Customs duty is a payment that is levied on the import or export of various groups of goods. As you know, there are a number of products and goods that can be imported without making these payments. In the Russian Federation, the import and export of various groups of goods is regulated by the law “On Customs Tariffs”. This document specifies the basic rates of customs duties, as well as the procedure for paying customs duties.

Classification

According to the current legislation, in 2021 the following types of customs duties are distinguished:

- Import customs duty. This payment is also called import payment.

- Export customs duty. Often this payment is called an export payment, since it is paid for the export of products outside of Russia.

Most goods are subject to import customs duties. This is primarily due to the fact that Russia in 2021 is actively “receiving” export products into its territory.

Import duties are imposed on all groups of goods imported into Russia. But it is worth remembering that according to customs rules, there are a number of goods allowed for import in a certain quantity. If they are imported in quantities exceeding the established norm, then customs duty is always paid.

Customs duty

The collection of customs duties on imported goods protects the domestic market of the Russian Federation from competition. Customs duties on imports are transferred to the Russian state budget. In recent years, it is these types of duties and taxes that have made up the bulk of the Russian Federation budget.

Customs duties and fees for the export of products are necessary to regulate the country’s foreign economic activity. They also replenish the Russian state budget.

Questions and answers

— Is the cost of delivery taken into account when calculating customs duties?

No, delivery costs are not taken into account when calculating customs duties. For example, if the buyer paid 205 euros for a parcel with goods, of which the delivery cost was 15 euros, the parcel will pass through customs without being charged a duty.

— What is the amount of duty calculated when purchasing at a discount?

If a product is purchased at a discount (for example, using a coupon or promotional code), the amount of customs duty will be calculated based on the actual amount paid (i.e. after the discount is applied). In rare cases, documentary evidence may be required.

— Is it necessary to indicate the TIN when registering the duty?

Citizens of Russia, in addition to their full name, address and passport details, must provide their TIN to the customs representative - this requirement is contained in the Order of the Federal Customs Service of July 5, 2021 No. 1060. For citizens of other countries living or staying in the territory of the Russian Federation, this the requirement does not apply.

— How to bypass customs limits when ordering expensive goods from abroad?

Firstly, you can try to find an option with shipping from Russia. In this case, the parcel does not pass customs, and no duty is charged (in fact, such a product has already passed customs, and the import duty was paid by the seller, albeit according to different rules and regulations). As a rule, goods delivered from Russian warehouses are slightly more expensive, but this difference may be less than the estimated amount of customs duty. Secondly, you can try to negotiate with the seller to indicate a lower amount in the customs declaration. Some sellers are willing to do this, despite the direct prohibition of such actions by the rules of trading platforms. Among other things, underestimation of the declared amount by the seller does not protect against the “draining” of the real value of the goods by the trading platform itself, as well as suspicions that may arise among customs officials. Thirdly, the seller himself can offer one of the legal ways to circumvent new customs regulations: transfer a significant part of the cost of the goods to the cost of shipping, send the goods as used, or send them in parts in different parcels. Obviously, sellers, trying to maintain momentum, will eventually learn to emerge victorious from the cat-and-mouse game with Russian customs, while acting on the side of buyers who want to save money.

— Could the consolidation of AliExpress parcels lead to exceeding new customs standards?

Formally, yes, since limits apply to postal items, and a consolidated (i.e., combined) parcel is nothing more than a regular postal item. I would like to hope that AliExpress will continue to approach the issue of parcel consolidation with the utmost care, taking into account the total cost of goods and customs regulations of the destination country. At least, there were no cases of exceeding previously existing limits due to the consolidation of parcels.

— Is it possible to refuse a parcel with accrued customs duties?

Yes, you don’t have to pay the duty and pick up the parcel. After the parcel has been stored for 30 days at the post office, it will be returned to the sender. After receiving the parcel by the sender (tracked by track number), you can return payment for the goods by opening a dispute. However, this should not be abused: the seller and the site bear postal costs, which are not compensated for in any way - if this “feat” is repeated many times, the buyer’s account will most likely be blocked.

— Which online stores transmit information about orders of Russian users to Russian Post?

