Export accompanying document

Inhalte

Verbergen

1 Information on creating an export accompanying document 1.1 Composition of an export accompanying document

1.2 Exporting a sample accompanying document

1.3 Constellation of participants

1.4 EORI-No. (Customs number)

1.5 Vehicles and weight

1.6 Customs offices involved in the procedure

1.7 MRN number structure + additional information

1.8 Customs items: description of goods and customs tariff number

2 Is there a customs form for the export accompanying document?

3 How does creating an export accompanying document work?

4 What happens after the export accompanying document is created?

5 Any more questions?

6 What is an export accompanying document?

7 When is an export accompanying document required? 7.1 One-step process 7.1.1 Example 1 for one-step process

7.1.2 Example 2 for one-step process

7.1.3 Summary of one-step process

7.2 Two-step process 7.2.1 Example 1 for a two-step process

7.2.2 Summary of the two-step process

8 Who can create an export accompanying document? 8.1 Preparation of documents

8.2 What happens after the export accompanying document is created

9 Customs clearance of cars 9.1 Import of cars into Switzerland

9.2 Importing cars into Germany

10 Transport solutions and delivery to Switzerland

Information on creating an export accompanying document

An export accompanying document (EX.1 or EAD = “export accompanying document”) is a document that is intended to accompany goods that will be exported from the country. More precisely, goods that are commercially exported from an EU country to a so-called third country, that is, a country outside the EU, for example goods that are sent by truck to Switzerland or by sea to the USA. The export accompanying document then accompanies the goods to the external border of the EU, that is, to the port or state border of a third country. For goods worth up to 1000 euros and weighing up to 1000 kg, an export accompanying document is not required. However, if one or both of these limits are exceeded, such a document is mandatory for commercial traffic. In principle, for every cross-border transport process, goods must be deregistered in the country to which they are sent (= export) and must be registered in the country to which the goods are sent (= import). Thus, the export accompanying document ensures that the registration of goods from the European Union is cancelled. However, in order to speed up the processes and make them easier for Customs, this procedure was only possible online for several years through a direct interface with Customs with expensive software and associated specialist knowledge. But the interface alone is not enough to create an export document, such as an export accompanying document. It may be necessary to check whether the export requires a permit or cannot be exported to the country in question at all. If a commercial shipper wishes to ship goods valued at more than €1,000 to a country outside the European Union, an export accompanying document must be created.

Composition of the export accompanying document

Below you will find out what information we need from you to create an export accompanying document (export accompanying document). You will gain a detailed understanding of the German export declaration structure. This can help you better understand the context and information.

Exporting a sample accompanying document

To give you a better understanding, we have created a sample export accompanying document for you. The finished document will look something like this after we create it for you (see below). Please note that this preview is only the first page of the document. If you click on the image, the entire document will open in a new window. If necessary, you can also download the PDF document. However, not all fields of the export accompanying document need to be completed in your specific case. So, what information is always required, and what information is required only in special cases?

Constellation of participants

Let's first take a look at the document provided in the example (see link above). The structure of the export accompanying document is always the same: the parties involved in the transaction and the details of the goods are indicated. Let's start in the top left corner with the Sender/Exporter field (Field 2). To understand why it says "sender" and not "sender", it is important to first know the following. In forwarding, the sender is the person who actually ships the item or where the item is originally shipped from. For example, the goods are sent to New York by a company from Hamburg. The forwarder/carrier is located in Bremen and is therefore the sender. The sender is therefore a company in Hamburg. The sender will be a freight forwarding company in Bremen. But on the export accompanying document (export accompanying document) it is not just “Sender”, but “Sender / Exporter”. Therefore, it is important to know that the exporter is the one who is responsible for the export of goods. Let's assume that the goods are located - returning to the example above - in a company in Hamburg. The latter dispatches the goods, but acts only on behalf of the company in Belgium. Ultimately they want to ship to New York. The exporter is decisive. In this case, this is a company from Belgium, which must be entered in the appropriate field. The company in Hamburg, where the goods are actually located, does not appear in the document. However, this does not mean that customs does not want to know where the goods are. In certain circumstances, he or she would like to take a closer look at the goods and check whether they are also registered goods.

