HS codes

8418 - Refrigerators, freezers and other refrigeration or freezing equipment, electric or other types; Heat pumps, other than air conditioning units of heading 8415:

| 8418 | Refrigerators, freezers and other refrigeration or freezing equipment, electric or other types; Heat pumps, other than air conditioning units of heading 8415: |

| 8418 10 | - combined refrigerator-freezers with separate external doors: |

| 8418 10 200 | - - with a capacity of more than 340 l: |

| 8418 10 200 1 | — — — household refrigerators-freezers |

| 8418 10 200 9 | - - - others |

| 8418 10 800 | - - other: |

| 8418 10 800 1 | — — — household refrigerators-freezers |

| 8418 10 800 9 | — — — others |

| — household refrigerators: | |

| 8418 21 | - - compression: |

| 8418 21 100 0 | — — — with a capacity of more than 340 l |

| - - - others: | |

| 8418 21 510 0 | — — — — in the form of a table |

| 8418 21 590 0 | — — — — built-in type |

| - - - - other, capacity: | |

| 8418 21 910 0 | — — — — — no more than 250 l |

| 8418 21 990 0 | — — — — — more than 250 l, but not more than 340 l |

| 8418 29 000 0 | - - others |

| 8418 30 | — chest-type freezers with a capacity of no more than 800 liters: |

| 8418 30 200 | - - with a capacity of not more than 400 l: |

| 8418 30 200 1 | — — — household freezers |

| 8418 30 200 9 | - - - others |

| 8418 30 800 | - - with a capacity of more than 400 l, but not more than 800 l: |

| 8418 30 800 1 | — — — household freezers |

| 8418 30 800 9 | - - - others |

| 8418 40 | — vertical freezers with a capacity of no more than 900 liters: |

| 8418 40 200 | - - with a capacity of not more than 250 l: |

| 8418 40 200 1 | — — — household freezers |

| 8418 40 200 9 | - - - others |

| 8418 40 800 | - - with a capacity of more than 250 l, but not more than 900 l: |

| 8418 40 800 1 | — — — household freezers |

| 8418 40 800 9 | - - - others |

| 8418 50 | - refrigerating or freezing chambers, cabinets, display cases, counters and similar furniture with built-in refrigeration or freezing equipment, other: |

| — — refrigerated display cases and counters (with a refrigeration unit or evaporator): | |

| 8418 50 110 0 | — — — for storing frozen foods |

| 8418 50 190 0 | - - - others |

| — — other furniture with built-in refrigeration equipment: | |

| 8418 50 910 0 | — — — for deep freezing, except for products of subheadings 8418 30 and 8418 40 |

| 8418 50 990 0 | - - - other |

| — other refrigeration and freezing equipment; heat pumps: | |

| 8418 61 00 | - - heat pumps, other than air conditioning units of heading 8415: |

| 8418 61 001 0 | — — — with a capacity of 3 kW or more |

| 8418 61 009 0 | - - - other |

| 8418 69 000 | - - other: |

| 8418 69 000 1 | — — — for the brewing industry |

| 8418 69 000 9 | - - - other |

| - parts: | |

| 8418 91 000 0 | — — furniture for building in refrigeration and freezing equipment |

| 8418 99 | - - other: |

| 8418 99 100 0 | — — — evaporators and condensers, except those used in domestic refrigerators |

| 8418 99 900 0 | - - - others |

(I) Refrigerators, freezers and other refrigeration and freezing equipment

Refrigerators and refrigeration units covered by this heading are apparatus capable of maintaining a low temperature for a long period of time (within 0°C or below) by absorption of heat from a liquefied gas (for example, ammonium, halogenated carbohydrate), a volatile liquid or, in the case of some ships, types, water.

This heading does not include:

(a) Salt freezers (heading 8210 or 8419);

(b) Water coolers of the simplest heat exchange type (see Explanatory Note to heading 84.19);

(c) Ice chambers, insulated cabinets, etc., which do not provide for the installation of refrigeration units (mainly heading 94.03).

