We hope everyone is aware that the national product traceability system has been operational since July 8, 2021? In the article we will talk about how to reflect in 1C accounting the receipt of traceable goods from various supplier companies: residents of the Russian Federation, (non)/members of the EAEU.

To begin with, let us recall the main goal of the goods traceability system - to ensure state control over the movement of imported goods from the manufacturer to the final consumer. Such control should reduce the percentage of illegal imports on the territory of the Russian Federation.

You can familiarize yourself with the main provisions in Government Decree No. 1108 dated 07/01/2021.

To understand which products are subject to traceability, we advise you to refer to the Decree of the Government of the Russian Federation of July 1, 2021 N 1110.

Having paid a little attention to the theoretical side of the issue, let's move on to practice.

Accounting for foreign trade activities in 1C for customs purposes

There is a regulated procedure for applying customs procedures, some of which directly relate to the work of accountants.

Moreover, we are talking not only about importing companies, but also about wholesalers of imported goods. Regulated accounting of commercial documentation implies detailed accounting information about the product through its identification (barcoding or marking of imported goods at customs, assigning a registration number of the customs declaration, etc.), as well as a comprehensive relationship of subsequent operations with all consignments that have passed the border of the Russian Federation. This procedure corresponds to the batch method of product accounting, which is especially relevant for importing companies under a special simplified regime for passing customs procedures.

The list of mandatory information for each product contained in the shipment, which must be reflected in the commercial documentation accounting system, includes data on:

- foreign trade contract;

- seller of goods under a foreign economic transaction;

- the sender and buyer of the goods;

- import transaction passport;

- imported goods;

- additional expenses of the buyer and amounts allowed to be deducted from the transaction price;

- receipt order;

- customs declaration.

The customs declaration must indicate the registration number of the customs declaration, which contains information about the goods, and the number of the goods in it.

Preparation of the document “Application for import of goods”

The application for the import of goods is strictly regulated. It is compiled for the total volume of supplies for the reporting period - a month, and is submitted along with the tax return by the 20th day of the month following the month of import of goods. This document can be generated in two ways - in the “Purchases” menu section or entered based on the goods receipt document.

In order to create an application for the import of goods, go to the “Purchases” section.

Fig. 10 Application for import of goods in the “Purchases” section

Click the “Create” button in the journal that opens.

Fig.11 Click the “Create” button

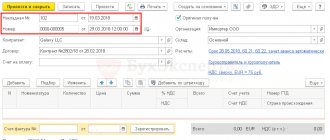

Having specified the counterparty and the agreement, click the “Fill” button and, by selecting the “Fill in by receipts” command, select our receipt documents.

Fig. 12 Selecting receipt documents

This method is convenient because it allows you to immediately select all documents for the selected counterparty. Data from documents is automatically transferred to the application. After completion, we will check the completed document and, if necessary, fill in the missing data.

Fig. 13 Let's check the completed document

The document must contain the code according to the Commodity Nomenclature of Foreign Economic Activity (commodity nomenclature for foreign economic activity), the weight of the goods, the code of the mode of transport, and the details of the declaration of goods. In the case of purchasing goods through a commission agent, the details of the specification and the participants in the transaction are additionally indicated (hyperlink “Specifications”, “Participants in the transaction”).

GTD in 1C

Information about customs declaration numbers and countries of origin is entered at the time of registration of documents for the supply of imported goods or a customs declaration.

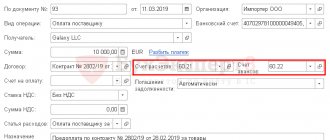

Unlike foreign corporate accounting systems, 1C configurations very conveniently implement the “Customer Customs Document for Import” document. It is filled out based on the data from the pre-filled document “Receipt of goods and services”.

In addition to the standard fields (date of import, customs office, agreement with customs office, customs declaration number, method of distribution of customs payments, etc.), you must indicate the rates of duty, excise tax, VAT and customs duty. Also in the customs declaration in 1C you can register and correctly distribute all additional costs during import:

- for transportation costs to the border;

- for customs clearance;

- cost of a customs broker;

- for transportation from the border to the customs warehouse.

Additional costs are calculated up to the moment the goods cleared through customs become the property of the company. In case of non-payment or incorrect accounting, the importing company may be subject to penalties.

“As practice shows, in any importing company, when changing an accountant or other circumstances, half of 1C users incorrectly use the functionality of the customs declaration document, and, as a result, suffer with cost calculations and reporting under IFRS.”

Konstantin Semchinov

director of the international project office assino.

Customs declaration in the purchase book. In invoices and the 1C purchase book, it is necessary to indicate only the registration numbers of customs declarations in the format of 23-27 characters, otherwise the Federal Tax Service will not accept the document.

