To identify objects that require increased attention from customs control and measures to reduce the number of unforeseen situations, the authorities of the Federal Customs Service (FCS) use a risk management system (RMS) in customs affairs. This provision is enshrined in the first paragraph of Article 378 “Use of the risk management system by customs authorities” of the Customs Code of the Eurasian Economic Union (EAEU Customs Code).

According to Standard 6.3 of the Kyoto Convention and related Methodological Recommendations, RMS is the systematic use of management procedures and practices that provide customs with the necessary information to control the movement of persons or goods that pose a certain risk. Let us tell you in more detail how the RMS is applied and interpreted in Russian customs affairs.

General provisions on the applied risk management system (RMS)

In Russia, the legal basis for using a risk management system consists of:

- provisions of the EAEU Customs Code (Federal Law of November 14, 2021 No. 317-FZ “On Ratification of the Treaty on the Customs Code of the Eurasian Economic Union”);

- Federal Law of August 3, 2021 No. 289-FZ “On customs regulation in the Russian Federation and on amendments to certain legislative acts of the Russian Federation”;

- other departmental, regulatory and legal acts.

In accordance with the second paragraph of Art. 310 “Conducting customs control” of the EAEU Customs Code, customs officers, during the control of objects crossing the state border, use the forms of control and (or) measures specified by the EAEU Code to ensure its implementation. The whole process is built on the principle of selectivity of objects, forms and measures by which customs control is carried out.

Reference. According to the fifth paragraph of Art. 310 of the EAEU Labor Code, forms and measures are used by customs officers to ensure compliance with the legislation of a member state of the Union, control over compliance with which is entrusted to the authorities of this member state (if established by the legislation of these countries).

Cargo imported into the territory of the EAEU is subject to control and inspection from the moment it crosses the customs border of the Union (the first paragraph of Article 1 of Article 14 of the EAEU Labor Code “Arrival of goods...”). But goods exported from the customs territory of the Union are placed under control from the moment the declaration is registered or an action is taken aimed at exporting goods from the customs territory of the Union, until the actual crossing of the border of the EAEU, the revocation of the customs declaration, or until the occurrence of the circumstances specified in paragraphs 9 and 10 of Article 14 TC EAEU.

Basic approaches to the use of RMS during customs control

The following basic approaches to the application of RMS are distinguished:

- Controls are kept to the minimum necessary to ensure compliance with customs legislation (Standard 6.2 of the Kyoto Convention).

- The FCS uses risk analysis to determine the persons and goods, including vehicles, that must be inspected and the extent of such inspection (Kyoto Convention Standard 6.4).

- In the process of customs control, FCS employees use the RMS (Standard 6.3 of the Kyoto Convention). Also, after selecting the object of control, commodity research and examination are used.

- In order to improve control, FCS employees strive to cooperate with trading participants and conclude a memorandum of understanding (Standard 6.8 of the Kyoto Convention).

They are determined according to the standards of the General Annex to the International Convention on the Simplification and Harmonization of Customs Procedures (Kyoto Convention) as amended in 1999 (Chapter 6. Customs control).

Risk management system: problems of implementation and implementation in the customs authorities of Russia

International trade has undergone significant changes in recent years, in particular, the speed of transactions has increased, the volume of sales of goods between countries has increased, the structure and nature of foreign trade turnover are changing. All these factors, along with increasing pressure from the international trading community, are forcing customs authorities to find a balance between facilitating international trade and conducting customs controls. In an effort to achieve an acceptable balance, customs authorities are moving away from traditional full-scale checks of passengers, goods and documents to decision-making based on a risk management system (hereinafter referred to as RMS).

According to Article 128 of the Customs Code of the Customs Union, customs authorities apply the RMS to determine goods, vehicles for international transportation, documents and persons subject to customs control, forms of customs control applied to such goods, vehicles for international transportation, documents and persons, as well as the extent of customs control control [1].

The RMS, which is in service with the customs service of the Russian Federation, has been continuously and intensively developing for several years. At the present stage, the development of the RMS is aimed at increasing the efficiency of its application in the activities of customs authorities.

In this regard, the work carried out by customs authorities allows, as part of the development of the RMS, to revise the categorization criteria and the procedure for analyzing information on the activities of organizations engaged in foreign economic activity, in order to promote the development of priority sectors of the economy and the creation of an attractive investment climate.

Note that the Federal Customs Service of Russia regularly publishes reports on the results of application of the RMS, reflecting the degree of implementation of the system in the practice of customs control.

