”, where they are specified as carpets.

Rule 3(b)

3 (6) finds itself, if it is necessary to classify mixed goods, those consisting of a combination, and having different components, or these are items of assorted trade.

Example

Sets of knives “8211”, forks and similar utensils “8215” are included in item “8115” if the number of knives is not greater than the number of other products.

Rule 3(c)

3 (c) in turn states that items whose systematization cannot be carried out with the assistance of 3 (a) or 3 (6) are codified into positions that are extreme among the selected ones as the positions of marketable products increase.

Example

A women's suit, a composition of leather "4203" and knitted fabric "6103", cannot be codified by norm 2 (6) by increasing the limits of use of items.

3(a) cannot be applied since each item contains only a fraction of the material of the goods.

It is also impossible to use 3 (6), since none of the components exceeds the other in any parameters. Therefore, we use 3 (c), and include the product in the outermost one of the two “competing” ones in sequential numbering - in the code “6103” - “Suits... knitted...”.

Rule 4

Products, the codification of which is not possible in accordance with the requirements of the above Rules, are systematized in TN, which corresponds to goods that are more closely related to the trade items in question.

The 4th standard applies to trade items that cannot be classified as standards 1, 2 or 3.

Its fundamental difference is that it finds its application when none of the positions of commercial products is suitable for systematizing the goods, and involves the classification of such products in technical specifications, to which goods close to them are most likely related.

With this classification, you need to compare the existing product with similar products to find similar products.

Similarity can be determined by various components, for example, material, functional features, production method, appearance, purpose.

In practice, this norm is not often used, since many groupings contain encodings of the “Other” type.

Rule 5

Rules 5 (a) and 5 (6) are used to systematize specific goods: containers and packaging.

The rule applies to the following products:

- are a configuration for containing certain (individual) trade items or product sets, that is, they have a design for a specific type of item. Some of the cases repeat the shape of the product - for example, a guitar case.

- suitable for long-term use, that is, they are as durable as the main product.

Example

Containers that come with the products. Boxes for jewelry – position “7116”.

Rule 5(b)

The essence of Rule 5(a), packaging that goes inextricably with the product of manufacture, is codified together.

5(6) sets out requirements for the systematization of packaging products other than those regulated by 5(a).

This packaging must meet the following criteria:

- the product and packaging must be kept together;

- packaging material is normal for the product in question.

Example

Plastic containers for water go inextricably with it - coding “2201”.

Rule 6

Having decided on the code from the product position (4 characters), you need to make it more specific.

The 6th means that the 1st – 5th are used with the necessary modifications and to systematize the sub-items of the product (six-digit coding) within the boundaries of one technical specification (four-digit code).

Example

In the “71” grouping, the meaning of the word “platinum” in Notes. 4 (6) differs from the component of the term “platinum” in Note. 2 to sub-item.

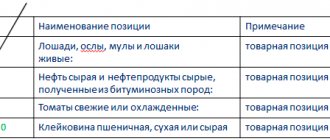

More details about the numbers

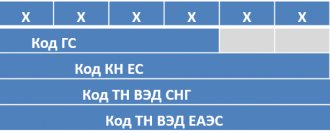

The beginning of the code, the first two digits are the product group; four digits – product position; six digits – product subposition; ten digits – subitem, or full product code.

The first six digits of the code determine its compliance with the state nomenclature system. The seventh and eighth digits correspond to European Union nomenclature; ninth digit – CIS countries. The tenth digit is intended for indication at the national level.

Thanks to this nomenclature and based on the basic rules of interpretation of the Commodity Nomenclature of Foreign Economic Activity of the CU (CU - Customs Union), duties, excise taxes, and VAT are collected. Also, the technical nomenclature determines the customs duty rate, allows for foreign trade statistics, and determines the type of goods. And, of course, it allows you to identify offenses and then take action.

Additional Information

Thanks to TN, the ratio of unambiguous (definite) assignment of trade items to classification groups is clearly observed.

