TYVA CUSTOMS The company was liquidated

OGRN 1021700511700 INN 1701008190 / KPP 170101001

Registration date

November 17, 1992

Main activity

Financial and tax management

Legal address

667009, Tyva Republic, Kyzyl, st. Rovenskaya, 3, a

On the map

Organizational and legal form

Federal government agencies

Liquidation

July 2, 2021 Termination of the activities of a legal entity through reorganization in the form of merger Successor: KRASNOYARSK CUSTOMS

Boss

Kacheev Igor Mikhailovich INN 041101167109

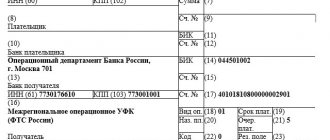

Requisites

| OGRN | 1021700511700 |

| TIN | 1701008190 |

| checkpoint | 170101001 |

| Code KLADR | 170000010000161 |

| OPF code | 75104 (Federal government agencies) |

| OKTMO code | 93701000 |

| SDR code | 03121000055 |

| ICU | 11701008190170101001 |

See also information about registration of TYVA CUSTOMS with the Federal Tax Service, Pension Fund and Social Insurance Fund

Reorganization

TYVA CUSTOMS is in the process of reorganization in the form of merger with another legal entity. Information about the status of companies after reorganization

| Organization | State after reorganization |

| KRASNOYARSK CUSTOMS OGRN: 1022402478009, INN: 2460001790 | Will continue to exist after reorganization |

| KHAKASS CUSTOMS OGRN: 1021900533423, INN: 1901015893 | Will cease to exist after reorganization |

| TYVA CUSTOMS OGRN: 1021700511700, INN: 1701008190 | Will cease to exist after reorganization |

History of changes in the Unified State Register of Legal Entities for 2002–2020

2020

- 16.01.2020

- GRN

2202400022218 - SPVZ code

12305

- Code NO

2468

Interdistrict Inspectorate of the Federal Tax Service No. 23 for the Krasnoyarsk Territory

Beginning of the procedure for reorganization of a legal entity in the form of merger

Documentation:

- P12003 notification of the start of the reorganization procedure

- Decision dated December 26, 2019

- Order dated May 13, 2019

2019

- 21.05.2019

- GRN

2191719045582 - SPVZ code

13101

- Code NO

1719

Interdistrict Inspectorate of the Federal Tax Service No. 1 for the Republic of Tyva

Submission by the licensing authority of information on the granting of a license

2017

- 09.03.2017

- GRN

2171719039545 - SPVZ code

12201

- Code NO

1719

Interdistrict Inspectorate of the Federal Tax Service No. 1 for the Republic of Tyva

Changing information about a legal entity contained in the Unified State Register of Legal Entities

Documentation:

- P14001 application for changes in information not related to changes. constituent documents (clause 2.1) dated 03/01/2017

- Order dated February 14, 2017

2016

- 10.11.2016

- GRN

2161719108440 - SPVZ code

15101

- Code NO

1719

Interdistrict Inspectorate of the Federal Tax Service No. 1 for the Republic of Tyva

Making changes to information about a legal entity contained in the Unified State Register of Legal Entities due to errors made by the registration authority

Documentation:

- Another document. in accordance with the legislation of the Russian Federation dated November 10, 2016

- 10.11.2016

- GRN

2161719108406 - SPVZ code

12201

- Code NO

1719

Interdistrict Inspectorate of the Federal Tax Service No. 1 for the Republic of Tyva

Changing information about a legal entity contained in the Unified State Register of Legal Entities

Documentation:

- P14001 application for changes in information not related to changes. constituent documents (clause 2.1) dated 02.11.2016

- Order dated October 25, 2016

2015

- 15.06.2015

- GRN

2151719041890 - SPVZ code

12101

- Code NO

1719

Interdistrict Inspectorate of the Federal Tax Service No. 1 for the Republic of Tyva

State registration of changes made to the constituent documents of a legal entity related to changes to information about a legal entity contained in the Unified State Register of Legal Entities, based on an application

Documentation:

- Р13001 statement on changes made to the constituent documents dated 06/04/2015

- Cover letter dated 06/04/2015

- Order dated 09/04/2014

- Regulations on the organization dated 09/04/2014

2014

- 17.12.2014

- GRN

2141719024764 - SPVZ code

15101

- Code NO

1719

Interdistrict Inspectorate of the Federal Tax Service No. 1 for the Republic of Tyva

