A customs receipt order (CRO) is a document that is issued in cases of payment of customs duties and payments that are not inherently customs, but their administration is also carried out by customs authorities. In this article we will tell you about the customs receipt order and consider the procedure for filling it out.

The form of the document was approved by Decision of the Customs Union Commission dated June 18, 2010 No. 288. In 2021, the form of the form was slightly changed, the new form is valid from July 1, 2016. Moreover, old TPO forms can be used until they are completely used up. Instructions for the use of TPO were approved by Order of the Federal Customs Service of Russia dated February 25, 2013 No. 350.

Type and composition of the TPO form

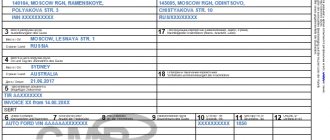

An incoming customs order is a strict reporting form. The TPO consists of the main form (directly the TPO) and additional sheets to the customs receipt order (CRW). The TPO form consists of three sheets bound together. In this case, self-copying paper is used, on which a serial number is printed. The number is called the “typographic number”. The TPO is filled out accordingly, in triplicate.

The DTPO form also consists of three bound sheets (copies) of self-copying paper, also drawn up in triplicate, and is an integral part of the DTPO.

General information ↑

Registration of a customs receipt order is the responsibility of many companies. And therefore it is important to understand what it is.

Basic Concepts

A customs receipt order is a customs document that is required when paying the following amounts:

- fee for the provision by the customs structure of a license and qualification certificates for registration at customs, renewal of such a license and certificate;

- fees for customs clearance, storage of goods and product support;

- fees for providing information and consulting services;

- for participation in a customs auction;

- payment, what is charged at a flat rate, etc.

In the case when the clearance of goods at customs is carried out according to cargo declarations, the customs order is not used when calculating and collecting customs duties.

TPO is produced on self-copying paper. Presented on 3 bound sheets.

What is it needed for?

The customs receipt order contains calculations of the amount of security and confirms the fact that payment has been made. This is a bank guarantee, collateral agreement or surety.

TPO is used when reflecting calculations and payments, as well as when automating accounting:

| Customs payment | What is charged when an individual moves goods for personal use across the border of the Customs Union |

| Other amount payable at customs | The administration of which is carried out by the customs authority |

The state that uses these documents can provide the necessary accounting of such payments that are listed using TPO and additional sheets.

Forms do not need to be filled out when calculating and reflecting the payment of customs duties on goods when cargo customs declarations are used.

Legal regulation

You should refer to the following documents:

| Order of the State Customs Committee dated October 29, 2003 No. 596-r | As amended July 25, 2008 |

| Order of the Federal Customs Service of Russia dated February 25, 2013 No. 350 | Instructions on the use of customs receipt orders |

| Decision of the CU Commission dated June 18, 2010 No. 288 | The form of the order and the rules for its completion and use (changes made by the Decision of the Board of the Eurasian Commission dated August 23, 2012 No. 135) |

| Federal Law dated June 2, 2010 No. 114 | — |

| Federal Law dated November 27, 2010 No. 311 | — |

The following normative act is no longer valid:

| Order of the State Customs Committee of the Russian Federation dated December 19, 1994 No. 670 | — |

| Order of the State Customs Committee dated October 30, 2001 No. 1029 | subclause 6.7 |

| Order of the State Customs Committee dated May 14, 1997 No. 265 | And some others |

Order filling procedure

- On the TPO form, data on goods transported through customs of only one name is filled out. It is also allowed to indicate on the TPO form up to four different payments (payments with different types of payment) that are not related to crossing the customs border.

- All other data is reflected in the DTPO. One DTPO may indicate payments for three items of goods or up to 12 payments not related to the movement of goods (up to 4 items in each section of the DTPO).

- One TPO can be accompanied by up to one hundred DTPO.

How to delegate signing authority

Since the manager and chief accountant are very often busy, in any enterprise with more than three employees, management tries to transfer this concern to the cashier. And it is much more convenient for him to perform this task on his own. After all, the cashier is always on site and personally monitors the receipt and transfer of funds.

There are two ways to delegate responsibilities. The first is to draw up a full power of attorney, if we are talking about an accountant who is abdicating his duties. But this is not the easiest and fastest way. It is much easier to publish an order, which also has legal force, indicating the transfer of powers. But only a leader can do this. Often it is the order form that is used in various companies.

If you have any difficulties with the execution of a power of attorney and any other operations related to accounting and the movement of funds, you can always use the help of the SEA BANK. Any volumes and directions of transfers, support of operations and standard efficiency in completing tasks are only a small part of the main qualities of a financial organization.

