Regularly, participants in foreign economic activity, without suspecting or foreseeing it, violate customs rules . This is evidenced by numerous protocols of detentions and decisions on violation of customs rules drawn up by customs control authorities.

It is worth noting that the current legislation provides for both administrative and criminal liability in the area of violation of customs rules. Our customs lawyer will help in protecting your rights in the field of customs legislation.

Types of violations of customs rules

- Illegal transportation of goods and vehicles for international transportation across the border of the Customs Union . This offense represents actions in which a person imports or exports goods, as well as hides them when moving them, or simply misinforms the customs authority about the quantity, weight or other characteristics of the declared goods transported across the border of the customs territory.

- Non-declaration, false declaration of goods . In case of non-declaration or false declaration of goods by individuals, the law provides for liability. For example, if you return from a foreign vacation and carry with you alcohol or tobacco in excess of the permitted limits and do not declare them, you will be subject to a corresponding sanction. Non-declaration or false declaration of cash by individuals. This article differs from the previous one only in the subject of the offense: if you are going on vacation abroad and carry cash with you in the amount of more than ten thousand dollars or traveler's checks without declaring them, you will be subject to the appropriate sanction.

- Failure to comply with bans on the import (export) of goods into the customs territory of the Eurasian Economic Union or the Russian Federation and vice versa . In case of non-compliance with the prohibitions established by international treaties when moving them across the border, an appropriate sanction is established in relation to certain goods. This article applies if goods are prohibited or restricted for import and export. For example, extremist literature or poisonous, toxic substances.

- Violation of the customs control zone regime . The above composition represents several subtypes; violation of the customs control zone can be expressed in the movement of goods, persons, or in carrying out economic activities without the permission of the customs authority, for example, opening a duty-free store (duty free).

- Failure to take action in the event of an accident or force majeure . This article makes the carrier liable for failure to take measures to ensure the safety of goods in the event of an accident or natural disaster, but only if the carrier could not prevent such negative consequences. The legislator has established a special procedure for actions in the event that an accident or natural disaster occurs during the transportation of declared goods, and if these actions are not performed, the carrier will face sanctions.

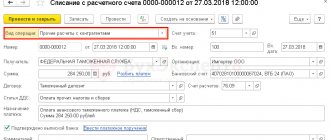

- Submission of invalid documents for customs operations . A violation of this article is the submission by declarants of forged documents or false information, which entailed the receipt of customs or tax benefits: exemption or reduction of customs or tax payments.

- Non-delivery, loss of goods or non-delivery of documents for them . This article is devoted to liability for the loss or shortage of goods or documents during customs transit, that is, along the route of goods from the point of departure to the point of destination.

ATTENTION : watch the video on the topic of disputes with customs and do not forget to subscribe to the YouTube channel to receive free advice from a customs lawyer in the comments to the videos:

- Failure to comply with customs transit procedures . This article of the Code of Administrative Offenses of the Russian Federation is devoted to liability for failure to comply with the deadlines established by the customs authority for goods or documents during customs transit, that is, along the route of goods from the point of departure to the point of destination. Read more about the help of our lawyer in case of non-compliance with the customs transit procedure at the link.

- Destruction or modification of means of identification . This article protects the normal functioning of customs authorities since, due to the destruction, removal, alteration, damage or loss of identification means used by the customs authority, it leads to destabilization and the inability to perform its state functions. More information about the composition and assistance of our administrative lawyer under Art. 16.11 Code of Administrative Offenses of the Russian Federation at the link.

- Failure to comply with deadlines for customs declarations and documents . This article is intended to prevent violations of non-compliance with the deadlines established by law for filing a full customs declaration, provided that the declaration is carried out after the actual export of goods. Moreover, this article establishes liability for failure by persons, including those carrying out activities in the field of customs affairs, to fulfill the obligation to store documents necessary for customs control, the storage of which is mandatory, for example, customs brokers.

- Carrying out transactions with goods without permission or notification of the customs authority . This article provides for liability for committing certain actions without permission or notification of the customs authority. Such operations include unloading, loading, unloading, reloading (transshipment), as well as taking samples of such goods, opening premises or other places where such goods may be located, and replacing a vehicle for international transportation.

