HomeCustoms clearancePlaces of clearanceCountries China

Our company “Universal Cargo Solutions” carries out prompt customs clearance of any cargo and goods delivered “from China to Russia” and “from Russia to China” by any type of transport at all customs offices of the Russian Federation:

- At airports

- In seaports

- At railway stations

- At cargo automobile terminals – temporary storage warehouse

- Express postal items

We are a customs representative - a customs broker and carry out operational:

- customs clearance of imported goods from China;

- customs clearance of exported goods from Russia to China.

If necessary, we carry out customs clearance of goods in any other customs procedures!

Our company does not carry out customs clearance of goods in China! We recommend that you contact your local customs brokers in China directly regarding this issue.

We work with any participants in foreign trade activities:

- Individuals

- Legal entities

- Individual entrepreneurs

Customs clearance of cargo or goods from China occurs at places - customs clearance points: border checkpoints for individuals or temporary storage warehouses located within the country: airports, seaports, railway stations and road freight terminals. Our customs broker company will help you clear your goods from China.

Our employees are ready to advise clients on what documents will be required in each specific case and help with their preparation.

Documents and information for customs clearance of cargo and goods from China

- List of documents for registration of an individual at customs (View)

- List of documents for registration of a Legal entity at customs (View)

- List of documents for registration of an individual entrepreneur at customs (View)

- List of documents for customs clearance “Import” (View)

- List of documents for customs clearance “Export” (View)

Do you need customs clearance of goods to/from China? – We will help you!

Delivery of cargo and goods from China and their customs clearance

Delivery of cargo and goods from China or “from Russia to China”, depending on the properties of the goods, can differ greatly from each other. For example, for ordinary goods no special conditions are required during transportation, for perishable goods it is important to maintain the required temperature, and when transporting dangerous goods, special requirements are imposed on the carrier. Our company can organize the delivery of cargo and goods from China of any type, as well as their customs clearance and, if necessary, certification:

- General

- Prefabricated

- Perishable

- Dangerous

- Container

- Bulk

- Oversized

- Oversized

- Heavyweight

- Live animals

- And others

Don't know how to register goods from China? – We will help you!

Smart Savings

My main advice to anyone starting a business with China is to spare no expense on quality control of the product you choose. You can organize logistics as competently as you like, but if in Russia you find a container with defective products, all your efforts will be in vain. We have been working in this market for a long time and regularly send defects for revision.

Fraudsters steal several billion dollars every year from honest merchants from all over the world! And we’re not just talking about low-quality goods here. Very often, Russian entrepreneurs become victims of scammers without receiving anything in return. For example, a businessman comes to China to visit a factory, he is given a tour, then he and the director go to a restaurant, there they negotiate a 30% discount, shake hands, and sign a contract. The satisfied entrepreneur returns home, transfers the advance and waits. Three weeks later he calls, but no one picks up. As a result, it turns out that the so-called “director” is not a director at all, but a simple agent hired by the factory to increase its sales. This person has the right to lead tours, but does not have the authority to sign documents. As a result, no goods, no money, no people to blame.

Specialized companies that conduct inspections of counterparties on a regular basis will help you avoid such situations. Such a service will cost from $100 to $300. You can order it either separately or in combination with logistics. Believe me, such an investment usually pays off a thousandfold. This is “smart” saving.

Nikolay Merny , logistics director

Customs duty on parcels from China to Russia

For goods and parcels imported from China to Russia through express carriers, customs duties must be paid if the permitted limit is exceeded. This payment is made at customs when registering the goods.

Individuals: from January 1, 2021, they can import an unlimited number of parcels per month not exceeding the duty-free limit of 200 euros and not more than 31 kg. In case of excess, you must pay a duty of 15% of the excess amount or 2 euros per kg also in case of excess. In 2021, this limit was per month, and not per shipment (parcel) - 500 euros and no more than 31 kg, and in case of excess, customs had to pay 30% of the cost or 4 euros per kg of the excess. Which for more expensive goods increased the amount of customs duties paid.

| Restrictions on postal items (MPO) and goods delivered by express carrier | |||

| Validity | Weight restrictions (gross) | Restrictions on the cost of goods | Unified rates of customs duties |

| From January 1, 2021 | no more than 31 kg | no more than 500 euros | 30% of the cost, but not less than 4 euros per 1 kg of weight in terms of excess |

| From January 1, 2021 | no more than 31 kg | no more than 200 euros | 15% of the cost, but not less than 2 euros per 1 kg of weight in terms of excess |

For example: For a mobile phone worth 800 euros ordered from a foreign online store by post at customs:

- In 2021 it was necessary to pay (900 euros – 500 euros) = 400 euros * 30% = 120 euros;

- In 2021 it was necessary to pay (900 euros – 200 euros) = 700 euros * 15% = 105 euros.