We know of at least two trading platforms that have connected to the Russian Post information system: AliExpress and Joom. Russian Post, as an authorized postal operator, in turn, transmits this information further - to the Federal Customs Service.

— What is the customs duty on parcels in 2021?

The standards for the import of goods for personal use sent by international mail, as well as the amount and rules for calculating customs duties, have not changed since the beginning of 2021, which, however, does not mean that they cannot be revised later during the year. To calculate customs duties, use our customs calculator.

What is allowed to be imported without paying duty?

If a person carries with him personal funds, not counting a car, the total amount of which does not exceed 500 euros, then he is not required to pay a customs duty. In this case, the total weight of goods or products cannot exceed 25 kilograms. This applies only to those goods that are transported by land (by car or train). These rules are in effect from January 1, 2021. If a person travels by air, then he can import goods worth up to 10,000 euros duty free.

Additionally, a person can carry:

- 50 cigars or two cartons of cigarettes. An alternative to cigarettes and cigars is tobacco in an amount of 250 grams.

- Three liters of alcoholic beverages.

In other words, if a person wants to import four or more liters of alcohol, then he is obliged to pay 10 euros to the Russian budget for each “extra” liter of alcoholic drink brought. But it is worth considering that you cannot transport more than five liters of such products for personal consumption. If a larger quantity of alcohol is transported, then the cargo is already considered commercial: additional documents must be submitted for it and an additional VAT of 18 percent and excise tax must be paid.

If the cargo is considered commercial, then the rate for alcohol is 0.6 euros for each liter of alcoholic beverages.

Who is affected by the changes?

Citizens who order goods from foreign online stores (AliExpress, Amazon, eBay) or bring them back from travel are required to pay customs duties. In this case, the cost of the goods is paid to the seller, and the duty for its purchase goes to the country’s budget. Thus, when placing an order on a foreign Internet site, you need to be prepared for the fact that its final price will be higher.

The amount of tax is affected by the weight and cost of the parcel, and the number of orders. The customer will be able to avoid paying only if he meets the duty-free limit. If desired, the order can be divided into several parts, and then sent at another time or paid for by another person.

Types of bets

Unfortunately, it is impossible to single out a single payment, since there are different types of customs duty rates, which, in turn, are divided by product type.

Lesson 7. Calculation of payments (columns 47, B) and completion of filling out the DT

According to the law, there are the following types of customs rates:

- ad valorem;

- specific;

- combined.

The ad valorem rate is often called the cost rate. It does not have a fixed amount. The customs rate is calculated as a percentage depending on the customs value of the product. For example, a TV worth 2,000 euros is imported and the interest rate on this product is 20 percent. Thus, the customs payment is 400 euros.

The specific rate is set in clear monetary terms for a specific unit of production. It is worth remembering that this rate is expressed in euros. For example, a box of wine (12 pieces) is transported. For one bottle you need to pay five euros. Thus, the import duty on a box of wine will be 60 euros.

The combined rate is presented as specific and ad valorem. In other words, it combined the last two rates, so the amount of duty is calculated based on the cost and quantity of goods transported.

For example, sports shoes are imported. Since a combined rate is applied, 15 percent of its customs value is paid for each pair of shoes transported, but the amount paid cannot be less than four euros.

Most often, combined bets are used.

It is worth remembering that customs rates exist for all categories of goods. Therefore, it is simply impossible to single out a basic single rate, since it differs depending on the product. All import customs duty rates are approved in accordance with decisions of the EEC Council, and export customs duties are regulated by the Russian government.

Import customs duty rates are calculated based on the CCT. CCT is a single customs tariff that was adopted in accordance with the rules of foreign economic activity of the Eurasian Economic Union.

Is it possible to bypass customs limits?

It is in the interests of online stores to maintain and maintain turnover. Therefore, as a rule, they meet foreign customers halfway and offer:

- partially attribute the order price to the delivery cost;

- send the goods in parts;

- send the goods, describing them as “used”;

- reduce the declared amount.

However, even if the seller underestimates the declared amount, the trading platform itself will transmit official data to the Federal Customs Service. It is precisely such cases that make its employees suspicious.

