—

The basic rules for interpreting the Commodity Nomenclature of Foreign Economic Activity of Russia are an integral part of the Commodity Nomenclature of Foreign Economic Activity of Russia, which contain the fundamental principles for constructing a classification system and determine the algorithm for the sequential inclusion of a specific product in a certain product heading, and then in the corresponding subheading and sub-heading.

There are six basic rules of interpretation.

Rules 1-5 regulate the procedure for determining the four-digit product code, that is, they determine the rules for classifying a product as a particular product item.

Rule 6 applies once the four-digit product code has been determined and determines the further procedure for including the product in the appropriate subheading and subheading.

You can use the Classification Rules ONLY CONSISTENTLY, moving from Rule 1 to Rule 2, from Rule 2 to Rule 3 and so on until Rule 6.

You cannot “select”, for example, Rule 3(c), without first applying Rules 1, 2, 3(a), 3(6) - Only if it is impossible to apply any rule when classifying a product, we have the right to move on to to the next one. In practice, unfortunately, this is often forgotten and the rule that gives a quick but incorrect answer is used.

Rule 1

1. The names of sections, groups and subgroups are given only for the convenience of using the Commodity Nomenclature of Foreign Economic Activity of Russia in work; for legal purposes, the classification of goods in the Commodity Nomenclature of Foreign Economic Activity of Russia is carried out on the basis of the texts of commodity items and the corresponding notes to sections or groups and, unless such texts require otherwise, in accordance with the following provisions.”

Rule 1 begins by stating that the titles of sections, groups, and subgroups are “intended for convenience of reference only,” that is, they have no legal effect; they are used only for ease of search, but not for product classification.

Example 1.

It is logical to start searching for ship propellers made of steel or copper alloy in Section XV “Base metals and articles thereof”, but they will be classified in heading 8485, which relates to Section XVI “Machinery, equipment and mechanisms...”

The second part of this rule says that the classification should be carried out:

- in accordance with the names of commodity items (four-digit code) and Notes to sections and groups; at the same time, the names of product items and notes have the same status, therefore priority is given to texts with the most accurate description of the goods).

- if such names and notes do not require other interpretation, then in accordance with Rules 2, 3, 4, 5.

This provision (b) makes it quite clear that the names of items and Notes to sections and groups are priority, that is, they are taken into account primarily when classifying the goods.

Example 2.

In accordance with Rule 1, “Hand tools with a built-in gasoline engine” are not included in product item 8508, “Electromechanical hand tools with built-in electric motors,” as well as “Electromechanical hand tools with a non-built-in electric motor.” These products are not in the title of item 8508.

Example 3.

In Chapter 31 Fertilizers, Note 2 states that some headings relate only to certain goods. Consequently, these headings cannot be extended to cover goods which would have been covered under Rule 2(6).

Example 4.

Nozzles for deodorant cans are often classified under heading 3926 “Other products made of plastic aerosols, aromatic and other hygienic atomizers, their nozzles and heads;...”.

Thus, Rule 1 determines that the classification of goods begins with a search for the code of the product item in the name of which the name of the product is mentioned. The names of sections and groups serve only to determine the direction of the search.

The names of commodity items and the texts of Notes to sections and groups have the same legal force; Priority is given to the text containing the most accurate description of the product.

Sometimes the notes to a section or group contain many items that are excluded from that section or group. Sometimes it is useful to deliberately look for a product in a product position where it clearly cannot be found. By reading the notes to such a heading, you can see which specific goods are excluded from it. Sometimes among these exceptions the desired product is found.

When categorizing an item, be sure to read the Section Notes. Section notes apply to all groups included in this section.

Rule 2(a)

“Any reference in the name of a commodity item to any product should be considered, inter alia, as a reference to such a product in an incomplete or unfinished form, provided that, being presented in an incomplete or unfinished form, this product has the basic characteristics of a complete or complete goods, and shall also be construed as a reference to complete or complete goods (or classified in the heading in question as complete or complete by this rule), presented unassembled or disassembled.

Rule 2(a) applies if a product code is specified;

- disassembled;

- in which there are no parts included in the complete product;

- on which it is necessary to perform further technological operations so that it is ready for use (operation).

The first part of Rule 2(a) extends the coverage of any heading relating to a particular article to include not only the complete article, but also that article in an incomplete or unfinished form, provided that the incomplete or incomplete article has the essential characteristics of the complete or incomplete article. finished product.

Example 1.

A crankshaft forging ready for finishing will, under this rule, be classified as a finished crankshaft in heading 8483 “Transmission shafts...”.

Example 2.

An offset printing machine that only lacks a paper feeder is classified as an offset printing machine and not in the position designated for parts.