True, in 2021, at the initiative of the Ministry of Industry and Trade, a significant reduction in the duty-free limit for Internet parcels to 50 euros is being considered!

Legal entities and individual entrepreneurs: can import any goods intended for commercial purposes from China to the Russian Federation, having paid customs duties depending on the type of goods imported. They are calculated and paid in Russian rubles at the Central Bank exchange rate at the time of filing the declaration. If the customs value of the parcel is up to 200 euros, no customs payment is paid!

Do you need a customs broker from China? – We will help you!

How to conclude a foreign trade contract

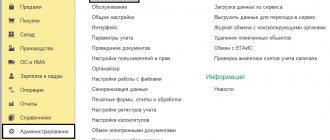

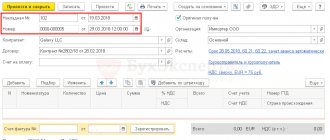

Keep records of exports and imports using the simplified tax system in the Kontur.Accounting web service. Currency accounting and work instructions, taxes, automatic salary calculation and reporting in one service Get free access for 14 days

Once you've selected a supplier and negotiated, it's time to draw up a contract. A foreign trade contract is the main document that governs an international transaction. Your legal protection directly depends on how thoroughly you took into account your interests when drawing up the contract.

It is important to stipulate in the contract:

- Delivery terms according to Incoterms 2010.

- Delivery times and payment terms.

- Accompanying documents.

- Insurance and warranty service.

- Procedure for resolving disputes.

- Procedure in case of force majeure.

Customs clearance of goods and cargo imported to the Russian Federation from China

Our company is a customs broker, conducting prompt customs clearance from China of goods and cargo imported into the Russian Federation by any participants in foreign trade activities. We help prepare the correct package of documents required for customs clearance, calculate the customs duties required for payment, if necessary, pay them for the client, prepare the necessary permits (certificates, declarations of conformity, phytosanitary or veterinary certificates, etc.), submit and issue a customs declaration for any customs office of the Russian Federation.

Do you need prompt customs clearance of cargo and goods from China? - We will help you!

Cost optimization

Entrepreneurs very often ask questions about safe savings on logistics. In fact, there are working tools. We always recommend our clients to buy services close to the source of their provision, but not directly from the international transport companies themselves, but from their nearest forwarders. It is more convenient and profitable for them to sell logistics to several large forwarders, who then resell the logistics along the chain. Also, most often, if you enter into an agreement directly with a large transport company, some difficulties will arise with prompt customer support.

There are dozens of different intermediaries operating in the transport market, who purchase services in bulk from large companies and then resell them to SME representatives. Due to the discounts received from large transport companies, they are able to give low rates to their customers and earn money.

However, delivery of goods to Russia, as I already said, is only half the battle. If you are not going to risk going through customs yourself, then I would advise purchasing services in a comprehensive manner. This is a convenient and safe way to save money. In package offers, specialized companies, as a rule, give good discounts on the logistics itself, which you buy almost at cost. The main income of such companies is customs declaration. But you will most likely receive these services at quite reasonable prices: firstly, due to the streaming work of the intermediaries themselves, and secondly, due to high competition. In this market, no one has super profits.

Customs duties on goods from China in Russia for legal entities

Customs duties from China to Russia on goods imported by legal entities and individual entrepreneurs for personal or commercial use must be paid at the time of filing and issuance of the customs declaration. Each type of product has its own import duty rate. At the same time, other customs payments are also paid: duties, VAT, excise taxes.

Types of customs payments:

- Import customs duty. The amount of import customs duty depends on the type of goods and is determined according to the HS code of the EAEU customs tariff. When determining the import duty, it is necessary to remember about preferences that reduce the amount of duty. Preferences apply to some goods imported from China;

- Value added tax (VAT) is established by the Tax Code of the Russian Federation depending on the HS code and can take the following values: 0%, 10%, 20%;

- Excise tax;

- Customs duty;

- Special, anti-dumping and countervailing duties.

The basis for calculating customs duties is the customs value of the goods, which consists of the cost of the goods and the cost of its delivery to the customs border.

