Protecting the interests of domestic producers, Russia strictly regulates the import of products from other countries. The legislation clearly defines the products allowed for import and the standards for their transportation for specific producing countries. To pass the customs procedure for import deliveries, a certain package of documentation is required. Before importing goods into the Russian Federation, it is worth consulting with experts in this matter (for example, customs brokers) and studying Russian laws.

Importing to Russia has certain difficulties, since the rules and regulations are quite strict, differing from the provisions of other countries. Documentation must be drawn up strictly in accordance with established requirements, otherwise problems will arise with passing customs, obtaining a certificate and paying for imported products.

Organization of accounting of import transactions

According to clause 5 of PBU 5/01 and clause 15 of the Methodological Instructions, regulated by Order of the Ministry of Finance dated December 28, 2001 No. 119n, products are registered at actual cost. It consists of the following components:

- contract price;

- additional costs of the importer not included in the transaction price, in particular, delivery costs, etc.;

- customs duties and fees;

- excise taxes (for excisable products).

This point is based on clause 6 of PBU 5/01 and clause 16 of the Guidelines.

The expenses related to the actual cost (clause 6 of PBU 5/01) include only customs duties, and there are no customs duties. But since their payment when importing products is an indispensable condition, these costs also need to be taken into account as directly related to the purchase of products and included in its cost.

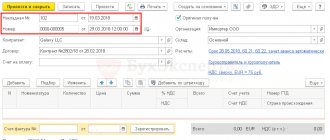

Correspondence in accounting by cost:

Dt 41 Kt 60 - cost of products at the time of transfer of ownership;

Dt 44 Kt 60 - transportation costs;

Dt 44 Kt 60 - intermediary services for the purchase of products (registration through an intermediary company);

Dt 44 Kt 76/Settlements with customs - customs duty (collection);

Dt 41 Kt 44 - cost of products taking into account purchase costs;

Dt 41 Kt 19/Excise taxes - inclusion of excise tax in the cost of imported products.

Valuation of products and costs paid in foreign currency

If the cost of purchased products is determined in foreign currency, then its valuation is carried out in rubles at the exchange rate of the Central Bank of the Russian Federation, which is established on the date of its reflection in accounting. This is indicated in paragraph 19 of the Methodological Instructions (Order of the Ministry of Finance No. 119n).

When paying in advance for imported products, its value under an agreement or contract in rubles must be calculated at the rate of the Central Bank of the Russian Federation on the date of payment upon the fact (paragraph 2, paragraph 9, paragraph 10 of PBU 3/2006). In this case, the unpaid part of the cost of the purchased product is determined at the exchange rate on the date of transfer of ownership of it (clause 5, paragraph 1, clause 9 of PBU 3/2006).

That part of the debt that was paid in advance does not require revaluation. The other part of the debt that has not been paid for products accepted for accounting must be revalued as of the end of each month and (or) on the date of repayment of the debt (clause 7 of PBU 3/2006). In this case, exchange rate differences appear - they must be reflected in accounting as part of other income and expenses (clause 13 of PBU 3/2006).

Customs payments

To calculate customs duties, it is necessary to determine the customs value of the product. It is established by the declarant or the customs authority (clause 3 of article 23 of the Law of August 3, 2018 No. 289-FZ, clause 14 of article 38 of the EAEU Labor Code).

Customs payments are not only duties and fees, but also excise taxes (for excisable products), as well as VAT for imported products (clause 1, article 46 of the EAEU Labor Code, subclause 13, clause 1, article 182, subclause 4, clause 1 Article 146 of the Tax Code of the Russian Federation).

Excise tax is a non-refundable tax; accordingly, its amount is included in the cost of products (clause 6 of PBU 5/01, clause 2 of Article 199 of the Tax Code of the Russian Federation).

The tax base for VAT when importing products into the Russian Federation is calculated as the sum of customs value, customs duties and excise taxes. This point is defined in paragraph 1 of Art. 160 Tax Code of the Russian Federation.

Typically, import VAT is paid to the customs account as an advance payment, and after that, if the company becomes obligated to pay VAT, the customs office writes off the required amount (Article 57 of the EAEU Labor Code).