Refrigerators of this heading are divided into two types:

(A) Compression type refrigerators

Their main parts are:

(1) A compressor that receives gas from the evaporator and pressurizes it into the

(2) Condenser, where the gas is cooled and turned into liquid, and

(3) Evaporator, an active cooling element consisting of a system of tubes in which the coolant, through an expansion valve, quickly evaporates and absorbs heat from the surrounding air. For larger refrigeration units, the evaporator may have a cooling brine or calcium chloride solution circulating through the coil.

In ship refrigerators, there is no compressor and condenser in the refrigeration (salt or water) circuit, but evaporation causes a vacuum, which is created by an injection pump operating with a steam condenser. The latter condenses and releases the resulting vapors without returning them to the system.

(B) Absorption type refrigerators

In this type of refrigerator, the compressor is replaced by a “generator” in which a saturated aqueous ammonium solution is heated (by gas, oil or an electrical element), the gas is removed and collected under pressure in a condenser. The cycle of condensation, accompanied by expansion and cooling in the evaporator, continues in the same way as in compression-type refrigerators, the expanded gas again dissolving in a weak solution, either in a separate absorber, which feeds the generator simply by pressure, or in the generator itself, which in some types acts as a heat absorber .

In some dry types, ammonium gas is absorbed into a dry substance (such as calcium chloride or silica gel) instead of a solution.

***

This heading classifies the following types of refrigeration equipment:

(1) Refrigeration equipment, with or without evaporators, in which the components included in the compressor (with or without motor) and condenser are mounted on a common base; autonomous absorption units (These units are installed in household refrigerators and other refrigerated cabinets). Some types of compression refrigerators, known as "liquid cooling units", have compressors and heat exchangers mounted on a single base (with or without a condenser) with an evaporator and coolant pipes.

(2) Refrigeration equipment in which refrigeration units or the evaporator of a refrigeration unit, with or without auxiliary devices such as faucets, molds, are built into cabinets and other furniture. Such equipment includes household refrigerators, refrigerated display cases, counters, ice cream or frozen food storage containers, water or beverage cooling tanks, milk cooling tanks, beer coolers, ice cream machines, etc.

(3) Large refrigeration units, which include equipment elements that are not located on the same base, or independent units, but work together according to a direct expansion scheme (the evaporator is located in the “cold consumer”), or by supplying a coolant cooled in refrigeration unit, to the “cold consumer” (indirect cooling). Such installations are used, for example, in refrigerated tanks or for certain operations (production of lump ice and quick-frozen food products, rapid cooling of chocolate products, separation of paraffin wax, in chemical production, etc.).

Auxiliary apparatus which are used in these installations are classified in this heading provided that they are presented together with other components of these installations. These include sectional or tubular-type freezers, refrigerated tables for the production of confectionery or chocolate products, etc.

***

This heading also covers refrigeration equipment which uses liquefied gas as a refrigerant and which consists of one or more gas chambers, a thermostat, a solenoid valve, a control panel, electrical switches and a perforated distribution pipe. These components are classified in this heading when presented together.

(II) Heat pumps

A heat pump is a device that removes heat from a suitable heat source (mainly ground or surface water, soil or air) and converts it, using an additional energy source (gas or electricity), into a heat source at a higher temperature.

A heat transfer fluid is usually used to transfer heat.

There are two types of heat pumps: compression type pump and absorption type pump.

A compression type pump usually consists of the following elements:

(1) an evaporator for releasing energy from the heat source and transferring it to the heat transfer fluid;

(2) a compressor, which mechanically pumps the vapor-forming composition from the evaporator at higher pressure to the condenser;

(3) a condenser, which is a heat exchanger in which vapors are liquefied and release heat to the environment.

In absorption-type heat pumps, instead of a compressor, a boiler with water and a refrigeration unit is used, combined with a nozzle.

