What is a declaration of customs value?

Customs value is one of the most important characteristics of the transported goods.

It shows exactly how much money was spent on the purchase and transportation of cargo to the customs post. This indicator is used when calculating tax duties, when placing goods in a temporary storage warehouse and in many other procedures. The declaration reflects this indicator. It is an integral part of the main cargo declaration and is always submitted along with it.

The information contained in the declaration must always be supported by documents. Otherwise, it has no legal force and cannot be used in basic customs procedures. Customs may refuse to accept the goods.

Having a problem? Call our customs specialist:

Moscow and region (call is free)

Saint Petersburg

Calculation of customs value

How to calculate this indicator? There are several basic methods for carrying out this procedure.

At the price of the transaction with the transported products

The first method is to calculate the indicator based on the transaction price. It is the most common among all the others. The formula for calculating the tariff in this way includes:

- Directly the price of the transaction in which transported goods are involved.

- Additional expenses.

What expenses can be considered additional? It can be:

- Buyer costs that were not included in the final market value of the product.

- The total cost of goods that the buyer received at a large discount or for free.

- The price of intellectual work, etc.

But this method is not used in all cases. It is not suitable if:

- The supplier provided an incomplete package of documents.

- It is impossible to find the exact tariff for transported products.

- The buyer does not have all rights to the products in full.

In this case, other methods are used.

The declaration of customs value is submitted together with the State Duma.

At transaction price with identical products

This method is similar to the previous one. A significant difference is that to determine the indicator, the price of transactions is used not with the transported product, but with its analogue.

The main condition is the deadline for importing identical products. It is 90 days. To determine the customs value, the lowest market indicator is used.

At the transaction price for similar goods

The third method is to determine the price of a transaction with homogeneous goods.

Homogeneous goods are those that have similar parameters and characteristics to the products involved in the procedures. They are not completely identical, but can be used to calculate the desired indicator.

As in the previous method, the lowest indicator on the market is selected for calculation.

Subtraction

The essence of this method is to use it to calculate prices for homogeneous and identical products. But they are reduced by the following indicators:

- Expenses for transportation and sale of goods.

- Commissions.

- Tax payments.

- Profit allowances.

Thus, the indicator is calculated by deducting additional costs from the market value of homogeneous and identical products.

Addition of cost

The main essence of this method is that the customs value is the sum of the following indicators:

- Exporter's profit from sales of products on the territory of the Russian Federation.

- Expenses for transportation and sale of products.

- Production costs, etc.

Average indicators are used for calculations.

Backup method

This method is used only in exceptional cases, which is why it is called a backup method. It provides the least accurate information about the product.

To find the indicator, the practice of other exporters is used. Data provided by government agency. They take into account the experience of previous years in identical transactions.

Differences between methods

All of the methods listed above differ not only in the calculation principle, but also in the documentation used for registration.

When using the first method (calculating the indicator based on the transaction value of transported products), a declaration is drawn up in the DTS-1 form. Registration of all other methods is carried out using the DTS-2 form. This is the main difference between the main method and all others.

Indicators used for calculation

What indicators can affect the tariff size? These include:

- Market value of products. It is indicated in the official documentation by the supplier.

- Costs for transporting products.

- Cost of services for unloading and loading products.

- Cost of insurance services.

- Cost of packaging and packaging services.

- Preparation of documents.

- Additional expenses.

These indicators can greatly influence the final result.

In what cases is it not necessary to submit a DTS?

Not all transport procedures require the submission of a complete package of documents. The DTS is not filled out if:

- Goods that are not subject to tax duties are transported. They are not subject to taxation based on customs value. Therefore, a declaration with this indicator is not needed.

- Goods for which a temporary declaration is issued are transported. This practice is used if the carrier cannot provide the government agency with accurate information about the cargo being transported.

In these cases, filing a declaration is not necessary. The main document is submitted without this paper.

State Customs Code, DTS-1, DTS-2. Simplified customs clearance procedures.

To carry out customs control over goods transported across the customs border of the Russian Federation, participants in foreign trade activities must provide certain documents confirming their right to carry out foreign trade activities. As noted above, determining the customs value is the most important stage of customs taxation, since it is the taxable base.

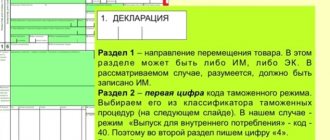

There are two ways to declare customs value. The first involves the use of a special declaration form (DTS-1 or DTS-2); the second allows for the declaration of customs value in the cargo customs declaration (CCD).

Form DTS-1 is intended for use when declaring customs value determined using method 1 (about 95% of all customs operations).

Form DTS-2 is intended for use in determining customs value using one of methods 2-6 in the manner prescribed by law. The DTS is an annex to the GDT and is not valid without it.

A cargo customs declaration (CCD) is a unified document that performs several functions. One of them is declaration, i.e. reporting to the customs office by participants in foreign trade activities all the necessary information about the goods (property) and about the foreign trade transaction that is carried out with foreign counterparties. Without submitting a cargo customs declaration, state customs control authorities do not accept goods and property for customs clearance for passage across the state border. Another function of the cargo customs declaration is a document-statement submitted by participants in foreign economic activity on the legality of the transaction, i.e., the compliance of all actions in the process of export and import operations with the legislation of the Russian Federation. The information specified in the cargo customs declaration must be in full compliance with other factual data presented for customs control of the goods (property). The presence of discrepancies between the information specified in the cargo customs declaration and the actual data discovered during customs control entails a delay of the goods and requires re-registration of the cargo customs declaration. The next function of the cargo customs declaration is confirmation of the legality of import and export of goods by customs control authorities. Customs control ends with identification marks from the customs office of the Russian Federation, after which the cargo customs declaration in the future acquires the meaning of a kind of international customs “passport” of goods, which has due legal force for foreign customs services and other governing bodies of the relevant foreign states. The presence of a cargo customs declaration is mandatory for customs clearance of goods in 98 countries with which Russia trades. The cargo customs declaration is also important as an accounting and statistical document. The cargo customs declaration is submitted to customs within the period established by law, which ranges from one day to two weeks, counting from the day the goods arrive at customs. The cargo customs declaration contains the number of the cargo document according to which the goods were accepted at customs (at port customs also the name of the ship on which the goods arrived), the tariff name of the goods or a link to the corresponding article of the customs tariff, the price and value of the consignment of goods. The cargo customs declaration also provides a list of documents usually attached to it (invoice, shipping specification, quality certificate, etc.). The cargo customs declaration is a set of four bound sheets TD1 (main sheet) and TD2 (additional sheets). There should be no erasures or blots in the cargo customs declaration.

The sheets of the cargo customs declaration are distributed as follows:

· the first sheet of the cargo customs declaration remains in the customs office and is stored in a special archive;

· the second sheet of the cargo customs declaration (statistical) - remains in the customs statistics department;

· the third sheet of the cargo customs declaration is returned to the declarant;

· fourth sheet of the cargo customs declaration:

o a) when exporting goods, it is attached to the shipping documents and sent along with the goods to the customs authority in the region of which the border checkpoint is located;

o b) when importing goods, it remains in the customs value department of the customs authority carrying out customs clearance.

Some countries allow the exporter or importer to submit a temporary or preliminary cargo customs declaration. The importer submits a preliminary cargo customs declaration when, by the time the cargo arrives at customs, he does not have accurate information about it. After unloading the goods and inspecting them, the importer submits a customs cargo declaration of the usual type. The exporter submits a preliminary cargo customs declaration when selling goods from a warehouse, supplying transit goods for which a refund of previously paid duties is provided, goods subject to various types of restrictions, etc.

Let us consider in more detail the procedure for processing and entering information into the declaration of customs value DTS-1 when using the method of determining customs value based on the transaction price of imported goods.

Example 1. A sales contract was concluded between a Russian (buyer) and a German (seller) for the supply of 100 pcs. to the Russian Federation. LCD computer monitors "Megascan" at a price of 250 euros per piece. for a total amount of 25,000 euros. The contract was concluded on the terms of delivery EXW-Hamburg <*> (Germany) in the amount of 25,000 euros. The condition of payment under the contract is 100% prepayment 15 days before delivery of the goods. The declarant submitted the following documents for customs clearance: 1) contract dated November 19, 2002 N 27-1 for the purchase of monitors; 2) invoice dated January 27, 2003 N 11-342 for the amount of 25,000 euros issued by the seller to the buyer for payment for goods delivered under contract dated November 19, 2002 N 27-1 on EXW-Hamburg (Germany) terms; 3) contract for the carriage of goods dated December 14, 2002 N 28-1001, concluded with the carrier for the delivery of goods from Hamburg to Moscow by road in the amount of 2,500 euros; 4) invoice dated January 29, 2003 N 03-612, issued by the carrier in the amount of 2,500 euros for the provision of goods delivery services; 5) an insurance policy in the amount of 27,500 euros, the insurance premium was 50 euros; 6) export customs declaration of the country of departure; 7) an invoice for the services of a customs broker in the country of export in the amount of 200 euros issued to the buyer; a copy of the payment order and an extract from the personal account of the enterprise, certified by the head and chief accountant of the enterprise, confirming the transfer of funds to pay for the goods from the personal account of the buyer to the account of the seller. From the presented documents it follows that there are no restrictions on the use of the method of determining customs value based on the transaction price of imported goods. The fact of interdependence between the seller and the buyer has not been established. The basis for calculating the customs value is the data from the sales contract and the invoice. Considering that under the basic EXW delivery conditions, the invoice issued by the seller to the buyer did not include the costs of delivering the goods to the customs border of the Russian Federation, it is necessary to make additional charges to the transaction price in accordance with the requirements of subparagraph “a” of paragraph 1 of Art. 19 of the Law of the Russian Federation “On Customs Tariffs”.

LCD computer monitors "Megascan" at a price of 250 euros per piece. for a total amount of 25,000 euros. The contract was concluded on the terms of delivery EXW-Hamburg <*> (Germany) in the amount of 25,000 euros. The condition of payment under the contract is 100% prepayment 15 days before delivery of the goods. The declarant submitted the following documents for customs clearance: 1) contract dated November 19, 2002 N 27-1 for the purchase of monitors; 2) invoice dated January 27, 2003 N 11-342 for the amount of 25,000 euros issued by the seller to the buyer for payment for goods delivered under contract dated November 19, 2002 N 27-1 on EXW-Hamburg (Germany) terms; 3) contract for the carriage of goods dated December 14, 2002 N 28-1001, concluded with the carrier for the delivery of goods from Hamburg to Moscow by road in the amount of 2,500 euros; 4) invoice dated January 29, 2003 N 03-612, issued by the carrier in the amount of 2,500 euros for the provision of goods delivery services; 5) an insurance policy in the amount of 27,500 euros, the insurance premium was 50 euros; 6) export customs declaration of the country of departure; 7) an invoice for the services of a customs broker in the country of export in the amount of 200 euros issued to the buyer; a copy of the payment order and an extract from the personal account of the enterprise, certified by the head and chief accountant of the enterprise, confirming the transfer of funds to pay for the goods from the personal account of the buyer to the account of the seller. From the presented documents it follows that there are no restrictions on the use of the method of determining customs value based on the transaction price of imported goods. The fact of interdependence between the seller and the buyer has not been established. The basis for calculating the customs value is the data from the sales contract and the invoice. Considering that under the basic EXW delivery conditions, the invoice issued by the seller to the buyer did not include the costs of delivering the goods to the customs border of the Russian Federation, it is necessary to make additional charges to the transaction price in accordance with the requirements of subparagraph “a” of paragraph 1 of Art. 19 of the Law of the Russian Federation “On Customs Tariffs”.

Since the invoice for the delivery of goods and the contract for the carriage of goods do not separately indicate the costs of delivering the goods before and after the place of import into the customs territory of the Russian Federation, the customs value includes the total cost of delivery - 2,500 euros. Also added to the transaction price are the costs of customs clearance of goods incurred by the buyer when exporting goods from the country of export, amounting to 200 euros. The amount of transport costs of 2,500 euros and the amount of customs clearance costs of 200 euros are converted into rubles at the rate established by the Central Bank of the Russian Federation on the date of acceptance of the cargo customs declaration for customs clearance, and the result is entered in column 17a of section B of DTS-1. Column 17c of section B of DTS-1 is calculated in rubles in the same way - the costs of cargo insurance (insurance premium), which amounted to 50 euros according to the insurance policy. The need to make other additional charges to the transaction price provided for in Art. 19 of the Law, was not identified from the submitted documents. The amount of data given in columns 17a and 17b must be indicated in column 18

“Total B” of section B of the DTS-1 form (Appendix No. 1,2).

Now let’s take a closer look at the procedure for processing and entering information into the declaration of customs value DTS-2 when using the method of determining customs value based on the transaction price of identical goods.

Example 2. To the Russian charity “A” (Volgograd), the Japanese organization “B” makes a free delivery of 50 pcs. Samsung Plano color TVs in accordance with the Free Supply Agreement dated September 18, 2003 N 09-01. The goods are delivered by air from Tokyo. During customs clearance, the declarant declared the customs value using the 1st method for determining the customs value. But since there is no purchase and sale transaction and there is no valuation of the goods in the submitted documents, the 1st method cannot be used. In accordance with Art. 18 of the Law, if the 1st method cannot be used, each of the methods for determining customs value is applied sequentially. For a previously made delivery under the purchase and sale agreement No. 48-2 dated 01.08.2003, the declarant declared information on the customs value of identical goods - 120 pcs. Samsung Plano TVs for $155 each. for a total amount of USD 18,600, which were sold for import into the territory of the Russian Federation and imported 20 days before the import of the goods being valued under FCA-Volgograd terms. There were no restrictions on the use of method 1. Accordingly, the customs value of the goods being valued can be determined using the method of determining the customs value based on the transaction price of identical goods and declared in the DTS-2 form. To confirm the declared information on the customs value of identical goods, the declarant presented documents that were submitted for a previously made delivery to confirm the validity of using the 1st method to determine the customs value of these goods, the transaction price of which was chosen as the basis for determining the customs value of the goods being valued: 1 ) cargo customs declaration and declaration of customs value (form DTS-1); 2) purchase and sale agreement No. 48-2 dated August 1, 2003 for the supply of 120 pcs. to the Russian Federation. Samsung Plano TVs on FCA-Volgograd terms; 3) invoice dated 05.08.2003 N 99-1, issued by the seller to the buyer to pay for goods in the amount of 18,600 US dollars; 4) a copy of the payment order and an extract from the personal account of the enterprise, certified by the head and chief accountant of the enterprise, confirming the transfer of funds from the buyer’s personal account to the seller’s account; 5) cargo transportation contract No. 34 dated August 10, 2003 for the delivery of goods from Tokyo to Volgograd, concluded by the buyer with the carrier for the amount of $1,000; 6) invoice dated August 28, 2003 N 75-001 for the delivery of cargo issued by the carrier to the buyer in the amount of $1,000; 7) an insurance policy in the amount of $18,600, the insurance premium was $37. Also, for customs clearance, the declarant submitted the Agreement on Free Delivery dated September 18, 2003 N 09-01. From the presented documents it follows that there were no restrictions on the use of the 1st method to determine the customs value of previously delivered goods. The transaction price for identical goods is taken as the basis for determining the customs value of the goods being valued. Since identical goods are imported in a different quantity, it is necessary to make an appropriate adjustment to their price taking into account these differences (Clause 2 of Article 20 of the Law). Since identical goods were imported under FCA-Volgograd terms, the costs of transporting and insuring the goods to the place of import into the customs territory of the Russian Federation were borne by the buyer. Consequently, these expenses are subject to additional accrual to the transaction price. An example of entering information into the DTS-2 form is given in Appendix No. 3.4.

Filling out the declaration

Correctly filling out the declaration will allow you to carry out the procedure for registering goods much faster. Even the most minor errors in a document can cause it to lose its legal force. To fill out the DTS, it is better to use special forms.

A declaration of any form consists of two sheets. The first sheet indicates basic information about the transported goods (quantity, customs value, characteristics and functions, etc.). The amount of fees will depend on the correctness of filling out this data.

When submitting a DTS, you need to prepare for the fact that customs may require additional documents that can confirm the accuracy of the information provided.

The second sheet should contain detailed information about the method for calculating the indicator.

Additional documents

All data specified in the declaration must be documented. It has no legal force if the following documents were not provided to the customs authority when submitted:

- Contract of sale.

- Constituent documents.

- Documents confirming the fulfillment of the obligation to pay customs duties, as well as methods for their calculation.

But this list can be supplemented at the discretion of the customs authority. The list of additional documents includes:

- License.

- Invoice.

- Accounting papers.

- Additional papers on all payments (commissions, funds in favor of the seller, etc.).

- Supply agreement.

- Documents containing information about the cost of goods and methods for calculating it.

- A copy of the declaration.

- Documents containing information about the main characteristics and functions of products, etc.

All these documents may be needed by the customs authority to confirm the information specified in the declaration and calculate customs duties.

Filling cost

Filling out a DTS is a rather complex procedure that requires special knowledge in the field of foreign trade activities and experience in drawing up such documents. If you are a “newbie” and have never dealt with customs clearance of cargo before, you should use the services of a customs broker.

An international customs broker is a specialist who is hired to conduct customs clearance. He can take responsibility not only for filling out the declaration, but also for performing other procedures:

- calculation and payment of customs duties,

- communication with customs officers,

- placement of cargo in temporary storage warehouses, etc.

The standard cost of filling out a customs value declaration is 1-2 thousand rubles.

Carefully! There are a large number of “black” brokers operating on the market. They do not have a license to carry out professional activities, therefore, they cannot provide their clients with 100% quality guarantees for their services.