Before paying customs tax, you need to find out whether the supplier or online store has a warehouse in Russia. In this case, the cargo does not need to go through customs, and the customer does not have to pay duties, since they were paid by the seller when he initially imported his products into the country. The cost of parcels delivered from Russian warehouses, although higher, often compensates for the duty.

Types of customs duties

Customs duties in the Russian Federation are divided into two types: seasonal and special.

Seasonal customs tariffs apply to agricultural products and other goods that are seasonal. In other words, there is a period of time in the year when, instead of the usual customs duty, a seasonal customs rate is applied to agricultural products.

For example, the established interest rate for tomatoes in 2021 is 15%, but not less than 0.08 euros per kilogram of product. Moreover, if tomatoes are imported into the country from May 15 to May 31, as well as from June 1 to October 31, then a seasonal rate of 15% is applied, but not less than 0.12 euros per kilogram.

Special customs tariffs and duties are classified as follows:

- special.

- anti-dumping.

- compensatory.

The use of customs duties of a special type is necessary for non-tariff regulation of foreign economic activity. They are used to protect Russian manufacturers of various types of goods.

What's happened?

From January 1, 2021, on the territory of the Eurasian Economic Union (the Republic of Armenia, the Republic of Belarus, the Republic of Kazakhstan, the Kyrgyz Republic and the Russian Federation), new cost, weight and quantitative standards for the import of goods for personal use sent in international mail to the customs territory of the Union began to apply . The maximum permissible duty-free threshold has become the cost of international postal items of 200 euros with a gross weight of 31 kg; Exceeding any of these two parameters will result in the postal item being subject to customs duties. The phrase “maximum permissible” means that the EAEU countries have the right to set their own limits, which may be lower, but not higher than those established for the territory of the Union. This right has already been used, in particular, in the Republic of Belarus, where goods costing no more than 22 euros and weighing no more than 10 kg can be imported without paying a duty.

The standards for the import of goods were established by decision of the Eurasian Economic Commission dated December 20, 2021 No. 107 “On certain issues related to goods for personal use”, and then adjusted by decision No. 91 dated November 1, 2021.

Despite the fact that at the end of 2021, judgments about the need to further reduce the duty-free threshold were repeatedly thrown into the information space, from January 1, 2021, the norms for the import of goods for personal use, determined by the decision of the EAEU, are in force on the territory of the Russian Federation - 200 euros and 31 kg; these standards continue to apply in 2021.

VAT and excise taxes

The system of Russian customs rules in 2021 provides for the payment of not only import duties, but also VAT when importing products. VAT is paid on the import of products, taking into account that they will be sold on the territory of the Russian Federation. VAT is an indirect tax. The procedure and deadlines for paying VAT are regulated by the Customs Code of the Customs Union.

Thus, according to the norms of the Tax Code of the Russian Federation, the following are required to pay VAT:

- organizations;

- enterprises;

- individual entrepreneurs.

Also, do not forget about excise taxes. Excise taxes are paid when the following groups of goods are sold:

- Ethyl alcohol. But it is worth remembering that excise duty is not paid on cognac alcohol. This is the only exception.

- Products that contain alcohol in an amount of more than nine percent.

- Alcohol products (vodka, wine, liqueurs, cognac and others). But if the product contains less than 1.5 percent ethyl alcohol, then no excise tax is paid.

- Beer.

- Tobacco products.

- Cars.

- Some types of motorcycles.

- Gasoline intended for refueling cars.

- Diesel fuel.

- Oils for different types of engines.

Services for settlement of customs duties and taxes

You need to calculate customs duties - we will help you!

Our company “Universal Cargo Solutions” provides services for the clearance of goods at any customs office of the Russian Federation, selection of HS codes, determination of customs value, calculation of customs duties required for payment, including customs duties. We work seven days a week, and if necessary, around the clock. We have the ability to promptly pay customs duties for the client and carry out prompt clearance of goods at customs, which significantly reduces time and costs.

We are confident that we will become a reliable partner at customs!

Car import rates

To import a car you need to pay VAT, excise tax and customs duty on the car.

But it’s worth noting right away that the amount of customs duties on a car depends on the following characteristics of the car:

- What is its customs value?

- Legal status of the person who imports: natural or legal person.

