An example of calculating customs duties for customs clearance of coffee

Let's look at a simple example of calculating customs duties. The recipient is a legal entity that imports a batch of roasted coffee into the territory of the Russian Federation. The calculation is carried out within the framework of the IM-40 regime (Release for domestic consumption). The customs cost of the shipment including delivery to the border is 32,000 Euro.

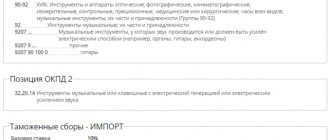

According to the HS code 0901 11 000 1, the duty rate is 0, VAT 20%, and not subject to excise tax.

Customs payments are calculated from the customs value according to the following formula:

Customs value (hereinafter referred to as CV) = the cost of the goods under the contract + the cost of transporting the goods to the border with Russia (transportation within Russia is not taken into account).

The Euro exchange rate on the date of filing the declaration is 78 rubles TC = 32,000 Euro * 78 = 2,496,000 rubles. Duty rate 0

VAT = 20% of the vehicle + customs duty

VAT = (2,496,000 + 0) * 20 / 100 = 499,200 rub.

At customs, a fixed customs duty is paid, which has its own calculation formula:

| TS of goods | Customs duty amount |

| does not exceed 200 thousand rubles inclusive | 500 rubles |

| From 200,000 rubles 1 kopeck or more, but does not exceed 450,000 rubles inclusive | 1,000 rubles |

| From 450,000 rubles 1 kopeck or more, but does not exceed 1,200,000 rubles inclusive | 2,000 rubles |

| From 1,200,000 rubles 1 kopeck or more, but does not exceed 2,500,000 rubles inclusive | 5,500 rubles |

| From 2,500,000 rubles 1 kopeck or more, but does not exceed 5,000,000 rubles inclusive | 7,500 rubles |

| From 5,000,000 rubles 1 kopeck or more, but does not exceed 10,000,000 rubles inclusive | 20,000 rubles |

| From 10,000,000 rubles 1 kopeck or more | 30,000 rubles |

Customs payments = VAT + Customs duties + Customs duties

Total payable = 499,200 (VAT) + 0 (Duty) + 5,500 (Fee) = 504,700 rubles

The given results of calculation of customs duties are for informational purposes only and are not final. The actual amount may differ depending on the country of origin, HS code, exchange rate and other economic and political factors.

Entrust the calculations to professionals!

Contact us in any convenient way, and TAISU-TB specialists will advise and calculate customs duties free of charge, taking into account all the features of your cargo.

Get an offer

Importing countries

The main suppliers of coffee in the Russian Federation are the following countries:

- Colombia;

- Argentina;

- Brazil;

- Ethiopia;

- Ecuador;

- Türkiye;

- Belgium;

- Italy;

- Vietnam and others.

Such popular brands of coffee are imported as:

- Jacobs;

- Nescafe;

- Paulig;

- Nespresso;

- Ambassador;

- Carte Noire, etc.

Deadlines

The established period for filling out and submitting a declaration for coffee ranges from several hours to 2 working days and depends on the type of cargo, the number of items in the invoice and the number of EAEU HS codes.

The customs authority checks and releases the declaration within a few hours from the moment of its registration, if no changes are required to the declaration and all permits are provided. There are also other reasons for delay, which our company, having extensive experience, minimizes, thereby saving time and money for its clients.

Any deviation from the planned customs clearance period is fraught with downtime and additional costs for the foreign trade participant, which is why it is important to minimize all risks of increasing customs clearance time.

Customs clearance procedure

Customs clearance of coffee occurs according to a standardized scheme. Initially, the declarant must register as a foreign trade participant. This procedure is performed once. Then an application about the intention to cross the customs border is sent to the customs post in advance. At this time, the necessary documents are collected and checked, in accordance with the nature of the cargo and legal requirements. Cargo insurance is also possible. This procedure is carried out at the request of the client. The classification code of the Commodity Nomenclature of Foreign Economic Activity is determined and mandatory payments are calculated in accordance with it. Documents and cargo are presented to the customs service, checked and inspected. After which a decision is made on the further fate of the cargo. If everything is in order, the goods are released under the declared customs procedure.

