Globally, any businessman has two options: turn to a professional logistics company that will do everything on a turnkey basis, or understand the topic yourself. The second option will require: a) studying literature on customs clearance; b) attending courses on declaration of goods; c) concluding contracts with transport companies; d) issuing an electronic digital signature; e) registration of a separate legal entity, which will be the direct importer.

Then begins the process of making your own bumps, which in the case of cross-border transportation of goods can be very expensive. Errors are controlled by the Administrative Code and the Criminal Code of the Russian Federation. For example, transporting goods without a certificate is punishable by a fine of 300,000 rubles. and possible confiscation of the cargo.

Options for legislative regulation of import issues

The rules governing the procedure for calculating VAT when importing goods into Russia are divided into two groups related to countries:

- members of the Eurasian Economic Union (EAEU);

- non-members of the EAEU.

There are few members of the EAEU. These are Russia, Armenia, Belarus, Kazakhstan and Kyrgyzstan. For them, there is a single document establishing the rules for taxation upon import (Treaty on the EAEU, signed in Astana on May 29, 2014). According to these rules, the amount of VAT is determined not at customs (there is none between these countries), but after the goods are accepted by the taxpayer for registration. The procedure is accompanied by the preparation of additional tax reporting forms. There are special deadlines for paying taxes and filing tax reports, which are the month following the month of importation. Such tax is paid to the tax authority.

Non-EAEU members are all other countries, and China is one of them. Between Russia and these countries, customs exists, and accordingly, customs legislation is applied (TC RF and documents published by the State Customs Committee of the Russian Federation), requiring payment of VAT at the time of import as one of the conditions allowing the release of goods into the territory of Russia (order of the State Customs Committee of the Russian Federation dated 07.02 .2001 No. 131).

It is necessary to apply both groups of rules regarding the imposition of VAT on imported goods not only by payers of this tax, but also by those who are not them, i.e. persons working in special regimes, as well as those who are exempt from the need to pay tax under Art. 145 Tax Code of the Russian Federation.

Important!

We strongly advise against trying to negotiate with manufacturers on your own without at least using the services of Chinese intermediaries. Even if you know the language (which is very, very doubtful), you will almost certainly be scammed. Don’t forget the usual rules of product rotation, when they try to sell the most illiquid samples first. From the Chinese point of view, you are ideal for this.

You need to understand Chinese legislation very well and have good friends or at least acquaintances among the Chinese, so as not to lose all your money.

Calculation and payment of VAT in the presence of customs

Goods passing through customs are subject to mandatory value added tax (clause 1 of the appendix to the order of the State Customs Code of the Russian Federation No. 131), if they are not among those exempt from this tax.

CLARIFICATIONS from ConsultantPlus: At what rate is VAT charged on the import of medical masks (OKPD2 code 32.99.11.120) and protective suits (OKPD2 code 32.99.11.199) on April 23, 2021 from China for the purpose of further transfer to a medical institution? The answer to this question can be found in ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

The amount required for payment is calculated when filling out a cargo customs declaration (CCD) at the tax rates applied in Russia and depending on the type of imported cargo (20% or 10%). The tax base becomes the customs value of the goods, increased by the amount of import customs duties and excise taxes (clause 5 of the appendix to the order of the State Customs Committee of the Russian Federation No. 131). The calculation should be made separately for each group of goods that have the same name, distinguishing among them those subject to and not subject to excise taxes, as well as those that are processed products previously sent for this purpose from the territory of Russia (clause 7 of the appendix to the order of the State Customs Code of the Russian Federation No. 131). The results of separate calculations are summed up to obtain the total amount of tax shown in a specific customs declaration (clause 12 of the appendix to the order of the State Customs Code of the Russian Federation No. 131).

Payment of VAT is one of the mandatory conditions for the release of goods from customs. The amount must be paid to the customs authority. Therefore, taxpayers who regularly import, in order to avoid delays in release, transfer advance payments to this authority, against which the required amount is credited.

Payment of tax by a person who is not a declarant is allowed (clause 2 of the appendix to the order of the State Customs Code of the Russian Federation No. 131). Such a person usually becomes a Russian intermediary (letters of the Ministry of Finance of Russia dated July 7, 2016 No. 03-07-08/39774 and dated July 2, 2015 No. 03-07-08/38192) or a customs representative (letter of the Ministry of Finance of Russia dated June 15, 2016 No. 03- 07-08/34569). Payment of tax made by a foreign supplier or on his behalf is possible, but will not allow a deduction for it to be applied in the future (letter of the Ministry of Finance of Russia dated June 14, 2011 No. 03-07-08/188).

