The personal account of the Federal Customs Service was developed with the aim of improving information interaction between participants in foreign trade activities and Russian customs. The online service allows you to simplify and speed up customs processes. From now on, the transfer of documents is carried out in electronic format - no personal presence is required. Receiving information on accounts occurs automatically.

Cash loans for any purpose

- Rate from 5,9% !

- Up to 7 years !

- Loan amount up to 5 million. rubles !

Submit your application

Personal account functionality

The Personal Account of the Customs Service contains about 30 electronic services that regulate various aspects of foreign economic activity.

The interface of the LC FCS of Russia allows the user to:

- generate electronic documents (declarations, notifications, reports, inventories, etc.);

- send electronic documents to the customs authority;

- store documents;

- request and receive information from the customs authority.

Service Personal account

The information service is intended for foreign trade participants to control the general status of their personal account, receive information in electronic form about the flow of funds, about provided bank guarantees and customs receipts.

The service ensures that foreign trade participants receive information on personal accounts with customs authorities in the form of reports:

- on balances on payment documents of foreign trade participants;

- on the expenditure of funds contributed as advance payments;

- on confirmation of payment of customs duties and taxes.

To obtain personal account information from the customs authorities you need:

- Fill out the request for information.

- Send a request to the customs authorities, verifying it with an electronic signature.

- Receive a response from the customs authorities, which will appear in the list of requests.

Information about provided bank guarantees and customs receipts is received by the service from customs authorities automatically.

Electronic declaration of goods

Customs declaration is a statement in the established form of accurate information about goods in accordance with the requirements of the selected customs regime or special customs procedure.

To create a new declaration procedure, you need to select the type of procedure and go through the following steps:

- Preparation of documents. Filling out the necessary documents (DT, DTS) and sending a set of documents to the customs authority.

- Submission and registration of documents. After receiving a set of documents, the customs inspector checks the conditions for registering the goods declaration and assigns it a unique registration number.

- DT check and inspection. At this stage, the customs authorities conduct a documentary check of the declaration for goods, request documents confirming the information specified in the DT, and also, if necessary, carry out an inspection (inspection) of the goods.

- Release of goods. After completing the documentary check of the customs declaration, the customs inspector makes a decision on the goods, which is indicated in the sent documents.

Electronic declaration of goods

ED is a method of maintaining statistical reporting in the Federal Customs Service on the movement of goods and services during mutual trade between the Russian Federation and the European Union. Documents must be submitted within the first eight working days of the month.

The sequence of actions for filling out the statistical form in the personal account and sending it on paper:

- Open the “Statistical Declaration of Goods” service, follow the “Get Started” link.

- Find the item “Fill out the statistical form” on the page, write the data in three blocks – general information, information about the product and the applicant.

- Click on the “Upload to file” link in the top panel to save the document on your PC in xml format.

- Click “Check” once completed, and if there are no errors, select “Get system number and print.”

- Certify the document with a signature, seal and send it in paper version to the regional body of the Federal Customs Service.

Registration in the office of the Federal Customs Service of Russia

You can register in the LC using the link at the top of the pages of the customs service website. In the form that opens, you must enter user data:

- login;

- email;

- password and its repetition.

Please note that the password is case sensitive - uppercase or lowercase letters. After clicking on the “Register” button, the service will display a message about user registration. A confirmation link will be sent to the specified email. Clicking the link will complete the procedure.

To work in a number of Personal Account services, an electronic signature (ES) is required. Services that require an electronic ID are marked with an ES.

Only one organization and only one electronic signature certificate can be confirmed in one personal account. One organization can open several personal accounts for different employees with their own electronic signature. An electronic signature certificate can be obtained from one of the trusted certification authorities.

If the company intends to work with an electronic signature in the Personal Account of the Federal Customs Service of the Russian Federation, the employee needs to confirm the organization in his personal account. The procedure is carried out in the “Profile” section, using the “Add organization” button. Confirmation is carried out in two stages. First, the electronic signature is certified by the federal service, then by the Federal Tax Service of the Russian Federation.

How to open an ELS for a new foreign trade participant

For new participants in foreign trade activities registering for the first time in the Unified Logistics System of the Federal Customs Service and the Russian Federation who have not previously carried out foreign economic activity (unregistered with customs), the registration procedure will be as follows:

- Obtaining an electronic signature (this can be done through the Internet portal of the State Services).

- Registration on the website of the Federal Customs Service in the “Personal Account of a Foreign Economic Activity Participant” system

- Filling out an application for opening an ELS. The application must indicate information about the presence of subsidiaries and divisions in the company capable of declaring goods to customs.

- Submitting an application. This can be done using postal services or via the Internet.

