New KBK

BCCs change quite often, and 2021 was no exception. Several new codes have been introduced at once - all of them are presented in the following table.

Codes that appeared in 2021

| KBK | Payment |

| 182 1 0100 110 | income tax on income received in the form of interest on bonds of Russian organizations in rubles issued during the period from January 1, 2021 to December 31, 2021 (Order of the Ministry of Finance of Russia dated June 9, 2021 No. 87n); |

| 182 1 0300 110 | excise taxes on electronic nicotine delivery systems produced in the Russian Federation; |

| 182 1 0300 110 | excise taxes on nicotine-containing liquids produced on the territory of the Russian Federation; |

| 182 1 0300 110 | excise taxes on tobacco (tobacco products) intended for consumption by heating, produced on the territory of the Russian Federation. |

How to pay personal income tax according to KBK 18210102010011000110

The deadlines for paying personal income tax depend on the income from which tax was withheld. In standard cases, tax is paid on the next business day after income is paid. This procedure applies to salaries and bonuses. But you can transfer personal income tax from vacation pay and sick leave until the end of the month in which the income was paid.

Personal income tax accrued during the month can be transferred in separate payment orders. Moreover, this must be done if tax payment deadlines differ for different types of payments.

Important! If personal income tax for a month is less than 100 rubles, then it can be paid together with personal income tax for the next month. The tax can be transferred in this way until December of the current year (clause 8 of Article 226 of the Tax Code, letter of the Ministry of Finance dated February 27, 2018 No. 03-04-06/12341).

Codes that are valid in 2021 for different taxes

The following is a complete list of budget tax classification codes that are in effect in 2021.

VAT

| Purpose of payment | KBK |

| Amount of tax (arrears) | |

| from sales in Russia | 182 1 0300 110 |

| when importing goods from countries participating in the Customs Union - through the tax office | 182 1 0400 110 |

| when importing goods - at customs | 153 1 0400 110 |

| Penya | |

| from sales in Russia | 182 1 0300 110 |

| when importing goods from countries participating in the Customs Union - through the tax office | 182 1 0400 110 |

| when importing goods - at customs | 153 1 0400 110 |

| Fine | |

| from sales in Russia | 182 1 0300 110 |

| when importing goods from countries participating in the Customs Union - through the tax office | 182 1 0400 110 |

| when importing goods - at customs | 153 1 0400 110 |

KBK for corporate income tax

| Purpose of payment | KBK |

| Amount of tax (arrears) | |

| to the federal budget (except for consolidated groups of taxpayers) | 182 1 0100 110 |

| to the budgets of the constituent entities of the Russian Federation (except for consolidated groups of taxpayers) | 182 1 0100 110 |

| to the federal budget (for consolidated groups of taxpayers) | 182 1 0100 110 |

| to the budgets of the constituent entities of the Russian Federation (for consolidated groups of taxpayers) | 182 1 0100 110 |

| when implementing production sharing agreements concluded before October 21, 2011 (before the Law of December 30, 1995 No. 225-FZ came into force) | 182 1 0100 110 |

| from the income of foreign organizations not related to activities in Russia through a permanent representative office | 182 1 0100 110 |

| from the income of Russian organizations in the form of dividends from Russian organizations | 182 1 0100 110 |

| from the income of foreign organizations in the form of dividends from Russian organizations | 182 1 0100 110 |

| from dividends from foreign organizations | 182 1 0100 110 |

| from interest on state and municipal securities | 182 1 0100 110 |

| from income in the form of profits of controlled foreign companies | 182 1 0100 110 |

| Penya | |

| to the federal budget (except for consolidated groups of taxpayers) | 182 1 0100 110 |

| to the budgets of the constituent entities of the Russian Federation (except for consolidated groups of taxpayers) | 182 1 0100 110 |

| to the federal budget (for consolidated groups of taxpayers) | 182 1 0100 110 |

| to the budgets of the constituent entities of the Russian Federation (for consolidated groups of taxpayers) | 182 1 0100 110 |

| when implementing production sharing agreements concluded before October 21, 2011 (before the Law of December 30, 1995 No. 225-FZ came into force) | 182 1 0100 110 |

| from the income of foreign organizations not related to activities in Russia through a permanent representative office | 182 1 0100 110 |

| from the income of Russian organizations in the form of dividends from Russian organizations | 182 1 0100 110 |

| from the income of foreign organizations in the form of dividends from Russian organizations | 182 1 0100 110 |

| from dividends from foreign organizations | 182 1 0100 110 |

| from interest on state and municipal securities | 182 1 0100 110 |

| The corporate income tax on income in the form of profits of controlled foreign companies will have its own code. | 182 1 0100 110 |

| Fine | |

| to the federal budget (except for consolidated groups of taxpayers) | 182 1 0100 110 |

| to the budgets of the constituent entities of the Russian Federation (except for consolidated groups of taxpayers) | 182 1 0100 110 |

| to the federal budget (for consolidated groups of taxpayers) | 182 1 0100 110 |

| to the budgets of the constituent entities of the Russian Federation (for consolidated groups of taxpayers) | 182 1 0100 110 |

| when implementing production sharing agreements concluded before October 21, 2011 (before the Law of December 30, 1995 No. 225-FZ came into force) | 182 1 0100 110 |

| from the income of foreign organizations not related to activities in Russia through a permanent representative office | 182 1 0100 110 |

| from the income of Russian organizations in the form of dividends from Russian organizations | 182 1 0100 110 |

| from the income of foreign organizations in the form of dividends from Russian organizations | 182 1 0100 110 |

| from dividends from foreign organizations | 182 1 0100 110 |

| from interest on state and municipal securities | 182 1 0100 110 |

| The corporate income tax on income in the form of profits of controlled foreign companies will have its own code. | 182 1 0100 110 |

Personal income tax

| Purpose of payment | KBK |

| Amount of tax (arrears) | |

| paid by tax agent | 182 1 0100 110 |

| paid by entrepreneurs and persons engaged in private practice, including notaries and lawyers (Article 227 of the Tax Code of the Russian Federation) | 182 1 0100 110 |

| paid by the resident independently, including from income from the sale of personal property | 182 1 0100 110 |

| in the form of fixed advance payments from the income of foreigners working on the basis of a patent (Article 227.1 of the Tax Code of the Russian Federation) | 182 1 0100 110 |

| Penya | |

| paid by tax agent | 182 1 0100 110 |

| paid by entrepreneurs and persons engaged in private practice, including notaries and lawyers (Article 227 of the Tax Code of the Russian Federation) | 182 1 0100 110 |

| paid by the resident independently, including from income from the sale of personal property | 182 1 0100 110 |

| in the form of fixed advance payments from the income of foreigners working on the basis of a patent (Article 227.1 of the Tax Code of the Russian Federation) | 182 1 0100 110 |

| Fine | |

| paid by tax agent | 182 1 0100 110 |

| paid by entrepreneurs and persons engaged in private practice, including notaries and lawyers (Article 227 of the Tax Code of the Russian Federation) | 182 1 0100 110 |

| paid by the resident independently, including from income from the sale of personal property | 182 1 0100 110 |

| in the form of fixed advance payments from the income of foreigners working on the basis of a patent (Article 227.1 of the Tax Code of the Russian Federation) | 182 1 0100 110 |

Transport tax

| Purpose of payment | KBK |

| Amount of tax (arrears) | |

| from organizations | 182 1 0600 110 |

| from individuals | 182 1 0600 110 |

| Penya | |

| from organizations | 182 1 0600 110 |

| from individuals | 182 1 0600 110 |

| Fine | |

| from organizations | 182 1 0600 110 |

| from individuals | 182 1 0600 110 |

Organizational property tax

| Purpose of payment | KBK |

| Amount of tax (arrears) | |

| for property not included in the Unified Gas Supply System | 182 1 0600 110 |

| for property included in the Unified Gas Supply System | 182 1 0600 110 |

| Penya | |

| for property not included in the Unified Gas Supply System | 182 1 0600 110 |

| for property included in the Unified Gas Supply System | 182 1 0600 110 |

| Fine | |

| for property not included in the Unified Gas Supply System | 182 1 0600 110 |

| for property included in the Unified Gas Supply System | 182 1 0600 110 |

Land tax for organizations

| Where is the land plot located? | Payment type | KBK |

| Moscow St. Petersburg Sevastopol | Tax | 182 10600 110 |

| Penalty | 182 10600 110 | |

| Fine | 182 10600 110 | |

| Urban district without additional administrative entities | Tax | 182 10600 110 |

| Penalty | 182 10600 110 | |

| Fine | 182 10600 110 | |

| Urban district if it contains intra-city administrative entities | Tax | 182 10600 110 |

| Penalty | 182 10600 110 | |

| Fine | 182 10600 110 | |

| Intracity administrative entity | Tax | 182 10600 110 |

| Penalty | 182 10600 110 | |

| Fine | 182 10600 110 | |

| Intersettlement territories | Tax | 182 10600 110 |

| Penalty | 182 10600 110 | |

| Fine | 182 10600 110 | |

| Rural settlement | Tax | 182 10600 110 |

| Penalty | 182 10600 110 | |

| Fine | 182 10600 110 | |

| urban settlement | Tax | 182 10600 110 |

| Penalty | 182 10600 110 | |

| Fine | 182 10600 110 |

Water tax

| Purpose of payment | KBK |

| Amount of tax (arrears) | 182 1 0700 110 |

| Penya | 182 1 0700 110 |

| Fine | 182 1 0700 110 |

Insurance contributions for pension insurance (former contributions to the Pension Fund)

| Purpose of payment | KBK |

| Amount of tax (arrears) | |

| for pension insurance for employees | 182 1 0210 160 |

| for pension insurance of an individual entrepreneur for himself based on the minimum wage | 182 1 0210 160 |

| for pension insurance of an individual entrepreneur for himself with income exceeding 300,000 rubles. | 182 1 0210 160 |

| Additional pension contributions at tariff 1 | 182 1 0210 160 – if the tariff does not depend on the special assessment; 182 1 0220 160 – if the tariff depends on the special assessment |

| Additional pension contributions at tariff 2 | 182 1 0210 160 – if the tariff does not depend on the special assessment; 182 1 0220 160 – if the tariff depends on the special assessment |

| Penya | |

| for pension insurance for employees | 182 1 0210 160 |

| for pension insurance of an individual entrepreneur for himself based on the minimum wage | 182 1 0210 160 |

| for pension insurance of an individual entrepreneur for himself with income exceeding 300,000 rubles. | 182 1 0210 160 |

| Additional pension contributions at tariff 1 | 182 1 0210 160 – if the tariff does not depend on the special assessment; 182 1 0220 160 – if the tariff depends on the special assessment |

| Additional pension contributions at tariff 2 | 182 1 0210 160 – if the tariff does not depend on the special assessment; 182 1 0220 160 – if the tariff depends on the special assessment |

| Fine | |

| for pension insurance for employees | 182 1 0210 160 |

| for pension insurance of an individual entrepreneur for himself based on the minimum wage | 182 1 0210 160 |

| for pension insurance of an individual entrepreneur for himself with income exceeding 300,000 rubles. | 182 1 0210 160 |

| Additional pension contributions at tariff 1 | 182 1 0210 160 – if the tariff does not depend on the special assessment; 182 1 0220 160 – if the tariff depends on the special assessment |

| Additional pension contributions at tariff 2 | 182 1 0210 160 – if the tariff does not depend on the special assessment; 182 1 0220 160 – if the tariff depends on the special assessment |

Insurance contributions for social insurance (former contributions to the Social Insurance Fund)

| Purpose of payment | KBK |

| Amount of tax (arrears) | |

| in case of temporary disability and in connection with maternity | 182 1 0210 160 |

| for insurance against industrial accidents and occupational diseases | 393 1 0200 160 |

| Penya | |

| in case of temporary disability and in connection with maternity | 182 1 0210 160 |

| for insurance against industrial accidents and occupational diseases | 393 1 0200 160 |

| Fine | |

| in case of temporary disability and in connection with maternity | 182 1 0210 160 |

| for insurance against industrial accidents and occupational diseases | 393 1 0200 160 |

Insurance premiums for compulsory medical insurance

| Purpose of payment | KBK |

| Amount of tax (arrears) | |

| to the FFOMS budget for employees | 182 1 0213 160 |

| for medical insurance of an individual entrepreneur for himself based on the minimum wage | 182 1 0213 160 |

| Penya | |

| to the FFOMS budget for employees | 182 1 0213 160 |

| for medical insurance of an individual entrepreneur for himself based on the minimum wage | 182 1 0213 160 |

| Fine | |

| to the FFOMS budget for employees | 182 1 0213 160 |

| for medical insurance of an individual entrepreneur for himself based on the minimum wage | 182 1 0213 160 |

Features and nuances of BCC for VAT payment

This tax is the main “filler” of the Russian treasury, so entrepreneurs should be especially careful when paying it. It is paid from the sale of goods and/or services, as well as from imported goods sold in Russia. It must also be paid when transferring goods for one’s own needs, if this is not reflected in the tax return. It is also relevant when importing goods.

There were very serious changes to the payment of value added tax a couple of years ago, so for 2021, legislators touched on this tax only in passing to give entrepreneurs the opportunity to adapt.

Calculation and payment procedure

VAT is a tax that requires quarterly declaration and payment. It is calculated based on the results of each quarter: the difference in the tax base and deductions is multiplied by the tax rate. Thus, the budget receives these tax payments four times a year.

IMPORTANT INFORMATION! If legal deductions exceed the revenue portion of the VAT, then the budget will compensate for the missing share: the amount will be counted toward future payments or to pay off any arrears. In the absence of arrears, the law allows the amount of compensation to be transferred to the bank account of the entrepreneur.

The tax base is considered to be the main characteristic of the goods or services being sold - their value on the day of shipment of the goods or transfer of the service or the day of their payment (the date of the event that occurred earlier).

There are some nuances regarding VAT tax rates:

- same rate – same base;

- if transactions are subject to VAT at different rates, then their base is also calculated separately;

- the cost is always calculated in national currency, revenue from imports is converted into rubles at the current exchange rate.

Main changes in VAT payment for 2021

- From January 1, preferential rates for the sale of goods and services provided for by the Tax Code come into effect. For some products it is recognized as zero.

- The conditions for confirming the right to a preferential VAT tariff have been simplified.

- Double taxation exceptions for those using the simplified taxation system and unified agricultural tax when issuing invoices.

- Elimination of paper media: starting from this year, VAT returns can only be submitted electronically.

- New budget classification codes for VAT transactions.

NOTE! Tax rates and the method of calculating VAT have not changed.

BCC for special tax regimes

For those who use special regimes, the following BCCs apply.

UTII

| Amount of tax (arrears) | 182 1 0500 110 |

| Penya | 182 1 0500 110 |

| Fine | 182 1 0500 110 |

simplified tax system

| Amount of tax (arrears) | from income (6%) - 182 1 0500 110; from income minus expenses (15%), including minimum tax - 182 1 0500 110 |

| Penya | from income (6%) - 182 1 0500 110; from income minus expenses (15%), including minimum tax - 182 1 0500 110 |

| Fine | from income (6%) - 182 1 0500 110; from income minus expenses (15%), including minimum tax - 182 1 0500 110 |

Unified agricultural tax

| Amount of tax (arrears) | 182 1 0500 110 |

| Penya | 182 1 0500 110 |

| Fine | 182 1 0500 110 |

Patent

| Amount of tax (arrears) | |

| tax to the budgets of city districts | 182 1 0500 110 |

| tax to the budgets of municipal districts | 182 1 0500 110 |

| tax to the budgets of Moscow, St. Petersburg and Sevastopol | 182 1 0500 110 |

| tax to the budgets of urban districts with intracity division | 182 1 0500 110 |

| to the budgets of intracity districts | 182 1 0500 110 |

| Penya | |

| tax to the budgets of city districts | 182 1 0500 110 |

| tax to the budgets of municipal districts | 182 1 0500 110 |

| tax to the budgets of Moscow, St. Petersburg and Sevastopol | 182 1 0500 110 |

| tax to the budgets of urban districts with intracity division | 182 1 0500 110 |

| to the budgets of intracity districts | 182 1 0500 110 |

| Fine | |

| tax to the budgets of city districts | 182 1 0500 110 |

| tax to the budgets of municipal districts | 182 1 0500 110 |

| tax to the budgets of Moscow, St. Petersburg and Sevastopol | 182 1 0500 110 |

| tax to the budgets of urban districts with intracity division | 182 1 0500 110 |

| to the budgets of intracity districts | 182 1 0500 110 |

KBK for VAT for tax agents

An organization and individual entrepreneur are considered tax agents for VAT when:

- purchase products, services, work from a foreign company that is not registered with the Federal Tax Service of the Russian Federation, and sell them in the Russian Federation;

- rent property that is owned by the state or municipality, and also acquire government property;

- by court decision, sell property, as well as ownerless, confiscated or purchased property;

- act as intermediaries for a foreign company not registered in the Russian Federation.

In all of the above cases, the tax agent is obliged to withhold VAT from the amounts it owes to the counterparty and transfer the tax to the budget. Companies that apply special tax regimes are not exempt from this obligation.

In the payment order, tax agents indicate the same BCC as legal entities - tax payers. In this case, in field 101 of the payment slip, you must indicate that the tax is transferred by a tax agent (code “02”).

KBK for payment of state duty in 2018

| Purpose of payment | KBK |

| on proceedings in arbitration courts | 182 1 0800 110 |

| on proceedings in the Constitutional Court of the Russian Federation | 182 1 0800 110 |

| on proceedings in constitutional (statutory) courts of constituent entities of the Russian Federation | 182 1 0800 110 |

| in proceedings in courts of general jurisdiction, magistrates. In addition to the Supreme Court of the Russian Federation | 182 1 0800 110 |

| on proceedings in the Supreme Court of the Russian Federation | 182 1 0800 110 |

| for state registration of: – organizations; – entrepreneurs; – changes made to the constituent documents; – liquidation of the organization and other legally significant actions | 182 1 0800 110 (if documents for state registration of an organization or entrepreneur are submitted not to the tax office, but to a multifunctional center, then the BCC must be indicated with the income subtype code “8000”, that is, 182 1 0800 110 (letter of the Federal Tax Service of Russia dated January 15, 2015 No. ZN-4-1/193)) |

| for state registration of rights, restrictions on rights to real estate and transactions with it - sale, lease and others | 321 1 0800 110 |

| for the right to use the names “Russia”, “Russian Federation” and words and phrases formed on their basis in the names of organizations | 182 1 0800 110 |

| for carrying out actions related to licensing, with certification provided for by the legislation of the Russian Federation, credited to the federal budget | 000 1 0800 110 |

| for registration of vehicles and other legally significant actions related to changes and issuance of documents for vehicles, registration plates, driver's licenses | 188 1 0800 110 |

| for carrying out state technical inspection, registration of tractors, self-propelled and other machines and for issuing tractor driver’s licenses | 000 1 0800 110 (in categories 1–3, the code is indicated depending on the competence of which chief administrator is in charge of administering a specific budget income (Appendix 7 to the instructions approved by order of the Ministry of Finance of Russia dated July 1, 2013 No. 65n). Indicate in categories 1– 3 KBK administrator code “000” is not allowed.) |

| for consideration of applications for concluding or amending a pricing agreement | 182 1 0800 110 |

KBC for payment of fines

| Purpose of payment | KBK |

| for violation of the legislation on taxes and fees provided for in Articles 116, 118, 119.1, paragraphs 1 and 2 of Article 120, Articles 125, 126, 128, 129, 129.1, 132, 133, 134, 135, 135.1, as well as the previously in force Article 117 Tax Code of the Russian Federation | 182 1 1600 140 |

| for violations of the legislation on taxes and fees provided for in Articles 129.3 and 129.4 of the Tax Code of the Russian Federation | 182 1 1600 140 |

| for violation of the procedure for registering gambling business objects, provided for in Article 129.2 of the Tax Code of the Russian Federation | 182 1 1600 140 |

| for administrative offenses in the field of taxes and fees provided for by the Code of the Russian Federation on Administrative Offenses | 182 1 1600 140 |

| for violation of the procedure for using CCP. For example, for violating the rules of technical maintenance of cash registers | 182 1 1600 140 |

| for violation of the legislation on state extra-budgetary funds and on specific types of compulsory social insurance, budget legislation (regarding the budget of the Pension Fund of the Russian Federation) | 392 1 1600 140 |

| issued by the Pension Fund of the Russian Federation in accordance with Articles 48−51 of the Law of July 24, 2009 No. 212-FZ | 392 1 1600 140 |

| for violation of the legislation on state extra-budgetary funds and on specific types of compulsory social insurance, budget legislation (regarding the budget of the Social Insurance Fund of Russia) | 393 1 1600 140 |

| for violation of the legislation on state extra-budgetary funds and on specific types of compulsory social insurance, budget legislation (regarding the budget of the Federal Compulsory Medical Insurance Fund of Russia) | 394 1 1600 140 |

| for administrative offenses in the field of state regulation of the production and turnover of ethyl alcohol, alcohol, alcohol-containing and tobacco products | 141 1 1600 140 (if the payment administrator is Rospotrebnadzor) 160 1 1600 140 (if the payment administrator is Rosalkogolregulirovanie) 188 1 1600 140 (if the payment administrator is the Ministry of Internal Affairs of Russia) (Chief administrators can delegate their powers to administer certain budget revenues to federal government agencies. In such situations, when transferring payments in categories 14–17 BCC, you must indicate the revenue subtype code “7000”) |

| for violation of the procedure for handling cash, conducting cash transactions and failure to fulfill obligations to monitor compliance with the rules for conducting cash transactions | 182 1 1600 140 |

| for violation of the legislation on state registration of legal entities and individual entrepreneurs, provided for in Article 14.25 of the Code of Administrative Offenses of the Russian Federation | 182 1 1600 140 |

| for evasion of administrative punishment provided for in Article 20.25 of the Code of Administrative Offenses of the Russian Federation | 182 1 1600 140 |

Transitional table of KBK codes for 2018

As you know, from the beginning of 2021, the administration of insurance premiums was transferred from the funds to the Tax Service. The exception was traumatic contributions - they remained under the jurisdiction of the Social Insurance Fund. In this regard, the structure of the budget classification codes itself has changed. Therefore, if you have to pay debts for past tax periods, the transitional BCCs, which are presented in the following three tables, will be useful:

- the first contains the BCCs for which contributions must be paid for employees;

- the second contains codes that entrepreneurs use when paying contributions for themselves;

- the third part lists the KBK for payment of pension contributions at additional rates.