Compliance with a certain procedure for using the OPI of the Commodity Nomenclature of Foreign Economic Activity makes it possible to clearly determine the product code.

According to Article 52 of the Customs Code of the Customs Union, goods must be classified when declared at customs. This means that declarants must independently determine TN codes. However, the Federal Customs Service often does not agree with the interpretation and makes its own decision on assigning the encoding. This is explained by the difficulty of classification and the lack of a clear, complete reference book.

It is important to know that the customs duty rate depends on the classification of goods. The Federal Customs Service, as a rule, charges additional payments, and even initiates cases under the Code of Administrative Offenses, imposing huge fines, as well as confiscating batches of products.

To avoid this kind of trouble, it is best to contact companies that provide specialized goods classification services.

Code sections

When goods are moved across the border, they are assigned a code. The responsibility to determine and assign the code lies with the declarant. Whether the code is assigned correctly is determined by the customs control authorities. The calculation and collection of payments depends on how correctly it is determined. Here it is also necessary to apply the rules of interpretation of the Commodity Nomenclature of Foreign Economic Activity.

When assigning a code, spaces and hyphens are not allowed. It allows you to quickly process data and provide information to competent persons. The code is specially selected for automation and faster and more accurate work of customs authorities.

Role in customs

Compliance with these rules allows you to:

- Unambiguously classify goods into classification groups.

- Simplify the methodology for determining the amount of customs payments and duties.

- Synchronize the product classification procedure with international requirements for this procedure, since its text complies with international standards.

- Determine the algorithm for including goods under a specific product item.

- Simplify the procedure for assigning a TN number to a product, since the rules themselves are step-by-step instructions for interpreting the product.

- Allows you to identify not only the product, but also their materials and components.

An example of using OPI 6 to determine a ten-digit product code

Distribution of product codes across the EAEU

For persons participating in the Euro-Asian circulation of goods, the use of the Commodity Nomenclature for Foreign Economic Activity is the main prerogative, since customs duties, prohibitions, restrictions, and non-tariff measures directly depend on this.

In order to distribute goods by class, using the basic rules for interpreting the Commodity Nomenclature of Foreign Economic Activity with the subsequent assignment of a code, an examination and the presence of certain technical knowledge of employees are required. For more objective statistics, the customs authorities introduced a classification of goods. The Euro-Asian Economic Union has provided certain measures for the control of goods through the adoption of the Customs Code of the Customs Union. Due to the fact that there are basic rules for interpreting the Commodity Nomenclature of Foreign Economic Activity of the EAEU, the member countries of this union can themselves determine the code of the product that crosses the border. In case of an error when assigning a code to a product, customs has the right to carry out this quotation at the request of a person interested in this operation. Also, customs authorities, guided by legislation, have the right to give explanations; make decisions and ensure the publication of information on specific types of goods.

Notes for rules

The principles by which goods are classified in headings are listed in the five rules above. As for the sixth rule, it defines sub-items and sub-items.

Should be considered:

- Rule 1 must be applied before all subsequent rules can be addressed.

- In the case where the first rule did not help with determining the code, you should be guided by the fact that for goods that have heterogeneous properties, the following subparagraphs are consistently applied (2.2; 3.1; 3.2; 3.3).

- Rules 2 and 6 can only be applied after the first rule.

- Rule 4 can only be used after it has been verified that the first rule under clause 3.3 did not match the acceptance code.

- Rule 6 can be applied together with subparagraphs (5.1; 5.2; 2.2), as well as separately in any order. For example, an unassembled scooter packed in a cardboard box falls under clauses 2.2 and 5.2.

To avoid errors when declaring, these rules should be applied. That is, a specific product is included in a product item, then a subitem is added according to the scheme, then a subitem. All these points are indispensable for this operation, since the declaration of goods and means of transport is carried out by the customs authorities. Compliance with the EAEU Commodity Nomenclature for Foreign Economic Activity is paramount and necessary.

The conditions under which the correct HS code is determined are the exact characteristics and name of the product itself, as well as the construction of the classifier itself with a meaning.