The import of goods into the country from abroad is always accompanied by customs checks and preparation of documents. To find out how much customs clearance will cost, use the customs duties calculator. Calculations will allow you to determine the amount of expenses. The result can be printed.

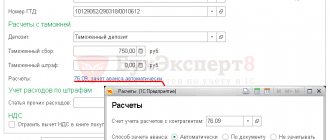

The customs duties calculator contains several items that must be specified: VAT rate, customs duty, customs value of goods, collection.

What is the customs value of goods?

Customs value is an important component for determining duties when importing goods. It is necessary to determine the cost if this type of product is imported into Russia for the first time. To confirm the cost, you need to collect a package of documents. Most often, this concept includes the cost of cargo, its transportation to the border of the Customs Union and insurance.

This value can be calculated in the following ways:

- at the cost of the concluded transaction and the amount of money paid for a specific product;

- at the value of the transaction concluded when importing identical goods, if it is impossible to apply the first method;

- by subtracting transportation costs and duties from the cost of the goods;

- by adding the cost of goods and profit.

It is necessary to determine the customs value and indicate it in the appropriate window of the customs calculator.

Fee calculation table

| Cost of goods and transportation, rub. | Customs duty, rub. |

| from 0 to 200000 | 775 |

| from 200000.01 to 450000 | 1550 |

| from 450000.01 to 1200000 | 3100 |

| from 1200000.01 to 2700000 | 8530 |

| from 2700000.01 to 4200000 | 12000 |

| from 4200000.01 to 5500000 | 15500 |

| from 5500000.01 to 7000000 | 20000 |

| from 7000000.01 to 8000000 | 23000 |

| from 8000000.01 to 9000000 | 25000 |

| from 9000000.01 to 10000000 | 27000 |

| from 10000000.01 and above | 30000 |

According to paragraph 2 of the Resolution of March 26, 2021 No. 342

If the customs value of goods imported into the Russian Federation is not determined and not declared, and also if in relation to goods exported from the Russian Federation (with the exception of goods specified in paragraph 26 of part 1 of Article 47 of the Federal Law “On Customs Regulation in the Russian Federation ", as well as in paragraphs 8 and 9 of this resolution) the rates of export customs duties are not established or specific rates of export customs duties are established; customs duties for customs operations are paid at the following rates:

- 6 thousand rubles - for customs operations if the number of goods specified in paragraph one of this paragraph in the customs declaration does not exceed 50 goods;

- 12 thousand rubles - for customs operations if the number of goods specified in paragraph one of this paragraph in the declaration is 51 goods or more, but not more than 100 goods inclusive;

- 20 thousand rubles - for customs operations if the number of goods specified in paragraph one of this paragraph in the customs declaration is 101 goods or more.

What is customs duty?

The online customs duties calculator contains such an item as “customs duty”. This is a mandatory payment that must be made by all legal entities importing goods into the country.

The amount of duty may vary depending on the country from which the cargo was brought, the purpose of import, and the value of the goods. Rates change over time. An online customs calculator will help you determine how much money you need to spend on importing a particular product.

What is customs duty?

The online calculator for calculating customs duties also includes the amount of customs duty. This is one of the mandatory payments made when importing goods. It includes 3 points:

- registration fee, the size of which directly depends on the cost of the goods;

- escort fee if the cargo is transported under customs control;

- storage fee (charged if the goods are stored in a warehouse - depends on the weight of the cargo).

As a rule, freight forwarders and carriers are responsible for the payment of customs duties.

VAT for goods

Value added tax is indirect. Part of the cost of the goods goes to the state. There are 3 VAT rates:

- 20% - for almost all imports;

- 10% - discount on some food and children's products, according to the Decree of the Government of the Russian Federation;

- 0% - on goods that are important for science and have no analogues in Russia, as well as on products of medical equipment registered in the prescribed manner.

The tax is calculated using the rate, as well as the cost of the goods and customs duties.

The calculation on the customs calculator is approximate. For more detailed information, you can use the services of professionals.

