Re-export is the removal from a country of previously imported goods for return or resale to other countries. The product must remain unchanged, without processing.

Removal for return

- List of goods for re-export

- Re-export regime restrictions

- Export conditions

- Documents for re-export mode

- Refund of customs duties upon re-export

Using the re-export regime, you can effectively engage in trading activities by purchasing foreign goods at low prices, and then resell them to foreign markets, for example, after repackaging. Thus, carry out profitable three-way transactions. Also, through the re-export mode, you can return defective goods to a foreign seller.

It is possible to both import goods into the territory of the Customs Union (direct re-export) and send goods to third countries without importing them into the country (indirect re-export).

List of goods for re-export

The main goods for re-export are oil, natural gas, rubber, non-ferrous metals, wool, leather and food products.

The re-export procedure includes foreign-made goods in the territory of the Customs Union. As well as goods for domestic consumption, when returned to the seller, when the following conditions are met:

- placement under re-export regime should not exceed one year from the date of transfer for domestic consumption;-

- provision of all necessary documentation to supervisory authorities;

- the goods have not been used and have been repaired or processed;

- products can be identified.

Export conditions

- Status of foreign goods.

- Permits for re-export of a specific group of goods.

- Contracts for the import and export of goods. The contract must contain products that are not prohibited for export.

- The declarant accepts and documents in a receipt the obligations for the re-export of goods in the presence of a customs representative.

- Submission to the control authorities of a letter of guarantee, which indicates a list of obligations for the safe import or storage of products in customs warehouses, with agreement to pay all duties.

In what cases is the re-export procedure applied?

Re-export

- a customs procedure when imported goods from one state are exported through the territory of a third to another state.

A good example of re-export can be considered natural gas, which is supplied from one state to another through the territory of a third through a gas pipeline.

Goods may be eligible for re-export if the following conditions are met:

- product lots must be produced abroad;

- the presence of a special permit for re-export.

To obtain a permit for re-export, the following documentation is required:

- contracts for the import (export) of goods, which confirm that the commodity item is being exported purely for the purpose of re-export;

- application for re-export;

- documents on payment of fees and tax payments.

Re-export is a customs procedure, the scheme of which may be indirect

(the operation is carried out through Russia, but the products are not imported into the country) and

direct

(with import into the Russian Federation). The indirect type of re-export of goods movement is more popular, as it reduces fuel costs and reduces the tax burden (such products are not subject to duties).

Re-export allows you to simply and without loss compensate for losses incurred due to the purchase of defective products, expired goods or product items with other defects for which the manufacturer is to blame. Returning products is possible even if they are already in free circulation.

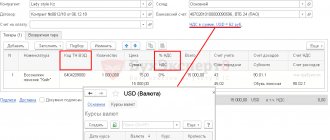

Documents for re-export mode

The documents must contain information about the circumstances of the import of goods, about the placement of goods under the release procedure for domestic consumption, about non-fulfillment of the terms of the foreign economic contract and about the use of these goods. Customs declarations are required for all goods. Identification of the goods by customs authorities during inspection is mandatory.

- agreement with the reason for import and conditions for the return of goods;

- invoices from the sender and recipient;

- electronic copies of the customs declaration;

- act of acceptance of goods;

- claim to the supplier from the recipient;

- response from the supplier, with agreement to accept the goods back;

- a letter confirming that the goods were not repaired or used during their stay in the country. The reasons why goods need to be placed in re-export mode are indicated.

Indirect re-export or sale of goods without import into the Russian Federation (Competition article)

Foreign economic activity (hereinafter referred to as FEA) is an essential component of the work of modern enterprises in a market economy. For Russia, this area has acquired particular relevance in connection with its accession to the World Trade Organization (WTO) and the need for further adaptation to the conditions of the world market. Currently, foreign economic relations in Russia are mostly represented by exports and imports. A rapidly developing market instantly reacts to changes and adapts to new conditions. Re-export has become one of the driving factors in this process. However, within the framework of this article, we will pay special attention to the issues of accounting, currency and tax regulation and control of re-export operations that do not involve the import of goods into the territory of the Russian Federation for subsequent sale. Let us consider in more detail what is meant by the re-export regime.

Re-export is the removal from the state of goods previously imported into it for the purpose of subsequent resale to other countries. In international practice, re-export is usually divided into two categories – direct and indirect. They differ in that with direct re-export the goods are imported into the territory of the country, and with indirect re-export they are sent directly to a third party, bypassing the condition of crossing the border of the resident country.

The advantages of using the indirect re-export regime are obvious.

Firstly, a significant reduction in the cost of transporting goods to the buyer leads to a reduction in costs with a subsequent reduction in the price of the goods, which is undoubtedly a competitive advantage for a company that is going to introduce goods to the international market; also, a reduction in delivery times leads to a reduction in the burden on the environment , indirectly, the eco-factor increases consumer confidence in the supplier.

