Five years ago, many accountants were faced with the unexpected task of determining new product codes. To understand what TN VED is and what the abbreviation means, you should get acquainted with a fairly large amount of information. The terms are spelled out in many sections of legal documentation, reference books, as well as in the Decision of the Eurasian Economic Commission No. 101 of December 18, 2016.

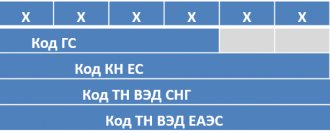

The certificate contains the entire set of necessary reference data. According to the presented informative extract, the structure of the codification in question has clearly defined instructions for completion. According to the rules, in a ten-digit serial number, the first two digits indicate the product group, and the remaining numbers act as an indicator of the subitem and subitem. This material offers a list of key declaration concepts that all representatives of enterprises oriented to the global market will have to become familiar with.

How is it deciphered?

The Unified Commodity Nomenclature for Foreign Economic Activity of the Customs Union is a classifier that is key in the entire process of border clearance of a particular product. The amount of duty payments depends on its indicator, as well as the need to provide all kinds of permits. As such, by the way, for example, certificates, certificates, passport or technical certificates, etc. are used.

The rules for the formation of the corresponding codification are based on the Harmonized System of Description from the WTO. Also, regulations in this area are presented in the legal documentation of the Commonwealth of Independent States. In accordance with the presented standards, the main person involved in assigning the code is the declarant. A person with such status may be the owner of the shipment in question or his official representative.

When carrying out all border activities, FCS employees check the correctness of the chosen codification, and, in accordance with this parameter, put forward a set of duties. Also, depending on what numbering was assigned to the cargo, the factors of the need for certification, the presence of import quotas, the entry into force of a preferential regime, etc. vary. Simply put, thanks to this classifier, border guard specialists generate statistics for the entire foreign trade industry of the country.

Customs tariff of the Russian Federation

The customs tariff of the Russian Federation was put into effect on July 1, 1993 by the Law of the Russian Federation of May 21, 1993 No. 5003-01 “On the customs tariff.” It determined the procedure for applying the customs tariff, types of customs duties, types of customs duty rates, the procedure for their establishment, as well as tariff benefits (preferences). According to the adopted legislation, the rates of import customs duties are established legislatively by the Government of the Russian Federation. By Decree of the Government of the Russian Federation of November 27, 2006 N 718, the Customs Tariff of the Russian Federation was approved, which was in force before the creation of the Customs Union.

Where is the HS code indicated and why is it needed?

According to the rules established on the territory of the Russian Federation (as well as in other countries of the EAEU!), the codification of the product nomenclature is prescribed in the customs declaration itself. As mentioned earlier, the completion of such a document is carried out by the direct owner of the shipment or his official representative.

If products transported across the border are issued taking into account certification papers, the classifier is also provided as part of the permitting documentation. Thus, the declaration may contain several regulatory numbers for foreign economic activity (depending on the number of products transported).

The main task of the Commodity Nomenclature of Foreign Economic Activity is to create the correct system for applying regulatory measures implemented by FCS employees in relation to goods transported by enterprises. Due to this state of affairs, the mission of finding a classifier (an indicator that exactly matches the cargo) and correctly entering it into the declaration is of great importance. Among the main functions solved by the set of numbers in question:

- correct calculation of border state duties;

- determination of tariff regulation procedures;

- tracking statistical parameters of external commercial activities.

The first two points are directly related to the person involved in sending the parcel across the border.

It is not difficult to guess that the process of transporting products intended, for example, for sale on the territory of another state is not the first task that appears to an entrepreneur. Such work is preceded by a huge amount of work, including in terms of loading, labeling, packaging, and accounting activities carried out in physical, nominal and documentary formats.

To simplify a number of such activities, modern owners of warehouses, retail outlets and transport points use software sets designed to automate business processes. For example, it produces products “Warehouse 15”, “Property Accounting”, “Store 15”, “Kirovka”, etc.

