Learning to avoid mistakes in DT

The Baltic Customs, when exercising control and supervision over currency transactions related to the movement of goods across the customs border of the Eurasian Economic Union (EAEU), as well as the import into and export of goods from the Russian Federation, analyzed the errors most often made by participants in foreign economic activity (FEA). ) when filling out declarations of goods (DT).

Particular attention was paid to the incorrect indication of information in the columns used for currency control purposes. As an analysis of the DT database for 9 months of 2015 showed, 218,085 DT were issued in the area of activity of the Baltic Customs. In 694 DTs, errors were made in the columns used for the specified control. In this case, we are talking about column 22 “Currency and total value of the account”, column 24 “Nature of the transaction” and column 44 “Additional information/Documents submitted”.

The information given in Diagram 1 indicates that the largest number of errors by declarants is made in columns 24 and 44 of the declaration of declaration, and slightly less in column 22 of the declaration of declaration. Other errors are little more than a percentage. Analysis of the data obtained showed that more than 60% of errors during declaration are “errors of the same type” within one or two DT columns. Below we will offer a detailed analysis of such errors.

Initially, examples are considered detailing the errors made when filling out columns 22 and 42 of the DT used for currency control purposes. The most common errors are indicated in diagram 2. It can be seen that two types of errors are most often detected: incorrect information about the currency code is declared and there is no information about the currency code.

Diagram 1

Diagram 2

Picture 1

Speaking about the statement of false information about the currency code (Figure 1), it should be noted that, as a rule, this type of error is made under foreign trade contracts when two and/or more currencies are used to determine the price of a product. For example, the contract stipulates that prices for goods can be determined by the resident both in US dollars and in euros or other currencies. In this case, in order to comply with the currency legislation of the Russian Federation, a transaction passport is issued at an authorized bank, where the main currency is US dollars. However, upon the next delivery of goods, the counterparty issues an invoice in euros. In the above example, the declarant erroneously stated in column 22 information about the price of the goods in the currency specified in the invoice.

Let us remind you that in accordance with the procedure for reporting information, approved by decision of the Customs Union Commission (CUC) dated May 20, 2010 No. 257 (as amended by the decisions of the Board of the Eurasian Economic Commission), column 22 DT can only be filled out in the currency of the transaction passport (if foreign trade contract is subject to the requirement to issue a transaction passport).

It should be noted that the payment currency (or the so-called currency clause) does not apply to the procedure for filling out column 22 of the DT. In the case of issuing invoices (invoices) in a currency other than the currency specified in the transaction passport, it is necessary to recalculate the cost of the goods given in the invoices into the currency specified in the transaction passport. Let us clarify that the procedure for recalculation is set out in the clarifications of the Office of Trade Restrictions, Currency and Export Control of the Federal Customs Service of Russia, sent by letter of the Federal Customs Service of Russia dated April 21, 2011 No. 14-99/18399. To prevent such errors, participants in foreign economic activity must verify information about the price currency code from the first subsection of column 22 of the DT with the information specified in columns 3 and 4 of section 3 “General information about the contract” of the transaction passport.

If we talk about the lack of information about the currency code in the DT, then, as a rule, this type of error is allowed for free deliveries. It must be remembered that information about the currency code of the contract price is declared in all cases.

Now about column 24 DT

The distribution of errors in column 24 is presented in diagram 3. It follows that two types of errors are most often identified: the first are made when stating the features of a foreign trade contract, the second are associated with a statement of the incorrect nature of the transaction.

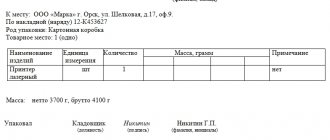

Let's start with an analysis of the mistakes made when declaring the features of a foreign trade contract. Thus, with the next delivery of a consignment under a foreign trade contract, the cost of which is less than 50 thousand US dollars, the feature code “06” is declared. It means that the transaction, based on its amount, is not subject to the requirement to issue a transaction passport (Figure 2).

Diagram 3

Figure 2

At the same time, the foreign trade contract within the framework of which the goods are moved is concluded for several thousand or millions of dollars and a transaction passport is issued for it at the authorized bank, information about which is usually indicated in column 44 of the DT.

In addition, errors when declaring the specifics of a foreign trade contract are allowed in the DT using transaction nature codes “050” - “060”. When declaring in columns 24 of the DT these codes of the nature of transactions on the right side of this column, it is not allowed to declare the features of a foreign trade contract other than the code “00” (“No features”). Exception: indicating the specificity code of a foreign trade transaction “07” when the transaction nature code is “058”.

Let's consider one of the fairly common examples of an error when declaring the incorrect nature of a transaction. One of them occurs when registering gratuitous supplies under paid contracts. In this case, it is necessary to declare information about the nature of the transaction “058” (“Free transaction”) from the “Other” section. They must be indicated instead of “018” (“Free delivery”) from the section “Paid transaction between a resident and a non-resident with settlements for goods being moved.”

In the lens of Count 44 DT

When filling out column 44 of the DT, as the analysis showed, three types of errors are identified, which are presented in diagram 4. The first is associated with inaccuracies allowed when indicating information about the number and date of the foreign trade contract, declared under the document type code “03011”. According to experts, such errors are most often the result of the inattention of those filling out the DT, who often make mistakes associated with adding an extra or failing to indicate the required character in the contract number; using the Latin alphabet instead of the Cyrillic alphabet; indicating instead of the contract date the date of the additional agreement changing it.

To avoid such errors, declarants must verify information about the number and date of the foreign trade contract under the document type code “03011” in column 44 of the DT with the information specified in columns 1 and 2 of section 3 “General information about the contract” of the transaction passport (Figure 3).

Diagram 4

Figure 3

Next, we will dwell on the mistakes made when declaring information about the transaction passport number (PS). One example is related to non-compliance with the format of the transaction passport number established by Bank of Russia Instruction No. 138-I dated June 4, 2012. Let us clarify that the number of the transaction passport issued after the entry into force of this instruction, that is, after October 1, 2012, can only end in the numbers 1, 2 or 3 (1 - legal entity or its branch, 2 - individual - individual entrepreneur, 3 - an individual engaged in private practice in accordance with the procedure established by the legislation of the Russian Federation). In the transaction passport issued before the specified date, the number ends only in “0”.

Information about the transaction passport number must be indicated under the document type code “03031”. In addition, mistakes are often made in indicating the number of the transaction passport, issued for another foreign trade contract and not related to the declared consignment.

The third category of errors is associated with the statement code “03999”. This refers to the indication of other documents confirming the right of ownership, use and (or) disposal of goods. This information is listed in Bank of Russia instruction No. 138-I dated June 4, 2012 “On the procedure for residents and non-residents to submit documents and information related to foreign exchange transactions to authorized banks, the procedure for issuing transaction passports, as well as the procedure for authorized banks to record foreign exchange transactions and control their implementation." This document does not apply to documents confirming in any way the right of ownership, use and (or) disposal of goods.

Summarizing the above, experts clarify that incorrect declaration of information in columns 22, 24 and 44 of the DT leads to the impossibility of receiving information about registered DT to the bank of transaction passports (PS), as provided for in the Regulations on the transfer by customs authorities of the Central Bank of the Russian Federation and authorized banks to electronic form of information on DT registered by customs authorities, approved by Decree of the Government of the Russian Federation dated December 28, 2012 No. 1459, and the bank automatically entering the PS into the bank control sheet under the specified agreement. In practice, this leads to the inability of the resident to carry out foreign exchange transactions for goods declared in the DT, or to a violation of accounting for foreign currency transactions already carried out by the resident.

Based on materials from the Baltic Customs

Material provided by the information and analytical review “Customs News”

&qt;

| December 16, 2015 / | Customs |

| Author / | Portal Administration | |||||

| print version |

| Tweet |

Filling out columns 2,8,9,14,15,17 of the goods declaration

In column 2 , according to the filling rules, the sender of the goods is indicated. Sender information is taken from transport documents. In the corresponding cells of the column the name of the organization is entered, as it looks, for example, in CMR, postal zone code, address, country. To select a country, you need to enter the country classifier in the program and select the required one. When exporting, this column will contain information about your organization (if you are the sender, of course); accordingly, fill in all the data in Russian, incl. TIN, KPP, OGRN (or OGRNIP). After filling out column 2, the program will prompt you to automatically change the contents of columns 15 (name of the country of departure) and 15a, b (code of the country of departure). If this does not happen, then you can select the country manually, again, from the classifier.

Column 8 - recipient of the goods - is filled in according to the same principle as column 2. i.e. The data is taken from the transport document. But if this is an import, then data about your recipient organization is entered in Russian, TIN, KPP, OGRN (or OGRNIP). Columns 17 and 17a ,b will be similarly filled in automatically, or selected in the column from the classifier. That is when importing, it will be “RUSSIA” and “RU”, respectively. If the data in column 8 coincides with the data in column 14, then the entry “ SM. COUNT 14 DT ".

The principle of filling out columns 9 and 14 is similar to the previous ones.

Column 9 indicates the person responsible for financial regulation, namely the contract holder. Those. upon import, if your legal entity. person (or individual entrepreneur) has entered into a contract and is the recipient of the cargo under it, then the contents of this column are copied from column 8. When exporting - from group 2. If the data in column 9 coincides with the data in column 14, then the entry “ SM. COUNT 14 DT ".

Column 14 contains information about the declarant. The declarant, according to Article 4 of the Customs Code of the Customs Union, is the person who declares the goods or on whose behalf the goods are declared. In this case, we do not mean the employee of your organization who fills out the declaration, but the legal entity itself. person or individual entrepreneur. Even if a customs representative submits the declaration for you, your organization will still be indicated in this column.

If you did not find the answer to your question in this material, then write to [email protected] and I will soon update the article.

You may be interested in the following: 1) We do customs clearance ourselves 2) We calculate customs payments 3) How to calculate the customs value?

If you find an error, please select a piece of text and press Ctrl+Enter.