Choosing a customs procedure

According to Art. 203 of the Customs Code of the Customs Union, at the choice of the applicant (the person moving the goods), goods moved across the customs border are placed under a certain customs procedure. This premises begins from the moment of submission to the customs authority of the customs declaration and (or) documents required for such premises (clause 1 of Article 174 of the Customs Code of the Customs Union). Moreover, having made a choice in favor of one of the customs procedures, you can not stop there, but replace the selected procedure with another. Types of customs procedures are listed in paragraph 1 of Art. 202 TK TS. Release for domestic consumption is (based on Article 209 of the Customs Code) a customs procedure, when placed under which foreign goods are located and used in the customs territory of the Customs Union without restrictions on their use and disposal, unless otherwise established by the Customs Code. The situation is different when goods are subject to conditional release (in this case they retain the status of foreign goods and are under customs control). Goods are placed under the customs procedure of release for domestic consumption subject to the conditions listed in paragraph 1 of Art. 210 TK TS. Firstly, import customs duties and taxes must be paid, if tariff preferences and benefits for their payment are not established. Customs duties and taxes in accordance with paragraph 3 of Art. 211 of the Customs Code of the Customs Union must be paid before the goods are released in accordance with the customs procedure for release for domestic consumption (that is, before the goods are placed under the customs procedure). If benefits for the payment of customs duties are used, associated with restrictions on the use and (or) disposal of goods, payment is made:

- in case of refusal to use benefits - before making changes in the customs declaration submitted to place goods under the customs procedure of release for domestic consumption regarding the refusal to use benefits;

- in case of actions with goods in violation of restrictions on the use and (or) disposal of them or in violation of the purposes corresponding to the conditions for providing benefits - on the first day of performing these actions. If such a day has not been established, they are guided by the day of registration by the customs authority of the customs declaration submitted to place goods under the customs procedure of release for domestic consumption.

Please note: violation of deadlines for payment of customs duties and taxes payable in connection with the movement of goods across the customs border of the Customs Union is an administratively punishable act. Officials can be fined from 5,000 to 10,000 rubles, legal entities - from 50,000 to 300,000 rubles. (Article 16.22 of the Code of Administrative Offenses of the Russian Federation).

Secondly, prohibitions and restrictions must be observed.

Thirdly, documents must be submitted confirming compliance with restrictions in connection with the use of special protective, anti-dumping and countervailing measures.

Only when these conditions are met, the imported product acquires the status of a Customs Union product, that is, it ceases to be foreign.

Customs clearance of goods without paying customs duties in 2019

Features of customs clearance when importing goods without paying customs duties in 2021 by participants in foreign trade activities:

Individual:

Cargo and goods transported for personal use are exempt from customs duties, provided that:

- Their weight does not exceed 50 kg, and the total cost does not exceed 10,000 euros (for air transport - accompanied baggage);

- Their weight does not exceed 25 kg, and the total cost does not exceed 500 euros (excluding air transport - accompanied baggage);

- Their weight does not exceed 31 kg, and the total cost does not exceed 500 euros (for postal items and goods delivered by the carrier - unaccompanied baggage).

If any of these indicators are exceeded, the citizen must pay customs duties at the rate of 30% of the amount exceeding the permissible value, or 4 euros for each kilogram of excess.

A citizen also has the right to transport across the customs border without paying duties:

- Up to 50 cigars, or 200 cigarettes, or 250 g of tobacco;

- Up to 3 liters of alcoholic beverages.

Customs clearance of individuals >>>

Legal entity or individual entrepreneur:

cargo and goods without paying customs duties and taxes can be imported with a value not exceeding 200 euros. But in this case, the customs declaration is submitted to the customs authority in any case.

Calculation of customs duties

Customs duties and taxes are paid in the member state of the Customs Union, whose customs authority releases goods (Clause 1, Article 84 of the Customs Code of the Customs Union).

The amount of customs duties is calculated by applying the base for calculating customs duties and the corresponding type of rate in force on the day of registration of the customs declaration by the customs authority. According to paragraph 2 of Art. 75 of the Customs Code of the Customs Union, the basis for calculating customs duties depending on the type of goods and the types of rates applied are:

— customs value of goods;

- physical characteristics of goods in physical terms (quantity, weight, taking into account primary packaging, which is inseparable from the product before its consumption and in which the product is provided for retail sale, volume or other characteristic).