EORI-No. (Customs number)

Thus, on the one hand, the exporter's address is required, on the other hand, the loading address (company name + address). You will also need what is called an EORI number for the recipient's address. This is used to enable customs to identify the person involved in accordance with customs legislation. Without this, exporting is not possible if you are trading on a commercial basis. You can apply for an EORI number free of charge from German Customs at www.zoll.de. For information about EORI numbers in other countries, please visit our EORI page. We now move on to the next field, the recipient field (field 8), directly below the Sender/Exporter field. Enter the name and address of the actual recipient here. Under "No". you can also enter the recipient's EORI number here if the recipient needs it. However, this is not absolutely necessary because, for example, a company outside the EU usually does not have an EORI number. In the field below for the declarant/representative (field 14) you can see the address of the person who submitted the declaration to customs. If you register, you will find your address here. Otherwise, this is the address of the customs broker, as he will represent you.

Vehicles and weight

In field 18, “Shipping Vehicle Identification,” enter the identification number of the truck that is transporting the goods. This field is optional. Often the license plate number is not even known to the sender at the time of registration. Field 25 indicates the mode of transport at the border. This means whether the goods are transported by truck, plane, ship, etc. - "33" means freight transport. Field 35 indicates the “gross weight” of the product (in kilograms). Gross weight is the total weight of the product, including packaging and pallets.

Customs offices involved in the procedure

Field 29 denotes the customs office of exit, that is, the customs office through which goods leave the EU. This could be, for example, customs at the border with Switzerland or at the port. There is no need to enter anything in field S28 “Customs seal number”, since customs can fill out this field itself. This guarantees the so-called product identification. You can read more on this topic in our other post about different customs procedures. So, we completed/processed the left half of the first page of the export accompanying document (export accompanying document) together. In the right column in field 1 we see the export procedure (more about this here). This could be, for example, exporting goods from the EU or exporting to an EFTA country, etc. - and in field S 32 any special circumstances. In field 3 of the “Forms” we see number 1 on the left and number 2 on the right. This information shows how many pages the document contains. So here it means we are on page 1 of 2 pages. Field S00 is filled in if safety-sensitive data is exported. So it doesn't matter to us because it fills in automatically.

MRN number structure + additional information

At the top right you can see the MRN number, which is the “Movement Reference Number”. It corresponds to the document tracking code. As with parcel tracking, each interface, that is, each border, scans the document. This makes it possible to track exactly where the goods left the EU. MRN has the following structure. 19 (year number, here 2019), DE for country, and then the first 4 digits of the customs office that issued the export accompanying document. This means that 19DE586600822952E8 represents the export accompanying document (export accompanying document) dated 2019, which was issued in Germany by customs under the number 5866. The following numbers represent the serial number and the calculated control number. Box A, immediately below, again displays the customs office, including address and date of issue. Field 5 shows the number of customs positions, i.e. how many different types of goods are contained in the shipment. You can find the number of packages in the shipment in field 6, for example "10", a total of 10 pallets of goods. The internal reference number of the customs service provider for this cargo/declaration is indicated in field 7. All other fields on the first page are filled in automatically and therefore do not require further explanation.

Customs items: description of goods and customs tariff number

In field 31 at the end of the page the exact name of the product is usually indicated. However, since this is a detailed product description, the text module was too large to fit on the first page. Therefore, all items and products are on page 2. There you will find a detailed description of the products, including gross/net weight, as well as customs tariff number and procedure. To create an export accompanying document, we will also need the exact customs tariff number, description of the goods, weight and documents such as invoice and delivery note, which can be seen on the export accompanying document. You can email us in advance at [email protected] or call us so we can discuss together what documents you need. We look forward to your contact!

