Customs legislation imposes numerous requirements on participants in international trade and transported goods. Hundreds of goods move across state borders every day; flows of goods from China, near and far abroad countries are sent to border inspection points, where they undergo customs clearance of goods.

Passing it is a difficult task even for a professional. This is due to the peculiarities of the application of customs regulations. Currently, two laws on customs regulation are in force in Russia simultaneously: the previously adopted (old) No. 311-FZ dated November 27, 2010 (in part) and the new No. 289-FZ dated November 28, 2018 (some provisions will come into force gradually). In addition, the passage of customs procedures is regulated by the EAEU Customs Code, dozens of by-laws and departmental acts, as well as more than 20 international agreements.

What is customs clearance of goods

Keep records of exports and imports using the simplified tax system in the Kontur.Accounting web service.

Currency accounting and work instructions, taxes, automatic payroll calculation and sending reports in one service Get free access for 14 days Before importing into Russia, you can wash the truck that will deliver your cargo. It will be more pleasant for customs officers to inspect him. But this has little to do with the cleaning procedure.

Customs clearance is a set of steps you must take to successfully clear customs. This is registration of a contract, collection and provision of documents, selection of the HS code, declaration, payment of fees, duties and taxes.

Import Clearance Procedure

Customs clearance of imports involves the implementation of a number of actions to confirm the compliance of the imported cargo with the requirements of national legislation, as well as the preparation of the necessary documents and payment of import duties. Chapter 20 of the EAEU Labor Code is devoted to the import procedure.

The process of clearing imported goods can be divided into several stages:

- arrival of cargo to the territory of the vehicle;

- clearance of customs transit or placement of goods for temporary storage;

- declaration of cargo and payment of mandatory duties and fees;

- release of goods (conditionally or for free circulation).

To undergo customs procedures you will need to present the following documents:

- foreign trade contract;

- invoice;

- transport documents: waybill (according to international form), packing list;

- cargo declaration (can be submitted electronically);

- title documents in relation to the transported cargo;

- permitting documentation for the product (if necessary).

It is better to calculate the fees and pay them in advance. For all countries of the Customs Union, the import fee is the same. The Code allows for the right of each state to establish seasonal duties on goods according to the approved list.

Note: since the formation of the EAEU, importers do not need to undergo customs clearance several times at the border of each state. Submission of the declaration and payment of duties occur once along the entire route of the cargo through the territory of the EAEU.

Regulatory acts regulating customs clearance

Keep records of exports and imports using the simplified tax system in the Kontur.Accounting web service. Currency accounting and work instructions, taxes, automatic salary calculation and reporting in one service Get free access for 14 days

Customs clearance, like all procedures of foreign economic activity, is regulated by the following basic acts:

- Customs Code of the Eurasian Economic Union;

- Federal Law No. 311-FZ “On customs regulation in the Russian Federation” dated November 27, 2010;

- Law of the Russian Federation No. 5003-1 “On customs tariffs” dated August 3, 2018.

Types of clients we work with

Legal entities Individual entrepreneurs

Our services are in demand by legal entities and individual entrepreneurs conducting foreign economic activity.

Exporters and importers contacting the Canavara Group holding represent different areas of activity.

We provide services to manufacturers, industry associations, trading houses, trading and many other companies.

Registration of a foreign economic contract

An important step is registering a contract with a foreign company with a bank. This procedure was introduced on March 1, 2021 instead of the transaction passport. To register, provide the bank with a foreign contract and details of the foreign partner. If other documents are required, employees of the bank where the contract is registered will inform you.

A foreign economic agreement may not be registered in the following cases:

- carrying out export operations in the amount of up to 6 million rubles;

- carrying out import operations and concluding loan agreements in the amount of up to 3 million rubles.

What additional documents are needed to clear customs?

