For more than ten years now, I have been working as an accountant in a commercial company and have often encountered the fact that my colleagues do not understand what is at stake when they need to enter the code of a document - a Russian passport for the tax office. In fact, this is a fairly simple action, and you just need to have an idea of the concept itself.

Today I will tell you what the passport code of a citizen of the Russian Federation is, where and how it needs to be entered into various reports and declarations for the Federal Tax Service, and we will also look in detail at what encoding is in effect today for identification documents of the applying citizen.

Coding for filling out tax papers

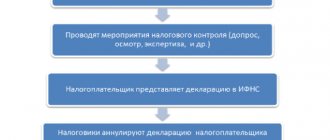

When a person submits any official document, such as an application or declaration, to the Federal Tax Service, he indicates in it information proving his identity.

At the same time, the Federal Tax Service has created an automated system for processing requests, that is, an application or declaration is drawn up on a special form, which is read by special programs. In such a situation, all the information that is possible will be encoded as much as possible to simplify reading and speed up review. Therefore, on the approved forms there is a special column - the code of the type of identity document; the passport has code 21.

The encryption system for types of papers is used when submitting almost all applications and declarations to the tax office. Moreover, the forms of these statements and declarations, as a rule, are established by specially issued acts of the Federal Tax Service. Along with the forms of applications and declarations, such acts also contain lists of numerical designations of various papers.

In what case are passport type codes used by federal subjects?

A few words should be said about how documents are codified by region. This will allow you to determine in which region or region of the country a civil passport or other form was issued.

A designation such as a document series can help with this. On the second and third pages the designation is made in red, and on the rest it is made using perforation.

As we have already noted, the first two digits indicate the region where the document was issued, but the second two digits indicate the year the passport was issued.

To understand which region your passport belongs to, you can use a standard table that can be found on the Internet.

As an example, here are just some notations:

- 84 - Altai Republic.

- 27 - Kaliningrad region.

- 46 - Moscow region.

- 77 - Chukotka Autonomous Okrug.

- 33 – Kirov region.

In other words, each region has its own two-digit designation, which is subsequently used to designate the series in the passport. As for the passport number, it does not contain any special information and is an individual characteristic.

Where to get official numeric designations

The necessary codes are established by orders of the Federal Tax Service regulating the procedure for filling out certain types of official papers. For example, among the acts issued by tax authorities, where the passport code is located:

- Order of the Federal Tax Service of Russia dated October 15, 2020 No. ED-7-11/ regulates the procedure for filling out the 6-NDFL declaration, ID codes are contained in Appendix No. 5 to this order;

- Order of the Federal Tax Service of Russia dated November 14, 2017 No. ММВ-7-21/ regulates the filling out of an application for benefits on a number of taxes, the document type code for the tax office, including the Russian Federation passport, is contained in Appendix No. 2 to it.

IMPORTANT!

Lists from different acts differ from each other in the number of positions, but the same certificates have the same code in them, in particular, the code of a foreign passport for the tax office is always 10, a military ID - 07, a residence permit - 12, a certificate of birth - 03, and temporary residence permit - 15.

Therefore, to determine what code a Russian citizen’s passport has, it is enough to contact any of them, it is the same everywhere - 21.

ConsultantPlus experts discussed how to request information that constitutes a tax secret, but is recognized as publicly available. Use these instructions for free.

Document code when applying to the Russian pension fund

There are situations in which it is required to provide reports to the pension fund. Typically, this is a type of pension statement. How to enter the names of documents on forms?

When filling out forms at the specified organization, you will also need to know the ID code. If you do not know the designated code, you will have to retake the documents several times. And again, as a result, a lot of wasted time resources.

In 2013, the pension fund posted a message about this, with the requirement and rules for applying the code. The message was posted on the organization's website. On this portal you can familiarize yourself in detail with the requirements of the organization.

The use of digital designation allows you to reduce labor costs when processing information. Labor costs are reduced by reducing the number of characters. Much less time is spent on processing papers filled out using this method.

This message also provides information about other types of codes. It will be useful to familiarize yourself with all types. This can be done by visiting the site.

List of ciphers

One of the acts where the passport code is written is the order of the Federal Tax Service of Russia dated April 10, 2017 No. ММВ-7-21/. Appendix No. 4 to it contains a table containing not only the name of the identity cards and their numerical designations, but also the abbreviated name and template of the series and number. For example, in accordance with it, the document code for a passport of a foreign citizen for the tax office is 10, the abbreviated name is “PasIns”, the series and number template is SSSSSSSSSSSSSSSSSSSSSSSSS, the birth certificate, whose code is 03, has the abbreviated name “SvdRzhd” and the series and number template - SSSSSSSSSSSSSSSSSSSSSSS, military ID details: numerical designation - 07, abbreviated name "VeBil" and series and number template - BB 0999999.

