Incoterms 2021 - rules of international trade. Incoterms rules represent trade terms abbreviated by the first three letters, reflecting business practices in the international supply of goods.

Incoterms 2021 - Incoterms 2021慣例。

Incoterms 2021 - international trade rules. The Incoterms rules are trade terms abbreviated in the first three letters, reflecting business practices in the international supply of goods.

Incoterms ® (International commerce terms) is a trademark of the International Chamber of Commerce (ICC).

Incoterms 2021 (Incoterms 2020) are rules applied in international trade that define the rights and obligations of the parties under a sales contract regarding the delivery of goods from the seller to the buyer (terms of delivery of goods).

Incoterms are international rules recognized by government customs authorities, law firms and businesses around the world as the basic terms for international trade in goods . Scope

Incoterms and obligations of the parties under a sales contract regarding the transportation of goods from the seller to the buyer, liability for loss and damage to the goods, its customs clearance and insurance .

Incoterms (English: Incoterms, International commerce terms ) is a trademark of the International Chamber of Commerce (ICC)

The ICC Incoterms rules are intended for the use of trade terms in national and international trade.

New Incoterms rules (Incoterms 2020)

Due to the need to provide traders with international rules for the interpretation of trade terms most often used in foreign trade, the International Chamber of Commerce (ICC) published the first edition of the Incoterms rules in 1936.

Further, with the change in trade parameters and the increase in various methods of delivering goods, the international rules of Incoterms also changed. Changes and amendments were made in 1953, 1967, 1976, and since 1980, Incoterms began to be periodically revised every 10 years, and updated in 1990, 2000, 2010.

On 10 September 2021, the latest ninth edition of the Incoterms 2021 rules was published and came into force on 1 January 2021 (ICC Edition No. 723). The new Incoterms 2021 rules are an updated version of the Incoterms 2010 rules, which were developed at the International Chamber of Commerce (ICC) by a committee of experts - the Drafting Group.

This committee included lawyers from the United States of America, Great Britain, France, Turkey, Germany, as well as, for the first time, representatives from China and Australia. The purpose of the Drafting Group and the revision of the current Incoterms rules was to simplify them as much as possible, and in addition, to remove unnecessary supply bases that can cause confusion and misunderstanding in the use of trade terms, to more clearly explain all terms of delivery for exporters and importers around the world .

CFR Incoterms (Cost and Freight)

According to CFR Incoterms, the seller delivers the goods to the buyer by placing them on board the ship or purchasing them delivered.[23] Consequently, the risk of loss/damage to the goods is transferred to the buyer when the goods are placed on board the vessel at the port of delivery rather than the port of destination as in the case of the above mentioned FOB Incoterms.

Regardless of the transfer of risk at the port of delivery, the seller is obliged to enter into an agreement for the carriage of goods to the port of destination. The seller must also bear all costs associated with unloading at the port of destination as a result of the contract of carriage, unless otherwise agreed. He is also required to clear goods for export, not import. An insurance contract from the seller or buyer is not required.

How to use Incoterms rules (Incoterms 2020)

The international rules of Incoterms 2021 can be applied from January 1, 2021, but it is also possible to continue to use the rules of Incoterms 2010, or the rules of Incoterms 2000, and even earlier versions of Incoterms. Therefore, in international sales contracts, when specifying the terms of delivery, it is necessary to accurately indicate the version of Incoterms.

It is important to know that Incoterms rules do not replace the purchase and sale agreement, but only allow them to be shortened. Incoterms delivery conditions do not determine the transfer of ownership of the goods, do not indicate the price for the goods and the method of payment or the consequences of violation of the contract.

Incoterms only reflect the distribution of responsibilities and financial costs between the seller and the buyer, such as: transportation of goods, their loading and unloading from a vehicle, customs clearance, payment of taxes, duties and fees, insurance, as well as the transfer of risks of loss and damage to goods.

The ICC offers the following template for applying Incoterms rules to your contract:

“[Selected delivery term Incoterm] [name of port, place or place] Incoterm [year of publication]”

For example: “FCA Moscow Russia Incoterms 2020”

The selected Incoterms delivery condition must correspond to the product, the method of its transportation, insurance and customs clearance.

Incoterms 2000 with comments

The purpose of Incoterms is to provide a set of international rules for the interpretation of the most widely used trade terms in foreign trade. In this way, the uncertainty of different interpretations of such terms in different countries can be avoided or at least greatly reduced.

Often the parties entering into a contract are not familiar with the different trading practices in their respective countries. This can lead to misunderstandings, disagreements and litigation, resulting in a waste of time and money.

It should be emphasized that the scope of Incoterms is limited to matters relating to the rights and obligations of the parties to a sales contract in relation to the delivery of goods sold (the word “goods” here means “tangible goods”, excluding “intangible goods” such as computer software) .

Most often in practice there are two variants of misunderstanding of Incoterms. The first is to understand Incoterms as having more to do with a contract of carriage rather than a contract of sale. The second is the idea that they should cover all obligations that the parties would like to include in the contract.

As has always been emphasized by the International Chamber of Commerce, Incoterms deal only with the relationship between sellers and buyers in sales contracts, and moreover, only in certain aspects.

While it is important for exporters and importers to consider the actual relationships between the various contracts required to complete an international sales transaction - where not only a sales contract is required, but also contracts of carriage, insurance and financing - Incoterms apply to only one of these contracts , namely the purchase and sale agreement.

Nevertheless, the agreement of the parties on the use of a certain term is also important for all other contracts. Here are just a few examples: having agreed to the terms of CFR or CIF, the seller cannot fulfill this agreement by any other mode of transport other than sea, since under these conditions he must present to the buyer a bill of lading or other sea transport document, which is simply impossible when using other modes of transport . Moreover, the document required under a documentary loan will necessarily depend on the means of transportation used.

Secondly, Incoterms deal with certain specific obligations of the parties, such as the seller's duty to place the goods at the buyer's disposal or to hand them over for carriage or to deliver them to the destination, and the allocation of risk between the parties in these cases.

Further, they relate to the obligations to clear the goods for export and import, to the packaging of the goods, to the buyer's obligation to take delivery, and to the obligation to provide evidence that the relevant obligations have been properly fulfilled. Although Incoterms are extremely important for the implementation of a purchase and sale contract, a large number of issues that may arise in such a contract are not considered at all, such as transfer of title, other property rights, breaches of agreement and the consequences of such breaches, as well as exemption from liability in certain situations . It should be emphasized that Incoterms are not intended to replace the contract terms required for a complete sales contract, either through the inclusion of statutory terms or individually negotiated terms.