Note! It is better to pay mandatory payments in advance, taking into account the time it takes to complete a bank transfer. Because the cargo will not be released from customs until confirmation of payment is received.

Cost of customs clearance services for coffee

In order to correctly calculate the prices for customs clearance of coffee and coffee drinks, you need to know a lot of specific information about the cargo. Our specialists are ready to calculate and optimize your costs, as well as carry out all the necessary procedures at customs.

The coffee customs clearance service includes:

- consulting on customs clearance issues;

- checking the package of documents provided by the Customer for customs clearance of one consignment (including shipping documents);

- formalization of delivery documents, preparation, filling out the declaration form and electronic submission to the customs authority.

One consignment of goods is understood as a consignment of goods sent at a time to the consignee using one waybill in one vehicle within the framework of one foreign trade contract.

| Type of work | Cost without VAT) |

| Carrying out customs operations and customs declaration of goods of one consignment in import mode (IM 40): | from 5,000 rubles |

| Carrying out customs operations and customs declarations for each subsequent consignment in import mode, if there are several consignments in one vehicle (IM 40): | from 4,000 rubles |

| Registration of each additional sheet of goods declaration, starting from the 5th (fifth) product in the import mode (IM 40). | from 450 rubles |

| Carrying out customs operations and customs declaration of goods of one consignment in export mode (EC 10): | from 3,000 rubles |

| Carrying out customs operations and customs declaration of goods of one consignment (other regimes): | from 10,000 rubles |

| Payment (additional payment) of any types of customs duties under one DT on behalf and on behalf of the Customer, when declaring goods, using the representative’s own funds through terminal payment using a customs card/online service of the ROUND payment system. | from 3% of the documented payment amount (additional payment), but not less than 1,000 rubles |

| Assistance in obtaining a Declaration of Conformity with the CU TR for goods, as well as other permitting documents. | discussed individually |

Attention! The specified information is not a public offer in the meaning provided for in paragraph 2 of Art. 436 of the Civil Code of the Russian Federation (part one) dated November 30, 1994 N51-FZ (as amended on August 3, 2018), prepared and posted in accordance with clause 2 of Art. 348 of the Federal Law of August 3, 2021 No. 289-FZ “On customs regulation in the Russian Federation and on amendments to certain legislative acts of the Russian Federation.”

Documents required for customs clearance of coffee

Documentation

Transportation and commercial documents are prepared for customs clearance. These include:

- foreign economic contract;

- invoice or invoice;

- transport documents (for example, air waybill, bill of lading, etc.);

- documents describing the nature of the cargo and its properties (in the case of coffee, information about the variety, degree of processing of the beans, and packaging must be present);

- transaction passport;

- certificate (declaration) of conformity.

The last document in the list is prepared in advance and confirms compliance with state standards, namely TR CU “On Food Safety”. The product for which the certificate has been received is marked with the EAEU sign.

Errors in documents, as well as corrections, blots, inaccuracies, and inconsistencies in the description of the cargo are unacceptable. The absence of any document or insufficient information leads to increased attention from customs officers: a thorough inspection of the cargo, examination. Serious problems can also arise if the wrong classification code is assigned, because it determines the amount of duty charged. Even though coffee is not a perishable commodity, it has a certain shelf life. Due to errors, processing delays are possible, in exceptional cases very long. Therefore, it is so important to provide for all the nuances and prepare properly.