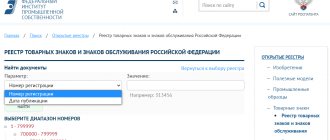

EX1 and MRN,EORI how to check whether EX1 is closed or not

About EORI

In order to engage in foreign economic activity (import goods from countries that are not members of the European Union, or export them there), a European company must have an EORI code. EORI stands for Economic Operator Registration and Identification and is a system for registering and identifying business entities in the European Union. Under this system, each foreign trade entity is assigned a code consisting of a country abbreviation (for example, “GB” for Great Britain) and a number, which must be used for all customs transactions and operations within the EU. Once the company receives the EORI code, it uses it for all its imports and exports. You can check the EORI code of the counterparty on the website of the European Commission. The main thing is that it is valid, i.e. "valid". In this case, complete information about the business entity (its name, address) may be displayed, or none may be displayed, do not be surprised by this. In the screenshots you see the results of checking the EORI codes of French and Polish companies, both codes are valid.

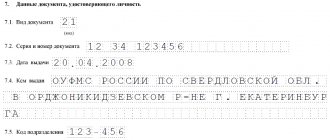

About EX1

EX1 is an export customs declaration. Such a declaration must be issued for cargo of European origin that is exported outside the European Union. The declaration is drawn up by the sender or forwarder, who has the authority to do so. Note that EX1 can be issued both on behalf of the shipper and on behalf of the seller (sometimes these are different European companies). For simplicity, we will use the word “sender”. If EX1 is issued by a forwarder, he will need to provide a power of attorney from the sender. The power of attorney can be drawn up in any form (but usually the forwarder provides its own sample) and must contain the details of the sender (including EORI code) and the forwarder, as well as their contact information. The power of attorney is certified by the seal and signature of the sender’s responsible person. It can be one-time, permanent or valid until a certain period. The original power of attorney must be kept by the forwarder (in practice, this condition is often neglected). If it is necessary to organize transportation with the condition that EX1 will be processed not by the sender, but by the forwarder, you should clarify the EORI code of the sender in advance, so that later it does not turn out that this company is making an external delivery for the first time and is not properly registered with the customs authorities, i.e. does not have an EORI code. The registration process may take some time; the carrier is unlikely to be happy with such a forced wait. To obtain an EORI, a company must contact the customs authorities of its country, they will advise on the algorithm for further actions. The registration procedure and duration may vary in different countries. If you find yourself in a situation where there is no one to clarify the EORI code, but you have found the sender’s VAT number (analogous to the UNP, you can try to find it in the sender’s invoice or on the Internet), try substituting the letters of the country of registration in front, and instead of the missing numbers at the end - zeros. Perhaps the resulting combination will turn out to be the desired EORI code. VAT number and EORI code often coincide, but not always. You can also try to find EX1 from previous deliveries; usually the EORI number is indicated in the upper right corner of column 2 (“Sender/Exporter”).

Is there a customs form for the export accompanying document?

We are repeatedly asked if you can fill out the export accompanying document at customs yourself, for example with a form. Unfortunately, since 2009 it was possible to create a document only in electronic form. This requires special software in which you can make notes. Registration can only be done on paper in exceptional cases, such as a system failure or technical malfunction of the EU customs server. Even then, the electronic form must be submitted later.

How does creating an export accompanying document work?

The accompanying export document is usually created by a customs service provider like us. It reports the goods to be exported to customs through an electronic interface. Thus, upon transfer, he applies for the release of goods and issuance of an export accompanying document. If the responsible customs office approves the export, a PDF document is generated. To release goods, it is usually necessary to register them with customs, which, according to the official directory, is responsible for the place where the goods are loaded. Depending on the zip code, a different domestic customs office may be responsible for the loading location at an external warehouse rather than the company's headquarters. The export accompanying document contains information about the sender of the goods, the recipient of the goods, the goods themselves and the export procedure. To identify companies dealing with customs, they must have a so-called EORI number, which can be requested from EU customs.

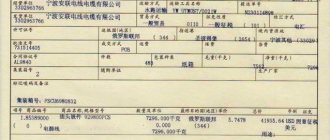

Export Declaration (EX-1)

As part of the delivery of goods under foreign trade contracts, the Export Declaration is the main customs document that describes the goods being exported and confirms the legality of the export of goods from the exporting country. The export declaration is always linked to the seller (supplier) of the goods.

The customs stamp on the customs declaration form (and not the declaration itself) is confirmation that the cargo has crossed the border and is important for the tax authorities of the country of origin (supplier) of the goods in the first place.

