It is impossible to go through the customs clearance procedure without an invoice. It is prepared by the exporter of the goods. This document is an invoice that contains all the details of the order: the name of the product, its cost, a brief description of each item, as well as information about the seller and buyer, the names of the countries (sending and receiving).

In cases where you cannot receive the parcel at customs or go through the customs clearance procedure, you need to check the correctness of the documents and the invoice as well - this may be the reason. In controversial cases, it is better to contact a professional lawyer - he will help protect your rights and resume the process of exchanging goods.

Do you want to figure it out, but don’t have time to read the article? Lawyers will help

Entrust the task to professionals. Lawyers will complete the order at the cost you specify

7 lawyers on RTIGER.com can help with this issue

Solve the issue >

Key Aspects

Before entering the territory of the Russian Federation, all goods, parcels, and commercial cargo undergo preliminary control and inspection at the Federal Customs Service, or, more simply, at the customs or border. But quite often people are faced with a situation where cargo is delayed at the initiative of service employees. If the cargo is delayed, this does not mean that it cannot be received. It is quite possible to pick it up if the cargo does not contain goods and products prohibited for import. The main thing is to be patient and find out the reason for the delay of the cargo.

If the parcel contains goods and products prohibited for import, the parcel will be confiscated by customs officers and liquidated, so it will no longer be possible to pick it up.

Reasons why cargo may be delayed:

- The total cost of goods exceeds 1,500 euros. But this is only if a declaration was not issued for this parcel and customs duties were not paid. In this case, the cargo is delayed until customs duties and VAT are paid.

- The total weight of the goods exceeds 50 kilograms. If this norm is exceeded, you will need to pay customs duty in the specified amount, in accordance with the laws and regulations of the Customs Code of the Russian Federation.

- Presence of similar goods in the parcel. Example: a large number of identical jackets, phones, and sneakers from China will make you think that this package is not intended for personal use, but is a commercial cargo, which, in accordance with the laws, must be taxed upon import.

- The presence in the parcel of goods prohibited for import into the territory of the Russian Federation.

Why may a parcel be detained at customs?

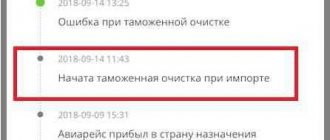

There are a number of reasons why goods from Aliexpress may get stuck at the customs clearance stage:

- Employees suspected the shipment was a commercial shipment (for example, the order contains a number of identical items).

- The cost of goods sent is deliberately underestimated.

- The weight of the parcel does not correspond to that stated in the accompanying documentation.

- The seller did not attach the necessary documents or there were errors in them.

- Customs needs to clarify information about the sender.

- The product is included in the list of prohibited imports (narcotics, weapons, spy equipment, valuable objects of art, etc.). In this case, the parcel is seized and an investigation is carried out.

- Counterfeit products that violate copyrights, such as counterfeit mobile phones, are being moved.

- The weight of the parcel exceeds the permitted limit of 31 kg and duty payment is required from the buyer.

- The total cost of goods is 200 euros or more. Or, orders to the same buyer for an amount exceeding 200 euros have already passed through customs within a month. In this case, the recipient is also required to pay a fee.

Note! To control duty-free limits, customs uses the TIN and passport data that the buyer indicates when placing an order on Aliexpress.

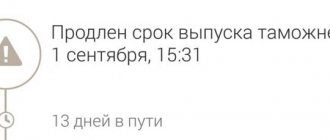

And if you become aware of the fact of the delay quite soon - through the mail tracking service, or from the delivery service, then no one will tell you the reason for the problems with customs. To find out, you will have to contact the customs office directly.

Prohibited items for shipment

The parcel can be confiscated only if it contains goods prohibited for import.

These products include:

- Any types and varieties of weapons.

- Drugs.

- Flammable substances.

- Any plants and animals.

- Waste hazardous to human life and the environment.

- Materials of all types containing pornographic or terrorist information.

- Materials of a Nazi nature.

- Human organs and tissues.

- Equipment for obtaining information.

- Alcohol products.

- Radioactive materials.

- Cultural values.

- Precious items (jewelry, antiques, etc.).

What acts regulate currency control?

The basic regulatory act of currency legislation is Federal Law dated December 10, 2003 No. 173-FZ . It requires legal entities and individual entrepreneurs who cooperate with foreign counterparties to undergo currency control and register transactions.

The second most important act of currency control is the instruction of the Central Bank of the Russian Federation dated August 16, 2017 No. 181-I . It establishes the procedure for processing foreign exchange transactions.

And, of course, we must not forget about the Federal Law of August 7, 2001 No. 115-FZ . Even if the settlement amounts are small, banks are required to monitor transactions in order to prevent the withdrawal of capital abroad through fictitious transactions.

For example:

- advance payment to a foreign partner without subsequent import of goods (false import);

- payment for consulting services at a cost that is many times higher than the prices for similar types of services;

- purchasing goods through a customs union country if the manufacturer is located in another state.