If you want to get more accurate calculations or learn more about favorable terms of cooperation, leave a request on the website or call the numbers provided.

Return to list

Limits for different types of transport

The need to pay duty also depends on how exactly the cargo will be imported into Russia. If the same TVs are delivered by air, the customer will automatically be exempt from paying tax. In general, foreign-made goods can be imported into the country:

- on foot,

- by mail,

- by plane,

- on ground transport,

- with the help of a carrier company.

The duty-free limit for cargo delivery by air is 10 thousand euros or 50 kg. If the cost is increased by 30%, you will have to pay tax. If you exceed the weight, you will need to pay 4 euros for each kilogram.

For land transport and cases where goods are imported into Russia on foot, the limit is 500 euros or 25 kg. If it is exceeded, you also need to contribute 30% of the cost to the treasury or pay 4 euros for each kilogram.

These restrictions must be taken into account by tourists and travelers who return to their homeland with suitcases full of souvenirs, clothes, and alcoholic beverages. It is better to distribute them among all participants of the trip, but do not hide them from customs officers, because this may result in a fine.

Turnkey customs clearance

General Cargo takes upon itself the resolution of all issues related to customs clearance of customer shipments. All that is required from the client is complete information about the cargo and a contract. This relieves the cargo owner of all legal issues and ensures the success and simplicity of transactions.

Advantageous features of this organization of the procedure:

- It is easier for customs officers to cooperate with professional brokers who are well aware of the current legal regulations and the nuances of paperwork. As a result, customs clearance takes place quickly and without surprises.

- Correct preparation of documentation reduces the time spent on customs clearance and financial costs.

- The cost of our specialists’ work is always compensated by the time saved, the absence of fines and overpayments associated with the elimination of errors.

The cost of customs clearance is determined individually for each order. Our prices for customs clearance of goods are always the most favorable in the chosen direction.

How to avoid paying duty on goods on Aliexpress?

There are several options here:

- Order items individually for up to 199 euros. If the amendments are adopted in 2021, the amount will change to 49 euros. It is necessary to take into account that if the goods arrive at customs in one shipment, they may be counted as one parcel and duty will have to be paid.

- Agree with the seller to indicate the lowest amount for the product. In personal messages, you can ask the seller to indicate in the parcel an amount less than 199 euros (or 49, respectively) (almost everyone makes concessions to you).

Useful excerpts from the law established by law:

Decision of the Customs Union Commission dated June 18, 2010 No. 318 (clause 1, clause 4.1.4):

4.1.4. An official of the authorized body checks the submitted phytosanitary certificate and makes a decision to prohibit the import of a batch of regulated products of high phytosanitary risk or its placement under the customs procedure of customs transit in the following cases:

1) the information contained in the phytosanitary certificate does not correspond to the information in commercial and transport (shipment) documents;

Decision of the Customs Union Commission dated June 18, 2010 No. 318 (clause 1, clause 4.1.6):

4.1.6 A phytosanitary certificate is invalid in the following cases:

1) the phytosanitary certificate is not fully completed;

Federal Law of July 15, 2000 No. 99-FZ “On Plant Quarantine”.

Article 9. Protection of the territory of the Russian Federation from quarantine objects.

Import into the territory of the Russian Federation of regulated products (regulated material, regulated cargo) is permitted if the specified products have documents for their import, as well as documents certifying the compliance of such products with the requirements of international treaties of the Russian Federation relating to plant quarantine, rules and regulations for ensuring plant quarantine .

Code of the Russian Federation on Administrative Offenses (Administrative Offenses Code of the Russian Federation).

Article 10.2. Violation of the procedure for import and export of regulated products (regulated material, regulated cargo) Violation of the procedure for import into the territory of the Russian Federation and into zones free from quarantine objects, export from the territory of the Russian Federation and from quarantine phytosanitary zones of regulated products (regulated material, regulated cargo) - entails imposition of an administrative fine on citizens in the amount of three hundred to five hundred rubles; for officials - from five hundred to one thousand rubles; for legal entities - from five thousand to ten thousand rubles.