- Violation of the procedure for storing goods and operations with them . In case of violation of the storage procedure established by the legislator or the procedure for performing operations with goods under customs control without the permission of the customs authority, as well as the requirements and conditions for placing goods under special customs regime: customs warehouse, temporary storage warehouse, other place of temporary storage, free stock.

- Failure to submit customs reports . This article provides for liability for failure to submit reports, violation of the deadline for submitting reports to the customs authority, and submission of reports containing false information. Customs reporting means not only declarations, but also other documents established by law.

- Violation of temporary storage of goods . By violation of the terms of temporary storage of goods, the legislator means those terms that were determined by the customs authority in a specific document for a given type of goods.

- Submission of inadequate documents for the release of goods before filing a customs declaration . In case of submission of invalid documents for the release of goods before filing a customs declaration, provided that those contained in such documents affect the customs authority’s decision to release goods before filing a customs declaration, the declarant or carrier will be liable. Since this information may affect the release of exported goods.

- Failure to comply with customs procedures . The customs procedure is a specific process that is clearly regulated by law. Therefore, the statement in the goods declaration of false information about them or the presentation of invalid documents, if such information and documents could serve as the basis for placing goods under a customs procedure providing for full or partial exemption from customs duties and taxes or a refund of amounts paid and (or) non-use non-tariff regulation measures. This sanction provides for liability for both citizens and officials.

- Illegal disposal of conditionally released goods . This article is intended to protect the interests of declarants and carriers. Since in the case of the use of goods that were seized during customs control, as well as the use of conditionally released goods, their transfer into possession, use, alienation or disposal in any other way will lead to a violation of the rights of the owners of these goods.

- Illegal use of goods . This article, unlike the previous one, is intended to protect the interests of government bodies. Since in the case of using goods that are illegally transported across the customs border and in respect of which customs duties, taxes have not been paid, or those established by international treaties have not been complied with, they are punishable by law.

- Violation of deadlines for payment of customs duties. In case of violation of the deadlines for payment of customs duties and taxes payable in connection with the movement of goods across the customs border, established by law. The declarant will face sanctions.

- Illegal activities in the field of customs issues. This article provides the elements of offenses that are provided for the performance of customs operations on behalf of the declarant or other interested parties by a person who is not included in the register of customs representatives, or included in the specified register on the basis of invalid documents, or excluded from it. The article is intended to protect the interests of both declarants and officials together with the professional community of brokers.

- Illegal transactions with motor vehicles . This composition, unlike the previous ones, differs in the object of protection: temporarily imported vehicles, violation of the temporary import of cars into the Russian Federation, their transfer into possession or use, sale or disposal in any other way in violation of established restrictions on the use and disposal of such vehicles.

Tax crime defense: organization, strategy and tactics

Defense for tax crimes, based on the basic principles of defense in criminal proceedings, has its own characteristics due to the fact that:

- the dispositions of the corresponding articles of the criminal code are blanket;

- The reason for initiating a criminal case in cases of tax evasion in most cases is a violation of tax legislation, established based on the results of an audit in the Tax Audit Report and the Tax Authority's Decision on criminal prosecution. Starting from 2021, all materials based on the results of on-site tax audits are sent to the investigative units of the Investigative Committee. Part 3 Art. 32 of the Tax Code directly prescribes that if, within 2 months from the date of expiration of the deadline for fulfilling the requirement to pay a tax (fee, insurance contribution), sent to the taxpayer on the basis of a decision to bring to tax liability, the taxpayer has not paid in full the specified amount of arrears, the amount of which allows us to assume that a crime has been committed, as well as the amount of penalties and fines, the tax authority is obliged to send materials to the Investigative Committee within 10 days.

- The prejudice of court decisions provided for in Article 90 of the Code of Criminal Procedure of the Russian Federation on claims to appeal the Act and the decision of the tax authority is of decisive importance for the adoption of a final procedural decision in the case. It should be taken into account that the investigative units of the Investigative Committee, whose exclusive jurisdiction includes tax crimes, when making a decision to initiate a criminal case, do not take into account the fact whether the person involved in the case has appealed the tax audit act and the decision of the tax authority;

- in relation to a person who has committed a tax crime for the first time, a special basis is provided for exemption from criminal liability in connection with compensation for damage caused to the budget system of the Russian Federation.

