Photobank Lori

Acquiring shares of foreign manufacturers is a common occurrence in modern economic conditions. Most often, goods are purchased from wholesale companies operating in foreign markets. And even at the transaction stage, it is important to establish the legality of importing goods into Russia. Checking the customs declaration is not mandatory; for example, the law does not require checking the customs declaration number indicated by the supplier in the invoice. However, such a check will make it possible to confidently establish the legality of the goods and avoid problems with VAT refunds for them - a similar consequence of incorrect declaration is more common in practice.

Structure and rules of application

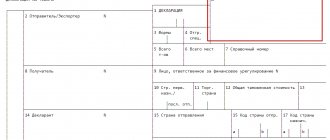

The updated cipher is 21 characters long. Essentially, the code consists of three groups of numbers:

- the first group is 8 digits indicating the code of the customs authority in which the declaration documentation was registered;

- the second group is 6 digits that disclose information about the date of registration of the report at the customs office;

- the third is the last 7 numbers indicating the serial numbering of the declaration report.

Externally, the cipher looks like this:

| First group | Second group | Third group |

| XXXXXXXXX/ | XXXXXXX/ | XXXXXXXXX |

Please note that the registration number of the customs declaration in the book of sales, purchases or invoice is indicated according to uniform standards. That is, groups of numbers indicating specific code information are separated by a fraction (slash).

What is a certificate of conformity and when is it needed?

A Certificate of Conformity (CC) is a document issued by a specially accredited body based on the results of laboratory tests. In other words, this is evidence that the products comply with the declared technical regulations and quality standards. The presence of a certificate of conformity for a particular product is a guarantee of its safety for the consumer. But not all products are subject to mandatory certification. The list of items for which this document is required is specified in the Decree of the Government of the Russian Federation No. 982 dated December 1, 2009 “List of goods subject to mandatory certification and declaration.”

It is necessary to certify goods not only for their legal sale, but also for smooth customs clearance.

A document of equal legal force—a declaration of conformity (DC)—is also drawn up to confirm product compliance with established standards. The register of declarations of conformity of the Eurasian Economic Union allows you to check its availability. But there are some differences in these documents:

- the certificate is issued on a special form, and the DS is on A4 sheet. Both of them have registration numbers and their data is entered into the electronic register of RosAccreditation;

- Both documents are stamped and signed by the head of the body that carried out the accreditation, but the DS still bears the stamp and signature of the recipient of the document.

How do you know what type of paper to get? Refer to Government Decree No. 982. If the product is included in the list of goods subject to declaration of conformity, a DS is issued. If the product is on the certification list, a certificate is issued.

Checking the correctness of filling out the customs declaration

To check whether the customs declaration is filled out correctly, you first need to find out whether the shipper is using a valid form. The current sample document is enshrined in the annex to the decision of the Customs Union Commission No. 257 of May 20, 2010. The declaration is usually filled out in triplicate. One of them remains with the employees of the Federal Customs Service of the Russian Federation, and the rest are transferred to the seller. The shipper will be able to transfer one of the copies to his business partner in the future.

Note! Most legal entities and entrepreneurs have connected electronic document management to the Federal Customs Service of the Russian Federation. In this case, the declaration is sent via electronic communication channels, and it can be printed in any number of copies.

You can check the declaration by checking the requirements contained in the decision of the Customs Union Commission No. 257 and the information specified in the document. The latter should contain:

- the name of the entrepreneur, commercial organization or customs broker who compiled the declaration;

- information about the unique characteristics of the cargo, as well as the presence of possible restrictions (for example, explosive substances are transported);

- a list of documents confirming both the name and characteristics of the product (passport, certificate, instruction manual);

- information about compliance with shipping requirements or other procedures (for example, information that the goods are fragile and were packaged in a protective form);

- data on the transaction with a foreign partner - the number of the purchase and sale agreement, delivery agreement, dealer agreement, other grounds for the emergence of legal relations, the currency in which the purchase and sale is made;

- the customs value of goods, which will be used by employees of the Federal Customs Service of the Russian Federation to calculate the amount of state duty;

- number of packages in a batch, full description of the goods (starting from the name in the declaration and ending with net and gross weight), cargo code according to the foreign economic activity commodity nomenclature;

- type of customs procedure;

- type of transport for transporting goods (you will also need to indicate the registration number of the transport in the customs declaration);

- complete information about the seller and buyer.

If the customs declaration contains all of the above information, then employees of the Federal Customs Service of the Russian Federation will accept the document for registration.

Important! The customs declaration is drawn up within 15 days after the cargo is moved to a warehouse for temporary storage. To check whether a product requires a declaration, you need to know the relevant conditions. The cargo must be more than 100 euros and be one of the items whose circulation is controlled by government agencies of the Russian Federation. The manufacturer pays excise duty on the product.

Customs officers have the legal right to check carriers' documents. If they have doubts about the legality of the transaction, the cargo will not be transported abroad. This right is enshrined in Art. 324 of the Customs Code of the Eurasian Economic Union (EAEU Customs Code).

