HomeCustoms payments Single personal account (USA) at customs

The unified personal account of the Federal Customs Service of the Russian Federation, or ELS , is an account on the balance sheet of the Federal Treasury of the Russian Federation, which is administered by the Federal Customs Service of the Russian Federation. It is replenished by cash payments from legal entities engaged in foreign economic activity (FEA). They are registered in the ELS system of the Federal Customs Service of the Russian Federation and replenish this account. The deposited funds act as an advance on future payments at customs. That is, they will be debited from the account when declaring and paying duties, taxes, fees and excise taxes.

Important! The single personal account of the Russian Customs is currently available only to legal entities; a little later, the opportunity to open this account will become available to individual entrepreneurs.

Transfer to ELS from the payer’s personal account

Previously, legal entities declaring their goods were registered at customs and opened a LSP - a payer’s personal account. Payments related to customs clearance were written off from an account opened at a specific customs office. If the next consignment arrived at another customs post, the registration procedure had to be repeated. The transfer to the ELS system is intended to simplify the procedure for declaring goods, eliminating the need for foreign trade participants to re-register at each customs office. Now legal entities only need to register once as a participant in foreign economic activity through the Federal Customs Service, for which it is enough to submit an application.

Simultaneously with submitting the application, it is necessary to write off the remaining funds from the LSP. To do this, you need to make a request about the balance of funds in the account and submit it to all customs offices where payments under the registered LSP were previously administered.

This process is called “cash balance reconciliation.” Having received a response, the legal entity must send an application to each customs office for the transfer of the remaining funds to the customs Unified Personal Account. The transfer of funds from LSP to ELS takes no more than a week.

Documents and information for customs clearance of cargo at the customs of the Russian Federation

- Application for opening an ELS (Watch)

- Application for crediting cash balances in the context of payment documents to the ELS resource (View)

- Advance payment to the ELS account (See)

- Advance payment for payment of import customs duties from the ELS account (See)

- Advance payment for payment of anti-dumping duties from the ELS account (See)

- Advance payment for payment of VAT from the ELS account (See)

But what about those who previously paid customs duties through the payer’s personal account (PAA), but are not yet registered in the ELS system?

What is ELS

ELS is a customs account, the owner of which is an entrepreneur participating in foreign trade activities. Control over it is carried out by the Federal Customs Service of Russia.

System goals:

- Integration of electronic accounting of payments and duties at customs;

- Prompt exchange of data on the movement of payments from entrepreneurs participating in foreign trade activities (information is stored on the Federal Customs Service website);

- Timely notification of customs officers about payments sent to the accounts of the Russian Treasury.

The ELS can be compared to a safe deposit box of a legal entity: financial resources of participants in foreign trade activities are stored here for the payment of customs duties.

Before the introduction of the ELS by customs, the execution of a payment document required the correct entry of codes of the customs authority receiving the funds. If there were violations in the specified number or its absence, payment was delayed: in this case, the entrepreneur was forced to contact customs with a request to solve the current problem.

The introduction of the ELS allows users to make payments using a single, centralized advance payment system: this saves time and costs for customs clearance and transportation of goods through border posts.

How to open an ELS for a new foreign trade participant

For new participants in foreign trade activities registering for the first time in the Unified Logistics System of the Federal Customs Service and the Russian Federation who have not previously carried out foreign economic activity (unregistered with customs), the registration procedure will be as follows:

- Obtaining an electronic signature (this can be done through the Internet portal of the State Services).

- Registration on the website of the Federal Customs Service in the “Personal Account of a Foreign Economic Activity Participant” system

- Filling out an application for opening an ELS. The application must indicate information about the presence of subsidiaries and divisions in the company capable of declaring goods to customs.

- Submitting an application. This can be done using postal services or via the Internet.

- Agreeing on the account opening date and receiving a reconciliation report. Having received the application, government officials will contact the declarant to clarify the dates for opening the ELS and submitting the balance reconciliation report.

- Crediting the remaining funds to the Unified Personal Account. After receiving the statement on the balance, the declarant must submit a corresponding application for offset of the remaining funds on the LSP in favor of the ULS.

- Submitting an application. This can be done using postal services, through, or by fax. A copy of this document must be sent to the place where customs clearance of goods belonging to the declarant is carried out.

- Transfer of funds to the Unified personal account. When opening an ELS, it is done exclusively using code 10000010. It is important to note that customs authorities need several days to transfer funds from the declarant’s old accounts to the ELS, so it is recommended to immediately transfer funds using the new details, without waiting for the balances to be transferred.

For additional advice, you can contact the hotline of the Federal Customs Service of the Russian Federation

Reference information - postal address for sending applications: Novozavodskaya st., 11/5, Moscow, 121087, e-mail box

Advantages of ELS

- Finding the funds of a foreign trade participant in one account from which duties, VAT, fees for customs clearance or excise taxes are debited;

- High degree of transparency and ease of use. From now on, a legal entity has the right to declare goods at any customs without the need for mandatory registration. In this case, duties are paid from a single personal account in the ELS system. And since the TIN is indicated during registration in the ELS system, then when subsequently declaring goods, it is not necessary to provide any separate information, since it is enough to indicate the declarant’s TIN in the declaration.

