A payment order is a document with which the owner of a current account instructs the bank to transfer funds to another specified account. In this way, you can pay for goods or services, pay an advance, repay a loan, make government payments and contributions, that is, in fact, ensure any movement of finances permitted by law.

Payment orders must be drawn up in accordance with the procedure established by the Ministry of Finance, since they are processed automatically. It does not matter whether the payment is submitted to the bank in paper form or sent via the Internet.

A complex form developed by the Central Bank of the Russian Federation and approved by federal legislation must be filled out correctly, since the cost of an error may be too high, especially if it is an order for tax payments.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

To avoid problems associated with incorrectly filling out the fields of a payment order, we will understand the features of each cell.

Filling out a payment order in 2021-2022

When filling out a payment order, you should be guided by:

- regulation No. 762-P;

- Order of the Ministry of Finance of Russia “On approval of the Rules for indicating information in the details of orders for the transfer of funds for payment of payments to the budgetary system of the Russian Federation” dated November 12, 2013 No. 107n - when drawing up payments for taxes, fees and contributions.

Note! Since 2021, there have been changes in the details of tax payments.

Read more about the innovations in ConsultantPlus. If you do not have access to the system, get a trial demo access. It's free.

Let's present a short step-by-step instruction. In this case, we will focus on filling out the details of a paper order, although at present few people make payments simply on a form. As a rule, special accounting programs are used for this, and for electronic payments, software of the “Bank-Client” type is used.

Step 1. Indicate the number and date of the payment.

Payment orders are numbered in chronological order. The number must be non-zero and contain no more than 6 characters. The date in a paper document is given in the format DD.MM.YYYY. In an electronic order, the date is filled in in the format established by the bank.

Step 2. Specify the type of payment.

It can have the meaning “Urgent”, “Telegraph”, “Mail”. A different value or its absence is possible if such a filling procedure is established by the bank. In an electronic payment, the value is indicated in the form of a code established by the bank.

Step 3. Payer status.

It is indicated in field 101, but only for payments to the budget. The list of status codes is given in Appendix 5 to the order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n. The typical payer may find the following useful:

- 01 - taxpayer (payer of fees) - legal entity;

- 02 - tax agent;

- 06 - participant in foreign economic activity - legal entity;

- 08 - payer - a legal entity (individual entrepreneur) transferring funds for payment of insurance premiums and other payments to the budget system of the Russian Federation;

As of October 1, 2021, the following codes have been abolished: 09 - individual entrepreneur paying taxes, fees, insurance premiums and other payments administered by the tax authorities; 10 - a notary engaged in private practice, paying taxes, fees, insurance premiums and other payments administered by the tax authorities; 11 - a lawyer who has established a law office that pays taxes, fees, insurance premiums and other payments administered by the tax authorities; 12 - head of the peasant farm, paying taxes, fees, insurance premiums and other payments administered by the tax authorities. These individuals must now indicate a single code 13, which was previously used by ordinary “physicists”.

- 13 - taxpayer (payer of fees) - another individual (bank client (account holder));

- 14 - taxpayer making payments to individuals;

- 16 - participant in foreign economic activity - an individual;

- 17 - participant in foreign economic activity - individual entrepreneur;

- 18 - a payer of customs duties who is not a declarant, who is obligated by the legislation of the Russian Federation to pay customs duties;

- 19 - organizations and their branches (hereinafter referred to as organizations) that have drawn up an order for the transfer of funds withheld from the wages (income) of a debtor - an individual to repay arrears in payments to the budget system of the Russian Federation on the basis of an executive document sent to the organization in in the prescribed manner;

- 21 - responsible participant in the consolidated group of taxpayers;

- 22 - participant of a consolidated group of taxpayers;

- 24 - payer - an individual who transfers funds to pay insurance premiums and other payments to the budget system of the Russian Federation;

- 25 - guarantor banks that have drawn up an order for the transfer of funds to the budget system of the Russian Federation upon the return of the amount of value added tax excessively received by the taxpayer (credited to him), in a declarative manner, as well as upon payment of excise taxes calculated on transactions of sale of excisable goods for limits of the territory of the Russian Federation, and excise taxes on alcohol and (or) excisable alcohol-containing products;

- 26 - founders (participants) of the debtor, owners of the property of the debtor - a unitary enterprise or third parties who have drawn up an order for the transfer of funds to repay claims against the debtor for the payment of mandatory payments included in the register of creditors' claims, during the procedures applied in a bankruptcy case;

- 27 - credit organizations or their branches that have drawn up an order for the transfer of funds transferred from the budget system of the Russian Federation, not credited to the recipient and subject to return to the budget system of the Russian Federation;

- 28 - participant in foreign economic activity - recipient of international mail.

Read more about payer status in this material.

Step 4. Specify the payment amount.

