International and domestic trade is an important part of modern society. Trade transactions are one of the main engines of the economy. However, regulations are needed that will regulate the partnership relations of the parties to the transaction and interpret the basic terms of the contracts. Such acts include INCOTERMS. These rules are regularly improved and adjusted to modern conditions. The current edition of 2010 includes many trading concepts. It presents their exact interpretations. One of these terms is CPT. Before using it, you need to familiarize yourself with the terms of delivery and the CPT basis. This will be discussed in this article.

What is CPT

“Transportation paid until...” - this is how the abbreviation stands for. It means that:

- The supplier is responsible for paying for delivery of the goods to the specified location.

- Risks are removed from the exporter at the moment of transfer of products to the freight forwarding company.

- After handing over the cargo to the carrier, the buyer is responsible for the goods. In some cases, risks may be distributed between the customer and the transport company.

- The buyer bears the costs associated with cargo insurance.

CPT delivery terms can be considered more favorable for the supplier, since he is not responsible for the bulk of the transportation.

Its task is to transfer the cargo to a carrier agreed with the buyer, who can use any type of transport to deliver the products. This allows the seller to minimize risks and financial costs, since he does not need to buy an insurance policy.

For the buyer, concluding a contract with such requirements will be beneficial if he picks up the goods by his own transport. This means that he does not need to overpay for the services of transport and forwarding companies. Also, concluding an agreement on such conditions is advisable if delivery is carried out by general container lines of the importer’s country.

Incoterms 2010 classification

Terms of delivery of goods for any type of transport

EXW / Ex Works – Ex-factory

FCA / Free Carrier - Free carrier

CPT / Carriage Paid to - Carriage paid to

СIP Carriage and Insurance Paid to - Transportation and insurance paid to

DAT / Delivered at Terminal

DAP / Delivered at Place

DDP / Delivered Duty Paid

Terms of delivery of goods for sea and inland water transport

FAS / Free Alongside Ship - Free along the side of the ship

FOB / Free on Board - Free on board

CFR / Cost and Freight - Cost and freight

CIF / Cost Insurance and Freight - Cost, insurance and freight

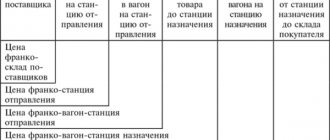

Delivery basis

Having deciphered the term, it becomes clear that the delivery basis of SPT INCOTERMS 2010 is determined by the terminal in which the seller transfers the cargo to the disposal of the first carrier. At the time of this transfer, the sender assumes no risk.

The seller's task is not only to transfer the products to the freight forwarding company chosen by the buyer, but also to clear the products from export duties.

The process of processing the import of goods into the country and paying customs duties is borne by the customer.

Learn more about cost sharing

However, the CPT delivery conditions (Incoterms 2010) provide for some conditions under which the buyer will also pay. Let's take a closer look at them.

Unless otherwise specified in the contract, he will pay all costs incurred up to the time of delivery. However, unless the documents indicate something else, the supplier pays for all this. Again, provided that there is such a clause in the contract, he can pay for the services of unloading and loading of goods, but usually the supplier himself is responsible for this.

If the buyer does not accept the goods within the specified period, although their delivery has been carried out, then he pays all additional costs incurred. In addition, payment of unforeseen expenses (related to cargo) when transporting goods through the territory of another country (unless otherwise specified in the contract) is almost always borne by the recipient.

So we looked at the CPT (Incoterms) delivery conditions. 2012 brought new rules, but all the provisions we described in them remained unchanged.

Duties of the parties

SPT delivery conditions allow you to distribute responsibilities between the exporter and importer. This makes the transaction process easier. Compliance with delivery requirements allows you to avoid possible problems and contributes to the clear fulfillment by the parties of their obligations under the foreign economic contract.

- The sending party provides:

- Delivery of goods to the terminal, where the cargo will be transferred to the buyer's forwarder or transport company, which has undertaken to supply the products to the customer.

- Carrying out customs formalities related to the export of goods from the country. This means that the seller transfers the cargo to the carrier, cleared of export duties.

