Home Foreign Economic Activity - Foreign Economic Activity

Foreign economic activity or FEA is economic activity related to the export or import of goods and services. In other words, this is trade between a national representative and a foreign one. In this case, trade can be understood not only as the purchase and sale of goods, but also as the implementation of international projects, as well as activities related to investments and loans. Participants in foreign economic activity can be government bodies, commercial and state-owned enterprises, and individuals.

Foreign economic activity is carried out in accordance with customs legislation.

As the economy grows, more and more Russian enterprises, both large and small, are entering the world market. Every year many international contracts are concluded, not only goods, but also equipment are purchased, and not only raw materials, but also products of our own production have become the subject of export. By carrying out such activities, Russian companies become participants in foreign trade activities.

Features of foreign economic activity - foreign economic activity

The main feature of foreign economic activity is the need to constantly improve the regulatory framework governing foreign economic activity in difficult political and economic conditions.

The foreign economic activity of Russian entrepreneurs is complicated by the fact that the sanctions in force against Russia from many foreign countries lead to a constant increase in prices for imported goods, raw materials and equipment. In turn, such external pressure requires a response from the comprehensive use of the entire range of foreign economic instruments.

How to conclude a foreign contract

Open a foreign currency account, enter into a foreign economic contract and register it with the bank.

Requirements for foreign contracts are specified in customs legislation. The structure and execution of the agreement are similar to internal agreements. The difference is that the foreign contract is drawn up in two languages of the partner countries. Write down the terms of the transaction, provide the technical characteristics of the goods, their quantity, delivery conditions according to Incoterms 2010, the moment of transfer of rights to the goods.

Incoterms 2010 are international terms associated with the delivery of goods during foreign trade activities. We talked about them in our article.

If you enter into an export contract worth more than 6 million rubles or an import contract worth more than 3 million rubles, you will have to register it with the bank. Registration takes one day.

Participants in foreign economic activity - foreign trade activities

There are a number of characteristics that allow classifying participants in foreign economic activity - place of registration, line of activity, organizational and legal form, etc.

If the main criterion is the type of activity of the company, then participants in foreign trade activities are divided into three groups:

- Manufacturers;

- Intermediaries;

- Supporting organizations.

To the first group

includes companies that work without the involvement of intermediaries - these are production associations, consortia, transport companies (regardless of the type of transport used), production cooperatives.

To the second group

include trading houses, mixed societies and specialized organizations of the Ministry of Industry and Trade of the Russian Federation.

To the third group

include customs brokers providing services for customs clearance of foreign trade activities. Such organizations include ours, which has been providing foreign trade services for more than 10 years.

If we consider participants in foreign economic activity by number, they are divided into individual and collective, which can be persons with limited legal capacity and legal entities, divided into commercial and non-profit organizations.

The Russian economy is characterized by a division of foreign economic activity participants into residents and non-residents of our country.

Residents are individuals - citizens permanently residing in the country, legal entities - domestic companies registered in Russia, as well as branches of foreign companies, Russian diplomatic missions located abroad.

Non-residents are individuals who are citizens of foreign states, legal entities registered abroad, diplomatic missions of foreign states located on the territory of Russia.

Results

The organization of accounting for foreign economic activity entails not only an increase in the number of accounting documents used, but also a number of features: both in the reflection of accounting transactions and in the preparation of reporting.

- MART assessed the experience of prepayment for goods in Wildberries and may change the law

Sources:

- Tax Code of the Russian Federation

- Federal Law of 02.08.2019 No. 265-FZ

- Bank of Russia Instruction No. 181-I dated August 16, 2017

- Order of the Ministry of Finance of the Russian Federation dated November 27, 2006 No. 154n

- Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n

- Decree of the Government of the Russian Federation of October 13, 2008 No. 749;

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Types of foreign economic activity - foreign economic activity

Despite the fact that foreign economic activity is primarily trade, there are several types of foreign economic activity, each of which is responsible for a certain direction of interaction between objects in foreign markets.

International trade

- this is export (export of goods), and foreign trade activity import (import of goods). In this type of foreign economic activity, deliveries are carried out exclusively by moving goods across the customs border.

Industrial cooperation

is an organization of commodity producers producing joint products. The main principle of international cooperation is to increase profits by minimizing costs by dispersing production in different countries, taking into account the difference in the cost of raw materials used, tax rates and workers' compensation.

Financial, credit and foreign exchange transactions –

carried out by lending or purchasing shares of foreign enterprises. In this case, loans are provided both in the form of cash and in the form of the supply of equipment or the purchase of debt obligations. It is possible to carry out such operations through the creation of joint ventures or through project financing.

International investment cooperation

– consists of combining efforts to increase competitiveness and facilitate the sale of products on the foreign market. As an example of international investment cooperation, one can cite the activities of various international non-governmental organizations, consortia, joint-stock companies and concessions.