Heat pumps are divided according to two factors: the first is the heat source, the second is the medium into which the heat is transferred. The main types of pumps include:

(i) An air-to-water or air-to-air pump, which takes heat from the atmosphere and converts it into warm water or warm air;

(ii) Water-water or water-air pump, which extracts heat from an underground source or the surface of water masses;

(iii) Earth-water or earth-air pump: In this case, heat is extracted through a system of pipes installed in the ground.

Heat pumps can be supplied as one product consisting of various components. This product is called a monoblock. The pumps can also be supplied as several individual products. Some heat pumps can be supplied without evaporators if they are installed in an installation that already has an evaporator. In this case, they are considered incomplete products, while maintaining the basic data of the assembled product.

Heat pumps are commonly used for space heating and domestic hot water supply. For these purposes, non-reversible heat pumps are usually used.

However, this heading excludes reversible heat pumps consisting of electrically driven fans and devices for changing temperature and humidity. These pumps are classed as air conditioners and are classified in heading 84.15.

Parts

In accordance with the general provisions concerning the classification of parts (see General provisions of the Explanatory Note to Section XVI), components of products for industrial and domestic use are also classified in this heading, for example, condensers, absorbers, evaporators, generators, cabinets, counters, refrigerators , built into furniture elements and other equipment of the type listed above in paragraph (2). This heading also includes components that are not installed in the refrigeration unit or evaporator, but the installation of which is provided for.

Compressors are classified as such in heading 84.14 even if they are designed for installation in refrigerators. Unspecified spare parts (eg pipes and tanks) are classified in their respective headings.

***

This heading does not include:

(a) Air conditioners with refrigeration unit or with refrigeration unit and evaporator (heading 84.15);

(b) Gas liquefaction apparatus (eg Linde apparatus) (heading 84.19).

Explanations to the subheading

8418 69 000 1 — 8418 69 000 9

This subheading also includes "refrigerated dryers", which are devices used for drying the air in swimming pool buildings and other steam containing areas. They mainly consist of a refrigeration unit and a fan driven by an electric motor. The fan absorbs moist air, which is then transferred through a pipeline to the evaporator of the refrigeration unit, where it condenses on the cold walls. The resulting condensate water flows into the gutter. The dried air for reheating passes through the heated condenser of the refrigeration unit and is supplied back to the room.

In refrigerated dryer housings used for drying compressed air in compressed air systems also covered by this subheading, the dried compressed air is usually reheated by means of an additionally mounted air-to-air heat exchanger. This heat exchanger transfers heat from the steam-containing compressed air entering the inlet side of the cooling dryer through the walls to the dried compressed air.

These devices are not equipped with devices for regulating air temperature.

However, this subheading does not include devices for the production of dry ice (slab ice) obtained by supercooling as a result of a sharp reduction in the pressure of high-pressure carbon dioxide (heading 84.79).

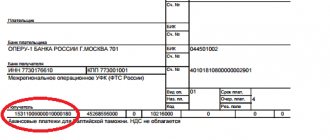

Customs duties of a car refrigerator

- import customs duty on automobile refrigerator from 12/01/2021

- value added tax

- excise tax

- customs duties

| Code options for car refrigerator | VAT | Promotion | Import duty |

| 8418290000 | 20% | is not a subject to a tax | 15, but not less than 0.165 euro/l |

When importing a car refrigerator, this is calculated based on the assigned HS code.

If you cannot select the code yourself or are importing through another customs broker, then the cost of selection is: 1 000

rubles When working with us, selecting a code is free!

Order

Types and Types of Frequently Imported Products

We have selected related product categories that are suitable for your products

- refrigerator car refrigerator

- refrigerator with food

- combined cycle gas plants

- gas generating power plants

- energy complexes

- generator sets

- guaranteed energy supply systems

- power generation equipment

- gas-diesel power plants

Come to our office, we will tell you how to properly import goods into Russia.