Home \ Flour for export

Exports of legumes, grains and flour are increasing annually. The main buyers of these products are Turkey, Egypt, the countries of the Middle East, Europe, Asia and Africa. In China, flour is used to produce colossal quantities of instant noodles, which are then shipped around the world.

Flour is used to make bread, pasta, baked goods and more. The range of flour is very wide and has a low cost, the product quality is high and has an absolutely natural composition, which allows Russia to get rid of competitors in the market.

Flour customs clearance points

Most often, flour is sent by air from these Russian airports:

- Domodedovo Airport (Domodedovo cargo temporary storage warehouse);

- Sheremetyevo Airport (temporary storage warehouse Sheremetyevo cargo, temporary storage warehouse Moscow cargo);

- Vnukovo Airport (SVH Vnukovo cargo);

- Pulkovo Airport (temporary storage warehouse Pulkovo cargo).

Flour is sent by sea:

- Novorossiysk seaport;

- Baltic seaport.

Flour dispatch points by road:

- Food Logistics LLC (Food City);

- East terminal (Kiev customs post);

- LLC "Avtologika" (Leningrad customs post) and others.

Flour also arrives at the railway station:

- Silicate;

- Kuntsevo;

- Vorsino;

- Khovrino.

Secrets of transporting flour

The secret to delivering flour is not only to find a reliable broker in Russia (Moscow), but also to find a customs broker in the country of export.

An unverified broker may first tell us some payments to the state, and then, when you deliver the cargo, he will say that all the laws in the country have changed, and you will now pay different duties. That is why before customs clearance to another country, sending cargo or before air delivery, all these points need to be agreed upon.

We coordinate the customs declaration with a customs broker in another country. The customs broker there coordinates with customs, and after that we send the cargo. This is the secret of correct delivery and customs clearance of flour.

If your customs broker in the export country does not do this, you may incur additional costs. Therefore, you need not only to find a reliable customs broker in Moscow, because a customs representative in Moscow does not understand the procedures in another country, but also to find a competent broker in this country.

Exporting flour does not include any risks associated with cargo being delayed at customs. Also, when exporting, customs duties are not paid to our state, but are paid only in the country of export. If you are planning to export flour, it is very important to find a broker in another country who will coordinate all the selected HS codes, description of the goods, and customs payments with a customs official.

According to the Ministry of Agriculture of the Russian Federation, by 2024, flour exports from Russia may increase to 1 million tons, which is 5 times higher than in 2021 (0.2 million tons). Today, about 20 enterprises in the industry provide 80% of flour exports, and it is they, according to the ministry, that should become the foundation for increasing export potential by adjusting the volume and direction of government support measures.

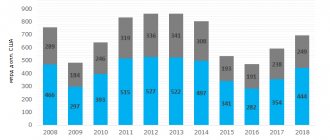

According to the Federal Customs Service of the Russian Federation, for 12 months of 2021 (from January to December), the volume of flour exported by Russia amounted to 201.2 thousand tons (in 2021 - 235.9 thousand tons, in 2015 - 264.2 thousand tons). Let us recall that in recent history, the export of domestic flour did not exceed 478 thousand tons (2008/09).

Among the importing countries of Russian flour, the leader is China, which accounts for 51.38% of total exports, followed by Abkhazia, the latter’s share is 11.11%.

According to forecasts by the International Grains Council (IGC), global flour trade in 2017/18 is expected to reach a record 17 million tons in grain equivalent, which is higher than in the seasons 2016/17 (16.9 million tons) and 2015/ 16 (16.6 million tons).

Afghanistan and Iraq will remain the leaders in flour imports. The volumes of purchases from these countries this season may also become a record. According to analysts' forecasts, Afghanistan imports about 2.75 million tons of flour (in 2016/17 - 2.48 million tons), Iraq - 2.6 million tons of flour (in 2016/17 - 2.4 million tons) , Uzbekistan - 900 thousand tons (in 2016/17 - 870 thousand tons), Sudan - 700 thousand tons of flour (in 2016/17 - 600 thousand tons), Brazil - 700 thousand tons of flour, which is 100 thousand tons more than a year earlier.

Turkey will remain the world's largest flour exporter in 2017/18, according to IGC. It is expected that it will supply 5.45 million tons of flour to foreign markets (5.32 million tons in 2016/17). The forecast for Kazakhstan has been increased - to 3.35 million tons (in 2016/17 - 3.14 million tons), the second largest exporter of flour. Projected exports from EU countries will be 950 thousand tons, which is lower than last year (1.1 million tons). Ukraine will increase flour exports to 600 thousand tons, compared to 562 thousand tons a year earlier. US flour exports in 2017/18 are forecast at 450 thousand tons, which is slightly lower than the previous season - 466 thousand tons. Flour exports from Russia are estimated at 276 thousand tons.

Today, the domestic flour and cereal industry has production facilities capable of fully satisfying domestic needs for flour and cereals, as well as providing export supplies in the amount of up to 3 million tons. The main factor constraining the export of bread products from Russia is the lack of government support.

The Russian Union of Flour and Cereal Enterprises (RUMCP) considers one of the priority measures of state support for flour exports to be reimbursement to enterprises of the flour and cereal industry of part of the costs of purchasing raw materials (15–20% of the cost) for producing products for export. The Government of Turkey is carrying out similar support measures, stimulating flour millers to develop export supplies, providing exporting enterprises with the issuance of licenses, this gives flour millers the right to purchase wheat from the Turkish Grain Union at prices lower than domestic commercial prices, as well as being exempt from import duties (130%) on wheat and VAT subject to the sale of flour for export. State support for exporting enterprises has allowed the country to increase export supplies of flour more than 20 times over the past 15 years, from 250 thousand tons (2002) to 5.32 million tons (2017). Türkiye has become the world's largest flour exporter for the sixth year in a row.