Among the goods exempt from import VAT (Article 150 of the Tax Code of the Russian Federation, clause 13 of the appendix to the order of the State Customs Committee of the Russian Federation No. 131) there are those for which such a prerogative is associated with a specific purpose for their use. If the goods turn out to be used for another purpose, then you will have to charge a tax and pay not only its amount, but also penalties from the date of import, and in some cases a fine (clauses 14, 21 of the appendix to the order of the State Customs Code of the Russian Federation No. 131).

Rules for communication with Chinese partners

Do not simply call a Chinese person by name - this will be considered disrespectful and familiar. In extreme cases, by last name and first name - yes, yes, in that order, but best of all - with an indication of the position. For example, Manager Wang, Director Li and so on.

Do not under any circumstances complain about your work, do not try to discuss his boss, salary, or relationships in the team with a Chinese man. The boss is sacred, he cannot be judged or criticized, and colleagues are a real second family for any honest Chinese. The same applies to politics: the Chinese are great patriots and do not tolerate irony about the state structure. And then, you won’t be talking about politics, but doing business.

But your partner will enjoy talking about Chinese culture, traditions, and local cuisine. Be sincerely interested in the traditions of the Chinese people, but do not overdo it - they see through falsehood and flattery very well.

Don’t rush to rejoice if your Chinese partners happily agree with your proposals and nod in agreement. This doesn’t mean anything: it ’s difficult for a Chinese to say “no”; it’s easier for him to agree, and then think about how to avoid an uncomfortable agreement. And if you were told “You need to think about this,” most likely, get ready for refusal.

In turn, soften the wording yourself and do not cut from the shoulder. Adapt to someone else’s mentality, avoid harsh answers , and if the proposal of your Chinese partners does not suit you, delicately say: “We need to consult with our partners,” “We need time to think about your proposal,” and so on. Believe me, the Chinese will understand the hints perfectly.

Try to enter into written contracts and agreements. What is said in words often means nothing, but before a letter or any business paper, the Chinese have deep respect.

Register on Chinese social networks - QQ and WeChat - and communicate with suppliers directly. This will be faster than by email. Don't forget about the time difference - five hours from Moscow.

Don't skimp on praise and compliments. The East is a delicate matter, everyone there praises each other, but most often acts in their own way. Accept the rules of the game, allow yourself to be praised and do not forget to lavish kind words in response. This will not be considered flattery - completely normal business communication.

Don't express your emotions too clearly. Of course, Chinese suppliers are accustomed to working with Russians, have read Dostoevsky and have heard a lot about the mysterious Russian soul. But still, you shouldn’t go into someone else’s monastery with your own rules and temporarily pacify your nature.

Don't dress too brightly. Yes, we remember that on the AliExpress website you can find clothes, shoes and accessories in the most crazy colors and styles, but they are produced for import - the Chinese themselves are unlikely to wear this, especially to a business meeting. Dress modestly and discreetly: no stretched T-shirts, ripped jeans, a shirt and trousers are the ideal option.

Well, the educational part is over, now let's move on directly to business processes.

Features of customs VAT deduction

The VAT paid when importing goods can be taken as part of deductions for the tax accrued for payment on sales in Russia (clause 2 of Article 171, clause 1 of Article 172 of the Tax Code of the Russian Federation). The conditions necessary for its inclusion in deductions (acceptance of goods for accounting; purpose for operations subject to VAT; payment of tax) are fulfilled at the time of import, i.e. the right to deduction arises immediately after release from customs. Moreover, the establishment by the supply contract of a special moment of transfer of ownership, occurring later than the date of import, does not matter, since the received goods are still accepted for accounting, but only on the balance sheet (letter of the Ministry of Finance of Russia dated July 22, 2016 No. 03-03-06/1/42943 and the Federal Tax Service of Russia dated January 26, 2015 No. GD-4-3/911).

The document confirming the amount of tax accrued upon import is the customs declaration. And it also plays the role of an invoice when including information about deductions in the purchase book, i.e. in column 3 of the book you should indicate the number and date of the customs declaration accompanying the import (subclause “e” clause 6 of section II of Appendix 4 to the Government Decree RF dated December 26, 2011 No. 1137). A GDT executed electronically (ETD) should be in a paper copy (letter of the Ministry of Finance of Russia dated March 2, 2015 No. 03-07-08/10606).