Unified customs tariff of the Customs Union (CU)

The Customs Union of the three countries of Russia, Belarus, and Kazakhstan was created in 2010, and its governing body was the Customs Union Commission (CUC). At first, complex integration processes were going on between the countries. The Unified Customs Tariff of the Customs Union came into force on January 1, 2012 by Decision of the Customs Union Commission (CUC) dated November 18, 2011 No. 850. The same document approved a new edition of the Unified Commodity Nomenclature. Since 2012, the Eurasian Economic Commission (EEC), which became the successor to the CCC, has become the supranational regulatory body of the Customs Union. During the same year, Resolution of the EEC Council of July 16, 2012 N 54 was adopted, which approved the new edition of the unified Commodity Nomenclature of Foreign Economic Activity of the Customs Union and the Unified Customs Tariff of the Customs Union (UCT CU). The adoption of these documents was caused by Russia's accession to the World Trade Organization (WTO) and the obligations undertaken in connection with this. Since Belarus and Kazakhstan were not members of the WTO, a transition period was established for these countries. The formed TS is an open organization, ready for new participants to join. In 2011, Kyrgyzstan expressed its intention to join, and approval was received in 2014. In 2013, Armenia expressed an intention to join, and approval was received in 2013. In 2014, Kyrgyzstan and Armenia became part of the Customs Union, but the current Customs tariffs of these countries differed from the Unified Customs Tariff of the Customs Union. For the newly joined countries, preferential conditions were in effect during the transition period, during which the rates of import duties on some goods remained the same. After the end of the transition period, the grace period ended and customs duties of the ETT CU came into effect.

Example. Until the end of the transition period, the rates of import customs duties on cars in Armenia were significantly lower than in other CU countries. For this reason, the cost of a car imported to Armenia from the USA was significantly lower compared to other CU countries. The imported car could be used throughout the entire territory of the vehicle.

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

Why is the EAEU HS code determined and what does it mean?

Correct completion of declaration papers is the key to the successful implementation of all transportation procedures and activities. Properly executed accompanying documentation will help to avoid problems with supervisory government authorities, and will also provide good support in terms of the speed of organizing all control operations. By the way, for any violations in this area, the declarant (the owner of the shipment or his representative) is responsible, including in an administrative (or criminal) format. For such an offense a fine is imposed, the amount of which is the amount of unpaid duties multiplied by 50-200%.

Principles of use

The question of what the HS code is and how it is deciphered is answered by a whole list of various legislative norms. The legal documentation also contains informative sections describing the reasons and needs for the introduction of such classifiers. The presented codification tools allow:

- Understand the processes of calculating state duties, transport payments and taxes, including in the format of VAT and customs duties.

- Monitor the need to use certificates for each individual transfer. For example, goods registered under certain numbers must be transported with authorization forms.

- Creation of a tool for obtaining statistical indicators of foreign economic trade activities. An aspect that in no way concerns private enterprises, the reason for which was the tasks put forward to the FCS specialists.

Please note: the process of correctly, correctly and competently filling out declaration certificates allows not only to speed up customs control operations, but also to save the company from administrative problems.

Basic rules for interpreting the Commodity Nomenclature of Foreign Economic Activity

Classification of goods in the Commodity Nomenclature of Foreign Economic Activity is carried out according to the following Rules:

Rule 1

The names of sections, groups and subgroups are given only for ease of use of the Commodity Nomenclature of Foreign Economic Activity; for legal purposes, the classification of goods in the Commodity Nomenclature of Foreign Economic Activity is carried out on the basis of the texts of commodity items and the corresponding notes to sections or groups and, unless otherwise provided by such texts, in accordance with the following provisions.

Explanations

(I) The nomenclature presents in a systematized form goods traded in international trade. These goods are grouped in it into sections, groups and subgroups, equipped with names indicating in the most concise form the categories or types of goods that they cover. In many cases, however, such a variety and number of goods are classified in a section or group that it is impossible to cover them all or list them specifically in the names.

(II) Rule 1 therefore begins with the disclaimer that these names are given “for ease of reference only.” Therefore, they have no validity in classification.

(III) The second part of this Rule states that classification should be made:

(a) by reference to the texts of the headings and the relevant section or chapter notes, and (b) unless otherwise provided by such texts, in accordance with the provisions of Rules 2, 3, 4 and 5, where applicable.

(IV) Clause (III) (a) is obvious and many goods are classified in the Nomenclature without further reference to Rules of Interpretation (for example, live horses (heading 01.01), pharmaceutical products mentioned in Note 4 to Chapter 30 (heading 30.06 )).

(V) In position (III) (b):

(a) the expression “unless otherwise provided by such texts” quite unambiguously means that the names of commodity items and notes to sections or groups have priority, that is, they are taken into account primarily when classifying the goods. For example, the notes to Chapter 31 stipulate that only certain goods belong to certain headings. Consequently, these headings cannot be extended to include goods which would otherwise fall within them under Rule 2(b);

(b) a reference to Rule 2 in the expression “subject to the provisions of Rules 2, 3, 4 and 5” means that:

(1) goods presented incomplete or unfinished (for example, a bicycle without a saddle and tires), and

(2) goods presented unassembled or disassembled (for example, an unassembled or disassembled bicycle, all components presented together), the components of which can be classified either separately by title (for example, tires, tubes), or as “parts” of these goods ,

shall be classified as if they were goods in a complete or complete form, subject to the provisions of Rule 2(a) and unless otherwise provided in the headings or notes.