Main responsibilities of a manager

Summarizing all of the above, let's highlight the key tasks and responsibilities of a specialist in foreign economic activity:

- Conclusion and support of foreign trade (import/export) contracts.

- Negotiations, business correspondence with logistics partners, brokers on the terms of cooperation. Foreign trade activities and logistics in any organization will be interconnected.

- Supporting deliveries from their placement to receipt by the addressee.

- Control over timely payment for products by partners, transfer of finances to suppliers.

- Preparation of all necessary supporting documentation for foreign economic transactions - licenses, certificates, permits, delivery schedules, etc.

- Participation in international exhibitions and conferences.

- Monitoring the foreign market aimed at finding new partners.

These are the main job responsibilities of a foreign trade manager. Let's move on to the next important question.

Documents required for carrying out foreign economic activity - foreign economic activity

Documentary registration of foreign economic activities is carried out in accordance with customs legislation, according to which all participants are required to provide information about goods transported across the customs border of Russia.

The sets of documents presented by the cargo owner at customs may vary depending on several factors:

- Goods are exported or imported;

- Under what conditions is the cargo transported?

- Customs procedure;

- Moving goals, etc.

Documents required for carrying out foreign trade activities

- List of documents for registration of an individual at customs (View)

- List of documents for registration of a Legal entity at customs (View)

- List of documents for registration of an individual entrepreneur at customs (View)

- List of documents for customs clearance “Import” (View)

- List of documents for customs clearance “Export” (View)

In addition to the documents required for customs clearance, everyone who takes part in foreign economic activity is required to register with the customs authorities as a participant in foreign economic activity.

To register, you will need to submit to customs once a package of documents indicating the right to perform customs operations. These may be the company’s constituent documents, an extract from the state register of legal entities, certificates of opening accounts, and others. At the same time, it is important to know that the participant in foreign economic activity is obliged to report changes made to the constituent documents to the customs authorities.

VAT for import transactions

Most of the additional actions arise when it is necessary to pay VAT. In this case, it is worth paying attention to the following points:

| Export requires special accounting of any operations | As well as additional control, filling out documentation and preparing an extended package of papers |

| When importing from the states of the Customs Union, it is necessary to take into account the limited deadlines for submitting information to the Tax Service | An additional declaration will also be required. |

| It is necessary to correctly calculate the tax when providing certain services if they are performed outside of Russia | You will also need to fill out a special section of the declaration |

Shipment for export will be taken into account in income at the moment when ownership and risks are transferred, that is, at the time of shipment of the goods, but the right to a tax deduction can be exercised in subsequent periods.

Customs and tariff regulation of foreign trade activities

Foreign economic activity is regulated by international treaties. They organize all the variety of foreign trade operations, punish violations of international trade rules and provide protection to law-abiding participants in foreign trade activities. Today, international legal acts regulating the activities of states in the field of foreign trade activities are adopted and approved by the World Trade Organization (WTO), the Supreme Eurasian Economic Council (the highest governing body of the Eurasian Economic Union), the World Customs Organization (WTO or CTC) and other organizations.

In order to stimulate its own production, develop and strengthen its own economy, and protect the interests of citizens, each state pursues a flexible customs and tariff policy - softens or tightens non-tariff regulation measures, improves control methods, and reduces document flow. For example, for the development of certain industries, the stimulation of which is considered a priority and appropriate, the state can establish low customs duties (down to 0%). At the same time, for other sectors of the economy, such duties, on the contrary, may be increased. A flexible customs and tariff policy is a serious tool for implementing state activities in the field of foreign economic activity.

In any country, foreign economic activity is carefully regulated by government agencies; the goal of any state in matters of foreign economic activity is to protect the economic sovereignty and economic interests of the country and its citizens, ensure compliance with the legality of foreign economic transactions, and support its own producers. State regulation of foreign trade activities includes such elements as:

- Customs tariff (duties, excise taxes, taxes, etc.);

- Mandatory declaration of goods transported across the border;

- Customs procedures;

- Product range;

The main instrument of government influence on import and export trade flows are tariff and non-tariff regulation measures.

Tariff regulation measures perform a fiscal or protectionist function. The first ensures the regular flow of funds into the state budget, the second protects national producers of goods and services from competition with foreign ones.

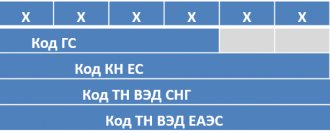

Tariff regulation measures are import and export duties levied on foreign trade participants when moving cargo through customs. Customs duties applied in foreign economic activity are established in the amounts determined by the legislative authorities and are fixed in the Commodity Nomenclature of Foreign Economic Activity of the EAEU. The declarant determines the amount of customs duty based on the product code in accordance with the Unified Commodity Nomenclature. Control over foreign trade payments is entrusted to the Federal Customs Service of Russia; it is customs officers who check the correctness of the accrual of customs taxes, fees and duties.