How we are working

Request for customs clearance

Contact us in any convenient way

Specialist consultation

We will find out your task in the field of foreign trade and inform you about the price for customs clearance

Signing the contract

Agreeing on the terms of cooperation and signing a maintenance agreement

Preparation of documents and certificates

Collection and preparation of necessary permits

Transportation Features

Coffee quickly absorbs extraneous odors and moisture, so it is advisable to transport it separately from other goods, or take this point into account when forming a shipment for transportation, and also maintain air humidity of no more than 7%. Transportation is carried out in plywood boxes, with paper or parchment. Coffee can be transported by any means of transport, but it is important that the vehicle is clean and dry. Boxes of coffee are placed in a row. Coffee beans can be transported in bags. Instant and ground coffee are often shipped in plywood boxes or containers.

VIRTUAL CUSTOMS CUSTOMS AND LOGISTICS PORTAL

An analysis of the database of electronic copies of the customs declaration carried out by the SFTD Department within the framework of the risk management system shows that in the region of operation of the Central Customs Administration in subposition 2101 12 of the Commodity Nomenclature of Foreign Economic Activity, intended for finished products based on extracts, essences or concentrates of coffee or based on coffee (import rate customs duty of 15% of the customs value of goods) goods are declared, based on the description of which in column 31 of the EGTD, there is reason to believe that they belong to subposition 2101 11 of the Commodity Nomenclature of Foreign Economic Activity “Extracts, essences and concentrates of coffee (import customs duty rate is 10%, but not less than 0.5 euros per 1 kg). Subposition 2101 11 of the Russian Commodity Nomenclature for Foreign Economic Activity classifies coffee extracts, essences and concentrates. These products can be prepared from natural coffee (caffeinated or decaffeinated) or from a mixture of natural coffee and its substitutes in any proportion. Subheading 2101 11 190 of the Commodity Code of Foreign Economic Activity includes products in liquid or powder form. Such products are used in particular for the preparation of ready-made food products (for example, chocolates, cakes, muffins, pastries, ice cream, etc.) Subheading 2101 12 of the CN VED classifies finished products based on extracts, essences and concentrates of coffee, including extracts, etc. d. with the addition of starch or other carbohydrates. Checking the correct classification of goods in subposition 2101 12 of the Commodity Nomenclature of Foreign Economic Activity revealed the following. 1. In subheading 2101 12 920 of the Commodity Nomenclature of Foreign Economic Activity the goods are declared: - At the Shchelkovo customs, CJSC "PRODIMPORT" (TIN 5010020728) imports the goods "Coffee drinks: based on coffee extracts (coffee - 70%, rye, barley, sugar beets - 30%) — 4740 kg in granules, packaged: 46 bum. bags of 15 kg, 162 paper. bags of 25 kg b/add. packaging"; — At the Moscow Eastern Customs, KORES SERVICE LLC (TIN 0411107328) imports the product “Instant coffee drink powder “COFFEE MIX C-1 (30)”, composition: coffee extract - 14%, barley extract - 40%, chicory extract - 46 %; without ethyl content. alcohol), for production purposes; net weight without packaging - 15,000 kg.” The descriptions of goods in column 31 of the Customs Declaration give reason to believe that these goods may relate to goods of subposition 2101 11 of the Commodity Nomenclature of Foreign Economic Activity. In addition, at the Zelenograd customs, NESTLE FOOD LLC (TIN 7729017598) imports the goods described in column 31 of the EGTD as “Ready dry drink based on instant natural coffee with additives “Nescafe Frappe / Vanillocchino” (with vanilla flavor) of the Nestle trademark "in polymer packaging weighing 1 kg." At the Odintsovo customs, DECOR STYLE LLC (TIN 7705596392) in an electronic copy of the customs declaration declares the goods as “Finished products based on conGLENCOR” (TIN 7718247381) imports the following goods: “Coffee drink, without ethyl alcohol “Mokate” in tin cans of 100 grams . — 118296 cans, composition: natural coffee extract, coffee substitute extracts”; Instant coffee liqueur with chicory powder in cardboard boxes of 30 kg. Ingredients: natural coffee extract, extracts of coffee substitutes, without ethyl alcohol, etc. - at the Noginsk customs, GEPARD LLC (TIN 7813307577) imports the product “Instant coffee drink with the addition of natural coffee from 3% to 10%, trademark “ Mokate", powder, in packs of 100 g. net weight excluding packaging - 8840 kg." The descriptions of goods in column 31 of the Customs Declaration give reason to believe that these goods may relate to goods of subposition 2101 11 of the Commodity Nomenclature of Foreign Economic Activity. In addition, in the region of activity of the Odintsovo customs, LLC "CREON-FINANCE" (TIN 7709338360) in subposition 2101 12 980 1 of the Commodity Classification of Foreign Economic Activity, intended for coffee-based goods, declares goods, "Instant coffee drinks t/m "Instantina" based on concentrates coffee (without ethyl alcohol), in cart. packages and glass jars of 100 grams, total - 1651.20 kg, from the first. pack - 3333.12 kg." At the Noginsk customs, AVTOMASHDOR LLC (TIN 5018073680) imports the goods “Instant coffee drink, with the addition of natural coffee, in powder form, “Stolichny”, in cart. packs of 100 g, 32 packs, 700 cards. Box, “Dachny”, 100 g, 32 packs, 700 cards. cor. not soda alcohol, see add. N 1 for 1 l.”; The description in column 31 of the EGTD does not contain information about the component percentage composition of goods, which does not allow them to be classified in a specific subheading of the Commodity Nomenclature of Foreign Economic Activity. In connection with the above, it is necessary: 1. Conduct a documentary check of the correct classification in accordance with the Commodity Nomenclature of Foreign Economic Activity of goods imported in 2005, declared in subposition 2101 12 of the Commodity Nomenclature of Foreign Economic Activity, in accordance with the Instruction on the actions of officials who classify goods in accordance with the Commodity Nomenclature of Foreign Economic Activity and control of the correctness of determining the classification code of the Commodity Nomenclature of Foreign Economic Activity, approved by Order of the Federal Customs Service of Russia dated September 29, 2004 N 85, as amended by Order of the Federal Customs Service of Russia dated February 28, 2005 N 149. 2. If facts of false declaration of goods are revealed, take measures for additional accrual and additional collection of arrears resulting as a result of incorrect classification of goods, penalties in connection with failure to pay customs duties in full, and to bring to justice persons who violated customs legislation. 3. A report on the documentary audit, indicating the information justifying the decisions made on the classification of goods in each audited customs declaration, the measures taken, the amounts of additionally accrued and additionally collected payments, must be submitted to the SFTD by 04/25/2005. The report, in addition to duly certified copies of the verified customs declaration, must be accompanied by information on the component percentage composition of products, manufacturing technology, and other information on the basis of which the issue of classification of goods was considered.