It also contains ciphers for many other papers, including, for example:

| Numerical designation | Name |

| 13 | Refugee ID |

| 14 | Temporary identity card of a citizen of the Russian Federation |

| 18 | Certificate of temporary asylum on the territory of the Russian Federation |

| 23 | Birth certificate issued by an authorized body of a foreign state |

Sample where the code fits in

One of the applications, the form of which requires an identification card code, is an individual’s application for registration with the Federal Tax Service. After such registration, the person is issued his personal taxpayer identification number - TIN. The application form was approved by order of the Federal Tax Service of Russia dated 05/08/2020 No. ED-7-14/, Appendix No. 1 to this order contains the passport code for the TIN, it is the same - 21.

New classifier of types of documents and information used to fill out DT

On August 29, the Decision of the EEC Board dated July 27, 2021 No. 90 “On amendments to the Decision of the Customs Union Commission dated September 20, 2010 No. 378” comes into force.

The decision amended Appendix No. 8 “Classifier of types of documents and information” to the Decision of the Customs Union Commission dated September 20, 2010 No. 378 “On classifiers used to fill out customs documents.”

In particular, the position with code 01191 was excluded and 15 new positions were included:

| 01401 | Certificate of compliance with the requirements of the technical regulations of the Eurasian Economic Union (Customs Union) |

| 01402 | Declaration of conformity with the requirements of the technical regulations of the Eurasian Economic Union (Customs Union) |

| 01403 | Certificate of conformity, issued in a unified form, for products (goods) included in the Unified List of Products Subject to Mandatory Confirmation of Conformity with the issuance of Certificates of Conformity and Declarations of Conformity in a unified form |

| 01404 | Declaration of conformity, drawn up in a unified form, for products (goods) included in the Unified List of Products Subject to Mandatory Confirmation of Conformity with the issuance of Certificates of Conformity and Declarations of Conformity in a unified form |

| 01405 | Vehicle type approval |

| 01406 | Chassis type approval |

| 01407 | Vehicle Design Safety Certificate |

| 01408 | Conformity assessment document provided for by the legislation of the member state of the Eurasian Economic Union, on the territory of which the products (goods) are placed under customs procedures |

| 01409 | Oil passport (oil quality passport) |

| 01410 | An agreement with an accredited certification body (accredited testing laboratory (center)) or a letter from such an accredited certification body (accredited testing laboratory (center)), confirming the quantity (weight and volume) of products imported as samples and specimens required for research and testing purposes (products) |

| 01411 | Certificate of state registration of products confirming product compliance with the requirements of technical regulations of the Eurasian Economic Union (technical regulations of the Customs Union) |

| 01412 | Certificate of classification of small craft |

| 01413 | Certificate of registration of mineral fertilizer |

| 01414 | Certificate of notification state registration of chemical products |

| 01415 | Permission to use chemical products |

In addition, a new section has been added “Documents confirming compliance with the conditions for the import of goods for personal use with exemption from customs duties and taxes” - document codes 13001 - 13010.

When recalculating old DT for a date after 08/29/2021, the Alta-GTD PC will offer to automatically replace the old code 01191 in column 44 with the new 0140x. The type of document is determined by the format of the number, for example, by the presence of the letter “D-”. However, the declarant must pay attention to the compliance of the document code with the new classifier for Certificates of Conformity, Declaration of Conformity, Approvals, Certificates and other documents.

Normative base

Order of the Federal Tax Service of Russia dated October 15, 2020 No. ED-7-11/ “On approval of the form for calculating the amounts of personal income tax calculated and withheld by the tax agent (Form 6-NDFL), the procedure for filling it out and submitting it, the format for providing the calculation of tax amounts for income of individuals, calculated and withheld by a tax agent, in electronic form, as well as forms of a certificate of income received by an individual and withheld amounts of personal income tax" (together with the "Procedure for filling out and submitting calculations of amounts of income tax for individuals, calculated and withheld by the tax agent (form 6-NDFL)")

Order of the Federal Tax Service of Russia dated November 14, 2017 No. ММВ-7-21/ “On approval of the application form for the provision of tax benefits for transport tax, land tax, personal property tax, the procedure for filling it out and the format for submitting an application for a tax benefit in electronic form"

Passport code of a citizen of the Russian Federation

To confirm the identity of an individual, a wide range of documents is used. Each type of paper is endowed with certain legal rights and has a given code. The codes are written in accordance with the tax order at the federal level, approved on October 30, 2015, document name – No. ММВ-7-11/ [email protected]

It establishes forms for submitting reports on income received by citizens, gives recommendations on the preparation of papers, and regulates the format for transmitting information to government agencies in electronic format. The appendices to the orders additionally provide a summary of income codes, documentation, deductions, and regions. The passport code for a citizen of a country when filling out forms is 21 . It is indicated in the documents sent when submitting reports to the tax office. If the forms are not prepared in person, then the applicant does not need it. Information about it can always be obtained upon request from the tax office.

