When making customs payments to the account of the treasury of the Russian state, there is a special classification code that is valid for Russian residents trading with foreign countries.

This scheme requires strict order when filling out payment details. The procedure for filling out and processing payment documents is set out in the regulations of the Central Bank of the Russian Federation and in the order of the Ministry of Finance of the Russian Federation. You can draw up a document one payment at a time indicating KBK 15311009000010000180. This budget classification code is deciphered as follows:

- Advance payment against future customs or other payments.

How does KBK stand for?

KBK - budget classification codes

The organizations' BCCs, which are necessary for the payment to go where it was intended, change almost every year. And the responsibility for their correct indication lies with the payer!

Let's try to figure out what these mysterious codes are, why they are needed, how they are formed and why they change regularly. We will also tell you what to do if you find an error in the specified code, and what you risk in this case, and most importantly, how to prevent this risk and not end up with accrued fines and penalties for paying taxes and fees on time.

Current list of KBK for 2021

KBK for paying insurance premiums for individual entrepreneurs for themselves

KBK for paying insurance premiums for employees

BCC for payment of simplified tax system

KBK for payment of UTII

BCC for payment of unified agricultural tax

KBK for VAT payment

KBK for personal income tax payment

KBK for payment of income tax

BCC for patent payment for individual entrepreneurs

KBK for payment of trade tax

KBK for payment of transport tax

KBK for payment of property tax

KBK for payment of land tax

KBK for payment of water tax

KBK for payment of mineral extraction tax

KBK for payment of state duty

KBC for payment of fees

KBK for payment of excise taxes

KBC for payment of monetary penalties (fines)

KBK for payment of other payments

Budget classification - what is it and why?

In July 1998, the Budget Code of the Russian Federation in Federal Law No. 145 first introduced the term “KBK”, used as a means of grouping the budget.

There are 4 types of KBK:

- relating to government revenues;

- related to expenses;

- indicating the sources from which the budget deficit is financed;

- reflecting government operations.

What are KBKs used for?

- organize financial reporting;

- provide a unified form of budget financial information;

- help regulate financial flows at the state level;

- with their help, the municipal and federal budget is drawn up and implemented;

- allow you to compare the dynamics of income and expenses in the desired period;

- inform about the current situation in the state treasury.

INFORMATION FOR ENTREPRENEURS! KBK is an internal coding necessary, first of all, for the state treasury, where the distribution of incoming funds takes place. Entrepreneurs need these codes insofar as they are interested in complying with the requirements for processing government payments, especially taxes and contributions to extra-budgetary funds. Therefore, do not forget to indicate the correct and current KBK code in field 104 of the payment receipt.

Structure of the KBK

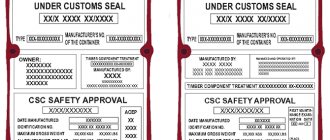

This code consists of 20 characters - numbers, separated by hyphens into groups, it has the following form XX - X XX XX XXX XX - XXXX - XXX.

Each group of characters corresponds to an encrypted meaning determined by the Ministry of Finance. Let's consider the structure of the profitable BCC, since they are the ones that entrepreneurs mainly have to use (expense codes can be found mainly when returning funds under any government program).

- "Administrator" . The first three signs show who will receive the funds and is responsible for replenishing this or that part of the budget with them, and manages the received money. The most common codes for businessmen begin with 182 - tax authority, 392 - Pension Fund, 393 - Social Insurance Fund and others.

- "Type of income" includes signs from 4 to 13. This group of signs helps to fairly accurately identify receipts based on the following indicators:

- group – 4th character (that is, the first in this paragraph);

- subgroup – 5th and 6th characters; a two-digit code indicates a specific tax, duty, contribution, fine, etc.;

- article – category 7 and 8 (the value of the purpose of the received income is encoded in the settlement documents for the budget of the Russian Federation);

- subarticle – 9, 10 and 11 characters (specifies the item of income);

- element - 12 and 13 digits, characterizes the budget level - from federal 01, municipal 05 to specific budgets of the Pension Fund - 06, Social Insurance Fund - 07, etc. Code 10 indicates the settlement budget.

- “Program” - positions from 14 to 17. These numbers are designed to differentiate taxes (their code is 1000) from penalties, interest (2000), penalties (3000) and other payments (4000).

- “Economic classification” – last three digits. They identify revenues in terms of their economic type. For example, 110 speaks of tax revenues, 130 - from the provision of services, 140 - funds forcibly seized, etc.