In addition to the standard requirements already listed, customs services are given the legal opportunity to request clarifying information and documentary evidence, which, in the opinion of responsible officials, is necessary to clarify controversial issues. So, for example, to confirm the declared value of the declared goods, you may need:

- Commercial price lists and specifications from the selling party.

- Cost calculation and available official proposals.

- Agreements stipulating the possibility of implementation on the territory of the Russian Federation.

- Accounting statements confirming acceptance and placement on the balance sheet.

- Statements, invoices, financial documentation.

In situations where a customs broker or other specialized service is involved in participating in a foreign trade transaction, or another specialized service that assumes obligations for the prompt preparation of a declaration, confirmation of the contractual relations concluded with the representative must also be provided.

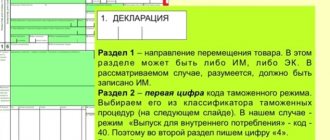

Selection of the EAEU HS code

Keep records of exports and imports using the simplified tax system in the Kontur.Accounting web service. Currency accounting and work instructions, taxes, automatic salary calculation and reporting in one service Get free access for 14 days

In addition to the documents, select the HS code. An incorrectly selected code will delay the customs clearance procedure, entail additional costs and even fines. What is a Commodity Nomenclature for Foreign Economic Activity code and how to choose it, read our articles “Commodity Nomenclature for Foreign Economic Activity Code” and “Directory of Commodity Nomenclature for Foreign Economic Activity” codes.

Using the HS code, you can find out the VAT rate levied on the goods, customs duties, the need for certification and licensing, and the presence of customs quotas for imported cargo.

Customs clearance of exports in STT Logistics

works as a customs representative, as well as a cargo transportation and warehouse logistics operator. We provide export clearance at customs, preparation of documents for this, international cargo transportation for delivery of goods to the recipient, placement of consignments in warehouses with their subsequent processing (packing, repackaging, labeling).

Advantages:

- We help speed up export clearance, provide preliminary declaration, support control procedures;

- we guarantee the correct organization of the export procedure: preparation of the necessary documents, certification, licensing, classification according to the Commodity Nomenclature of Foreign Economic Activity, calculation of the amount of mandatory payments;

- We optimize mandatory payments and other costs of foreign trade activities: we effectively plan logistics, help reduce duties and fees, eliminate delays and minimize risks;

- We work reliably: the company's professional liability is insured. Experience in organizing international transportation and supporting customs clearance procedures - since 2005. We work with almost any exported goods, including complex and project cargo.

STT Logistics has an affiliated customs warehouse. Export clearance is possible at any customs post.

Declaration and determination of customs value

The goods declaration itself is a difficult document to fill out. But the main difficulty is to indicate the correct customs value. It includes: contract costs, certification and licensing costs, insurance, delivery, and so on. At first glance, its calculation is quite simple.

But at this stage, a “conflict of interest” is clearly visible. The high cost is of interest to customs, since taxes, duties, excise taxes and fees are charged on it. Therefore, employees will require all documents confirming the customs value you indicated.

Advantages

QUALITY

We carefully monitor the quality of the services provided, thanks to which we have earned the trust of numerous clients.

Price policy

Individual delivery conditions for each client.

Reliability

We ensure the safety of cargo at all stages of transit.

Speed

We guarantee prompt delivery and customs clearance of goods.

Innovation

We are developing dynamically and keeping up with the times.

Versatility

We do not leave any client unattended.

Payment of taxes, excise taxes, duties and fees

Keep records of exports and imports using the simplified tax system in the Kontur.Accounting web service. Currency accounting and work instructions, taxes, automatic salary calculation and reporting in one service Get free access for 14 days

Payment of mandatory payments is a necessary condition for the release of goods from customs. LLCs and individual entrepreneurs on the simplified tax system or UTII at this stage are faced with an unpleasant surprise - they are obliged to pay VAT on an equal basis with everyone else, although they are exempt from it on the domestic market. Simplified tax deductions cannot be accepted. Companies and entrepreneurs on OSNO retain this right. Read about refunds in our article “VAT refund on imports”.

