Export of goods (EC10) is an export customs procedure relating to all goods exported from the territory of the EAEU member countries. The products are exported permanently, and after registration they lose the status of Union goods. However, the possibility of return remains available for 3 years - to do this, you need to preserve the appearance of the product and use the re-import procedure.

Customs broker “Svarog” is a reliable and competent assistant in completing the “Export 10” procedure. We know the specifics of working with different categories of goods, in practice we have studied all the pitfalls and internal requirements of regulatory authorities, therefore we guarantee prompt and, most importantly, trouble-free passage of EC10 for individual entrepreneurs, individuals and legal entities.

Basic information

The main task of EC10 is to control exports, check for the presence of valuable or prohibited cargo, and also resolve the issue of collecting payments required by law. In addition, the procedure can be used as a final procedure when:

- temporary import of goods;

- processing of products outside the customs territory;

- IM70 or EK70 (customs warehouse);

- IM78 or EK78 (free customs zone).

Each such case has its own specifics, so we recommend that you seek advice and assistance from our company’s specialists in advance.

- Individuals may export goods for personal use. Commercial cargo, as well as “prohibited” cargo, cannot be exported. If the property is of cultural or historical value, it is necessary to obtain permission from the Ministry of Culture in advance. The same applies to pets - do not forget to obtain a certificate from a veterinarian.

- Individual entrepreneurs, commercial companies and other legal entities can export goods only if they undergo the appropriate procedure. No customs duty is charged, except for the categories listed in Decree 754.

The concept of restrictions and prohibitions

Placement of goods under customs procedures for the export of goods can only be carried out in compliance with the restrictions and prohibitions that apply during the registration period. Restrictions and prohibitions are measures that are used regarding goods transported across the border, affecting foreign trade, export control, technical regulation, veterinary, sanitary-epidemiological, quarantine, phytosanitary requirements that are established by treaties of countries that are members of the EAEU, as well as decisions of the CCC .

How to place cargo for export?

For the procedure to be successful, make sure that you have met all the necessary conditions:

- paid customs duties (for cases provided for by law);

- the exported goods do not fall into the category of prohibited or subject to restrictions (cultural objects, flora and fauna from the Red Book, narcotic substances, etc.). You can obtain a complete list of such products at a consultation with specialists;

- prepared the goods in accordance with the internal requirements of the receiving country (for example, ensured the availability of instructions, stickers, etc. with translation into a foreign language);

- issued certificates of origin (each country has its own document - for example, ST-1 for CIS member states, Form A for the USA or the European Union).

Non-tariff regulation measures

The customs export procedure provides for the following non-tariff regulation measures:

- Quantity restrictions. These include prohibitions and restrictions in order to prevent or reduce shortages of relevant goods on the domestic market, as well as those that are important for this market.

- Certain types of goods are exported on the basis of a license.

- Customs surveillance is established for individual goods.

Measures related to foreign trade operations are introduced if they:

- Needed to maintain law and order or morality.

- To protect the health and lives of citizens, as well as the environment.

- We are talking about gold or silver items.

- It is necessary to ensure the protection of cultural heritage and values.

- Prevent depletion of natural resources.

- Provide sufficient materials for the manufacturing industry when the price is kept at a lower level compared to the global situation; for stabilization or purchase and distribution of goods in case of shortage.

- Needed to fulfill international obligations.

- To ensure compliance with international legal acts.

Do I need to pay for EK10?

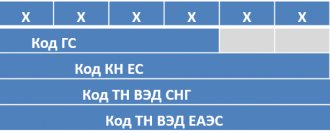

Export payments have been canceled for almost all categories of goods, with the exception of group 27 of the Commodity Nomenclature of Foreign Economic Activity (timber and wood products, oil and oil products, gas, etc.).

- Customs duty is paid only for goods whose export requires payment of duty.

- VAT is not paid (Article 164 of the Tax Code of the Russian Federation), in addition, the state returns the value added tax previously paid when purchasing goods (for individual entrepreneurs and legal entities working for the public tax service).

- No excise tax is paid, but a bank guarantee is required to complete the procedure.

If you are not sure whether or not you need to pay customs duties, seek advice from a customs broker “Svarog”: our specialists will study the specifics of your goods, tell you about the nuances of its export clearance, and if payments are necessary, they will help with their implementation.

The influence of exports on the state economy

Many countries are striving to increase their exported goods. Each of the companies operating in the international market is trying to increase volumes. The company's competitive advantage depends on the quantity of products and services shipped to other countries. This is due to gaining experience in the production of services and goods to other countries.

In addition, organizations receive the necessary knowledge to increase sales in the foreign market. The government is also interested in increasing export volumes. This is explained by the increase in the number of jobs in this case. Workers, in turn, begin to receive good wages, which has a positive impact on their standard of living.