There are three types of customs duty rates:

— ad valorem (their size is set as a percentage of the customs value of taxable goods);

- specific (set depending on the physical characteristics of the goods in kind);

— combined (combine the above types of bets). For example, the rate of import customs value for household refrigerators-freezers with dividing external doors with a capacity of more than 340 liters (HS code 8418 10 200 1) is 20% of the customs value, but not less than 0.24 euros per 1 liter.

The rates of import customs duties applied to goods imported into the single customs territory of the Customs Union from third countries are established by the Unified Customs Tariff of the Customs Union (Adopted by Decision of the Council of the Eurasian Economic Commission dated July 16, 2012 N 54). In this document, goods are systematized in accordance with the unified Commodity Nomenclature of Foreign Economic Activity of the Customs Union (TN FEACN CU). Therefore, in order to establish the customs duty rate, it is necessary to correctly classify the goods according to the Commodity Nomenclature of Foreign Economic Activity. In this process, the Collection of decisions and clarifications may be useful - Appendix to the Order of the Federal Customs Service of Russia dated 01.03.2012 N 34-r.

As for refrigerators and freezers of commodity item 8418 of the Commodity Nomenclature of Foreign Economic Activity of the Customs Union, the Collection, in particular, draws attention to this point (clause 116). Manufacturers of refrigerators and freezers use several designations of capacity (internal volume, capacity) in liters to determine the characteristics of their products, for example: gross, gross (ISO), usable (ISO), total capacity, usable capacity, total volume, capacity. Moreover, for the same model of refrigerator and freezer, the manufacturer indicates different capacities (internal volume, capacity).

To classify such goods, you need to use information about the maximum value - the total (gross, total gross volume) capacity of the refrigerator and (or) freezer of a specific product model. In other words, you should focus on the maximum value declared by the manufacturer (Resolution of the Federal Antimonopoly Service of the Russian Federation dated March 6, 2013 in case No. A11-13278/2011).

New items in the List of equipment excluding VAT

In addition, several new items have been added to the List of Technical Equipment without VAT. For example:

- equipment for a technological line for the production of benzene and derivatives;

- equipment for a technological line for the production of ethylene and propylene;

- methanol production plant;

- drying-stirring machines models 180/8, 180/10, Montex 5000;

- textile steaming machine UNIVAPOR 1K/150/200;

- salt picker Dart SH1000;

- high-temperature furnace for annealing sapphire products PCST-1850FLED-G2;

- traction unit of the Dart 5225C salt moving machine;

- Dart 5225C salt moving machine body;

- towing device for salt moving machine Dart 5225C;

- Installation of non-contact measurement of geometric parameters MICROPROF 200 MHU.

In conclusion, we note that the List of Equipment without VAT in the new edition includes 79 EAEU HS codes.

Calculation of customs VAT

The tax base for calculating taxes levied when importing goods into the customs territory of the Customs Union (VAT, excise duty) is determined in accordance with the legislation of the member state of the Customs Union, on whose territory the goods are placed under the customs procedure of release for domestic consumption (clause 3 of Art. 75, clause 4 of article 76 of the Labor Code of the Customs Union).

Based on paragraphs. 4 paragraphs 1 art. 146 of the Tax Code of the Russian Federation, the import of goods into the territory of the Russian Federation and other territories under its jurisdiction is subject to VAT. At the same time, on the basis of paragraph 1 of Art. 160 of the Tax Code of the Russian Federation, the tax base is defined as the amount:

— customs value of imported goods;

— subject to payment of customs duties;

— excise taxes payable (on excisable goods).

The tax base is determined separately for each group of goods of the same name, type and brand.

It is necessary to take into account that when importing into the territory of the Russian Federation (to other territories under its jurisdiction) technological equipment, including components and spare parts for it, analogues of which are not produced in the Russian Federation, according to the List approved by Decree of the Government of the Russian Federation of April 30, 2009 N 372 , there is no need to pay customs VAT. In this case, the benefit established by clause 7 of Art. 150 Tax Code of the Russian Federation. For example, this List includes:

— equipment and devices for filtering or purifying drinks other than water (HS code 8421 22 000 0);

— equipment for packaging drinks into bottles, cans under excess pressure, capping, labeling bottles with a capacity of at least 30,000 bottles or cans per hour (code 8422 30,000 3);

— grape harvesters (code 8433 59 850 1);

— line equipment for the production of semi-hard cheeses (code 8434 20 000 0);

— equipment for winemaking, production of cider, fruit juices or similar drinks (code 8435 10 000 0);

— equipment for the production of pasta, spaghetti or similar products (8438 10 900 0);

— equipment for the sugar industry (code 8438 30 000 0);

— equipment for the brewing industry (code 8438 40 000 0);

— equipment for processing tea or coffee (code 8438 80 100 0);

— equipment for the preparation or production of drinks (code 8438 80 910 0);

— line for the production of baker's yeast, technological line for the production of freeze-dried coffee (code 8438 80 990 0);

— equipment for the preparation or preparation of tobacco (code 8478 10 000 0).