In addition to VAT, you will pay fees and customs duties. The duty rate is calculated based on the HS code. For excisable goods, excise tax is also paid.

Import documentation

Commercial activities related to the import of products from abroad require the mandatory payment of duties and also require the provision of a larger number of accompanying documentation certifying the import permit. In preparation for declaring imported goods, you will need to draw up a standard package containing:

- A certified copy of the current contract, with additional agreements, attachments and specifications.

- Invoice, that is, an invoice for payment for delivery.

- Payment orders confirming an advance payment - if such a requirement is contained in the terms of the transaction.

- Logistics customs documents are various types of invoices, contracts for the provision of transport services and insurance, receipts for payment for transportation.

- Documentation containing basic information about the transported cargo, including name, description, quality and technical characteristics.

- Financial statements showing timely payment of fees and charges.

- A packaging package issued at the shipping warehouse for each item being transported.

- Documentary confirmation of the permit issued for the import of products.

In cases where the language of the foreign counterparty was selected by default, certified translations will also be required. In addition, the above list can be expanded if this is due to the specifics of the imported product or the peculiarities of the concluded transaction. Legislative provisions determine the right of customs to request any materials related to the implementation of a contract, intermediary operations (logistics), or directly with the cargo.

Organizations importing any types of products into the Russian Federation for the first time must also provide a package of constituent and banking documents, including reports on financial activities. In addition, it is worth paying attention to regulations that are not restrictive, but rather motivational in nature. So, for example, the optional list includes a certificate of origin, which allows you to determine the country in which the goods in question were manufactured or produced. Despite its secondary status, it allows you to receive certain benefits that reduce the amount of deductions.

What does this status mean?

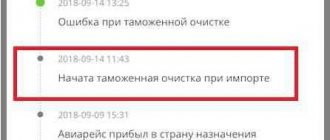

“Customs clearance for import has begun” is an important status when tracking the track number, which indicates that the parcel is undergoing customs control and verification of document compliance with all shipping standards.

Import customs clearance status in AliExpress

Customs clearance is often called a word more familiar to the mass consumer - customs clearance. Every shipment goes through this process, be it goods from AliExpress, Pandao, Joom, or a large number of materials purchased in bulk. Naturally, companies do not carry out the procedure on their own - this only delays customs clearance, and hence the delivery time to the recipient.

Where does the package go next?

After successful completion of the operation, the parcel continues its movement within the recipient’s country (with the exception of transit through the state).

The next stage is the passage of one/several ASC (Automated Sorting Center). This organization of the Russian Post is engaged in sorting, additional verification and logistics redirection of shipments for speedy arrival.

Sorting and distribution in the ASC of Russian Post

The last point includes competent route planning, including side factors - overload of departments, delays. After processing by several departments of postal services, the parcel is delivered to the regional, and then to the district Post Office. This stage is considered final - after its implementation, the recipient is sent a ZK notification about the arrival of the parcel/parcel/registered letter.

How long do we have to wait?

On average, the stage under consideration takes from several days to a week - provided there are no problems with documentation and timely payment of mandatory payments.

Further movement of the parcel (without delays) - on average 1-2 weeks, depending on the distance of the region from the checkpoint, the number of intermediate ACCs, and other sorting organizations. As a result, you only have to wait about 2-3 weeks, of course, if you successfully complete each of the verification/redirection stages.

What does the list of documents depend on?

The fact that the legislative norms do not provide a single standard list that would define all forms and forms required to be submitted is due to the influence of a number of factors on the completeness:

- international transaction format;

- regime applicable to the cargo;

- type of procedure chosen;

- the method of mutual settlements specified in the contract;

- nomenclature codification;

- the presence of special requirements or restrictions;

- specifics of the organization's commercial activities.

Before a shipment reaches the border, existing regulations should be clarified. This can be done both through services acting as intermediaries and from representatives of regulatory authorities.