The above grounds are the four pillars on which the entire defense has to be based.

As practice shows, most entrepreneurs turn to a criminal lawyer for protection after a criminal case has been initiated: before the initiation of a criminal case, namely at the stage of a tax audit, entrepreneurs, underestimating the criminal legal risks, prefer to cope with the help of in-house lawyers and security officers or attracted specialists in tax and arbitration disputes.

The exception is the small number of cases that are initiated in the absence of a tax audit report, based on the results of so-called pre-investigation checks carried out by employees of the operational units for combating economic crimes of the Ministry of Internal Affairs and the FSB of the Russian Federation, or by employees of the Investigative Committee.

Cases of tax evasion are almost always initiated after the fact, without identifying a suspect. In some cases, when the role of the head of an organization in the management of the company and his involvement in the commission of actions covered by the disposition of the tax article is indisputable, especially in cases where the head is at the same time the sole founder of the organization, criminal cases are initiated against a specific person. However, charges are almost always brought after receiving the results of a forensic examination.

The peculiarity of the initial actions for defense of tax crimes is determined by the course of the investigation, which involves:

- seizure of documents related to the financial and economic activities of the organization (primary documents), tax registers, accounting and reporting documents

- interrogation of managers and employees of counterparties

- interrogation of managers and employees of affiliated and controlled organizations

- interrogation of managers and employees of an organization brought to tax liability

- appointment of a forensic examination;

- bringing charges, choosing a preventive measure and interrogating the accused;

- seizure of property;

- making a decision to terminate or sending the case to court.

After accepting an assignment to defend a tax crime, a tax lawyer must first of all do the following:

- determine the prospect of terminating the criminal case in connection with compensation for damage to the budgetary system of the Russian Federation;

- determine the circle of persons who need to be provided with legal support;

- understand the prospect of appealing a tax audit report and decision and join the process of representing the organization in a court of second instance or interact with representatives of the organization for the purpose of effective interaction;

- decide on the position of building relations with the investigation in terms of assistance in providing the necessary documents and take measures to prepare the organization’s employees for carrying out operational investigative activities (searches, seizures);

- ensure legal protection of the assets of the principal and the organization in case of arrest.

The circle of persons who need to be provided with legal support depends both on the nature of the tax offense charged and on the actual circumstances of the case. When charging non-payment of taxes associated with the fragmentation of a business, the use of affiliated and controlled organizations, or the presence of structural divisions in an organization, a lawyer must not only provide protection to the manager or owner of the business, but also provide legal assistance to all other employees of this organization, its branches and structural divisions , employees of controlled organizations. At the same time, the need for team work on tax crimes in this part is of particular increased importance: one lawyer should not be allowed to participate in the defense of both the accused (potential accused), and in providing legal assistance during interrogations of other persons, since this is associated with the risk of the lawyer being recused. At the same time, due to the need to ensure the consistency of testimony, it is impossible to leave the interrogations of the above-mentioned persons to chance, therefore it is necessary to provide for the participation of partner lawyers in the case. It should be noted that in some cases the number of witnesses for tax crimes, in whose interrogations it would be desirable to ensure the participation of “your” lawyer, reaches several dozen; in addition, it is not always possible to coordinate the interrogations of these persons in advance, which must be taken into account when building a defense.

One of the initial actions of the defense in tax cases is to determine the client’s position regarding the desire and ability to compensate for the damage to the budgetary system of the Russian Federation. According to clause 2 of the Note to Art. 199 of the Criminal Code of the Russian Federation, Part 1, Art. 76.1 of the Criminal Code of the Russian Federation, when paying the amount of tax arrears, as well as penalties and fines, investigative authorities and courts are obliged to terminate the criminal case and release the person who committed a tax crime for the first time from criminal liability. It should be initially remembered that in order to terminate a criminal case for tax evasion, it is necessary to pay not only the amount of tax, non-payment of which is charged, but also the amount of fines and penalties, if any have been calculated. The formal basis for the investigator to make a procedural decision on exemption from criminal liability in connection with compensation for damage is a certificate from the tax authority confirming the absence of debts on taxes, penalties and fines.