Please note: restrictions on the use and disposal of technological equipment, the import of which is subject to VAT exemption, are not established either by the Tax Code or by Decree of the Government of the Russian Federation of April 30, 2009 N 372. Therefore, when they are placed under the customs procedure of release for domestic consumption, they acquire status of goods of the Customs Union, unless the equipment is subject to conditional release on other grounds determined by the Customs Code of the Customs Union (Letter of the Federal Customs Service of Russia dated June 30, 2009 N 01-11/29792).

If an enterprise, when importing technological equipment, despite being exempt from taxation, still pays customs VAT, this amount will be considered overpaid on the basis of Art. 89 TK TS. It is subject to return by decision of the customs authority, which administers these funds, at the request of the payer (the application is submitted to the customs authority where the goods were declared, no later than three years from the date of payment of the tax) (Article 90 of the Customs Code of the Customs Union, Article 147 Federal Law N 311-FZ). In the described situation (unless circumstances arise in which a refund is not made), the customs office has no legal grounds for refusing an enterprise a refund of overpaid VAT (examples - Resolutions of the Federal Antimonopoly Service of the North-West District dated December 9, 2011 in case No. A56-5863/2011, FAS UO dated September 21, 2011 N F09-5584/11). Refunds of overpaid customs VAT are not made in the following cases:

— the payer has arrears in paying customs duties and taxes in the amount of the overpaid amount. Then, at the request of the payer, the overpaid amounts can be offset against the specified debt;

— the amount of customs taxes subject to refund is less than 150 rubles;

- an application for the refund of customs taxes is submitted to the customs authority after the established deadlines.

What to follow

Initially, the List of technological equipment, components and spare parts for it, analogues of which are not produced in the Russian Federation and the import of which is not subject to value added tax, was approved by Decree of the Government of the Russian Federation dated April 30, 2009 No. 372.

By virtue of Decree of the Government of the Russian Federation dated May 27, 2021 No. 796, from July 2, 2021, this list is valid in a new edition. We'll tell you what changes and whether there are new positions.

Determination of customs value

Clause 3 of Art. 64 of the Customs Code stipulates that the customs value of goods is determined by the declarant or a customs representative acting on behalf and on behalf of the declarant, and in cases established by the Customs Code, by the customs authority. Determination of the customs value of goods moved across the customs border of the Customs Union when imported into the Russian Federation is carried out in accordance with the international agreement of the member states of the Customs Union, regulating the issues of determining the customs value of goods moved across the customs border (Clause 1, Article 64 of the Customs Code of the Customs Union, Clause 1, Article 112 of Federal Law No. 311-FZ). Such an agreement is the Agreement between the Government of the Russian Federation, the Government of the Republic of Belarus and the Government of the Republic of Kazakhstan dated January 25, 2008 “On determining the customs value of goods transported across the customs border of the Customs Union” (hereinafter referred to as the Agreement).

The customs value of imported goods is determined by one of the methods proposed in the Agreement (each subsequent method is applied if the customs value cannot be determined using the previous method). If possible, the cost is established using the method based on the transaction value of imported goods. In this case, the customs value consists of the price actually paid (to be paid) for imported goods, that is, the total amount of all payments for goods made (to be made) by the buyer directly to the seller or another person in favor of the seller, and additional charges to this price.

The customs value of imported goods is calculated using the method based on the transaction value of imported goods, subject to the following conditions provided for in paragraph 1 of Art. 4 Agreements:

— there are no restrictions on the buyer’s rights to use and dispose of goods;

- the sale of imported goods or their price does not depend on any conditions or obligations, the impact of which on the price of goods cannot be quantified;

- no part of the income or proceeds from the subsequent sale, other disposal or use of goods by the buyer is due directly or indirectly to the seller, except in cases where, on the basis of Art. 5 of the Agreement, additional charges may be made;

- the buyer and seller are not related persons or are so in such a way that the value of the transaction with imported goods is acceptable for customs purposes in accordance with clause 4 of Art. 4 Agreements.