- Engine volume.

- Power in kilowatts.

- Vehicle weight (vehicle weight is calculated in tons).

- Engine type.

- Year of manufacture (in other words, age).

How to clear a car through customs - customs auto calculator

There are only four ages:

- less than three years;

- from three to five years;

- from five to seven years;

- more than seven years.

In the latest amendments to the bill, it was decided to make a single rate for cars based on age and engine size.

So, if the car is less than three years old, then a combined rate of 54% applies. This does not apply to cars that were manufactured in the Russian Federation. But it is worth considering that the minimum bet is 2.5 euros.

Table. Calculation of customs duties based on engine volume for cars less than three years old.

| Price for 1 cm cube. (In Euro) | Minimum cost of the car (in rubles) | Maximum cost of the car (in rubles) |

| 2,5 | 325 000 | |

| 3,5 | 325 000 | 650 000 |

| 5,5 | 650 000 | 1 625 000 |

| 7,5 | 1 625 000 | 3 250 000 |

| 15 | 3 250 000 | 6 500 000 |

| 20 | 6,500,000 or more |

For cars that were manufactured in the Russian Federation, a single rate applies. It is equal to one euro per cm3.

Table. Calculation of customs rates based on engine volume for cars over five years old.

| Price for 1 cm cube. (In Euro) | Minimum engine capacity (in cm3) | Maximum engine capacity (in cm3) |

| 3 | 1000 | |

| 3,2 | 1000 | 1500 |

| 3,5 | 1500 | 1800 |

| 4,8 | 1800 | 2300 |

| 5 | 2300 | 3000 |

| 5,7 | 3000 or more |

For yachts, other categories of cars, boats, a single tariff rate of 30% of the cost of equipment is applied. For example, if the estimated value of the yacht is 20,000 euros, then the payment amount is 6,000 euros.

Payment of customs duties

The obligation to pay customs duties, as well as other customs payments, lies with the declarant. When importing into Russia, payment of the fee is made in rubles.

How is customs duty paid?

Customs duties are paid in advance. This avoids customs delays and unnecessary costs. The declarant must transfer the money before submitting the customs declaration. To pay customs duties and other customs payments, you must have a Unified Personal Account (UPA), which can be replenished through the Bank by filling out a Payment Order. It is possible to pay at the place of filing the declaration:

- Individuals have the opportunity to deposit funds through specialized terminals on the territory of the customs post;

- Legal entities can use the electronic payment system “Customs Card” or “Round”, which allows making customs payments without delays.

In addition, all participants in foreign economic activity (Legal entities, individual entrepreneurs and individuals) have the opportunity to pay customs duties and other customs payments through a customs representative. To do this you need to conclude an agreement.

Clarification for individuals: if the import of goods is carried out according to the passenger declaration, then payment is made independently. If the imported goods are registered under the procedure, then payment can be made by a customs broker.

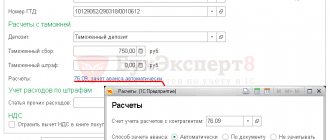

Information about customs duties is indicated in columns 47 and “B” of the customs declaration form ED2.

Column 47 is called “Calculation of payments” and consists of several sections.

The “Type” section contains a four-digit customs payment code approved by the classifier, which is used to fill out customs documents. Customs duty codes:

- “1010” - customs operations (customs clearance, declaration);

- “1020” - customs escort;

- "1030" - storage.

In the section “Base of accrual” the amount of the customs value of the declared goods in Russian rubles is indicated, for example, 264,320 rubles. 28 kopecks, or 303,968 rubles. 32 kopecks If several goods are declared, their total customs value is indicated.

In the “Rate” section the customs duty rate is indicated: 375 rubles, 750 rubles, 1500 rubles. etc.

In the “Amount” section, information about the amount payable as customs duty for customs operations is indicated, that is, the same 375 rubles, 750 rubles, 1500 rubles. etc.

In the section “SP” (payment specifics), a letter code approved by the Classifier is indicated (“IU” - customs duty is paid by the declarant before the release of goods, “UR” - imputed calculation of customs duty, “UM” - customs duty is not payable; other two-digit codes are also used ).