For foreign trade transactions, the composition of the costs of the seller and the buyer is determined by the delivery terms of Incoterms; this is, among other things:

• costs of containers and packaging in finished product warehouses;

• costs of loading, unloading, storage, transshipment of goods;

• costs of transportation, insurance and customs clearance.

Incoterms do not deal at all with the consequences of breach of contract and relief from liability due to various impediments. These issues must be resolved by the other terms of the purchase agreement and relevant laws.

Incoterms were originally always intended to be used when goods were sold for delivery across national borders: they are thus international trade terms. However, Incoterms in practice are often included in contracts for the sale of goods exclusively within domestic markets. Where Incoterms are used in this way, Art. A.2 and B.2 and any other provisions of other articles relating to export and import become redundant.

Section VI of the Civil Code of the Russian Federation provides for the possibility of using Incoterms in contracts concluded by Russian enterprises with foreign firms and institutions. Thus, in accordance with the code, in the event “if the contract uses trade terms accepted in international circulation (which, in fact, includes Incoterms ), in the absence of other indications in the contract, it is considered that the parties have agreed on the application of business customs, designated by the corresponding trade terms, to their relations” (Article 1211 of the Civil Code of the Russian Federation).

Business customs are defined in Article 5 of the Civil Code of the Russian Federation:

1 A business custom is a rule of behavior that has been established and widely used in any area of business activity, not provided for by law, regardless of whether it is recorded in any document.

2. Business customs that contradict the provisions of legislation or agreement that are mandatory for the participants in the relevant relationship are not applied.

While in Russia the use of basic terms of delivery of Incoterms is permissible, but not mandatory, in other countries, in particular in Spain, Iraq, and Ukraine, Incoterms are used without fail.

According to the Decree of the President of Ukraine “On the application of international rules for the interpretation of commercial terms” dated October 4, 1994, when Ukrainian business entities of all forms of ownership conclude agreements (contracts), the subject of which are goods, the basic delivery conditions are determined in accordance with Incoterms. Thus, Ukrainian Business entities, as well as their foreign partners, when concluding contracts, are required to comply with the rules of Incoterms. The new edition of the Incoterms rules comes into force in Ukraine 10 days after its publication in the Ukrainian language in the Uryadoviy Kur'er newspaper.

In the USA, basic delivery conditions are regulated by E

Single

Trade

Code

(ETC;

Uniform

C

ommercial

C

ode

) . The Code was first published in 1952. The Code governs sales and other commercial transactions in all 50 US states.

The ETK sets out the basic delivery conditions FOB and FAS (Article 2/319), as well as CIF (Article 2/320). The basic delivery conditions formulated in the code apply not only in the USA, but also in Canada[13].

Some basic terms adopted in the UTC differ significantly from similar terms in Incoterms. In particular, this applies to the treatment of destinations and departures under the FOB condition.

In addition, the basic terms of supply to the United States are regulated by a document called “American Foreign Trade Definitions of 1941.” (The American Foreign Trade Definition).

The basic terms of delivery to the USA, according to the UTC, contain six different interpretations of the term “FOB”.

The terms included in Incoterms are also interpreted ambiguously in the French Law of 03.01.1969 on chartering and maritime trade (Articles 30, 32, 36, 37, 39–41).

Despite the fact that in the Russian Federation Incoterms are advisory in nature, if a reference to them is made in the contract, compliance with the basic delivery conditions becomes mandatory. The main advantage of Incoterms is that the supplier and buyer do not need to specify in the contract each time a full list of their rights and obligations under the contract - a unified interpretation of the terms makes it possible to achieve such mutual understanding in which the parties to the foreign trade contract will not have disagreements regarding its terms.

Delivery terms are of great importance from the point of view of the distribution of costs between the supplier and the buyer. By indicating under what delivery conditions the selling prices for goods are calculated, the supplier implies that they already include costs associated with transportation and insurance of cargo en route, and customs clearance of goods. Consequently, the choice of basic delivery conditions includes the need to formulate a price taking into account the additional costs of the exporting supplier.

For example, if goods are intended to be exported from Russia on CIF terms to Marseille (France), the Russian supplier must, at his own expense, organize:

• delivery of goods to a Russian (or even foreign - for example, Ukrainian) port;

• concluding a contract with a carrier (vessel charter) for the transportation of goods to the port of Marseille;

• loading of goods onto the ship;

• insurance of cargo in transit.

This means that the costs of all these activities must be added to the normal selling price of the goods (i.e. the EXW price) to form the contract export price.

The destination should be understood as an exact geographical point (for example, St. Petersburg, Rostov-on-Don), and the basic terms of delivery are indicated in accordance with Incoterms as follows: “the short name of the basic rule according to Incoterms is the destination”; for example, “SRT - St. Petersburg” (Pulkovo airport).

For some terms of group “C” (CIP and CPT), as well as group “D” (DDU and DDP), it is recommended not only to indicate the final destination, but also to precisely determine the place where the cargo is transferred to the buyer: for example, “DDP - Rostov-on-Don” on-Don, st. Richard Sorge, 28.”

In addition, in order to avoid possible misunderstandings, the Incoterms option used in the contract should be indicated; For example:

• “OF - St. Petersburg (Pulkovo Airport) according to Incoterms 1990”;

• “DDU - Rostov-on-Don, Stachki Ave., 37, according to Incoterms 2000.”

Incoterms delivery bases actually determine the level of transport costs for the seller. For example, delivery of goods at a price of €200 per 1 m3 on the terms “FOB St. Petersburg” means that for €200 the goods will be delivered and handed over to the buyer after loading the goods on board the vessel at the specified port; delivery at the same price on the terms “CIF Rostov-on-Don” will mean that for the same amount the goods will be delivered to Rostov-on-Don, and will also be insured against the risks specified in the contract.

The parties, if desired, can supplement or change the terminology of Incoterms, as well as apply conditions that differ significantly from the basic ones. For example, “in contracts for the pumping of oil and gas, the terms “ex-office of metering” or “ex-seller’s warehouse” are indicated, which are not in the official version of Incoterms”[14].

If the contract makes reference to the term Incoterms, but other clauses of the contract contradict the basic Incoterm delivery conditions used, then the corresponding clauses of the contract, and not the Incoterms, apply. In this case, it is considered that the parties have established the necessary exceptions from Incoterms in order to change certain delivery bases.

To facilitate negotiations with importers, prices should be calculated in advance for several delivery conditions, including depending on various methods of transportation (if the goods can be delivered by sea, rail or road).

In table Figure 11 shows which basic delivery conditions were most often used by Russian exporters and importers at the turn of the millennium.

Table 1.1.