- Loading of goods onto a vehicle named by the customer. The costs associated with loading are paid by the seller.

- Payment for storage of products at the loading terminal.

- Product labeling and packaging. Packaging materials are paid for by the supplier.

- Inspection of goods under CPT conditions.

- The receiving party provides:

- Taking out insurance and taking on risks associated with the delivery of products.

- Collection of goods at a named terminal and transportation of cargo to our own warehouses.

- Payment of import duties and completion of customs formalities during the import of goods into the country of destination.

- Fulfillment of the conditions for acceptance of the goods at the loading terminal for the first carrier.

Incoterms are international rules in the form of a dictionary that provide uniform interpretations of the most commonly used trade terms in the field of private foreign trade, primarily regarding the place of transfer of responsibility for the cargo from the seller to the buyer. International trade terms are standard terms of contracts for the international sale of goods that are defined in advance in an internationally recognized document, in particular, used in a standard sales contract developed by the International Chamber of Commerce.

The International Chamber of Commerce first published uniform international rules for the interpretation of trade terms, known as Incoterms 1936, in 1936. Additions and changes were subsequently made in 1953, 1967, 1976, 1980, 1990, 2000, 2010 to bring the rules into line with current international trade practice.

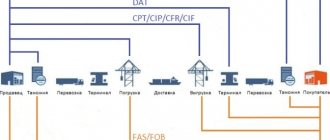

- Group E

- shipment, transfer of obligations to the buyer - at the place of dispatch of the goods. The seller is obliged to provide the goods to the buyer directly at the manufacturer, his warehouse, the seller does not perform customs clearance of the goods; EXW.

- Group F

- the main transportation of goods is not paid for by the seller, transfer of obligations at the departure terminals for the main transportation. The seller undertakes to place the goods at the disposal of a carrier, whom the buyer independently hires; FCA, FAS, FOB.

- Group C

- the main transportation of goods is paid by the seller, the transfer of obligations is at the arrival terminals for the main transportation. The seller is obliged to enter into a contract for the carriage of goods, but without taking on the risk of accidental loss or damage to the goods; CFR, CIF, CPT, CIP.

- Group D

- arrival, transfer of obligations from the buyer, full delivery. The seller bears all delivery costs and assumes all risks until the goods are delivered to the destination country; DAT, DAP, DDP.

TO GET A CONSULTATION

ExWorks (EXW) From the Factory The term “Ex Works” or simply “Ex-works” means that the seller fulfills his obligation to deliver and disclaims responsibility for the goods when he places the goods at the disposal of the buyer at his enterprise (plant, factory, warehouse and so on.). In particular, he is not directly involved in the loading of the goods - he is not responsible for loading the goods onto the vehicle provided by the buyer, as well as for customs clearance of the goods for export and import into the country of destination, unless otherwise agreed, the buyer bears all costs and risks in connection with with the transportation of goods from the seller’s enterprise to the destination. Thus, this term imposes minimal obligations on the seller. Preparation of export documents also falls entirely on the buyer. It does not apply if the buyer is unable to carry out or ensure the completion of export formalities. In this case, it is recommended to use the term FCA.

Free Carrier (FCA) Free Carrier The term “Free Carrier” means that the seller is considered to have fulfilled his obligation to deliver the goods, cleared for import, from the moment it is placed at the disposal of the carrier at the designated point. If the buyer does not indicate such a point, the seller has the right to determine such a point himself among a number of similar points where the carrier takes the goods at his disposal. In cases where, according to commercial practice, the seller’s assistance is necessary to conclude a contract of carriage (when transporting goods by air or rail), he may act in such cases at the expense and risk of the buyer. Export documents are prepared by the seller, and the seller also pays export duties.

This term can be used when carrying out transportation by any type of transport, including multimodal transport.

Carrier means any person who, on the basis of a contract of carriage, undertakes to carry out or ensure the transport of goods by rail, road, air, sea or inland waterway transport or using multimodal transport. If the buyer authorizes the seller to deliver the goods to a person other than the carrier, for example, a freight forwarder, the seller is considered to have fulfilled his obligation to deliver the goods from the moment of transferring them to this person for storage.

