Transactions concluded with foreign counterparties for the shipment or supply of commercial products are regulated by certain regulations and requirements, compliance with which is an important condition. First of all, this concerns document flow - timely and competent execution of accompanying documentation allows, for example, to avoid difficulties with going through customs or submitting an application to participate in a federal tender, where standards for suppliers are strictly prescribed. For market participants, it is important that all information provided is consistent, including the country of origin of the product, the criteria and rules for determining and designating which in the EAEU Labor Code are enshrined in the provisions of the current international agreement.

General overview

The specified document regulating the issue under consideration was signed in Yalta in 2009, and includes a number of specific rules that should be taken into account when registering transactions and financial transactions. Based on the content, each state that has ratified the agreements reached and in whose territory the product was produced or underwent significant processing in accordance with established legal standards is the country of origin of the product.

It is important to take into account that there is a difference between this concept and the wording characterizing the name of the place of receipt of products - in accordance with the Civil Code (Article 1516), in the second case a specific territorial location is meant, which is strongly associated with the unique features of production. As an example - Vologda butter, Tula gingerbread, etc. In addition, there is a difference from such a term as the location of the manufacturer. Thus, if one of the market participants plans to submit an application for a state or municipal tender, the indication of the manufacturer, and not the country of origin of the goods according to the classifier and register of names, as prescribed by 44-FZ, is the basis for the customer to make a negative decision - due to inconsistency of the documentation.

It is also worth noting that the state in which the trademark is officially registered and the actual place where the product is manufactured are not always the same region. Today, it is a common practice in which large corporations, licensed in the USA or Germany, organize manufactories in the territories of third world subjects, thereby significantly reducing labor costs and tax costs.

Difference between Russia and Russian Federation

The existence of a connection between the names in question is presented in the main document of the state - the Constitution. According to Article 1 of Chapter 1 of the Supreme Law, the country of Russia or the Russian Federation are identical names of our state, which have the same legal status. That is, it is fair to pronounce and write both the first name and the second - the semantic load of this will remain unchanged.

Russia has the legal status of an autonomous state with officially defined territorial borders. In the country of Russia or the Russian Federation, state bodies are endowed with sovereignty - the right to independently form political decisions regarding domestic policy and vision of the external world situation, regardless of what the highest authorities of other states think.

How to determine the country of origin of a product

The following list of rules applies to products that have completely gone through the production cycle or have undergone significant processing in the territory of one of the states participating in the previously mentioned Agreement. Completely produced include:

- Resources of natural origin, the extraction of which is carried out in the bowels of the earth, bodies of water or airspace.

- Products of plant and animal groups, cultivated, grown and collected within the subject.

- Commercial catch resulting from hunting or fishing on the territory of the country.

- Products obtained during the processing of raw material reserves as a result of marine fishing, as well as selected from the bottom or subsoil of waters beyond territorial borders - in cases where the exclusive right to develop them is secured within the framework of international agreements.

- Industrial waste and secondary raw materials, as well as products that have already been in use, the condition of which is suitable only for recycling.

- High-tech products used in the space industry.

When considering how to find out the country of origin of a product, it is worth considering the manufacturing and production criteria applied within the framework of the cumulative method - that is, when the processing of the source material was carried out sequentially. If the final product was created in the territory of one of the states participating in the Agreement, but raw materials were used for this, received from other entities of similar status, which is confirmed by a certificate of the ST-1 form, the region where the final phase of production was carried out is determined as the final product. But in cases where there is no certification document, the basis of sufficient processing is applied - the same as in the presence of a third party that is not a party to an international treaty. In the latter version, the key criteria are:

- The fact of a change in the nomenclature position of foreign economic activity in at least one of the first four characters, which is a consequence of processing.

- Implementation of a sufficient number of stages of the production and technological cycle to allow products to be attributed to a specific country of origin.

- Application of the ad valorem share rule, which determines whether the price of consumed foreign raw materials reaches a certain fixed percentage of the total cost.

If the raw materials are foreign, the Agreement on the Rules for Determining the Country of Origin of Goods requires that the territory of final production of the product be designated as the TPO. The exception is situations in which the commodity item of the raw material is identical, and its cost does not exceed 5%.

Appellation of origin and geographical indication: how will they differ?

Geographical indication as a designation separating goods

Geographical indications are means of individualization, however, they are usually compared not with popular trademarks in this area, but with less frequently registered appellations of origin of goods. The reason for this state of affairs lies in the following circumstances:

- Both types of designations contain an indication of the name of a geographical object, the features of which determine the specific characteristics or indicators of the product.

- The territory whose name (or a derivative thereof) is used must be the place of manufacture of the goods identified by this designation.

- It is permissible to use one means of individualization by an unlimited number of persons who, independently of each other, have received the right to use the designation.