Frequency of references to various Incoterms terms by Russian exporters and importers in 2000–2001[15]

The rules for the transportation of imported and exported goods “have specific features in the Russian Federation. Points (places) for the delivery of imported and dispatch of exported goods must be within the control zone of customs authorities”[16].

Similar zones in the Russian Federation are:

• sea ports;

• international airports;

• railway border stations;

• temporary storage warehouses;

• customs and other warehouses included in customs control zones.

The experience of economically developed countries confirms that certain Incoterms in practice are often included in contracts for the sale of goods within domestic markets:

“Russian entrepreneurs also seek to regulate their relations related to the sale of goods within the country, referring to certain provisions of Incoterms”[17]; “there are no obstacles to the inclusion of Incoterms in domestic sales contracts”[18].

Incoterms rules, experts say, “have become increasingly used in domestic trade”[19].

Experts also note the widespread use of “the term “free”, borrowed from the Incoterms dictionary, to determine the basis of delivery in contracts between Russian legal entities”[20].

In this regard, the question of the relationship between Incoterms and Russian legislation on purchase and sale, primarily the norms of the Civil Code of the Russian Federation, becomes especially relevant.

The possibility of using Incoterms when concluding internal supply contracts follows from the following provisions of the Civil Code of the Russian Federation:

• “if the terms of the contract are not determined by the parties or by a dispositive norm, the corresponding conditions are determined by business customs applicable to the relations of the parties” (Article 421 of the Civil Code of the Russian Federation);

• “delivery of goods is carried out by the supplier by shipping them by transport provided for in the supply agreement, and on the terms specified in the agreement. In cases where the contract does not specify what type of transport or under what conditions delivery is carried out, the right to choose the type of transport or determine the conditions for delivery of goods belongs to the supplier, unless otherwise follows from the law, other legal acts, the essence of the obligation or business customs" ( Article 510 of the Civil Code of the Russian Federation).

When applying Incoterms delivery conditions, it is necessary to pay attention to the peculiarity associated with the differences in the terminology of Incoterms and Russian civil and tax legislation.

The fact is that “the Incoterms rules determine the moment of transfer of risks of loss and damage to goods, but they do not establish the moment of transfer of ownership rights”[21] (since in international practice the moment of transfer of ownership rights is usually associated with the transfer of the risk of accidental loss or damage to goods from seller to buyer).

Therefore, in order to avoid problems associated with determining the date of receipt of payments for the export of goods and, accordingly, with determining the moment of occurrence of tax obligations, when concluding a foreign trade contract, it is necessary to separately indicate the moment of transfer of ownership of the goods. It is best that this moment coincides with the time of transfer of risks loss and damage to the goods.

The use of Incoterms for domestic supplies in Ukraine is stipulated by the country’s Economic Code: “The terms of supply contracts must be set out by the parties in accordance with the requirements of the International Rules regarding the interpretation of Incoterms terms”[22].

At the same time, in Ukraine, only five basic delivery conditions are predominantly used: EXW, FCA, CPT, CIP, DDU[23].

For example, pricing authorities in Belarus recommend that the cost of goods be based on the EXW price for single-city deliveries.

Incoterms rules apply only to sales contracts; Moreover, Incoterms cannot cover all the obligations of the subjects of even a purchase and sale transaction, for example, such as transfer of ownership, breach of contract, etc. [24]

For each basic delivery condition (Incoterms term), the obligations of the parties are grouped into ten main areas in such a way that each obligation of the seller corresponds to the corresponding obligations of the buyer in the same areas. As a result, all obligations under each delivery condition are grouped as follows (Table 1 2).

In addition to the distribution of responsibilities, the Incoterms terms also determine how the costs associated with transportation, insurance and customs clearance of goods are distributed between the parties to the contract. Each term “highlights the main issues located within a single numbering; This method made it possible to mirror the obligations of the parties...”[25].

Table 1.2.

List of obligations of the seller and buyer indicated for each basic delivery condition of Incoterms

We can say that Incoterms stipulate the main obligations of counterparties. At the same time, Incoterms are completely “not concerned with the rights of these persons”[26].

The “Transport Conditions” section of the contract, as a rule, stipulates in sufficient detail the responsibilities and expenses of the parties for organizing the delivery of cargo.

Typically, transport terms include the following arrangements:

• the period for shipment of goods from the point/port of departure when choosing the basic delivery conditions of groups “E”, “F” and “C” or delivery of goods to the point/port of destination when choosing the conditions of group “D”;

• name of the point of departure for EXW and group “F” delivery bases and the name of destination when concluding a contract on the terms of groups “C” and “D”.

In developing Incoterms 2000, considerable effort has been made to achieve the greatest possible and desired consistency with respect to the various expressions used in the thirteen terms. In this way, the use of different formulations to express the same meaning was avoided. In addition, whenever possible, expressions used in the United Nations Convention on Contracts for the International Sale of Goods were used.

The term DAT has been renamed to the delivery condition DPU

The delivery basis DAT (Delivered at Terminal) has been renamed to the delivery terms DPU Incoterms 2020 (Delivered Named Place Unloaded).

This change was caused by two reasons. First, there has been confusion regarding the differences between the Incoterms 2010 DAT term (Delivery at Terminal) and the Incoterms 2010 DAP term (Deliver at Destination).

The key difference between these terms is that under the DAT rule, delivery occurs after the goods have been unloaded from the vehicle and made available to the buyer at the designated terminal.

Whereas under the DAP condition, delivery takes place before the goods are unloaded - when they are provided to the buyer on an arriving vehicle ready for unloading.

The second reason for this change was to provide greater flexibility in determining where the goods should be delivered. Now the seller and buyer can agree on any location for delivery of goods, and not just in a specific terminal. The delivery conditions of DPU Incoterms 2021 and DAT Incoterms 2010 are otherwise identical in content. The Incoterms 2021 DPU rule is the only term that instructs the seller to unload the goods.

FCA Incoterms (Free Carrier)

Under FCA Incoterms, delivery of goods occurs as follows:

- When the designated place of delivery is the seller's premises, the goods are deemed to be delivered when they are loaded into the vehicle registered by the buyer;

- When the named place of delivery is in another place, such as a warehouse or factory, etc., the goods are considered delivered when the following requirements are met: after being loaded into the seller's vehicle, they reach the named place, are ready to be unloaded from the seller's vehicle and handed over at the disposal of the carrier appointed by the buyer.[8]

Regarding the carrier, it is usually “a company that transports goods or passengers for hire itself, rather than simply organizing such transport. Examples are a delivery line, an air freight company, or a railroad. Under the terms of the FCA, however, the Carrier may be any person who is contractually “obliged to provide or acquire” such services.”[9]

In 2021, several new obligations have been added to the FCA Incoterms. For example, the parties may agree that the buyer instructs the carrier to issue a transport document (landing) with an on-board record to the seller. In the queue, the seller undertakes to send this document to the buyer “who will need the invoice to receive the unloading of the goods from the carrier.”[10]

FCA Incoterms also require the seller to clear the goods for export, where applicable. However, the seller is not required to clear the goods for import. No insurance obligations are imposed on either the seller or the buyer.

