Selling your products on Amazon is a great way to expand the reach of your e-commerce business. But are you ready to start crossing international borders when shipping your products? If so, then it's time to familiarize yourself with the HS codes.

As a shipper, you will use these codes to identify the goods you are shipping internationally as they pass through customs.

HS (Harmonized System) codes, also known as tariff codes, ensure that your products sold on Amazon travel smoothly across international borders and reach customers without unnecessary delays.

This quick guide gives you an understanding of the HS code system and how to use it.

What are HS codes?

HS codes are standard, internationally recognized codes that identify products for import purposes. Each code contains at least six digits, which are arranged in pairs, sometimes followed by additional digits. Each number represents specific product categories and characteristics.

When a package arrives at an international border, customs authorities check the HS codes to determine the contents. They do this for many reasons. In some cases, certain products may be subject to special taxes or import bans. Customs authorities may also track HS codes for statistical studies to track the import of certain goods.

The HS code system covers up to 98% of all products sold on the international market. This means that no matter what products you sell on Amazon, there will almost always be an HS code that you can use to identify it for customs purposes.

What do HS codes look like?

To show you what HS codes look like and how they work, let's look at an example:

‘6109.10’ this is the HS code for cotton T-shirts.

If you break this code you will see how the code system works:

The first two digits ( '61' ) refer to a broad product category: "Knitted or crocheted garments and clothing accessories" .

These numbers are followed by additional numbers ( '09' ) which narrow things down even further: "T-shirts, tank tops and other vests, knitted or crocheted" .

The last numbers ( '10' ) refer to an even more specific category: "T-shirts, tank tops and other vests, knitted or crocheted, of cotton."

Additional codes may be added to the codes to indicate additional product features. However, the basic six-digit code usually provides enough information for customs authorities to be able to identify common consumer products, such as those sold on Amazon.

Who issues HS codes?

The HS code system is governed by the International Convention on the Harmonized System of Description and Coding of Goods. This international treaty is intended to standardize international customs operations. Its purpose is to ensure that goods like yours can cross international borders smoothly as long as there are no import restrictions.

The system is currently used by customs authorities in almost every country in the world, including all Amazon markets.

It is up to the World Customs Organization (WCO) to determine the list of codes. This international body also publishes an updated list of HS codes every five years. The list is updated to include new products and product features.

Abbreviations, symbols in HS

| BIS | large integrated circuit |

| Bk | becquerel |

| IN | volt |

| W | watt |

| Hz | hertz |

| GHz | gigahertz |

| dtex | an off-system unit of linear density of fibers or threads, equal to the ratio of their mass to length. 1dtex = 10mg/m |

| IR | infrared |

| TO | kelvin |

| kVA | kilovolt-ampere |

| kW | kilowatt |

| kHz | kHz |

| kgf | kilogram-force |

| km | kilometer |

| kN | kilonewton |

| kPa | kilopascal |

| kcal | kilocalorie |

| wt.% | percentage content by weight |

| Mbit | 1,048,576 bits |

| MHz | megahertz |

| m- | meta- |

| mg | milligram |

| mm | millimeter |

| µCi | microcurie |

| mN | millinewton |

| N | newton |

| about.% | content percentage by volume |

| O- | ortho- |

| P- | pair- |

| With | second |

| sg | centigram |

| cm | centimeter |

| cm² | square centimeter |

| cm³ | cubic centimeter |

| cN | centinewton |

| cm/sec | centimeter(s) per second |

| °C | degrees Celsius |

| ASTM | American Society for Testing and Materials |

| INN | International Nonproprietary Name |

| INNM | International Nonproprietary Name Modified |

| ISO | International Organization for Standardization, International Organization for Standardization |

| + | the specified digital code was used in the previous edition of the Tax Code, but had a different coverage of goods |

How to use HS codes when selling on Amazon?

As an Amazon seller, you must include HS codes on commercial invoices and other required customs documents (such as Forms CN22 and CN23) attached to your international shipments. Attach these documents to the outside of the package so they can be easily seen by customs officials.