- Compared to trademarks, geographical indications and appellations of origin only partially contain fantasy elements. First of all, such designations are aimed at creating an association in the consumer between the characteristics of the product and the geography of the place of origin. Therefore, the main role is assigned to the verbal element indicating the name of the territory.

Differences between geographical indications and appellations of origin of goods

The following are examples of the means of individualization under consideration [1]:

| Geographical indication (those that can be registered prospectively) | Name of place of origin of the goods |

| Russian caviar | Russian vodka |

| Kamchatka crab | Vologda oil |

| Penza maple syrup | Bashkir honey |

A comparative analysis reveals similarities in designations and raises doubts about the validity of the simultaneous existence of a geographical indication and an appellation of origin of a product. Why allow the registration of two means of individualization that seem, at first glance, to be identical in nature and content? In this case, it should be noted that despite the presence of a number of similar features, the concepts being studied also have features that will explain the need for both legal institutions.

The differences between geographical indications (hereinafter GI) and appellations of origin (hereinafter AO) can be classified on the following basis:

- Depending on the designation applied for registration.

Any designation that allows a product to be linked to its place of origin is intended to be protected as a GI. Only a verbal designation, including the name of a geographical object, can be registered as an NMPT.

- According to the degree of popularity of the means of individualization.

To apply for a GI, it is acceptable to be able to identify the product and the territory of origin. When registering an innovative product, it is important that the designation becomes recognizable as a result of its use in relation to the product.

- Depending on the characteristics of the product.

To provide legal protection for a GI, the applicant attaches information about the quality, reputation or other specific characteristics of the product determined by the place of origin. In the case of ADP, special properties of the product are required.

- According to the degree of location of production within a geographical entity.

For a designation to qualify for GI status, it is sufficient to have at least one stage of production within the specified territory. When a person applies for the right to use an appellative product, a mandatory condition is the location of all stages of production on a specified geographical site.

- Depending on documents confirming the relationship between the exceptional characteristics of the product and the place of origin.

To register a GI, the applicant independently provides information confirming certain product qualities, indicators and reputation, depending on the location of production. For a positive decision on the provision of a certificate for an original product, a conclusion from an authorized federal or regional body is required that the applicant is manufacturing a product with specific characteristics on the territory of the specified geographical area.

- According to the sign of protection, which indicates that the owner has exclusive rights and that the designation used is registered in the Russian Federation.

The feasibility of introducing the institution of geographical indications into Russian legislation

An analysis of the differences between the legal concepts under consideration allows us to conclude that registering an object as a geographical indication is more accessible and easier for manufacturers. To obtain the right to use the latter, it is sufficient to locate at least one stage of production within a geographical area. For example, raw materials can be brought for processing using traditional technologies for the region, or, conversely, crops grown in an area with unique and favorable climatic conditions will subsequently be processed at a plant located in an industrial zone. Another positive aspect is that there is no need to present a conclusion from a government agency, which often becomes the cornerstone in obtaining a certificate of appellation of origin of a product.

As noted at the meeting of the Federation Council on Registration, Legal Protection and Protection of Geographical Indications: “...today, there are 170 registrations of ATMs in force in the Russian Federation, 135 of them are Russian. At the same time, more than 3,000 geographical indications and appellations of origin of goods are protected in the European Union.”[2] Obviously, such modest indicators are largely due to the difficulties that arise when filing an application and subsequently obtaining a certificate for the appellation of origin of a product, as well as the low level of awareness of regional manufacturers about the benefits of using and registering such means of individualization. It is worth assuming that the popularization of regional brands and the introduction of the institution of geographical indications will lead to an increase in applicant activity and an increase in the number of registered designations containing geographical names located on the territory of Russia.

[1] See in more detail: Kiriy L. On the state and prospects in the field of registration, legal protection and protection of geographical indications // URL: https://rupto.ru/content/uploadfiles/KiriyIPForum2019.pdf

[2] See in more detail: Federation Council: Subjects of the Russian Federation began to pay more attention to the promotion of regional brands // URL: https://rupto.ru/ru/news/sovet-federacii-subekty-rf-stali-udelyat-bolshe-vnimaniya -prodvizheniyu-regionalnyh-brendov

Source: https://zuykov.com/ru/about/articles/2019/07/11/naimenovanie-mesta-proishozhdeniya-tovara-i-geogra/

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

Eurasian Economic Commission

Article 58. General provisions on the country of origin of goods1. The country of origin of goods is considered to be the country in which the goods were completely produced or subjected to sufficient processing (processing) in accordance with the criteria established by the customs legislation of the Customs Union. In this case, the country of origin of goods can be understood as a group of countries, or customs unions of countries, or a region or part of a country, if there is a need to distinguish them for the purpose of determining the country of origin of goods.