Deputy Head of the Department for Economic Affairs, Colonel of the Customs Service I.Yu. Kostyuchenko

HS codes: 0901110001 - 0901210001

0901110001

UNRoasted, caffeinated, Arabica coffee beans (made in BOLIVIA) IN 70KG BAGS (TRANSPORT PACKAGING NOT INTENDED FOR RETAIL SALE) LAVADO EXTRA STANDARD SIEVE 16

Having a problem? Call our customs specialist:

Moscow and region (call is free)

Saint Petersburg

0901110001

ARABIC COFFEE (BRAZIL COFFEA ARABICA), UNRoasted, CAFFEINED, GREEN, BEANS, UNWASHED, “SANTOS” GRADE, INTENDED FOR FURTHER INDUSTRIAL PROCESSING, PACKED IN JUTE BAGS – 20 BAGS, NET WEIGHT 1,196 .00KG, MARK. 002/1145/1420

0901110001

ARABIC COFFEE (COFFEA ARABICA) NATURAL, UNROASTED, WITH BEANS, WITH CAFFEINE, PACKED IN VACUUM FOIL BAGS FOR RETAIL: PART OF A SET OF 4 TYPES OF COFFEE “ROAST BEAN STORY KIT/WAY OF THE COFFEE BEAN” (GREEN BEANS 1 PCS)