Declaration of customs value

The customs value of imported goods must be declared by declaring information about the method of determining and the amount of the customs value of goods, about the circumstances and conditions of the foreign economic transaction related to the determination of the customs value, and by submitting documents confirming them (clause 2 of Article 65 of the Customs Code of the Customs Union). This information is recorded in the declaration of customs value, which is an integral part of the declaration for goods (The procedure for declaring the customs value of goods was approved by Decision of the Customs Union Commission dated September 20, 2010 N 376). According to the general rule established by paragraph 1 of Art. 185 of the Customs Code of the Customs Union, a customs declaration for goods imported into the customs territory of the Customs Union is submitted before the expiration of the period for temporary storage of goods (two months from the day following the day of registration by the customs authority of the documents submitted for placing goods in temporary storage).

Please note: for indicating false information in the declaration and failure to fulfill the obligations provided for in Art. 188 of the Labor Code of the Customs Union, administrative liability is established. For example, the statement of false information about the customs value of goods threatens legal entities with a fine in the amount of 1/2 to twice the amount of customs duties and taxes payable with or without confiscation of goods that were the subject of an administrative offense or confiscation of the items of an administrative offense. In this case, officials may also be fined in the amount of 10,000 to 20,000 rubles. (clause 2 of article 16.2 of the Code of Administrative Offenses of the Russian Federation).

Deduction of customs VAT

We are interested in the “fate” of the VAT amounts paid by the taxpayer when importing goods into the territory of the Russian Federation and other territories under its jurisdiction in the customs procedure of release for domestic consumption. These amounts according to paragraphs. 1 item 2 art. 171 of the Tax Code of the Russian Federation are subject to deduction if goods are purchased to carry out operations recognized as subject to VAT. Otherwise, customs VAT is included in the cost of purchased goods, including fixed assets and intangible assets (clause 2 of Article 170 of the Tax Code of the Russian Federation).

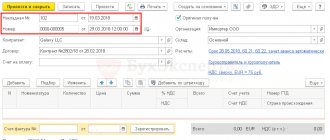

Registration

In our case, the tax deduction is made on the basis of documents confirming the actual payment of customs VAT amounts after the goods have been accepted for registration (clause 1 of Article 172 of the Tax Code of the Russian Federation). The same paragraph contains the following clarification: deductions of tax amounts paid upon import into the territory of the Russian Federation and other territories under its jurisdiction of fixed assets, equipment for installation, intangible assets are made in full after the registration of these fixed assets, equipment for installation, intangible assets. This norm allows the Ministry of Finance to draw such conclusions.

Firstly, if the imported equipment requires installation, the VAT paid can be deducted in the tax period (quarter) in which it was accepted for accounting on account 07 “Equipment for installation” (Letter dated July 23, 2012 N 03-07-08 /211).

Secondly, if the equipment does not require installation, the VAT related to it can be deducted only after the said equipment is registered as an item of fixed assets (see, for example, Letters dated January 24, 2013 N 03-07-11/19, dated 09/18/2012 N 03-07-11/380, dated 08/28/2012 N 03-07-11/330). In this part, one can argue with the position of officials, counting on the support of judges. The latter believe: tax legislation does not correlate the right to deduction with the accounting account on which purchased goods must be recorded (Resolutions of the Federal Antimonopoly Service of the North-West District dated January 27, 2012 in case No. A56-10457/2011, FAS Eastern Military District dated August 27, 2009 No. A11-10083/2008 -K2-21/543, FAS MO dated September 15, 2011 in case N A40-113023/09-126-735, dated February 26, 2010 N KA-A40/978-10). Consequently, the right to deduct for equipment that does not require installation arises after it is registered in account 08 “Investments in non-current assets”.

