To receive payment for services rendered from foreign counterparties, it is not enough to issue an invoice. International standards provide for the issuance of an invoice.

Invoice is an international designation for an invoice for payment issued by the seller to the buyer as a request for payment. The invoice includes a list of services, their characteristics, terms of the transaction and information about its participants. The extract of the document indicates that the subject of the transaction has been transferred to the buyer and he has an obligation to pay in accordance with the specified conditions.

In Russian practice, the invoice has no analogues. It is often compared to an invoice, although these documents have different purposes. An invoice is used for tax control and VAT reporting. An invoice for services is required for exchange control purposes to ensure that payment has been received legally.

It also cannot be said that the invoice is a foreign version of the classic invoice for payment used in the Russian Federation. If we compare international and Russian document flow, then in legal and accounting essence, an invoice for services is closest to the service acceptance certificate.

In international commercial practice, there are two types of invoice: commercial invoice and proforma invoice. Let's look at each of them in more detail.

What is an invoice (commercial invoice)

The invoice is used only in international transactions. In Russian practice it has no direct analogue. In our opinion, this is an invoice for payment, which states the terms of the transaction. Sometimes an invoice replaces an agreement and a deed.

With services, it is enough to write down the following condition: “By full or partial payment of the invoice agreement, the customer confirms that all the conditions of the contract listed below have been fulfilled in full, on time and with proper quality.” Payment will mean that the customer has accepted the work, so there is no need to exchange documents.

Andrey programs for foreign companies. He reached an agreement with the customer, created a website and sent an invoice to the foreign company. The foreigners received the document and transferred money to Andrey. After this, the transaction is considered completed. The customer's signature is not required.

If you are selling goods, most likely one invoice will not be enough and you will need other documents. It depends on the shipping method. Check this point with the transport company or bank support.

Export invoice preparation

Regardless of which transportation method was used within the framework of a particular foreign trade transaction, all cargo deliveries must go through customs clearance. In order to quickly pass Russian customs and not delay the delivery of goods, it is better to entrust all the nuances of the process to specialists who are well familiar with the peculiarities of this procedure.

TOP-Logistics specialists will prepare an invoice and other customs documentation within a few hours. Thanks to this, checking the provided papers with a customs representative will take 1-2 hours; in some cases, you can clear customs in a few minutes.

30.08.2021

Why do you need an invoice?

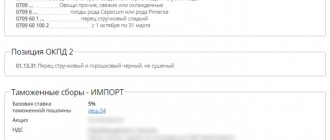

- For customs control. Based on the invoice, customs calculates taxes and duties on goods.

- For currency control.

An invoice is suitable for small one-time transactions, but even in this case, one invoice may not be enough for currency control. It is better to call the bank and find out if other documents are needed.

Currency control is a requirement of the Central Bank. Here's how it works: money is transferred to your account from a foreign counterparty, the bank freezes the currency in the transit account and requests documents related to the transaction, including an invoice. To gain access to the money, you must provide documents within 15 working days.

If the transaction amount is less than 200 thousand rubles at the Central Bank exchange rate, simplified rules apply: you just need to fill out a special electronic form from the bank; you do not need to send a scan of the agreement.

A major transaction is when you pay more than three million or more than six million rubles are transferred to you. In this case, you will need to take a certificate of supporting documents and register the contract.

What documents accompany a transaction with a foreign organization?

In domestic trade, the basis for the provision of services or the supply of goods is a contract, payment is made according to an invoice, and supporting documents are an act, an invoice, a UPD, a goods or waybill - depending on whether services are provided or goods are supplied. The rules for maintaining these documents, both in paper and electronic form, are enshrined in legislation and are regularly updated.

In the case of foreign trade, accounting deals with a completely different set of documents. The basis of international trade relations between two organizations is a contract , which must be drawn up in two languages - the languages of the subjects of trade relations for an unambiguous interpretation of all its terms by both parties. Formally, there are not many differences between a contract and an agreement; sections of the documents are identical.

But with supporting documents, not everything is so clear. In foreign legislation there are no concepts of invoices, invoices, acts and UPD . Some counterparties agree to sign acts of any form drawn up by Russian partners in order to accept them for accounting, but they cannot be obliged to do this.

The main document when working with a foreign company, confirming the supply of goods or provision of services, is an invoice, which is also the basis for making a payment . To deliver goods and clear customs, in addition to the invoice and contract, other accompanying documents must be attached to the cargo:

- packing list;

- bill of lading (for transportation by sea);

- railway waybill (for transportation by rail);

- certificate of origin;

- customs declaration;

- certificates and permits for the import of goods (depending on the imported cargo);

- other accompanying documents that are required according to the legislation of the Russian Federation for the import of certain types of goods.