Delivery of goods from China to Russia

China is known as the world center for the production of the most popular goods. Therefore, it is not at all surprising that most people order products made in this country. Methods of transporting products from China to Russia:

- By air transport. But it is worth remembering that the transportation of flammable substances by plane is prohibited. Therefore, harmless, at first glance, hair and nail polishes, paints and batteries cannot be transported by this transport.

- By water. Almost all groups of goods are transported by this type of transportation. The advantage of transportation this way is that there is less chance of damage to the product. The downside is the impossibility of delivery to many cities that do not have access to the sea or river.

- By car.

- By rail.

The last two methods of transportation are considered the most popular and optimal both in terms of the cost of transportation and the possibility of delivery to any city.

Cargo delivery from China, auto delivery from China, air delivery from China

According to the law, every citizen has the right to import up to 50 kg of goods permitted for import with a total value of no more than 1,500 euros once a month. If a person receives parcels more often, this may already serve as a basis for delaying the cargo at customs.

How and when to open a dispute on Aliexpress

The standard period for a detained Aliexpress parcel to remain at customs is 14 – 30 days from the date of notification of the recipient, depending on the type of postal item. After this time, the order is sent back to China. It is at the moment when the track shows that the goods are being returned that you can begin negotiations with the seller. Perhaps he will not bargain when he sees that the parcel is already on its way, and will agree to return you the full cost of the goods.

If you yourself are to blame for problems with customs, a good compromise would be to agree on a refund, minus shipping costs. Agree to this option, because if you decide to escalate the dispute, Aliexpress may take the seller’s side, and you will lose not only the goods, but also the entire amount paid for the order.

Postal rules state that until the package is delivered to the buyer, responsibility for it lies with the seller. He is obliged to look for the loss himself, resolve issues with documents, and if the client does not receive it, compensate him for the cost of the goods.

However, in the case of customs returns, everything is not so simple. If a product ordered from Aliexpress is detained at customs, the site places the burden of proof on the buyer and gives him only 7 days to do so. Moreover, a screenshot from the order is, as a rule, not enough, and when opening a dispute they are required to provide “live” documents with stamps and signatures. At the same time, a request to the customs service to receive the necessary papers can be processed up to 30 days. Therefore, before opening a dispute, visit the postal distribution point.

Be sure to take with you:

- Passport (original and copy), TIN, parcel track number.

- Copies of documents of relatives, if the order contains the same type of goods, so that customs has no doubt that the items were purchased for their personal use.

- As complete information as possible about the products: their list, photographs, links, descriptions, purpose, etc.

- Bank statement confirming payment for goods, invoices, and other financial documents.

Try to resolve all issues with customs, if necessary, pay the duty. Based on the submitted request, the government service will issue you with official papers containing the justification for the refusal of customs clearance.

As soon as you have the documents in your hands, feel free to open a dispute and be sure to attach the scans within a week.

Don’t despair if you don’t have a customs office nearby to quickly collect your documents. When you open a dispute, write to the mediators that you live in a remote place and are unable to receive an answer within the allotted time frame. Attach a screenshot from the order with your address and Google Maps, where you indicate the distance to the nearest customs office. In the parcel tracking service, take a screenshot of the information about returning the parcel to the seller. Be sure to refer to the postal convention, which obliges the sender to be responsible for the parcel until it is delivered to the buyer.

Documents for currency control and deadlines for their submission

The larger the transaction amount, the stricter the bank’s control:

| Type of transaction | Transaction amount, thousand rubles. | |||

| up to 200 | 200 — 3 000 | 3 000 — 6 000 | > 6 000 | |

| What documents are required by currency control? | ||||

| Export | No documents needed. We only inform the bank of the transaction code* | Invoice, contract, acceptance certificate or other document so that the bank can determine the transaction code | Invoice, contract, acceptance certificate or other document so that the bank can determine the transaction code | The contract to be registered |

| Import (credit) | The contract to be registered | |||

*The transaction code can be found in the list (Appendix No. 1 to the Central Bank Instruction No. 181-I dated August 16, 2017).

As can be seen from the table, in case of serious transaction amounts, the resident needs to present a contract with a foreign partner to the bank. The bank will register the document and assign it a number. If there is no ready-made contract yet, you can submit a draft of it to the bank. The main thing is that the project is signed by the counterparty. The deadline for submitting the draft contract is no more than 15 days from the date of signing .

For all contracts that have been registered, a special form must be drawn up - a certificate of supporting documents (SPD). It is a list of documentation related to the execution of the contract.

The SPD is submitted within the prescribed period - no later than 15 days after the end of the month in which the transaction took place.

In particular:

- when shipping goods for export or when importing imports, the month of the transaction is the month in which the customs declaration was completed;

- when providing services - the month in which the acceptance certificate was signed.

Ak Bars Bank provides a full range of services for cash settlements in foreign currency for legal entities and individual entrepreneurs. We offer:

- free opening of foreign currency accounts when connecting to the package;

- receiving details immediately for accounts in dollars and euros;

- free consultations on foreign exchange transactions.

Open an account in dollars and euros online