Why does the Ministry of Finance want to change the threshold?

In his address, Siluanov, with reference to data from the Association of Internet Trade Companies (AKIT), actually repeats the argument of the ministry in 2021: cross-border trade has been actively growing in Russia in recent years, but foreign online stores do not pay VAT and import customs duties, as a result of which “there is a flow of profits and taxes from Russian retail to foreign online stores.

In 2021, according to AKIT, the Russian online trading market was valued at 1.66 trillion rubles. According to the association’s forecast, by the end of 2019 the volume of the online trading market will increase by 32.5%, to 2.2 trillion rubles. The share of foreign online platforms in sales volume in 2021 decreased for the first time since 2012 and amounted to 30.4% instead of 36% a year earlier. However, the income of foreign sellers on the Russian market increased by 34.7%, to 504 billion rubles, and the number of shipments reached 380 million. In 2021, AKIT predicts an increase in the number of shipments from foreign stores by 18.4% compared to last year, to 450 million

Some market participants surveyed by RBC do not agree with AKIT’s assessments. “This figure is doubled, it seems to us that in the interests of Russian traditional and online retail, the Russian government is being misled,” noted one of RBC’s interlocutors. For example, the estimates of the research company Data Insight do not coincide with the AKIT data. According to its forecasts, in 2021 the income of foreign sellers on the Russian market will reach 435 billion rubles, a year earlier they amounted to about 350 billion rubles, says Fedor Virin, a partner of the company.

Data Insight's estimates of cross-border trade are comparable to data provided by researchers of the Russian e-commerce market at the Institute of Economic Policy. Gaidar. Institute experts estimated the market at 262 billion rubles. in 2021 and 316 billion rubles. in 2018. Forecast values for 2021 were 360–380 billion rubles, excluding the decrease in the average bill and the growth rate of the number of orders by 15–20%.

Export from Russia

Exports of agricultural products from Russia show good results, but not every year is a record year. By global standards, exports of the “vegetables” segment are not significant. The main export volume is potatoes, onions, tomatoes, carrots, and cabbage. Vegetable supplies mainly go to Ukraine, Azerbaijan, Uzbekistan, Pakistan, Turkey, Moldova, Kazakhstan, Turkmenistan, Belarus, and Georgia.

Russia also exports relatively small volumes of fruit. The dominant position in fruit exports is occupied by frozen wild berries. The main buyers of berries from Russia are Latvia, Lithuania, Estonia, Finland, Sweden, and Poland. The re-export of bananas to neighboring countries brings good income to the country. Watermelon and melons are another type of product that is in demand abroad. Major consumers of Russian melons are Belarus, Lithuania, Latvia, and Estonia.

What documents will be needed?

As with customs clearance of any product, when importing, the importer will need a foreign economic contract with a unique contract number (UCN), an invoice, and a waybill. Additionally, the package of documents includes:

- detailed description of the cargo indicating technical characteristics and scope of application;

- permitting documents: certificates, test reports, etc.;

- certificate of origin of equipment (not always required);

- registration certificate (for medical equipment).

If you have questions, you can ask your

Personal Manager

Olga Murzina

Work experience 9 years

+7

To get a consultation

If your parcel is stuck at customs

The customs clearance time can vary from several hours to 3-5 days, which is considered the norm. But if the goods are at customs for more than 10 days, it means that the contents of the parcel have raised a number of questions among customs officers.

Reasons for failure to clear customs:

- The cost of production is greatly reduced.

- The customs service representative considered the parcel to be commercial (for example, it contains products of the same names).

- The weight of the parcel differs from that indicated in the accompanying documents.

- Customs officers needed to double-check information about the sender.

- The online store manager provided an incomplete package of documents, or gross errors were found in them.

- The parcel contains goods that violate copyrights, such as counterfeit smartphones.

