The most difficult thing when purchasing services from a foreigner is to determine whether our organization is a tax agent or not? Should we pay VAT to the budget for a foreign partner? The price of such a mistake is penalties, fines, account blocking.

Reading the Tax Code, we simply get lost in the wording and do not understand what we need to do.

In this article, we offer you a scheme for quickly and clearly determining the place of sale of services (work), and therefore, understanding whether we are a tax agent for VAT or can simply make a payment to a foreigner without VAT and sleep peacefully.

Export to Kazakhstan: customs clearance, documents, VAT refund, transaction control

Are you planning to start exporting your products to Kazakhstan, but do you have many questions?

RTA LLC organizes the entire process of customs clearance and export of your products to Kazakhstan from almost any locality in the Russian Federation. We will advise on issues of export registration and statistical accounting of the transaction. The Republic of Kazakhstan is a member of the EAEU (formerly the Customs Union). In addition to the Russian Federation and Kazakhstan, this association also includes (Belarus, Armenia, Kyrgyzstan).

The Eurasian Economic Union is an international organization for regional economic integration, established by the Treaty on the Eurasian Economic Union. The EAEU ensures freedom of movement of goods, as well as services, capital and labor, and the implementation of a coordinated, coordinated or unified policy in sectors of the economy.

The EAEU was created for the purpose of comprehensive modernization, cooperation and increasing the competitiveness of national economies and creating conditions for stable development in the interests of improving the living standards of the population of the member states.

Between the countries of the Eurasian Economic Union, has been abolished and there is no need for customs clearance for exports to Kazakhstan, however, there are several nuances related to the accounting of imports/exports between the member states of the EAEU. Therefore, consultations and participation of a qualified customs broker when carrying out export transactions with Kazakhstan may be needed at any stage.

included in the register of customs representatives

We bear full responsibility to customs and the client for the quality of services provided

VAT on import of services from CU countries

Good afternoon The expert of the Reference and Legal Service Standard https://normativ.kontur.ru/ When purchasing services, the VAT tax consequences depend on the territory of which state (territory of the Russian Federation or the territory of a foreign state) is recognized as the place of sale of services in accordance with Art. 148 Tax Code of the Russian Federation. When concluding an agreement with a resident of the Republic of Kazakhstan who is a resident of a member state of the EAEU (starting from January 1, 2015), one should also be guided by paragraphs. 28, 29 of the Protocol on the procedure for collecting indirect taxes and the mechanism for monitoring their payment when exporting and importing goods, performing work, and providing services (Appendix No. 18 to the Treaty on the EAEU).

Based on the terms of your question, you have concluded an agreement for the provision of advertising services with a counterparty of the Republic of Kazakhstan. In accordance with paragraphs. 4 clause 29 of Appendix No. 18, if advertising services are purchased by a taxpayer of a member state of the EAEU, then the place of sale of the services is recognized as the territory of the EAEU member state. Therefore, in your case, you, as a taxpayer of an EAEU member state (Russia), are purchasing advertising services from another taxpayer of an EAEU member state (Kazakhstan). This means that the place of their provision is recognized as the territory of the Russian Federation.

If the place of sale of services is the territory of the Russian Federation, then operations for the provision of services are subject to VAT and the Russian customer in this case is recognized as a tax agent (clauses 1, 2 of Article 161 of the Tax Code of the Russian Federation). A Russian organization as a tax agent is obliged, when transferring payment to a foreign contractor for services rendered, to withhold VAT and pay it to the budget (clause 2 of Article 161, clause 4 of Article 173, paragraph 2.3 of clause 4 of Article 174 of the Tax Code of the Russian Federation). The amount of tax is determined by the calculation method based on the contract value including VAT, to which the tax rate provided for in paragraph 4 of Art. 164 of the Tax Code of the Russian Federation (clause 1 of Article 161 of the Tax Code of the Russian Federation).

If the contract concluded with a foreign contractor specifies the cost of services excluding VAT, which is subject to withholding in accordance with Russian legislation, the organization (customer) should independently determine the tax base - increase the cost of services by the amount of VAT (Letter from the Ministry of Finance of Russia dated 06/05/2013 No. 03-03-06/2/20797, dated 02/04/2010 No. 03-07-08/32).

The customer has the right to deduct the amount of VAT paid to the budget in the same tax period if there is a correctly executed invoice and documents confirming payment of VAT, provided that the purchased services are used in transactions subject to VAT (clause 3 of Article 171, p. 1 Article 172 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of Russia dated October 23, 2013 No. 03-07-11/44418).

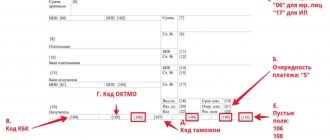

Summarize. Since you paid an advance, it turns out that the foreign counterparty has already received income. For this tax period, in which the advance payment is transferred to the supplier, you must draw up an invoice in one copy, register it in the sales book and submit a VAT return, where you fill out section 2 “The amount of tax payable to the budget, according to the tax agent When providing you with advertising services and providing the Supplier with a report, you fill out the appropriate lines in section 2 of the declaration (show the work performed and recover VAT from the transferred prepayment) and the amount of VAT calculated as a tax agent is also reflected in section 3 of the declaration “Tax deductions” in the line 180. That is, you will have VAT both payable and refundable. It should be noted that when remitting VAT as a tax agent, you should correctly indicate the status “2” in the payment order. If you specify the status “1”, then this VAT will be included in the “regular” VAT and it will be considered that you have not paid VAT as a tax agent.