The amount of the paid amount in the payment order is given in numbers and words.

The amount in words is indicated from the beginning of the line with a capital letter - in rubles and kopecks (kopecks are written in numbers). In this case, the words “ruble” and “kopeck” are written in full, without abbreviation. If the amount is in whole rubles, then kopecks may not be indicated.

In the amount of numbers, rubles are separated from kopecks by a “–” sign. If the payment is without kopecks, put an “=” sign after the rubles.

For example:

- the amount in words “Twelve thousand three hundred forty-five rubles fifty kopecks”, in numbers “12 345–50”;

- or the amount in words “Ten thousand rubles”, in numbers “10,000=”.

In the electronic order, the payment amount is indicated in numbers in the format established by the bank.

Step 5. Fill in the payer's details.

This:

- TIN and checkpoint;

- name or full name, if you are an individual entrepreneur or other self-employed person;

- bank details: account number, name of the bank, its BIC and correspondent account.

As a rule, the details are already entered into the program, so you don’t have to fill them out. At the same time, if you, for example, have several current accounts, make sure to indicate the one from which you were going to transfer money.

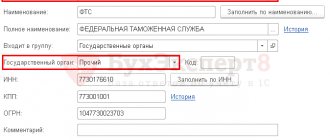

Step 6. Fill in the recipient's details.

They are the same as those of the payer:

- TIN and checkpoint;

- Name;

- account details.

If a payment order for the payment of taxes is filled out, then the corresponding UFK is indicated as the recipient, and next to it in brackets is the name of the revenue administrator (inspectorate or fund). Payment details can be obtained from the Federal Tax Service or the fund.

Note! From 05/01/2021, be sure to indicate on your payment slips when paying taxes, contributions and other payments administered by the Federal Tax Service:

- in field 15 - the UFC account starting with 40102 (previously this field was not filled in);

- in field 17 - a new treasury account, starting with 03100 (previously, this detail contained the account number of the UFC (starting with 40101).

If the payment is not tax, the payment details are taken, for example, from the contract or invoice for payment.

Step 7. We provide additional codes and ciphers.

This is the table below the payee's bank details. It always indicates:

- Type of operation. The payment order is assigned code 01.

- Code purpose of payment (“Name of pl.”)

From 06/01/2020, the code for the type of income is entered here when making payments to employees. Find out what value to enter in this field in ConsultantPlus. To do everything correctly, get trial access to the system and go to the Review material. It's free.

- Sequence of payment. Payments to counterparties and for self-payment of taxes, fees, and contributions have the 5th priority.

- Code. For current tax and non-tax payments, you need to enter 0. If the payment is made according to a document that has a UIP (unique payment identifier), a 20-digit UIP code is entered.

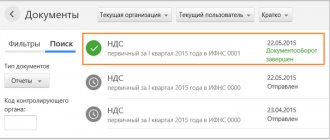

Step 8. Specify payment information.

If the payment is not tax, everything is simple. In field 24 you must indicate the basis on which the payment is made. This may be the number of the contract, account, etc. Information about VAT (rate, tax amount) is also provided here or a note is made: “VAT is not subject to.”

See also the article “Indicate the purpose of payment correctly in the payment order.”

In tax payments, you additionally need to fill out a number of cells above field 24.

First of all, the BCC is reflected in accordance with the order of the Ministry of Finance on the approval of codes for the corresponding year.

Read about the currently used BCCs in this article.

Next comes the OKTMO code in accordance with the All-Russian Classifier of Municipal Territories (approved by order of Rosstandart dated June 14, 2013 No. 159-ST). It must match the OKTMO in the declaration for the relevant tax.

The next cell indicates the two-digit code of the payment basis. The main codes are as follows:

- TP - payments of the current year;

- ZD - repayment of debt for expired tax, settlement (reporting) periods, including voluntary.

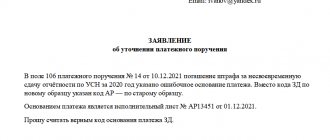

From 10/01/2021, the following codes are no longer used in field 106: TR - repayment of debt at the request of the tax authority to pay taxes (fees, insurance contributions); PR - repayment of debt suspended for collection; AP - debt repayment according to the inspection report; AR - repayment of debt under a writ of execution. Instead, you need to enter a single PO code.

The next field is the tax period. The format XX.XX.XXXX indicates either the frequency of payment of the tax payment or the specific date of its payment. The frequency can be monthly (MS), quarterly (QU), semi-annually (SL) or annual (YA).

Samples of filling out the tax period indicator:

MS.02.2021; KV.01.2021; PL.02.2021; GD.00.2021; 02/04/2021.

This is followed by cells for the number (108) and date of the document (109), which is the basis for the payment. For current tax payments, enter 0 in the number, and indicate the date of signing the declaration (calculation) as the date.