IMPORTANT INFORMATION! The 20-digit code must be entered correctly and without errors in the “Purpose of payment” field (field No. 104) of the payment order. In fact, it duplicates the information indicated in the “Base of payment” field, as well as partially in the “Recipient” and “Recipient’s current account” fields.

Setting up settlement accounts with customs

For settlements with customs, account 76.09 “Other settlements with various debtors and creditors” is used (chart of accounts 1C). This is an active-passive account; it can have a balance of both debit and credit.

It reflects:

- by debit - advances transferred to customs;

- for a loan - offset of advances on customs payments.

By default, invoice 76.09 is not inserted into the document Write-off from the current account and the customs declaration for import . There are two options for filling out the Settlement account .

Option #1

Account 76.09 can be filled out in documents manually by selecting from the Chart of Accounts .

This method is suitable if settlement transactions with customs are one-time or very rare.

Option No. 2

Account 76.09 is filled in automatically according to the data in the Account for settlements with counterparties .

This is a universal option that is best suited for working in 1C for both rare and frequent transactions involving settlements with the customs authority.

BukhExpert8 recommends using automatic filling of the Settlement Account in documents. To do this, you need to set up settlement accounts immediately when creating an Agreement with the customs authority.

The setup can be done by clicking on the Accounts with counterparties link directly:

- from the counterparty's card;

or from the Agreement .

In the form that opens, you need to fill out settlement accounts, as shown in the figure below. Then click the Burn and close .

Why are budget classification codes changing?

This is the cry from the heart of the vast majority of entrepreneurs: how much easier it would be if these codes were uniform and established once and for all. But the Ministry of Finance makes certain changes to the BCC almost every year. Entrepreneurs and accountants do not always have the opportunity to timely monitor innovations and correct the specified BACs, this is especially evident during reporting periods. Responsibility for incorrectly specified code lies entirely on the shoulders of businessmen, which often results in unexpected expenses and hassle in correcting the error and proving that they are right.

There are various versions put forward by entrepreneurs and the Ministry of Finance and the Ministry of Justice do not comment in any way.

- The more receipts passed through incorrect BCCs, the more funds will be “suspended” for some time as unknown. Until errors are corrected, they can be used for unseemly purposes, and on a national scale this is a huge amount.

- Additional filling of the budget by charging fines and penalties for “overdue” payments that were made through the already inactive BCC. Proving timely payment is quite troublesome.

- Inconsistency between the actions of the Ministry of Finance, which assigns codes, and the Ministry of Justice, which approves them.

- Since the KBK is directly “tied” to the public sector, any changes within the relevant structures, the receipt of new directives, etc. lead to a change in coding.

FOR YOUR INFORMATION! There are opinions that since this coding is an internal matter of the Treasury, it should be done by them, and not by taxpayers. The KBK code can be assigned by bank employees based on the specified data about the recipient and purpose of the payment, or by treasury employees upon receipt of it. However, today the additional work of coding is placed on the shoulders of payers; they cannot avoid it, which means that all that remains is to comply with the current requirements and keep abreast of the latest innovations.

Document overview

From January 1, 2021, the BCC for the payment of customs duties, fees, advances and deposits will change.

A table of the relationship between current and future codes is provided. The new codes will be valid strictly from January 1st. If you use them before this date, the payment will be recorded as unclear and in the future the payer will have to clarify the code.

There is also a list of BCCs that participants in foreign economic activity are recommended to use when paying customs and other payments to the federal budget.

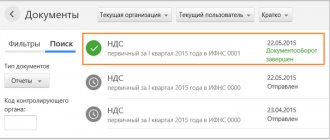

To view the current text of the document and obtain complete information about the entry into force, changes and procedure for applying the document, use the search in the Internet version of the GARANT system:

What are the consequences of an error in the KBK?

If the payment purpose code is specified incorrectly, the payment will be transferred to the budget, but it will not be distributed correctly there, which means that the state will not actually receive it. The result may be the same as if the money had not been transferred at all: the tax office will count the arrears under a certain item. At the same time, if the BCC is simply mixed up, there may be an overpayment under another item.

As a result, the tax office will issue a demand for payment of arrears, a fine for late payment of tax or a fee and penalties for late payment. This situation is extremely unpleasant for a conscientious entrepreneur who paid the tax on time, whose entire fault lies in confusion with numerous CBCs.

The usual procedure for an entrepreneur when an error is detected in the KBK

- The most important thing is to make sure that the error did not lead to non-receipt of income to the budget, otherwise it will be considered that the funds were not paid, with the payer being fully responsible for this.