Thus, based on the results of the implementation of the RMS in 2015, the Federal Customs Service of Russia, in order to prevent the possible movement of goods and vehicles of international transport across the customs border of the EAEU in violation of the law of the EAEU and (or) the legislation of the Russian Federation on customs, approved 35,140 risk profiles. The result of their application is additionally accrued customs duties (19.0 billion rubles, including an additional 18.5 billion rubles collected), the application of sanctions provided for by criminal and administrative legislation (934 and 32,231 cases were initiated, respectively), the release and prohibited the import/export of goods (24,304 and 12,556 decisions were adopted, respectively) [4].

Compared to 2013 and 2014, there was a significant increase in the indicator of approved risk profiles: 3.7 times and 62.6%, respectively.

As can be seen from the statistical data, customs authorities have significantly increased the creation and approval of risk profiles, which indicates an increase in the effectiveness of customs control. This once again confirms the thesis previously voiced by scientists and practitioners that the RMS plays an important role in ensuring the completeness of customs payments, compliance with prohibitions and restrictions, combating crimes and offenses in the customs sphere, optimizing the use of customs authorities’ resources, reducing time and costs for stakeholders to carry out customs operations [5-7; 9; 10].

However, despite the obvious successes and advantages of using RMS in the practice of customs authorities, some problems should be highlighted.

One of them is the complexity of the process of coordinating the risk profile that is created in customs with the Federal Customs Service of Russia. According to Order of the Federal Customs Service of Russia No. 778, it is first necessary to collect the relevant information to create a draft risk profile, and then go through the approval stages in the RTU and the coordinating units of the central office of the Federal Customs Service of Russia. All these actions require considerable time, which reduces the effectiveness of customs control [2].

When using a gradation of risk degree, it is assumed that it is possible to approve part of the risk profiles, for example, with a low and medium degree, directly in the Customs Control Division and in the Customs Control Department (Fig. 1), and with a high degree, send them for approval to the RTU and the Federal Customs Service of Russia. This approach will reduce the time from identifying a risk object to taking measures to eliminate the risk.

Rice. 1. Structure of divisions of customs authorities exercising customs control

The next problem is unformalized risks, which are not subject to qualitative description, but directly depend on the subjective opinion of the inspector.

Figure 2 shows the classification of risks and methods for identifying them.

Rice. 2. Types of risks

Obviously, there are psychological characteristics of the official here, and this is sometimes an obstacle to making the right decision when conducting customs control. It is necessary to reduce the degree of informalization of risks through partial risk automation (combined approach).

Rice. 3. Combined approach to risk identification

At the moment, foreign trade participants can be divided into only two categories – low-risk and all others. At the same time, there are two systems for categorizing participants in foreign trade activities: the “industry” approach and automatic categorization. The “sectoral” approach is based on the declarative procedure; it is used when analyzing the activities of persons engaged in production activities, including the industrial assembly of vehicles, import of meat products; import of fish products, etc. Automatic categorization is used when analyzing the activities of all organizations importing goods.

Currently, 40 criteria are used, which are divided into two large groups: general indicators characterizing the activities of the participant in foreign trade activities (the size of the authorized capital; the period of foreign economic activity; the presence of “offshore” contracts and indirect deliveries; debt on customs duties, interest, penalties; information from the tax authorities; status of an authorized economic operator, etc.), and criteria characterizing the results of customs control in relation to a participant in foreign trade activities (comparative analysis of the main risk indicators; dynamics of the customs value index and customs duties; effectiveness of the application of the RMS; identified offenses; availability of classification decisions goods; facts of recall or refusal to issue diesel fuel, etc.). A new order is currently under discussion, which will contain 43 criteria (three new ones have been added and some have been updated) [8].

However, such a “two-channel” system for separating foreign economic activity participants is not effective enough. Some well-established enterprises are still at a high level of risk and are forced to undergo full customs control, and some enterprises that are at a low level of risk begin to take advantage of their “advantageous” position and violate customs rules.

From December 3, 2013 to March 31, 2014, an experiment was carried out to introduce a “five-channel” categorization system. During its implementation, it was recorded how legal entities “change.” Since the beginning of the experiment, 90 new organizations have appeared in such a narrow market, which fell into the category of foreign trade participants with a very high level of risk.

The World Customs Organization Risk Management Compendium provides four categories of risk level: low, which includes foreign trade participants who voluntarily act in accordance with the law; average (moderate), which includes participants in foreign trade activities who try to act in accordance with the law, but are not always successful in this; high (foreign trade participants who avoid compliance with legislation, if possible) and very high (foreign trade participants who deliberately do not comply with legislation) [3]. EU customs services successfully work with such categories. They clearly understand who is behind such definitions as “a foreign trade participant who voluntarily acts in accordance with the law” and “a foreign trade participant who never complies with the law.”