The correspondence is as follows:

Dt 76/Settlements with customs for VAT Kt 51 - advance payment for VAT at customs;

Dt 19 Kt 68/VAT calculations - VAT payable at customs;

Dt 68/Calculations for VAT Kt 76/Settlements with customs for VAT - write-off of VAT on imported products by customs.

In a situation where the importer uses OSNO and is not exempt from VAT, the amount of tax upon import is accepted for deduction. Of course, this is provided that the imported products will be used in operations subject to VAT (clause 2 of Article 171 of the Tax Code of the Russian Federation).

Importers using special tax regimes are also required to pay VAT to the budget. In this case, the amount of VAT is not deducted, but is taken into account as expenses.

If VAT deduction is applied, you need to generate correspondence:

Dt 68/VAT calculations Kt 19 - VAT deduction paid at customs.

Posting of imported products

In accounting, imported products must be reflected at the actual cost on the account. 41 (clause 5 of PBU 5/01). The costs of its acquisition, if they are not included in the customs value, can be taken into account by a trade organization in the cost of production or as part of sales costs (clause 13 of PBU 5/01).

If a shortage (damage) of imported products is detected, the commission draws up an act, for example, in form No. TORG-3.

You can purchase services that help you work as an accountant here.

Do you want to install, configure, modify or update 1C? Leave a request!

Features of paperwork for import from China

Many countries, including Russia, actively cooperate with the world's largest exporter of goods - China. Products for import to the Russian Federation - equipment, electronics, household goods. The huge distances that cargo has to travel are not a problem if the logistics are organized correctly. You can learn more about the certification of goods from China in this article.

Customs clearance of goods is carried out at the points of arrival. During customs clearance, in addition to the standard package of documents, the authorities must submit the following papers:

- licenses and certificates from government agencies for types of goods for which this is provided for by Russian legislation;

- exact name of the product, photographs of products and packaging;

- certificate of conformity form A;

- transportation agreement marked “Before the Russian Federation” and “After the Russian Federation”;

- Swift confirmation of payment for cargo;

- a document confirming the value of the cargo;

- customs declaration.

The established list of documents may vary depending on the requirements of various customs posts, which it is advisable to clarify in advance. The “clearance” procedure will begin after submitting the necessary documents and a cargo customs declaration. When importing cargo up to 50 kg, customs duty is not charged.

What is included in customs clearance

To begin the procedure, all documents confirming the origin of the cargo, its characteristics, and value must be submitted to the Customs Service. The process takes place in several stages.

First stage

Filling out a customs declaration is the primary procedure carried out by the owner of the cargo or his representative. Customs officers, in turn, check the correctness of the entered data and their compliance with reality. You can declare goods online. The cargo is placed for temporary storage in a special warehouse and remains there until the inspection is completed.

Second phase

After declaration, all documents provided for the cargo are subject to careful verification. The presence and compliance with the requirements of seals and signatures is monitored. All product codes must be indicated correctly and correspond to the data in the unified nomenclature directory. The package of documents must be complete and contain certificates, licenses, and permits. If a document is found missing, customs will request it from the owner. If any inaccuracies are identified, customs officials can correct the declaration themselves. After checking and correcting the shortcomings, the owner receives an invoice for making an advance payment.

Third stage

Tax fees and duties are calculated and written off from the advance amount. Their value depends on the tariffs current at the time of the transaction. If there is no advance payment, further customs clearance is impossible. The process is suspended, and a fine may be issued to the owner of the goods.

When all financial issues have been settled and write-offs have been carried out, a control check of the documentation and the release of the cargo from their storage facility through the customs control line are scheduled. Now the goods are ready for legal transportation throughout Russia. This completes customs clearance.

ADVANTAGES OF WORKING WITH US

PROFESSIONALLY

Your trading operations are carried out by experienced professionals in the foreign trade industry. All specialists have certificates from the Federal Customs Service of Russia and more than 8 years of practical experience.

