Home — Articles

The introduction of information technologies in government agencies has a positive effect on economic development. The customs service is no exception. Over the past ten years, the Customs Service of the Russian Federation has been actively introducing information and communication technologies into its activities. It is obvious that the use of information customs technologies makes it possible to simplify the process of preparing and making decisions on the release of goods and make it more transparent for business.

Currently, in order to simplify customs clearance and improve the quality of provision of public services in the field of foreign economic activity (hereinafter referred to as FEA), a number of information customs technologies have been developed and implemented. Among the main ones are:

— electronic declaration;

— preliminary information;

— remote release;

— customs payment card;

— provision of public services (functions) in electronic form;

— work with permits, etc.

The introduction of information technologies (Order of the Federal Customs Service of Russia dated January 24, 2008 N 52 “On the introduction of information technology for submitting information to customs authorities in electronic form for the purposes of customs clearance of goods, including using the international association of Internet networks”) in the customs sphere allowed the Federal Customs service (FTS of Russia), while providing support for its own customs processes and promoting international trade, create favorable conditions for attracting investments, minimize the impact of the human factor, and reduce public administration costs. The basis for the use of these information technologies are the provisions of such legal acts as:

— Customs Code of the Customs Union (clause 2, part 2, article 15, clause 42, 43, 54, 95, 98, clause 3, article 158, clause 2, article 163, clause 1, article 169 , clause 4 of article 176, clause 3 of article 179, clause 5 of article 180, clauses 5 - 6 of article 183, clause 5 of article 187);

— decision of the Customs Union Commission dated December 8, 2010 N 494 “On the Instructions on the procedure for submitting and using a customs declaration in the form of an electronic document;

— Agreement on the presentation and exchange of preliminary information on goods and vehicles moved across the customs border of the Customs Union, dated May 21, 2010;

— Federal Law of the Russian Federation of July 27, 2010 N 210-FZ “On the organization of the provision of state and municipal services”;

— Order of the State Customs Committee of Russia dated August 3, 2001 N 757 “On improving the system of payment of customs duties” (together with the Technology of settlements for customs and other payments using microprocessor plastic cards (customs cards));

— letter of the Federal Customs Service of Russia dated March 28, 2012 N 01-11/14513 “On the use of technology for remote release of goods.”

Electronic declaration

The introduction of electronic declaration in the customs service of the Russian Federation began in 2002 with the use of ED-1 technology, which consists of transmitting electronic customs declarations over a dedicated communication channel. In 2008, ED-2 technology began to be introduced, which used the Internet to transmit electronic declarations. The first electronic declaration using ED-1 technology was issued on November 25, 2002, and using ED-2 technology on September 9, 2008. The regular implementation of the new technology in the Federal Customs Service of Russia began in September 2009. Data on the number of electronic declarations issued using ED-1 and ED-2 technologies by year, are given in table. 1. Currently, 66,100 foreign trade participants out of 77,950 registered use electronic declaration.

Table 1

Data on the number of issued electronic declarations

| Number of electronic declarations (% of the total number of customs declarations) | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 |

| according to ED-1 | 3 | 5,99 | 6,7 | 6,9 | 10,5 | 10 |

| according to ED-2 | 0 | 0,0 | 2 | 16,1 | 77,5 | 86 |

| Total | 3 | 6 | 8,7 | 23 | 88 | 96 |

To submit a customs declaration electronically, three components are required - an electronic digital signature, a software product that allows you to create an electronic declaration, your own subscriber point (ED-1 technology) or an information operator (ED-2 technology), which provides information transfer services and ensures compliance with security requirements when sending information from a participant in foreign economic activity to the Central Information and Technical Customs Administration (formerly the Main Scientific Information Computing Center of the Federal Customs Service (GNIVC FCS of Russia)). The differences between the ED-1 and ED-2 technologies are shown in Table. 2.

table 2

Comparison of electronic declaration technologies ED-1 and ED-2

| ED-1 | ED-2 |

| Connection to the departmental network of customs authorities. When located remotely from the customs authority, it is necessary to build communication channels | Internet connection |

| The need to create your own access node | Use of information operator services (41 operators) |

| Only one software provider (LETI) | 7 software providers + FCS portal |

| Costs for using the electronic declaration system (software + setup) from 500 thousand to 1.5 million rubles. | Costs when using an electronic declaration system through an information operator are about 100 thousand rubles. |

| It is allowed to submit non-formalized documents (scans, photos) | Only formalized documents are provided |

| It is necessary to use special programs to fill out electronic declarations | It is possible to use standard programs for filling out electronic declarations |

| The customs inspector works in three software tools - electronic declaration system, EGTD converter, AIST-RT21 software | The customs inspector works in one software - AIST-RT21 or AIST-M |

| Closed exchange specification | Open Exchange Specification |

| When returning an electronic declaration, an error log is generated manually by the inspector | When returning an electronic declaration, an error log is generated automatically based on the results of format control |

| Long-term documents are stored in an electronic archive without automatic access from the submitted list of documents to the electronic declaration | Long-term documents are submitted to AIST-RT21. Access to documents is carried out automatically from the list of documents for the electronic declaration |

The advantages of the Russian electronic declaration system also include:

— reduction of customs clearance time (up to three hours instead of two days);

— connection availability;

— the ability to submit an electronic declaration to any customs post of the Federal Customs Service of Russia;

— transparency of the declaration process and reduction of direct contacts with customs officials.

The disadvantages include: the need to obtain an electronic digital signature (valid for 1 year) (Federal Law of April 6, 2011 N 63-FZ “On Electronic Signature” (as amended on July 10, 2012)), technical problems data transfer, manual data entry into electronic documents. In addition, “in addition to the electronic declaration, customs also requires a bunch of paper documents... Most permitting documents are still issued by other departments and ministries on paper.” Customs authorities are required to check these documents.

The Federal Customs Service is actively promoting the use of electronic declaration, as evidenced by the reduction in customs clearance fees (Resolution of the Government of the Russian Federation of December 12, 2012 N 1286 “On amendments to the Decree of the Government of the Russian Federation of December 28, 2004 N 863”) by 25% and eliminating the need to provide a transaction passport when submitting an electronic declaration.

Electronic declaration will become mandatory from January 1, 2014, and the use of paper declarations will be permitted in certain cases provided for by law. In May 2013, the Federal Customs Service of Russia plans to begin an experiment on the automatic release of goods, i.e. without the participation of customs officials. It is assumed that the information system will issue an electronic declaration submitted by the declarant. In this case, the customs officer will not take part in registration, verification of information, or release of goods.