- Submit to your tax accounting office a statement about the detected error and a request to clarify the basis, type and affiliation of the transfer of funds, if necessary, the tax period or tax payer status.

- The application must be accompanied by payment orders for which the tax was paid and received by the budget.

- If necessary, a reconciliation of paid taxes is carried out jointly with the inspector (a report is drawn up about it).

- After a few days (the period is not defined by law), a decision is made to clarify this payment and is handed over to the applicant.

IMPORTANT! When a payment is clarified, it is considered completed on the day the payment order is submitted with an incorrect BCC, and not on the day the decision on clarification and offset is received. Thus, the delay in mandatory payment, which provides for penalties, does not actually occur.

Let's look at various cases that occur due to errors in the CBC and analyze what an entrepreneur should do.

- The inspectorate assessed penalties for non-payment of taxes . If there was a beneficial request from the payer to offset the amount paid, then you should additionally ask the tax office to recalculate the accrued penalties. If the tax office refuses to do this, going to court will most likely allow for a recalculation (there is a rich case law with similar precedents).

- The BCC does not correspond to the payment specified in the assignment . If the error is “within one tax”, for example, the KBK is indicated on the USN-6, and the payment basis is indicated on the USN-15, then the tax office usually easily makes a re-offset. If the KBK does not completely correspond to the basis of the payment, for example, a businessman was going to pay personal income tax, but indicated the KBK belonging to the VAT, the tax office often refuses to clarify, but the court is almost always on the side of the taxpayer.

- Due to an error in the KBK, insurance premiums were unpaid . If the funds do not reach the required treasury account, this is almost inevitably fraught with fines and penalties. The entrepreneur should repeat the payment as quickly as possible with the correct details in order to reduce the amount of possible penalties. Then the money paid by mistake must be returned (you can also count it against future payments). To do this, an application is sent to the authority to whose account the money was transferred erroneously. Failure to comply with a request for a refund or re-credit is a reason to go to court.

- The funds entered the planned fund, but under the wrong heading . For example, the payment slip indicated the KBK for the funded portion of the pension, but they intended to pay for the insurance portion. In such cases, contributions are still considered to have been made on time, and you must proceed in the same way as under the usual procedure. The court can help with any problems with a fund that refuses to make a recalculation, and an illegal demand for payment of arrears and the accrual of penalties.

REMEMBER! According to the law, an error in the KBK is not a reason for which the payment will not be considered transferred. The payment order contains additional information indicating the purpose of the payment and its recipient, therefore, if it is indicated correctly, there is and cannot be a reason for penalties against the entrepreneur; other decisions can be challenged in court.

Offset of advance payment to customs according to documents

The organization transferred advance customs payments (VAT, fee) and customs duties under five payment orders: No. 1, No. 2, No. 3, No. 4, No. 5.

According to the declaration for goods 10129052/250121/0010112, the customs authority wrote off the amounts for two payment orders No. 1 (VAT, customs duty) and No. 4 (duty):

- VAT – 189,000 rubles;

- fee – 750 rubles;

- duty – 45,000 rubles.

TOTAL: 234,750 rub.

When posting a customs declaration document for imports in automatic mode, the advance payment will be offset against payment order No. 1: out of the total payment amount, 300,000 rubles. the entire amount of 234,750 rubles will be credited, which differs from the actual payments.

Let's consider how to reflect the offset of advances paid to the customs authority for specific payment orders.

On the Main the customs declaration for import document :

- open the link Calculations ;

- establish the method of offset of advances - By document ;

- by button Add in field Advance document go to form Selecting documents for settlements with counterparties.

- Generate a list of documents in Selection mode, For example, By balances.

- Select a document from the resulting list Debiting from current account for payment orders No. 1 and No. 4. First select payment order No. 1, then through the button Add— № 4.

- The documents will be transferred to the Calculations . In the Offset Amount , you must indicate the amounts that need to be offset for each payment order: paragraph No. 1 - VAT 189,000 rubles. + fee 750 rub. = 189,750 rub.;

- PP No. 4 - duty 45,000 rubles.

The result of posting a customs declaration document for imports can be checked using the Turnover Balance Sheet (TSV) for account 76.09 through Reports – Standard Reports – Turnover Balance Sheet for the account. In SALT Settings Grouping by Documents of settlements with the counterparty .

Checking the offset of the advance payment for settlements with customs: