Presentation "Classification decision"

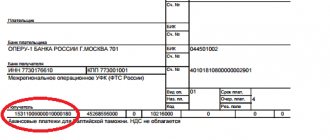

When delivering complex equipment (for example, a production line) from abroad to the territory of the Russian Federation, it is worth obtaining a classification decision from the Federal Customs Service to indicate the classification of goods in the declaration. This is the main document on which the import duty rate and the amount of other payments depend. In addition, this significantly simplifies the customs clearance process, because the equipment within the framework of a given delivery will be declared with one code, and not different for each component.

The catch is that quite often customs officials, when registering complex equipment, refuse to classify the goods according to the code declared by the declarant and require additional permitting documentation. Otherwise, the customs authority assigns the EAEU HS code that it deems necessary.

Both options - additional documents and a different code - are undesirable for the declarant. The first threatens with delays and an increase in the time required for customs clearance, and in the worst case, also with administrative liability and the imposition of fines. The second option, when customs itself assigns a code, means that the declarant will pay more duties than planned, because customs, as a rule, assigns the code for which import and other payments are higher.

How to get the desired HS code?

Classifying a product by the correct code is a difficult, but completely solvable task. Importers have the opportunity to contact the customs authority in advance to obtain a preliminary classification decision, which the customs post will be obliged to follow when processing the delivery.

There are preliminary classification decisions issued at the level of regional customs departments - TsTU, SZTU, YuTU, etc. And there are classification decisions for equipment that is unassembled, disassembled, incomplete or unfinished. Making these classification decisions is within the competence of the Federal Customs Service. They are more complex than preliminary ones in terms of the package of required documents.

Typically, the period for obtaining a preliminary classification decision is 1.5 months, although the regulations define 90 days. But it will be valid for 3 years and will prevent the code from being challenged by customs officers. The issuance of a preliminary classification decision is a public service, which means that the customs authority charges a fee for it.

Of course, optimizing customs payments in a legal way implies the presence of pitfalls and obstacles. To receive the desired code, you need to confirm the correctness of the classification so that the RTU or FCS - depending on where you apply - does not have even a shadow of doubt about your correctness.

Various factors may be the basis for refusal to confirm the declared code. For example, incomplete information about the characteristics of the product or contradictions identified in the documents provided are provided. The absence of the necessary certificates or a contract drawn up with errors can also become a reason for refusal to assign the desired code. Preparing documents to obtain a preliminary classification decision is painstaking and complex intellectual work, but the result pays for the resources spent.

The ideal option for importing a large and voluminous consignment of goods is to take care in advance to have on hand classification solutions that establish a single code for the entire cargo. The regulations for issuing a preliminary CD are determined by Order No. 1907 of the Federal Customs Service of the Russian Federation dated September 24. 2012. You should contact the regional customs department for it.

Introduction to Export

Order of the Federal Customs Service of Russia No. 1761 of September 17, 2013On approval of the Procedure for using the Unified Automated Information System of Customs Authorities during customs declaration and release (refusal to release) of goods in electronic form, after the release of such goods, as well as when exercising customs control in relation to them

(Comes into force on November 12, 2014, see letter of the Federal Customs Service of the Russian Federation No. 15-13/45331 dated September 23, 2014))

41. In the case of using an electronic form when declaring goods placed under customs procedures involving the export of goods

outside the customs territory of the Customs Union, the declarant ensures that the package of documents submitted by the carrier to the customs authority located at the checkpoint at the customs border of the Customs Union contains

information about the EDT number and information about the consignment.

—————————————————————————————————————————————————— ————

Letter of the Federal Customs Service of Russia No. 01-11/42354 dated September 5, 2014

On informing customs authorities

We are re-sending a copy of the Decision of the Joint Board of Customs Services of the Member States of the Customs Union dated February 12, 2014 No. 10/19 “ On the abolition of the requirement for the presence of marks of the customs authority of release on a paper copy of the declaration for goods,

presented in the form of an electronic document

upon departure and confirmation of the actual export

from the customs territory of the Customs Union of goods placed under the customs export procedure using information systems of customs authorities.”

Deputy Head Lieutenant General of the Customs Service

| R.V.Davydov |

——————————————————————————————————————————————————————

Order of the Federal Customs Service of Russia No. 2092 of October 28, 2014

On reducing the list of documents submitted during customs declaration of goods placed under the customs export procedure and not subject to export customs duties

I order:

1. When customs declaration in electronic form of goods placed under the customs procedure of export and not subject to export customs duties, customs authorities do not require the presentation of transport (transportation) documents.

| Supervisor Actual State Advisor of the Customs Service of the Russian Federation | A.Yu.Belyaninov |

Order of the Federal Customs Service of Russia No. 1761 of September 17, 2013

Order of the Federal Customs Service of Russia No. 1761 of September 17, 2013

On approval of the Procedure for using the Unified Automated Information System of Customs Authorities during customs declaration and release (refusal to release) of goods in electronic form, after the release of such goods, as well as when exercising customs control in relation to them

(Registered with the Ministry of Justice of Russia on February 28, 2014. Reg. No. 31465. Published in Rossiyskaya Gazeta No. 56 (6328) dated March 12, 2014. Comes into force on November 12, 2014, see letter of the Federal Customs Service of Russia No. 15-13/45331 dated September 23 .2014)

Attention! For application, see: Telegram of the Federal Customs Service of Russia TF-980 dated November 10, 2014 Letter of the Federal Customs Service of Russia No. 04-48/00329 dated January 13, 2015 Letter of the Federal Customs Service of Russia No. 01-11/64261 dated December 23, 2015 See information of the Federal Customs Service of Russia dated June 30, 2014 of the year “Comparative table of changes in the procedure for declaring goods in electronic form, provided for by Order of the Federal Customs Service of Russia dated September 17, 2013 No. 1761”

In accordance with Part 3 of Article 97 of the Federal Law of November 27, 2010 No. 311-FZ “On Customs Regulation in the Russian Federation” (Collected Legislation of the Russian Federation, 2010, No. 48, Art. 6252; 2011, No. 27, Art. 3873 , No. 29, Art. 4291, No. 50, Art. 7351; 2012, No. 53 (Part I), Art. 7608; 2013, No. 14, Art. 1656, No. 26, Art. 3207, No. 27, Art. 3477, No. 30 (Part I), Art. 4084)

I order:

1. Approve the attached Procedure for using the Unified Automated Information System of customs authorities during customs declaration and release (refusal to release) of goods in electronic form, after the release of such goods, as well as when exercising customs control in relation to them.

2. To recognize as invalid:

Order of the State Customs Committee of Russia dated March 30, 2004 No. 395 “On approval of the Instructions on performing customs operations when declaring goods in electronic form” (registered by the Ministry of Justice of Russia on April 22, 2004, registration No. 5767);

order of the Federal Customs Service of Russia dated September 5, 2006 No. 840 “On amending the order of the State Customs Committee of Russia dated March 30, 2004 No. 395” (registered by the Ministry of Justice of Russia on September 15, 2006, registration No. 8314);

order of the Federal Customs Service of Russia dated November 29, 2006 No. 1243 “On introducing amendments to the order of the State Customs Committee of Russia dated March 30, 2004 No. 395” (registered by the Ministry of Justice of Russia on January 10, 2007, registration No. 8725);

order of the Federal Customs Service of Russia dated July 14, 2010 No. 1331 “On introducing amendments to the order of the State Customs Committee of Russia dated March 30, 2004 No. 395” (registered by the Ministry of Justice of Russia on November 12, 2010, registration No. 18945).

3. Control over the implementation of this order is assigned to the Deputy Head of the Federal Customs Service of Russia R.V. Davydov.

This order comes into force after eight months from the date of its official publication.

| Head Actual State Advisor of the Customs Service of the Russian Federation | A.Yu.Belyaninov |

Appendix to the order of the Federal Customs Service of Russia dated September 17, 2013 No. 1761

The procedure for using the Unified Automated Information System of Customs Authorities during customs declaration and release (refusal to release) of goods in electronic form, after the release of such goods, as well as when exercising customs control in relation to them

I. General provisions

1. This Procedure for using the Unified Automated Information System of customs authorities during customs declaration and release (refusal to release) of goods in electronic form, after the release of such goods, as well as when exercising customs control in relation to them (hereinafter referred to as the Procedure) determines the sequence of actions for use The Unified Automated Information System of Customs Authorities (hereinafter referred to as the UAIS of customs authorities) upon submission to the customs authorities authorized to register declarations for goods (hereinafter referred to as the customs declaration authorities), documents and information in electronic form when declaring goods (hereinafter referred to as electronic declaration), including when accepting, registering (refusing to register) a declaration for goods submitted in the form of an electronic document (hereinafter referred to as EDT) , when making a decision on the release (refusal to release) of goods declared in electronic form, when releasing goods before filing an EDT, when declaring goods using preliminary EDT, when declaring goods using temporary EDT, as well as in the interaction between customs authorities and declarants after the release of goods and when carrying out customs control of goods declared in electronic form.

2. The interaction of declarants (customs representatives) (hereinafter referred to as declarants) with customs authorities during customs declaration and release of goods, taking into account the Procedure, is carried out through electronic information exchange:

in accordance with the specification of the interaction interface between information systems of customs authorities and information systems intended for the submission of information by participants in foreign economic activity to customs authorities in electronic form, developed in accordance with the procedure approved by Order of the Federal Customs Service of Russia dated January 24, 2008 No. 52 “On the introduction of information technologies for submitting information to customs authorities in electronic form for the purposes of customs clearance of goods, including using the international association of Internet networks (registered by the Ministry of Justice of Russia on February 21, 2008, registration No. 11201) (hereinafter referred to as Order of the Federal Customs Service of Russia dated January 24, 2008 No. 52);

using enhanced qualified electronic signatures (hereinafter referred to as ES) in the manner prescribed by the Federal Law of April 6, 2011 No. 63-FZ “On Electronic Signatures” (Collected Legislation of the Russian Federation, 2011, No. 15, Art. 2036, No. 27, Art. 3880; 2012, No. 29, Art. 3988; 2013, No. 14, Art. 1668, No. 27, Art. 3463, Art. 3477).

Order of the Federal Customs Service of Russia No. 1761 of September 17, 2013

On approval of the Procedure for using the Unified Automated Information System of Customs Authorities during customs declaration and release (refusal to release) of goods in electronic form, after the release of such goods, as well as when exercising customs control in relation to them

(Registered with the Ministry of Justice of Russia on February 28, 2014. Reg. No. 31465. Published in Rossiyskaya Gazeta No. 56 (6328) dated March 12, 2014. Comes into force on November 12, 2014, see letter of the Federal Customs Service of Russia No. 15-13/45331 dated September 23 .2014)

Attention! For application, see: Telegram of the Federal Customs Service of Russia TF-980 dated November 10, 2014 Letter of the Federal Customs Service of Russia No. 04-48/00329 dated January 13, 2015 Letter of the Federal Customs Service of Russia No. 01-11/64261 dated December 23, 2015 See information of the Federal Customs Service of Russia dated June 30, 2014 of the year “Comparative table of changes in the procedure for declaring goods in electronic form, provided for by Order of the Federal Customs Service of Russia dated September 17, 2013 No. 1761”

In accordance with Part 3 of Article 97 of the Federal Law of November 27, 2010 No. 311-FZ “On Customs Regulation in the Russian Federation” (Collected Legislation of the Russian Federation, 2010, No. 48, Art. 6252; 2011, No. 27, Art. 3873 , No. 29, Art. 4291, No. 50, Art. 7351; 2012, No. 53 (Part I), Art. 7608; 2013, No. 14, Art. 1656, No. 26, Art. 3207, No. 27, Art. 3477, No. 30 (Part I), Art. 4084)

I order:

1. Approve the attached Procedure for using the Unified Automated Information System of customs authorities during customs declaration and release (refusal to release) of goods in electronic form, after the release of such goods, as well as when exercising customs control in relation to them.