Column “B” is called “Counting Details”. It contains the same four-digit code for the type of customs duty, information about the amount charged, a three-digit currency code (the Russian ruble has code 643) and information about the payer and the date of payment. All data is written on one line and separated from each other by the “-” sign. Spaces are not allowed!

Latest news in customs legislation

According to amendments to customs legislation, from May 16, 2015, an import customs duty of 0% will be introduced on caviar. This means that certain types of fish caviar can be imported duty free.

From October 1, 2015, the export duty on grain was 50 percent. But according to the law, 6,500 rubles will need to be subtracted from the resulting amount. It is worth noting that each “extra” ton cannot cost less than 10 rubles. This decision was made by the government to maintain exports and strengthen the position of the Russian market on the world stage.

Tax payment methods

Carrier companies are required to collect data about the buyer for declaration, as well as transfer it to the Federal Customs Service register. As soon as the buyer places an order, the delivery service sends him an invitation to register in his personal account. Here he states:

- passport details;

- TIN (citizens of other countries who temporarily stay or permanently reside in Russia are not required to provide a TIN);

- contact number;

- email;

- link or screenshot of the order with the name and cost of the product.

After the parcel arrives at Russian customs, the customer is sent a message about the need to pay duty. It also contains instructions on how to pay customs tax. This can be done through the Russian Post mobile application or by bank payment. The application is convenient in that it notifies the user about the accrual of customs duties and allows them to pay it immediately.

When paying tax by bank transfer, you need to check that the destination and details entered are correct. If the data is entered incorrectly, FCS employees have the right to demand that the fee be paid again. The previous payment is usually returned, but with a delay.

For citizens who often make purchases in foreign online stores, it is more profitable to cooperate with shipping companies. Many of them can pay the customs duty for the customer. To do this, he only needs to deposit the required amount into the account in his personal account. This form of cooperation makes life easier for both the customer and the courier service.

Customs rates for other goods and food products

Import customs duty rates in 2021 directly depend on the quantity and cost of products. Thus, for brushes, whisks, shaving brushes, nail files, combs, mops, shoe brushes, sieves, sieves, travel kits, pens, ribbons, lighters, an ad valorem customs rate of 20% of the customs value of products of one item is applied. The total quantity (kg) is calculated for ivory, corals, materials of plant origin, accessories, etc. The bid price is equal to 20% of the cost of the goods.

Table. Calculation of customs duties for 2021

| Name of product | Customs duty |

| Furniture | |

| Desks, cabinets, beds, plastic, metal furniture, mattresses | 20%, but not less than 1 euro per 1 kilogram |

| Rattan, bamboo furniture | 20%, but not less than 1.3 euros per 1 kilogram |

| Lighting equipment | 5 % |

| Weapons and ammunition | |

| Revolvers, pistols, cannons, howitzers, mortars, grenade launchers, launchers, flamethrowers, rifles, gas guns | 20 % |

| Cartridges, cases | For 1000 pieces 20% of their cost is paid |

| Swords, sabers, bayonets, pikes | 20 %. |

| Equipment | |

| Cables, fibers, filters | 15 % |

| Lenses, eye glasses, weapon sights, navigation systems | 5% of the cost of 1 piece |

| Binoculars, cameras, movie cameras | 15% of the cost of 1 piece |

| Products | |

| Locks, keys, latches, hinges, gongs, photo frames, blocks, rivets, mirrors, plugs, caps, covers, electrodes | 20 % |

| Sharp objects | |

| Forks, rakes, pruners, scissors | 15 % |

| Saws, circular blades, blowtorches. | 5 % |

| Animals (live) | |

| Horses, mules, heifers, pigs, goats, turkeys, geese | 5% of the cost of 1 animal |

| Meat | |

| Cattle | 15%, but not less than 0.2 euros per 1 kilogram of weight |

| Pork | 15%, but not less than 0.25 euros per 1 kilogram of weight |

| Lamb, goat, horse meat | 15%, but not less than 0.15 euros per 1 kilogram of weight |

| Vegetables | |

| Old potatoes | 5 % |

| Young potatoes, onions, cabbage, cauliflower, turnips, carrots, asparagus, eggplant, celery and others | 15 % |

| Tomatoes cucumbers | 15%, but not less than 0.08 euros per 1 kilogram |

| Gherkins | 15%, but not less than 0.12 euros per 1 kilogram |

| Fruits and nuts | |

| Nuts | 5 % |

| Dried dates | 10 % |

| Citrus fruit | 5%, but not less than 0.02 euros per 1 kilogram |

| Satsuma, tangerines, tangerines | 5%, but not less than 0.03 euros per 1 kilogram |

What is not subject to import/export tax?