When filling out customs documents, try to indicate the exact code of each product inside the package. Use the full six-digit code along with any additional digits that apply to a specific product. Some countries, such as the United States, require additional code numbers as determined by their local customs laws.

The US code system is known as the US Harmonized Rate Plan system. It is based on the HS system, but contains additional figures to more accurately classify goods entering the country.

Units of measurement in HS

| Unit name | Symbol | Unit codes |

| Basic unit of measurement | ||

| Kilogram | kg | 166 |

| Additional units of measurement | ||

| Gram | G | 163 |

| Gram of fissile isotopes | g D/I | 306 |

| Load capacity in tons | t grp | 185 |

| Square meter | m² | 055 |

| Kilogram of nitrogen | kg N | 861 |

| Kilogram of potassium hydroxide | kg KOH | 859 |

| Kilogram of sodium hydroxide | kg NaOH | 863 |

| Kilogram of potassium oxide | kg K2O | 852 |

| Kilogram of hydrogen peroxide | kg H2O2 | 841 |

| Kilogram of phosphorus pentoxide | kg P2O5 | 865 |

| Kilogram of 90% dry matter | kg 90% dry | 845 |

| Kilogram of uranium | kg U | 867 |

| Cubic meter | m³ | 113 |

| Curie | CI | 305 |

| Liter | l | 112 |

| Liter of pure (100%) alcohol | l 100% alcohol | 831 |

| Meter | m | 006 |

| Metric carat (1 carat = 2 10-4 kg) | car | 162 |

| Pair | steam | 715 |

| One hundred pieces | 100 pieces | 797 |

| A thousand pieces | 1000 pcs | 798 |

| Thing | PC | 796 |

| 1000 kilowatt hour | 1000 kWh | 246 |

| 1000 cubic meters | 1000 m3 | 114 |

| 1000 liters | 1000 l | 130 |

Where can I find the correct HS codes?

When you consider that HS codes cover more than 200,000 types of products, you can imagine how complex and comprehensive the code system is.

To make finding the correct HS code easier, try using an online HS Code Finder. These tools will help you find the exact code you need to correctly identify your product for international shipping.

If you are still unsure which code to use, check with your logistics partner. They will usually offer the option to search by HS code themselves, and can also advise you of any additional digits you may need for specific destination countries.

Are HS codes really that important?

Any Amazon seller who ships products internationally benefits from using HS codes. These codes ensure that your shipments comply with international law. However (and more importantly for you as a seller), they also ensure that your product gets to customers as quickly as possible.

Using the correct HS codes will allow you to provide good service to your customers.

The "importer" (who is effectively your customer) is required by law to use the correct customs documentation for the goods they receive from overseas. However, you can't expect customers to take responsibility for this.

Very few average consumers who shop on Amazon even know what the HS system is.

This means that in practice, you as a seller must use the coding system correctly.

If you do not use the correct codes, your package may be delayed through customs. In some cases, the product may be confiscated or additional import duties (taxes) may be applied. This could result in unexpected costs and inconvenience for your customers, which is something you definitely want to avoid.

HS codes help ensure a positive customer experience

If you sell on Amazon, then you know how much your customers value fast and efficient shipping. For international shipments, customs clearance is the main obstacle your package faces on its way to the customer. This makes it extremely important for you to do everything possible to get your package through customs efficiently.

So, think of HS codes as a way to add a positive experience to your customers. By using these codes correctly, you do everything possible to prevent delays and ensure the package moves as quickly as possible.

Notes to the Unified Customs Tariff of the EAEU

The Unified Customs Tariff of the Eurasian Economic Union (UCT EAEU) is a set of rates of import customs duties on goods imported into the customs territory of the EAEU from third countries, systematized according to the unified commodity nomenclature (HS EAEU).