Rule 2

(a) Any reference in a heading to any good shall be construed as a reference to such good in an incomplete or unfinished state, provided that, when presented in an incomplete or unfinished state, the good has the essential characteristic of a complete or complete good, and shall also be construed as a reference to a complete or complete good (or classified in the heading in question as complete or complete by virtue of this Rule) presented unassembled or disassembled.

(b) Any reference in the heading to any material or substance is to be construed as a reference to mixtures or combinations of that material or substance with other materials or substances. Any reference to a product made of a particular material or substance shall be construed as a reference to goods consisting wholly or partly of that material or substance. Classification of goods consisting of more than one material or substance is carried out in accordance with the provisions of Rule 3.

Rule 2(a)

(Items presented incomplete or unfinished)

(I) The first part of Rule 2(a) expands the content of any heading to which a particular good relates to cover not only the complete article, but also that article in an incomplete or unfinished form, provided that, as presented, the article has the main property of a complete or finished product.

(II) The provisions of this Rule also apply to blanks unless they are classified in a specific heading. The term "blank" means a product not ready for immediate use, having the approximate shape or outline of a finished product or part, and which can be used, except in exceptional cases, only for completion into a finished product or part (for example, plastic bottle blanks that are semi-finished products in the shape of a tube, with one closed end and one open end threaded for closure with a screw cap, the area below the threaded end is intended to be blown to the desired size and shape).

Semi-finished products that do not yet have the characteristic shape of finished products (such as bars, disks, pipes, etc.) are not considered “blanks”.

(III) Having regard to the content of the headings of Sections I to VI, this part of the Rule generally does not apply to goods in these Sections.

(IV) Certain cases covered by this Rule are referred to in the general provisions of sections or groups (for example, section XVI and groups 61, 62, 86, 87 and 90).

Rule 2(a)

(Products presented unassembled or disassembled)

(V) The second part of Rule 2(a) provides that complete or finished articles presented unassembled or disassembled are classified in the same headings as assembled articles. Products are presented in this manner usually due to packaging, handling or transportation requirements.

(VI) This Rule also applies to incomplete or unfinished products presented in disassembled or unassembled form, provided that they are considered complete or completed products by virtue of the first part of this Rule.

(VII) For the purposes of this Rule, the term “goods presented unassembled or disassembled” means products the components of which must be assembled using fastening material (screws, nuts, bolts, etc.) or, for example, riveting or welding, provided that that this requires only assembly operations.

In this case, the complexity of the assembly method should not be taken into account. However, the components will not undergo any further work to complete them.

Unassembled components of a product in excess of those required to assemble the product must be classified separately.

(VIII) The cases covered by this Rule are mentioned in the general provisions of the sections or groups (for example, section XVI and groups 44, 86, 87 and 89).

(IX) Having regard to the scope of the headings of Sections I through VI, this part of this Rule generally does not apply to goods in those Sections.

RULE 2 (b)

(Mixtures and compounds of materials or substances)

(X) Rule 2(b) deals with mixtures and combinations of materials or substances and goods made from two or more materials or substances. It applies to headings that specify a material or substance (for example, heading 0507 - ivory) and to headings that specify a good of a specific material or substance (for example, heading 4503 - articles of natural cork). . It should be noted that this Rule applies only unless otherwise stated in those headings or section or chapter notes (for example, heading 1503 - lard stearin, unmixed...).

Prepared mixtures described as such in a section or group note or heading are to be classified in accordance with Rule 1.

(XI) The intent of this Rule is to extend any heading covering a material or substance to cover mixtures or combinations of that material or substance with other materials or substances. The effect of this Rule is also to extend any heading covering goods made from that material or substance to include goods made partly from that material or substance.

(XII) This does not, however, widen the heading so far as to include goods which, under Rule 1, cannot be regarded as corresponding to the description in that heading; this occurs when the addition of another material or substance deprives the goods of the characteristics of those goods mentioned in the heading.

(XIII) As a consequence of this Rule, mixtures and combinations of materials or substances and goods made from more than one material or substance if they, prima facie

, may be classified under two or more headings, must be classified in accordance with the principles of Rule 3.