Problems of information support for customs authorities

The development of the economy in the era of technological progress is largely determined by advanced information technologies, without which it is impossible to imagine the further development of society. The starting point of information progress in full is the formation of a single global information space, the creation of technologies and global information systems, the structuring of information flows and resources, as well as the formation of a market for information products and services.

The use of information and innovative technologies in public authorities at the present stage is especially relevant, since their activities are directly related to the need to process and analyze a large array of data and information. It is the use of advanced information technologies that is the fundamental factor determining the development trends of the Federal Customs Service of the Russian Federation (FCS of Russia) and administration tools. In order to increase the efficiency of customs control and improve customs operations, new information technologies are being introduced [1]:

− functioning of the transport system with fast and reliable transfer of information data to customs authorities;

− electronic preliminary information system;

− improved electronic declaration system;

− technology for auto-registration of declarations;

− technology for automatic issuance of declarations;

− improved databases that provide storage and statistical processing of a large number of customs documents [3].

The information system of customs authorities is one of the largest and most dynamic systems, which consists of a large number of elements that implement the functions of foreign economic activity. The management system of customs authorities has a multi-level structure, extensive internal and external connections, where a variety of material, labor and financial resources interact, reflecting their information flows. In order for such a complex system to function normally, both individual structural elements and systems as a whole are controlled.

The basis of a state’s customs business is its customs policy, as well as the procedure and conditions for moving goods, vehicles across the customs border, collecting customs duties, customs clearance, customs control and other functions of implementing customs policy [4].

Central to the problem of improving the customs system is the problem of assessing and, accordingly, increasing the efficiency of its management system. One of the main reasons that led to the presence of such a problem is the low level of processes of operational and strategic management of the activities of customs authorities. Also relevant are the unsolved problems of assessing the efficiency and optimization of the activities of customs authorities and the lack of proper adjustment of their staffing levels in accordance with the goals, objectives, functions and volumes of activity [5].

Currently, the main issues of automation are partially resolved within the framework of the policy of the Unified Automated Information System (UAIS) of the Federal Customs Service of Russia. At the same time, only certain tasks are implemented in the UAIS, such as automation of the functions of entering information, processing, storing, monitoring, generating reports and other information and reference documents of customs authorities [1].

The main component of information technology policy is the targeted activities of the Federal Customs Service of Russia to informatize customs authorities, as well as ensuring the operation of information technology infrastructure facilities. Informatization of customs authorities is an independent and priority direction of the Federal Customs Service of Russia, which is the process of introducing advanced information technologies in customs affairs.

Currently, a radical modernization of the Federal Customs Service of Russia is being carried out in accordance with the Target Program for the Development of Customs Authorities. Measures are also being taken to bring them into line with international customs practice [2].

Unfortunately, there are a significant number of problems in the customs business, the solution of which requires resolution. One of the pressing problems today is the insufficient efficiency of customs control when moving individuals, goods and vehicles across the customs border. It would be advisable to begin solving this problem with the introduction of advanced innovative technologies that will improve customs control, timely and effectively use advanced technical control means to identify and prevent various types of violations of customs legislation [5]. Thus, there is a growing need to create an interdepartmental automated system for collecting, storing and processing information used in the implementation of state control by the relevant services. In addition, this system can minimize the time required for carrying out such customs procedures as preliminary information, electronic clearance and declaration of goods. But the processes of globalization and informatization of economic relations lead to a complication of orientation not only of commercial organizations, but also of public services, which means, on the one hand, an increasing role of their management, and on the other, positive changes in the entire structure and methods of management. The implementation of these obligations is ensured through the application of the latest methods, such as control based on risk management, standardization and unification of customs procedures and the use of advanced information and communication technologies.

Thus, one of the stages in increasing the efficiency of customs procedures will be the creation and implementation of new information technologies that will help support the activities of government organizations, simplify the collection and processing of statistical data on the quantity and nature of transported goods, and the completeness of vehicle loading. In order for such information models to function quickly without errors, it is necessary to use more accurate data obtained from various government services [6].

Currently, customs authorities continue to take measures to create, ensure the functioning and develop the Integrated Information System of the EAEU. This system is a combination of the integration segment of the Eurasian Economic Commission and national segments united by secure data transmission channels [2]. The project was developed on the basis of the Concept of the Integrated Information System of Foreign and Mutual Trade. The purpose of the Concept is the effective regulation of foreign and mutual trade, the implementation of customs and other types of government control using information technology [1].

The integrated information system of foreign and mutual trade was supposed to implement a “single window” mechanism, combining, on the basis of international data exchange standards, the integration segment of the Customs Union itself and the national segments of the “single window” of the Republic of Belarus, the Republic of Kazakhstan and the Russian Federation [1].

Unfortunately, neither the Russian Federation nor the rest of the EAEU member states currently have a “single window” mechanism and are in no hurry to develop it. To implement the “single window” mechanism it is necessary [1]:

− national program for the implementation of the “single window” mechanism, defining the schedule, sources of financing and responsible executors;

− a single body authorized to receive data from participants in foreign economic activity through the “single window” mechanism and transfer it to other government bodies;

− a unified list of standardized documents;

− single throughput channel (data transmission system) of the “single window”.

None of the above conditions have yet been met in the Russian Federal Customs Service system, despite the existence of several programs and plans to create and develop a “single window” mechanism.

Summarizing the above, we can conclude that in order to expand integration and increase its efficiency in the conditions of the EAEU, it is necessary to consolidate the efforts of the EAEU member states aimed at creating and implementing a single, highly effective information support for a number of processes carried out in the conditions of the EAEU.

In the future, it is planned that the EAEU IIS will provide information support on issues of customs tariff and non-tariff regulation, crediting and distribution of import customs duties. The expected result of the implementation of such a system is increased awareness, reduced costs in carrying out administrative procedures, and access for foreign trade participants to interstate services.

Literature:

- Decree of the Government of the Russian Federation of September 8, 2010 No. 697 “On a unified system of interdepartmental electronic interaction.”

- Development Strategy of the Customs Service of the Russian Federation until 2020 [Electronic resource]: [Government Order No. 2575-r dated December 28, 2012] – g. Moscow.

- Malyshenko Yu. V. Information customs technologies: textbook. Part 1/ Yu. V. Malyshenko, V. V. Fedorov. - M.: RIO RTA, 2007–352 p.