- 1C)

The import customs duty rate is 0% of the customs value. - 2C)

The import customs duty rate is 0% of the customs value. - 3C)

The import customs duty rate is 0% of the customs value. - 4C)

The import customs duty rate is 0% of the customs value. - 5C)

The import customs duty rate is 0% of the customs value. - 6C)

The import customs duty rate is 0% of the customs value. - 7C)

The rate of import customs duty is 0% of the customs value. - 8C)

The import customs duty rate is 0% of the customs value. - 9C)

The rate of import customs duty is 0% of the customs value. - 10C)

The rate of import customs duty is 0% of the customs value. - 11C)

The rate of import customs duty is 0% of the customs value. - 12C)

The rate of import customs duty is 0% of the customs value. - 13C)

The rate of import customs duty is 5% of the customs value. - 14C)

The rate of import customs duty is 5% of the customs value. - 15C)

The rate of import customs duty is 0% of the customs value. - 16C)

The rate of import customs duty is 0% of the customs value. - 17C)

The rate of import customs duty is 5% of the customs value. - 18C)

The import customs duty rate is 3.5% of the customs value, but not less than 0.44 euros per 1 kg. - 19C)

The import customs duty rate is 3.5% of the customs value, but not less than 0.99 euros per 1 kg. - 20C)

The rate of import customs duty is 5% of the customs value. - 21C)

The rate of import customs duty is 0% of the customs value. - 22C)

The rate of import customs duty is 0% of the customs value. - 23C)

The rate of import customs duty is 0% of the customs value. - 24C)

The rate of import customs duty is 0% of the customs value. - 25C)

The rate of import customs duty is 0% of the customs value. - 26C)

The rate of import customs duty is 0% of the customs value. - 27C)

The rate of import customs duty is 0% of the customs value. - 28C)

The rate of import customs duty is 0% of the customs value. - 29C)

The rate of import customs duty is 5% of the customs value. - 32C)

The rate of import customs duty is 0% of the customs value. - 33C)

The rate of import customs duty is 0% of the customs value. - 35C)

The rate of import customs duty is 0% of the customs value. - 37C)

The rate of import customs duty is 10% of the customs value, but not less than 4 euros per 1 piece. - 38C)

The rate of import customs duty is 0% of the customs value.

Cargo transportation Russia - Ukraine

Foreign trade contract → certification → insurance → loading → freight forwarding → cargo transportation → customs clearance → unloading... Having our own representative office in Ukraine (Dnepr), our company will ensure the delivery of any cargo weighing from 1 ton from Ukraine to Russia and the EAEU countries.

The liability of our forwarders is insured!

Navigation through the HS code system

The HS coding system is a bit confusing at first. After all, it is a very complex system that covers many different types of products. On the other hand, the system becomes easier to use once you become familiar with how it works. There are also many useful resources at your disposal, including HS Code Lookup Tools offered by your logistics partners.

Additionally, if the product range you offer through Amazon is focused on specific product types, you will only need to look at products covered by multiple HS codes. This will help you focus on the part of the HS code system that you really need for your products.

However, you may encounter some common problems when using the HS encoding system. The key is to always use the codes that best describe your products.

Choosing the right code

Because the HS code system has nearly 5,000 product categories to choose from, it can sometimes be difficult to determine which code best identifies your product. There are usually subtle differences included in the terms of the code description.

For example:

‘6109.10’ applies to: T-shirts, tank tops and other vests; cotton, knitted or crocheted

while

‘6109.90’ refers to T-shirts, tank tops and other vests; of textile materials (other than cotton), knitted or crocheted

This means it's important to know the specifics of your product and choose the code that works best. In the example above, the difference in material (cotton or not) helps you choose which code to use.

Check your product range regularly

Because of the importance of selecting the correct HS codes, you will also want to regularly check your product range. If the characteristics of a product change, it may suddenly fall into a different HS code category.

Imagine, for example, that you sell T-shirts on Amazon, but you decide to switch from selling cotton shirts to shirts made from a polycotton blend. This means you will need to use a different HS code if you want to ship these shirts internationally.

This is even more important if you are selling products such as food, living organisms (plants) or other items that may be subject to stricter customs clearance requirements. Especially such items should always be carefully identified using the correct HS codes.

Notes to the EAEU HS

- 1) Technical parameters, intended for operation at specified temperatures and/or in an environment containing hydrogen sulfide (H2S), must be confirmed by a corresponding entry in the factory test certificate.