- Agreeing on the account opening date and receiving a reconciliation report. Having received the application, government officials will contact the declarant to clarify the dates for opening the ELS and submitting the balance reconciliation report.

- Crediting the remaining funds to the Unified Personal Account. After receiving the statement on the balance, the declarant must submit a corresponding application for offset of the remaining funds on the LSP in favor of the ULS.

- Submitting an application. This can be done using postal services, through, or by fax. A copy of this document must be sent to the place where customs clearance of goods belonging to the declarant is carried out.

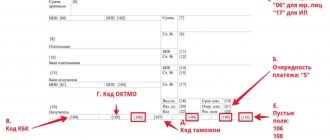

- Transfer of funds to the Unified personal account. When opening an ELS, it is done exclusively using code 10000010. It is important to note that customs authorities need several days to transfer funds from the declarant’s old accounts to the ELS, so it is recommended to immediately transfer funds using the new details, without waiting for the balances to be transferred.

Authorization in the Personal Account of the Federal Customs Service of Russia

The customs service website provides two options for logging into your personal account edata.customs.ru:

- by login and password;

- using an electronic signature.

To go to the authorization form, click on the link at the top of the FCS website - “Login to your personal account.” On the page that opens, enter the login and password specified during registration, or click on the login link using an electronic signature.

In the first option, the personal account will open after clicking on the “Login” button. In the second case, the digital signature file selection form will open. After completing the action, your personal account will open.

Using the authorization form, you can recover your password if you lose it. To do this, you will need to enter your login or email. A link to change the password will be sent to the user's email.

Digital advertising of products

A border proclamation is a statement written in a designated form of precise information about the product, taking into account the conditions of the selected border regime or special border operation. To make a new declaration process, you must select the type of operation and complete the following steps:

- Collect papers. Fill out the necessary documents and send them to the border structure.

- Submit and register papers.

- After receiving the list of papers, the border guard will check the conditions for registering the proclamation for the product and give it a special registration number.

- The specialist checks the diesel fuel and carries out an inspection.

- At this stage, border structures carefully check the declaration papers for the products, request papers that confirm the data noted in the DT, and also, if necessary, inspect the products.

- Products are being released.

- After checking all the documents, the specialist makes a decision on the product, which he indicates in the submitted papers.

Customer support via account

Contacting technical support is possible only after registering in your Personal Account. The user can send a letter using the buttons on the page header. In the appeal you must indicate the name, telephone number for contact and the text of the appeal itself.

You can attach a file (screenshot, XML file, etc.) to the letter by clicking the Attach files button. By default, the email is pulled from your personal account profile. You can change it if you wish. In response to the request, the user will be contacted either by phone or by E-mail.

Hotline number

Citizens can receive advice on customs control/clearance issues via the multi-channel hotline +7(495)740-18-18. Specialists will help resolve all problems that fall within the competence of this department. You can also leave complaints at this number. Calls are paid according to the tariffs of telecom operators whose services are used by legal entities/individuals.

The Federal Customs Service currently operates information support telephone numbers:

- Help Desk.

- Trust.

The Federal Customs Service of the Russian Federation is an agency that performs the functions of supervision/control in the field of currency control, customs affairs in the fight against smuggling of goods and other crimes.

Algorithm for filling out the declaration

The algorithm for filling out a statistical declaration is described in detail in Appendix No. 2 to the rules for maintaining statistics. The declaration consists of the following columns:

- registration number - filled in automatically upon registration;

- number of the canceled statistical form - filled in by the applicant if the report is submitted again to replace the previously submitted one;

- system number - assigned to a form submitted on paper automatically after passing format and logical control;

- 20 semantic graphs; if reporting is completed for several types of objects, columns 1 to 10 inclusive are general, and columns 11 to 20 inclusive are filled out separately for each object; in one report it is allowed to declare no more than 999 transportation objects;

- summary columns: document date, reporting period and information about the applicant.

The procedure for filling out reports in customs statistics for foreign trade transactions

| Column number | Name | Content |

| 1 | Salesman | Information about the person indicated as the seller in the contract and shipping documents:

After the “N” sign, the TIN is indicated, and after the separator sign “/” - the OGRN and KPP (if available). |

| 2 | Buyer | Information about the person indicated as the buyer in the contract and shipping documents. The rules for presenting information are similar to column 1. |

| 3 | Person responsible for financial settlement | Information about the person carrying out tax transactions in the territory of the Russian Federation in relation to the declared objects. The rules for presenting information are similar to columns 1 and 2. |

| 4 | Direction of movement |

|

| 5 | Trading country | The first subsection contains the name of the country in which the counterparty of the person responsible for the financial settlement is registered. The second contains the code of this country. |

| 6 | Destination country | The first subsection contains the name of the country to which the objects are transported. The second contains the code of this country. Filled in only when exporting. |

| 7 | Currency code and total cost of goods | The first subsection contains the letter code of the value currency. The second subsection shows the total cost of all transported objects. |

| 8 | Departure country | The first subsection contains the name of the country of departure. The second contains its code. Filled in only upon import. |

| 9 | Type of transport at the border | The first subsection shows the type of vehicle. The second contains his code. |

| 10 | Documentation | It is necessary to indicate the details of the contract, the relevant invoices for payment and delivery, the shipping document, the transaction passport (if any), a document confirming compliance with the restrictions imposed by technical regulation and export control measures (if any). |

| 11 | Product code | The first subsection contains the serial number of the object, starting from one. The second contains its classification code. |

| 12 | Product description | Name of the object in accordance with the transport documents, information about the manufacturer, additional information that allows you to identify the cargo. |

| 13 | Cost of goods | The actual price paid in the currency indicated in column 7 of the statistical form. If the transaction is free of charge, the estimated value is indicated. |

| 14 | Statistical cost of goods (in US dollars) | The cost of the object together with the costs of delivery to the border of the country, converted into US dollars. |

| 15 | Country of origin | The first subsection contains the name of the country of origin. The second contains its code. |

| 16 | Product net weight (kg) | The net weight is indicated taking into account only the primary packaging or excluding any packaging. For cargo transported without packaging - total weight. |

| 17 | Statistical cost of goods (in rubles) | Cost together with delivery costs, converted into Russian rubles. |

| 18 | Additional units | The first subsection shows the quantity of goods. The second contains the code for the additional unit of measurement. |

| 19 | additional information | A mark is placed in the declaration if the following types of transactions are present:

|

| 20 | Declaration of goods | The first subsection contains the number of the declaration according to which the cargo was released in the customs territory of the EAEU. The second contains the serial number of the goods in the declaration. The column is filled in if the objects were imported into the territory of the EAEU. |

Filling out the declaration form is completed by indicating the date of completion, indicating the reporting period (month and year of shipment of the goods) and information about the applicant.

Formation of a statistical form based on accounting data

When importing into the territory of the member states of the Customs Union of the EAEU, along with the obligation to submit a statistical form to the Federal Customs Service, organizations and entrepreneurs (regardless of the taxation system applied) have an obligation to pay indirect taxes and submit to the tax service an Application for the import of goods and payment of indirect taxes. As in the case of the statistical form, the application form in the program can be filled out manually or according to the accounting system.

To draw up an application manually in 1C: Reporting, there is a regulated report Statement on the import of goods and payment of indirect taxes, which can be opened from the Tax reporting group of reports (if you select grouping report types by category) or from the Federal Tax Service report group (if you select grouping report types by recipients).

To record the import of goods from the countries of the EAEU, the document Application for the Import of Goods is intended, which can be accessed via the hyperlink of the same name from the Purchases section. The tabular part of the document is filled in automatically based on the data from the Receipt documents (act, invoice). The document Application for the import of goods can be drawn up for an unlimited number of deliveries from one counterparty during the reporting period (month).

After posting the document, an entry is generated in the accounting register, reflecting the VAT accrued to the budget, as well as an entry in the VAT accumulation register presented.

The document Application for the Import of Goods is also a form of a regulated report, and therefore, in the same way, it can be generated directly from a single 1C-Reporting workplace. To draw up an application based on accounting data in 1C-Reporting, the regulated report Application for the import of goods (based on receipt) is intended (Fig. 5).

statisticheskaya_forma_ucheta_peremeshcheniya_tovara.jpg

Related publications

“Statistical form for recording the movement of goods” was approved by Government Decree No. 1329 dated December 7, 2015 (Appendix No. 1). It is used as a state instrument to control external trade turnover between the EAEU countries. The document is intended to reflect products transported across the border of the Russian Federation as part of transactions with counterparties registered in one of the EAEU member countries. The norm does not apply to goods that were purchased for personal consumption.

How to recover your login and password

Sometimes remembering credentials from all accounts can be very difficult. Some people write down all their logins and passwords in a notepad or keep a file on their personal computer or in notes on their phone. But even if you have lost or forgotten your account password, the site has a button to restore your login and password.

Typically, all you need to do is provide a code word or verify your identity via email or SMS.

This form of verifying a client’s identity is the most common procedure when restoring access to a personal account. Services often request additional confirmation via the user’s email and phone number.

The password recovery procedure itself is essentially replacing the old password with a new one, which you need to come up with and remember.