- Kukharenko V. B. Modernization of the customs service. Monograph - M.: IC "Classics" // 2000.

- Bormotova E. G. Interdepartmental information interaction is an element of improving the organization and increasing the efficiency of customs authorities // E. G. Bormotova // TDR. 2013.

- Tomachkova D. G., Chuskovskaya T. N. System of electronic declaration of goods in customs authorities in modern conditions / Document publication service // 2021

Preliminary information

Note. This article discusses the system of preliminary informing by participants of foreign economic activity of customs authorities about the planned crossing of vehicles and cargoes of the border of the Customs Union when importing them.

One of the indicators of the level of development of the customs service is the use of preliminary information during customs clearance. The use of advance information serves as the basis for the implementation of the WCO High Level Strategic Group Framework of Standards to Secure and Facilitate Global Trade. Preliminary information is the basis for integrated supply chain management within the ongoing work of the World Customs Organization (Integrated Supply Chain Management Guidelines (WCO, June 2004)) and the application of the International Convention on the Simplification and Harmonization of Customs Procedures (Kyoto Convention, 1999).

Preliminary informing of customs authorities (hereinafter - PI) consists of submitting to the customs of a member state of the Customs Union (hereinafter - CU), on the territory of which the checkpoint is located, information about imported goods and vehicles at least two hours before the planned import of goods to territory of the Customs Union (Decision of the Commission of the Customs Union of December 9, 2011 N 899 “On the introduction of mandatory preliminary notification of goods imported into the customs territory of the Customs Union by road transport”).

Preliminary information can be provided by the sender, recipient, carrier, customs representative or other interested party, regardless of where he is located: in the CU member countries or in any other state. In test mode, the preliminary information system (Order of the Federal Customs Service of Russia dated March 10, 2006 N 192 “On approval of the Concept of the preliminary information system for the customs authorities of the Russian Federation”) began operating on the territory of the Russian Federation in 2008.

For goods imported by road into the customs territory of the Customs Union from June 17, 2012, preliminary notification became mandatory. For goods imported by other means of transport, provision of preliminary information is not necessary.

To submit preliminary information to the Federal Customs Service of Russia, a Portal for electronic provision of information (edata.customs.ru) has been created, based on the use of WEB technologies and the Internet. When importing goods through sections of the borders of other CU member states, preliminary notification must be carried out through the information systems of the relevant customs services.

Preliminary information “allowed us to reduce the time of customs operations by 30 minutes for those trucks for which such information was received in advance. But if the car has already arrived at the checkpoint, and there is no information at customs, then the data is entered manually.” A reduction in the time of customs operations by 30 minutes occurs solely due to the fact that the data is not entered manually, but is compared with the data specified in transport and commercial documents, which are presented in paper form when crossing the border. Thus, preliminary notification does not relieve the carrier from providing paper transport and commercial documents to customs officers at the checkpoint to verify the information specified during preliminary notification.

Preliminary information (Order of the Federal Customs Service of Russia dated July 5, 2012 N 1345 “On approval of the procedure for using, within the framework of the risk management system, preliminary information on goods imported into the territory of the Russian Federation by road transport, and international transport vehicles moving such goods”) is especially relevant. in the face of threats and the danger of growing international terrorism. Similar programs are approved by a number of countries, for example, Partners in Protection (PIP) of Canada Customs, Front Line and Accredited Client of Australian Customs, C-TPAT and CSI of US Customs, SEP and FrontLine of New Zealand Customs and etc.

Information technology in customs

Currently, informatization is increasingly used in customs. On the one hand, this process is due to the need to speed up customs operations, on the other hand, it promotes the transparency of customs operations, which reduces corruption risks. In this article we will consider the use of automation of technological operations when carrying out preliminary informing of customs authorities about the import of goods into the territory of the Customs Union, and also talk about electronic declaration of goods.

Information technology is usually understood as a system of methods, methods and means of collecting, recording, storing, searching, accumulating, processing, generating, analyzing, transmitting and distributing data, information and knowledge based on the use of computer technology and telecommunications.

The use of information technology in customs clearance is expressed in two aspects :

1)preliminary informing of customs authorities about goods and vehicles before they cross the customs border (hereinafter referred to as preliminary informing);

2)declaring goods by submitting a goods declaration in electronic form, as well as submitting documents confirming the information stated in the goods declaration in electronic form during customs clearance.

Preliminary information

The Framework Standards for the Security and Facilitation of Global Trade, which were adopted on June 3, 2005 by the heads of national customs administrations representing 166 member countries of the World Customs Organization in Brussels, established that in order to ensure an adequate risk assessment, the customs administration must promptly require advance electronic information on cargo or container shipments.

In this regard, Art. 42 of the Customs Code of the Customs Union (hereinafter referred to as the Customs Code of the Customs Union) it is determined that authorized economic operators, carriers, including customs carriers, customs representatives and other interested parties may submit preliminary information :

- about goods intended for movement across the customs border;

- on international transportation vehicles transporting such goods;

- on the time and place of arrival of goods into the customs territory of the Customs Union or departure from such territory;

- about passengers arriving at the customs territory of the Customs Union or departing from such a territory.

In turn, Art. 3 Agreement on the presentation and exchange of preliminary information on goods and vehicles moved across the customs border of the Customs Union (concluded in St. Petersburg on May 21, 2010; hereinafter referred to as the Agreement on the presentation and exchange of preliminary information on goods and vehicles), the following has been established: cases of mandatory provision of preliminary information when moving goods across the customs border of the Customs Union of the Republic of Belarus, the Republic of Kazakhstan and the Russian Federation must be determined by a decision of the Commission of the Customs Union depending on the type of transport on which the goods are moved.

As a result, the Customs Union Commission adopted Decision No. 899 dated December 09, 2011 “On the introduction of mandatory preliminary notification of goods imported into the customs territory of the Customs Union by road transport” (hereinafter referred to as Decision No. 899).

The document introduced mandatory preliminary information regarding goods imported into the customs territory of the Customs Union by road. Information must be provided by authorized economic operators, carriers, including customs carriers, customs representatives or other interested parties at least 2 hours before the import of goods into the customs territory of the Customs Union.