According to INCOTERMS delivery conditions, the export declaration is almost always drawn up (filled out) by a representative of the exporter (seller). The exception is the EXW delivery condition, when the buyer or his representative (carrier) picks up the goods at the seller’s enterprise (warehouse).

Organization of foreign trade activities

What happens after the export accompanying document is created?

Once your customs service provider has registered the export with the relevant domestic customs office, there is an immediate release of goods (value of goods up to 3,000 euros) or a so-called presentation period (value of goods from 3,000 euros) depending on the value of the goods. During this 24-hour presentation period, Customs has the opportunity to inspect the goods on site and verify the information you provided at the time of export. At the same time, this means that the goods cannot be loaded during this time and cannot be removed from the loading location specified in the export. After the 24-hour period, you will receive customs clearance for export. Your customs service provider can then print or email your export accompanying document so you or your carrier can transport the goods to the border. The export accompanying document is then scanned at the external EU border. For this purpose, there is a barcode on the accompanying export document, the so-called movement reference number, also abbreviated as MRN. Movement reference number literally means movement reference number. Using this number, you can track at any time which borders the goods have crossed. Sometimes the MRN is mistakenly equated with an export accompanying document. However, this is incorrect as the MRN is only a number which is part of the export accompanying document and other export documents such as T1 or T2 documents also have such an MRN. Once the export accompanying document is scanned by border customs, the document is automatically converted into an exit bill of lading. This completes the process. The departure notice serves as proof that the goods actually left the country. Therefore, you will need this invoice to prove during a tax audit that the goods were not sold in an EU country (subject to VAT) and not abroad (not subject to VAT). The status of each export accompanying document, i.e. whether the document has already left the EU, can be checked at the following link: Export MRN Tracking

How to check the EU export declaration

In practice, this question arises quite often and, in order to protect themselves from surprises, importers are forced to take out insurance.

So, EX1 is an EU customs declaration issued for exported goods whose country of origin is a member of the European Community. Each such declaration is assigned an MRN number (Master Reference Number) similar to our DT registration number. The number is placed in the upper right corner of the declaration along with a unique barcode. The letter code indicates the sending country.

On the European Commission website you can use the MRN number to check the status of a specific export declaration.

If the number is not found, this does not mean that such an export declaration does not exist. For example, there may be no declarations in the EU database if the country of departure and the country of export outside the EU are the same. Or EX1 is completely new and has not yet entered the database. Or, on the contrary, it is completely old and has already been removed from the database.

If the goods were not produced in the EU countries and are transiting through the territory of the EU countries, a T1 transit declaration is opened for it, which also has its own MRN identification number. After the actual export, T1 is closed, and you can also find out by using the corresponding section of the European Commission website.

In addition, in some cases it is useful to check whether a foreign counterparty exists in principle as a person engaged in exporting. To do this, it must be registered in the EORI (Economic Operator Registration and Identification) system and receive a code consisting of an alphabetic country code and numbers. The EORI code is obtained by the company once and is used for all its import and export transactions.

You can also check the EORI code on the European Commission website.

Source

Are there any other questions?

We are happy to assist you with your EORI application, take care of creating your export supporting document, and provide you with years of professional experience. Just call us or send an email. Further help and information on the export accompanying document can be found further down this page or in our dedicated articles on the export accompanying document. We have collected for you the most common definitions of terms in our customs glossary. We are also happy to help with other customs related issues. ==> At our prices

Consultation What documents must be provided to customs, goods can be presented to customs, etc. We will be happy to advise you!

Creating an Export Accompanying Document Creating an Export Accompanying Document is the first step to successfully exporting your goods. We have a reliable partner on your side!

Special Conditions If you export more frequently in the future, we can offer you especially favorable conditions and exclusive benefits.

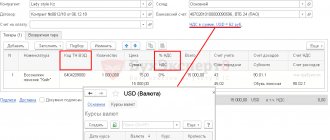

Setting up the program

To use this document and generate a Register of complete customs declarations, transport and shipping documents to confirm the zero percent VAT rate, the program must be configured. To do this, go to the Main

—

Functionality

, go to the

Trade

and check the

Export goods

.