Employee contributions

| Payment | KBC in 2021 | KBC in 2017-2018 | |

| For periods up to 2021 | For the periods 2017-2018 | ||

| Contributions to employee pension insurance at basic rates | |||

| Contributions | 392 1 0200 160 | 182 1 0200 160 | 182 1 0210 160 |

| Penalty | 392 1 0200 160 | 182 1 0200 160 | 182 1 0210 160 |

| Fines | 392 1 0200 160 | 182 1 0200 160 | 182 1 0210 160 |

| Social insurance contributions | |||

| Contributions | 393 1 0200 160 | 182 1 0200 160 | 182 1 0210 160 |

| Penalty | 393 1 0200 160 | 182 1 0200 160 | 182 1 0210 160 |

| Fines | 393 1 0200 160 | 182 1 0200 160 | 182 1 0210 160 |

| Employer contributions to health insurance | |||

| Contributions | 392 1 0211 160 | 182 1 0211 160 | 182 1 0213 160 |

| Penalty | 392 1 0211 160 | 182 1 0211 160 | 182 1 0213 160 |

| Fines | 392 1 0211 160 | 182 1 0211 160 | 182 1 0213 160 |

IP contributions

| Payment | KBC in 2021 | KBC in 2017-2018 | |

| For periods up to 2021 | For the periods 2017-2018 | ||

| Entrepreneurs' contributions to pension insurance | |||

| Fixed contributions (minimum wage × 26%) | 392 1 0200 160 | 182 1 0200 160 | 182 1 0210 160 |

| Contributions from income over 300 thousand rubles. | 392 1 0200 160 | 182 1 0200 160 | |

| Penalty | 392 1 0200 160 | 182 1 0200 160 | 182 1 0210 160 |

| Fines | 392 1 0200 160 | 182 1 0200 160 | 182 1 0210 160 |

| Fixed contributions of entrepreneurs for health insurance | |||

| Contributions | 392 1 0211 160 | 182 1 0211 160 | 182 1 0213 160 |

| Penalty | 392 1 0211 160 | 182 1 0211 160 | 182 1 0213 160 |

| Fines | 392 1 0211 160 | 182 1 0211 160 | 182 1 0213 160 |

Pension contributions at additional rates

| Payment | KBC in 2021 | KBC in 2017-2018 | |

| The tariff does not depend on the results of SOUT | The tariff depends on the results of the SOUT | ||

| For workers from List 1 | |||

| Contributions | 392 1 0200 160 | 182 1 0210 160 | 182 1 0220 160 |

| Penalty | 392 1 0200 160 | 182 1 0200 160 | |

| Fines | 392 1 0200 160 | 182 1 0200 160 | |

| For workers from List 2 | |||

| Contributions | 392 1 0200 160 | 182 1 0210 160 | 182 1 0220 160 |

| Penalty | 392 1 0200 160 | 182 1 0200 160 | |

| Fines | 392 1 0200 160 | 182 1 0200 160 | |

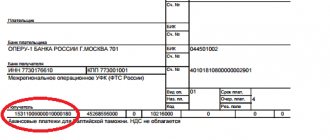

Filling out a payment order for VAT in 2021

To transfer the main VAT payment (penalty or fine) to the budget, you must correctly indicate the details in the payment order. First of all, you must correctly indicate your taxpayer status in field 101:

- 01 - legal entity;

- 02 - tax agents;

- 06 - import tax;

- 09 - IP.

The tax amount (field 6) is indicated in round rubles without kopecks. The type of transaction (field 18) for VAT payment is filled in with code “01”, and the order of payment (field 21) with code “5”. The BCC corresponding to the type of operation (see table above) is indicated in field 104. In field 105, OKTMO is entered, indicating the payer’s affiliation with a specific municipal entity. The meaning of OKTMO can be found on the Federal Tax Service website.

The basis for payment (field 106) is indicated as “TP” - current payment. And in the adjacent 107 field the period for which the tax is paid is entered. In the case of VAT, this will be the corresponding quarter, for example, “KV.01.2021”. Below is an example of a VAT payment for the 1st quarter of 2021.