The second part of Rule 2(a) provides that complete or finished (completed) articles presented unassembled or disassembled are classified in the same headings as assembled articles. Goods are usually presented in this form based on the possibility of meeting the requirements for their packaging and transportation.

According to this Rule, “goods presented unassembled and disassembled” means products the components of which must be assembled using simple fastening material (screws, nuts, bolts, etc.) or, for example, riveting or welding, meaning: that only simple assembly operations are required.

Unassembled components of a product that exceed the quantity required to assemble the product must be classified separately.

Example 3.

A disassembled motorcycle, the parts of which, when assembled together, form a motorcycle without individual elements (muffler, fairing, etc.) is classified as a motorcycle, since it retains the main characteristics of the motorcycle.

Example 4.

The kit for assembling a wooden parcel box, consisting of top and bottom boards, horizontal and vertical posts, is an unassembled parcel box and is included in the same position as the assembled one.

Example 5.

A set of treated wood slats from which a hanger is made, but without a hook, will be classified as a finished hanger as it retains its essential characteristics.

Sometimes in the Nomenclature, incomplete or unfinished goods are specifically mentioned in the texts of headings that include complete or completed goods, for example, 9606 - “buttons and button blanks.” Obviously, in this case there is no need to use Rule 2(a).

Example 6.

Blanks for stoppers in accordance with Rule 1 are included in heading 4502 "Natural cork ... including blanks for stoppers)...", while finished stoppers are classified in heading 4503 "Products of natural cork".

Rule 2(b)

“Any reference in the heading to any material or substance shall also be construed as a reference to mixtures or combinations of that material or substance with other materials or substances. Any reference to a product made of a particular material or substance shall be construed as a reference to goods consisting wholly or partly of that material or substance. Classification of goods consisting of more than one material or substance is carried out in accordance with the provisions of Rule 3.”

While Rule 2(a) applies to incomplete or unfinished goods. Rule 2(6) applies in contrast to cases where the goods consist of more parts than are stated in the text of the heading.

Rule 2(6) applies only where the heading makes reference to the material or substance from which the goods are made.

Rule 2(6) clarifies that if in the TN FEA of Russia there is no commodity item in the name of which the name of the product being sought is listed, then it is necessary to highlight the main material from which the product is made and look for a commodity item that includes products made from this material. If the main material from which the product is made cannot be separated, Rule 26 for classifying such product is not applicable.

The rule expands any heading relating to a material or substance to include mixtures or combinations of that material or substance with other materials or substances.

Example 1.

Commodity item 4503 “Products made of natural cork” includes cork plugs with linings made of metal, plastic, etc.

Example 2.

The name of heading 0503 - “Horse hair and its waste, including in the form of a web with or without a backing” - already contains the possibility of including in it a composite product consisting of both horse hair and some base from a different material.

Example 3.

Leather clothing is classified in heading 42.03, although it also includes materials other than leather: plastic or metal zippers or buttons, textile or fur lining, etc.

This Rule also extends any heading covering goods made from that material or substance to include goods made in part from that material or substance.

This does not, however, widen the heading so much as to include goods which, under Rule 1, cannot be regarded as falling within the description of the heading. This occurs when the addition of another material or substance changes the nature of the goods, that is, it ceases to correspond to the given heading. In other words, Rule 2(6) does not apply if the presence of the addition of other material cannot be neglected. In this case, Rule 3 must be applied.

Rule 2(6) also does not apply in cases where the texts of the headings explicitly state that other materials cannot be present, for example, 2940 - “Sugars, chemically pure...”.

Example 4.

Commodity item 1503 "Lard stearin... not mixed." In this case, Rule 2(6) cannot be extended to this heading, since its title already contains a prohibition on mixtures of this substance with others.

Prepared mixtures described as such in Section or Chapter Notes or headings should also be classified in accordance with Rule 1.

Mixtures and combinations of materials or substances and goods made from more than one material or substance that can be classified under two or more headings must be classified in accordance with the principles of Rule 3.

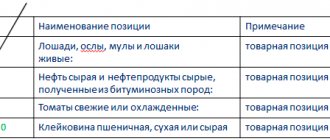

Concepts in the field of classification and coding of goods

Classification (from the Latin classic - rank, facere - to lay out) is the sequential distribution of a set of objects into certain subsets. The resulting system is called classification.

Classification of goods allows:

- identify general characteristics of product quality;

- study the structure of the product range, organize rational accounting of goods;

- correctly carry out economic transactions with goods (calculation of duties, etc.);

- maintain automated accounting of goods.