According to Decision No. 899, in the case when imported goods are intended to be placed under the customs procedure of customs transit at the place of arrival, the interested party submits preliminary information to the information system of the customs authorities in the amount of information established for the transit declaration. The information should contain information :

- about the sender, recipient of goods in accordance with transport (transportation) documents;

- about the country of departure, country of destination of goods;

- about the declarant;

- about the carrier;

- about the means of international transportation on which goods are transported;

- on the name, quantity, cost of goods in accordance with commercial, transport (shipment) documents;

- on the code of goods in accordance with the Harmonized System for Description and Coding of Goods (hereinafter referred to as the HS) or the unified Commodity Nomenclature for Foreign Economic Activity of the Customs Union (hereinafter referred to as the CU FEACN) at a level of at least the first six digits;

- on the gross weight of goods or volume, as well as the quantity of goods in additional units of measurement (if such information is available) for each HS or HS code;

- on the number of cargo items;

- about the destination of goods in accordance with transport (shipment) documents;

- on documents confirming compliance with restrictions associated with the movement of goods across the customs border of the Customs Union, if such movement is allowed;

- about the planned reloading of goods or cargo operations in transit;

- on the time and place of arrival of goods into the customs territory of the Customs Union.

In the case when imported goods are not intended to be placed under the customs procedure of customs transit (for example, the release of goods is planned in accordance with the customs procedure of release for domestic consumption) at the place of arrival, the interested person submits to the information system of the customs authorities of the state member of the Customs Union in the territory where the place of arrival of goods and vehicles is located, the following preliminary information :

- on state registration of a vehicle for international transportation;

- on the name and address of the carrier;

- on the name of the country of departure and country of destination of goods;

- on the name and address of the sender and recipient of the goods;

- about the seller and recipients of goods in accordance with the commercial documents available to the carrier;

- on the number of packages, their markings and types of packaging of goods;

- on the name, as well as codes of goods in accordance with the Civil Code or Commodity Nomenclature of Foreign Economic Activity of the Customs Union at the level of at least the first four characters;

- on the gross weight of goods (in kilograms) or volume of goods (in cubic meters), with the exception of large-sized cargo;

- on the presence of goods, the import of which into the customs territory of the Customs Union is prohibited or limited;

- on the place and date of drawing up the international consignment note;

- on the time and place of arrival of goods into the customs territory of the Customs Union.

The introduction of preliminary notification imposes on the carrier the need to submit information to the customs authority before the cargo crosses the border and entails some additional material costs.

Carriers should remember that in accordance with the Procedure for customs authorities to carry out customs operations related to the submission, registration of a transit declaration and completion of the customs procedure for customs transit, approved by the Decision of the Customs Union Commission dated August 17, 2010 No. 438 (hereinafter referred to as Procedure No. 438), when placing of goods under the customs procedure of customs transit, the carrier is obliged to submit a transit declaration.

Documents containing the information specified in clause 3 of Art. are used as a transit declaration 182 TK TS:

- completed transit declaration sheets;

- TIR Carnet, filled out in accordance with the provisions of the Customs Convention on the International Transport of Goods using a TIR Carnet, 1975, with transport (carriage) and commercial documents attached to it;

- ATA carnet, filled out in accordance with the Customs Convention on the ATA Carnet for Temporary Import of 1961 and the Convention on Temporary Import of 1990, with transport (transportation) and commercial documents attached to it (for transportation within the territory of a member state of the Customs Union, if this provided for by the legislation of such state);

- transport (shipping), commercial and (or) other documents;

- electronic copy of the transit declaration.

Should a Russian carrier organization submit preliminary information to customs authorities in the case of importing goods using an ATA carnet?

According to the letter of the Federal Customs Service of Russia dated May 30, 2012 No. 01-11/26843 “On the direction of information,” Decision No. 899 was issued in accordance with Art. 3 Agreements on the presentation and exchange of preliminary information on goods and vehicles.

The Main Directorate for the Organization of Customs Clearance and Customs Control of the Federal Customs Service of Russia is working to amend this Agreement in terms of its non-application in relation to goods placed under a special customs procedure, as well as goods transported using ATA carnets.

The need to make these changes is due to the provisions of the Convention on Temporary Import of June 26, 1990, which do not provide for preliminary information about goods transported using ATA carnets under the conditions and in the manner determined by the said convention, as well as the fact that a special customs procedure is applied for special product categories.

In addition, according to paragraph (h) of Art. 181c of Section VI of the Customs Code of the European Union, no prior notification is required for goods transported using ATA carnets.

Taking into account the principles of reciprocity of international law and in order to optimize customs operations, Decision No. 899 does not apply to goods placed under a special customs procedure, as well as goods transported using ATA carnets.

At the same time, paragraph 5 of Decision No. 899 determines that in the case of provision of preliminary information in the amount established for placing imported goods under the customs procedure of customs transit at the place of arrival, the submitted preliminary information is used as an electronic copy of the transit declaration in the absence of discrepancies between the preliminary information and information contained in documents used as a transit declaration.

Thus, preliminary submission to the customs authority of information in the amount of information established for the transit declaration allows :

1) reduce the period of stay of vehicles with cargo at points of entry.

Firstly, this is due to the fact that the carrier does not need to generate an electronic copy of the transit declaration from the customs representative in cases where transportation occurs using a TIR Carnet.

Secondly, the period for performing customs operations by customs officials has been significantly reduced. So, for example, clause 12 of Order No. 438 determines that the release of goods is carried out by the customs authority of departure within a period not exceeding the time specified in Art. 196 TC TC. This article establishes the following: the release of goods must be completed by the customs authority no later than 1 (one) working day following the day of registration of the customs declaration.

In turn, paragraph 5 of Decision No. 899 establishes that a decision on the release of these goods in accordance with the customs procedure of customs transit is made no later than 2 hours from the moment of registration of the transit declaration, provided that there is no risk of non-compliance with the legislation of the Customs Union. Thus, the deadline for completing customs operations has been reduced by 12 times.

In addition, according to paragraph 3 of Decision No. 899, customs authorities are required to analyze it using a risk management system within 2 hours from the receipt of preliminary information.

Thus, if in relation to the goods being moved the risk of violation of customs legislation is minimal, then the customs authority will promptly release the goods in accordance with the customs procedure of customs transit;

2) reduce queues at checkpoints, since it takes less time to process one vehicle carrying out international transportation of goods;

3) reduce the carrier's material costs. This is due to the fact that carriers resort to the services of customs representatives both when generating electronic copies of transit declarations and when generating electronic preliminary information. However, when generating electronic preliminary information, the working time of customs representatives is used more rationally. In this regard, the largest customs representatives are slightly reducing tariffs for the provision of services for the generation of preliminary information.