2. The country of origin of goods is determined in all cases where the application of customs tariff and non-tariff regulation measures depends on the country of origin of the goods.

3. Determination of the country of origin of goods is carried out in accordance with international treaties of the member states of the customs union regulating the rules for determining the country of origin of goods.

Determination of the country of origin of goods originating from the territory of a member state of the customs union is carried out in accordance with the legislation of such a member state of the customs union, unless otherwise established by international treaties.

4. Customs authorities may make preliminary decisions on the country of origin of goods in the manner established by the legislation of the member states of the customs union.

Article 59. Confirmation of the country of origin of goods

1. To confirm the country of origin of goods, the customs authority has the right to require the presentation of documents confirming the country of origin of goods.

2. Documents confirming the country of origin of goods are a declaration of origin of goods or a certificate of origin of goods.

Article 60. Declaration of origin of goods

1. A declaration of origin of goods is a statement about the country of origin of goods made by the manufacturer, seller or sender in connection with the export of goods, provided that it contains information allowing the country of origin of the goods to be determined. Commercial or any other documents related to goods are used as such a declaration.

2. If in the declaration of origin of goods information about the country of origin of goods is based on criteria other than those the application of which is provided for in international treaties of the member states of the customs union regulating the rules for determining the country of origin of goods, the country of origin of goods is determined in accordance with the criteria defined these international treaties.

Article 61. Certificate of origin of goods

1. Certificate of origin of goods is a document that clearly indicates the country of origin of goods and issued by authorized bodies or organizations of this country or the country of export, if in the country of export the certificate is issued on the basis of information received from the country of origin of goods.

If in the certificate of origin of goods information about the country of origin of goods is based on criteria other than those the application of which is provided for in international treaties of the member states of the customs union governing the rules for determining the country of origin of goods, the country of origin of goods is determined in accordance with the criteria defined by these international contracts.

2. When exporting goods from the customs territory of the Customs Union, a certificate of origin of goods is issued by authorized bodies or organizations of the member states of the Customs Union, if the specified certificate is required under the terms of the contract, according to the national rules of the country of import of goods, or if the presence of the specified certificate is provided for by international treaties.

Authorized bodies and organizations that issued a certificate of origin of goods are required to store a copy of it and other documents on the basis of which the origin of goods is certified for at least 3 (three) years from the date of its issue.

3. The certificate of origin of the goods is presented simultaneously with the customs declaration and other documents submitted when placing goods imported into the customs territory of the Customs Union under the customs procedure. If the certificate is lost, its officially certified duplicate is accepted.

4. If the certificate of origin of goods is issued in violation of the requirements for its execution and (or) completion established by the customs legislation of the customs union, the customs authority independently decides to refuse to consider such a certificate as a basis for granting tariff preferences.

5. When conducting customs control, the customs authority has the right to contact the authorized bodies or organizations of the country that issued the certificate of origin of goods with a request to provide additional documents or clarifying information. Such treatment does not prevent the release of goods on the basis of information about their country of origin declared when placing the goods under the customs procedure.

Article 62. Submission of documents confirming the country of origin of goods

1. When importing goods into the customs territory of the customs union, a document confirming the country of origin of the goods is provided if the country of origin of these goods in the territory of the customs union is granted tariff preferences in accordance with customs legislation and (or) international treaties of the member states of the customs union. In this case, a document confirming the country of origin of the goods is provided to the customs authority simultaneously with the submission of the customs declaration. In this case, the provision of tariff preferences may be conditioned by the need to provide a certificate of origin of goods in a certain form in accordance with the legislation and (or) international treaties of the member states of the customs union.

If there are signs that the declared information about the country of origin of goods, which affects the application of rates of customs duties, taxes and (or) non-tariff regulation measures, is unreliable, the customs authorities have the right to require the submission of a document confirming the country of origin of the goods.

2. Regardless of the provisions of paragraph 1 of this article, the provision of a document confirming the country of origin of goods is not required:

1) if goods imported into the customs territory of the Customs Union are declared for the customs procedure of customs transit or the customs procedure of temporary import with full exemption from customs duties and taxes, except in cases where the customs authority has detected signs that the country of origin of the goods is the country of origin of the goods which are prohibited for import into the customs territory of the customs union or transit through its territory in accordance with the customs legislation of the customs union or the legislation of the member states of the customs union;

2) if goods are moved across the customs border by individuals in accordance with Chapter 49 of this Code;

3) if the total customs value of goods transported across the customs border, sent at the same time in the same way by the same sender to the same recipient does not exceed the amount established by the Customs Union Commission;

4) in other cases provided for by the customs legislation of the customs union.

Article 63. Additional conditions for placing goods under the customs procedure when determining their country of origin

1. In the absence of documents confirming the country of origin of goods, if their presentation is mandatory for the provision of tariff preferences, in respect of such goods customs duties are subject to payment at the rates applicable to goods originating from the territory of a foreign state (groups of foreign states) with which there is mutual contractual obligations to provide treatment no less favorable than the treatment provided to other states (groups of states) (hereinafter referred to as the most favored nation treatment), except for the case provided for in subparagraph 1) of paragraph 2 of this article.

2. In other cases of absence of documents confirming the country of origin of goods, or if signs are detected that the submitted documents are executed improperly and (or) contain false information, before submitting documents confirming the country of origin of goods or clarifying information:

1) in respect of goods, customs duties are subject to payment at the rates applied to goods originating from the territory of a foreign state (groups of foreign states), with which there are no mutual contractual obligations to provide most favored nation treatment, if the customs authority has detected signs that the country of origin the goods are a foreign state (group of foreign states), with which there are no mutual contractual obligations to provide most favored nation treatment, or security is provided for the payment of customs duties at the specified rates;

2) the placement of goods under the customs procedure is carried out subject to the presentation by the declarant of documents confirming compliance with the established restrictions, or ensuring the payment of special, anti-dumping or countervailing duties, if the customs authority has detected signs indicating that the country of origin of the goods is the country for the import of goods from which restrictions have been set. Ensuring the payment of special, anti-dumping or countervailing duties is carried out in the manner prescribed by this Code to ensure the payment of import customs duties;

3) the placement of goods under the customs procedure is not carried out only if the customs authority has detected signs indicating that the country of origin of the goods may be a country whose goods are prohibited for import into the customs territory of the customs union.

3. In relation to the goods specified in paragraph 1 and subparagraph 1) of paragraph 2 of this article, the regime for granting tariff preferences or the most favored nation regime is applied (restored), subject to confirmation of the country of origin of these goods before the expiration of 1 (one) year from the date of registration by the customs customs declaration authority. In this case, the paid amounts of import customs duties are subject to refund (offset) in accordance with Chapter 13 of this Code.

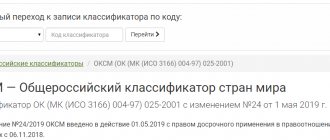

All-Russian classifier

Resolution No. 529, approved by the State Standard of the Russian Federation, became the basis for the creation of a general register, which today is not difficult to find in open sources. Its use is important from the point of view of preventing possible errors made when writing letter and number codes. In accordance with OKSM, each region of origin of the goods - Russia, China, the USA, as well as the countries of the European Union - Italy, Germany, etc. — the directory assigns a digital code and a specific name, the correctness of which is strictly controlled when checking the completion of the relevant fields of the declaration or accompanying documents.

Declaration

A declaration of origin is a statement made by the manufacturer of the product, its seller or the person who ships it from the country of origin. The declaration includes information on the basis of which it is possible to determine in which country the product was produced. A declaration of origin of a product can be considered, for example, commercial or other documents related to this product.

In the territory of the Customs Union, the same rules apply to declarations as for certificates. That is, if the country of origin indicated in the declaration is determined by any criteria different from those adopted in the EAEU, then local criteria should be used.

Last changes

Since January 2021, updated rules have come into force, according to which the states where certain types of government procurement items were manufactured must be determined. The purpose of implementing the regulations agreed upon by the Council of the Eurasian Economic Commission is to regulate such supplies, taking into account the specifics of the applied national regimes, which provide for certain restrictions. The new provision is relevant for all participants of the EAEU.

The procedure for determining the countries, the list of which is indicated in the appendix to the document, is based on conditions, production and technological operations, divided into several areas:

- railway engineering industry;

- light industry;

- wood processing, chemical and oil and gas sectors;

- machine tool building and production of special machines, furniture, refrigeration and compressor equipment.

In cases where manufacturers do not comply with the established procedure, the parties to the agreement have the right to introduce a transition period, limited in duration, and temporarily excluding suppliers of a particular state from the list of applicants for submitting bids in tender procurements.

Supplied or Used Product: What's the Difference?

Unfortunately, the difference between “used” and “supplied” goods is not legally established. At the same time, it is quite obvious that when amending Law No. 44-FZ in this part, the goal was to eliminate unreasonable requests by customers for characteristics for a huge list of goods, including those that are fundamentally unimportant to the customer, in order to reject applications from “undesirable” procurement participants, when The subject of procurement is work or services.

The most common case is procurement for current repairs, in which customers, as part of the application, require indicators for almost all goods from the estimate. This is done in such a way that only a limited number of participants can fill out the application correctly. As a rule, 1-2 procurement participants. The rest must make mistakes so that their applications are rejected for formal reasons.

In layman’s understanding, the following difference can be made between “supplied” and “used” goods:

Supplied goods are those that are transferred by the participant to the customer independently and are not consumed when performing work or providing services (for example, medical equipment, furniture, etc.).

Used are those goods that are consumed when performing work or providing services (for example, detergent, wallpaper, glue, paint, etc.).

Indirect signs of the goods supplied are: independent accounting of these goods by the customer, including placing them on the balance sheet, transfer of goods according to invoices, etc. However, the absence of such signs does not indicate that the goods are “used” and not “supplied”.

How to determine where a product was made

A memo containing instructions for establishing the place of manufacture of imported products imported into the territory of the EAEU was agreed upon by the board of the Eurasian Economic Commission and contains instructions on how the Russian origin of a product is determined. This aspect is relevant in light of the requirements for organizing public procurement. The conditions allowing recognition of territorial affiliation include:

- Complete receipt or implementation of the production cycle in a specific region.

- Sufficiency of processing of foreign materials.

In cases where foreign raw materials or workpieces were used in the manufacture of products, the country may be recognized as a manufacturer if the following circumstances exist:

- Processing or production operations have resulted in a change in the classification code defined by the Harmonized Description and Coding System at the level of one of the first four digits.

- The cost of the materials used, determined based on the calculation results, does not exceed 50% of the final price value.

For products similar to the range covered by legislative measures protecting the domestic market, residual criteria are also applied, in most cases making it possible to clarify where exactly the production cycle was carried out:

- If the production process was carried out using resources received from one region, different from the place of their actual processing, the subject of receipt is indicated in the documents, declarations and certificates confirming the country of origin of goods, works or services.

- When using materials originating from several countries, priority is determined based on the ratio of the shared costs of all components.

- Determining the origin of goods: legal basis

Determination of the origin of goods is based on the provisions that are established:

- Chapter 4 of the Customs Code of the Eurasian Economic Union;

- Chapter 4 of the Federal Law of August 3, 2018 No. 289-FZ “On customs regulation in the Russian Federation and on amendments to certain legislative acts of the Russian Federation”;

- Article 37 of the Treaty on the Eurasian Economic Union.

The origin of the goods is the origin of the goods in the country in which the goods were fully received, or produced, or subjected to sufficient processing in accordance with the criteria for determining the origin of goods. A country can be understood as a group of countries, or a customs union of countries, or a region or part of a country, if there is a need to distinguish them for the purpose of determining the origin of goods.

Determination of the origin of goods is carried out for the purposes of:

- application of customs tariff regulation measures (i.e. application of import customs duty rates, tariff quotas, tariff preferences, tariff benefits);

- application of prohibitions and restrictions (these include: non-tariff regulation measures, technical regulation measures, sanitary, veterinary-sanitary and quarantine phytosanitary measures, export control measures, measures regarding military products, and radiation requirements);

- application of measures to protect the domestic market (special protective, anti-dumping and compensation measures);

- establishing requirements for marking the origin of goods;

- implementation of state (municipal) procurement;

- maintaining statistics of foreign trade in goods.

Determination of the origin of goods in the customs territory of the Union is carried out according to uniform rules for determining the origin of goods imported into the territory of the Union.

If tariff preferences are not applied to imported goods, the Rules for determining the origin of goods imported into the customs territory of the Eurasian Economic Union (non-preferential rules for determining the origin of goods), approved by Decision of the Council of the Eurasian Economic Commission dated July 13, 2018 No. 49, are applied.

Such non-preferential rules are applied in trade carried out on the basis of most favored nation treatment, which is understood as an international legal regime, when each of the contracting parties undertakes to provide the other party with the same favorable conditions for economic, trade and other relations that it will provide in the future to any third state , its legal entities and individuals.

For the purpose of providing tariff preferences for goods imported into the customs territory of the Union from developing or least developed countries - users of the unified system of tariff preferences of the Union, the Rules for determining the origin of goods from developing and least developed countries, approved by the Decision of the Council of the Eurasian Economic Commission dated June 14, are applied. 2018 No. 60.

For the purpose of providing tariff preferences for goods imported into the customs territory of the Union from states with which the Union applies a free trade regime in trade and economic relations, the rules for determining the origin of goods established by the relevant international treaty of the Union with a third party providing for the application of a free trade regime are applied. .

Such agreements include:

- Agreement on the rules for determining the country of origin of goods in the CIS dated November 20, 2009;

- Rules for determining the origin of goods in the CIS, 1993 (applied in mutual trade with the Republic of Uzbekistan and Turkmenistan);

- Rules for determining the origin of goods under the Free Trade Agreement with Vietnam (EAEU-Viet Nam FTA's Rules of Origin);

- Rules for determining the origin of goods within the framework of the Interim Agreement leading to the formation of a free trade zone between the Eurasian Economic Union and its member states, on the one hand, and the Islamic Republic of Iran, on the other hand;

- Free trade agreement between the Eurasian Economic Union and its member states, on the one hand, and the Republic of Serbia, on the other hand.