In Art. 131 Federal Law No. 311 of November 27, 2010 contains a list of names of goods that are not subject to the need to pay duties during export/import. This list included:

- property belonging to the category of property of diplomats, consulates, missions of foreign countries and their employees;

- goods equivalent to humanitarian aid items;

- cultural assets - property owned by museums, various archives, and storage facilities;

- items that participate in large-scale government exhibitions, including air shows;

- state currency in the form of cash belonging to member countries of the Customs Union (commemorative coins do not fall into this category) - if import/export is carried out by the central banks of the countries;

- goods with a total value of less than 200 Euros (calculation is made at the exchange rate provided by the Central Bank at the time of filling out the declaration);

- supplies;

- items used by private individuals for personal purposes;

- vehicles that are transported and subsequently used for international transportation;

- spare parts together with the vehicle;

- goods that will be used in sports competitions and filming;

- equipment intended for media work;

- scientific samples.

Rates on alcohol and tobacco products

Table. Rates on alcohol and tobacco products in 2021

| Name of product | Bet size |

| Mineral water | 15%, but not less than 0.07 euros per 1 liter |

| Non-alcoholic beer | 0.6 euros per 1 liter |

| Malt beer | 0.6 euros per 1 liter |

| Sparkling wines, including champagne | 20 % |

| Vermouths, wines | 20 % |

| Undenatured ethyl alcohol with an alcohol concentration of less than 80 vol. | 100%, no less than 2 euros per 1 liter |

| Cognac, brandy, whiskey | 100%, no less than 2 euros per 1 liter |

| Tobacco with unseparated midrib | 5 % |

| Cigarettes, cigars | 30%, but not less than 3 euros of the cost of 1000 pieces |

| Smoking tobacco | 20 % |

What do you need to know to calculate customs duties?

a) Cost of goods

Let's start with the accrual basis - this is the cost of the goods you buy abroad. It is very important to understand that payments are not always calculated based solely on the amount indicated on the invoice (import purchase invoice).

b) Cost of transporting goods to the border

In order to understand the cost of transportation to the border, you need to know the delivery basis under the contract, according to Incoterms.

As an example, we will look at four options that are the main ones for land transportation of goods and are most often used by customers of the Eride.ru service:

EXW (X-works or Ex-works)

– ex-factory. It sounds somewhat incomprehensible, so let’s put it simply – this is a shipment directly from the production site or its warehouse. That is, we pick up the goods directly from the overseas factory, and local export processing fees may be added to the price of the goods. Under these conditions, it is necessary to add transport costs to the border of the Russian Federation or the Customs Union.

FCA (EF-si-ey or Fe-se-a) –

free carrier. It is also a rather unclear term, but in essence it is the transfer of goods to the buyer at the carrier’s warehouse. For example, you give the seller the address of the Eride.ru warehouse in the EU, which you chose during the ordering process on our website, and the supplier delivers the goods to us independently. Under these conditions, it is also necessary to add transportation costs to the border of the Russian Federation or the Customs Union.

DAP (Di-ey-pi or Dap)

– delivery to the destination specified in the contract, import duties and local taxes are paid by the buyer. These conditions already imply that transportation is organized and paid for by your foreign supplier of goods. In this case, the main calculation of customs duties will be the cost in the invoice, to which it will no longer be necessary to add transportation costs to the Russian border.

CIP delivery conditions

(ES IP or SIP). In this case, the goods are delivered to the customer’s main carrier, the main transportation to the customs terminal of arrival in the Russian Federation specified in the contract is paid by the seller (that is, it will be included in the price of the goods according to the invoice), but the goods are subject to compulsory insurance and the costs of insurance are borne by the buyer.