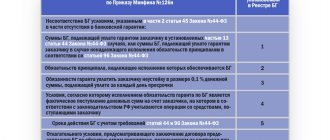

An effective management system based on compliance with legal requirements through risk assessment assumes that participants in foreign trade activities belonging to the selected categories require different treatment. Incentives and simplified procedures should be applied to those who voluntarily comply with legal requirements; those who try to comply with the requirements of the law, but do not always succeed in this, should be assisted; Those who evade legal compliance should, if possible, be subject to compliance measures, and those who willfully fail to comply should be subject to enforcement measures [11] (Table 1).

The main point of the functioning of the management system, based on compliance with legal requirements through risk assessment, is the active direction of foreign trade participants in the low-risk category by creating incentives and concessions (providing the status of “Authorized Economic Operator”, simplifying the procedures for paying customs duties, reducing the amount of customs duties). fees for the export of non-commodity goods, etc.) or, conversely, by introducing sanctions and restrictive measures, thereby forcing them to comply with the law.

Table 1

Compliance-based management model

In general, it is advisable to implement WTO risk management standards in the customs authorities of the Russian Federation in the following areas:

creation and (or) development of a legislative and regulatory framework regulating the application of a risk management system in customs authorities with the mandatory determination of sanctions for non-compliance with standards and rules by participants in customs operations;

creation of a conceptual framework for risk management in customs authorities, defining the principles, strategy and tactics of using RMS, risk management processes, tools and targets;

creation of an organizational framework for risk management, including organizational, technical, information and technological risk management systems, systems of authority, planning and reporting;

creation of methodological and methodological foundations for assessing the effectiveness of risk management during customs control of goods and vehicles of international transportation.

It is necessary to create a unified database about participants in foreign trade activities, which, among other things, will display a gradation according to the degree of risk. This base will become uniform for all government agencies and departments, and, consequently, the efficiency of enterprises carried out by government agencies will increase (Table 2).

table 2

Unified database of foreign trade participants

| Organization Violation of the law | LLC "A" | LLC "B" | LLC "V" |

| Tax | — | + | + |

| Customs | — | — | + |

| Administrative | — | — | + |

| — | — | + | |

| Risk level | Short | Moderate | Very tall |

Thus, the need to modernize the RMS is beyond doubt. Work on the implementation of the RMS should be reflected at all levels of the Russian Federal Customs Service system and increase the efficiency of customs authorities. It is necessary to continue to study the experience of using RMS in other countries, build models and analyze how this or that innovation affects the work of customs authorities, the effectiveness of customs control, increase interaction between customs authorities and other government bodies, as well as with customs administrations of foreign countries . All this will be facilitated by the introduction of WTO standards for risk management in the activities of the customs authorities of the Russian Federation, which involves the creation of not only a viable and effective RMS, but also the formation and development of methodological and methodological foundations for assessing the effectiveness of the application of the RMS itself (risk management) during customs control of goods and transport means of international transportation.

Literature

- Customs Code of the Customs Union (annex to the Agreement on the Customs Code of the Customs Union, adopted by the Decision of the Interstate Council of the EurAsEC at the level of heads of state dated November 27, 2009 No. 17 // Reference and legal system "ConsultantPlus".

- Order of the Federal Customs Service of Russia dated April 24, 2014 No. 778 “On approval of the Temporary Instruction on the actions of customs officials in the implementation of the risk management system” - URL: https://www.alta.ru/tamdoc/14pr0778 (date of access: 25.03. 2016).

- WCO Customs Risk Management Compendium – URL: https://www.wcoomd.org/en/topics/facilitation/instrument-and-tools/tools/~/media/0653E0C1 C07C498FBA1D5F206AE86655.ashx (accessed: 03/21/2016).

4. Draft final report on the results and main activities of the Federal Customs Service of Russia for 2015 URL: https://www.customs.ru/index.php?option=com_ content&view=article&id=22889:-2015-&catid=475:2015- 03-12-09-57-15&Itemid=2588 (date of access: 03/20/2016).

- Afonin P.N. Customs risks: intellectual analysis and management: monograph. SPb.: Publishing House Polytechnic. Univ., 2007. 266 p.

- Boyko A.P. Improving customs control management taking into account risk factors: dis. ...cand. econ. Sci. M., 2008. 151 p.

- Ershov A.D., Zavyalova O.V. Risk management system in customs: textbook / A.D. Ershov, O.V. Zavyalova. SPb.: RIO St. Petersburg named after V.B. Bobkov branch of the Russian Customs Academy, 2013. 401 p.