The object of classification is an element of the set being classified. A classification attribute is a property or characteristic of an object by which classification is made. One of the most important issues of classification is the correct choice of characteristic by which a particular product will be assigned to a certain group.

The main features of the classification of goods are:

- unity of technological production processes;

- direction or purpose of use of the goods;

- physicochemical characteristics

Coding of goods is the formation and assignment of a code to a classification group of goods and/or an object of classification. A product code is a sign or a set of signs used to designate a classification group and/or classification object. The purpose of coding is to systematize objects by identifying them, ranking them and assigning a symbol (code) by which any object can be found and recognized among many others.

A goods classifier is a systematic list of classified objects, which allows you to find a place for each object and then assign it a certain symbol (code).

Product nomenclature is a system of names and terms used in any branch of science, technology, or practical activity. Product nomenclature is a classifier of goods.

Top

Rule 3

This Rule provides for three modes of classification of goods which prima facie may be classified into two or more headings either under Rule 2(6) or for any other reason.

Rule 3 consists of three parts: 3(a), 3(6) and 3(c). These parts apply in the order in which they appear in this Rule: Rule 3(6) applies only when Rule 3(a) does not assist in classification, and if both Rules 3(a) and 3(6) do not result, then Rule 3(c) applies.

According to Rule 3(a), you must first try to classify the product according to the description of the product item that provides the most specific description of the product you are looking for.

If there is no such position, Rule 3(a) does not apply.

Rule 3(6) applies where it is necessary to classify mixtures, combined goods consisting of different components or goods included in a set for retail sale if it is possible for them to identify the material or component that determines the essential nature of the goods.

Rule 3(c) specifies that goods which cannot be classified by Rule 3(a) or 3(6) are classified in the last heading selected in ascending order of heading.

Rule 3 can only be applied provided that the names of headings and notes to sections and groups do not require other interpretation.

Example 1.

Note 4(6) to Chapter 97 states that heading 9706 Antiques over 100 years old does not fall within the earlier headings of Chapter 97 (ie an original engraving 150 years old would be classified in 9702 Original engravings, prints and photographs" and not in 9706). .

Methods for classifying goods

There are three classification methods: hierarchical, facet and mixed. The hierarchical method involves the sequential division of a set of objects into subordinate classification groups (subsets). Below is a diagram of the hierarchical method for classifying grape wines.

In hierarchical classification, the distribution of objects is made from a more general characteristic to a less general one, and each subsequent link specifies the characteristic of a higher level. The main advantage of hierarchical classification is its large information capacity, ease and familiarity of use. The disadvantage is the weak flexibility of the structure and the pre-established order of distribution stages, which does not allow the introduction of new objects and characteristics in the absence of reserve capacity. The number of features and steps determines the depth of classification. The depth of classification can theoretically be infinite, but in practice such classification is too complex, so if you need to increase the number of features, then use the facet classification method.

The facet classification method is a parallel division of many objects into independent classification groups (facets). The peculiarity of the facet classification is that the individual facets do not depend on and are not subordinate to each other; each facet, belonging to the same set, characterizes only one of the sides of this set. Classification groupings in facet classification are formed from objects taken from the corresponding facets. The advantage of facet classification is the flexibility of the structure, since changes in any one of the facets do not affect the others. The disadvantage of facet classification is the insufficient use of capacity, the unfamiliarity of application, as well as the difficulty of using this method for manual information processing. Each classification method has its own disadvantages and advantages, so in some cases both methods are used at once ( mixed method ).

Top

Rule 3(a)

“Preference is given to the product item that contains the most specific description of the product over product items with a more general description. However, when each of two or more headings relates only to part of the materials or substances included in a mixture or multi-component article, or only to individual parts of the goods presented in a set for retail sale, then these headings should be considered equivalent in relation to this product, even if one of them gives a more complete or accurate description of the product."

The first method of classification is found in Rule 3(a), under which a heading that describes a good more specifically is given preference to a heading that describes a product more generally.

If a product performs two or more functions described by different product items, it is necessary to establish which of these functions is decisive.

Example 1.

An apparatus for sealing the lids of cans is included in heading 8422 “Dishwashing machines... equipment for filling and capping bottles...”, and not in heading 8468 “Equipment and apparatus for soldering...”, as the first of them contains a more complete description of the functions of the product.

Example 2.

Textile floor mats for automobile interiors are not to be classified as accessories for automobiles in heading 87.08, but rather in heading 57.03, Carpets and other textile floor coverings, where they are more specifically described as carpets,

Often when classifying a product, a conflict arises between the position describing the function the product performs and the position describing the material from which the product is made.

SKUs that describe the functions of the products are generally preferred.

Example 3.