How is preliminary information provided to Russian customs authorities about the import of goods into the customs territory of the Customs Union?

According to information from the Federal Customs Service of Russia dated June 14, 2012 “On the obligation to submit preliminary information on goods transported by road transport,” preliminary information is submitted to the customs authority of the member state of the Customs Union on whose territory the automobile checkpoint is located, by the interested party at least 2 hours before planned import of goods traveling by road transport into the customs territory of the Customs Union.

When importing goods through Russian checkpoints, preliminary information is presented in Russian, with the exception of symbols used as classifiers.

Foreign trade participants moving goods through Russian checkpoints can submit preliminary information through the website of the Federal Customs Service of Russia (using the electronic submission of information portal (EPS portal), located at: https://edata.customs.ru/Pages/ Default.aspx) or through the information systems of organizations connected to the unified automated information system of the customs authorities of the Russian Federation.

If the preliminary information was not sent in advance by the foreign trade participant or the carrier, and the vehicle with the goods arrived at the automobile checkpoint, then the preliminary information can be submitted within the next 2 hours after the vehicle arrives at the checkpoint. For this purpose, at the customs post at the Russian checkpoint, a place for temporary placement of the vehicle in the customs control zone is provided, and an access point to the EPS portal is also equipped.

To summarize the above, we note that reducing the time spent by vehicles at points of entry entails a reduction in delivery times for goods, and therefore leads to an increase in cargo turnover and profits of transport companies. Thus, the introduction of advance notification is clearly a good thing for law-abiding transport companies.

Can customs authorities begin customs control operations (in particular, customs inspection) in cases where errors are identified in the preliminary information (for example, errors were made in the number of the international consignment note)?

Decision No. 899 determines that at the place of arrival of goods, customs authorities compare preliminary information with information contained in transport (carriage), commercial and (or) other documents.

In the event of a discrepancy between the information contained in the preliminary information databases of customs authorities and the information contained in the documents submitted by the carrier, the identified discrepancies are taken into account when deciding on the application of customs control forms in relation to the presented goods using the risk management system.

Further customs operations in relation to the presented goods are carried out in accordance with customs legislation.

Thus, the presence of a discrepancy between the real number of the international consignment note and information about this number contained in the preliminary information database may indicate the substitution of shipping documents. Consequently, customs authorities can carry out any forms of customs control provided for by the Customs Code of the Customs Union, including customs inspection. Therefore, the provision of preliminary information must be approached responsibly, as otherwise additional costs may arise for the carrier.

What actions must the carrier take if he has not provided preliminary information in a timely manner?

In accordance with Decision No. 899, if the interested party fails to provide preliminary information, he must submit this information to the information system of the customs authorities in the amount established by clause 2 of this Decision within the next two hours. Accordingly, this procedure may entail additional costs for the carrier in cases where customs representatives set their tariffs for services depending on the urgency of the operations performed.

Based on the results of the analysis of the information provided by the interested party, the customs official makes a decision to conduct customs control in relation to goods and vehicles using a risk management system in accordance with the customs legislation of the Customs Union.

If preliminary information for technical reasons cannot be received by the customs authority, customs operations in relation to the goods presented are carried out in accordance with the customs legislation of the Customs Union.

The Russian carrier organization intends to import goods into Russian territory through the Belarusian-Polish section of the border of the Customs Union. How is the Belarusian customs authorities informed in advance about the import of goods into the customs territory of the Customs Union?

On this occasion, there is relevant information from the Federal Customs Service of Russia “On the submission of preliminary information to the customs authorities of the Republic of Belarus”. In accordance with this information, in connection with the entry into force of Decision No. 899 on June 17, 2012, the State Customs Committee of the Republic of Belarus (hereinafter referred to as the State Customs Committee of the Republic of Belarus) developed Technical conditions for information interaction between the automated system of customs authorities of the Republic of Belarus and information systems of interested parties providing preliminary information about goods and vehicles that are posted on the website of the State Customs Committee of the Republic of Belarus at: https://gtk.gov.by/ru/epi. Also on the website of the State Customs Committee of the Republic of Belarus a banner “Electronic preliminary information” has been created, which contains links to regulatory legal acts governing issues of preliminary information.

Currently, the customs authorities of the Republic of Belarus operate an automated preliminary information system (hereinafter referred to as ASPI).

To use ASPI by interested parties, it is necessary :

- availability of software and hardware that ensure interaction with information systems of customs authorities of the Republic of Belarus when exchanging preliminary information;

- availability of access to the international Internet;

- inclusion in the Register of interested parties providing preliminary information to the customs authority. To be included in the specified register, it is necessary to contact the State Customs Committee of the Republic of Belarus, and also undergo an inspection of the information system of the interested participant in foreign trade activities at the Minsk Central Customs to determine its readiness to organize information interaction with the information system of the customs authorities.

RUE "Beltamozhservice" has developed a software product e-Client, which provides information interaction with the information system of customs authorities.

RUE "Beltamozhservice" on a contractual basis provides services to interested parties in providing preliminary information to customs authorities, and also sells developed software to interested parties.

The customs authorities of the Republic of Belarus have provided the possibility of submitting preliminary electronic information about goods transported using TIR Carnets (TIR-EPD system). The TIR-EPD system has been used by the customs authorities of the Republic of Belarus since October 1, 2011, and any carrier can use it when transporting goods under the TIR procedure.

Electronic declaration

In paragraph 3 of Art. 179 of the Customs Code of the Customs Union establishes that customs declarations are made in written and (or) electronic forms using a customs declaration. The procedure for submitting and using a customs declaration in the form of an electronic document is regulated by the Decision of the Customs Union Commission dated December 8, 2010 No. 494 “On the Instructions on the procedure for submitting and using a customs declaration in the form of an electronic document” (hereinafter referred to as Instructions No. 494).

In accordance with paragraph 2 of Instruction No. 494, a customs declaration in the form of an electronic document (hereinafter referred to as the ETD) is submitted by the declarant or customs representative to the customs authority authorized in accordance with the customs legislation of the Customs Union to register customs declarations.

According to paragraph 1 of Art. 204 of the Federal Law of November 27, 2010 No. 311-FZ (as amended on March 12, 2014) “On Customs Regulation in the Russian Federation” (hereinafter referred to as Federal Law No. 311-FZ), the declaration for goods is submitted in electronic form. The Government of the Russian Federation establishes lists of goods, customs procedures, as well as cases in which declaration can be made in writing.