We deliberately used this interpretation in brackets, since when working with a carrier and broker, this is the pronunciation of these bases that will most often be used.

In the cases of FCA and EXW, in order to calculate customs duties, the cost of transportation to the border of the Customs Union will need to be added to the cost of the goods according to the invoice. You can easily find out this amount from your carrier and, if necessary, request a cost estimate. As we said earlier, under DAP conditions, the cost of transportation is already included in the invoice, so there is no need to add anything. Under CIP conditions, instead of transportation costs to the Russian border, you will need to add the amount of insurance that will be indicated in the policy.

c) VAT

Value added tax. The VAT rate in the Russian Federation is 20%.

d) Customs clearance fee

The customs clearance fee is calculated at a fixed rate in rubles depending on the customs value of the goods (invoice value of the goods + transportation costs to the border).

Until 2021, it was possible to submit declarations in paper form using the old, more expensive tariff. Since 2021, more than 95% of customs declarations are processed using electronic declarations; paper declarations are used in rare, exceptional cases.

The amount of customs duty for electronic declaration:

- if the value of the cargo is no more than 200,000 ₽ inclusive, you need to pay a customs fee of 775 ₽ ;

- for goods valued from 200,000.01 to 450,000 ₽ inclusive, the fee will be 1,550 ₽ ;

- when valuing goods from 450,000.01 to 1,200,000 ₽ inclusive - customs duty 3,100 ₽ ;

- if the value of the goods on the date of filing the declaration is from 1,200,000.01 to 2,700,000 ₽ inclusive , you need to pay 8,530 ₽ ;

- for cargo valued from RUB 2,700,000.01 to RUB 4,200,000 inclusive , a fee of RUB 12,000 ;

- for goods worth from 4,200,000.01 to 5,500,000 ₽ inclusive, 15,500 ₽ is paid ;

- for goods worth from 5,500,000.01 to 7,000,000 rubles inclusive, 20,000 rubles is paid ;

- for cargo from 7,000,000.01 to 8,000,000 rubles inclusive, you must pay a customs fee of 23,000 rubles ;

- for cargo from 8,000,000.01 to 9,000,000 rubles inclusive, you must pay a customs fee of 25,000 rubles ;

- for cargo from 9,000,000.01 to 10,000,000 rubles inclusive, you must pay a customs fee of 27,000 rubles ;

- if the value of the goods is more than 10,000,000.01 rubles, the customs duty is 30,000 rubles .

Read a detailed article about customs duties

Payment deadlines

Import customs goods upon import are paid within the first 15 days from the date of presentation of the products to the control authority. The deadlines for payment of customs duties are regulated by the Customs Code of the Russian Federation. According to the law, the deadline for paying customs duties cannot exceed the day on which the declaration was submitted. In cases of exception, payment of customs duties is carried out on the day of submission of declaration documents. Within the established deadlines for payment of customs duties, the entire amount of customs duties is paid, including VAT and excise tax if necessary.

What changed?

During 2021, a resident of Russia had the right to import from abroad in the form of postal items without paying customs duties for one calendar month

goods

with a total value of

no more than 500 euros and a total weight of no more than 31 kg.

From the beginning of 2021, the monthly limit no longer applies, and a new limit of 200 euros and 31 kg applies to each parcel

.

On the one hand, Russian shopaholics (as well as the notorious “hucksters” at online flea markets) are incredibly lucky: now they can, in particular, buy dozens of budget smartphones without worrying about duties. On the other hand, buyers with higher demands suffered: ordering a flagship device on AliExpress risks completing a quest to pay a fee and parting with a couple of thousand rubles.

How is the fee calculated?

Calculation of duties when the amount limit is exceeded

Let's look at this question with an example. You ordered a smartphone for €400. To calculate the customs duty from 400 euros, we subtract 200 and get the amount from which you need to pay tax to the state (400 - 200 = 200). Subtracts 15% from this amount using the formula 200×0.15=30. The amount of tax duty on the smartphone was €30.

Calculation of duties when exceeding the weight limit

For example, your order amount was €150 and the weight was 38 kg. We subtract from the resulting weight limit 31 kg and multiply by 2 euros. (38-31) * 2 = 14 euros