As for the amount of VAT presented by a foreign contractor (including a resident of a member state of the EAEU) for services provided, the place of sale of which is not recognized as the territory of the Russian Federation, are not accepted for deduction, since the norms of the Tax Code of the Russian Federation do not provide for the deduction of such tax amounts.

Registration of offset of Value Added Tax when exporting to Kazakhstan

Starting from 07/01/2016, the right to offset input VAT, in other words, to refund the Value Added Tax on the amount of the transaction when making export supplies, arises for the taxpayer at the time of registration of the incoming tax return, and not after providing the required set of accounting documents. Confirmation of the 0% Value Added Tax rate for export to Kazakhstan must be completed within six months from the date of shipment of the products.

In order to prove a 0% rate, the following set of documents is required:

- Foreign economic agreement (copy);

- Contact account number (formerly Transaction Passport);

- Shipping documents (copies) (invoices, waybills in the TORG-12 form, waybills or CMR);

- Application (original) for payment of taxes from the importer, or notification from the tax office of the importer's state about acceptance and payment of taxes in their country.

Results

The acquisition of services is recognized as import when the foreign service provider is not registered with the Federal Tax Service of Russia as a taxpayer, and the place of provision of the service is the territory of the Russian Federation. When importing services, the Russian buyer becomes a tax agent.

The tax agent's obligation to withhold VAT arises at the time of transfer of payment for the service received from a foreign counterparty.

The tax amount is calculated in rubles based on the amount of the foreign currency payment converted into rubles at the Central Bank exchange rate on the day of payment. The bank will not accept a payment order from a tax agent to transfer money to a foreign supplier without simultaneously submitting a payment order for the amount of tax withheld. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Customs clearance of goods transported between members of the EAEU

Filling out declarations for goods in the usual manner for goods transported between the states of the EAEU has been abolished; accounting is carried out through the submission of a statistical declaration form (statistical form) to the customs office of the state of export. Submission of statistical forms is carried out in order to record the movement of goods during Russia’s foreign trade with member countries of the Eurasian Economic Union. The statistical form is drawn up by the person who made the transaction, or on whose instructions this transaction was made, or who is vested with the right to own and dispose of goods.

The statistical form is submitted to customs no later than the eighth working day of the month following the month in which the goods were shipped.

Important! For violation of the deadlines for submitting a statistical form for recording exports to Kazakhstan, a fine may be imposed on officials in the amount of ten thousand to fifteen thousand rubles under Article 19.7.13 of the Code of Administrative Offenses of the Russian Federation; for legal entities - from twenty thousand to fifty thousand rubles.

The statistical accounting form in the form of a paper document can be sent through the Personal Account of a participant in foreign trade activities on the website of the Customs Service in the following order:

- It is necessary to fill out the statistical form electronically;

- Make sure that the form is filled out correctly and completely;

- Request a system number and save the form;

- Certify the received document with the signature and seal of the applicant;

- Send the received document in paper form in person or by post with acknowledgment of receipt to the customs office at the place of registration of the applicant;

- The customs inspector, having received the statistical form in paper form, will download it from the customs system using the system number, verify the information and register it, assigning an official registration number;

What if this is a licensing agreement?

The exercise of rights under a license agreement on the territory of the Russian Federation is not subject to VAT in several cases:

- if the subject of the license agreement is exclusive rights to inventions, know-how, utility models, industrial designs, databases, etc.

- if the subject of the license agreement is the rights to use the above-mentioned results of intellectual activity.

If a Russian company, under a license agreement, acquires rights to the results of activities not listed above (clause 26, clause 2, Article 149 of the Tax Code) from a foreign supplier who is not registered with the tax authorities in the Russian Federation, it is recognized as a tax agent and must remit agency VAT to the budget of the Russian Federation.

ATTENTION!

Tomorrow, Clerk will start training in an online training course to obtain a certificate that will be included in the state register. Course topic: management accounting .

- Duration 120 hours in 1 month

- Your ID in the Rosobrnadzor register (FIS FRDO)

- We issue a Certificate of Advanced Training

- The course complies with the professional standard “Accountant”

Increase your value as a specialist in the eyes of the director. View full program

Difficulties that may arise for exporters

Despite the simplified procedure for processing export-import transactions in the EAEU states, there are many peculiarities. For example:

- In the absence of confirmation of the 0% rate of Value Added Tax within a certain period, the exporter may be additionally charged Tax at the internal rate on the amount of goods exported to Kazakhstan.

- Tax inspection - you need to prepare for a serious desk audit of the exporting company and its counterparties.

- Some products are on control lists and require permits or licenses from various government agencies to export them. Only an experienced customs representative can determine whether a product belongs to the control lists.

Our company guarantees the fulfillment of its promises regarding the organization of foreign trade activities. With our help, customs clearance for the export of your products to Kazakhstan from Russia will be easy and transparent, and will also significantly expand the number of potential partners in both countries.

Service consultation

OUR ADVANTAGES

COMFORTABLE

A personal account allows you to carry out most procedures without personal presence, from unloading documents to monitoring the progress of customs clearance. The declaration for goods is submitted to customs through a secure channel using Electronic Declaration technology (ED-2).

FAST

Thanks to our extensive experience in interacting with customs, we have created clearly defined rules of interaction that allow you to complete the customs clearance procedure with the least amount of time.

PROFITABLE

Our clients receive an Export Declaration and transport documents at a single price specified in the Agreement, with no additional costs.