- 2) Technical parameters, purpose for operation at specified temperatures and/or in an environment containing hydrogen sulfide (H2S), must be confirmed by the corresponding entry in the passport for machines and equipment.

- 3) Upon confirmation by the executive authority authorized in the field of transport of a member state of the Eurasian Economic Union of the intended purpose of the imported goods.

- 4) Upon confirmation by the authorized executive body carrying out the functions of developing state policy and legal regulation in the field of healthcare of a member state of the Eurasian Economic Union of the intended purpose of the imported goods.

- 5) Upon confirmation by the authorized executive body exercising the functions of developing state policy and legal regulation in the field of industry, a member state of the Eurasian Economic Union, of the intended purpose of the imported goods.

- 6) Upon confirmation by the authorized executive body exercising control and supervision functions in the field of veterinary medicine, quarantine and plant protection of a member state of the Eurasian Economic Union of the intended purpose of the imported goods.

- 7) The environmental class must be confirmed by the corresponding entry in the vehicle type approval or in the certificate of conformity, issued in the manner established by the legislation of the member state of the Eurasian Economic Union.

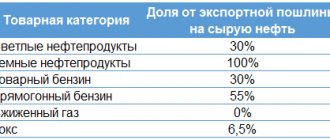

Upon confirmation by the authorized executive body performing the functions of developing and implementing state policy and legal regulation in the field of fuel and energy complex, together with the authorized executive body performing the functions of providing public services and managing state property in the field of subsoil use, the fact of production crude oil having the specified physical and chemical characteristics in the following fields:

Upon confirmation by the authorized executive body performing the functions of developing and implementing state policy and legal regulation in the field of fuel and energy complex, together with the authorized executive body performing the functions of providing public services and managing state property in the field of subsoil use, the fact of production crude oil having the specified physical and chemical characteristics in the following fields:- Russian Federation:

Yurubcheno-Tokhomskoye oil and gas condensate field, Talakanskoye oil and gas condensate field (Eastern block), Alinskoye gas and oil field, Srednebotuobinskoye oil and gas condensate field, Dulisminskoye oil and gas condensate field, Kuyumbinskoye oil and gas condensate field, North-Talakanskoye oil field, East Alinskoye oil field birth, Verkhnepeleduyskoye gas condensate field, Pilyudinskoye oil field, Stanakhskoye oil and gas field, Yaraktinskoye oil and gas condensate field, Danilovskoye gas and oil field, Markovskoye oil and gas condensate field, West Ayanskoye oil and gas condensate field, Tagulskoye oil and gas condensate field, Suzunskoye gas and oil field, South Talakanskoye oil and gas condensate field, Chayandinskoye oil and gas field zocondensate field, Vakunayskoye oil and gas condensate field, oil and gas condensate field named after . Yu. Korchagin, oil and gas condensate field named after. V. Filanovsky, Prirazlomnoye field, West Khosedayuskoye oil field named after. D. Sadetsky;- Republic of Belarus:

Rechitsa oil field, Ostashkovichskoe oil field, Davydovskoe oil field, Vishanskoe oil field, Marmovichskoe oil field, Nadvinskoe oil field, Zolotukhinskoe oil field, East Pervomaiskoe oil field, Barsukovskoe oil field, Yuzhno-Ostashkovichskoe oil field, Tishkovskoe oil field , Sosnovskoye oil field, Ozershchinskoye oil field, Berezinskoye oil field, Ozemlinskoye oil field, West Tishkovskoye oil field, Polesskoye oil field, Pervomaiskoye oil field, Malodushinskoye oil field, Dnieper oil field, Aleksandrovskoye oil field, Yuzhno-Sosnovskoye oil field, Sudovitskoye oil field, Borshchevskoye oil field, Vetkhinskoye oil field, Dubrovskoye oil field, Khutorskoye oil field, Yuzhno-Ozemlinskoye oil field, Yuzhno-Alexandrovskoye oil field, Borisovskoye oil field, Komarovichskoye oil field, Slavanskoye oil field, East-Drozdovskoye oil field, Leteshinskoye oil field, Kazan oil field, Zapadno-Sosnovskoye oil field, Oktyabrskoye oil field, North Domanovichskoye oil field, South Tishkovskoye oil field, North Pritokskoye oil field, North Nadvinskoye oil field, Kerbetsky oil field, Danube oil field, Pozhikharskoye oil field, Chkalovskoye oil field, Levashovskoye oil field, Zapadno-Malodushinskoye oil field, North-Novinskoye oil field, South-Vishanskoye oil field, North-Malodushinskoye oil field, Otrubovskoye oil field, Vedrichskoye oil field, Novo-Sosnovskoye oil field, Vostochno -Berezinskoye oil field, Novo-Davydovskoye oil field, North-Chistoluga oil field, West Slavanskoye oil field, Novo-Drozdovskoye oil field, Nekrasovskoye oil field, North-Berezinskoye oil field, Prokhorovskoye oil field, Savichskoye oil field, Moskvichevskoye oil field , Chistoluzhskoye oil field, Zapadno-Bobrovichskoye oil field, Denisovichskoye oil field, Novo-Korenevskoye oil field, Kotelnikovskoye oil field, Zapadno-Davydovskoye oil field, Zuevskoye oil field, Geological oil field, Kalininskoye oil field, Krasnoselskoye oil and gas condensate field, Zapadno-Aleksandrovskoye oil and gas condensate field, Shatilkovskoye oil field, Shumyatiche oil field, Novo-Berezinskoye oil field, Novo-Polesskoye oil field, West Kalininskoye oil field. - Republic of Kazakhstan:

Karachaganak oil and gas condensate field, Kashagan oil field. - 9) Upon confirmation by the authorized executive body exercising the functions of developing and implementing state policy and legal regulation in the field of the fuel and energy complex of a member state of the Eurasian Economic Union, together with the authorized executive body performing the functions of providing public services and management state property in the field of subsoil use of a member state of the Eurasian Economic Union, the fact of production of stable gas condensate having the specified physical and chemical characteristics and obtained as a result of processing unstable gas condensate produced at the South Tambeyskoye field, Salmanovskoye (Utrenneye) oil and gas condensate field, Geofizichesky oil and gas condensate field .

- 10) Upon confirmation by the authorized executive body that carries out the functions of developing and implementing state policy and legal regulation in the field of the fuel and energy complex, together with the authorized executive body that carries out the functions of providing public services and managing state property in the field of subsoil use, the fact of production of crude oil having the specified physical and chemical characteristics, as well as in the presence of an extract from the state balance of mineral reserves as of January 1 of the year preceding the year of the period of oil production and export, containing information on the viscosity of oil not less than 10,000 mPa * s (in reservoir conditions ) in the fields of the Russian Federation.

- 11) Upon confirmation by the authorized executive body of a member state of the Eurasian Economic Union of the destination of the imported goods for the purpose of drilling oil and gas wells within the Kazakh part of the bottom and subsoil of the Northern Caspian Sea on the following geological structures: Zhemchuzhiny, Zhambay (Karabulak), Abay, Isatay-Shagala , Zhambyl, Satpayev, Ustyurt, Makhambet, Bobek, Darkhan, Madina, Shattyk, C1, C2, Sholpan, Kairan, Aktoty, Kalamkas.

- 12) Upon confirmation by an executive authority authorized by the government of a member state of the Eurasian Economic Union that the imported goods are high-quality beef. The classification procedure is approved by a decision of the Eurasian Economic Commission.

- 13) Technical parameters must be confirmed by the corresponding entry in the equipment passport.

- 14) Upon confirmation by the authorized executive body exercising the functions of developing and implementing state policy and legal regulation in the field of defense of a member state of the Eurasian Economic Union, the intended purpose of the imported goods.

- 15) Technical parameters must be confirmed by the corresponding entry in the factory test report.

Transport Commissioners

executive authorities of the member states of the Eurasian Economic Union

| Republic of Belarus | Ministry of Transport and Communications of the Republic of Belarus |

| The Republic of Kazakhstan | Ministry of Transport and Communications of the Republic of Kazakhstan |

| Russian Federation | Ministry of Transport of the Russian Federation |