- Interview with the Head of the Department of Risks and Operational Control of the Federal Customs Service of Russia V. Goloskokov to the Customs Information Server TKS.RU “How to become an ideal participant in foreign trade activities” dated 08.26.2014 URL: https://www.customs.ru/index.php?option=com_ content&view= article&id=19830:-tksru-26082014&catid=26:2011-01-24-14-45-21&Itemid= 1830 (date of access: 03/18/2016).

- Kondrashova V.A. Risk management when carrying out customs operations with goods imported into the territory of the Customs Union: dis. ...cand. econ. Sci. M., 2013. – 129 p.

- Kostin A.A. Risk management system during customs control: Training manual. St. Petersburg: IC Intermedia, 2013. 224 p.

- Theoretical foundations of the application of the risk management system in the customs service of the Russian Federation: scientific and methodological manual / E.G. Anisimov, R.F. Arslanov et al. M.: Publishing House of the Russian Customs Academy, 2015. 284 p.

Purposes of using RMS

According to the third paragraph of Art. 378 of the EAEU Labor Code “Use of the risk management system by customs authorities”, the main goals of using the risk management and control system include:

- preparation of conditions for simplifying the procedure and reducing the time of movement across the customs border of the Union of goods for which the need for application of measures to minimize risks has not been identified;

- ensuring the effectiveness of customs control;

- focusing on those areas where the risk is high and where it is necessary to ensure the effective use of FCS resources.

In order to establish uniform approaches to the management, implementation and improvement of the RMS in the customs of the Russian Federation, on August 18, 2015, by order of the Federal Customs Service of the Russian Federation No. 1677, the “Strategy and tactics of using the RMS, the procedure for collecting and processing information, conducting analysis and risk assessment ...” was approved. Its essence is the achievement of the goals listed above.

Note. The tactics for using RMS determine the set of RMS techniques and methods, as well as the order of operation of the system and the implementation of actions to control probable threats.

Assessing the company for risk management

What should a company do if it is just thinking about implementing an RMS or if the elements of the system are already present, but it is not clear how and in what direction to move further? In this case, experts recommend performing an analysis of the risk management system at the enterprise in order to determine its strengths and weaknesses and ways for further development.

It would be very useful for current and potential stakeholders in the company's activities and in investing in it to learn about the real state of affairs from the perspective of regular risk management. In 2015, the KPMG consulting group conducted a study “Risk Management Practices in Russia”, in which 48 respondents were asked about conducting RMS diagnostics. The results of the answers are presented in the diagram below.

Results of a survey of 48 Russian companies on RMS diagnostics. Source: KPMG Russia. 2015

The study notes that most system assessments are carried out by internal audit. Many companies conduct diagnostics using other internal departments. For example, responsibility for this work is assigned to the risk manager or to the department that coordinates the functioning of the RMS in the company. A significant part of companies invite consultants. These are mainly large companies and organizations with foreign capital.

In any case, the system must be assessed quite regularly. It is better if diagnostic measures are carried out independently, there is more objectivity. However, at first, you can start with a self-assessment procedure. It's useful and simple. I would suggest that the head of a company starting work in this direction conduct risk management testing. Gather a board of directors or board, invite several promising and experienced specialists who “support” the business, and fill out the table below in group work.

Self-assessment table of risk management in the company

Follow the instructions below for working with the table.

- Divide the gathered managers and specialists into four groups.

- Give each group a blank table.

- Ask each group to list the five most important risks facing the company.

- Invite participants to rate each risk on a 10-point scale based on the criterion of importance.

- Ask to evaluate the effectiveness of each risk management.

- Collect tables, instruct the secretary to compile a single list of risks and calculate the level of the gap for them in the form of the difference between importance and effectiveness.

- If the groups' answers differ significantly, then the risks are likely to be much greater than one might imagine.

What does the risk management process in customs include?

The risk management process is the systematic work of FCS employees to minimize the likelihood of events related to non-compliance with international treaties and acts in the field of customs regulation and the legislation of member states on customs regulation, and possible damage from their occurrence. It consists of:

- threat assessments;

- identifying measures to minimize risk situations and the procedure for their application;

- analysis and monitoring of the results of applying these measures;

- collection and processing of data on objects of customs control, on operations performed and the results of control carried out both before and after the release of goods;

- descriptions of threat indicators;

- selection of control objects;

- creation and approval of risk profiles.

Risk analysis and assessment

Analysis and assessment of risky situations is carried out in order to determine the likelihood of a threat and the consequences of violations of the law of the Union and the legislation of the Russian Federation (in accordance with the Strategy and tactics of applying the RMS). This process is automated through the use of targeted techniques.

