Customs control is a procedure that is required when crossing the state border of the Russian Federation during cargo transportation. For its successful implementation, it is necessary to collect and submit the necessary package of documents in a timely manner. Otherwise, products may remain idle, fines may be received, etc. In order to avoid this, contact St. Petersburg. Our specialists have deep knowledge of customs legislation and extensive experience in cargo transportation in St. Petersburg. With us, your goods will be delivered on time.

Customs operations for your goods at the border involve the implementation of a number of formal activities that are associated with the transportation of goods from one state to another. A participant in foreign economic activity must correctly determine which customs release procedure his cargo falls under. It can be placed for:

- customs transit or warehousing;

- processing;

- temporary or internal use;

- return export;

- duty free shops, etc.

The CU Labor Code specifies seventeen procedures, the implementation of which is accompanied by nuances: prohibitions, restrictions and specific documentation. A feature of customs operations is the presence of mandatory conditions. Participants in foreign trade activities will be required to provide declarations and other documents. In the process of carrying them out, it is impossible to do without strict compliance with the instructions of customs legislation.

Types of customs operations

We will divide the entire process of goods clearance sequentially into types of customs operations and list them in detail below.

1. Crossing the goods through the customs border:

- preliminary declaration of products;

- collection and submission of documents on the approval of a vehicle for transportation of products;

- collection and submission of documents for the application of individual customs procedures.

2. Activities prior to filing and registration of a customs declaration:

- arrival of goods at customs;

- moving a consignment for temporary storage;

- customs transit.

3. Activities performed during product declaration.

4. Activities carried out upon completion of customs declaration of goods:

- conditional release of goods at customs;

- removal of cargo from customs territory.

5. Registration of the end of the customs regime.

License payments and their impact on the customs value of goods.

By virtue of paragraphs. 7 clause 1 art. 40 of the Customs Code of the Eurasian Economic Union (hereinafter referred to as the EAEU Customs Code), to determine whether license payments should be included in the structure of customs value, it is necessary to answer two questions:

- Do royalties apply to imported goods? (hereinafter referred to as the criterion of relevance); And

- Is the payment of license fees a condition for the sale of imported goods for export to the customs territory of the EAEU[1] (hereinafter referred to as the condition of sale criterion).

In this case, both criteria must be met simultaneously.

If, as a rule, no problems arise with the first question, and everything is quite obvious, then it is the second question that gives rise to many disputes with the customs authorities. This is due to a number of factors, starting with an insufficiently detailed analysis by customs of the terms of foreign economic contracts and licensing agreements that mediate the import of goods, and ending with an incorrect interpretation by the customs authorities (and subsequently the courts) of the wording “sale for export.” It is these problems that we would like to dwell on in more detail.

The answer to the question whether payment of license fees is a condition for the sale of valued (imported) goods for export to the customs territory of the EAEU is obvious in the case when both the license agreement and the foreign economic contract are concluded, for example, between the same persons, and both documents are interrelated , contain references to each other and provide for the payment of license fees as one of the conditions for the delivery of goods. However, such explicit terms are rarely included in contracts.

At the same time, even in the absence of such obvious provisions regulating legal relations for the supply of goods and payment of license fees, customs authorities very often assess additional customs duties. To do this, it is not even necessary that the declarant pay any license fees. It is sufficient that, for example, the person to whose address goods containing an object of intellectual property are imported pays license fees to the copyright holder. This position is due to the fact that customs authorities equate the wording “sale for export to the territory of the Union” with the wording “import to the territory of the Union”.

Indicative in this aspect is the position of the Supreme Court of the Russian Federation, set out in the Ruling of May 29, 2015 in case No. A40-110311/2013, where the Court supported the positions of the lower courts, which concluded that it is necessary to include license fees in the structure of the customs value of goods on the basis , that “a condition for the sale of goods/introduction into civil circulation in the territory of the Customs Union is the indirect payment by the user to the copyright holder of license fees for the use of intellectual property in an amount not included in the price of the goods”[2].

As can be seen from the above quote, in the context of the case, the courts, when analyzing the terms of payment of license fees, took into account the possibility of selling goods not on foreign territory for export to the territory of the EAEU, but directly selling them on the territory of the EAEU, which led to an erroneous, in our opinion, conclusion about the need to include license fees in the customs value of goods. This interpretation, unfortunately, is widespread, although it is not correct.

Another important point that should be especially noted is the ability of the copyright holder to exercise control over the production of goods that goes beyond the scope of ordinary quality control (hereinafter referred to as the manufacturer control factor). This factor appears among the factors that need to be analyzed in the context of checking the fulfillment of the criteria for the conditions of sale, outlined in EEC Recommendation No. 20 of November 15, 2016 No. 20 “On the Regulations on adding license and other similar payments for the use of intellectual property to the price actually paid or payable for imported goods" (hereinafter referred to as EEC Recommendation No. 20).

When considering the factor of control of manufacturers, it is necessary to analyze what possibilities of legal influence the copyright holder has in relation to the manufacturer of the licensed product. For example, can the rights holder, as part of its control, prohibit certain companies from producing licensed products if the license fees are not paid by the licensee.

Indicators of the presence of such control may also include, for example, provisions of the licensing agreement that allow the copyright holder to pre-approve the concept of the appearance of the licensed product before its production or require the mandatory conclusion of an agreement with third-party manufacturers if they are not parties to the licensing agreement, but are involved by the licensee.