Do you need customs clearance of goods, but do not want to register and receive a customs single personal account? – We will do it for you!

If your company carries out foreign trade operations on an ongoing basis, then registering on the website of the Federal Customs Service of the Russian Federation and receiving an Unified Certificate will simplify the procedure for clearing goods at customs. But if you declare goods periodically, or for the first time, then you do not have to register in the ELS system. You can entrust this task to the company's customs representative - a customs broker. She will perform customs clearance of your goods under her electronic digital signature (EDS) and pay your customs duties for you. The service is provided on a commercial basis and allows the foreign trade participant not to have any balances in the customs office on the unified transport system.

Single customs account

The development of electronic payment technologies has also affected the customs sphere: participants in foreign trade activities can see from their own experience how simplified the process of settling customs payments has become. We are talking about the ULS FCS - a single personal account of the payer.

The system simplifies customs payments and optimizes financial accounting within the Federal Customs Service of the Russian Federation. Now all related procedures are performed much faster.

Prime logistics company specializes in the delivery of goods from China to Russia only for large shipments from 50 kg

.

Delivery is carried out by any means of transport, including multimodal transport. Wholesale deliveries of goods are carried out both in individual containers (volume 20, 40.45 feet) and as part of consolidated cargo. In addition, we undertake customs clearance of goods, provide financial and legal advice, and provide warehouse services. Only for legal entities!

Leave a request or call

Customs broker services for payment of customs duties from the Unified Personal Account - ULS

Ours is a customs representative - broker and carries out professional customs clearance of any goods at any customs offices of the Russian Federation. If necessary, we make customs payments to the customs office for the client, which relieves him of the obligation to register the unified vehicle. We promptly fill out payment orders for payment of import and export customs duties, VAT, excise taxes, fees and process them through the “Round” and “Customs Card” systems for prompt receipt of funds to the customs account.

The cost of the customs payments transfer service in our company is 3% of the payment amount, but not less than 150 rubles per payment order.

We are confident that we will become your reliable partner in customs!

What are the advantages of ELS:

- minimizing the time it takes for money to be credited to payers’ accounts (reducing the time to a couple of hours);

- settlement with customs departments virtually from anywhere in Russia;

- full control of transactions by foreign trade participants in the “Personal Account” section on the FCS online service;

- a single details for payments of all types (code “10000010”) reduces the risk of errors when transferring funds;

- optimization and acceleration of customs clearance procedures.

How to find out the ELS for paying utility bills?

Each citizen can very quickly find out his single personal account. To do this, you need to go to the portal GIS Housing and Communal Services (State Information System of Housing and Communal Services) my.dom.gosuslugi.ru.

You need to log into the site and go through authorization. After passing, you will be able to log into your personal account and follow the “Connected personal accounts” link. Your accounts will appear at the bottom of the screen. Here, a single personal account will be indicated in a separate column. If the owner does not yet have a personal account, it can be connected. To do this you need to enter the following data:

- house address;

- indicate the apartment;

- The room number is indicated if a room is rented, for example, in a dormitory;

- any available payer identifier.

The facial code is generated automatically based on the information provided by the consumer. The encoding of a single personal account is as follows: the first digit is the designation of the control row, the second to tenth is the directly unique ULS number.

ELS is what helps a financial organization that accepts payments for utilities, contributions for repairs, pays fines and penalties, pays expenses for the maintenance of common property, etc., to identify the making of any of these payments as those related to housing and communal services. Information about payment is immediately transmitted to the Housing Information System.

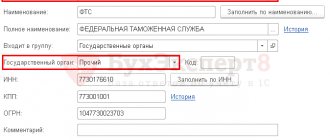

The Federal Customs Service of Russia issued Order No. 1039 dated June 26, 2019 “On approbation of the administration of a single resource of personal accounts... “Personal Accounts - ELS”” (previously Order No. 1329 of the Federal Customs Service of Russia dated August 24, 2018), which, in particular, established:

— Temporary procedure for working with the ELS resource of customs authorities and payers;

— the principle of the place of tax accounting when administering personal accounts of Russian legal entities, and in relation to individuals and foreign legal entities — the principle of performing a customs operation;

— automatic determination of the corresponding ELS according to the payer’s TIN specified in the payment or customs document, regardless of the checkpoint of the organization or its separate divisions. Information about the checkpoint is taken into account on the personal account to determine the place of its tax accounting, and, accordingly, the authorized administering customs authority;