Non-tariff measures are applied as an exception to free trade rules in certain cases:

- If necessary, protect the national market;

- To ensure the security of the state, its residents, property and environment;

- In order to maintain law and order and protect public morals;

- To protect cultural property;

- To ensure national security;

- When fulfilling international obligations;

Non-tariff regulation measures are mainly of a prohibitive nature, such as sanctions, quotas, licensing, restrictions on the import and export of certain products. In addition to bans, non-tariff regulatory measures include measures to stimulate foreign trade, certification, foreign exchange restrictions and exchange controls.

An example of such measures to regulate foreign trade activities by government agencies is veterinary and phytosanitary control, which all cargo of plant and animal origin arriving from abroad must undergo at the border.

We quickly found our bearings

The conference will traditionally sum up the results of the region’s export activities. Since the year has not yet ended, it is premature to talk about the results of 2020 as a whole. But the final figures for January-June also allow us to draw important conclusions. Firstly, while the value of exports of products from Novosibirsk enterprises decreased by 0.6 percent compared to the first half of 2019, the physical volume of supplies of goods increased. Secondly, some industries have taken the lead in the cost of products shipped abroad: for example, supplies of machinery increased by 5.5 percent, food products - by 33.7 percent.

“Accordingly, we come to the encouraging conclusion that the disruption in export activities caused by the global situation turned out to be uncritical, and our companies were able to quickly navigate the market to minimize their risks,” states Alina Musienko. — It’s difficult to say that the commodity structure of exports has changed dramatically this year, but the crisis has made its own adjustments. Mainly, fuel and energy goods, engineering products, food and agricultural raw materials, and chemical industry products were supplied abroad. If we talk about small and medium-sized businesses, the export structure is dominated by food products, construction and finishing materials, and electrical goods. For obvious reasons, medical products deserve special attention - as for medicine and biotechnology, the Novosibirsk region, of course, has something to offer.

China and Kazakhstan remain the leaders in the export of Novosibirsk products; Germany, Bulgaria, Vietnam, and India are also among the main partners.

How does customs clearance take place?

We, as a customs representative, will select the HS code, calculate the customs payments that you will transfer to the ELS (single personal account - can be opened in any bank in the Russian Federation), according to the Statutory documents we will register your company at customs, submit a declaration when the cargo arrives in RF to the customs control zone (Sheremetyevo or any other customs post, both air and truck).

The primary documents for the transaction are a foreign currency account and a foreign economic contract with the sender, then an invoice - a payment document, a packing list, transport documents for the carriage of goods.

Invoice

Further, if everything goes well according to the documents, if the actual data coincides with them, the declaration will be released and the cargo will receive the status “Release for free circulation.”

Cons of the profession

Like all other work activities, this one will also have disadvantages. Let's list the most important ones:

- Quite a nervous and stressful job. This is due to the fact that in conditions of uncertainty you need to quickly make decisions on which both your own career and the development of the employing company depend.

- So-called deadlines are situations when a large amount of work needs to be completed in a limited time.

- A high share of responsibility for each of your actions or decisions.

- The need to find a common language and establish successful communication even with diametrically opposed partners.

Negotiation

- Choosing a place for negotiations is a very important detail of the process. If this responsibility falls on the side of the foreign partner, make sure that you are notified of the regulations. You should be warned about the format of the negotiations, especially if food is expected. If you did not know in advance that the program included dinner or lunch, you have the right to refuse the treat.

- If you choose where to negotiate, don't skimp. Rent a special room in a hotel, an office in a business center, or use the services of an embassy. This will demonstrate the seriousness of your intentions.

- If negotiations are taking place in Russia, do not allow your partner to independently choose the location. It is better if the process takes place on your territory. Moreover, the first meeting can be held in a rented meeting room, if your office does not have one. On the second day, it is better to schedule a visit directly to your office.

- The Chinese often conduct “empty negotiations” for the sake of practice or try to persuade you to unfavorable conditions through blackmail. Using their own tactics will help you insure yourself against such problems. If you see that such steps are being taken, do not forget to tell them that you are considering a number of other offers that are much more profitable, and are inclined to agree.

- If you feel that your partners are showing dissatisfaction for no apparent reason, try to keep your cool, since the so-called demonstration of anger is only an attempt to confuse you and force you to make concessions.

- Do not tell the Chinese the exact date of your departure, otherwise they may resort to stalling tactics in order to force you to make concessions. The easiest way to reschedule your flight is if you see that signing a contract is only a matter of time. If your counterpart delays signing the contract, you can inform him that you are flying away not the day after tomorrow, but tomorrow.

- The Chinese often take notes on what their partners say, so try to stick to the same numbers, data, and facts all the time.

- Be prepared to bargain. Artificially inflating prices is a common practice, so don't be scared by big numbers, be prepared for the fact that by the end of the process they will reach the figures you need.

- Carefully study all the details of the contract. Make sure there are no misunderstandings between you and your partner.

- Try to understand the culture and mentality of your foreign partner. It will be easier for you to interact if you are aware of how the person you plan to do business with sees the world and perceives the situation.