By the way, the deduction can be claimed within three years after the end of the tax period in which such a right arose. True, the Ministry of Finance believes that for this, an updated declaration must be submitted to the tax authority for the tax period in which the right to apply a tax deduction arose (Letters dated 03/12/2013 N 03-07-10/7374, dated 02/13/2013 N 03 -07-11/3784, dated 01/15/2013 N 03-07-14/02, dated 10/31/2012 N 03-07-05/55). The Federal Tax Service also joins it (Letter dated March 30, 2012 N ED-3-3/ [email protected] ). Judges also take a different position on this issue: tax legislation does not contain restrictions on the choice of the period in which the amount of VAT can be claimed for deduction (but the mentioned period must be included within a three-year period from the end of the tax period in which the right to deduct arose) ( Resolutions of the Presidium of the Supreme Arbitration Court of the Russian Federation dated June 15, 2010 N 2217/10, FAS MO dated April 13, 2012 in case N A40-68415/11-107-296, dated July 22, 2011 N KA-A40/7420-11, FAS TsO dated September 7. 2012 in case No. A35-12327/2011, FAS BVO dated 09.14.2011 in case No. A17-4441/2010, FAS ZSO dated 02.21.2011 in case No. A27-6570/2010, dated 01.24.2011 in case N A45-10406 /2010).

Fact of tax payment

Regarding documentary confirmation of the fact of payment of the amount of customs VAT, you need to pay attention to the following point. At one time, financiers noted (Letter dated June 21, 2012 N 03-07-08/158) that the amounts of VAT paid by the Russian taxpayer to the customs authority, including with the use of advance payments , on goods imported into the territory of the Russian Federation are subject to deduction from named taxpayer:

- after acceptance of the specified goods for registration on the basis of documents confirming the actual payment of tax, and customs declarations confirming the import of goods into the Russian Federation. Such a document can be a report from the customs authority on the expenditure of funds made as advance payments (Letter of the Ministry of Finance of Russia dated June 30, 2008 N 03-07-08/159);

- subject to the use of these goods in transactions subject to VAT.

All these arguments are broken down by the definition of advance payments given in paragraph 1 of Art. 73 Labor Code of the Customs Union, clause 1, art. 121 of Federal Law N 311-FZ. Advance payments are recognized as funds contributed to pay for upcoming export customs duties, taxes, customs duties and not identified by the payer in terms of specific types and amounts of export customs duties in relation to specific goods.

Funds paid as advance payments are the property of the person who made them and are not considered as customs payments or funds contributed as security for their payment until the person receives an order to this effect to the customs authority or the customs authority. the authority will not foreclose on advance payments. The order can be made in the form of submitting a customs declaration, an application for the return of advance payments, or performing other appropriate actions. Moreover, upon application of the payer, the customs authority, within 30 days from the date of receipt of such an application, is obliged to submit a report on the expenditure of funds paid as advance payments, but not more than for three years preceding the specified application. It was this report, as a document confirming the fact of payment of customs duties, that the Ministry of Finance focused on.

Currently, officials of the financial department have revised their point of view, drawing attention to the fact that the fact of transferring funds to the customs authority as advance payments cannot be considered as payment of VAT in relation to goods imported into the territory of the Russian Federation (Letter dated 02/05/2013 N 03- 07-14/08). In this regard, the only document that can confirm the fact of payment of customs VAT is a payment order. Thus, in paragraph 17 of the Rules for maintaining a purchase book used in calculations of value added tax (Approved by Decree of the Government of the Russian Federation of December 26, 2011 N 1137), it is stated that when goods are imported into the territory of the Russian Federation, a customs declaration for imported goods is registered in the purchase book and payment documents confirming the actual payment of the tax amount to the customs authority.

Documentary support of imports from Uzbekistan at customs

For customs clearance of Uzbek products, it is necessary to submit a declaration and a list of import documents specified by law to the customs authority. 4 months are allotted for this.

The above list should include:

- Contract with an Uzbek supplier.

- Invoice.

- Packing list.

- Certificates, licenses and other permits. We especially note the ST-1 certificate of origin, confirming the country of origin that is part of the CIS. If CT-1 is issued, imported products are exempt from paying import duties. Uzbekistan is a member of the CIS, so you can save on import duties by confirming your country of origin.

- Documents on payment for products.

- Shipping documents for goods.

- Cargo insurance documents.

- Documents on transportation of products.

- Documents confirming information about the declarant.

IMPORTANT! Previously, one of the required documents was the transaction passport. However, as of March 1, 2018, it is no longer needed (directive of the Bank of Russia dated August 30, 2017 No. 4512-U).

The customs declaration is submitted on paper and electronically. In addition, the customs service is involved, where it is possible to carry out electronic declaration of imported products.

Registration of a customs declaration takes place within two hours, after which customs officers check the submitted papers, analyze the declaration, ensure the accuracy of calculations and timely payment of all necessary payments. If customs officers do not have any questions for the declarant, the products are released from the customs control zone.