The origin of goods is determined by the declarant and declared to the customs authority during the customs declaration of goods. In the declaration of goods, information about the origin of goods is stated in column 16 “Country of origin” and in column 34 “Country of origin code”. These columns indicate the short name (code) of the country (region or part of the country) in accordance with the classifier of countries of the world.

- Preliminary decisions on the origin of goods

The EAEU Customs Code establishes that in order to reduce the time of customs operations during customs declaration, at the request of persons, customs authorities make preliminary decisions on the origin of goods imported into the customs territory of the Union before the customs declaration of such goods.

A preliminary decision on the origin of goods is made for each item of goods imported into the customs territory of the Union from a specific country.

The attractiveness of preliminary decisions on the origin of goods lies in the fact that declarants can decide in advance on measures of customs tariff, non-tariff regulation and protection of the internal market, the application of which depends on the origin of goods (for example, the provision of tariff preferences, the use of bans or restrictions on the import of goods, etc. .) and plan your activities taking into account this information, which significantly facilitates both foreign economic activity itself and declaration.

Preliminary decisions on the origin of goods are applied in the territory of the Member State whose customs authorities made such preliminary decisions on the origin of goods, during the period of validity of such preliminary decisions on the origin of goods.

In the Russian Federation, preliminary decisions on the origin of goods are made by the Federal Customs Service of Russia on the basis of a person’s application submitted in the form of an electronic document signed with an enhanced qualified electronic signature of the interested person, using the federal state information system “Unified portal of state and municipal services (functions)” or a document on on paper.

The application must contain all the information necessary to make a preliminary decision on the origin of the goods.

In particular, the statement states:

- full commercial name, trade name (trademark);

- main technical and commercial characteristics of the product (functional purpose, grade, brand, model, article number, description of individual and transport packaging);

- product code in accordance with the Unified National Economic Code of the EAEU, its cost;

- materials from which the goods are made, their origin, codes in accordance with the Harmonized System for Description and Coding of Goods, cost;

- production and technological operations performed for the manufacture of goods.

The application is accompanied by examination certificates of chambers of commerce and industry and (or) other expert organizations of the country (group of countries, customs union of countries, region or part of the country) of the manufacturer of the goods and a certificate of origin of the goods in respect of which a preliminary decision on the origin of the goods is made.

Also, other documents confirming the information specified in it may be attached to the application: test reports, conclusions of specialists from expert organizations, which present the results of examination of the goods, documents confirming the completion of a transaction involving the movement of goods across the customs border of the Union, calculation of the cost of the goods produced, commercial invoices , accounting documents, a detailed description of the technological process of manufacturing the goods and other documents indicating that the goods were fully received, produced or subjected to sufficient processing (processing) in the territory of the country (group of countries, customs union of countries, region or part of the country) of origin of the goods , photographs, drawings, drawings, product passports and other documents necessary to make a preliminary decision on the origin of the goods. In addition, samples and (or) samples of the goods may be attached.

The application form for making a preliminary decision on the origin of goods and the procedure for filling it out were approved by Order of the Federal Customs Service of Russia dated December 5, 2019 No. 181 “On approval of document forms used when making a preliminary decision on the origin of goods, when such a decision is revoked and its validity is terminated, and their procedures filling out, as well as a notification form about the need to provide additional information.”

If the documents and information submitted by the applicant do not allow determining the origin of the goods, the Federal Customs Service of Russia sends the applicant, within twenty calendar days from the date of registration of the said application, a notice of the need to provide additional information.

Additional information is provided within sixty calendar days from the date of registration by the customs authority of the notification sent to the applicant about the need to provide additional information.

A preliminary decision on the origin of goods is made no later than sixty calendar days from the date of registration of the application for a preliminary decision on the origin of goods.

If it is necessary to provide additional information or if a certificate of origin of goods is sent for inspection, the specified period is suspended and resumed from the day the customs authority receives additional information or a response from the state body (authorized organization) that issued and (or) authorized to verify the certificate of origin goods.

A preliminary decision on the origin of goods is valid during the validity period of the certificate of origin of goods, on the basis of which such a preliminary decision was made.

The Federal Customs Service of Russia refuses to make a preliminary decision on the origin of goods in the following cases:

- if the applicant was previously issued a preliminary decision on the origin of the goods for the same goods that are indicated (described);

- if the additional information requested by the Federal Customs Service of Russia is not provided within the prescribed period or is not provided in full;

- if the application, documents attached to it, and the additional information provided requested by the Federal Customs Service of Russia contain conflicting information;

- if, as a document confirming the origin of the goods, a certificate of origin of the goods is presented, which is filled out in violation of the established requirements, or during the verification of the certificate of origin of the goods, it is revealed that the certificate of origin of the goods is not genuine and (or) contains inaccurate information;

- if the state body or authorized organization that issued and (or) authorized to verify the certificate of origin of the goods did not respond to the request sent by the Federal Customs Service of Russia.