Changes to FCA terms of delivery

The delivery term FCA Incoterms 2021 (Free Carrier) is the most common Incoterms rule (about 40% of international commercial transactions take place with this trade term).

This is a very universal rule, allowing goods to be shipped to various locations (for example: address, terminal, port, airport, etc.) that are located in the buyer's country.

The FCA Incoterms 2021 delivery basis provides for two possible places of shipment by the seller of the goods:

The first option is a place owned by the seller (for example: his warehouse, factory, store). For the seller, delivery is considered complete when the goods are physically loaded onto the vehicle specified by the buyer.

However, the second option applies to the place specified in the contract, which does not belong to the seller (for example: seaport, terminal). In this situation, it is considered that the shipment was made after loading the goods onto the carrier's vehicle, paid for by the seller. It should be noted that unloading the goods from the vehicle is not the responsibility of the seller.

Problems arose with this term when the goods were delivered by sea (sea container), and if the seller and buyer agreed to use a bank letter of credit as a method of payment for the goods.

To receive payment, the seller must confirm dispatch of the goods to the buyer, i.e. After loading the goods on board the sea vessel, provide the bank with a bill of lading marked “on board” to receive payment.

But the sea carrier, as a rule, did not provide the seller with a bill of lading with such a mark. Therefore, exporters often used FOB delivery terms for container shipping, which required the seller to load the goods onto the ship and the ocean carrier to provide a bill of lading to the seller.

Under the new Incoterms 2021 rules, the FCA condition of delivery allows the parties to agree in the sales contract that the buyer must instruct its carrier to issue a bill of lading with on-board entry to the seller.

EXW Incoterms (Ex Works)

EXW Incoterm imposes only minimal obligations on the seller. In particular, the seller is simply obligated to deliver the goods to the buyer at the named delivery place, which is usually the seller's place of business, but may be any specific place, such as a warehouse, factory, etc., and within the agreed time frame specified in the contract.[ 2] The seller is not required to load the goods onto any particular means of transport or to clear the goods for export. If the place of delivery is not specified in the contract, or if several places of delivery may be provided, the seller may select the point that best suits his purpose. "[3] In general, until the goods have been delivered as specified in the sales contract, the seller bears all risks of loss or damage to the goods. Upon delivery, such risk automatically passes to the buyer. The same applies to any costs associated with the goods - until the goods are delivered, the costs are borne by the seller; after their delivery, by the buyer.

Some authors suggest that EXW Incoterm is better suited for home use. (and not international) transaction[4] and state that it is “typically used in courier delivery where the courier collects the package from the customer's premises and loads the courier's own truck. Payment terms for EXW transactions are generally prepayment and open account."[5]

As mentioned in the ICC Incoterms Manual 2010, parties sometimes insert the term "loaded" after a reference to the EXW Incoterm, that is, EXW loaded, in their sales contract. Such an addition is usually intended to extend the responsibility for loading. However, without further clarification, it is quite difficult to say whether such a term means “loaded at the seller’s risk” or “loaded at the buyer’s risk”[6] and is subject to interpretation in the event of a dispute. In this regard, if "loaded" is intended to extend liability to the seller, the parties may consider including FCA Incoterms (see below), rather than EXW, in their contract. However, they should remember that the FCA Incoterms require that the responsibility for clearing the goods for export also falls on the seller. [7]

Insurance Coverage for CIP Term

The delivery terms CIF Incoterms 2021 (Cost Insurance and Freight) and the delivery terms CIP Incoterms 2020 (Carriage and Insurance Paid to), are two Incoterms rules that oblige the seller to purchase insurance in favor of the buyer for the export of goods.

In the new edition of Incoterms 2021, for CIF delivery conditions, as previously in the Incoterms 2010 rules, minimum insurance coverage is required. The parties can agree in the contract to higher levels of coverage if they wish.

For CIP Incoterms 2021 delivery conditions, the seller is now required to insure the goods against all risks with maximum insurance coverage and an insured amount of at least 110% of the value of the goods. The parties may agree in the contract to a lower level of insurance coverage if they so desire.

This amendment is justified by the fact that the CIF Incoterms 2021 delivery condition is usually used for the maritime transport of bulk goods (raw materials, minerals, etc.). The cost per kilogram of which is very low, and requiring insurance with maximum coverage would significantly increase the final price of the product. Delivery term CIP Incoterms 2021 is a multimodal term often used for the delivery of industrial goods that may require higher levels of insurance coverage.

Each Incoterms 2021 rule contains two sections of ten clauses: A1 / B1 General obligations A2 / B2: Delivery A3 / B3: Passing of risks A4 / B4: Carriage A5 / B5: Insurance A6 / B6: Carriage and transport documents A7 / B7: Customs Export/Import Clearance A8/B8: Inspection/Packaging/Labeling A9/B9: Cost Allocation A10/B10: Notices Section “A” outlines the responsibilities of the seller and Section “B” outlines the responsibilities of the buyer.

FOB Incoterms (Free on board)

Under FOB Incoterms, goods are considered delivered by the seller to the buyer when they are delivered on board the ship nominated by the buyer at the named port of shipment or the seller purchases the goods so delivered.[22] Consequently, the risk of loss/damage to the goods passes to the buyer once the goods are placed on board the vessel. The seller must clear the goods for export, not import.

As with Incoterms FSA, the seller is not required to enter into a contract of carriage. All costs of delivery of the goods from the named port of shipment are borne by the buyer.

Insurance is not required under FOB Incoterms, which must be negotiated by the seller or buyer.

Transportation of goods using our own transport

The international rules of Incoterms 2010 were drafted on the assumption that when goods are transported from seller to buyer, they will be transported by a third-party carrier hired by the seller or buyer.

This did not take into account situations where a third-party carrier was not actually required because the seller or buyer used their own transport to deliver the goods.

The new Incoterms 2021 rules now take into account situations where you can use your own transport to deliver goods or enter into a contract of carriage.