However, when checking the right to deduction, the Federal Tax Service considers the customs declaration alone to be insufficient to confirm the fact of tax payment and requests additional information from the taxpayer about making payments. Such confirmation becomes especially important in cases where VAT is paid at customs in advance. To obtain information about payments made under specific customs declarations, the taxpayer will have to make a request to the customs authority to issue him a document confirming the linking of the transfers made by him to specific declarations (letter of the Federal Tax Service of Russia dated April 24, 2018 No. ED-4-15/7800). The current form of such a document was approved by order of the Federal Customs Service of the Russian Federation dated December 23, 2010 No. 2554.

Keep your finger on the pulse

Ask your supplier how long it will take to prepare your item, and then ask the shipping company how long the shipment will take. Let's say it takes your supplier 6 weeks to produce the product, and another 6 weeks for the shipping company to deliver. So, your waiting time will be approximately 3 months.

Planning will help you control the situation and prepare for the arrival of the cargo in time. Make sure you know all the details and are ready to receive the goods, check the following points:

- date of shipment;

- approximate date and time of cargo arrival;

- the name of the vehicle on which the transportation will be carried out (so that you can track it yourself if necessary).

Reflection of import VAT in accounting and in the VAT return

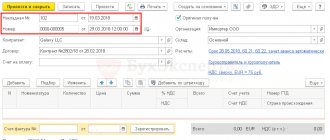

In accounting, the VAT accrued according to the customs declaration is reflected by posting Dt 19 Kt 68. Its payment, depending on how the tax is paid, will be shown:

- as a direct payment for a specific customs declaration - Dt 68 Kt 51;

- as an offset of the corresponding amount against advance payments previously made to customs - Dt 68 Kt 76.

The deduction will be displayed by posting Dt 68 Kt 19.

Value added tax defaulters, despite having an obligation to pay import tax, do not have the right to take it into deductions that reduce VAT charged on sales in Russia (since they do not pay it). They must include the amounts paid at customs in the cost of the goods (subclause 1, clause 2, article 171, clause 2, article 170 of the Tax Code of the Russian Federation). The taxpayer should do the same if he intends to use the imported goods for transactions not subject to VAT.

The import tax taken into account in the deductions and paid at customs will be reflected in the value added tax declaration of form KND 1151001, generated quarterly, where it will appear in line 150 of section 3 specially designated for it.

ConsultantPlus experts explained in detail how to calculate the tax base for imports from countries outside the EAEU. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

Look for a reliable supplier

Make sure your supplier produces high quality products. If this is your first time importing, there are several options to find out who you are dealing with:

- choose trusted companies such as Alibaba and Made In China. Millions of customers turn to these suppliers. In addition, they send product samples;

- contact the inspection agency. Maybe we can help you with this;

- visit the factory in person if you can afford it. If you plan to make a large order, it makes sense to spend money on a trip to Asia.

When does it become necessary to restore customs VAT?

Customs VAT must be restored in cases provided for by law. All recovery situations are listed in clause 3 of Art. 170 of the Tax Code of the Russian Federation, but only the following will be relevant to the tax paid at customs: transfer of imported property to the authorized capital of legal entities;

- a taxpayer who has not used the imported goods becomes a tax defaulter or begins to use it for transactions that do not require VAT;

- the taxpayer becomes the recipient of reimbursement from the budget for costs associated with the import of goods into the territory of Russia.

Restoration occurs when grounds for it arise. When switching to a special regime, this occurs in the last tax period preceding the start of application of the special regime.

In accounting entries, tax recovery will be displayed as follows:

- Dt 19 Kt 68 - the amount subject to recovery has been accrued;

- Dt 01 (10, 41) Kt 19 - tax is included in the cost of the goods.

In the quarterly VAT return, the restored amounts will also fall into section 3, but in line 090, which relates to accruals.

Currency control after payment for goods

This is a procedure that is carried out after payment to the supplier in China. Currency control involves accounting for a contract between a domestic buyer and a foreign seller and is carried out by a Russian bank. It is mandatory when the value of the contract exceeds 3 million rubles.

To pass control, a copy of the contract with the supplier is uploaded to the Internet bank, specialists study and register it. The service is paid.

Some novice entrepreneurs, out of a desire to save money, split up the contract with an amount exceeding 3 million rubles. into several small ones. And if the bank charges from 0.15 to 0.25% of the value of the goods for currency control, then if a violation of currency legislation is detected, a foreign trade participant will be fined in the amount of 75-100%.

However, even if your contract with a Chinese supplier costs less than 3 million, supporting documents still need to be submitted to the bank, according to the official form of the Bank of Russia. You need to show all the documents available for the transaction: the contract itself, declarations and invoices. Moreover, copies of documents and a certificate from the customs service are uploaded to the Internet bank.