Rule 3

In the event that, by virtue of Rule 2(b) or for any other reason, there is a prima facie

, the possibility of classifying goods into two or more product positions, the classification of such goods is carried out as follows:

(a) Preference shall be given to the heading which contains the most specific description of the goods over headings with a more general description. However, when each of two or more headings relates only to part of the materials or substances included in the composition of a mixture or multicomponent article, or only to part of the goods presented in a set for retail sale, then these headings should be considered equivalent in relation to that product, even if one of them gives a more complete or accurate description of the product.

(b) Mixtures, multiple-component articles consisting of different materials or made from different components, and goods presented in sets for retail sale, the classification of which cannot be made in accordance with the provisions of Rule 3(a), must be classified according to that material or components that give the goods an essential property, provided that this criterion is applicable.

(c) Goods which cannot be classified in accordance with the provisions of Rule 3(a) or 3(b) shall be classified in the heading last in ascending order of codes among the headings equally eligible for consideration in the classification of the data. goods.

Explanation

(I) This Rule provides for three methods of classification of goods which, prima facie

, may be classified under two or more headings, either under the terms of Rule 2(b) or for any other reason. These methods are applied in the sequence in which they are given in this Rule. Thus, Rule 3(b) applies only when Rule 3(a) is not suitable for classification, and if both Rule 3(a) and Rule 3(b) are not suitable, then Rule 3(c) applies. Therefore, the order is as follows: (a) specific description of the product; (b) basic property; (c) the product item that comes last in ascending order of codes.

(II) This Rule shall have effect only to the extent that the heading text or section or chapter notes do not otherwise state. For example, Note 4(B) to Chapter 97 requires goods falling within the description of both headings 97.01 to 97.05 and heading 97.06 to be classified in one of the former headings. Such goods must be classified under Note 4(B) to Chapter 97 and not under this Rule.

Rule 3(a)

(III) The first method of classification is given in Rule 3(a), whereby the heading providing the most specific description of the goods is given preference to the heading giving a more general description.

(IV) It is not practical to lay down strict rules by which it can be determined whether one heading gives a more specific description of the goods than another, but in general it should be noted that:

(a) the good is more specifically characterized by its names than by the name of the group of goods (for example, electric shavers and hair clippers with a built-in electric motor are classified in heading 85.10 rather than in heading 8467 as hand tools with a built-in electric motor or in heading 85.09 as electromechanical household machines with a built-in electric motor);

(b) if the goods correspond to a description that more clearly identifies them, that description is more specific than one in which the identification is less complete.

Examples of the latter category of goods are:

(1) Textile floor mats for automobile interiors are not to be classified as accessories of a motor vehicle in heading 87.08, but rather in heading 57.03, where they are more specifically described as carpets;

(2) Unframed safety glass, including toughened or laminated glass of specified shapes for use in aircraft, is to be classified not in heading 88.03 as part of the articles of heading 88.01 or 88.02, but in heading 70.07, where it is more specifically described as safety glass.

(V) But if two or more headings mention only part of the materials or substances contained in mixtures or multipart articles, or only part of the articles in a set for retail sale, those headings are to be treated as equally specific descriptions of those goods, even if one of them gives a more complete and specific description than the others. In such cases, the classification of goods must be made under Rule 3(b) or 3(c).

Rule 3(b)

(VI) The second method applies only to:

(i) mixtures;

(ii) multi-component goods consisting of different materials;

(iii) multi-component goods consisting of different components;

(iv) goods included in a set for retail sale.

It is used only if Rule 3(a) does not apply.

(VII) In all these cases, the goods must be classified as if they consisted only of a material or component which gives them an essential property to the extent that this criterion is applicable.

(VIII) The factor which determines the basic property will be different for different types of goods. It may, for example, be determined by the nature of the material or component, its volume, quantity, weight, cost, or the role that the material or component plays in the use of the product.

(IX) When applying this Rule, multi-component goods made from different components should be considered not only those goods in which these components are attached to each other, forming a practically inseparable whole, but also goods with separable components, provided that these components are adapted to each other, complement each other and taken together form a single whole, which usually does not allow them to be put up for sale in the form of separate parts.

Examples of the latter category of goods are:

(1) ashtrays consisting of a stand including a replaceable ash bowl;

(2) home spice storage racks consisting of a special frame (usually wood) and an appropriate number of empty spice containers of a specific shape and size.

The components of such multi-component products are usually placed in a common package.

(X) For purposes of this Rule, the term “goods presented in a set for retail sale” refers to goods that:

(a) consist of at least two different items, prima facie

classified under various headings. For this reason, for example, six fondue forks cannot be considered as a set for the purposes of this Rule;

(b) consist of products or articles assembled together to satisfy a specific need or perform a specific job; And

(c) packaged in such a way that they do not require repackaging when sold to the final consumer (for example, in boxes or crates, or on bases).