Transport terminal means a railway station, pier, container terminal or yard, a point for receiving various types of cargo, that is, any containers and/or pallets.

Carriage Paid To (CPT) Carriage Paid To means that the seller pays freight for transporting the goods to the specified destination.

The risk of loss or damage to the goods, as well as any increase in costs arising after the goods have been handed over to the carrier, passes from the seller to the buyer when the goods are handed over to the carrier.

Carrier means any person who, under a contract of carriage, undertakes to carry out carriage or arrange for carriage by sea, air, rail, road, inland waterway or intermodal transport.

When transport is carried out by several carriers in an agreed direction, the risk of loss or damage passes when the goods are placed at the disposal of the first carrier.

According to the CPT term, the main transportation to the arrival terminal specified in the contract is paid by the seller, insurance costs are borne by the buyer, import customs clearance and delivery from the arrival terminal of the main carrier is carried out by the buyer. Export duties are paid by the seller.

This term can be applied to all types of transportation, including multimodal transportation.

Carriage & Insurance Paid To (CIP) means that the seller has the same obligations as under the term CIP, but with the addition that the seller must provide transport insurance against risks loss or damage to the goods during transportation. The seller enters into an insurance contract and pays the insurance premium. The buyer should note that the CIP term only requires the seller to provide insurance on minimum terms.

According to these conditions, the seller is obliged to ensure customs clearance of the goods for export. This term can be used when transporting goods by any type of transport, including multimodal transport.

Delivered At Terminal (DAT) means that the seller's obligations to deliver the goods are considered fulfilled when the goods, cleared for export, arrive at the specified point or place at the border, but before the goods arrive at the customs border host country. Export payments and main transportation, including insurance, are paid by the seller, customs clearance for import is carried out by the buyer. The term border refers to any border, including the border of the country of export. Therefore, in this condition, it is very important to accurately determine the boundary by indicating a specific point or place.

This term is intended to be used primarily when transporting goods by rail or road, but it can be applied to any other method of transporting goods.

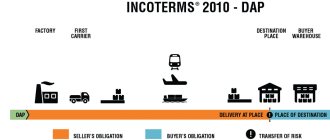

Delivered At Place (DAP) Delivered without payment of duty "Delivered without payment of duty (name of destination)" means that the supplier will be considered to have fulfilled his obligations from the moment the goods are delivered to the desired point according to the contract in the country of import. The seller must bear the costs of paying all related expenses and bear all risks falling on the goods (excluding payment of taxes when importing goods, import duties on goods), as well as all costs and risks in connection with the implementation of customs formalities.

If the buyer fails to fulfill the obligation to clear the goods upon import on time, all additional costs are imposed on him and he bears all additional risks.

If it is agreed between the parties that customs clearance is the responsibility of the seller and he bears the associated costs and risks, it must be expressly stated by adding the appropriate words.

If it is agreed between the parties that the payment of costs levied in connection with reimbursement (for example, value added tax, VAT) will be the responsibility of the seller, this should be expressly stated by adding the appropriate words: “Delivered duty free, VAT payable ( agreed destination).

This term can be used regardless of the method of transportation of goods.

Delivered Duty Paid (DDP) Delivered Duty Paid means that the supplier is deemed to have fulfilled his obligations upon delivery of the goods to the agreed point in the country of import. The seller bears all risks and expenses associated with the import of goods, including payment of taxes, duties and other fees levied upon import of goods, and cargo insurance. While the term EXW "Ex Works" imposes a minimum obligation on the seller, the term DDP "Delivered Duty Paid" imposes a maximum obligation on the seller.

This term cannot be used if the seller is unable, directly or indirectly, to obtain an import license.

This term can be used regardless of the method of transportation of goods.