EEC Recommendation No. 20 does not clarify whether the licensor should exercise control directly, and therefore, for customs authorities to assess additional customs duties, it will be enough for the fact that such an agreement has been concluded with the licensee, and not directly with the copyright holder.

Let's give an example from practice. In case No. A40-228733/15, courts of all instances, including the Supreme Court of the Russian Federation, supported the position of the customs authority on the need to include license fees in the structure of customs value, and the main factor influencing the adoption of such a decision was the conclusion that the right holder has control over the production of licensed products . Such control, according to the courts, was evidenced by:

- the existence of a procedure for approval of licensed products by the copyright holder at certain stages of production;

- the need to submit elements under development to the licensor for review and approval in writing;

- carrying out audits of manufacturing enterprises;

- control of procurement plans;

- availability of a procedure for admitting manufacturing enterprises to produce products;

- the licensor's ability to prohibit production.

Based on the foregoing, we can conclude that before concluding a license agreement and a foreign economic contract for the supply of licensed products, it is necessary to check whether any factor identified in EEC Decision No. 20 is met as indicating the feasibility of the sales condition criterion. To do this you need to check:

- is there a mutual reference between the license agreement and the foreign economic contract;

- what rights are granted to the licensee for payment of license fees. Does the list of these rights include the right to sell licensed products for export to the territory of the EAEU, and whether the licensor can prohibit such sales. What methods of legal influence does the licensor have on a foreign seller? What is the territory of the license;

- what is the limit of the licensor's authority to control the production of licensed products. Does the licensor have any means of legal influence on the manufacturer (for example, does the licensor have the right to prohibit the production of licensed products by certain manufacturing companies).

The indicated conditions are the most important, however, it is necessary to understand that for the most objective assessment of risks it is necessary to analyze individually the provisions of individual license agreements and foreign economic agreements.

Additionally, we will dwell on the issue related to the taxation of license payments, which became especially relevant after the appearance of the Letter of the Ministry of Finance of Russia dated 08/04/2016 No. 03-10-11/45719 (hereinafter referred to as the Letter). This Letter states that when determining the customs value of goods, the structure of the customs value of which includes license payments, the amounts of VAT and corporate income tax calculated and withheld by a person who performs the duties of a tax agent in accordance with the legislation of the Russian Federation on taxes and fees are taken into account. .

In our opinion, this position is due to the fact that license payments are calculated in favor of a foreign copyright holder who is not a resident of the Russian Federation. Thus, the copyright holder receives profit on the territory of the Russian Federation. That is, in fact, an object of taxation for VAT and corporate income tax arises.

In this case, the payer obligated to calculate and withhold tax will be the Russian company – the licensee, as a tax agent.

The question logically arises: does double taxation occur in such a situation? Responding to it, the Russian Ministry of Finance explains that double taxation does not arise, since in this situation there is taxation of different persons: the person who imported the goods and the persons who are licensors. Each person has its own object of taxation: (1) importation of goods into the territory of the Russian Federation and (2) transfer of property rights and sale of goods on the territory of the Russian Federation.

The basis for this position is Recommended Opinion 4.16 of the WCO Technical Committee on Customs Valuation (hereinafter referred to as Recommended Opinion 4.16), according to which, if, in accordance with the tax legislation of the country of import, when paying license fees to a foreign copyright holder by the importer, tax amounts are subject to withholding, then these amounts should be considered as part of license fees. Consequently, the customs value of goods in accordance with Article 8.1(c) of the WTO Agreement must include the total amount of royalties accrued in favor of the copyright holder, that is, before taxes, and not the actual amount transferred.

Based on the above, the Russian Ministry of Finance concludes that the customs value should include license payments, taking into account the amounts of VAT and corporate income tax.

The position of the Russian Ministry of Finance must be taken into account when determining the amount of license payments, as well as the customs value, since it was brought to the attention of the Federal Customs Service of Russia, which means it cannot be ruled out that the customs authorities adhere to the same position.

Obviously, every year certain “interesting” clarifications from government bodies appear that regulate the inclusion of additional charges in the customs value, but this is the main motivation for challenging decisions on additional charges of customs duties.

Authors:

Irina Malikova Counsel, Customs Law and Foreign Trade, Bryan Cave Leighton Paisner

Anna Parfentyeva Junior Associate, Bryan Cave Leighton Paisner

List of sources:

[1] Eurasian Economic Union

[2] Resolution of the Ninth Arbitration Court of Appeal in case No. A40-110311/2013

- Pravo.ru

Carrying out customs operations

Carrying out customs operations at customs is a correct and consistent set of measures for collecting and submitting the necessary documentation, which includes:

- notification to customs authorities about crossing the border, as well as about the desire to export any goods abroad;

- determination of HS codes;

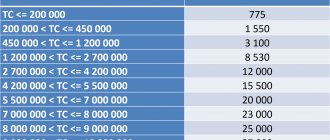

- determining the price of a commodity lot;

- payment of customs duties;

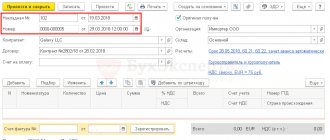

- filling out a customs declaration;

- inspection and release of cargo.

Remember that lack of experience in customs clearance can cause a long delay of your cargo at the border and multiple fines. As a result, you will lose a significant part of your profits. Turning to professionals will help you avoid this.

Call now! Our specialists will reduce your costs for transporting goods, collecting and submitting the necessary documentation. We guarantee timely delivery, customs clearance and no cargo downtime.