A rubber police baton is included in heading 9304 “Other weapons ... for example, batons)”, and not in heading 4017 “Hard rubber ... products made of hard rubber.”

However, when classifying parts or accessories, product headings that describe the material from which the parts or accessories are made are often preferred.

Example 4.

Tempered glass for use in aircraft should not be classified in heading 8803 "Parts of aircraft...", but in heading 7007 "Safety glass...".

Where two or more headings refer only to part of the materials or substances included in a multi-component article, or only to individual goods included in a set for retail sale, then these headings should be treated as equally specific, even if one of gives a more complete or accurate description of them than others. In such cases, classification must be made under Rules 3(6) and 3(c), since the application of Rule 3(a) in this case may lead to incorrect results.

Example 5.

Conveyor belts made of plastic (60% of the total weight and value of the belt) and vulcanized rubber (40% of the total weight and value of the belt) may be included in heading 3926 “Products of plastic Conveyor belts ... of vulcanized rubber.” Heading 4010 more precisely defines the material and further specifies the function performed by the product. However, the second sentence of Rule 3(a) prohibits its application in this case, and in accordance with Rule 3(6) (see below) the goods are classified according to the material that gives the product its main property - plastic, based on its weight and cost. The provisions of Rule 3(a) do not apply to “basket” headings, which are used only when the goods are not included in any heading of a specific description.

Basic moments

Russia is a member of the Eurasian Customs Union, within the framework of which it conducts close trading activities with the countries that are members of this association.

Exported and imported goods are transported through customs, where they are subject to mandatory registration and are also subject to customs duties.

The Commodity Code for Foreign Economic Activity, which is uniform and valid in all countries of the EAEU, allows determining the amount of the penalty, as well as the rules for transporting goods.

What it is

OPI TN VED stands for the basic rules of interpretation in the commodity nomenclature of foreign economic activity.

They represent an algorithm for determining the assignment of a product used in foreign economic activity to a certain group according to the classifier.

The commodity nomenclature of foreign economic activity is a classifier of goods that are used for international trade within the Eurasian Customs Union, of which the Russian Federation is a member.

It is used by customs authorities and participants in international trade when processing export and import transactions.

Before deciding on the meaning of classification rules, it is necessary to first understand the use of the classifier itself.

They include 21 sections that unite 99 product groups. Please note that as of today, three of these groups, defined as 77, 98 and 99, are reserved.

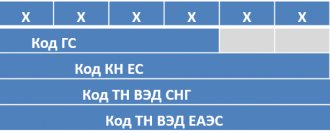

The code itself used by this classifier consists of 10 digits. Let's consider their meaning in more detail:

| First two digits | Determine the product group |

| Then two more digits are added | And already a four-digit number indicates the product position |

| The products are further divided into subitems | Which is determined by a combination of the first 4 digits plus two more |

| Full code | Defines a commodity subposition, which is marked with 10 digits and is included in the customs declaration |

The code is determined by customs officials, but the person filling out the declaration bears responsibility for errors made.

When using a product classification note, the following factors are taken into account:

- material;

- product functions;

- degree of processing;

- units of quantitative measurement.

Please note that the product nomenclature code does not contain the numbering of the section into which the classifier is divided. Why? This will be discussed later.

What are they needed for

Rules are needed to determine the order in which a product is assigned to a particular group in the classifier.

The classifier itself is necessary to simplify customs operations that involve filling out documentation.

This classifier is necessary for equal identification of products in all countries that are members of the Eurasian Customs Union.

The code determined by the classifier is required for inclusion in customs documentation. Based on this information, the collection of duties is calculated and special measures are applied, if such are provided for by law.

Please note that the nomenclature contains information only about the goods being transported.

It does not characterize the country of origin, official dealer or other persons related to the transportation of products.

Application of the basic rules for using the Commodity Nomenclature of Foreign Economic Activity allows you to accurately determine the coding of a product.

Legal basis

The main regulatory act that provides the basis for the activities and development of other laws by the participants of the Customs Union of the Eurasian Countries is the Customs Code of the Customs Union.

It, like other acts, is part of international trade law within the Eurasian Customs Union.