Comfortable

Your personal account allows you to carry out all procedures without personal presence, from uploading documents to tracking the status of customs clearance. DT is sent to customs via ED-2

Fast

Thanks to the accumulated experience of working with customs services, we have created a clear procedure that allows you to expedite customs clearance

Profitable

We will provide a declaration for Goods (DT), and all related documents at a single price, without additional payments

Trading partners

Considering Russia’s main trading partners among non-CIS countries in 2017-2020, it is interesting to consider the situation from the point of view of exported and imported goods between them. So, over the past 3 years the situation in US dollars is as follows:

- Russia exports approximately $18 billion to China. And it imports $20 billion.

- With Germany, the turnover is already almost 2 times less. Russia exports $12.3 billion, and imports $10.6 billion.

- Russia exports goods worth $18.8 billion to the Netherlands, but imports only $1.8 billion.

- It exports to Italy for $6.9 billion and imports for $4.3 billion.

- The United States supplies $5.8 billion worth of products to Russia in its own currency, and receives $4.9 billion worth of products from Russia.

- The situation with Korea is as follows. Imports with this country are 3.5 billion, and exports are 6.3 billion $.

- Russia has the following indicators of foreign trade in goods with Turkey. Exports amount to $8 billion, and imports 1.4.

- With Japan, exports are 4.9 billion and imports are $3.5 billion.

If we talk about our closest neighbors in the CIS, then the most developed economic relations are with Belarus. Less with Kazakhstan, and even less with Ukraine.

Which products are subject to traceability?

The list of traceable items may be updated, so please check for changes. To avoid double interpretation of names, the list contains EAEU and OKPD2 HS codes. Check on the Federal Tax Service website whether the product is subject to tracking.

As of June 2021, the list includes:

- household and industrial refrigerators, freezers;

- household and industrial washing machines;

- monitors, projectors, television receivers;

- prams;

- children's car seats;

- industrial heat pumps;

- forklifts, bulldozers, excavators, road rollers.

If there are difficulties with the classification of goods, use the HS code from the supplier’s invoice or check the data from the certificate of conformity.

If a traceable product was produced on the territory of the Russian Federation with full or partial use of imported spare parts, the created product is considered imported and is also subject to traceability. Exceptions:

- components are placed under the customs procedure of release for domestic consumption, that is, they have no restrictions on their use;

- Imported spare parts are placed under the customs procedure of a free customs zone, that is, they are processed by residents of such free economic zones as Alabuga, Titanium Valley, or under a similar customs procedure of a free warehouse.

You can determine the customs procedure using the customs declaration codes.

There is no need to report transactions with traceable goods if they involve state secrets, for example, the purchase of refrigerators as part of a defense contract. If the tracked product is intended for representative offices of international organizations, then it is also not included in the tracking system.

How to assign a registration number for a product batch

If the product is traceable, it is assigned a registration number (RNPT). It is created not for each unit of goods, but for the entire batch. RNPT must be indicated in universal transfer documents, invoices and tax reporting. The number is not physically applied to the product.

If the goods are imported from countries outside the EAEU, the number is assigned by the importer himself.

The number consists of blocks separated by a “/” sign. The first three blocks coincide with the number of the customs declaration in section A:

- customs code (section 29 of the customs declaration);

- date of registration of the customs declaration (section 54 of the customs declaration);

- serial number of the declaration.

The last block of RNPT numbers represents the serial number of the goods from section 32 of the customs declaration. If there are several parties in the customs declaration, then the RNPT is assigned to each of them.

Example.

A batch of 5 monitors was imported according to the customs declaration dated July 1, 2021 with the following data.

The registration number of the batch will be: 10129020/010721/0000123/001.

There is no need to notify the tax office about the assignment of a batch number, but it must be indicated in all shipping documents when moving goods from this batch.

If the goods are imported from the EAEU countries, the RNPT is assigned by the tax office.

To do this, submit an import notification to the tax office in the form KND 1169008 within 5 working days from the date of acceptance of the goods for registration. The Federal Tax Service will assign the RNPT within 24 hours and notify you.

If for any reason you return the imported goods to the supplier back to the EAEU, no later than the next business day after the return, submit an adjustment notification of import.