CPT Incoterms (Carriage Paid To)

Under Incoterms, delivery of goods occurs when they are delivered by the seller to the carrier at the agreed place or purchased by the seller so delivered. In this regard, the seller is obliged to enter into a contract, at his expense, for the carriage of the goods from the point of delivery to the place of destination of the goods. The existence of a contract of carriage does not affect the transfer of risk from the seller to the buyer, which occurs at the point of delivery, that is, by handing over the goods to the carrier.[11] However, if the seller bears the costs associated with unloading the goods at the place of destination under the contract of carriage, it must bear them until others agree.

CPT Incoterms also require the seller to clear the goods for export, where applicable, and to assume all risks associated with this. However, the seller has no such import obligations. Neither the seller nor the buyer is required to enter into an insurance contract.

Cost Allocation

All costs associated with the various aspects of the sale are now listed in A9/B9 Cost Allocation clauses for each Incoterm rule, as well as the relevant Incoterm clauses to which they relate.

The purpose of this change is to provide users with a complete list of costs in one place so that the seller and buyer are better aware of the costs that each will be responsible for as defined in Incoterms 2021.

DDP Incoterms (Comes Duty Paid)

Under DDP Incoterms, goods must be delivered by the seller to the buyer when they are placed at the buyer's disposal, cleared for import, on an arriving means of transport, ready for unloading at the place of destination or at the agreed point at such place, if any.[18] The DDP Incoterm imposes maximum liability on the seller since it is the only Incoterm requiring import authorization from the seller.[19]

As with other Incoterms, DDP Incoterm requires the seller to contract for carriage or otherwise arrange for carriage at his own expense. No insurance contract, however, is required from the seller/buyer.

Customs clearance: export, transit and import

The Incoterms 2021 international rules explain more precisely which party, the seller or the buyer, is responsible for carrying out customs clearance and customs formalities at the border, bearing the costs and risks. And the release of goods that are in transit is included for the first time.

With regard to the latter, the rule used is that liability is assigned to the one who assumes the risk of transportation to the place of delivery. Therefore, if the risk of transportation is transferred in the country of origin (the seller’s country), the buyer assumes responsibility for customs clearance of transit; conversely, if the risk passes at the destination (buyer's country), the seller is liable.

DPU Incoterms (Delivered at Unloading Place)

DPU Incoterms introduces a new feature of the 2021 Incoterms, which replaced the DAT (Delivered at Terminal) Incoterms created under the 2010 Incoterms, which, in turn, replaced the DEQ Incoterms (Delivered at the Quay) created under the 2000 Incoterms.[16]

According to the Incoterms ADP, Delivery of goods by the seller to the buyer occurs when the goods are unloaded from the means of transport and placed at the disposal of the buyer at the place of destination or at the agreed point at the place of destination, if any. This is the only Incoterm "that requires the seller to unload the goods at the destination."[17] Again, the place of delivery and the place of destination are the same under the Incoterm DPU. Therefore, the seller bears the risk until he unloads the goods at the destination.

In addition, the seller undertakes to conclude a contract for transportation or arrange transportation at his own expense. He is also required to clear goods for export. However, no such obligation is imposed on imports. The buyer is obliged to assist the seller in obtaining the appropriate documentation for customs clearance, at the seller's expense.

Unlike CIP Incoterms, the seller (or buyer) has no obligations under the insurance contract under Incoterms DPU.

Incoterms 2021 - safety requirements

Transport security has become the new norm (for example: mandatory inspection of containers). Article A4/B4 ("Transportation") of each Incoterms rule now requires the seller, where applicable, to comply with any transport-related safety requirements to the point of delivery and/or to provide the buyer with any information regarding transport-related safety requirements that necessary for the buyer to organize transportation.

Article A7/B7 (“Export/Import Customs Clearance”) of each Incoterms rule, where applicable, now also explicitly requires the seller to complete any security-related formalities when clearing exports and to assist the buyer in obtaining any documents or information necessary to comply with customs formalities related to import or transit.

Transport-related security costs have also become more prominent in the separate list of expenditure obligations under Articles A9/B9 of each Incoterms rule. It should be noted that references to “security” in Incoterms 2020 are general in nature, there is no specific reference to cybersecurity or other forms of security.

Differences between the 2010 editions of Incoterms and Incoterms 2021

In the 2010 edition, a unified DAP was introduced, while 3 terms were abolished - DAF (delivered at frontier), DES (delivered ex ship) and DDU (delivered, duty unpaid), and DEQ (delivered ex quey) was replaced by DAT (Delivery to terminal). In the 2020 edition of the Rules, DAT was renamed DPU. As in Incoterms 2010, some terms apply only to sea (river) transport (FAS FOB CFR CIF).

Changes have been made to the classification of terms - all supply bases are divided into 4 groups - E, C, F, D. Their division is based on the distribution of responsibilities between the parties to a foreign trade transaction.

The term DAT has been renamed to the delivery condition DPU

Changes to FCA terms of delivery

The delivery basis DAT (Delivery at Terminal) has been renamed to DPU (Delivery at Unloading Place). The reason for this change was the confusion between the terms DAT and DAP (Delivered at Destination). The main difference between the two was that under DAT, delivery was made after the goods were unloaded from the vehicle and presented to the buyer at the terminal. According to DAP, delivery is made before the goods are unloaded - after which the products are presented to the buyer on the vehicle.

Another reason for this change was the need to provide greater flexibility in determining the location of cargo delivery. Sellers and buyers can agree on any convenient location for product delivery, not just at a specific terminal. Otherwise, the terms of the DAT 2010 and DPU 2021 are identical in content. DPU is the only term that instructs the seller to unload the goods.

Up to 40% of commercial transactions in the world are carried out under the trade term FCA (delivery terms - free carrier). This is a universal rule according to which goods can be shipped to different places located in the seller's country.

It is possible to ship the goods:

- at a location owned by the seller. Once the goods are loaded onto the buyer's vehicle, the transaction is completed;

- in a place that is specified in the contract and does not belong to the seller (for example, terminal, port). The shipment is considered completed after the goods have been loaded onto the carrier’s vehicle, paid for by the seller. Unloading the goods is not the responsibility of the seller.

Changing the level of insurance coverage for a CIP term

Transportation of goods using our own transport

Cost Allocation

Customs clearance: export, transit and import

Safety requirements

Explanatory Notes

- when the risk passes

- when the rule should be applied,

- how expenses are distributed, etc.

The new 2021 edition of the CIF delivery conditions, as well as the 2010 edition of Incoterms, provides for minimum insurance coverage (at least 110% of the cost of the goods). However, the parties may agree to lower coverage. Higher levels of insurance coverage may also be available at the discretion of the companies entering into the sales contract.