What is an export accompanying document?

An export accompanying document (export accompanying document) is written evidence that the export of certain goods is permitted. Therefore, you can export the goods listed in the document from the European Union. You can then transport the goods to an EFTA country (for example Switzerland) or to a third country. Sometimes the terms export declaration or export declaration are synonymous with export accompanying document. Since July 1, 2009, this registration is only possible electronically through ATLAS (Automated Tariff and Local Customs System). Paper registration has been replaced by this one. Depending on the group of parties involved in the legal transaction, the weight and value of the goods, an electronic export declaration is mandatory in some cases and not required in others. The export accompanying document contains information about the parties involved, the procedure and the goods. Using a unique 18-digit tracking number (MRN = Movement Reference Number) in the form of a barcode, you can always see at which EU customs your goods have cleared customs. Once customs at the external EU border scans the accompanying export document, a so-called exit consignment note is created. This is proof that the goods were correctly exported from the EU. The information contained in the export accompanying document is used to record trade flows and is included in foreign trade statistics published by the Federal Statistical Office. An export accompanying document can be used to verify that the exporter is complying with export regulations and foreign trade laws.

How to fill out the EX-1 export declaration

Let's say right away that the EX-1 export declaration indicates the commercial invoice number, and not the value of the cargo. Therefore, from the point of view of common sense, if you have the remaining shipping documents, presenting an export declaration at Russian customs is not necessary, but you need to be prepared for everything at our customs.

Transport identification number (MRN)

The barcode contains information about the cargo and the customs office where the export declaration was completed. All necessary information is displayed when scanning this barcode.

Today, for all cargo exported from the European Union (place and date of opening and closing, information about delay or cancellation of the declaration), you can check the export declaration using the MRN number on the European Commission website.

The export declaration is closed the moment the cargo crosses the border. To do this, a printed copy of the export declaration is provided to customs with an individual export number and a unique barcode. The customs stamp on this form allows the supplier of the goods to be exempt from paying intra-European VAT (VAT).

When is an export accompanying document required?

To export goods from the EU to an EFTA/third country, you must always create an export accompanying document for goods valued at €1,000 and/or weighing more than 1,000 kg. However, if you are exporting goods as an individual and transporting them yourself, some customs offices will not release the export. However, it is always better to export on time to avoid difficulties at the border. So you will need an export accompanying document if • The goods leave the EU * and • the value of the goods exceeds 1000 euros or • the weight of the item exceeds 1000 kg * = if the goods leave the customs union for a short time, for example, as is the case with shipment from Spain to the Canary Islands islands, you will also need an export accompanying document. In our last Export Accompanying Document online help article, we already explained how an Export Accompanying Document is structured. We will now show the differences between the various procedures for export accompanying documents. These are basically two different procedures. The so-called one-stage procedure and two-stage procedure. Depending on the procedure, different conditions apply to obtaining an export permit.

One step process

For amounts up to €3,000, the one-step export accompanying document procedure must be used. The customs agent sends a notification via ATLAS to the export customs office. Export customs always corresponds to domestic customs at the location of the seller. If the goods are located elsewhere, you must register the goods with the export customs office responsible for the loading location. In a one-step procedure, this export customs office also acts as the exit customs office. The exit customs office is always the customs office at the external EU border.

Example 1 for a one-step process

Since this sounds very theoretical, here's an example: A German mail order company receives a large order from Switzerland in the morning (cost: 2500 euros, weight: 880 kg). Within a few hours, the company has the goods on pallets and can export the goods. To do this, she or the customs agency must register with customs. The forwarding company must deliver the palletized goods by truck across the Weil am Rhein/Basel border to Switzerland. The Weil am Rhein Autobahn customs office therefore receives the electronic export declaration in advance via the ATLAS software. The customs agency then automatically receives a document with a barcode number (MRN), which it forwards to the transport company. The forwarding company transports the goods to the Weil am Rhein border and shows a document with the barcode number of the export accompanying document. Customs at the external border of Germany and the EU compares goods with local registration and releases them for export. This completes the export.