“Retail sale” does not include sales of goods intended for resale after further processing, preparation, repackaging or combination with other goods or placement in other goods.

The term “goods presented in a set for retail sale” therefore refers only to sets consisting of goods intended for sale to the final consumer in which the individual goods are intended to be used together. For example, different food products intended to be used together in the preparation of a ready-to-eat dish or meal, packaged together and intended for consumption by a consumer, are considered a “retail sale set.”

Examples of sets that may be classified under Rule 3(b):

(1) (a) Sets consisting of a beef sandwich, with or without cheese, in a bun (heading 1602), packed with potato chips (deep fried) (heading 2004): are classified in heading 1602.

(b) Sets, the components of which are intended to be used together in the preparation of spaghetti, consisting of a bag of uncooked spaghetti (heading 19.02), a sachet of grated cheese (heading 04.06) and a small tin of tomato sauce (heading 21.03), packaged in a cardboard box: classified in heading 1902.

The rule does not, however, apply to sets of products packaged together and consisting, for example, of:

— tins of shrimp (heading 16.05), tins of foie gras (heading 16.02), tins of cheese (heading 04.06), tins of bacon in slices (heading 16.02) and tins of sausages (heading 16.01); or

- bottles of alcohol tincture of heading 2208 and bottles of wine of heading 2204.

In the case of these two examples, and in the case of similar food baskets, each product should be classified separately in its appropriate heading. This also applies, for example, to instant coffee in a glass jar (heading 2101), a ceramic cup (heading 6912) and a ceramic saucer (heading 6912) put up together for retail sale in a carton.

(2) Sets for hairdressers, consisting of a pair of electric hair clippers (heading 85.10), a comb (heading 96.15), a pair of scissors (heading 82.13), a brush (heading 96.03) and a towel of textile material (heading 6302), placed in a leather case (heading 4202): classified in heading 8510.

(3) Drawing sets consisting of a ruler (heading 9017), a rotary calculator (heading 9017), a protractor (heading 9017), a pencil (heading 9609) and a pencil sharpener (heading 8214), placed in a case of plastics (heading 42.02): classified in heading 90.17.

In the case of the sets mentioned above, the classification is made according to one or more components taken together, which can be considered as giving the set as a whole its basic property.

(XI) This Rule does not apply to goods that consist of separately packaged components presented together, including in one common package, in certain quantitative proportions for industrial production, for example, drinks.

Rule 3(c)

(XII) When goods cannot be classified under Rule 3(a) or 3(b), they should be classified in the heading last in ascending order of codes among those equally suitable for consideration in classifying those goods.

Rule 4

Goods, the classification of which cannot be carried out in accordance with the provisions of the above Rules, are classified in the heading corresponding to the goods that are most similar (close) to the goods in question.

Explanations

(I) This Rule applies to goods which cannot be classified under Rules 1 to 3. It provides for the classification of these goods in the heading to which the goods most closely related to them belong.

(II) When classifying under Rule 4, the goods presented must be compared with similar goods in order to determine those goods to which the former are most closely related. The goods presented are classified in the same heading as the goods to which they are most closely related.

(III) The similarity of goods may, of course, depend on many factors, such as type, property, purpose.

Rule 5

In addition to the above provisions, the following Rules shall apply to the following goods:

(a) Cases and cases for cameras, musical instruments, guns, drawing supplies, necklaces, and similar containers, specially shaped or adapted to contain the item or set of items in question, suitable for long-term use, and presented with the items for which it is intended. intended, must be classified together with the products packaged in them, if this type of container is usually sold together with these products. However, this Rule does not apply to containers, which, forming a single whole with the packaged product, give the latter its main property.

(b) Subject to the provisions of Rule 5(a) above, packaging materials and containers supplied with the goods they contain shall be classified together if they are of the kind normally used for packaging those goods. However, this provision is not mandatory if such packaging materials or containers are clearly suitable for reuse.

Rule 5(a)

(Cases, boxes and similar containers)

(I) This Rule applies only to containers that:

(1) is specially shaped or adjusted to accommodate a specific product or set of products, that is, it is designed specifically for a specific type of product. Some containers follow the shape of the product it contains;

(2) suitable for long-term use, that is, it has the same durability as the products for which it is intended. These containers also serve to ensure the safety of products when they are not in use (for example, during transportation or storage). These criteria distinguish it from conventional packaging;

(3) is presented together with the products for which it is intended, notwithstanding that the products themselves may be packaged separately for ease of transportation. Presented separately, these containers are classified in their corresponding product headings;

(4) are containers of a type typically sold with the applicable product; And

(5) do not give the whole a basic property.