Making changes to information about a legal entity contained in the Unified State Register of Legal Entities due to errors made by the registration authority

- 17.12.2014

- GRN

2141719024676 - SPVZ code

15301

- Code NO

1719

Interdistrict Inspectorate of the Federal Tax Service No. 1 for the Republic of Tyva

Recognition of an entry made in the Unified State Register of Legal Entities in relation to a legal entity as invalid

- 17.12.2014

- GRN

2141719024665 - SPVZ code

15101

- Code NO

1719

Interdistrict Inspectorate of the Federal Tax Service No. 1 for the Republic of Tyva

Making changes to information about a legal entity contained in the Unified State Register of Legal Entities due to errors made by the registration authority

- 27.03.2014

- GRN

2141719007549 - SPVZ code

13801

- Code NO

1719

Interdistrict Inspectorate of the Federal Tax Service No. 1 for the Republic of Tyva

Submission of information on the issuance or replacement of identity documents of a citizen of the Russian Federation on the territory of the Russian Federation

Documentation:

- Information on changes in the passport data of an individual provided by the authorities issuing and replacing identity documents of a citizen of the Russian Federation on the territory of the Russian Federation

2013

- 22.12.2013

- GRN

2131719026680 - SPVZ code

13801

- Code NO

1719

Interdistrict Inspectorate of the Federal Tax Service No. 1 for the Republic of Tyva

Submission of information on the issuance or replacement of identity documents of a citizen of the Russian Federation on the territory of the Russian Federation

Documentation:

- Information on changes in the passport data of an individual provided by the authorities issuing and replacing identity documents of a citizen of the Russian Federation on the territory of the Russian Federation

- 26.04.2013

- GRN

2131719010894 - SPVZ code

12201

- Code NO

1719

Interdistrict Inspectorate of the Federal Tax Service No. 1 for the Republic of Tyva

Changing information about a legal entity contained in the Unified State Register of Legal Entities

Documentation:

- Application for making changes to the information about a legal entity in the Unified State Register of Legal Entities that are not related to changes in the constituent documents dated 04/19/2013

- Cover letter dated 04/18/2013

- Order dated 04/02/2013

2011

- 10.03.2011

- GRN

2111719011215 - SPVZ code

13200

- Code NO

1719

Interdistrict Inspectorate of the Federal Tax Service No. 1 for the Republic of Tyva

Submission of information on registration of a legal entity with the tax authority

2010

- 06.10.2010

- GRN

2101719026847 - SPVZ code

13101

- Code NO

1719

Interdistrict Inspectorate of the Federal Tax Service No. 1 for the Republic of Tyva

Submission by the licensing authority of information on the granting of a license

2009

- 09.12.2009

- GRN

2091719074511 - SPVZ code

13300

- Code NO

1719

Interdistrict Inspectorate of the Federal Tax Service No. 1 for the Republic of Tyva

Submission of information on registration of a legal entity as an insurer in the territorial body of the Pension Fund of the Russian Federation

- 13.02.2009

- GRN

2091719005728 - SPVZ code

13101

- Code NO

1719

Interdistrict Inspectorate of the Federal Tax Service No. 1 for the Republic of Tyva

Submission by the licensing authority of information on the granting of a license

2008

- 30.06.2008

- GRN

2081719001880 - SPVZ code

12201

- Code NO

1719

Interdistrict Inspectorate of the Federal Tax Service No. 1 for the Republic of Tyva

Changing information about a legal entity contained in the Unified State Register of Legal Entities

Documentation:

- Application for making changes to information about a legal entity in the Unified State Register of Legal Entities that are not related to changes to the constituent documents

- Order dated June 23, 2008

- Order dated July 12, 2007

- Order dated September 17, 2007

- 19.04.2008

- GRN

2081701007188 - SPVZ code

13300

- Code NO

1719

Interdistrict Inspectorate of the Federal Tax Service No. 1 for the Republic of Tyva

Submission of information on registration of a legal entity as an insurer in the territorial body of the Pension Fund of the Russian Federation

- 26.02.2008

- GRN

2081701003943 - SPVZ code

12201

- Code NO

1719

Interdistrict Inspectorate of the Federal Tax Service No. 1 for the Republic of Tyva

Changing information about a legal entity contained in the Unified State Register of Legal Entities

Documentation:

- Application for making changes to the information about a legal entity in the Unified State Register of Legal Entities that are not related to changes in the constituent documents dated 02/19/2008