In the article, we looked at the requirements for issuing a cash receipt order and figured out why it is needed in principle. As the review showed, PQR is of particular importance. At a minimum, because it records any movements of funds within the enterprise. And together with RKO, these two papers can easily be called the most frequently used in the activities of a business entity. Therefore, you should get to know him with special attention.

RKO

Procedure for storing the TPO form

Since the TPO is a strict reporting form (SRF), the general rules associated with working with strict reporting forms apply to it. This applies to the production of forms, working with them and storing them.

The first TPO and DTPO forms are stored together with the customs declaration and other customs documents, depending on what operations were paid for.

In accordance with the internal rules for working with BSO in a department, the second copies of the TPO and DTPO can either be stored with the first copies or transferred to the accounting service. The third copies of the TPO and DTPO are handed over to the persons who made the payment.

Instructions for filling out a receipt order

It is impossible to say that this type of document may cause any difficulties when filling out, since it has a completely simple and understandable form. The standard receipt order form can be divided into several parts, which contain three tables.

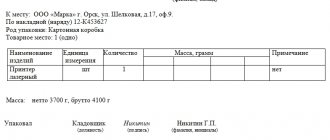

Filling out the “header” and first table of form M-4

The first table is the “header” of the document. First, it indicates the order number for the company’s internal document flow. Then enter the name of the organization receiving the goods, indicating its legal form (IP, LLC, OJSC, CJSC), the OKPO code (All-Russian Classifier of Enterprises named after Organizations - the code is contained in the constituent papers of the company), as well as (if necessary) the structural unit , which issues the order.

Next, the table includes the date the document was compiled, the transaction type code (if such coding is used), the supplier’s warehouse number, its full name, code (if any) and the insurer (if the inventory items are insured). Then the accounting account numbers, analytical accounting code (if such a system is used), and the numbers of the accompanying and payment documents are indicated here.

Filling out the second table of form M-4

The second table of the receipt order relates directly to incoming products . First, the name of the product and its item number are indicated, then the unit of measurement: its code - in accordance with the Unified Classifier of Units of Measurement, and the name (pieces, kilograms, cubes, meters, etc.). Next, information is entered on the number of accepted inventory items (according to documents and actually) - they must match.

After this comes information about the cost: in the seventh column the price per piece is entered, then the total cost excluding VAT, then the allocated VAT, and then the total price including VAT. The passport number is indicated if inventory items have this accompanying document (for example, jewelry). Lastly, the card number according to the warehouse card index is entered into the table.

The remaining unfilled lines must be crossed out (in the form of the letter Z or crosswise).

Filling out the reverse side of the M-4 form

The reverse side of the document summarizes the receipt : the total quantity of goods received, its total cost excluding VAT, the amount of VAT and the cost including VAT. There is no need to decipher the amounts in writing.

Finally, the receipt order must be signed by the direct recipient of the goods (in this case, the storekeeper) and the supplier’s representative (in this case, the forwarder) with a mandatory decoding. There is no need to certify the order with a seal, because from 2021, legal entities may not have their documents stamped.

Requirements for filling out TPO and DTPO

TPO and DTPO are filled out electronically using the Unified Automated Information System (hereinafter referred to as UAIS) of the customs authorities, and then printed out. The responsible employee certifies them with a numbered stamp and signature. If there is no numbered stamp, only a signature indicating the surname and initials.

In places and in cases where electronic filling is not possible, handwritten filling of documents is allowed with the obligatory subsequent creation of an electronic copy in the UAIS. If any information in the TPO and DTPO is not filled in, a dash is placed in such a column.

Cases when the form is filled out

The aspect that often raises doubts is that entrepreneurs consider it unnecessary to manage cash flow documents if the enterprise operates without cash register equipment. This is quite acceptable for some types of individual entrepreneurs. But the absence of a cash register will not save the entrepreneur from accounting for incoming funds and studying the concept of a cash receipt order. And it makes no difference whether the equipment itself is used, whether a receipt is printed, and so on. If the fact of cash transfer took place, then it must be recorded accordingly.

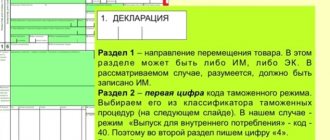

Filling out column 8 “Payments”

This column must be filled out in stages.

- All available columns of the document are filled in sequentially. If data on payments of several types is filled in, then at the end of the “Calculated Amount” column “Total” is entered and the total amount of payments in the currency of the Russian Federation is indicated.