From 10/01/2021, field 108 can be used to distinguish voluntary repayment of debt from forced repayment. In the second case, the TR, PR, AP and AR codes previously used in field 106 must be indicated in field 108 before the base document number:

- “TR0000000000000” - number of the Federal Tax Service’s request for payment of taxes, fees, and insurance contributions;

- “PR0000000000000” - number of the decision to suspend collection;

- “AP0000000000000” - number of the decision to prosecute for a tax offense or to refuse to prosecute;

- “AR0000000000000” - number of the executive document or enforcement proceedings.

In field 109 the date of the corresponding document is reflected:

- requirements of the tax authority for the payment of taxes (fees, insurance contributions);

- decisions to suspend collection;

- decisions to bring to justice for committing a tax offense or to refuse to bring to justice for committing a tax offence;

- executive document and enforcement proceedings initiated on its basis.

Field 110 “Payment type” is not filled in.

Read about the nuances of filling out each field of a payment order here.

Step 9. Sign the payment order.

The paper payment must be signed by the person whose signature is on the bank card. The electronic order is signed by the person who owns the signature key. If there is a seal, it is affixed to a paper copy.

See also “Basic details of a payment order”.

If you have access to ConsultantPlus, check whether you have filled out payments for taxes and contributions correctly. If you don't have access, get a free trial of online legal access.

What document numbers are indicated when making customs payments?

In the case of customs transfers, field 108 can take numeric values when the following payment grounds are indicated in field 106:

- DE or CT. The last 7 digits of the customs declaration are written down.

- BY. The existing customs receipt order number is indicated.

- ID. The number of the executive document serving as the basis for payment is indicated.

- THAT. Applies if customs duties are paid upon request.

- IN. The number of the collection document is indicated.

- DB. Number of the document created by the accounting department of the customs authorities.

- KP. The number of the current agreement between large taxpayers when paying centralized payments is indicated.

Filling field 108 with numbers indicating the numbers of documents on the basis of which the payment is made is possible only if there are certain statuses in field 101 of the payment.

Read about payer statuses in the payment order in this material .

NOTE! The number sign (No.) is not indicated in field 108.

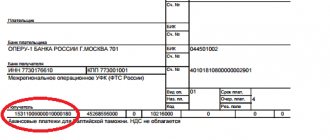

Example of filling out a payment order in 2021-2022: sample

Let's show a sample of filling out a payment order using a conditional example.

Let's say the organization ICS LLC needs to pay personal income tax for January 2021 in the amount of 22,340 rubles.

About the deadlines established for paying personal income tax on wages, read the material “When to transfer income tax from wages?” .

The specific features of the order will be:

- payer status - code 02, since the payer organization is a tax agent;

- KBK for personal income tax - 18210102010011000110;

- the basis of the payment is the TP code, since this is a payment of the current period;

- The frequency of payment is MS.01.2021, since this is a payment for January 2021.

Our articles will help you fill out payment orders correctly in various situations:

- “Payment order for payment of state duty - sample 2021”;

- “Payment order to bailiffs - sample 2021”;

- “Payment order for trade fee - sample”;

- “Payment order for penalties in 2021 - 2021 - sample.”

New payment form and filling rules

From September 10, 2021, with the exception of certain rules, Bank of Russia Regulation No. 762-P dated June 29, 2021 “On the rules for transferring funds” (hereinafter referred to as Regulation No. 762-P) came into force. It replaced the previous similar regulation, enshrined in the Central Bank Regulation No. 383-P dated June 19, 2012.

This document does not provide for fundamental changes in the design of settlements with the budget system.

Also see “ Rules for transfer of funds from 09/10/2021: new regulations of the Central Bank ”.

Appendix 2 to Regulation No. 762-P established the form of the payment order (0401060). She remained the same.

Here is a sample payment order from October 1, 2021:

Results

The fields of the payment order can be filled in partially or completely depending on the type of payment (regular or tax).

Field 22 “Code” can take the value 0 or be filled in if the payment identifier is known. For tax payments, fields 104–109 are additionally filled in in the payment order. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Which fields will be filled out in a new way as of 10/01/2021?

On the payment form above we have marked them in yellow. These are the following details:

- 101 – payer status;

- 106 – basis for payment;

- 108 - document number - basis for payment;

- 109 – document date.

Next, we will look at the new rules for filling out each of these fields of the payment order from October 1, 2021.

Changes from 10/01/2021 to the Rules for indicating information in the details of orders for the transfer of funds when transferring payments to the budget system of the Russian Federation (Order of the Ministry of Finance dated 11/12/2013 No. 107n) were approved by Order of the Ministry of Finance dated 09/14/2020 No. 199n.

For fields 106 and 108, which identify the payment, the order in which information is indicated in them has been changed. And when filling out field 101, a number of statuses identifying the payer are abolished.