- Letter dated January 24, 2007

2007

- 28.02.2007

- GRN

2071701009576 - SPVZ code

15101

- Code NO

1719

Interdistrict Inspectorate of the Federal Tax Service No. 1 for the Republic of Tyva

Making changes to information about a legal entity contained in the Unified State Register of Legal Entities due to errors made by the registration authority

2005

- 20.04.2005

- GRN

2051700512092 - SPVZ code

12201

- Code NO

1719

Interdistrict Inspectorate of the Ministry of the Russian Federation for Taxes and Duties No. 1 for the Republic of Tyva

Changing information about a legal entity contained in the Unified State Register of Legal Entities

Documentation:

- Application for making changes to information about a legal entity in the Unified State Register of Legal Entities that are not related to changes to the constituent documents

- 14.04.2005

- GRN

2051700511872 - SPVZ code

12101

- Code NO

1719

Interdistrict Inspectorate of the Ministry of the Russian Federation for Taxes and Duties No. 1 for the Republic of Tyva

State registration of changes made to the constituent documents of a legal entity related to changes to information about a legal entity contained in the Unified State Register of Legal Entities, based on an application

Documentation:

- Application for state registration of changes made to the constituent documents of a legal entity

- Regulations on the organization

- Order dated January 12, 2005

2004

- 10.12.2004

- GRN

2041700529880 - SPVZ code

13400

- Code NO

1719

Interdistrict Inspectorate of the Ministry of the Russian Federation for Taxes and Duties No. 1 for the Republic of Tyva

Submission of information on registration of a legal entity as an insurer in the executive body of the Social Insurance Fund of the Russian Federation

- 30.08.2004

- GRN

— - SPVZ code

13200

- Code NO

1719

Interdistrict Inspectorate of the Ministry of the Russian Federation for Taxes and Duties No. 1 for the Republic of Tyva

Submission of information on registration of a legal entity with the tax authority

2003

- 05.12.2003

- GRN

2031700523336 - SPVZ code

12101

- Code NO

1701

Interdistrict Inspectorate of the Ministry of the Russian Federation for Taxes and Duties No. 1 for the Republic of Tyva

State registration of changes made to the constituent documents of a legal entity related to changes to information about a legal entity contained in the Unified State Register of Legal Entities, based on an application

2002

- 28.11.2002

- GRN

1021700511700 - SPVZ code

11101

- Code NO

1701

Interdistrict Inspectorate of the Ministry of the Russian Federation for Taxes and Duties No. 1 for the Republic of Tyva

Entering into the Unified State Register of Legal Entities information about a legal entity registered before July 1, 2002