The following can be distinguished from them:

| List of goods (indicating CU FEACN codes) | In respect of which Kazakhstan applies reduced rates of customs duties (until 2015) |

| Decision of the Customs Union Commission | “On the Unified Customs and Tariff Regulation of the Customs Union” No. 130 of November 27, 2009 |

The following rules apply to certain categories of goods:

| Decision of the CCC dated September 20, 2010 No. 394 | “On the classification of polyurethane foam” |

| Decision of the CCC dated 08.12.2010 No. 498 | “About the classification of the BLUETOOTH headset” |

| Decision of the CCC dated 03/02/2011 No. 555 | “On the classification of household and industrial meat grinders” |

| Decision of the CCC dated 03/02/2011 No. 557 | “On the classification of medical hygroscopic non-sterile cotton wool” |

| Decision of the CCC dated 03/02/2011 No. 558 | “On the classification of the RAS 6000 system (radio communication stations with subscribers)” |

The classifier itself is also a normative act, like a set of rules. Among the internal regulations, one can highlight the Tax Code, which fixes the payment of a duty, the amount of which is determined according to this classifier.

In case of violation of the rules of declaration when transporting goods participating in the foreign economy, Article 16.2 of the Code of Administrative Offenses of the Russian Federation is applied.

Rule 3(b)

Mixtures, multiple-component articles consisting of different materials or manufactured from different components, and goods presented in sets for retail sale, the classification of which cannot be made in accordance with the provisions of Rule 3(a), shall be classified according to the material or component which determine the essential nature of the goods in question, provided that this criterion is applicable.”

The scope of Rule 3(6) is:

- mixtures,

- combined products consisting of different materials,

- combined goods consisting of different components,

- items included in the kit for retail sale.

It is used only if application of Rule 3(a) fails.

In all these cases, the goods must be classified as if they consisted of a material or component that determines their essential characteristic, if such a criterion is acceptable.

Factors that determine the main characteristic may vary depending on the type of product. They may, for example, be determined by the nature of the material or component, its volume, quantity, weight or value, or the role played by the constituent material or component in the use of the product.

Example 1.

An example of the use of Rule 3(6) in the case of a combined product consisting of different materials (conveyor belt) is given in the previous paragraph.

A combined product made from various components is considered not only to be a product in which the components are attached to each other, forming practically one inseparable whole, but also goods with separable components, provided that these components are adapted to each other and complement each other and taken together form a whole that cannot be presented for sale in the form of separate parts. As a rule, the components of such combined products are placed in a common package.

Example 2.

A set for home storage of spices, consisting of a special stand (usually wooden) and an appropriate number of empty glass containers for spices, is classified in heading 7010 "Bottles, ... jars, ... and other similar glass articles" if these glass containers are a defining part of the set by cost and weight.

When applying this Rule, the concept of “goods included in a set for retail sale” refers to goods that:

- consist of at least two separate goods classified under different headings. For this reason, for example, a set of six forks cannot be considered as a set for retail sale for purposes of this Rule;

- consist of products or articles assembled together to perform a specific function;

- packaged in such a way that repackaging is not required when sold to the consumer (for example, in boxes or crates).

This concept therefore covers sets consisting, for example, of different food products that are to be used together to prepare a ready-to-eat dish or meal.

Example 3.

A drawing set consisting of a ruler (9017), a disk calculator (9017), a protractor (9017), a pencil (96091 and a pencil sharpener (8214), placed in a plastic case (4202), are classified in heading 9017, since most of the goods in the set are included in it.

Example 4.

Hairdressing set consisting of an electric hair clipper (heading item 8510), comb (9615), scissors (8213) and brush (9603). packed in a plastic case (4202), included in heading 8510 “Electric shavers, hair clippers...”, which includes the main element of the set at cost.

For the sets mentioned above, classification is made by the component or components taken together and considered as giving the set its specific character.

This Rule does not apply to goods consisting of separately packaged parts, both assembled (in one package) and disassembled, as well as parts in certain proportions intended for industrial production (for example, for the production of alcoholic beverages).

When classifying sets, one should remember Rule 1, which prohibits the application of Rules 2-6 in the event that the texts of headings and Notes to groups and sections contain special clauses for the classification of these sets

Example 5.

First aid kits are not included in the heading describing the main component of this kit, but in subheading 3006 50 000 0 “Sanitary bags and first aid kits”.

Example 6.

Sets of knives (heading 82.11), forks and similar cutlery (heading 82.15) fall in heading 81.15 if the number of knives in the set does not exceed the number of other articles (Note 3 to Chapter 82).

Determination of the HS code

The commodity nomenclature of foreign economic activity of the Eurasian Economic Union ( TN VED EAEU ) is a classifier of goods in the form of a list of these goods with a code assigned to each of them.

The EAEU HS code consists of ten digits. But a small number of products have an additional 4 digits, i.e. their code consists of 14 digits. The first 2 digits are called a group, up to the fourth digit is a product item, up to the sixth is a subitem, and the rest are called a subitem.

For example, sprats in cans with a key have the code 1604139000 1210. Then “16” is a group, “1604” is a position, “160413” is a subposition, and “1604139000 1210” is a subposition. This example is one of the few options for 14-digit codes. Most codes still have 10 characters.