(II) Examples of containers presented together with the articles intended for them that are to be classified in accordance with this Rule are:

(1) boxes and boxes for jewelry (heading 7113);

(2) cases for electric shavers (heading 85.10);

(3) cases for binoculars and telescopes (heading 9005);

(4) covers and cases for musical instruments (for example, heading 9202);

(5) gun cases (for example, heading 9303).

(III) Examples of containers not subject to this Rule are containers such as a silver teapot containing contents or a decorative ceramic bowl containing sweets.

Rule 5(b)

(Packaging materials and containers)

(IV) This Rule governs the classification of packaging materials and containers commonly used for packaging the goods to which they relate. However, this provision does not apply in cases where these packaging materials or containers can clearly be reused, for example, some ferrous cylinders or tanks for compressed or liquefied gas.

(V) This Rule shall apply subject to the provisions of Rule 5(a), therefore the classification of covers, cases and similar containers referred to in Rule 5(a) shall be made in accordance with that Rule.

Rule 6

For legal purposes, the classification of goods in subheadings of a heading must be in accordance with the names of the subheadings and the notes relating to the subheadings, and, mutatis mutandis

, the provisions of the above Rules, provided that only subpositions at the same level are comparable. For purposes of this Rule, appropriate section and chapter notes may also apply unless the context otherwise requires.

Explanations

(I) Rules 1 to 5 above apply, mutatis mutandis,

for classification at the sub-item level within the same product item.

(II) In Rule 6, the following expressions have the following meanings assigned to them:

(a) “subheadings at the same level” are subheadings with one hyphen (level 1) or subheadings with two hyphens (level 2).

Thus, in a comparative analysis of two or more subheadings with one hyphen within one product heading under Rule 3 (a), the possibility of classifying a product as one of them should be determined only by the description of the goods in these subheadings with one hyphen. Once the single-dash subheading that provides the most specific description of the product has been selected, and if the subheading itself is divided, then and only then is the description at the two-dash subheading level taken into account and one of them is selected;

(b) “unless the context otherwise requires”—except when the section or chapter notes are inconsistent with the text of the subheading or the subheading notes.

This is the case, for example, in Chapter 71, where the meaning of the term “platinum” in Chapter Note 4(B) is different from the meaning of the term “platinum” in Subheading Note 2. Therefore, in the case of interpretation of subheadings 7110 11 and 7110 19, note 2 to the subheadings applies, and not note 4 (B) to the group.

(III) The scope of a two-dash subheading shall not extend beyond the scope of the one-dash subheading to which the two-dash subheading belongs; and the scope of a subheading with one hyphen must not extend beyond the limits of the heading to which the given subheading with one hyphen belongs.

Responsibility of the declarant when determining the HS code

Modern regulatory documents: regulations, certificates and acts, include a set of information blocks within which measures for regulating the operation of filling out transport papers are prescribed. As mentioned earlier, the registration of such forms is carried out by the owner of the shipment or his official representative. Such categories of persons must cope with the assigned tasks with the maximum degree of correctness, including in order to avoid possible punishment.

Let’s say a person involved in transporting any items across the border provided FCS specialists with a customs declaration with an incorrectly specified codifier. Also, the documentation contained unreliable and incomplete information, the list of which included characteristics and properties of the product. The result was a legal change in the classification of shipped products without any factual prerequisites for this. In the general format, the situation entailed a change in the amount of state duties, of course, downward.

More information about possible penalties

If employees of border government structural units disclose the presented fact, they will assign it the status of an administrative offense. Committed forgery is an offense falling under Article 16.2 of the Code of Administrative Offenses of the Russian Federation. As punishment for the actions committed, the declarant will receive a fine of 10 to 20 thousand rubles, if he has the status of an individual. For companies, the figure increases to the amount of unpaid duties multiplied by a factor of 50-200%.

Please note: a customs declarant who notices marks can independently report them to FCS specialists. This setting is valid from 07/04/2016. At the same time, employees of supervisory authorities lose the opportunity to impose an administrative penalty on such a citizen, since the principle of “voluntary admission of a mistake” will apply here.

How to Avoid Responsibility

However, in practice, it is quite difficult to implement the rights that allow you to avoid punishment for incorrect declarative documentation. This can only be done within a limited list of situations:

- inspection work for the person in question has not yet begun, for example due to priority being taken;

- the person (or company representative) who reported the inaccuracies does not have any debts on the relevant duties;

- After a detailed examination of the cargo by border guards, no violations were identified.