When filling out the data on payments of customs duties for customs operations, in the column “Base of accrual” the total customs value of all goods from all sub-columns 7.1 of the Customs Customs and Customs Customs is indicated.

When filling out the TPO in case of payment of interest and penalties, in the column “Accrual Basis” the amount that is the basis for calculating interest or penalties is indicated. In the “Rate” column, in this case, the size of the refinancing rate of the Central Bank of the Russian Federation is indicated.

- Next, fill in the “Payment Details” column of Column 8.

This field contains information about the currency in which the payment is made, details of payment documents, and method of payment.

How to fill out the PKO form

cash receipt order is the first stage of the task, and the next step will be to correctly fill out this document. A completed PQS sample may look like this:

A cash receipt order can be issued on paper or using technical means - data is entered on a computer, then the PKO is printed and signed. In addition, the receipt can be issued in electronic form, provided that it is protected from unauthorized access, distortion and loss of information. In this case, the PKO is signed with an electronic signature (clause 4.7 of instruction No. 3210-U).

You can print out the completed sample cash receipt order and place it on the cashier’s desk along with instructions for filling it out, which we will provide below.

Features of filling out TPO in individual cases

In case of making a payment through a banking organization

The TPO is filled out by an authorized customs officer. In this case, a PTO receipt is printed. A sample receipt is given in Appendix No. 1 to the Instructions for filling out the TPO. The receipt is handed over to the payer.

The payer makes the payment through a banking organization. After receipt of payment, the TPO and DTPO are generated and printed. Payment is possible through payment terminals. If technically possible, during such an operation the barcode is read from the receipt and payment is made.

In case of payment to the cash desk of the customs authority

In this case, a payment receipt is also generated, which the payer presents to the cashier, pays, and receives a cash order receipt. Based on the cash order receipt, the TPO and DTPO are completed and printed.

Payment to an authorized customs officer

In this case, payment is made directly to the authorized financially responsible person. The procedure for registering TPO and DTPO is similar to those discussed above. At the end of the day, the authorized person hands over to the cashier the cash received from payers with a register in the form of Appendix 2 to the Instructions for filling out the TPO.

Cash receipt order form-2021: download for free

The cash receipt order has a unified form KO-1 (OKUD 0310001). It is mandatory for all companies. We have a free cash receipt order 2021 in different formats. Choose one that is convenient for you. You can PKO in excel. Enter the company information in the header of the document, and then simply enter the payment information.

PKO in Excel

Download form

Get the form for free!

Register in the online document printing service MoySklad, where you can: completely free of charge:

- Download the form you are interested in in Excel or Word format

- Fill out and print the document online (this is very convenient)

Below is a completed cash receipt order - look at the sample and check yourself.

The document is drawn up in one copy. The form consists of two parts: the order itself and the receipt for the PKO, which must be torn off and given to the person who deposited the money into the cash register.

A cash receipt order is filled out when money arrives at the cash register as:

- capitalization of proceeds,

- return of accountable funds,

- receiving money from a bank account,

- return of borrowed cash,

- receipt of funds into the authorized capital.

Correction of data in TPO and DTPO

As in any primary document, there should be no erasures or erasures in the TPO and DTPO. If it is necessary to make corrections that do not affect the amount of payments, then the corrections are made in the usual way. Incorrect information is carefully crossed out and correct information is entered.

The correction is accompanied by the signature “Corrected to believe”, an imprint of the personal numbered seal (if available) and the signature of an authorized official. The same corrections are made to the electronic version of the document. In all other cases, the document is canceled and a new one is issued. The TPO form is given below.

Basic rules for filling out form M-4

Since 2013, this form has not been strictly mandatory for use, however, it is still widely used in enterprises and organizations.

The receipt order has two sides and contains all the necessary information regarding the supplier, consumer and the product itself: its name, grade, size, quantity, cost, etc. (it should be noted that some cells can be left empty). If the inventory contains precious metals or stones, then this document must indicate information from the accompanying technical passport.

When filling out an order, you should avoid mistakes and omissions, and if there are any inaccuracies, it is better to fill out a new form.

According to the rules, the form can be filled out either by hand or on a computer, but in any case, the document must necessarily contain “live” signatures of the supplier’s representative and the consumer.

After registration, the number of the receipt order must be registered in the materials accounting card and transferred for storage to the accounting department of the enterprise, where it, like other primary documents, must be stored for at least five years.

The document is issued exactly on the day the goods are received and reflects the actual receipt. A receipt order is drawn up in one copy, and if there are several deliveries from the same supplier within one day, they can all be entered into one document.