Economists from the Gaidar Institute and the Higher School of Economics analyzed the consequences of tightening cross-border trade rules

Specialists from the Gaidar Institute and the Higher School of Economics assessed the consequences of various payment administration scenarios for purchases in foreign online stores. Neither the state nor consumers will benefit from the measures discussed

Photo: Kirill Kukhmar / TASS

In 2021, scientists from the E.T. Institute of Economic Policy Gaidar (Gaidar Institute) and the National University Higher School of Economics (HSE) conducted two studies on the social and economic consequences of regulating cross-border trade.

Specialists from the Gaidar Institute have prepared the work “Regulating the administration of cross-border trade in the Russian Federation and the EAEU. Establishing minimums for cross-border trade,” and the National Research University Higher School of Economics — “Assessing the socio-economic effect of the introduction of VAT, other taxes and fees on cross-border online trade.”

RBC talks about the main conclusions of economists.

How is cross-border trade regulated now?

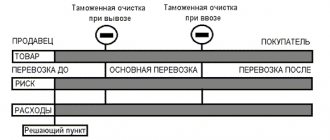

Currently, parcels worth €500 per month are exempt from duty (30% of the cost of ordered goods). From January 1, 2021, the threshold should be reduced to €200, but for each individual parcel the duty will be 15% of the excess amount, but not less than €2 for excess (maximum permissible parcel weight is 31 kg).

However, last week it became known that the government has returned to the idea of radically lowering the threshold for collecting duties - from 2022 they will begin to charge them on items over €20. The corresponding proposal of the Ministry of Finance was approved by Prime Minister Dmitry Medvedev. He instructed to work out the issue for consideration at the Council of Heads of Government of the Eurasian Economic Union. The Ministry of Finance has already prepared and sent for approval to interested departments a draft instruction from the Council of the Eurasian Economic Commission on the development of the Russian side’s proposal.

Just a year ago, the head of the Department of Tax and Customs Policy of the Ministry of Finance, Alexey Sazanov, called the measure to introduce a €20 threshold radical.

How does cross-border trade affect the economy?

Cross-border trade is not only an important factor in the development of modern retail, but also stimulates competition within the industry, HSE specialists note in their study.

The ability of Russian consumers to place online orders in other countries helps smooth out regional imbalances in retail trade. Today, the leaders in the number of incoming international parcels per capita are not only Moscow and St. Petersburg, but also cities in the northern regions and small towns in industrialized areas: if on average in Russia this figure in 2021 was 2.4 parcels per person, then in Salekhard, for example, 14.8 parcels.

The rapid growth of online trading and cross-border online trading in Russia in the 2010s was associated with the low base effect and will slow down as the market becomes saturated, the Higher School of Economics states. According to its experts, Russia still lags behind European countries in terms of the number of parcels per capita: for example, in the UK, residents receive twice as many parcels, and in the Netherlands - three times.

Processing international shipments is one of the main factors in increasing profitability for international postal operators. Handling such parcels accounts for 20% of Russian Post’s revenue, according to the HSE. The highest figure is for German postal operators - 69%.

What will happen when VAT is introduced?

Researchers from the National Research University Higher School of Economics considered two scenarios under discussion: the introduction of VAT, which will be collected by an authorized person (postal operators) and VAT registration of online stores (online platforms with a turnover of more than $50-100 thousand are registered in a special Federal Tax Service system).

The introduction of VAT for foreign online traders has been discussed for several years. In particular, it was advocated by the Association of Internet Trade Companies (AKIT), which represents the largest Russian online retailers. The Federal Tax Service also discussed the introduction of the tax with interested departments. This issue was raised again in May 2019 at a meeting dedicated to equalizing competition in the field of online commerce at the FAS.

Experts have calculated options at different levels of the tax-free limit: €0–20–50–100–200–500–1000. The calculations took into account direct costs, including average salaries, labor cost standards, processing time and other indicators that affect the cost of parcel administration. International practice shows that postal operators, in order to cover the costs associated with the inspection of parcels, are forced to impose additional fees, significantly increasing the final cost of the parcel, experts from the National Research University Higher School of Economics note.