What goods in the Russian Federation can be declared in writing?

In accordance with the Decree of the Government of the Russian Federation dated December 13, 2013 No. 1154 “On the list of goods, customs procedures, as well as cases in which customs declaration of goods can be carried out in writing”, at the choice of the declarant, customs declaration of goods in writing using a declaration for goods can be carried out :

1) in relation to goods, information about which is classified as a state secret;

2) in relation to goods placed under:

- customs destruction procedure in accordance with Ch. 42 TK TS;

- customs procedure for refusal in favor of the state in accordance with Ch. 43 TK TS;

- special customs procedure in accordance with Ch. 41 Federal Law No. 311-FZ;

3) in cases of customs declaration of goods:

- in accordance with Ch. 44 TK TS;

- in accordance with Ch. 45 TK TS;

- in accordance with Art. 217 of Federal Law No. 311-FZ;

- when using an ATA carnet, transport (transportation), commercial and (or) other documents as a declaration of goods.

Consequently, in all other situations, declaration is carried out exclusively in electronic form.

In accordance with Instruction No. 494, when performing customs operations using an ETD, including when releasing goods before submitting an ETD in accordance with Art. 197 of the Customs Code of the Customs Union, documents the provision of which is provided for by the customs legislation of the Customs Union (hereinafter referred to as documents) are submitted in the form of electronic documents and (or) paper documents.

According to Art. 99 of Federal Law No. 311-FZ, documents the submission of which is provided for in accordance with the customs legislation of the Customs Union and the legislation of the Russian Federation on customs, including a customs declaration, may be submitted in the form of an electronic document subject to the requirements for documenting information established by the legislation of the Russian Federation.

What documents must be submitted together with the goods declaration submitted electronically?

In accordance with Art. 183 of the Customs Code of the Customs Union, the submission of a customs declaration must be accompanied by the submission to the customs authority of documents on the basis of which the customs declaration is completed.

Such documents include :

1) documents confirming the authority of the person submitting the customs declaration;

2) documents confirming the completion of a foreign economic transaction, and in the absence of a foreign economic transaction - other documents confirming the right of ownership, use and (or) disposal of goods, as well as other commercial documents available to the declarant;

3) transport (shipping) documents;

4) excluded (Protocol dated April 16, 2010 “On Amendments and Additions to the Agreement on the Customs Code of the Customs Union dated November 27, 2009”);

5) documents confirming compliance with prohibitions and restrictions;

6) documents confirming compliance with restrictions in connection with the use of special protective, anti-dumping and countervailing measures;

7) documents confirming the country of origin of goods in cases provided for by the Customs Code;

documents on the basis of which the classification code of the product was declared according to the Commodity Nomenclature of Foreign Economic Activity;

documents on the basis of which the classification code of the product was declared according to the Commodity Nomenclature of Foreign Economic Activity;

9) documents confirming payment and (or) security for payment of customs duties;

10) documents confirming the right to benefits for the payment of customs duties, to apply full or partial exemption from customs duties and taxes in accordance with customs procedures established by the Customs Code of the Customs Union, or to reduce the base (tax base) for calculating customs duties and taxes;

11) documents confirming changes in the deadline for payment of customs duties and taxes;

12) documents confirming the declared customs value of goods and the chosen method for determining the customs value of goods;

13) a document confirming compliance with the requirements in the field of currency control, in accordance with the currency legislation of the member states of the Customs Union;

14) document on registration and nationality of the vehicle for international transportation - in the case of transportation of goods by road when they are placed under the customs procedure of customs transit.

At the same time, when submitting a declaration for goods to be placed under the customs procedure for the export of goods to which export customs duties are not applied, it is not necessary to submit to the customs authority documents other than those specified in subparagraph. 1, 2, 5, 8, 9, 13, as well as in sub. 3 - if such documents are available.

Are there cases when the list of documents to be submitted is reduced when declaring goods using ETD?

In accordance with paragraph 2 of Art. 208 of Federal Law No. 311-FZ, the federal executive body authorized in the field of customs affairs has the right to further reduce the list of documents submitted during the customs declaration of goods, depending on the form of customs declaration (written, electronic), customs procedure, categories of goods and persons.

In particular, according to the Order of the Federal Customs Service of Russia dated July 20, 2012 No. 1470 “On failure to present a transaction passport when declaring goods,” customs authorities are instructed not to require the presentation of a transaction passport (hereinafter referred to as the PS) when submitting a declaration for goods in electronic form, while maintaining the requirement to indicate the number PS in the declaration of goods in the prescribed manner. In this case, the customs authorities verify the accuracy of the information about the PS stated in the declarations for goods using the central currency control database.

Order of the Federal Customs Service of Russia dated December 5, 2013 No. 2299 “On the failure to submit documents confirming the authority of a person filing a declaration for goods in electronic form” established that customs authorities, when filing a customs declaration in electronic form, also do not need to require the presentation of an identification document for confirmation powers of the person submitting the customs declaration.

Are there any specific features of filling out a goods declaration if it is submitted as an electronic document?

Yes they exist. In particular, in accordance with the Instructions on the procedure for filling out a declaration for goods, approved by the Decision of the Customs Union Commission dated May 20, 2010 No. 257 (as amended on October 1, 2013) “On the Instructions for filling out customs declarations and customs declaration forms” (hereinafter referred to as the Decision No. 257), in the case of using a declaration for goods in the form of an electronic document, in the third subsection of column 1 “Declaration” the entry is made: “ ED ”.

Is it possible to declare information about goods imported under different contracts in one ETD?

In accordance with clause 2 of the Instructions on the procedure for filling out a declaration for goods, approved by Decision No. 257, one declaration for goods (hereinafter referred to as DT) declares information about the goods contained in one consignment, unless otherwise established by this Instruction, which are placed under the same customs procedure.