2. To recognize as invalid:

Order of the State Customs Committee of Russia dated March 30, 2004 No. 395 “On approval of the Instructions on performing customs operations when declaring goods in electronic form” (registered by the Ministry of Justice of Russia on April 22, 2004, registration No. 5767);

order of the Federal Customs Service of Russia dated September 5, 2006 No. 840 “On amending the order of the State Customs Committee of Russia dated March 30, 2004 No. 395” (registered by the Ministry of Justice of Russia on September 15, 2006, registration No. 8314);

order of the Federal Customs Service of Russia dated November 29, 2006 No. 1243 “On introducing amendments to the order of the State Customs Committee of Russia dated March 30, 2004 No. 395” (registered by the Ministry of Justice of Russia on January 10, 2007, registration No. 8725);

order of the Federal Customs Service of Russia dated July 14, 2010 No. 1331 “On introducing amendments to the order of the State Customs Committee of Russia dated March 30, 2004 No. 395” (registered by the Ministry of Justice of Russia on November 12, 2010, registration No. 18945).

3. Control over the implementation of this order is assigned to the Deputy Head of the Federal Customs Service of Russia R.V. Davydov.

This order comes into force after eight months from the date of its official publication.

| Head Actual State Advisor of the Customs Service of the Russian Federation | A.Yu.Belyaninov |

Appendix to the order of the Federal Customs Service of Russia dated September 17, 2013 No. 1761

The procedure for using the Unified Automated Information System of Customs Authorities during customs declaration and release (refusal to release) of goods in electronic form, after the release of such goods, as well as when exercising customs control in relation to them

I. General provisions

1. This Procedure for using the Unified Automated Information System of customs authorities during customs declaration and release (refusal to release) of goods in electronic form, after the release of such goods, as well as when exercising customs control in relation to them (hereinafter referred to as the Procedure) determines the sequence of actions for use The Unified Automated Information System of Customs Authorities (hereinafter referred to as the UAIS of customs authorities) upon submission to the customs authorities authorized to register declarations for goods (hereinafter referred to as the customs declaration authorities), documents and information in electronic form when declaring goods (hereinafter referred to as electronic declaration), including when accepting, registering (refusing to register) a declaration for goods submitted in the form of an electronic document (hereinafter referred to as EDT) , when making a decision on the release (refusal to release) of goods declared in electronic form, when releasing goods before filing an EDT, when declaring goods using preliminary EDT, when declaring goods using temporary EDT, as well as in the interaction between customs authorities and declarants after the release of goods and when carrying out customs control of goods declared in electronic form.

2. The interaction of declarants (customs representatives) (hereinafter referred to as declarants) with customs authorities during customs declaration and release of goods, taking into account the Procedure, is carried out through electronic information exchange:

in accordance with the specification of the interaction interface between information systems of customs authorities and information systems intended for the submission of information by participants in foreign economic activity to customs authorities in electronic form, developed in accordance with the procedure approved by Order of the Federal Customs Service of Russia dated January 24, 2008 No. 52 “On the introduction of information technologies for submitting information to customs authorities in electronic form for the purposes of customs clearance of goods, including using the international association of Internet networks (registered by the Ministry of Justice of Russia on February 21, 2008, registration No. 11201) (hereinafter referred to as Order of the Federal Customs Service of Russia dated January 24, 2008 No. 52);

using enhanced qualified electronic signatures (hereinafter referred to as ES) in the manner prescribed by the Federal Law of April 6, 2011 No. 63-FZ “On Electronic Signatures” (Collected Legislation of the Russian Federation, 2011, No. 15, Art. 2036, No. 27, Art. 3880; 2012, No. 29, Art. 3988; 2013, No. 14, Art. 1668, No. 27, Art. 3463, Art. 3477).