If the customs authority or the applicant identifies errors that were made when making a preliminary decision on the origin of the goods and which do not affect the information about the origin of the goods, changes are made to such a decision.

A decision may also be made to terminate or revoke a preliminary decision on the origin of the goods.

The decision to terminate the preliminary decision on the origin of goods is made in the following cases:

- the customs authority has established that the applicant, in order to make this preliminary decision on the origin of the goods, submitted documents containing unreliable and (or) incomplete information, forged documents or unreliable and (or) incomplete information;

- The customs authority has identified errors that were made when making this preliminary decision on the origin of the goods and that affect the information about the origin of the goods.

The decision to revoke a preliminary decision on the origin of goods is made if changes are made to the rules for determining the origin of imported goods in terms of the criteria for determining the origin of goods that affect the determination of the origin of goods.

Additional material on the topic in the section Origin of goods

Video on the topic:

Differences from similar terms

The complexities of terminology at the initial stages can confuse entrepreneurs who are not familiar with the specifics of defining a specific territorial entity. There are several similar concepts that require market participants to be especially careful when preparing documentation:

- Designation of origin of products. In this case, we are talking about regions associated with unique products, be it the previously mentioned Tula gingerbread, or another stable combination.

- Manufacturer's location. Despite the apparent identity, the value is not identical to the country of production, which is due to the possible difference between the registration data and the actual location of production facilities.

In addition, it is important to take into account that the provisions enshrined within the framework of Article 33 of Federal Law-44 determine the list of requirements in accordance with which documentation must be drawn up. Such rules, in particular, indicate that the description of an object appearing as the subject of a tender should not contain references indicating trademarks, the name of the place of origin or the manufacturer.

Information about the product in the participant’s application

23.02.2020

From January 1, 2020, Federal Law No. 449-FZ dated December 27, 2019 fundamentally changed the approach to the content of an application in electronic procedures. We are talking about indicating information about the product offered by the participant for delivery or for delivery (use) when performing work or providing services.

It should be noted that the adoption of Federal Law No. 449 dated December 27, 2019 will in the near future give rise to a wide variety of contradictory administrative practices, which, in some cases, unfortunately, will end with the imposition of administrative responsibility on officials of customers and members of commissions

How to indicate in the application

Design is not particularly difficult, but requires a careful and thorough approach. The algorithm that allows you to comply with the existing regulations for participation in public procurement provides for the following sequence of actions.

- Find out what documents confirm the country of origin of goods, and whether it is necessary to indicate the results of examination reports when replacing after concluding a contract.

- Determine the place of manufacture using non-preferential rules.

- Indicate the states in the register for each nomenclature item, or make a note that the entire batch of products was produced by one entity.

- Enter the codes in accordance with OKSM.

As stated by the country of manufacture in the contract

Here's how to indicate the country of origin when purchasing services in a government contract: indicate the place of origin of the purchased item. This characteristic is indicated among other parameters of the procurement object directly in the text of the agreement or in one of the annexes to it - technical specifications or specifications.

There are no big peculiarities in how to specify the country of origin of the goods in the contract - the wording is copied from the text of the application of the winning participant.

About the author of this article

Polina GoltsovaLawyer My initial specialty was lawyer, legal consultant. For the first two years of practical activity, she worked in the general legal department of the organization, where she provided comprehensive legal support to the employer’s activities.

However, since 2013, government procurement has become the main focus of my practical activity. I worked in the contract services of several large budgetary institutions at the federal and regional levels and a commercial organization whose activities are related to government procurement. She was involved in legal support of government procurement, contractual and claims work, represented the interests of employers in arbitration courts and the Federal Antimonopoly Service.

For the last three years I have been creating legal content, writing popular articles on current issues of law enforcement for several information portals.

Other publications by the author

- 2021.12.06 Applications How the rules for evaluating applications of competition participants will change from 2022: PP 1085 is cancelled!

- 2021.11.15Customer documentsInstructions for the purchase of furniture under 44-FZ

- 2021.10.28 Bank guarantees All changes in 44-FZ for 2021 and 2022: tables by month

- 2021.10.18 Procurement control Instructions for drawing up an order for the appointment of a contract manager

Features of working with the electronic platform

A government decree published in February 2020 under No. 180 determines that bidders applying for a competition or auction, or submitting proposals, are required to select the attribute in question using the item qualifier when filling out the standard form. The official directory also contains a digital code of the country of origin of the goods (Russia - 643) for issuing a customs declaration, UPD, invoice, as well as other permits and accompanying documents. The technical specifications contain data for each item planned for delivery, use within the production process or provision of services. The responsibility of the customer, in turn, comes down to putting forward a requirement to provide the specified information, and their subsequent verification for compliance with legal standards.