Other ways to check the customs declaration

Another option for checking the authenticity of the customs declaration is to contact a specialized company that provides support services for foreign economic activity. Everyone has access to the necessary databases and will provide information on the declaration of interests for a small fee. This option is optimal for a one-time purchase, but if you plan to work with a large number of import suppliers for a long time, it makes sense to purchase special software or subscribe. The costs of such control are justified, since the information obtained allows you to protect yourself from unscrupulous suppliers[[kov.]]> The customs database[]> will also help to obtain information from customs declarations[[s]]>.

See also: Code 1010 in GTE - what does it mean?

GTD base. Online access for each foreign trade participant

Evaluate the capabilities of the system yourself. Demo access to the database has no functional limitations and is provided free of charge. The demo version will allow you to test the functionality, understand the operating algorithm and evaluate the advantages of the interface. To receive attributes, simply fill out the feedback form or use email, indicating corporate contacts and the name of the organization.

Please contact us with any questions or by phone. +7 (495) 946‑88-86

Our customs declaration database will help you find documentation, without which it is impossible to maintain reports, analyze the company’s work, and outline plans for future work for business development. We provide the opportunity to make a selection of customs declarations by number online. An expanded database of documents since 1998 makes it possible to conduct an in-depth analysis. Constant updating of data allows each participant in foreign economic relations to check the customs declaration by number online and clarify the correctness of deductions for foreign trade activities.

Customs bases

Our online customs declaration database will help every company involved in export-import activities. It contains detailed data on declarations registered at all Russian customs posts.

Be extremely careful when purchasing a customs database on disks from hand or on the market; such a customs database of the customs declaration may turn out to be incomplete, out of date or with duplicate entries. Abbreviations in declarations, insufficient information about goods and contractors can cause negative consequences. The online customs declaration database provided by us is a guarantee of data reliability.

Our resource has been storing information from the FEA-GTD database since 1998. In it, at any time you can obtain complete information about all declarations registered at the customs posts of the country. You can get access to the customs declaration database for free by contacting our manager.

Our customs customs declaration database contains information in the maximum format. You have the opportunity to use not only the first page of the declarations, which contains all the data about counterparties, banks, production volume, transport, but also the second side of the document, which includes information about the product, its manufacturers and properties.

Ease of use of the FEA-GTD database

An extensive document database is always available. At any convenient time, you can go to the resource and familiarize yourself with the contents of customs declarations. The CCD databases are provided free of charge as a demo version, allowing you to familiarize yourself with the capabilities of the site.

The online customs declaration will make it possible to:

- get acquainted with the category of competitors in your field;

- estimate the volume of their transportation;

- identify reliable counterparties;

- enter into mutually beneficial relationships.

Our accurate database of declarations is updated weekly, providing companies with reliable information, allowing timely adjustment of plans, creating strategies for future development and obtaining guaranteed profits.

Online customs declaration databases for business development

Declaration data can be ideal assistants in forming future business development plans. Information about goods, suppliers, manufacturers will allow you to determine sales and procurement areas. Transportation data will help you choose a reliable delivery company. You can carefully study the HS codes in the Customs Declaration Database. Information will allow you to correctly select these important indicators and avoid unnecessary costs.

For companies that have long been participants in foreign trade activities, regular checks of the customs declaration provide an opportunity to monitor the correctness of deductions in this area and assess the profitability of export-import operations.

Registration number of the customs declaration (DT, GTD). Structure. Column A.

Where can I get the goods declaration number (GTD)?

— The number of the declaration of goods (formerly called the customs declaration) is indicated in column A (upper right corner) of all sheets of the declaration and in additions. The number is assigned (generated) automatically during the process of submitting the declaration to the customs authority. The declaration is transferred by the declarant to customs using electronic data transmission through special programs and is signed with an electronic digital signature. After this, the declaration is registered, i.e. assigning it a unique number.

Results

It is advisable, but not necessary, to record the customs declaration number in the invoice, provided that the other information reflected in the document makes it possible to establish information about the supplier, buyer and product. The DT number can be found in column A of the customs declaration. Subsequently, it is recorded in column 11 of the invoice.

You can learn more about the specifics of using tax documentation when importing goods and services from abroad in the articles:

- “VAT when importing services: how to pay the tax correctly?”;

- “Code of the country of origin of the goods in the invoice.”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to check a customs declaration by number online

There are practically no services for free control of customs declarations. The only exception is the CCD check on the FCS website. This opportunity is available only to legal entities connected to []> personal account> participant in foreign economic activity on the official website of the Customs Service. Therefore, this option is possible for companies working with foreign suppliers.

You can consider another option, for example, checking the authenticity of the customs declaration online and for free []> services[i]> on the Federal Tax Service website - “Checking the receipt by the Federal Customs Service of information on documents confirming the validity of the application of the 0% VAT rate.” The service is aimed at the registrants themselves, but in some cases its functionality is also useful for other market participants to ensure that the specified declaration number is actually in the FCS database.