When drawing up the rules of Incoterms 2010, the assumption was made that a third-party carrier would be involved in transporting the goods. Moreover, both the seller and the buyer can hire him. However, situations in which the services of a third-party carrier were not required were not taken into account; delivery was carried out by the buyer or seller’s own transport. The new edition of the rules for 2021 provides for such situations - you can use your own transport to transport goods or enter into a transportation agreement.

Costs relating to sales and purchases are now contained in clauses A9/B9 Allocation of Costs for all rules and in the Incoterms clauses to which they relate. The purpose of this change is to provide parties entering into a supply agreement with a complete list of costs in one place. The amendments allow the buyer and seller to see all the costs for which they are responsible.

The Incoterms 2021 edition provides a clearer explanation of who, the seller or buyer, is responsible for customs clearance, the associated costs and risks. The same applies to the release of goods that are in transit. This category is included in the Rules for the first time. Regarding the latter, the rule applies according to which responsibility falls on the party transporting the goods to the place of delivery. If this risk falls on the origin (seller), responsibility for customs transit rests with the buyer. If the risk passes at destination, liability rests with the seller.

Transport safety has become the new norm of Incoterms 2021. For example, mandatory inspection of containers has been introduced. The requirements are set out in Article A4/B4 (“Transportation”) of each regulation and require the seller to strictly comply with transport safety requirements wherever applicable.

Article A7/B7 (Customs Export/Import Clearance) sets out the requirements that the seller, where applicable, must comply with any security-related formalities for export clearance. The seller is also obliged to provide assistance to the buyer in preparing documents and obtaining information that will allow him to comply with customs formalities regarding transit or import. Security costs related to transport are highlighted in items A9/B9 for each regulation.

The Incoterms 2021 Rules contain “Explanatory Notes for Users”.

They contain detailed explanatory notes regarding the various delivery conditions, in particular:

Explanatory notes are intended to help users choose the most appropriate rules and provide their interpretation in the event of a dispute.

Incoterms 2021 - Explanatory Notes

Each Incoterms 2021 rule now contains “Explanatory Notes for Users”, which provide much more extensive explanatory notes with illustrations of the relevant Incoterm delivery condition, in particular:

• When this rule should be used, • When the risk is transferred, • How the costs are allocated.

The Explanatory Notes aim to help users select the most appropriate Incoterms and provide interpretative guidance in the event of disputes.

FAS Incoterms (Free with ship)

According to FAS Incoterms, the seller delivers the goods when he either places them next to the ship/vessel nominated by the buyer at the named port of shipment or purchases the goods delivered.[20] Risk/damage to the goods passes from the seller to the buyer when the goods are next to the ship. The seller undertakes to clear the goods for export, not to import.

The seller is not obliged to enter into a contract of carriage. In line, all costs associated with transporting the goods from the named port of shipment are borne by the buyer. Therefore, FAS Incoterms are not suitable for cases where the goods need to be handed over only to the carrier, for example at a container terminal, before they are placed next to the ship . For this scenario, the above mentioned FAS Incoterm is more appropriate.[21]

Moreover, the seller is obliged to clear the goods for export (not to import). No insurance is required.

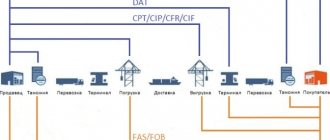

Incoterms 2021 - table of rules

Structurally, Incoterms 2021 look the same as in the previous version: eleven three-letter abbreviations ranging from “EXW” (Ex-Works) to “DDP” (Delivered Duty Paid), which are still divided into 2 categories depending on the mode of transport:

| I INCOTERMS RULES 2021 FOR ANY TYPE OR TYPES OF TRANSPORT | II INCOTERMS RULES 2021 FOR MARINE AND INLAND WATER TRANSPORT |

| EXW - "Ex Works / Ex Works" FCA - "Free Carrier / Free Carrier" CPT - "Carriage Paid to / Transportation paid to" CIP - "Carriage and Insurance Paid to / Transportation and insurance paid to" DPU - "Delivered Named Place Unloaded / Delivery at the place of unloading" DAP - "Delivered at Place / Delivery at the destination" DDP - "Delivered Duty Paid / Delivery with payment of duties" | FAS - "Free Alongside Ship" FOB - "Free on Board" CFR - "Cost and Freight" CIF - "Cost Insurance and Freight" |

In Incoterms 2021, four groups of rules for the basic terms of delivery of goods can be distinguished (E, F, C and D). This classification is based on two principles:

determining the obligations of the parties in relation to the transportation of the goods supplied and increasing the seller’s obligations from minimum to maximum.

Group “E” - EXW delivery condition, according to which the seller only makes the goods available to the buyer on his premises; Next comes group “F” - delivery terms FCA, FAS and FOB, according to which the seller is obliged to transfer the goods to the carrier specified by the buyer; then group “C” - delivery terms CFR, CIF, CPT and CIP, according to which the seller is obliged to enter into a contract of carriage, but without accepting the risk of loss or damage to the goods or additional costs due to events occurring after shipment and dispatch;

Group “D” – delivery terms DAP, DPU and DDP, under which the seller must bear all costs and risks necessary to deliver the goods to the destination.

DAP Incoterms (Delivered to Place)

This Incoterm is generally used in cases where the parties do not wish the seller to bear the risk and cost of unloading, contrary to the DPU Incoterm (see below). Under DAP Incoterms, goods are deemed to be delivered by the seller to the buyer when they are placed at the buyer's disposal on a means of transport ready for unloading at the place of destination or at the agreed point at such place, if any.[15] Unlike CPT/CIP Incoterms, place of delivery and destination are the same as per DAP Incoterms. Consequently, the Seller bears the risk until he makes the goods available to the buyer at the place of destination as described above.

Although he is obliged to enter into a contract of carriage or arrange at his own expense for the carriage of goods and clear the goods for export (not import), the seller is not obliged to unload the goods from the vehicle at the destination. In addition, neither the seller nor the buyer is required to sign an insurance contract.

Incoterms 2021 - decoding and translation of rules

Group E (Shipment)

Delivery terms EXW Incoterms 2020

“Ex Works” named place stands for, “Ex Works” the specified name of the place is translated.

The seller is obliged to: provide goods ready for shipment.

The buyer is obliged to: complete export and import customs clearance and deliver the goods.

Risks pass when the goods are transferred to the seller’s warehouse.

The main difference is that the EXW delivery basis places minimal responsibilities on the seller.

Group F (Main freight paid by buyer)

Delivery terms FCA Incoterms 2020

“Free Carrier” named place stands for “Free Carrier”, the specified name of the place is translated.

The seller is obliged to: complete export customs clearance and ship the goods to the carrier appointed by the buyer.