It should be noted that the fact of paying taxes, penalties and fines does not prevent the initiation of a criminal case, and therefore in recent years, in order to improve performance indicators, there have been frequent cases of initiating criminal cases for tax crimes “on the basket”: if the debt is fully repaid, the investigation is initiated criminal case, dismissing it and receiving a bonus in statistical reporting both on the case initiated and terminated on non-rehabilitative grounds, and on the reimbursement of unpaid taxes. Despite the paradoxical nature of this situation, the risks for the manager should not be underestimated. So, even though in such a situation the case has been opened for termination, the investigative authorities are forced to collect evidence of the crime committed, in connection with which searches, seizures, and interrogations are carried out, which interferes with the normal activities of the organization. In addition, in a criminal case initiated for termination, a forensic economic examination is ordered, which is often carried out for three years, which raises the possibility of expanding the charges to impute other tax periods and amounts of unpaid taxes. Also, during the investigation, measures of procedural coercion, including preventive measures, may be applied, which also negatively affects the activities of the organization. Finally, the termination of a criminal case due to compensation for damage carries reputational risks for the person against whom the case is terminated. The current legislation does not contain any requirements regarding the need to terminate a case exclusively in relation to a specific person. In practice, the investigation and the prosecutor's office do not terminate the case if the person is not the accused or, at least, a suspect. For a manager, reputational risks do not differ from the fact whether he was a suspect or an accused. One of the possibilities for eliminating reputational risks for a business manager who is also the owner is to shift responsibility to one of his deputies: this option is very doubtful from the point of view of current legislation, but the investigation in some cases agrees to it.

Thus, if the principal makes a decision to pay accrued taxes, penalties and fines and agrees to terminate the criminal case:

Punishment for violation of customs rules

The Code of Administrative Offenses of the Russian Federation provides for the following measures of administrative penalties for offenses in the field of customs law:

- warning - issued to the person who committed the offense in writing, as a rule, for the first time an administrative offense has been committed.

- fine. It can be fixed, or it can vary from smaller to larger. As a rule, such a sanction as a fine for legal entities and officials is much greater than for individuals.

- confiscation of goods. For example, for violation by individuals of the terms of transfer of the right to use or disposal of temporarily imported vehicles, they may be brought to administrative liability in the form of confiscation of the items of such an administrative offense.

The Criminal Code of the Russian Federation provides for the following criminal penalties for crimes in the field of customs law:

- Imprisonment with or without a fine.

- Restriction of freedom

Structure of customs law

In jurisprudence, customs legal relations refer to the totality of social relations that are regulated by the norms of customs law. It is necessary to talk about the content of the presented relationships. The object of regulation here is the totality of relations associated with the transportation of goods across borders.

Subjects of legal relations of a customs nature are specific participants in relations - persons and bodies involved in the transportation of goods across borders. The powers and professional functions exercised by the subjects of the relationship form the content of the legal relationship.

Responsibility for violation of customs rules

When is the help of our customs lawyer needed?

Failure to declare or falsely declare goods may result in the imposition of administrative or criminal liability on the violator. Since the provision of declaration documents is controlled by legislative acts (in particular, non-declaration: Article 16.1 of the Code of Administrative Offenses of the Russian Federation, or false declaration: Article 16.2), preventive measures can be quite serious: this can be a fairly large fine, which is calculated as a percentage of the amount of customs duties paid or confiscation of goods and application of criminal liability to the violator. Fines for administrative liability are quite large and can cause material damage to the company. In order to prevent penalties in your practice when transporting goods across the border, you should prevent false declaration of goods. Companies that, due to their specific nature, do not constantly transport goods, may unknowingly make this mistake.

Undeclared goods are those that are transported without filing a declaration. Also, part of the cargo may be undeclared, when a separate part is accompanied by a declaration, and a separate category of goods is transported without documentation at customs.

A product is considered to be falsely declared when, when filling out a declaration, the data on the imported product is distorted accidentally or intentionally. These violations are considered by judicial practice under Part 1 of Art. 16.2 Code of Administrative Offenses of the Russian Federation. For intentional false declaration of goods, criminal liability is applied to the person who allowed this situation to arise only after the case was reviewed by a lawyer.