0901110001

UNRoasted (Green) COFFEE BEANS WITH CAFFEINE “ARABICA SANTOS SITO 19” IN 60KG BAGS, FOR INDUSTRIAL PROCESSING

0901110001

NON-ROASTED COFFEE (GREEN) WITH CAFFEINE IN "ARABICA IPANEMA" BEANS IN 60KG BAGS FOR INDUSTRIAL PROCESSING

0901110002

COFFEE “ROBUSTA” GREEN, NOT Roasted, IN BEANS, WITH CAFFEINE, HUMIDITY MAX.12.5%, MASS FRACTION OF CAFFEINE 0.8%, USED FOR INDUSTRIAL PROCESSING, PACKED IN POLYMER BAGS (BIG BAGS) WITH NET WEIGHT EACH 21600 KG. ONLY 10 POLYMER BAGS.

0901110002

COFFEE “ROBUSTA” GREEN, NOT Roasted, IN BEANS, WITH CAFFEINE, HUMIDITY MAX.12.5%, MASS FRACTION OF CAFFEINE 0.8%, USED FOR INDUSTRIAL PROCESSING, PACKED IN POLYMER BAGS (BIG BAGS) WITH NET WEIGHT EACH 21480 KG. ONLY 3 POLYMER BAGS.

0901110002

UNROASTED COFFEE WITH CAFFEINE: ROBUSTA (COFFEA CANEPHORA), IN BAGS OF 60 KG/NET, FOR INDUSTRIAL PROCESSING

0901120001

GREEN ARABIC COFFEE (COFFEA ARABICA), UNRoasted, Decaffeinated "GUATEMALA DECAFENED" - 10 JUTE BAGS OF 59-61 KG. RAW MATERIALS FOR INDUSTRIAL PROCESSING OF ROASTED COFFEE

0901120001

GREEN ARABIC COFFEE (COFFEA ARABICA), UNRoasted, Decaffeinated "GUATEMALA DECAFENED" - 20 JUTE BAGS OF 59-61 KG. RAW MAKING RAW COFFEE, FOR PRODUCTION OF ROASTED COFFEE, FOR INDUSTRIAL PROCESSING

0901210001

ARABIC COFFEE (COFFEA ARABICA), NATURAL, ROASTED, WITH CAFFEINE, IN BEANS, /FOR RETAIL/, IN VACUUM BAGS FROM ALUMINUM FOIL, NET NET WEIGHT – 2190 KG:

0901210001

ARABIC COFFEE BEAN, N/F, PREMIUM GRADE (30% BRAZ.SANTOS 70% TANZ.GRINDERS) GOST R 52088-2003 - 70 PCS; PACKED IN CARDBOARD BOXES;

0901210001

100% NATURAL COFFEE: ARABIC COFFEE (COFFEA ARABICA) ROASTED, WITH CAFFEINE, IN BEANS, IN METAL CANS OF 3 KG, ART.40024-3 “GRAND RESERVE” - 60 PCS., 1 PIECE EACH. IN 60 CARDS. COR.

0901210001

Roasted coffee with caffeine in Arabica beans (COFFEA ARABICA) 100%, IN VACUUM PACKAGING, “BRAZIL SANTOS NATURAL ARABICA”: 250 GR - 500 PACKS, 1000 GR - 35 PACKS. TOTAL 535 PRIMARY PACKAGINGS. NET WEIGHT WITHOUT PRIMARY PACKAGING—160KG.

You can find additional information on the topic in the Unified Customs Tariff section. Section II.

Free consultation by phone:

Moscow and region (call is free)

Saint Petersburg

Attention! Due to recent changes in legislation, the legal information in this article may be out of date!

Our specialist will advise you free of charge.