In the declaration of goods (DT), the code is indicated in gr. 33 of each product declaration.

The product nomenclature itself, as a document, represents the basic rules of interpretation (GRI), the nomenclature itself and notes. It is precisely to determine the HS code that rules have been created - OPI, and to distinguish between sections, groups, and sometimes subitems, there are notes to them that explain some concepts and have legal force. Also in the notes there are definitions of some terms whose meaning differs from the dictionary or commonly used ones.

Another very important point: you need to pay special attention to punctuation marks: commas and semicolons. Commas are used for simple enumeration, and then the entire description is applied to all listed components. A semicolon is intended to describe a completely new product to which the previously specified information does not apply.

Let's move on to choosing the HS code. To do this, you need to use the rules - OPI.

Basic rules of interpretation (GRI).

Rule 1 reads as follows: “The names of sections, groups and subgroups are given only for ease of use of the Commodity Nomenclature of Foreign Economic Activity; for legal purposes, the classification of goods in the Commodity Nomenclature of Foreign Economic Activity is carried out on the basis of the texts of commodity items and the corresponding notes to sections or groups and, unless otherwise provided by such texts, in accordance with the following provisions.”

The fact is that for ease of use, the nomenclature is divided into sections, groups and subgroups. But to select a code, you must use the description of product items, i.e. where there are four numbers, and notes for sections or groups. Those. To select a code, not only must the item-level description match your product, but also that the product meets the instructions in the notes. The algorithm is as follows: select a group by description, then a position, open the notes for the section in this position, then the notes for the group. If everything that is indicated in the note applies to your product, then the selected item may be one of the options. Why one of the options? The Commodity Nomenclature of Foreign Economic Activity is so diverse that there may be several descriptions suitable for your product. We select all possible options and move on to the next rule.

Rule 2 consists of two parts:

a) “Any reference in the title of a heading to any goods shall also be considered as a reference to such goods in an incomplete or unfinished form, provided that, being presented in an incomplete or unfinished form, such goods have the essential property of a complete or completed goods, and shall also be construed as a reference to a complete or complete good (or classified in the heading in question as complete or complete by virtue of this Rule) presented unassembled or disassembled.”

Part of this rule applies to goods in incomplete or unfinished form, but only on condition that such goods have the basic properties of the product specified in the heading. These can also be blanks, if they are not named separately. Semi-finished products, if they do not have the characteristic shape of finished products, are not considered blanks.

The second part of the rule talks about goods that are delivered unassembled or disassembled. We classify it as an assembled product. As a rule, the goods are delivered in this form for ease of packaging and transportation. And only assembly operations need to be applied to them. But all parts must be complete to assemble a certain number of products. All parts remaining after assembly must be classified separately.

b) “Any reference in the heading to any material or substance shall also be construed as a reference to mixtures or combinations of that material or substance with other materials or substances. Any reference to a product made of a particular material or substance shall be construed as a reference to goods consisting wholly or partly of that material or substance. Classification of goods consisting of more than one material or substance shall be carried out in accordance with the provisions of Rule 3.”

It says here that mixtures of goods and substances belong to the headings in which this material or substance is indicated. But if a mixture or combination of materials can be classified into two different positions, then go to rule 3.

Rule 3:

“Where, by virtue of Rule 2(b) or for any other reason, there is, prima facie, the possibility of classifying goods under two or more headings, the classification of such goods shall be as follows:

a) Preference is given to the product item that contains the most specific description of the product, compared to product items with a more general description. However, when each of two or more headings relates only to part of the materials or substances included in the composition of a mixture or multicomponent article, or only to part of the goods presented in a set for retail sale, then these headings should be considered equivalent in relation to that product, even if one of them gives a more complete or accurate description of the product.

b) Mixtures, multi-component articles consisting of different materials or made from different components, and goods presented in sets for retail sale, the classification of which cannot be made in accordance with the provisions of Rule 3(a), shall be classified according to that material or component. parts that give the goods an essential property, provided that this criterion is applicable.

c) Goods which cannot be classified in accordance with the provisions of Rule 3(a) or 3(b) shall be classified in the heading last in ascending order of codes among the headings equally eligible for consideration in the classification of those goods. ."

This rule describes three methods of classification in cases where a product can be classified into several headings. These methods are applied sequentially, i.e. rule 3b is used when it is impossible to apply 3a, and 3c only after 3b.

Rule 3a states that when choosing a product item, you should choose the one where the description of your product is more accurate. But it does not apply if this description only applies to part of the product, set, material, substance - in this case, we move on to rule 3b.