How to fill out an invoice

The invoice is filled out by the person who provides services or sells goods. The document is drawn up in the customer’s language, usually English. For customs you will need a copy in Russian. You can compose it in English and Russian at once.

Two copies are sufficient for services. For goods, it is recommended to send 1 original and 5 copies.

Good instructions for filling out an invoice for goods are offered by transport companies, for example, TNT. There is a constructor on the DHL website that will help you create an invoice according to all the rules.

The invoice does not have a set form. You can design your own and print it on letterhead or a standard A4 sheet. The main thing is that it contains required fields:

- Date and invoice number. The date is required, you can put any number or not indicate it at all.

- Information about the contractor (exporter) and customer (importer): country, company name, legal form, address, full name.

- The subject of the invoice is what the customer receives money for, a product or service, the quantity of goods or the number of hours spent on the work.

- Detailed description of each item.

- Price and total amount of the transaction indicating the currency of the customer (importer).

- Delivery terms and conditions according to the rules of Incoterms 2010. The most common: DAP - the duty is paid by the recipient, DDP - the duty is paid by the sender.

- Air waybill number if you are selling goods.

- Bank account details of the contractor (exporter) and payment deadline.

- Stamp or seal of the company, if any.

- Signature of the person issuing the invoice (exporter)

Document verification

Errors, typos and any incorrect information in a commercial invoice are a direct reason to start re-checking the customs value of the goods. If a customs officer identifies contradictions in a commercial document, especially if they are associated with a lower level of customs value compared to the ITS, the customs office will send a request to the declarant for the transfer of additional documentation, which will allow the customs service to verify the accuracy of the previously provided information.

The risk of adjusting the customs value can be minimized by conducting a preliminary analysis of documentation on foreign trade activities. The following measures will further reduce the risk of additional customs value assessment:

- conducting a customs audit;

- preliminary verification of the correctness of the information specified in the accompanying documentation;

- bringing the invoice form into compliance with the rules of the UNECE working group on simplification of foreign trade procedures and the practice accepted at Russian customs.

Important

Participants in a foreign economic transaction need to carefully study the document - check the commercial invoice for non-compliance with the requirements of customs legislation and currency control.

Common mistakes when preparing a commercial invoice

Among the most common mistakes made when preparing a customs document:

- description of not all goods from the batch, insufficiently complete description of the goods;

- the declared value in the currency of the importing country, which is necessary for customs settlements, is not specified;

- the price for each individual item is not indicated;

- no total cost;

- the sender's signature is missing.

Important

Before sending the consignment, we advise you to check the document for the absence of such errors and omissions. If the invoice is filled out incorrectly, this may result in the goods being delayed at customs.

How to describe services and goods in an invoice

Write in detail and without abbreviations. Do not use general phrases in your description. For services, indicate the price of the service element and what the result looks like.

Example: preparing layouts for the website www.hellburg.io, for the sections “What to do”, “News”, “Places”, “Maps”, “Calendar” in .psd format. The cost per hour is $20. The total number of hours is 80.

If you are selling a product, write the model name, color, size and characteristics. The more expensive and complex the product, the more detailed the description should be. This is important for customs and bank exchange control.

Polishing machine “Snezhinka” for processing metal materials; model S002, manufactured in RU (Russia), serial number S/N PM-S002-F146896, 1 unit.

Here's what you should pay attention to when describing a product:

- Name;

- numbers of export documents (foreign economic agreement or order, if any), dates of their preparation;

- application area;

- serial number;

- number from the HS list (if known);

- the material from which the product is made;

- type of packaging;

- weight (ounces, kg, pounds);

- unit price;

Product description rules

The description of each item of goods must include a certain list of information, the completeness of which determines the time the cargo passes through customs control and, as a result, compliance with the delivery time of the parcel. In this part of the invoice you need to indicate:

- Name of product;

- scope of application of the product;

- serial numbers, tariff number (if available);

- material of manufacture;

- number of units of production;

- type of product packaging;

- weight;

- volume, area, number of places occupied by cargo;

- units of measurement (kg, l, pcs., etc.);

- unit price;

- total cost of the cargo.

A complete description of the cargo is the main requirement for its successful delivery to its destination. It should answer basic questions: what kind of product is this? what is it made of? for what (how will it be used)? what is the quantity?

What is the difference between an invoice and an invoice?

These are completely different documents. The invoice contains the request for payment and the terms of the transaction. An invoice is needed to report VAT to the state.

An important point: when importing, everyone pays VAT. Even those who work on the simplified tax system, UTII and patent. But the point is not in the invoice, but in the customs declaration. We wrote more about this in the article “Purchasing goods abroad: VAT and customs clearance.”