Important! The result of the threat assessment is the basis for creating a profile of a dangerous situation or making a decision on the need to apply measures to minimize it.

A risk profile is a basic RMS tool that allows you to influence and minimize a threat. It is a document that reflects information about the area, indicators and measures to minimize risks (according to Article 376 of the EAEU Labor Code “Definitions”). Information from profiles and risk indicators is classified as confidential data and is not subject to disclosure except in cases established by the legislation of the Union member states.

Reference. The risk profile is formed if, based on the results of the analysis and assessment of the threat, a high level of risk of violation of the law of the Union and the legislation of the Russian Federation is identified.

In the process of forming a risk profile, it is necessary to appoint officials from various structural divisions of customs authorities, as well as a certain mechanism for its approval, in which at each stage the risk of violation of customs legislation and the validity of the measures contained therein to minimize threats are assessed.

The results of applying measures to minimize threats in accordance with risk profiles are taken into account in the information resources of the Federal Customs Service of the Russian Federation and are analyzed on an ongoing basis. This is done in order to update or cancel outdated profiles.

The Federal Customs Service of the Russian Federation assesses and monitors the effectiveness of measures to minimize risk situations using certain indicators, as well as methods for their calculation and evaluation.

Stages

According to the definition proposed by the World Customs Organization, a standard customs risk management process includes five main stages:

- Establishing the context: import of goods, export controls, passenger traffic, etc.

- Identification of threats: ensuring the safety of government revenues (for example, based on assessed value, payment orders, payment of import duties, origin and classification).

- Analysis of risky situations: probability of danger occurring (unlikely, likely, high degree of probability).

- Risk assessment and ranking: assessing the impact and consequences of a risk (eg high, medium, low).

- Addressing Risks: Defining countermeasures and assigning threat levels (e.g., skip, delay, move, or destroy).

In addition to the five steps above, the risk management process requires ongoing monitoring and review to ensure that both false negatives and false positives are eliminated.

Proper documentation, communication and consultation with all stakeholders are key to this process, as risk management is a corporate-wide task that requires the participation of the entire organization, not just a specific department.

Principles for implementing the RMS

The operating principles of the RMS in the company also determine the processes of its implementation and development. These principles are subject to compliance by managers, specialists responsible for the implementation of system procedures and all employees of the company.

- The principle of goal orientation. Goals are stated in the company’s strategic documents: development strategies, strategic action plans, corporate maps, business plans.

- The principle of balancing risks and profits. The RMS should promote a balance between risk and profitability of the business, taking into account the requirements of legislative acts and the provisions of internal regulations.

- The principle of accounting for uncertainty. Uncertainty is present in any business activity and is an integral part of the company's decisions. The RMS serves to systematize information about the sources (factors) of uncertainty and helps reduce it.

- Systematic principle. A systematic approach allows you to timely and fully identify, identify and assess risks, reduce their negative consequences or compensate for the impact on business results.

- The principle of quality information. The functioning of the RMS requires timely, secure and accurate information. When making decisions, however, it is necessary to take into account the limitations and assumptions of information sources, the possible subjectivity of the experts’ position and the features of the methods used for assessing and modeling risk situations.

- The principle of assigning responsibility for risk management. The concept of “risk owner” is introduced; this status is assigned to one of the company’s managers. He is given responsibility for the relevant management procedures within the limits of the assigned powers and functional composition.

- The principle of efficiency. The RMS must provide a reasonable and economically justified combination of management effectiveness and costs for its organization and production.

- The principle of continuity. The RMS operates under conditions of regularity (cyclicity) of the main processes and their continuity. The system's processes begin at the time of development of the company's strategy and cover all areas of its activities.

- The principle of integration. The decision-making system at all levels of management must include the subject area of the RMS. Decisions are made and approved taking into account the circumstances and the likelihood of adverse consequences associated with their adoption.

- The principle of expansion. RMS involves identifying, assessing and resolving all possible threats to activity, not limited only to financial and insurable risks. For the last three principles, diagrams of their main elements are presented below.

Composition of procedures for the principle of continuity of the RMS

Composition of procedures for the principle of continuity of the RMS

Diagram of the main elements of the RMS extension principle

Criteria for assigning a risk level

There are many criteria according to which the effectiveness of RMS application is assessed.

Among them are the following key indicators:

- the effectiveness of measures to minimize threats;

- the degree of achievement of customs control goals;

- resources of customs authorities spent on the application of measures to minimize threats;

- the number and share of customs control objects in respect of which measures to minimize risks were applied;

- the degree of optimality of distribution of measures to minimize threats at different stages of customs control, as well as between the stages of customs control before and after the release of goods, etc.