Rule 3b applies to mixtures, to multi-component goods consisting of different materials or components, to goods included in a set for retail sale. In such cases, the code is determined by the component that gives the main property of this product. As for the sets, they must be packaged for retail sale and follow the same purpose, need, performance of a specific action, and the products from these sets would be separately classified in different product headings. This rule does not apply to parts packed separately, even if they are in the same general package.

Rule 3c is used when it is impossible to apply rules 3a and 3b. From several product items suitable for your product, choose the last one in order of increasing code.

Rule 4 : “Goods, the classification of which cannot be carried out in accordance with the provisions of the above Rules, are classified in the heading corresponding to the goods most similar (close) to the goods in question.”

We come to this rule only if the first three do not apply. Select the code with the closest description to your product.

Rule 5 : “In addition to the above provisions, the following Rules shall apply to the following goods:

a) Cases and cases for cameras, musical instruments, guns, drawing supplies, necklaces, as well as similar containers, specially shaped or adapted to accommodate the corresponding product or set of products, suitable for long-term use and presented together with the products for which it is intended , must be classified together with the products packaged in them, if this type of container is usually sold together with these products. However, this Rule does not apply to containers, which, forming a single whole with the packaged product, give the latter its main property.

b) Subject to the provisions of Rule 5(a) above, packaging materials and containers supplied with the goods they contain shall be classified together if they are of the kind normally used for packaging those goods. However, this provision is not mandatory if such packaging materials or containers are clearly suitable for reuse."

Rule 5a applies to special durable containers for a certain type of product, such as covers, cases, etc. Such packaging is coded together with the product packaged in it, if this product is supplied together with such packaging. But the presence of this packaging should not change the basic properties of the product itself.

Rule 5b governs the classification of packaging materials and containers commonly used for packaging the goods to which they relate. However, this provision does not apply in cases where these packaging materials or containers can clearly be reused, for example, some ferrous cylinders or tanks for compressed or liquefied gas. This rule is applicable subject to the provisions of Rule 5a.

Rule 6 reads as follows: “For legal purposes, the classification of goods in the subheadings of a heading shall be in accordance with the names of the subheadings and the notes relating to the subheadings and, mutatis mutandis, the provisions of the above Rules, provided that only the subheadings at the same level are comparable. For the purposes of this Rule, appropriate section and chapter notes may also apply unless the context otherwise requires."

When the product item has already been determined, we move on to rule 6. We use the text of the subitems, notes to it and rules 1-5 for further classification. Subheadings are comparable at only one level (i.e. with the same number of hyphens before the subheading description).

Using our example, we will explain the choice of code. So, the following product is given: canned food - sprats in oil in a tin jar that has a key.

The word “sprats” appears in the following descriptions of commodity items: 0302, 0303, 0305, 1604.

We carefully read the descriptions of these positions and draw conclusions:

0302- not suitable, because our product is not fresh or chilled fish;

0303- not suitable, because it is not frozen fish;

0305 - seems to fit the description, but we study the notes, where we see that this item does not include canned fish in oil.

Position 1604 remains. We carefully study the notes to section 1, to group 16, to position 1604. They do not exclude our product and match the description. Then we go further along the structure: there is a division into fish whole or in pieces, into other fish and into caviar. Our sprats are whole fish - we choose the first option. We go there and see the division into subitems by type of fish. We find sprats there - this is subposition 160413. We go further, where we see the division into sardines and others. Because We don’t have sardines, then we move on to others. There is division again - we go to sprats. And there we already see a division by type of packaging. Let's go to where the tin cans are. And then we finally select the code for the cans with a key - 1604139000 1210. And if the same product had cans that do not have a key to open them, then at the end of the code there would be a value ... 1290.

Above is a fairly simple example of code selection. But choosing a code is not always so easy and unambiguous. There are often pitfalls. To take them into account requires a lot of experience. Sometimes even the very fact of having sufficient information about the product and documents describing it can affect the code. There is only one recommendation - contact specialists.

If you did not find the answer to your question in this material, then write to [email protected] and I will soon update the article.

Return to list of articles

If you find an error, please select a piece of text and press Ctrl+Enter.

Rule 3(c)

“Goods which cannot be classified in accordance with the provisions of Rule 3(a) or 3(6) shall be classified in the heading last in ascending order of codes among the headings equally eligible for consideration in the classification of those goods. »

When the question of classification of goods cannot be decided by Rule 3(a) or 3(6), they should be classified in the heading last in order among those to which they are equally likely to fall.

This rule allows you to resolve situations where none of the “competing” product items provide a sufficiently complete description of the product or when it is impossible to determine the material or component that gives the product its main property.