Secondly, reducing the tax burden, namely: goods sold in the indirect re-export mode, i.e. without import into the territory of the Russian Federation, are not subject to taxation under value added tax. Clause 1 of Article 146 of Part Two of the Tax Code of the Russian Federation establishes that the object of VAT taxation is the sale of goods (work, services) on the territory of the Russian Federation. In this regard, products sold by Russian organizations to foreign legal entities outside the territory of the Russian Federation are not subject to VAT taxation on the territory of the Russian Federation and, accordingly, are not subject to this tax. Therefore, according to the current procedure for applying VAT, there is no reason to deduct tax amounts on goods (work, services) purchased on the territory of the Russian Federation and used in the sale of such products. The procedure for determining the place of sale of goods is established in Art. 147 of the Tax Code of the Russian Federation, namely, the place of sale of goods is recognized as the territory of the Russian Federation, in the presence of one or more of the following circumstances:

- the goods are located on the territory of the Russian Federation and are not shipped or transported;

- the goods at the time of the start of shipment or transportation are located on the territory of the Russian Federation

Considering that currency control of re-export transactions in which goods are imported into the customs territory of the Russian Federation is regulated, in this article we will consider the issues of currency regulation and control of re-export transactions without import of goods into the customs territory of the Russian Federation, and the use of the term “indirect re-export” will include transactions (mainly transactions for the purchase and sale of goods).

Currency control of re-export transactions, as a rule, comes down to the implementation of currency control of non-cash payments (for these foreign trade transactions), which can be carried out in foreign currency and in the currency of the Russian Federation. Currency legislation in the Russian Federation is regulated by the Federal Law of December 10, 2003 No. 173-FZ “On Currency Regulation and Control” (hereinafter referred to as the Law on Currency Regulation). As a result of the analysis of currency legislation on the regulation of re-export transactions, a number of features were identified.

The purpose of currency control is to ensure compliance with currency legislation when carrying out currency transactions by a resident.

The main document confirming the transaction in the case of re-export may be a contract or supply agreement. When carrying out such a transaction, in order to correctly prepare the necessary documents, it is strongly recommended to consult an authorized bank. In case of improper execution of documents for an upcoming transaction, the bank may provide a participant in a foreign economic transaction with a reasoned refusal to control operations. Within the framework of the current currency legislation, there are a number of advantages of using transactions using indirect re-export.

1) Lack of a regulated package of documents confirming the transaction. This means that in order to control this transaction, any documents confirming the transaction must be provided to the bank. Such documents can be:

- supply agreement;

- invoice (account, specification);

- consignment note in the form TORG-12;

- certificate of completion;

- CMR (international transport bill of lading).

Currency transactions within the framework of transactions between residents and non-residents involving the acquisition by residents of goods from non-residents outside the territory of the Russian Federation and/or the sale of these goods to other non-residents without their import into the territory of the Russian Federation are carried out without residents issuing transaction passports in accordance with the provisions of the Instructions of the Central Bank of Russia dated June 4, 2012 No. 138-I “On the procedure for residents and non-residents to submit documents and information related to foreign exchange transactions to authorized banks, the procedure for issuing transaction passports, as well as the procedure for authorized banks to record foreign exchange transactions and control their implementation.”

2) There is no control over the timing of contract execution by the currency control authorities, i.e. currency controllers will not record a violation in the event of untimely crediting of foreign exchange earnings according to the deadlines specified in the contract, due to the fact that transactions of this type are not subject to the Currency Regulation Law.

3) According to Art. 2 of the Federal Law “On the Fundamentals of State Regulation of Foreign Trade Activities” No. 164-FZ, foreign trade activities should be understood as activities in the field of foreign trade in goods, services, information and intellectual property.

This article includes the import and (or) export of goods as foreign trade. Import operations include the import of goods into the customs territory of the Russian Federation without the obligation of re-export, and export operations include the export of goods from the customs territory of the Russian Federation without the obligation of re-import.

To summarize the above, the requirements of Article 19 of the Law on Currency Regulation apply to foreign trade transactions, the result of which involves the import or export of goods from the customs territory of the Russian Federation. Consequently, this article does not apply to residents engaged in foreign trade activities, under the terms of which goods are transferred by a resident to a non-resident outside the customs territory of the Russian Federation.

When making this type of transaction when concluding a foreign trade contract, one should take into account the provision of the Law on Currency Regulation on the crediting of funds due for goods transferred to a non-resident. Only if the terms of the foreign trade contract stipulate that the resident seller is due money for the goods transferred to the non-resident minus the commissions of intermediary banks, then failure to credit the account of this resident with the amounts of commission fees and bank expenses in foreign currency or the currency of the Russian Federation stipulated by the foreign trade contract will not constitute a violation currency legislation of the Russian Federation.

From the point of view of making a decision on the resident’s compliance with currency legislation, the fact of transfer of goods from the seller to the buyer is decisive. When determining the moment of fulfillment of the seller’s obligation to transfer the goods, it is necessary to be guided by the norms of civil legislation, in particular, Article 458 of Part Two of the Civil Code of the Russian Federation.

Let's illustrate with a practical example.