To fulfill this requirement, 15 working days are given from the moment the money is sent to the supplier. A certificate from the customs service is not needed if the payment amount is less than RUB 200,000.

Results

VAT when importing goods into Russia from China is calculated according to the rules of customs legislation. Its amount is reflected in the cargo customs declaration (CCD). Payment of tax is a prerequisite for the release of goods into Russia.

The import tax paid at customs can be taken as VAT deductions. The conditions for acceptance as deductions - the posting of goods, their intended use for taxable transactions, payment of tax - are fulfilled at the time of release into the territory of Russia. In the purchase book, such tax is reflected with reference to the number and date of the customs declaration. The Federal Tax Service may require from the taxpayer a document issued by customs confirming the payment of tax under a specific customs declaration, in the case of making advance VAT payments to the customs authority. In a normal quarterly VAT return, a separate line is provided to indicate the import tax paid at customs.

In the cases provided for in Art.

170 of the Tax Code of the Russian Federation, customs VAT should be restored. In a regular quarterly VAT return, a separate line is also allocated for recoverable amounts, which will also include VAT paid at customs, if it needs to be recovered. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Find out all the conditions

Be careful when studying the terms of purchase and transportation of goods. Please note which shipping costs are your responsibility and which the supplier is responsible for. We recommend purchasing goods on FOB terms. This is the most profitable and safe option. Avoid CIF/CFR shipping terms as these terms may increase your costs significantly.

Make sure you know when the supplier expects to receive payment; you may need to make an advance payment or pay for the goods in part once they are loaded onto the vehicle.

Exporting goods to China - step-by-step instructions from an expert

This topic is vast and multifaceted, but entering a product on the Chinese market is not easy, and it is difficult to provide a single step-by-step instruction that is universal for all sellers. Therefore, you can ask questions in your area in the comments, and I will definitely answer them!

However, I will try to briefly outline the directions in which a new exporter should move.

Step 1. Prepare for export

Many people mistakenly skip this stage, considering it unimportant, but in export it is fundamental and consists of several points.

Any product that you want to import into the Middle Kingdom must be checked according to the following parameters:

- Competitiveness in price, taking into account the costs of customs clearance, taxation, duties.

- Checking the possibility of export (product composition: physico-chemical, ingredients).

- Documentary support of the goods (label registration, obtaining the necessary permits and documents for import to China, declaration).

- Testing for taste preferences and visual perception.

Step 2. Finding a partner

On the Chinese side you will need an external importing partner. They deal with the entry of goods into the country, carry out logistics, and prepare and check documentation for customs clearance. They also accompany the procedure for checking goods at the quarantine bureau and receive the appropriate certificates.

You can search for a partner on the Internet in open databases of importers in China, but this method is ineffective. The second way is to search in various customs unions and entrepreneurs' unions.

The most effective way to find a competent, responsible partner is to visit exhibitions that are aimed at importers and distributors. To find a good partner, I advise you to take part in the largest industry exhibition, for example, SIAL China, and then in the largest exhibition specifically for your product, which is attended by local distributors.

Step 3. First shipment

When you have fully prepared the product and found a partner, it is time for the first shipment of the goods. This is the starting point at which you will understand whether you have done the right preparation, whether you are on the right path.

Also at this stage, mistakes that you made during the preparatory stage are identified.

Step 4. Consolidation in the market

The next stage of development is entering federal networks. But this is only possible when distribution is already well established and there are reliable partners.

Here we are talking about choosing a strategy for working in the Chinese market, advertising the product, establishing distribution channels, and strengthening your brand in the country of sale. You can work to strengthen your products in different ways, for example, use online marketing, conduct tastings and presentations, and work with top bloggers. This is usually handled by importers and distributors, but you must keep an eye on how your brand develops in the new country.

An importer is a partner, a company that buys foreign goods from the Chinese side for its further sale.

The distributor deals with operational issues related to the delivery of goods in the assigned territory.

A brand manager is a specialist who represents a brand, but does not physically supply its products. He negotiates with clients, informs them about promotions, finds out the client’s needs, discusses sales and advertising issues.

Products do not always sell well on their own, so you need to take the promotion of your brand into your own hands, controlling the work of all these links.

Important Takeaways

- Export is an important and necessary stage in business development, but it requires careful preparation.

- If you decide to refuse to export or believe that your product is not interesting for the markets of other countries, then most likely you are closing the door to the development of your production.

Thank you for your attention! Leave your questions on the topic in the comments to the article, we will be happy to answer you!

Best regards, exporter Viktor Akulinin

(

5 ratings, average: 5.00 out of 5)