For the purposes of these Instructions, the following are considered as one consignment :

- when importing goods into the single customs territory of the Customs Union (hereinafter referred to as the customs territory) - goods transported from the same sender to the same recipient in the customs territory as part of the fulfillment of obligations under one document confirming the completion of a foreign economic transaction (or one document on the conditions of processing of goods during the customs declaration of processed products), or under a unilateral foreign economic transaction, or without making any transaction, and also if such goods are within the time limits provided for in Art. 185 of the Customs Code of the Customs Union, presented to the same customs authority at the place of arrival at the customs territory or at the place of delivery, if the customs procedure of customs transit was applied, and are in the same place of temporary storage (if the goods were placed in temporary storage), or released within the time limits specified established for the submission of diesel fuel in accordance with Art. 197 TC TC;

- when exporting goods from the customs territory - goods that are simultaneously shipped or shipped within a certain period of time in cases determined by the legislation of the member states of the Customs Union, in the region of activity of the same customs authority by the same sender to the address of the same recipient located outside the customs territory, as part of the fulfillment of obligations under one document confirming the completion of a foreign economic transaction (or one document on the conditions of processing of goods during the customs declaration of processed products), either under a unilateral foreign economic transaction, or without completing any transaction;

- when changing or completing a previously declared customs procedure without moving goods across the customs border of the Customs Union (hereinafter referred to as the customs border) - goods placed under the same previous customs procedure under one agreement, if when making a foreign economic transaction a corresponding agreement was concluded (or under one document on the conditions of processing of goods), products of their processing, goods manufactured (obtained) from such goods, waste generated from such goods, which are under the customs control of the same customs authority or released within the time limits established for filing the DT in accordance from Art. 197 of the Customs Code of the Customs Union, the declarant of which will be the same person who placed the goods under the previous customs procedure, or a person who acquired property rights to the declared goods after they were placed under the previous customs procedure.

Thus, it is unacceptable .

Conclusion

This publication discusses issues of preliminary informing customs authorities about the import of goods into the customs territory of the Customs Union, as well as issues of submitting a declaration for goods in the form of an electronic document.

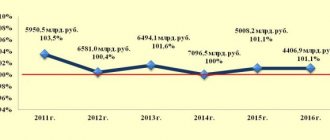

Remote release

The development of electronic declaration became the basis for the introduction of remote release technology (hereinafter referred to as RW) of goods. In table Figure 3 shows the growth rate in the number of electronic declarations issued using remote access technology.

Table 3

Growth rate of the number of electronic declarations issued using remote access technology

| 2010 | 2011 | 2012 | |

| Total number of ED declarations issued using remote access technology | 6500 | 54000 | 200000 |

The technology for remote release of goods is based on the principle of separation of customs procedures. Documentary and physical customs control of goods is carried out in various customs authorities on the territory of the Russian Federation (Order of the Federal Customs Service dated April 22, 2011 N 845 “On approval of the Procedure for performing customs operations during customs declaration in electronic form of goods located in the region of activity of the customs authority, different from the place of their declaration"). For example, documentary customs control is carried out at a customs post located inside the country, and actual control is carried out at a checkpoint at the customs border.

The use of carbon fiber technology for goods contributes to a uniform workload of human resources and a reduction in the load on customs terminals, which are currently concentrated along the border of the Russian Federation. The use of technology for remote release of goods makes it possible to reduce the flow of international transport traveling under customs control along the roads of the Russian Federation, as well as to large cities. However, there are inherent disadvantages of electronic declaration of goods - the presentation of paper documents at the request of customs authorities.

The use of HC technology makes it possible to redistribute and optimize the load on customs authorities, including depending on their specialization. Also, remote release technology makes it possible to reduce the overall time for completing customs operations in relation to transported goods. CS is implemented using the same software tools that are used for electronic declaration of goods.

In order to develop remote release technology, as well as optimize the location of customs authorities in the Russian Federation, 26 specialized customs posts - electronic declaration centers - have been created. They are located in all regional customs departments of the Russian Federation. The competence of these customs posts is limited to carrying out customs operations exclusively in electronic form.

Chapter 52. Information systems and information technologies used by customs authorities

Article 301. Information systems and information technologies used by customs authorities

1. Information systems and information technologies are used by customs authorities in order to ensure the fulfillment of the tasks assigned to them, including for the exchange of information in electronic form with federal executive authorities, other bodies and organizations, for the provision of public services to the population and participants in foreign economic activity, etc. interested parties. 2. The provision of public services and the performance of government functions in electronic form is carried out, inter alia, using the infrastructure that ensures the information and technological interaction of information systems used to provide state and municipal services and the performance of state and municipal functions in electronic form, and its components.

Article 302. Ensuring the use of information systems and information technologies

The procedure for actions of customs officials when using information systems in customs affairs is established by the federal executive body exercising functions of control and supervision in the field of customs affairs, in accordance with international treaties and acts in the field of customs regulation and the legislation of the Russian Federation.

Article 303. Requirements for technical means intended for processing information

Technical means intended for processing information contained in information systems used for customs purposes, including software and hardware, must comply with the requirements of the legislation of the Russian Federation.

Article 304. Information resources of customs authorities

1. Information resources of customs authorities constitute an ordered set of documented information (information) contained in the information systems of customs authorities, received by customs authorities in accordance with international treaties and acts in the field of customs regulation, this Federal Law, other federal laws, including: 1 ) represented (represented) by persons when performing customs operations in accordance with international treaties and acts in the field of customs regulation, the legislation of the Russian Federation on customs regulation; 2) presented (represented) by federal executive authorities in accordance with interdepartmental agreements on the exchange of information; 3) sent (sent) by government bodies of foreign states at the request of the federal executive body exercising control and supervision functions in the field of customs affairs, and (or) in accordance with international treaties of the Russian Federation on the exchange of information; 4) other information received (collected) by customs authorities about persons carrying out foreign economic activities related to the movement of goods across the customs border of the Union, or other activities in relation to goods under customs control. 2. The procedure for the formation of information resources of customs authorities and access to them is established by the federal executive body exercising the functions of control and supervision in the field of customs affairs.