Over the past 10 years, the number of countries to which Turkey exports flour has grown to 160. More than 40% of exported flour is supplied to Iraq. Other major buyers include Sudan, Syria, Angola, Yemen, Indonesia, Vietnam and even the Philippines. Another advantage of Turkey is its favorable geographical location for supplies to the Middle East and African countries.

The main supplier of wheat to Turkey is Russia, which from January to December 2021 exported about 3.5 million tons of grain to this country. On the one hand, Turkey is a stable sales market for Russia, on the other hand, Russia promotes the development of Turkish flour exports, and with the above government support measures, it is difficult for Russian exporting enterprises to compete on equal terms with Turkish processors.

Kazakhstan consistently occupies second position in the ranking of world flour exporters, thanks to the availability of high-quality wheat and its convenient location in close proximity to world flour importers in Central Asia. The country, which until 1992 imported a third of its flour consumption from Russia, has since the early 2000s. managed to build its grain production and processing in such a way that it is now able to export about 50% of its flour output. This phenomenon could not have occurred without government support and is worthy of study. Everyone benefited from this: the state, society, and business.

Kazakhstan is the main supplier of flour to the countries of Central Asia, displacing Russia from the markets of Uzbekistan, Tajikistan and Afghanistan. Kazakhstan is geographically closed to other countries, and in order to expand sales markets, Astana had to seriously work on transport routes. In 2009, Kazakhstan, together with China, built a railway line with access to the Indian Ocean, and in 2014, together with Turkmenistan and Iran, a railway line to Iran, opening up a direct non-transshipment route to the countries of the Middle East, bypassing Russia, and also to northern Africa.

The main consumer of Kazakh flour is Afghanistan: 1.545 million tons of flour were exported to this country. Uzbekistan imports 760.6 thousand tons of flour from Kazakhstan, Tajikistan – 53.1 thousand tons.

A threat to Kazakhstan’s position could be the desire of the main importing countries to develop their own grain processing industry. This explains the decrease in exports to Uzbekistan, which introduced duties on imported Kazakh flour.

Russia may well set a goal to take one of the leading positions in the markets of Africa and Central Asia. In this region, our country has the greatest opportunities for exporting flour, having entered the markets of key importing countries, but to radically change the situation, government support in this direction is necessary. Among the main reasons holding back exports from Russia are the difficulties of transporting and storing grain, primarily due to the size and geographical location of the country. Another reason is the growing competition from Turkey and Kazakhstan, which continue to increase production and export of flour, taking advantage of their advantageous geographical location.

To increase flour exports in this region, RSMKP considers it necessary to take the following government support measures: reimbursement of part of the costs of purchasing raw materials for the production of products for export; subsidizing tariffs for the transportation of finished products across Russia; reduction of transit tariffs when transporting goods through the Republic of Kazakhstan, within the framework of the free movement of goods throughout the EAEU. All these measures will create equal competitive opportunities for Russian enterprises with Turkish and Kazakh flour exporters in the markets of Africa and Central Asia.

Today, in addition to the regions of Africa and Central Asia, countries in the Asia-Pacific region (APR) are ready to buy Russian flour, and the Far Eastern direction has become a priority for the domestic economy in the last few years. In this regard, large Russian manufacturers are increasingly looking towards the Eastern Partnership, and here China should become a new driver for the development of exports.

The flour milling industry is developed in China; about 100 million tons of flour are produced annually in the country. But, given the population, the country also needs imported raw materials.

For food security purposes, the Chinese government regulates the import of wheat and flour through a quota system, according to which only Chinese companies that have received quotas in the prescribed manner based on a decision of the State Committee of the People's Republic of China for Development and Reform have the right to import. The quota allows the importer to import flour with a reduced customs duty of 6%; import of flour without a quota is subject to a customs duty of 65%.

In fact, quotas are issued only to Chinese processing enterprises, and not to trading companies, and do not have a national characteristic, i.e. they are not available for import from a specific country. The PRC simply sets a total quota for the import of products from different countries for a year. Such barriers make imports to China unattractive.

Serious pressure on official supplies is exerted by uncontrolled “gray” imports going through border duty-free trade zones, into which flour is supplied in small quantities (“shuttle” method) as part of duty-free import for individuals (within 8,000 yuan per 1 citizen of the PRC). This practice allows you to import goods into the country using a simplified scheme or without customs clearance at all. Officially, such flour is not intended for sale; it can be used for direct consumption by those individuals who directly imported it. Flour imported in this way does not undergo certification and laboratory tests; no import duty is paid upon its import and, accordingly, it is sold at a lower price than flour imported through the official route.

To develop flour exports in this direction, agreements are needed at the intergovernmental level on the removal of trade barriers (quotas and import duties), as well as on the Chinese side strengthening control over the payment of customs duties by importers who do not have quotas, which will reduce “gray” imports through border zones free trade.

In the Far Eastern region, it is necessary to build export terminals and apply special railway tariffs for ports shipping goods from Russia to Southeast Asia. At the same time, shipment through the Black Sea terminals, unfortunately, is not promising due to the huge transport shoulder. Without solving logistics issues, increasing the volume of flour exports is impossible, and the problem cannot be solved without the participation of the Government of the Russian Federation. In general, there are prerequisites for the growth of flour exports to Asia-Pacific countries, which is what the regions of Siberia and the Far East are interested in. Increasing export activity will allow us to unlock the flour market in the Siberian Federal District and gain access to new markets. Russian flour has serious prospects in the Chinese market, since it is of high quality, and, despite having its own flour-grinding industry, China will purchase high-quality baking flour from Russia.