Principles for filling out citizenship items

When filling out sections of forms and questionnaires, every uninformed Russian applicant may have problems filling out the submitted documents, which is why cases of their incorrect execution are common. A particularly popular and private question is what to write in the line “citizenship” and “nationality”. These terms are legally different. In the “citizenship” column, you must indicate the state whose direct subject is the applicant. It is correct to write in full, namely, “Russian Federation”, because not all authorities accept the spelling “Russia”. In the nationality section you need to indicate “Russian”, “Chuvash”, “Kazakh”, that is, the applicant’s belonging to an ethnic group.

Now you should understand how to write: the country is Russia or the Russian Federation. We also tried to describe individual cases when preparing documents regarding the indication of citizenship and nationality.

Difficulty filling out these lines may arise in a government agency in any country. Usually there is auxiliary information for filling out - forms, stands with a sample option. In some instances, specialists working there come to the rescue.

At the end of the article about how to write correctly: the country of Russia or the Russian Federation, we note that both versions are correct when used in oral speech and official documents, that is, they are equivalent and identical. However, in the latter it is recommended to stick to two-word spelling, excluding abbreviations to two letters.

How to confirm SPT

The presence of certain prohibitions, restrictions or conditions of admission, including those related to the application of national treatment, necessitates the need to confirm the country of origin of the goods by providing special documentation. Specific standards are fixed within the framework of government regulations and legislative norms - the list of documents that participants in public procurement may need includes:

- Certificate of expert opinion of the Chamber of Commerce and Industry.

- Certificate corresponding to form ST-1.

- An extract confirming inclusion in the register of products of the EAEU or the Ministry of Industry and Trade.

In addition, Order No. 126n of the Ministry of Finance, which came into force in 2018, determines the obligation of participants to declare the country of origin. This means that the relevant information must be included in the application, without providing additional information. It is important to take into account that the lack of supporting documentation is the basis for considering a product as imported by default.

What documents are confirmed by the SPT and where can I get them?

The agreement proposes a Certificate in form ST-1 and a declaration of conformity for confirmation of the SPT.

Certificate ST-1 can be found in Appendix 2 of the Agreement. It includes all the necessary information: consignor/consignee, name of the issuing country, vehicle and its route, Certificate number, etc. (see Fig. 3) The document is valid for 1 year from the date of issue.

The Declaration of Origin can be found in Annex 5 of the Agreement. It is signed by an authorized person of the seller/manufacturer/shipper of the product and looks like this:

To confirm the production of products on the territory of the EAEU, the ST-1 certificate and an examination certificate obtained from the Chamber of Commerce and Industry, or copies of investment contracts are often used.

If the customer has not requested additional documents, then the state of origin only needs to be declared. In this case, the contractor must provide reliable information, otherwise the customer may not sign the contract or terminate it unilaterally and send information about the supplier to the RNP.

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

Indication of the country of origin of the goods according to 44-FZ

From 2021, such a requirement is mandatory not only in cases where the subject of the transaction involves products to which a national regime is applied, limiting market access for certain products of foreign origin. As part of the preparation of tender documents, information about the state that is the manufacturer is indicated in the application, and, if necessary, supplemented with certificates and declarations submitted by the customer.

Concept

Federal Law 44 does not in any way disclose the concept of the country of origin of goods within the framework of procurement activities. In order to determine the official position regarding this term, you can refer to the explanatory letter of the Ministry of Economic Development. In letter No. D28I-1889 of 2014, customers were recommended to adhere to the concept that was enshrined in Part 1 of Art. 58 of the Customs Union.

According to it, the country of origin of a product is the state or several countries in whose territory the product was completely produced or processed.

Why is it necessary to indicate the country of origin in the application? The answer to this question is contained in Art. 14 44-FZ. It says here that for all purchases carried out by state and municipal customers, the national regime applies.

In addition, for some categories of goods produced in the EAEU countries (Russia, Belarus and Kazakhstan) 15% price preferences apply. The list of such goods is approved by Government Decrees.

The requirement to indicate the country of origin is mandatory in the documentation on open competitions under Part 2 of Art. 51 44-FZ and on electronic auctions under Part 3 of Art. 66 44-FZ.

Do requests for quotes need to include details about where the item was manufactured? Based on clause 6, part 3, art. 73 44-FZ, the requirement to indicate the country of origin is imposed by the customer only if the purchase is carried out within the framework of the national regime. In Art. 14 44-FZ establishes cases when foreign-made goods are not allowed for procurement, or their admission is limited.

In other cases, there should not be a clause that would require an indication of the country of production in the application for participation.