The buyer is obliged to: deliver the goods and perform import customs clearance. Risks pass at the moment the seller transfers the goods to the carrier.

Delivery terms FAS Incoterms 2020

It stands for “Free Alongside Ship” named port of shipment.

The seller is obliged to: complete export customs clearance and place the goods at the port of shipment along the side of the vessel specified by the buyer.

The buyer is obliged to: load the goods onto the ship and deliver them to the port of unloading, as well as carry out import customs clearance.

Risks pass at the port when the goods are placed along the side of the ship.

Delivery terms FOB Incoterms 2020

“Free On Board” stands for named port of shipment.

The seller is obliged to: complete export customs clearance, deliver the goods to the port of shipment and load them on board the vessel specified by the buyer.

The buyer is obliged to: deliver the goods to the port of unloading, as well as perform import customs clearance. Risks transfer on board the vessel from the moment of full loading.

Group C (Main freight paid by seller)

Delivery terms CFR Incoterms 2020

“Cost and Freight” stands for named port of destination.

The seller is obliged to: complete export customs clearance, load the goods on board the vessel and deliver them to the port of unloading.

The buyer is obliged to: unload and accept the goods at the port of unloading, as well as perform import customs clearance.

Risks transfer on board the vessel from the moment of full loading.

Delivery terms CIF Incoterms 2020

“Cost, Insurance and Freight” stands for named port of destination.

The seller is obliged to: complete export customs clearance, insure, load the goods on board the ship and deliver to the port of unloading.

The buyer is obliged to: unload and accept the goods at the port of unloading, as well as perform import customs clearance.

Risks transfer on board the vessel from the moment of full loading.

Delivery terms CIP Incoterms 2020

“Carriage and Insurance Paid to” stands for named place of destination.

The seller is obliged to: complete export customs clearance, insure and deliver the goods to the agreed destination.

The buyer is obliged to: unload the goods and perform import customs clearance. Risks pass at the moment the seller transfers the goods to the carrier.

Delivery terms CPT Incoterms 2020

“Carriage Paid To” stands for named place of destination.

The seller is obliged to: complete export customs clearance and deliver the goods to the agreed destination.

The buyer is obliged to: unload the goods and perform import customs clearance. Risks pass at the moment the seller transfers the goods to the carrier.

Group D (Delivery)

Delivery terms DAP Incoterms 2020

“Delivered At Point” stands for named point of destination.

The seller is obliged to: complete export customs clearance and deliver the goods to the agreed destination.

The buyer is obliged to: unload the goods and perform import customs clearance. Risks pass at destination.

Delivery terms DPU Incoterms 2020

“Delivered Named Place Unloaded” stands for named place of destination.

The seller is obliged to: complete export customs clearance, deliver the goods to the destination and unload it.

The buyer is obliged to: accept the goods and perform import customs clearance. Risks pass at destination after complete unloading.

Delivery terms DDP Incoterms 2020

“Delivered Duty Paid” stands for named place of destination.

The seller is obliged to: complete export customs clearance, deliver the goods to the agreed destination and complete import customs clearance with payment of duties.

The buyer is obliged to: unload and accept the goods. Risks pass at destination.

The main difference is that the DDP delivery basis places maximum responsibilities on the seller.

CIP Incoterms (Carriage and Insurance Paid to)

Under CIP Incoterms, the seller has the same obligations as under CPT Incoterms, that is, to hand over the goods to the contracted carrier and clear the goods for export,[12] with the addition of the obligation to enter into an insurance contract to cover the risk/damage to the goods by the buyer at the location. delivery to at least the destination.

As for insurance, this must be done in accordance with Article (A) of the Institute of Freight Articles, or similar clauses, and will cover, at a minimum, the contract price plus 10%. Until the 2021 revision of Incoterms, only minimum insurance coverage in accordance with Article (C) of the Institute of Freight Articles was required.[13] However, even today, parties can agree on lower coverage.[14] After the contract, the seller is required to provide an insurance policy or certificate to the buyer.

Relevance of using the DEQ basis

Previously, instead of the term DEQ, the delivery basis EXQ (Ex Quay) . The first mention of EXQ (Ex Quay) terms of delivery was in the 1936 Incoterms. Then in 2010, two new terms: DAT (Delivered at Terminal) and DAP (Delivered at Destination) replaced the following Incoterms 2000 terms: DAF (Delivered at Frontier), DES (Delivered Ex Ship), DEQ (Delivered Ex Quay) and DDU (Delivered Duty Free). However, the International Chamber of Commerce only recommends, but does not oblige, the use of Incoterms 2010, so supply contracts can refer to DEQ Incoterms 2000 delivery terms.

>

A. Seller's DEQ Responsibilities | B. Buyer's Obligations Under DEQ |

| A.1. DELIVERY OF GOODS IN ACCORDANCE WITH THE AGREEMENT The Seller is obliged, in accordance with the purchase agreement, to provide the buyer with the goods and a commercial invoice or equivalent electronic message, as well as any other evidence of compliance that may be required under the terms of the purchase agreement. | B.1. PAYMENT OF THE PRICE The buyer is obliged to pay the price of the goods stipulated in the purchase and sale agreement. |

| A.2. LICENSES, CERTIFICATES AND FORMALITIES The seller must, at his own expense and risk, obtain any export license or other official certificate or other documents and, if required, complete all customs formalities required for the export of the goods and for their transit through third countries. | B.2. LICENSES, CERTIFICATES AND FORMALITIES The Buyer must obtain, at his own risk and expense, an import license, other official permit or document for the importation of goods, and, if required, complete all customs formalities necessary for the importation of the goods and their subsequent transportation. |

| A.3. CONTRACTS OF CARRIAGE AND INSURANCE a) Contract of Carriage The seller must contract at his own expense for the carriage of the goods to the named pier at the named port of destination. If a special berth is not agreed or determined by the practice of this type of delivery, the seller may choose the most suitable berth at the named port of destination. b) Insurance contract - no obligations. | B.3. CONTRACTS OF CARRIAGE AND INSURANCE a) Contract of carriage - no obligations. b) Insurance contract - no obligations. |

| A.4. DELIVERY OF GOODS The seller is obliged to make the goods available to the buyer at the quay in accordance with Article A.3 a) on the agreed date or within the agreed period. | B.4. ACCEPTANCE OF DELIVERY The Buyer is obliged to accept delivery of the goods when it is made in accordance with Article A.4. |