Citizens who deliberately change codifiers in their declarations are subject to criminal liability. The result of this state of affairs can be a number of unpleasant situations: from a huge fine (from 1 million rubles) to the complete destruction or alienation of the shipment in favor of the state. However, in practice, it is extremely difficult to prove malicious intent - the violator can almost always refer to the fact that all the blots were made due to inattention.

What is a preliminary classification decision?

A more reliable option for determining the HS code is to contact the Federal Customs Service (FCS) for a preliminary classification decision , in jargon called a class decision (CR). High-tech and large equipment is usually supplied in parts and disassembled and is submitted for customs clearance in batches and at different times. The Federal Customs Service of Russia has a special procedure for moving such equipment. In accordance with this procedure, classification decisions are issued for such goods and a single HS code for the entire equipment is assigned. If the Federal Customs Service has issued a classification decision for your goods, this will allow you to avoid controversial issues during customs clearance. The classification decision of the Federal Customs Service is mandatory for adoption by any customs authority on the territory of Russia in accordance with paragraph 6 of Article 52 of the Customs Code of the Customs Union. In practice, this means that when contacting customs to clear the cargo, the declarant has a ready-made class solution in hand and completely avoids the risks associated with possible ambiguous interpretation of the coding of goods. The customs authority that carries out cargo clearance, based on the class decision, no longer checks the classification according to the Commodity Nomenclature of Foreign Economic Activity. To obtain a preliminary classification decision, you must contact the Commodity Nomenclature Department of the Federal Customs Service with a written request and provide a package of documents required for this. The Federal Customs Service considers requests for a classification decision within 90 days. In practice, it often turns out that the package of documents is not complete or there is not enough information, the period for consideration of the application may be extended indefinitely, or the Federal Customs Service may completely refuse to issue a preliminary decision on the classification of your product. There are many assistance companies that, for selfish purposes, will study the issue, draw up an application and help collect documents.

You can choose the code yourself using the HS codes directory, this is not a secret. The code can be requested from the sender of the goods. But we don’t advise you to be tricky by choosing a HS code with a small duty; you will have to defend your code at customs. Consult your customs broker; he will paint a clear picture of how customs accepts value and classification.

Article 16.2 of the Code of Administrative Offenses of the Russian Federation provides for administrative liability for declaring false information when declaring goods, if this served as the basis for exemption from customs duties, taxes, or for underestimating their amount, or for non-application of state prohibitions and restrictions.

Article 40 of the Customs Code of the Russian Federation states that all goods are subject to classification when declared. The rates of customs duties, taxes, the application of non-tariff regulation measures, and obtaining permits from various regulatory authorities depend on the product code. The first six characters should be the same in most countries of the world. Therefore, when importing, it is important to ask your foreign partner what codes he uses to send this or that product for export.

The product nomenclature provides for 5 levels of product detail:

- section level (take the agricultural sector);

- group level (cereals);

- level of commodity items (cereals are divided into rye, wheat);

- Levels 4 and 5, lower levels of detail (durum wheat)

The main criteria used for classification: 1 - the material from which the product is made; 2 - the functions it performs; 3 - degree of processing (manufacturing).

In total, HS codes consist of 97 groups and 21 sections.

The basic unit of measurement of goods according to the Commodity Classification of Foreign Economic Activity is weight in kg.

For example: GROUP 10, CEREALS

General provisions This group includes only grains, including those in sheaves or ears. Grain of this group, cut before ripening and not threshed, is classified with simple grain. Fresh grains (other than sweet corn of Chapter 07), whether or not suitable for use as vegetables, are classified in this chapter. Rice is classified in heading 1006 even if threshed, bleached, polished, dried or milled, provided that it is not otherwise processed. Any other grains, if threshed or otherwise processed, are excluded from this chapter, such as those described in heading 1104 (see relevant HS Explanations).

Explanation of subheadings Dried ears (cobs) of cereal crops (for example, corn), bleached, dyed, impregnated or otherwise processed for decorative purposes, are classified in subheading 0604 99 900 0. Cereals remain in this group, even if they have undergone heat treatment for storage purposes, which may cause the grains to partially gel and sometimes cause them to explode. Partial gelatinization (pre-gelatinization) occurs during the drying process and involves only a small portion of the grains. This transformation of starch is not the purpose of heat treatment, but is only a side effect. A product processed in this way shall not be considered to be “otherwise processed” within the meaning of Note 1(B) to Chapter 10.

Note: 1.(A) Headings in this Chapter are to cover only grains, including those not separated from ears or stems. (B) This chapter does not include grains that have been shelled or otherwise processed. However, rice whether husked, hulled, polished, glazed, parboiled or broken is classified in heading 1006. 2. Heading 1005 excludes sweet corn (Chapter 07).