- The products are classified as prohibited for import. These could be valuable pieces of art, narcotic and psychotropic drugs, or spy gadgets. In this case, the parcel is seized and an investigation begins.

You can find out about a parcel delay at customs using the postal tracking service. But to find out the cause of problems with customs, you need to contact the customs authority.

You can find out about a parcel delay at customs using the postal tracking service

Procedure for delaying goods at customs

If the parcel is held at customs for more than 10 days, it is time to contact customs. In some cases, the delay is caused by the need to clarify the tax identification number, passport details or delivery address. But there may be more serious questions.

If the parcel has been assigned the status “Customs clearance failed,” you need to contact both the customs service and the seller. It’s better to start with the manager of the online store; it will be easier for him to find out the reason for the delay of the goods.

Customs clearance has begun

If a customs representative proves that you ordered goods prohibited for import or do not agree to pay customs duties, difficulties will automatically arise with a refund. Few sellers agree to 100% compensation for the order. This is due to the fact that the manager has already paid for the non-refundable delivery service. Therefore, while the order protection option is active, try to negotiate with the seller. If that doesn't work, open a dispute on AliExpress.

Customs clearance failed

If the product is returned back to the sender due to the fault of the store manager (incomplete package of accompanying documents or the seller sells counterfeit goods), do not rush to initiate a dispute. In this case, it is necessary to prepare an impressive package of documents and send it to the administration of the trading platform within 7 working days.

In difficult situations, you can open a dispute

Type of product and exporting countries

Importing fruits and vegetables is very important for our country. In winter, fresh products appear on the shelves of our stores thanks to established imports from nearby warm countries. The main suppliers of fruits and vegetables to Russia are:

- CIS countries (Azerbaijan, Georgia, Moldova, Turkmenistan, Tajikistan, Uzbekistan);

- EAEU countries (Armenia, Belarus, Kazakhstan, Kyrgyzstan);

- Türkiye;

- Iran;

- India;

- China;

- Israel;

- Egypt;

- Countries of South and North America.

From late autumn to early summer, various vegetables and fruits are continuously imported into Russia. To ensure the completeness of the consumer basket of every Russian, our state purchases the following types of fresh products from foreign partners:

- Vegetables - tomatoes, cherry tomatoes, cucumbers, zucchini, radishes, carrots, garlic, onions, different types of cabbage, potatoes, chili peppers, garlic, etc.

- Fruits - oranges, tangerines, bananas, kiwis, apricots, peaches, pineapples, apples, exotic fruits.

- Berries - watermelon, blueberries, blackberries, strawberries, cranberries, currants, raspberries, rose hips, cherries.

- Greens - spinach, cilantro, dill, parsley, arugula, lettuce.

- Nuts – walnuts, pine nuts, Brazil nuts, cashews, almonds, peanuts, pistachios.

- Dried fruits - raisins, figs, dried apricots, dates, prunes.

Advantages of customs clearance with General Cargo

- Correct and legal execution of a complete set of documents.

- Minimum terms for customs clearance of all consignments of goods.

- Extensive work experience, established contacts and connections.

- Wide range of goods. We carry out customs clearance of a wide variety of goods, from souvenirs to industrial equipment.

- Cooperation with individuals and legal entities of all forms of organization of activities.

- Preliminary consultation when concluding a transaction and preparing for customs clearance.

- Reasonable pricing policy.

Where do Russians mostly buy?

The main player in cross-border trade in Russia is China; among importers, the country leads both in the number of parcels and in their total value: it accounts for 92% of parcels; in monetary terms, the share of online merchants from China is 54%, follows from AKIT data for 2021 The leadership is also confirmed by a joint study by GfK and Yandex.Market, which showed that 73% of respondents placed orders on Chinese online platforms. Only 29% chose online platforms from other countries. A year earlier, 70% of buyers ordered goods from China and 26% from other countries.

According to AKIT, in 2021, among all transactions, parcels costing over €500 accounted for less than 1% of orders, and the majority of orders from Russians (64.3%) were for parcels costing up to €22.