Also, Incoterms 2010 defines 4 terms that apply exclusively to maritime transport and transport of territorial waters:

Free Alongside Ship (FAS) The term FAS means that the supplier is deemed to have fulfilled its obligation to deliver the goods when the goods are placed alongside the ship at the quay or lighters at the agreed loading point. This means that from this moment the buyer must bear all costs and risks of loss or damage to the goods. Transshipment and loading of cargo onto the vessel is paid in full by the buyer. Under the terms of the Federal Antimonopoly Service (FAS), the buyer is responsible for clearing the goods and duties for their export. This term should not be used when the buyer is directly or indirectly unable to ensure the completion of customs formalities.

Free on Board (FOB) Free on Board means that the supplier is deemed to have fully fulfilled its delivery obligations from the moment the goods pass the ship's rail at the port of shipment. This means that from this moment the buyer must bear all costs and risks of loss or damage to the goods. Under FOB, the buyer is responsible for clearing the goods for export. Transshipment and delivery of cargo to the port of loading is fully paid by the seller.

This term can only be used when transporting goods by sea or inland water transport. In cases where the moment of passage of goods over the ship's rail is of no practical importance, for example, when transporting on a roll-on or roll-off basis or when transporting in containers, it is more appropriate to use the term FAS.

Cost & Freight (CFR) Cost & Freight "Cost and Freight" means that the seller is obligated to pay the costs and freight necessary to bring the goods to the named port of destination, but there is a risk of loss or damage to the goods, as well as the risk of any increase in costs arising after the passage goods on board the ship, passes from the seller to the buyer at the moment the goods pass the ship's rail at the port of shipment. Under the CFR, the seller is required to clear the goods for export.

This term can only be used when transporting goods by sea or inland water transport. In cases where the moment of passage of goods over the ship's rail is of no practical importance, for example, when transporting on a roll-on or roll-off basis, or when transporting in containers, it is more appropriate to use the term CPT.

Cost, Insurance & Freight (CIF) “Cost, Insurance & Freight” means that the seller has the same obligations as under the CFR, but he must provide marine insurance against the risk of loss of or damage to the goods during carriage, the seller enters into an insurance contract and pays the insurance premium to the insurer.

The buyer should note that under the terms of the CIF the seller is only required to provide insurance on minimum terms.

This term can only be used when transporting goods by sea or inland water transport. In cases where the moment of passage of goods over the ship's rail is of no practical importance, for example, when transporting on a roll-on or roll-off basis, or when transporting in containers, it is more appropriate to use the term CIP.

TO GET A CONSULTATION

Preparation of documents and licenses

CPT deliveries require counterparties to prepare a number of documents, as well as acquire export and import licenses. Responsibilities for paperwork are distributed between the supplier and the customer along the lines of delimiting the risks of counterparties.

The supplier is required to:

- Documents confirming the fact of delivery of products to the prescribed destination.

- Permits to store goods at the specified loading location.

- Approvals for loading operations.

- Papers confirming the completion of customs procedures related to the export of products. In order to complete customs formalities when exporting goods from the country, the supplier must ensure that there are certificates confirming the quality and country of origin. The cargo becomes completely cleared of export duties at the moment when the customs authorities affix stamps on the shipping documents.

- Preparation of shipping documents on the acceptance and transfer of cargo to a freight forwarding company. Such papers are prepared by the seller together with the carrier. The format of these documents depends on the routes by which the cargo will be delivered.

The customer is required to:

- Documents confirming cargo insurance.

- Papers confirming the completion of customs formalities when importing goods into the country.

Definition of the concept

In world practice, CPT delivery terms mean that the seller undertakes to deliver the goods to the buyer who paid for the purchase, but not the transportation. This is a key feature of this type of transportation: the seller assumes all obligations regarding the costs of the service. The buyer, in turn, fully agrees with all risks.

The “carrier” in this particular case means any individual or legal entity that can carry out (under the terms of the contract) the delivery of cargo by road, air, sea or other mode of transport provided for in the documents. If the CPT delivery conditions provide for the shipment of goods with the participation of several suppliers, all risks pass from one of them to another at the moment when the goods are transferred from one mode of transport to another.

All customs operations are also the responsibility of the seller himself. Please note that the term CPT can be used in relation to any existing mode of transport.