Note on subitems. 1. The term “drum wheat” means wheat of the species Triticum durum and hybrids obtained as a result of interspecific crossing of Triticum durum with other species having the same number of chromosomes (28).

The easiest and least expensive option to deliver cargo without surprises with customs is to hire a customs carrier .

How to determine the code

The entire list of legislative norms states that a product nomenclature is a classifier used by border customs control authorities and participants in foreign economic cooperation to conduct operations. Within the framework of the same legal documents, a whole set of methods is also provided, using which declarants can determine the desired codification for certain categories of goods. It is impossible to avoid generally accepted rules - as mentioned earlier, for incorrect or incorrect information the declarant will receive the status of an administrative offender, with all the consequences arising from such a situation.

Methods

Today, in order to determine the code of the transport nomenclature of foreign economic activity, citizens involved in the implementation of relevant shipments can use a selection of the following methods:

- Independent work, taking into account a huge number of regulatory documents. The responsible person must be guided by such documents as Art. 52 TC CU, Classification Rules (6 OPI), Explanations of the Federal Customs Service of Russia, etc.

- With the involvement of specialists functioning as customs representatives. An application for operations is submitted through the government services portal.

- With the help of government bodies, using the service of making decisions by certain departments on the preliminary codification of the list of presented products. The application is addressed within the network platform of the EPGU State Services.

- Through the border service, by contacting the FCS department, which will subsequently carry out supervisory operations. You can apply for the implementation of the procedure in the personal account of the foreign economic activity user.

Through all the presented options, the declarant receives a HS code in the UTD, calculated with the maximum degree of correctness.

Please note: the scheme with independent search and subsequent assignment of the desired classifier has a huge number of various nuances. In modern organizations engaged in foreign economic trade activities, a separate person with impressive experience in a similar field of professional work is responsible for the implementation of such work. Factors that help determine the codification of certain products are their functionality and the set of basic manufacturing materials.

What is HSDD? Structure of the HS code. Application of HS in practice.

Commodity Nomenclature of Foreign Economic Activity (TN FEA) is a classifier of goods created for use by customs and participants in foreign trade activities. The Commodity Nomenclature of Foreign Economic Activity of the Russian Federation is a more complete Russian version of the Harmonized System, developed by the world customs organization and adopted as the basis for commodity classification in European and some other countries. The essence of the classifier is that each product or group of goods is assigned its own unique code and a customs duty is assigned. This classifier is used to ensure unambiguous identification of goods, collection of customs duties and to simplify automated processing of customs declarations.

Some tips for self-categorization of goods

In accordance with the normative and regulatory documentation, the entire procedure for setting the HS code comes down to the consistent application of the six basic rules of the OPI. Specialists engaged in such activities as part of their job responsibilities at large enterprises regularly publish collections of articles that help beginners understand the principles of codification construction. Having selected the most important information blocks from such materials, we can highlight several tips by following which the user can avoid mistakes when assigning classifiers:

- To carry out the work with the maximum degree of accuracy, the person in charge will definitely need information about the purpose, principles of operation and material of manufacture of the product in question.

- Particular attention should be paid to column No. 31, also present in the declaration papers. Here you need to indicate all the characteristics of the product, taking into account regulatory provisions.

- An entrepreneur (or an employee with the appropriate range of responsibilities) must remember that at the same time, products are classified according to one central indicator.

- Consistent interpretation of the six OPI rules will help you understand questions about positions, numbering, subpositions and sub-subpositions.

- Before starting settlement transactions, you should carefully read all accompanying explanations. Such papers include an exhaustive list of goods and their properties, through which parts of future shipments are placed into a single group.

If any extraordinary difficulties arise, the responsible person should consider the possible transfer of responsibilities, for example, to customs specialists (as part of a separate paid service).

Documents for confirmation: how the structure of the HS code is approved

According to established legislative rules, a person with the status of a declarant must provide certificates confirming the correctness of the codification he has chosen for the transported goods. Various forms can be used as such documents, the set of which varies depending on what item is being sent.

If the main classification characteristic is the presence of any substances or materials in the product, the responsible person will have to attach a set of certificates that will contain the names, as well as the physical and chemical compositions of the product. Similar principles are established for other things to which a code has been assigned, for example, based on general processing and processing processes. Then, as part of the declaration, a paper describing technological diagrams, technical maps, descriptions, drawings, etc. is also attached.

Thus, now you know what it is - the EAEU HS code, how the abbreviation stands for and what it is needed for.

Number of impressions: 2046