Often, the distinction between these offenses cannot be made without the participation of an experienced lawyer. The scope of liability for both offenses is different. If the violation regarding false declaration did not contain the intent to significantly reduce customs payments, the lawyer, with well-organized defense tactics, will be able to achieve an administrative penalty. For non-declaration or false declaration of goods, the Code of Administrative Offenses provides for various penalties and the lawyer’s goal is to achieve administrative punishment without taking measures to confiscate property. An experienced defense lawyer will be able to help at the time the offense occurs or subsequently by appealing the decision.

If you are under criminal prosecution, for example, under an article of the criminal code such as smuggling, we recommend that you visit our criminal cases section, or better yet, directly contact our criminal lawyer to take timely measures to build a line of defense.

Responsibility of tax authorities

Based on the norms of the current legislation of the Russian Federation, it becomes clear that responsibility, be it administrative, criminal or disciplinary, is an integral companion of any legal entity. This also applies to the tax system of our country, as well as its officials.

Tax authorities may become subject to certain liability if they violated the rights and legitimate interests of other participants in tax legal relations, as well as in the event of inaction.

The provisions of the tax legislation of the Russian Federation provide that the responsibility of tax authorities can be expressed in the need to compensate for losses if they were caused to taxpayers as a result of unlawful actions of officials and employees of tax authorities, or inaction that led to such a negative result.

The fact that there really was a violation on the part of tax authority employees or officials must be appropriately confirmed and proven.

The application of various measures and prosecution for violations in relation to employees of tax authorities and their officials is aimed, first of all, at protecting the interests of taxpayers, as well as at the most effective and strict compliance with the established norms of the current tax legislation of the Russian Federation.

At the same time, the prosecution itself must follow the established rules. Only certain authorized persons – courts, etc. – have the right to engage.

Lawyer for violations of customs rules in Yekaterinburg

Our smuggling lawyer will provide you with qualified legal assistance in the event of a criminal case being initiated in this area.

If an illegal decision on an administrative offense is made against you, our customs lawyer is ready to appeal such a decision and seek a fair solution to your problem, violation of customs rules does not always lead to severe punishment (read about the work of a lawyer in the field of customs disputes at the link). Officials do not always explain your rights to you when drawing up decisions on an administrative violation:

ATTENTION: the period for appealing the decision is 10 days from the date of its issuance. Also, by virtue of current legislation, a period for voluntary execution of punishment is provided, which is 60 days. Do not miss the deadlines if you violate customs rules because... restoring them is a troublesome process.

The emergence of customs legal relations

Experts in the field of jurisprudence identify three sources of formation of legal relations:

- The moment of crossing the border - for example, the formation of a legal connection between an individual and the customs authority.

- After crossing the border - for example, between a participant in foreign economic activities and the customs authority.

- Before crossing the border - for example, this is consultation and information with authorities before transporting goods.

In all the presented cases, the grounds for the formation, termination and change of legal relations will be legal facts. Such facts are always certain events or actions. For example, this is the emergence of a citizen’s obligation to place goods under customs regime due to the expiration of the maximum storage period in a warehouse.

Customs legal relations are divided into legal and illegal, which depends on the presence of a certain legal fact. Unlawful legal facts are also called torts. As a rule, legal sanctions are established for them.

Payments, duties and taxes

What applies to customs duties? According to Russian legislation, the following types of cash payments are included here:

- Export and import customs duties.

- Customs duties.

- Value added tax.

- Excise taxes.

All presented types of payments are valid only within the framework of Russian customs legal relations. If we talk about international treaties of various states, then in the field of customs policy we should highlight anti-dumping, countervailing and special duties.

There are also rates - mandatory payments that are collected at the border by the relevant authorities. Such payments include:

- Specific rates are set depending on the natural characteristics of the goods being transported.

- Ad valorem rates are set as a percentage of the customs price of goods.

Finally, there are customs fees. Their size and types are determined by the states themselves. Fees are required to be paid by all citizens wishing to transport goods across borders.

All presented types of payments relate to the management of tax legal relations. Customs authorities play an important role in this regard.