Risks and insurance

The terms of INCOTERMS CPT 2010 guarantee the distribution of risks associated with the supply of products between counterparties. It means that:

- Until the goods are transferred to the first carrier, who undertakes to deliver the goods to the specified terminal, the supplier is responsible for the product.

- After transferring the products into the hands of the freight forwarding company, the risks are transferred to the carrier and seller. Therefore, the customer must take care of obtaining insurance.

Risk transfer procedure

It is necessary to take into account the key moments of delivery of goods at which their transfer occurs. Since in any transaction this procedure occurs at least twice, all participants (seller, buyer and carrier or carriers) must clearly allocate their responsibilities. This is especially true for loading and unloading operations, during which it is recommended to have step-by-step instructions.

Life practice and the imperfections of Russian legislation show that in a situation with several cargo carriers and the absence of an exact delivery point, a contradiction may arise between the first carrier and subsequent ones. As a rule, the first carrier on the list, indicated in the documents, by default assumes all risks regarding the safety of the goods and discrepancies in the documents. To avoid this blatant injustice, all participants in the delivery of cargo should provide in documentary form (in the purchase and sale agreement, transportation agreement and shipping documents) all the key points of the transfer of responsibility.

Otherwise, critical moments will be resolved exclusively in court. And such sad practice, for example, exists for SRT-Moscow delivery conditions. There have been cases when suppliers of building materials were left without cargo and money due to the fact that unscrupulous carriers simply stole other people's property.

Subtleties of work

CPT, like other foreign trade transactions, is distinguished by its subtleties. To avoid problems when concluding a contract on such terms, you need to familiarize yourself with their pitfalls in advance. There are several nuances that you should pay attention to first:

- A controversial situation between counterparties who are conducting a foreign trade transaction can be caused by an erroneous determination of the place of arrival of the cargo. For example, if the concluded contract specifies a warehouse located in the buyer’s country as the destination, then the supplier will be responsible for completing import customs formalities. But it's not right. The buyer must pay import duties and go through customs procedures related to the import of products into the country.

- Due to the similarity of terms in CPT and DAP contracts, problems periodically arise between suppliers and buyers. This happens for the reason that counterparties, when concluding a foreign economic contract, confuse the terms of the transportation agreement.

- If, according to CPT, the risks associated with the delivery of goods are assigned to the freight forwarding company or the buyer, then according to the requirements of DAP, they are fully borne by the exporter. This difference in terms, which is of particular importance due to the additional costs, may give rise to financial disputes between counterparties.

- Having concluded a transaction, the customer must remember that the seller is not obliged to ensure the unloading of the goods at the destination. This responsibility falls on the receiving party.

- If you do not pick up the cargo from the point of arrival on time, the transport company or the terminal owner may impose a fine on the customer. Therefore, the importer must ensure timely unloading.

- The sending party has the right to independently choose transport and routes for delivery. If the supplier tries to deliver cargo via a non-standard route, which may affect the customs value of the goods, the buyer has the right to demand that the sender reduce the cost of the product.

When drawing up a contract, pay attention to these nuances.

Determining your destination

Thus, in the final contract it is recommended to determine as precisely as possible the destination to which responsibility for the transported goods will rest with the logistics company (or the seller himself, subject to independent transportation). It is the seller's responsibility to ensure that appropriate supply agreements are in place. Note! According to the rules of CPT DAP, the terms of delivery do not provide for compensation to the seller for the costs of unloading the goods, unless otherwise provided by agreement of the parties, which is reflected in the executed documents.

Let us note once again that the seller will also be required to fulfill all customs formalities if the conditions of transportation require travel across a state or internal border. But! In no case is he obliged to bear the costs and carry out formalities when importing cargo, pay customs duties or other services.

Having finished considering the general points, we should discuss more specific nuances of deliveries that are directly related to the seller.

Cases of force majeure

This refers to situations where one of the parties cannot fulfill its obligations for reasons that do not depend on the supplier or buyer. As a rule, these are natural disasters, destabilization of the political situation in the country, or something similar. Most often, the contract contains a clause according to which the parties can separate amicably. If this does not happen, the situation is considered in arbitration court.