The supply contract provides for the purchase of goods by a resident from a non-resident on the terms of FCA Klaipeda (Incoterms 2010). In this case, the non-resident is considered to have fulfilled his obligations to the resident for the supply of goods at the time of delivery of the goods to the agreed place of delivery. The contract does not provide for deadlines or obligations for the import of goods into the customs territory of the Russian Federation. A resident who has entered into such a foreign trade contract is not subject to violation and complies with the requirements of Article 19 of the Law on Currency Regulation in the event that a non-resident fails to comply with the terms of delivery of goods.

The democratization of foreign economic policy has opened up the opportunity for every independent entrepreneur to establish international contacts. At the same time, every Russian enterprise that decides to expand its business outside the country faces the task of organizing accounting at a higher level.

Within the framework of this article, I would like to note the issue of organizing accounting for inventory items that are not intended for sale in the indirect re-export mode.

The main tasks of accounting for re-exported goods can be considered:

- control over the movement of goods from a foreign supplier to the place where goods are stored in a warehouse outside the Russian Federation;

- notification of the exact location of goods in the directions of their movement and storage locations;

- control over the quantitative and qualitative safety of goods;

- accounting for overhead costs for re-export operations;

Accounting for re-exported goods depends on the type of assets being sold.

In accordance with clause 5 of PBU 5/01, inventories (MPI) are accepted for accounting at actual cost. In accordance with clause 6 of PBU 5/01, the actual cost of inventories is the sum of the organization's actual costs for their acquisition, excluding VAT and other refundable taxes.

The cost of inventories in accordance with the Instructions for the application of the Chart of Accounts for accounting the financial and economic activities of organizations, and the Instructions for its application (approved by Order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n.) is formed on accounts 41 “Goods” and 10 “Materials”.

To summarize information about the procurement and acquisition, account 15 “Procurement and acquisition of material assets” can also be used. In this case, all expenses for the procurement and delivery of goods, included in their actual cost, will be collected in the debit of account 15, and the generated actual cost of goods will be written off in the debit of account 41. To ensure operational control over the movement of goods intended for sale without their delivery to territory of the Russian Federation, re-exporting organizations maintain their synthetic records. Thus, the following subaccounts can be opened for account 41 “Goods”:

- “Re-export goods on the way”;

- “Re-export goods in warehouses and processing abroad”;

- “Re-export goods for sale in the CIS countries”;

- "Imported goods on the way to the Russian Federation."

The last subaccount is presented in the classification not by chance, since a situation may arise in the economic activity of an enterprise when it will be necessary to supply goods to the domestic market that were originally intended for sale using the indirect re-export regime. At the same time, they should be reclassified in accounting within account 41 “Goods”.

In order to reclassify goods previously intended for the application of the re-export regime, the seller’s desire alone is not enough. In order to import this product into the territory of the Russian Federation, you will need to provide documents confirming that the product is intended for sale on the territory of the Russian Federation; such a document is the manufacturer's Invoice, which must indicate that the product is intended for sale in Russia. This is due to the fact that within the framework of foreign trade relations, the pricing policy for the same item number may differ depending on the terms of delivery.

Therefore, the importing organization in this case should contact the manufacturer with a request to re-qualify the delivered goods and make changes to the primary documents, i.e. an invoice which will indicate the place of sale of goods. Thus, in order to correctly reflect re-exported goods in accounting, Russian re-exporting buyers need to ensure full control over the movement of goods, as well as clearly monitor how the foreign trade contract provides for the transfer of ownership of these goods, as well as the possibility of selling these goods domestically. market.

Elena Rantseva

| New generation berator PRACTICAL ENCYCLOPEDIA OF AN ACCOUNTANT What every accountant needs. The full scope of always up-to-date accounting and taxation rules. Connect berator |

Refund of customs duties upon re-export

Any customs taxes and duties upon re-export are waived. All fees are charged in the general manner: separately for import and separately for export.

When a consignment that was in re-export mode has been exported, paid deposits can be returned with the written permission of customs.

When moving from the regimes of processing on customs territory or temporary import, a refund of previously paid funds is possible if re-export is carried out no later than 2 years after import and the goods were not imported for commercial purposes.

Returned deposits may not be subject to interest or indexation.

Deductions for customs VAT

If the importer sells the cargo already in Russia or makes transactions with the goods subject to VAT, then he will have to calculate and pay the tax again. And here he receives the right to a tax deduction - that is, a tax reduction on the VAT already paid. To do this, you need to meet some conditions.

Individual entrepreneurs and companies that, according to the laws of the Russian Federation, are required to pay VAT (mainly taxpayers on the main taxation system) on goods from the list in paragraph 2 of Art. 171 Tax Code of the Russian Federation. Also, to apply the deduction, goods must be registered and have a package of documents to confirm their value:

- foreign trade contract;

- customs declaration;

- CMR with marks that are placed when crossing the border;

- confirmation of payment of customs duties, excise taxes (if any) and VAT.

Customs VAT can be deducted within three years from the tax period when all these conditions are met (clause 1.1 of Article 172 of the Tax Code of the Russian Federation).

If changes had to be made to the declaration and the amounts of customs duties were adjusted, a deduction is claimed for the amount of VAT actually paid at customs. It is this amount that is transferred to customs accounts, and then goes to the tax office.

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service