The population becomes happier, and as a result, people are more willing to support the country's current leaders. Exports also affect the increase in gold and foreign exchange reserves on the balance sheet of the Central Bank. This is because foreign countries pay for exports in dollars or in their national currency.

If a country has a sufficient amount of reserves, it can use them to manage the volume of national currency in circulation. This becomes possible thanks to the availability of foreign currency, which comes at the time of payment for export goods and services. This also affects the cost of exports to other countries.

Foreign exchange can also be used for liquidity management, which is necessary to control inflation. This is done by purchasing national currency with foreign currency. Thanks to this, it is possible to reduce supply, which will result in an increase in the value of the national currency.

Turnkey export of goods

Customs broker “Svarog” is a well-coordinated team of experts who are ready at any time to take on the export procedure at airports, river and sea ports, railway stations, cargo terminals, as well as for postal shipments. We work with individuals and legal entities, individual entrepreneurs. We help prepare documents and place goods under the EC10 procedure. Our advantages:

- Minimum terms – from 1 day!

- Affordable prices.

- Personal approach taking into account the quantity and volume of goods, the client’s wishes.

- Consulting support at all stages.

- Assistance in any customs procedures.

Leave a request or contact us by phone to get a free consultation on customs procedures!

Customs clearance of export

Export of goods from Russia is the export of goods and intangible products from the customs territory of the Russian Federation. This procedure requires the participation of both transport and logistics companies and customs brokers clearing cargo for export. In the context of the developing need of Russian enterprises to sell goods for export, the Group has developed a universal solution to the problem. One of ours, an export customs representative, was specially authorized by us to work with Russian companies exporting goods abroad. We will reveal the advantages of working with an export customs representative on this page.

Analysis of clearance of export cargo through “export” and regular customs representatives (CB)

| "Export" TP (LLC ") | Ordinary TP (JSC ") |

| - only goods for export that are not subject to export customs duties | — export (all customs procedures, all goods), import (all customs procedures) |

| — lower risks (reduced searches, inspections, inspections) | — all risks associated with import and export are taken into account |

| — accelerated customs clearance (risks are lower, therefore auto registration of diesel fuel, auto release) | — less frequent auto-registration and auto-issue |

| — reduction of document flow (LLC “on the simplified tax system, VAT rate – without VAT) there is no need to confirm the zero VAT rate during customs clearance and delivery | — customs clearance with VAT |

| — does not affect the increase in the VAT rate from 18% to 20% | — affects the increase in the VAT rate |

| Conclusion: lower cost of services, fewer documents, fewer problems during registration | Conclusion: higher cost, more documents, lower speed of customs clearance |

When exporting goods, customs clearance is usually carried out within 2-4 hours. As practice shows, this process can usually occur even faster. The release record for which customs released goods is from 1 minute to an hour, but only if there are no export customs duties and no additional controls.

Export customs representative LLC “is not only accelerated customs clearance due to the automatic procedure for registering an electronic customs declaration, but also the “automatic release” of the declaration. For our client, this is reflected in the efficiency of providing this service. The customs clearance time (from registration to release) is a matter of minutes.

The GTK-S Group of Companies offers participants in foreign trade activities the most relevant and effective solution for organizing customs clearance of a commercial consignment of goods sent abroad under your contract - cooperation with LLC ", an export customs representative. At the first contact, our specialists will tell you in detail how to prepare documents for export delivery for export, the deadline for receiving confirmation of the actual export of goods, provide a list of documents for customs clearance of exports and explain the procedure for “customs clearance” of cargo in Russia.

Risk management system

The RMS was introduced only in 2003. It defines the main aspects of control and risk management systems. The introduction of new principles contributed to the improvement of the customs export procedure, which had a positive impact on the economic situation of customs and the state as a whole. The use of a risk minimization mechanism increased the receipt of customs payments to the country's budget.

The purposes of using this system include the following:

- Ensuring customs protection of national security, as well as the health and life of people, protection of the external environment.

- Focus on high-risk areas and ensure optimal use of resources.

- Identification, forecasting and prevention of violations of current legislation, which occur most often, are associated with evasion of customs duties that undermine competition in the EAEU, and also speed up the implementation of customs operations.

Customs authorities continuously collect, process and analyze relevant information in order to further improve their work.

Forms of control

We have already mentioned above that customs control serves as the main direction to ensure compliance with the requirements of external economic regulation, as well as the protection of economic interests within the country. Here are the forms of control that customs officers have the right to apply:

- Verification of information and documents, goods accounting and reporting system.

- Inspection, screening, surveillance, checking markings with identification insignia, inspection of premises, personal search, accounting of goods.

- Oral survey.

- Receiving explanations.