12+

04/26/2017 Individuals traveling abroad should familiarize themselves with the rules for importing goods for personal use into the customs territory of the Eurasian Economic Union before traveling. Without paying customs duties and taxes, individuals can import goods (except for vehicles) in accompanied and unaccompanied baggage, the total value of which does not exceed the equivalent of 1,500 euros, and the total weight of which does not exceed 50 kg, and when transported by air, the total the cost must not exceed the equivalent of 10,000 euros. If the above standards are exceeded, then to the extent of such excess a single rate of customs duties and taxes is applied in the amount of 30% of the customs value of the specified goods, but not less than 4 euros per 1 kg. It must be taken into account that this procedure applies only to goods for personal use, that is, intended for personal, family, household and other needs of individuals not related to business activities. In addition, we recommend that tourists keep sales receipts for goods purchased abroad so that they can confirm the cost of items. If baggage and hand luggage exceed the duty-free import limits, you must fill out a passenger customs declaration. You can import alcoholic beverages and beer in a maximum amount of 3 liters per individual over 18 years of age. In case of excess from 3 to 5 liters inclusive, customs duties are levied at a flat rate of 10 euros per 1 liter in terms of excess of the quantitative norm, also tobacco and tobacco products no more than 200 cigarettes or 50 cigars (cigarillos) or 250 grams of tobacco, or the specified products in assortment with a total weight of no more than 250 grams, per individual over 18 years of age. If the amount of imported alcohol or beer exceeds the established norm, then it must be declared in writing, indicating in the passenger customs declaration the actual amount of alcohol imported. In case of excess (from 3 to 5 liters inclusive), customs duties are levied at a flat rate of 10 euros per 1 liter in relation to the excess of the quantitative norm of 3 liters. We remind you that the discovery of goods subject to customs declaration during selective customs control entails bringing the person to justice in accordance with the administrative or criminal legislation of the Russian Federation. In addition to customs regulations, veterinary and phytosanitary regulations also apply. To import products of animal origin, a veterinary certificate and permission from Rosselkhoznadzor are required. Individuals may not present a veterinary certificate from the country of departure when importing up to 5 kg of products of animal origin in hand luggage and baggage, if the products are finished and in their original packaging. In addition, an individual can import into the Russian Federation per person up to 5 kg of finished products of animal origin in original packaging, only if the country from which this product is imported is free from epizootic conditions (for example, if in relation to it the Russian The Federation has not established a ban due to African swine fever). Products such as milk and dairy products (cheese, butter, cottage cheese, etc.), meat and meat products, fish and fish products, eggs, beekeeping products, products used for animal feeding, live animals are subject to veterinary control. animals, hunting trophies, stuffed animals, etc. The list of goods subject to veterinary control was approved by the Decision of the Customs Union Commission of June 18, 2010 No. 317, taking into account the changes adopted by the Decision of the Board of the Eurasian Economic Commission of December 10, 2013 No. 294. In accordance with veterinary requirements When importing into the customs territory of the EAEU and (or) moving between the Parties fur-bearing animals, rabbits, dogs and cats, approved by the Decision of the Customs Union Commission dated June 18, 2010 No. 317, the import of dogs and cats transported for personal use in quantities of no more than 2 is allowed. -x heads, without an import permit and quarantine, accompanied by an international passport, which in this case is equivalent to a veterinary certificate, provided that it contains a mark from the competent authority about a clinical examination within 5 days before shipment. When importing more than 5 heads of dogs or cats, an individual permit from Rosselkhoznadzor is required for the import by an individual of dogs or cats into the Russian Federation and a veterinary certificate that meets veterinary requirements. When exporting dogs and cats, permission from Rosselkhoznadzor is not required for the export of dogs and cats transported by owners for personal use in the amount of no more than two animals, accompanied by an international passport issued in accordance with international acts of the EAEU, provided that it contains a mark from the authorized body on the conduct of clinical inspection within five days before shipping. When exporting pets from the Russian Federation, it is necessary to take into account the veterinary requirements of the country where the animal will be imported and obtain a veterinary certificate in advance in accordance with the requirements of the destination country. An individual in hand luggage or baggage without presenting a phytosanitary certificate may import into the customs territory products of plant origin, provided that their weight does not exceed 5 kg and these products are not planting or seed material or potatoes. Quarantine phytosanitary control includes such goods as fruits, vegetables, dried fruits, cereals, flour, cereals, plants and seeds, wood and lumber, soil and soil, etc. The list of goods subject to veterinary control was approved by the Decision of the Customs Union Commission dated 18 June 2010 No. 318. For goods subject to prohibitions and restrictions, the law of the Eurasian Economic Union and the legislation of the Russian Federation on customs provide for their customs declaration in writing using a passenger customs declaration (PTD). The list of goods to which bans or restrictions on import or export apply is approved by the Decision of the Board of the Eurasian Economic Commission No. 134 “On regulatory legal acts in the field of non-tariff regulation.” In accordance with this document, brass knuckles, surikens, boomerangs and other objects of impact-crushing, throwing, piercing and cutting action specially adapted for use as weapons are included in the list of service and civilian weapons prohibited for import, export and transit through the customs territory EAEU. Detailed information about the requirements for goods imported by individuals is posted on the website of the Federal Customs Service - www.customs.ru in the section: “Information for individuals.” The texts of customs legislation acts are officially published and available for review on the website of the Eurasian Economic Commission (https://www.eurasiancommission.org). You can also get the necessary advice from the legal group of the Tyvin Customs. Contact phone number 8 (39422) 95739, 95740.

Senior State Customs Inspector for Public Relations B.B.

Kalzan Description for the announcement: Number of impressions: 1796

brief information

The organization TYVINSKAYA CUSTOMS was registered on November 17, 1992 by the registrar: Interdistrict Inspectorate of the Federal Tax Service No. 1 for the Republic of Tyva

.

After registration, the company was assigned: OGRN: 1021700511700, INN: 1701008190 and KPP: 170101001. The main type of activity is “ Management of financial activities and activities in the field of taxation

.” Legal address TYVA CUSTOMS - 667009, Republic of Tyva, Kyzyl, st. Rivne, 3, a.