When calculating customs duties, it is necessary to remember that upon presentation of a certificate of origin, preferences (reduced import duty rates) may be provided for a number of goods. For goods exported to China, a general certificate of origin is issued.

An example of calculating customs duties when importing from China

A consignment of wristwatches with a mechanical indication, powered by a battery (HS code 9102110000), is being imported from China to Russia. The goods are not excisable and are not subject to excise duty; the import duty on it is 7% and VAT is 20%. The customs value of the declared goods is 1000 US dollars. The batch is declared under the customs procedure “Release for domestic consumption” (IM-40). Having completed and submitted a customs declaration to the customs authority, the foreign trade participant must pay customs payments: customs clearance fees, import duties and VAT.

| Payment type | Basis for accrual | Bid | Sum |

| customs duty | 1000$ | 375 RUR | 6.05$ |

| Import duty | 1000$ | 7% | 70$ |

| Import VAT | 1070$ | 20% | 214$ |

| The total customs payment will be: | 290.05$ | ||

* — In our example, the Central Bank exchange rate at the time of filing the declaration is taken at the rate of 62 rubles per 1 US dollar

Thus, the customs payment to the customs of the Russian Federation upon import will be 290.05 US dollars or 17983.10 rubles.

We clear customs of any cargo of any participants in foreign trade activities 365 days a year at all customs offices in Russia!

How to choose a reliable partner

Be careful and learn to distinguish reliable manufacturers from scammers. When researching manufacturers in the same region, check for those who post the same photos or sell everything from slippers to auto parts.

To check a manufacturer, visit their factory and see what's going on there. Although even this does not always help to see the deception. A trading company, a Chinese intermediary and a manufacturer can collude and cheat an inexperienced foreigner.

A legally operating company must be registered with the Chamber of Commerce and Industry, have a unique number and a Certificate of Import & Export received from the Ministry of Commerce.

The easiest way to find reliable and honest partners is at trade fairs - Canton, Hong Kong, CHTF and others. There you will be able to personally communicate with company representatives, evaluate the quality of products and receive a lucrative offer for cooperation.

But even after concluding a deal, you shouldn’t relax. It is better to constantly monitor the production process, otherwise the result may unpleasantly surprise you. If you cannot do this yourself, turn to the services of third-party specialists. Chinese entrepreneurs also like to independently change the terms of the contract if something changes in production. And it is almost impossible for a Russian businessman to punish the Chinese for failure to comply with the terms of the contract - private companies are closed and opened under a new name so as not to be found.

If you are looking for a buyer in China, consider an intermediary company that will sell your product or help you find a good buyer. If you want to save on the services of an intermediary, post your offer on thematic Chinese forums, send a commercial offer to Chinese enterprises, or use trading platforms.

Terms and cost of services for customs clearance of cargo and goods from China (to China)

The time it takes to clear goods from China (to China) at customs is several hours!

The price and cost of the customs clearance service for cargo and goods: “for customs clearance from China when importing, importing” or “customs clearance to China when exporting” in our company are the minimum in the market and are discussed individually depending on the tasks and place of customs clearance. And can be:

- for individuals: 3000-10000 rub.

- for legal entities or individual entrepreneurs (IP): 5000-17500 rub.

We work for you and try to be useful to you!

How to negotiate

Keep records of exports and imports using the simplified tax system in the Kontur.Accounting web service. Currency accounting and work instructions, taxes, automatic salary calculation and reporting in one service

Get free access for 14 days

European and Chinese mentality are very different. The Chinese make all appointments several days or even weeks in advance. Be sure to let us know that you have received an invitation. Even in China, they prefer to negotiate in person and do not like to communicate by phone or video.

Before negotiations, read articles or books about negotiations with China. You will learn a lot: for example, the Chinese prefer a two-handed handshake and exchange business cards at the beginning of a meeting.

The ability to bargain is no less important than caution when choosing a partner and control of production. To get the right price, follow these rules:

- Research similar offers and set an appropriate price range. Negotiations often start with an inflated price, and you need to understand how far you can bargain.

- Do not demand a low price for products, otherwise the factory will have to skimp on quality, and you will receive a product made from cheap materials, because the manufacturer will not save on employee salaries, electricity and its profits.

- Stay calm and be polite. Don’t blackmail your potential partner by going to a competitor if they don’t give you a discount.

- If during negotiations you inadvertently offered too high a price, and the manufacturer immediately agreed, then simply put forward demands that are unfavorable for your partner so that he understands that the price should be lower.

- Don’t make concessions just like that, wait for reciprocity.