- distribution of functions for administering payments between customs authorities, starting with the Federal Customs Service and ending with customs houses of declaration - departments for control of electronic payments (OKEP) of regional customs departments administer customs payments (manage ELS), while payment departments of customs houses of declaration carry out daily reconciliation and control receipts and write-offs of payment amounts under their control and administer payments to individuals and foreign legal entities that do not have a Russian Taxpayer Identification Number (TIN). Therefore, for example, the mere presence on the ELS of funds sufficient to pay additional accrued payments does not mean that the amount will be written off - for this it is necessary that the KDT was accepted (or entered) by the customs declaration authority and information about this reached the OKEP through customs payments department of customs declaration;

— that the ELS is used to account for balances and use of funds within the framework of the centralized payment of customs and other payments, the collection of which is entrusted to the customs authorities (i.e. customs duties, taxes, special, anti-dumping, countervailing duties, amounts of cash deposits, penalties, interest , accrued on the amount of overpaid or overcharged customs duties);

— that the accounting of cash balances on the ULS is carried out in the amount of the total balance in the context of each BCC, but without detailing to payment documents;

- that the function of the administrative document for write-off is now performed by column “B” of the DT (it indicates the payer’s INN if it is not the declarant, but, for example, a customs representative), and in case of adjustment of the declaration - the corresponding KDT;

— that in the event of reorganization of the payer, the transfer of the balance of funds, as well as the cash collateral to the legal successor’s ELS is carried out by the regional customs departments at the place of tax registration of the reorganized person;

- that in the event of an erroneous indication of the BCC or other payment details, the identification of funds received on the ELS is carried out by the Main Directorate of Federal Customs Revenue and Tariff Regulation of the Federal Customs Service of Russia, and in the event of errors in the details of the payer (Russian legal entity) - by the administering customs authority at the place of tax registration of the payer , upon receipt from payers of a written request to correct errors, therefore, depending on the error made, an application for changes in the payment document must be sent to the State Department of the Federal Technical and Technical Inspectorate of the Federal Customs Service of Russia or the payer’s administrative office;

— that electronic accrual documents (DT, customs receipt order, resolution in the case of an accident, other documents used for accrual and payment of customs and other payments) are displayed on personal accounts in the ELS resource, if they are issued after the opening of this personal account by the relevant customs authority . In relation to previously issued accrual documents or in case of changes in customs procedures, information is reflected on the personal account only in terms of changes in accrued and (or) paid amounts of customs and other payments that occurred after the opening of the personal account in the unified tax system of the corresponding payer;

— that the return of overpaid or excessively collected amounts of customs payments (including as a result of adjustments, contested collection or refusal to issue DT), as well as amounts of cash collateral, is carried out in the form of their offset against advance payments by the information system of the customs authorities is carried out automatically without the payer submitting a corresponding application, and is displayed on the personal account in the ELS system the next day;

- that the return of funds from the personal account to the payer’s current account is made upon the latter’s application in the manner established by the currently effective provisions of Law No. 311-FZ “On Customs Regulation in the Russian Federation”;

- payment of interest accrued on the amount of overpaid or excessively collected customs and other payments (including on the basis of a judicial act) is carried out on the basis of a calculation generated by the customs authority, whose actions (inaction) resulted in the need to pay the specified interest, after the claimant submits an application to the RTU, which administers payments.

Features of a single personal account of a foreign trade participant

The centralized system of the Single Personal Account on the resource of the Federal Customs Service of Russia has serious advantages over the previous scheme for making customs payments, which simplify the work of customs authorities and international trade for foreign trade participants. The key differences of the ELS are also the advantages for carrying out customs operations:

- accelerated terms for crediting funds to the account (within a few hours instead of several days);

- the ability to use money from the ELS for settlements during customs operations in any region;

- ensuring payer control over the expenditure of funds through the personal account of a participant in foreign economic activity on the website of the Federal Customs Service of Russia;

- one details for all types of payments minimizes the likelihood of errors during transfer;

- acceleration of the customs declaration process due to the rapid write-off of funds;

- There is no need for reconciliation with several customs authorities: everything is controlled centrally.

Attention! When switching to working with the ELS system, payment of customs duties on imports, special, anti-dumping and countervailing duties remains as before - according to separate payment documents.

Working with the ELS resource during the transition period has some difficulties:

- The system can block debits from old and new payment orders simultaneously. As a result, the movement of funds temporarily stops, which delays customs clearance operations. The problem is related to the operation of the resource that has not yet been adjusted and is resolved within one to two days.

- When filling out the declaration, you must indicate the number of the payment order from which the money should be debited. This clause is planned to be canceled over time; until then, you will still have to present this requisite.

- If both the declarant and the customs broker - representative of the foreign trade participant - pay at the same time. Each of them has the right to manage funds only in his own account, therefore, if there is not enough money for payments, the broker will not be able to pay extra for the declarant. In this case, the representative can make the full cost of payment for a customer who does not have an ELS.

Despite certain difficulties in the transition period, experts made a clear conclusion that the ELS system is justified - it is especially beneficial to use the scheme when carrying out operations at several customs points.

Are there any problems in the field of foreign trade?

Don’t know how to solve them at the lowest cost? Contact EIG professionals, because solving foreign trade problems is our job!

Or contact us by phone,

Or via email