If in the document 1C Purchase of goods and services the customs declaration number is entered in the appropriate format as for import into the territory of the Russian Federation, then it must be entered in column 13 “Registration number of the customs declaration” of the purchase book.

When selling or otherwise writing off products from the warehouse, the customs declaration numbers will be selected automatically.

EAEU and payment of indirect taxes

The organization importing the goods must fill out an application, which is recorded in the tax service of the importing country. Its purpose is to confirm the fact of import of goods and the deduction of VAT on imports. This allows the exporter to apply VAT at a rate of 0%. The amount of taxes payable to the budget depends on the correctness of filling out the application.

In order to account for VAT accrued upon import, in the 1C: Accounting 3.0 program, starting with release 3.0.35, the ability to draw up the document “Application for the import of goods” has been implemented. Let's look at the necessary program settings and the procedure for filling it out.

Solution from assino

assino is an international consulting company, a leader in the automation market for international companies in Russia and the CIS countries. We, in close partnership with 1C, are implementing accounting systems for key Russian and foreign customers.

The assino company has successful experience in implementing projects for the implementation of ERP systems for maintaining regulated and management accounting of companies participating in foreign trade activities, and also automates all processes of the labeling and traceability system for imported goods within the framework of the legislative requirements of the Russian Federation.

Find out more about the capabilities of 1C systems for foreign economic activity. Order a free audit of your company's business processes to choose the optimal solution!

Examples of updating classifiers

Experienced users and administrators likely know where the information is about which directories are automatically updated and when they are updated. You can find out in the following sections:

- Administration;

- Service;

- Routine and background tasks.

This menu displays tasks that are performed on the server without user assistance. In it you can view not only whether a task is enabled or not, its execution status, but also when it will be completed, its schedule and name in the configuration. The best time to set routine tasks to complete is at night, since the operation will not disturb users. Of course, for this, the server must have a round-the-clock operation, like most other organizations.

It is also worth considering the option of clustering technology. It consists in the fact that all regulated and background tasks are carried out to a specific running server within the cluster. cluster technology will increase the costs of setting up and maintaining the IT infrastructure , but will significantly increase the productivity of user functionality.

To stop loading the classifier to free up memory or quickly load data manually, you need to use the button to open the desired 1C routine task. At the top you will find the “Enabled” window nearby with a checkmark that you need to click to remove, and later record all amendments to the information base. But you need to do this carefully, because in this case you will be updating the classifier yourself.

We recommend contacting the 1C consultation line if you doubt that you can cope with such a task.

In order for users to have accurate information without using routine tasks, it is necessary to update the classifiers manually. Let's consider updating using the example of a bank classifier.

The update goes like this:

- First you need to go to the “Bank Classifier” directory. Go to the “All functions” menu or use the “Select” button from any window where you need to enter a bank. Most often, banks are missing when adding bank accounts of parties or banks to 1C;

- Then click on “Load classifier...”. In a new window, select downloading through the official 1C website or from a file on the ITS disk. Of course, you will find more detailed information on the website, but usually the supplied ITS discs are the only option;

- Next, click on “Download” and wait for the classifier to update;

- If you have any problems with 1C servers, you can consider using alternative servers provided for cases where there is no connection with 1C servers. Go to the “All functions” menu and set “Use an alternative server to load the bank classifier” to “true”;

- Try downloading the classifier from the site again.

Check the availability of data in the database after downloading, if you updated for it to appear. Next, return to the directory and add all the jars from the classifier. The operation of updating classifiers in 1C 8.3, standard configurations and other areas is carried out in the same way.

Do you have any questions or need help from 1C specialists? Call!

Receipt of advance payment

The receipt of partial payment for the upcoming delivery of goods (operation 3.1 “Receipt of advance payment from the buyer”) is reflected in the program using the document Receipt to the current account with the transaction type Payment from the buyer, which is generated:

- based on the document Invoice for payment to the buyer (menu Sales -> Sales, document log -> Invoices for payment to the buyer);

- or by adding a new document to the Bank statements list (menu Bank and cash desk -> Bank, document journal -> Bank statements).

As a result of posting the document, the following accounting entry is entered into the accounting register:

Debit 51 Credit 62.02 - for the amount of the received prepayment, which is 600,000.00 rubles.

In accordance with paragraph 1 of Article 154 of the Tax Code of the Russian Federation, upon receipt by the taxpayer of payment, partial payment for upcoming supplies of goods (performance of work, provision of services), which are taxed at a tax rate of 0% in accordance with paragraph 1 of Article 164 of the Tax Code of the Russian Federation, such payment to the tax the base does not turn on. Consequently, the seller does not have the obligation to calculate VAT on the received advance payment amount and prepare an invoice.