Address on the map

Ivan Suvandii: how Tuvan customs became

Tuvan customs was formed relatively recently, in 1992. This year she celebrates a milestone – her 25th anniversary. To find out how customs began, the younger generation of customs officers met with the first head of customs, Ivan Maksimovich Suvandii.

Ivan Maksimovich can rightfully be called a “pioneer”, the creator of the customs business in Tuva.

Ivan Maksimovich’s work biography is rich, but at first it was not connected in any way with customs business. Ivan Maksimovich Suvandii began his career in the distant 60s. After graduating from high school, he entered the Moscow Veterinary Academy at the Faculty of Technology, majoring in animal science. After graduating from the academy, he was sent to Tuva. Where he worked as the chief livestock specialist on the collective farm in the Ovyur district. Then he was appointed to the post of head of the Department of Agriculture in the village of Khandagayty, and later deputy minister of agriculture of the Republic of Tyva. For his conscientious attitude to work, by decision of the bureau of the district party committee, he was sent to Moscow to the Higher Party School. At the end of it, Ivan Maksimovich returned to work in Tuva. In the late 80s, he became deputy chairman of the State Agro-Industrial Committee of the Tuvan Autonomous Soviet Socialist Republic, then was elected to the Supreme Council of the Tuvan Autonomous Soviet Socialist Republic.

In the 90s, after the collapse of the Soviet Union, Ivan Maksimovich was sent to Moscow to create a permanent Representative Office of the Republic of Tyva under the President of the Russian Federation. Having founded the embassy of the republic, he wanted to return to his native land. At that time, in connection with the abolition of the state monopoly of foreign trade, customs authorities began to be created in the constituent entities. And again he is sent to Moscow for an interview with the chairman of the State Customs Committee of the Russian Federation. Later, on November 17, 1992, an order was issued by the State Customs Committee of Russia, which stated: “To transform the Kyzyl customs post of the Krasnoyarsk customs into the Tuva customs (Kyzyl), defining the Republic of Tuva as its area of activity. Establish the staffing level of Tuva customs at 25 units.” And I.M. was appointed its head. Suvandi. Starting from this date, he assembled the Tyvin customs bit by bit. He was given a responsible task - to qualitatively staff the customs office in the shortest possible time, resolve all financial and economic issues, and ensure the full functioning of the customs office.

The fate of the young customs officer was not easy. Although customs officers almost immediately found a permanent place of residence - a solid three-story building on the outskirts of the city, the situation with personnel was catastrophic. There were few brave souls who decided to work in the newly created and, as many believed, short-lived structure. Everyone was scared by the unknown.

Ivan Maksimovich recalls: “From the day of its creation there were no professional customs officers. He recruited personnel himself, inviting people from other law enforcement agencies with similar occupations. The newly hired employees had to master new customs functions, not only for themselves, but for the entire republic. The Customs Code had not yet been published, and the first customs officers were guided in their work by temporary Instructions, orders of the State Customs Committee of Russia, and decrees of the Government of the Russian Federation. They became customs officers on their own, learning from their own mistakes. When the Customs Code of the Russian Federation came out, we stayed after work and studied it for 2-3 hours.”

Despite the difficulties, all tasks assigned to customs were carried out at a professional level. The experience of working with people, acquired in leadership positions, helped a lot and, as Ivan Maksimovich himself notes, the enormous merit of his family, those people with whom he had to create customs: N.G. Pankratova, V.F. Seglenmay, N.A. Goryainov, V.N. Nekrasov, A.I. Mileikin, K.E. Merzlyakov, D.V. Lambyn et al.

“Current graduates of the Russian Customs Academy are true professionals. With me in 2000, the first RTA graduate Shonchalai Salchak (Damba) came to work at customs. I am pleased to look at customs professionals.” - Ivan Maksimovich expressed himself.

Young customs officers listened with interest to Ivan Maksimovich’s memories: about how they brought official transport from Moscow, Kazan, Kaluga, how they shared the only computer for the entire customs office.

For his work, Ivan Maksimovich was awarded a medal in honor of the 100th anniversary of V.I. Lenin, has the title “Honored Worker of the Republic of Tyva”, is one of the remarkable people of the republic, whose names are included in the book “People of the Center of Asia”. His name will forever go down in the history of his native land. Despite his advanced age, he is still cheerful, strong in spirit and continues to lead an active lifestyle. Of course, he visits his native customs walls, where the traditions he established to this day live on.

print version