Example 2 for a one-step process

Another example. The same mail order company in Germany also receives an order in the morning for a parcel to Brazil (cost: 1100 euros, weight: 20 kg). Since the recipient of the parcel is different from the shipment to Switzerland in example 1, a separate export accompanying document must be issued by the seller. The company hires a package delivery service provider to pick them up in the afternoon. At the same time, the sender asks the parcel delivery service provider which airport they will use to transport the goods to Brazil. He informs his customs service provider that the goods will leave Germany via Frankfurt Airport. An export application is then created through ATLAS and sent electronically to the appropriate customs office. Then customs accepts the declaration for now. The export barcode is available to the parcel delivery service provider as a printout and electronically to customs. After the goods have been collected by the parcel delivery service and before the goods leave the country by air, Frankfurt Airport Customs processes the export. Export done.

Summary of the One-Step Process

Therefore, it must always be an EU exit customs office. To do this, you must submit an export application through ATLAS for an amount of up to 3,000 euros. In theory, exports can be carried out immediately, without any procedural waiting periods. However, if a company were to send more than one shipment (for example, in the form of multiple partial shipments) to the same recipient on the same day, it can record the goods as a single export. This will save the company the additional cost of another process carried out by the customs broker.

Two-step process

If the value of the goods exceeds €3,000, you should always use the two-step export accompanying document procedure. The customs agent must also send a notification to customs through ATLAS. However, in this case the operator does not send the declaration to the exit customs office. Instead, the declaration is sent directly to export customs. This is an inland customs office near the exporter. On the EU Customs website you can find out which customs office is responsible for the relevant postcode (find export customs office). Registration in the two-step procedure at the customs office of export includes the same information as registration in the one-step procedure. However, exit customs differs from export customs in a two-step process. While the customs office of exit and the customs office of export are the same office in a one-step procedure, this is usually not the case for a two-step export. This is because customs offices of exit, i.e. customs offices at the external border of the EU, are not usually assigned a specific postal code as an export customs office (inland customs office). Unlike the one-step process, the carrier cannot deliver the goods directly to the border. Instead, he must present the goods at domestic customs. This can be done in two different ways. The freight forwarder transports the goods to domestic export customs. Alternatively, his customs agent reports the goods to the relevant Inland Customs office one day in advance. It defines a period of two to four hours the next day. During this time, customs may arrive at the sender's loading location. Upon expiration of the period, the customs agent automatically receives permission to export.

Example 1 for a two-step process

Below is an example of a two-step procedure. A South German car manufacturer wants to sell and send several cars to a car dealership in Belarus. To do this, he provides his customs agency with the necessary documents. Based on the postal code where the goods are loaded, it determines which export customs office is in charge of the seller's headquarters. In this case, the customs agency sends a notification electronically to the domestic customs office in Böblingen. At the same time, the customs agent discusses the transportation route with the carrier. Therefore, he knows that the freight forwarding company will deliver the goods along the S19 expressway, which connects Poland and Belarus. Thus, the customs agent indicates the customs office in Kuźnica in Poland as the customs office of exit. However, the cars will not be exported until the next few days. Therefore, the car manufacturer transmits information to the customs agent that customs can arrive the next day between 10:00 and 14:00. The next day, not a single employee shows up for the car manufacturer. Instead, the customs broker electronically issues the export permit at 2:02 p.m. In this case, the export customs officer did not consider it absolutely necessary to inspect the goods. The truck will then arrive at the Polish-Belarusian border in the coming days. There Polish customs checks the export, which takes care of it.

Summary of the two-step process

Therefore, the exit customs office does not have to be German customs. The goods are declared at domestic customs (export customs) and the approved declaration is submitted to the EU customs office of exit at the time of export. Exports can be requested through ATLAS for amounts over 3,000 euros. Export must occur in advance. Theoretically, this can also be done immediately by delivering the goods to domestic customs. Alternatively, the goods may be inspected by customs at the sender's location (presentation outside the office).

Who can create an export accompanying document?

The accompanying export document is usually created by a customs agency or freight forwarding agency. The customs agency then acts as the declarant's representative at customs. It has special software for electronic registration with direct connection to customs. For such a program, manufacturers typically charge a one-time setup fee, additional monthly base fees, and then a transaction fee for each customs declaration.