Article 305. Receipt by persons of information contained in the information resources of customs authorities

1. Persons carrying out foreign economic activities related to the movement of goods across the customs border of the Union, or other activities in relation to goods under customs control, as well as other persons in respect of whom customs control was carried out, have the right to access information available to the customs authorities documented information about yourself and to clarify this information in order to ensure its completeness and reliability. 2. Customs authorities provide the persons specified in part 1 of this article with available information about them free of charge. 3. Information is provided by customs authorities within the time limits established by the legislation of the Russian Federation for consideration of written appeals of citizens to government bodies, based on an application from the person specified in Part 1 of this article, sent to the customs authority in writing or in the form of an electronic document using the network " Internet". 4. To obtain the necessary information, the person specified in part 1 of this article has the right to contact any customs authority. 5. The person specified in subparagraph 11 or 17 of paragraph 1 of Article 2 of the Code of the Union has the right to access information available to the customs authorities on the release of goods. 6. Customs authorities provide the person specified in Part 5 of this article with such information free of charge. 7. The applicant receives information about the release of goods on the basis of an application sent to the customs authority (except for customs posts) in the form of a paper document or an electronic document using the Internet. 8. The applicant’s appeal, provided for in Part 7 of this article, must contain information about the registration number of the goods declaration and the name of the country of origin of the goods indicated in the goods declaration, the quantity of goods in kilograms (gross weight and (or) net weight) and (or ) in other units of measurement, as well as the serial number of the goods in the goods declaration. 9. If the applicant’s application does not contain any information specified in Part 8 of this article, the information in the application is illegible or there are corrections in it, the customs authority considering this application requests the missing information from the applicant within five working days days from the date of receipt of the application. The applicant is obliged to provide the requested information within ten working days from the day following the day of receipt of the request. 10. The customs authority provides the applicant with information about the release of goods in the form of a paper document within no more than ten working days from the date of receipt of the applicant’s written request. 11. If the applicant sends an application in the form of an electronic document, the customs authority provides information on the release of goods using the Internet no later than five working days from the date of registration of such application by the customs authority’s information system. 12. If the customs authority does not have information about the release of goods, then the applicant’s application, provided for in Part 7 of this article, is sent to the customs authority in the region of activity of which the goods were released, within two working days from the date of receipt of this application, with simultaneous notification to the applicant about forwarding this application to another customs authority. In this case, the period for providing information on the release of goods, provided for in Part 10 of this article, is suspended from the day the applicant’s application was sent by the customs authority to which it was received until the day this application was received by the customs authority in the region of activity of which the goods were released. 13. In the case provided for by Part 9 of this article, the period for consideration of the applicant’s request for the provision by the customs authority of information on the release of goods is suspended from the day the customs authority sends the request until the day the applicant submits the requested information. In this case, the total period for consideration of an application for the provision of information on the release of goods cannot exceed forty days from the date of receipt of such an application. 14. If documents or information requested from the applicant in accordance with Part 9 of this article are not provided, the customs authority, before the expiration of the general period established by Part 13 of this article, sends a response to the applicant about the impossibility of providing information about the release of goods, indicating the reason. 15. Information on the release of goods must contain information about the names of goods, the status of goods in terms of their release, manufacturers (if information about them is available), trademarks, marks, models, articles, grades of goods, as well as the correspondence of information about the quantity of goods in kilograms (gross weight and (or) net weight) and (or) in other units of measurement contained in the circulation of the person specified in part 5 of this article, the information specified in the declaration of goods. 16. Standard forms of application of the person specified in part 5 of this article for the provision of information on the release of goods and the provision by the customs authority of information on the release of goods sent in the manner established by this article, as well as the sequence of administrative procedures (actions) of the customs authority when providing such information is established by administrative regulations, which are approved by the federal executive body exercising the functions of developing state policy and legal regulation in the field of customs.

Article 306. Protection of information by customs authorities

1. The use of software, hardware and other means of protecting information in information systems used by customs authorities, as well as assessing the level of information protection in information systems used by customs authorities, is carried out in accordance with the legislation of the Russian Federation on information protection. 2. The procedure for using software, hardware and other means of protecting information is established by the federal executive body exercising control and supervision functions in the field of customs affairs, in accordance with international treaties and acts in the field of customs regulation and the legislation of the Russian Federation. 3. Monitoring compliance with the requirements for the use of information security means is carried out by the federal executive body exercising control and supervision functions in the field of customs affairs, and other federal executive bodies in accordance with the legislation of the Russian Federation.

Electronic freight (E-freight)

“E-freight” is a program of the International Air Transport Association IATA (IATA - International Avia Transport Association). To organize international transportation of cargo by air, it is necessary to issue over 30 forms of paper documents. The E-freight program allows you to abandon paper-based technologies and helps to simplify and modernize business procedures in the field of air cargo transportation. The E-freight program supports the transition to electronic data exchange technologies for freight transport using commercial, transport and customs documents (“All you need to know about... IATA e-freigh”, IATA Cargo, May 2010).

Thus, the use of electronic declaration programs by customs services has a significant impact on the implementation of the E-freight program in the process of cargo transportation.

Four Russian airports take part in this program: Sheremetyevo and Domodedovo (Moscow), Tolmachevo (Novosibirsk), Emelyanovo (Krasnoyarsk). To date, the first stage of this program has been successfully implemented, and preparations are underway for the next stage.

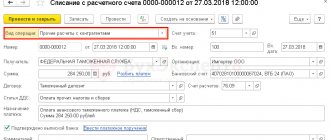

Customs payment card

The payment system “Customs Payments Card” is a tool for paying customs and other payments. The basis for building the payment system was the payment technology approved by Order of the State Customs Committee of Russia dated August 3, 2001 N 757 “On improving the system for paying customs duties.” In accordance with this technology, payments are made using a plastic card, which is a microprocessor bank card. It is issued by credit institutions (issuing banks) and is a tool for accessing the account of the payer of customs duties with the issuing bank. Payment of customs duties from this card is made in the currency of the Russian Federation. The presence of an invoice (a check confirming the completion of a transaction using such a card), signed by the card holder and the customs authority inspector, is considered the actual receipt of funds into the customs account.

Currently, 35% of all customs payments are made using card data. It is used by about 2,500 foreign trade participants.

Currently, there are two coordinators for the issuance of microprocessor bank cards in Russia: Customs Card LLC - Customs Card and Multiservice Payment System LLC - Round (PayHD) (Order of the Federal Customs Service of Russia dated November 6, 2012 N 2222 "On the coordinator of the issue of customs cards" kart").

Advantages of using microprocessor bank cards:

— payment is made at the customs office during clearance of the goods;

— payment does not depend on the bank’s opening hours;

— the required amount of customs duties is paid from the card, resulting in no overpayments of funds;

— no advance payments required;

— the card can only be used to make customs payments at terminals installed at customs. Payment for other transactions is blocked (only for customs cards);

— the ability to pay customs duties via the Internet (only for the “Round (PayHD)” card).

Despite the large number of advantages, these cards have one significant drawback. The costs of servicing such cards are quite high and can range from 0.2 to 1.3% of the payment amount, depending on the volume of customs duties.