| A.5. TRANSFER OF RISK The Seller is obliged to deliver the goods subject to the provisions of Article B.5. and bear all risks of loss or damage to the goods until they are delivered in accordance with Article A.4. | B.5. PASSION OF RISK The Buyer must bear all risks of loss or damage to the goods from the time of delivery in accordance with Article A.4. The buyer is obliged - if he fails to fulfill his obligation, to give notice in accordance with Article B.7. – bear all risks of loss or damage to the goods from the expiration of the agreed date or agreed delivery period. The condition, however, is that the goods comply properly with the contract. This means that the goods must be properly identified, that is, clearly separated or otherwise identified as the goods that are the subject of the contract. |

| A.6. ALLOCATION OF COSTS The seller is obliged, subject to the provisions of Article B.6: – in addition to the costs arising from Article A.3 a), to bear all costs associated with the goods until the goods are delivered to the quay in accordance with Article A.4, and – if required, pay all costs associated with the completion of customs formalities, as well as other duties, taxes and other charges payable upon export of goods and their transit through third countries prior to delivery in accordance with Article A.4. | B.6. ALLOCATION OF COSTS The Buyer is obliged to: – bear all costs associated with the goods from the moment of their delivery in accordance with Article A.4., including all costs associated with the handling of the goods at the port until their subsequent transportation or placement in a warehouse or terminal, and – bear all additional costs arising from his failure to fulfill his obligation to accept the goods after the latter has been placed at his disposal in accordance with Article B.7. The condition, however, is that the goods comply properly with the contract. This means that the goods must be properly identified, that is, clearly separated or otherwise identified as the goods that are the subject of this contract, and - pay, if required, all duties, taxes and other fees, as well as the costs of completing customs formalities , payable upon import of goods and for their subsequent transportation. |

| A.7. NOTICE TO BUYER The seller must give the buyer sufficient notice of the expected date of arrival of the said vessel in accordance with Article A.4, and also give the buyer such other notices as are required for him to take such steps as are normally necessary to take delivery of the goods. | B.7. NOTICE TO THE BUYER The Buyer is obliged, in the event that he has the right to determine the time within the agreed period and/or the point of acceptance of delivery at the named port of destination, to duly notify the seller about this. |

| A.8. PROOF OF DELIVERY, TRANSPORT DOCUMENTS OR EQUIVALENT ELECTRONIC COMMUNICATIONS The seller must provide the buyer at its expense with a transport document (for example, a negotiable bill of lading, non-negotiable sea waybill, proof of inland waterway transport or multimodal transport bill) to enable the buyer to take delivery of the goods and remove him from the pier. In the event that the seller and buyer have agreed to use electronic communications, the documents mentioned above may be replaced by equivalent electronic messages (EDI). | B.8. PROOF OF DELIVERY, TRANSPORT DOCUMENTS OR EQUIVALENT ELECTRONIC MESSAGES The Buyer must accept the transport document and/or other documents provided for in paragraph A.8 as evidence of delivery of the goods. |

| A.9. INSPECTION - PACKAGING - LABELING The seller must bear the costs associated with the inspection of the goods (e.g. quality, size, weight, quantity) necessary to deliver the goods in accordance with Article A.4. The seller is obliged to provide, at his own expense, the packaging (except in cases where it is customary in the trade to deliver the contracted goods without packaging) necessary for delivery of the goods. The packaging must be properly labeled. | B.9. INSPECTION OF GOODS The Buyer must bear all costs associated with inspection of the goods before shipment, unless such inspection is carried out by order of the authorities of the country of export. |

| A.10. OTHER OBLIGATIONS The Seller is obliged, at the request of the Buyer, to provide the latter, at his expense and risk, with full assistance in obtaining any documents or equivalent electronic messages (other than those mentioned in Article A.8.) issued or used in the country of dispatch and/or in the country origin of the goods, which the buyer may require to import the goods. The seller is obliged to provide the buyer with all the information necessary to carry out insurance. | B.10. OTHER OBLIGATIONS The Buyer must pay all costs and fees associated with receiving the documents or equivalent notices specified in paragraph A.10 by electronic communication, as well as reimburse the seller for any expenses incurred in providing the assistance provided for in paragraph A.10. If necessary, the buyer is obliged to provide, in accordance with paragraph A.3a), to the seller, at his request, but at the risk and expense of the buyer, a currency permit, other permits, other documents or their certified copies, and also inform him of the final destination of the goods in the country of import for the purpose of receipt of a through transport document or other document in accordance with paragraph A.8. |

Responsibilities under the basic terms of delivery DEQ (DEC)

DEQ delivery terms

impose on the seller the obligation to bear all costs associated with transporting the goods to the specified port of destination and unloading them at the port.

DEQ delivery terms

impose on the buyer the implementation of customs formalities necessary for the import of goods, as well as payment of all formalities, fees, taxes and other expenses levied upon import of goods. This is a fundamental change compared to previous editions of Incoterms, according to which the customs formalities necessary for the import of goods were the responsibility of the seller. If the parties intend to include in the seller's obligations full or partial payment of the costs charged for the importation of goods, then this must be clearly expressed by adding a corresponding clause to the purchase and sale agreement.

DEQ term

can only be used when transporting goods by sea, inland waterway transport or in multimodal transport, if it is unloaded onto the berth (pier) at the port of destination from a vessel. If the parties intend to hold the seller responsible for the costs of moving the goods from the quay to another location (warehouse, terminal, station, etc.) in/or outside the port, the terms DDU or DDP should be used.

What does DES delivery mean, how does it stand for?

Delivery conditions DEQ Incoterms 2000 - decoding “Delivered Ex Quay” named port of destination means that the seller is considered to have fulfilled his obligations when the goods released under the customs regime of export are made available to the buyer at the pier (wharf) at the agreed port of destination and not cleared of customs duties required for the importation of the goods.

CIF Incoterms (Cost, Insurance and Freight)

The Incoterms CIF mode is very similar to the Incoterms CFR mode:

- the goods must be delivered in accordance with CIF Incoterms when the seller places them on board the ship or purchases them delivered;[24]

- although the transfer of risk occurs at the port of delivery, the seller is obliged to enter into a contract for the carriage of goods to the port of destination;

- the seller must bear all costs associated with unloading at the port of destination arising from the contract of carriage, unless otherwise agreed;

- The seller is obliged to clear the goods for export, not to import.

The fundamental difference between CIF and CFR is that under CIF Incoterms, the seller must take out insurance cover against the risk of loss/damage to the goods by the buyer from the port of shipment to at least the port of destination. However, notwithstanding CIP Incoterms (see above), the seller is required to obtain minimum insurance in accordance with Article (C) of the Institute of Freight Clauses, or another clause (not Article (A) of the Institute of Cargo Clauses as required for CIP Incoterms).[25]