The passport code allows you to reduce the amount of data provided. It is used when you need to fill out established documentation forms. When drawing up appeals, applications, requests, information from the identity document of the applicant himself or a third party is recorded in full.

Free legal consultation

+7 800 100-61-94

What is it needed for

The use of digital designations for internal documentation of the Federal Tax Service is based on the need to simplify the circulation of declarations received from private entrepreneurs and other categories of citizens. The tax department employee, as well as the applicant himself, does not need to write the full name of any certificate or certificate each time. It is enough to indicate a two-digit digital combination.

Authors of tax returns have great difficulty entering codes. However, they can always find out the document code for their Russian citizen passport. If you wish, you can obtain the necessary information in a matter of minutes via the Internet.

There is also another way to find out your passport code. To do this, you will have to seek help from a tax officer. This can be done by calling your local Federal Tax Service office.

What documents are proof of identity?

In the absence of a passport, a citizen has the right to present another document with a photograph issued by the head or other authorized person of a state organization. This could be a driver's license, military ID, or work ID. If necessary, a citizen can present another identification document other than a passport, if it has a photo, seal and signature of the manager.

Sample application for obtaining information about income

According to the norms of the Labor Code of the Russian Federation, a written statement from an employee requesting information about income is not mandatory. But it is recommended to request it - it is beneficial for both the employee and the employer. The three-day period for issuing the certificate begins from the date of its receipt. If there is disagreement about this, it will be easier to prove that you are right.

It is allowed to write an application for the issuance of 2-NDFL upon dismissal in 2021 in any form, the main thing is that there is the signature of the applicant and the date of preparation. This is what an example sample looks like:

| General Director of PPT.RU LLC Petrov P.P. from the forwarder Savelyev M.L. Statement Please give me a certificate of income and personal income tax amounts for January-March 2021. 04/28/2021 Savelyev |

Results

At first glance, it may seem that entering codes for each ID card complicates paperwork. However, practice shows that this is just the opposite: thanks to this norm, the completion of various reporting forms, including tax returns, is reduced. Having memorized a two-digit combination of numbers, any citizen can easily use the code designation in the documentation submitted to the Federal Tax Service and the Pension Fund.

☎️ Still have questions after reading the article? Get a free consultation from a qualified lawyer. Call now! +7 800 302-76-57

For a foreign citizen

[flat_ab id=”4"] Representatives of other states who are in the Russian Federation legally, with permits (residence permit or temporary residence permit), have the right to engage in entrepreneurial activities. It follows from this that they need to indicate the foreign citizen’s passport code for the tax authorities. indicated by the number 10.

For hired workers who come to Russia for only a few months, providing a document code such as a foreign citizen’s passport is not required. Their taxes are withheld from their salaries, and the reports are filled out by the accountant of the company they work for.

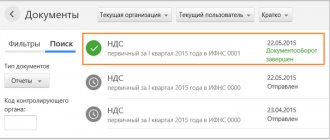

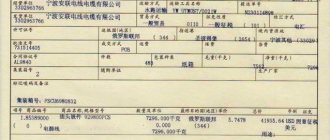

What does Form 2-NDFL look like in 2021?

For issuance to employees, there is a separate 2-NDFL certificate for 2021 for the employee on income and tax amounts. Its form is no different from the abolished 2-NDFL. This is what a sample of the new form looks like:

Algorithm for filling out the document:

- Indicate the period and date when the 2-NDFL certificate was issued for 2021;

- Indicate the details of the tax agent (organization) - name, OKPO code, INN, telephone number, address.

- Indicate the taxpayer's details - full name, tax identification number, date of birth, details and identification document code, taxpayer status code.

- Give the current tax rate - in the example, the standard 13%.

- Provide in Section 3 the codes of income received by the taxpayer for each month (in the example, salary - code 2000).

- Report the deductions used, indicating their codes.

- Indicate the total amounts of payments and tax withheld.

The accountant who compiled it certifies the certificate with his personal signature.