Preparation of documents

In the next step, you must make the following preparations to be able to create an export accompanying document yourself: • You need a document disclosing the nature of the transaction. It must indicate the value of the goods, the seller and the buyer or the sender/exporter and the recipient. • You need information about which customs offices you must indicate in your declaration. These are export customs at the seller and export customs at the place where goods are exported from the EU. • You know the weight (gross and net weight) of individual items and the entire shipment • You know the number of packages in the shipment, if applicable • If you are shipping commercial items, you have an EORI number. • You know the customs tariff number of the relevant goods and, if applicable, export restrictions + additional codes for the customs declaration. Have you noticed all the above items from our checklist? After this, you can begin to create an accompanying document for export:

What happens after the export accompanying document is created?

Have you created and printed an accompanying export document? It now needs to be handed over to your parcel delivery service provider/shipper. If you are shipping goods to the border yourself, you must print the export accompanying document with a readable barcode and take it to the customs office of exit. There it is then scanned by customs, which creates what is called an exit bill. You can later pick up this note yourself from the IAA portal. This is proof that the goods were correctly exported from the customs union. The exporter of goods must retain the exit invoice for possible tax audits. This means that there is no tax liability on the sale of goods as it is a tax-free export. Otherwise, you could be taxed without valid proof and subsequently have to pay 19% VAT. The EU export accompanying document is a preliminary step in customs clearance of imports in Switzerland. Goods must always be exported from one country first in order to be able to be imported into another country. Information about customs clearance: Switzerland can be found here.

Document Customs declarations (export)

Now in the Sales

Customs declarations (export) appears

This document is intended for registration of customs declarations, shipping documents confirming the export of goods outside the Russian Federation.

This document is regulatory. Information from it is used to automatically fill out Registers of complete customs declarations, transport and shipping documents.

Customs clearance of cars

Have you discovered an interesting car abroad and now want to know how customs clearance works? As a customs agency, we are available to answer questions about vehicle imports and exports. In addition to cars, we can also declare your trailer, carry out customs clearance for trucks, imported boats or service aircraft. You can find out more about this on the following pages and in the section “What is customs clearance?” and to prepare the vehicle for "internal processing". We can also arrange vehicle transport for you upon request - everything else is explained on our road transport information page.

Importing cars to Switzerland

Do you want to import a car from Germany or another country to Switzerland? We will be happy to assist you with Auto Import Switzerland. Our guide will walk you through the entire process from buying a car to customs clearance. We'll also explain how car repurchase works and how you can save even more. Now straight to the => Guide to importing cars into Switzerland.

Importing cars to Germany

Are you wondering how importing a car from Switzerland to Germany or another country works? We are happy to help you with the export of cars from Switzerland. Our guide will walk you through the entire process from buying a Swiss car to customs clearance. We will also tell you how car registration works and how you can save additional money. Now directly to the => Guide to importing cars into Germany. Every first consultation with us is free!

Transport solutions and delivery to Switzerland

Are you planning to send goods to Switzerland? Should the transport be done by truck or is it sent to Switzerland? Read our detailed guide: => Shipping to Switzerland Guide If you need import customs clearance in Switzerland, you can find out everything else on our customs clearance information page. Call us, we will be happy to make you a non-binding offer. We also offer other types of transport, such as transportation to the Czech Republic, delivery to Belgium or special transport to the Netherlands

Request a call back right now! With your request, you are already one step ahead in creating your export accompanying document or other customs documents.

Customs clearance of goods

The concept of “customs clearance” or “customs clearance” implies, in addition to the registration and closing of the Export Declaration, a set of sequential operations carried out to legalize cargo (goods) imported into the territory of the Russian Federation after crossing the border.

Regularly fulfilling orders for the delivery of goods or technical imports from EU countries to Russia, our company combines the functions of an importer, carrier and forwarder. Our specialists will ensure competent and fast customs clearance of cargo without any problems.

Road freight transportation

Delivery of goods by road to any point in Russia and the continent.

The liability of our forwarders is insured!