Example 1.

A men's jacket consisting of leather (heading 42.03) and knitwear (heading 61.03) cannot be classified under Rule 2(6) by extending the scope of those headings. The application of Rule 3(a) is excluded due to the fact that each heading includes only part of the materials of the goods. Classification based on Rule 3(6) is not possible since neither of the two materials dominates in terms of mass, volume or function. In this case, Rule 3(c) should be applied and the jacket should be included in the last sequential number of the two “competing” positions - in position 6103 “Suits, sets, jackets ... knitted ...”.

Classification of chemical elements

This is the case when natural classification helped make a real breakthrough in science.

The Russian scientist Mendeleev was able to identify the relationship between the properties of chemical elements and their atomic mass. As a result, all elements were ordered and sorted according to the periodic table.

The classification led to scientific discoveries:

- Mendeleev left gaps in the table, predicting the existence of chemical elements that had not yet been discovered at that time.

- Some elements had incorrectly calculated atomic masses. The scientist was able to find these inaccuracies and correct them.

- Discovery of the periodic law: the properties of elements begin to repeat periodically with increasing mass. For example, fluorine is similar to chlorine, and gold is similar to silver.

Rule 4

“Goods, the classification of which cannot be carried out in accordance with the provisions of the above Rules, are classified in the heading corresponding to the goods most similar (close) to the goods in question.”

This Rule applies to goods that cannot be classified according to Rules 1 - 3. It, unlike Rule 3, is used if none of the headings is suitable for classifying the goods, and provides for the classification of such goods in the heading , which includes the products closest to them.

Rule 4 provides for the classification of such goods in the heading to which the goods closest to it belong.

When classifying according to Rule 4, it is necessary to compare the presented goods with similar goods in order to determine the most similar (similar) goods. Similarity can be determined by various factors, such as the material of manufacture, the functions performed by the product, the method of production, appearance, and purpose.

In practice, this rule is used very rarely, since many groups have basket positions of the “Other” type.

Rule 5(a)

Rules 5(a) and 5(6) apply to the classification of goods of a certain type, namely containers and packaging materials.

“Cases and cases for cameras, musical instruments, guns, drawing supplies, necklaces, as well as similar containers (packaging) that have a special shape and are intended for storing the corresponding products or a set of products, suitable for long-term use and presented together with the products, for which it is intended must be classified together with the products packaged in it. However, this rule does not apply to containers (packaging), which, forming a single whole with packaged products, gives the latter a significantly different character.”

This Rule applies only to packaging materials that:

- are shaped or adjusted in such a way as to contain a specific product or set of products, that is, designed specifically for a specific type of product. Some of the containers follow the shape of the products they contain;

- suitable for long-term use, that is, they have the same durability as the products themselves for which they are intended. These containers also serve to ensure the safety of products when they are not in use (for example, during transportation or storage). These features distinguish them from conventional packaging;

- are presented together with the products for which they are

- are intended, regardless of the fact that the products themselves may be packaged separately for ease of transportation;

- are sold together with the product.

Example 1.

Packaging materials presented with the product for which they are intended, which should be classified in accordance with this Rule:

Jewelry boxes and boxes (commodity item 7116 “Products made of natural or cultured pearls...”);

Cases for binoculars (commodity item 9005 “Binoculars, monoculars...”):

Holster for revolvers (commodity item 9303 “Firearms...”)

Example 2.

Packaging materials not subject to Rule 5(a) are packaging materials such as silver teapots or decorative ceramic sweet vases.

Presented separately, packaging materials are included in their product items!

Rule 5(b)

“Subject to the provisions of Rule 5(a) above, packaging materials and packaging containers supplied with goods shall be classified together if they are of the kind normally used for packaging the goods. However, this provision is not mandatory if such packaging materials or packaging containers are clearly suitable for reuse."

Rule 5(6) governs the classification of packaging material and packaging containers other than those covered by Rule 5(a). These packaging materials must satisfy the following conditions:

- they must be presented together with the goods they contain;

- they must be packaging of the usual type used for the product.

Example 1.

Plastic bottles for mineral water are included together with mineral water in heading 2201 “Waters, including natural or artificial minerals...”.

Example 2.

Cardboard boxes for washing powder are included together with washing powder in heading 3402 “Organic surfactants... detergents...”.

Rule 5(6) does not apply where packaging materials and packaging containers can clearly be reused, such as milk and beer bottles, metal cylinders and compressed or liquefied gas tanks.

This Rule is secondary to Rule 5(a) and therefore the classification of covers, cases and the like containers referred to in Rule 5(a) shall be in accordance with Rule 5(a).