The main conclusion that the experts came to: the total economic effect, that is, the difference between the costs of all participants in the chain from seller to buyer and possible revenues to the budget, as well as from the introduction of VAT on imported parcels, regardless of the limit, will be negative.

- When paying VAT to an authorized person with a zero limit, when all parcels are subject to tax, the net economic effect will be minus RUB 32 billion. In this case, additional costs for consumers will amount to more than 110 billion rubles, and postal operators, against the backdrop of a reduction in the number of incoming parcels, will spend more than 30 billion rubles.

- With a limit of €20, the total economic effect will be minus 36 billion rubles, and only the costs of VAT administration are estimated at 28.9 billion rubles.

- In the case of VAT registration of online stores, the total economic effect will be better, but will still remain negative. With an unlimited threshold of €20, this is minus 9.6 billion rubles, in which case online stores will spend more than 10 billion rubles, and consumers will pay 36.6 billion rubles. more.

- With VAT registration, researchers also note an increase in risks with a decrease in tax collection - the state will not always be able to track whether an online store has registered in the system.

“This issue needs to be considered comprehensively, since, on the one hand, we are talking about regulating foreign economic activity, and on the other, about supporting Russian domestic production. The tools, of course, must correspond to the technical development of the country, and they will be determined by the government,” AKIT President Artem Sokolov commented on the results of the study. To him, the HSE’s calculations seemed overpriced: the operator’s model for online trading only requires the integration of software with an online platform and does not involve budget costs.

Trade in Duty Free - a closed club for selected brands

Retail . ru : Oleg, what is the

duty free today, how serious is this sales and promotion channel?

Oleg Glazunov:

The duty-free market is the Global Travel Market (DF & TR). It includes shops at airports, on board (air, sea) and duty free in cities. Sales through airports account for approximately 65% of all Duty Free trade. In contrast to traditional retail, the Duty Free market as a whole has shown steady growth in recent years. Turnover in 2011 reached $32.23 billion.

Experts predict a further rise in duty-free trade over the next few years. The main driver of sales is the significant increase in travelers from developing countries, primarily China and India.

There are more than 25 large duty-free operators in Russia, which operate approximately 150 stores. Their total turnover is approximately $1 billion.

Unlike global retail, which is highly fragmented by number of operators, the Duty Free market is dominated by a small number of operators, with the top 10 accounting for 64% of sales.

Retail . ru : What alcoholic drinks are best sold in Duty Free ?

Oleg

Glazunov :

Sales of alcohol of all categories in Duty Free increased in 2011 by 7% compared to 2010 and amounted to about 7.655 billion dollars. Moreover, the growth is due to strong alcoholic drinks, which accounted for 72.6% of all alcohol sales. This is a repeat of the 1999 figure, which was a record in the history of the DF market. The wine sector, with annual sales at 7.6 cases, is stagnating. In value terms by alcohol category, whiskey accounts for about 35% of sales, wine 24%, cognac about 15%, and vodka 6%. The total sales volume of white strong alcohol (vodka, gin, rum, etc.) amounted to $840.6 million, with the share of vodka in this category being more than half (53.5%).

Retail . ru : What is the average markup on alcohol in Duty Free stores?

Is there a difference in the markup compared to regular stores?

Oleg

Glazunov :

The markup in Duty Free is higher than in traditional retail. Minimum markups in Dubai and Singapore. In Europe – price in the city minus VAT.

It is interesting that, despite the high trade markup in Duty Free, Sheremetyevo and Pulkovo airports are among the ten airports with the largest sales of vodka at the end of 2011. Behind such powerful air hubs as Heathrow, Frankfurt and Dubai. Hong Kong takes first place. But Domodedovo is only in 29th place. In general, alcohol provides about 40% of the revenue of Russian duty-free stores.

Retail . ru : Oleg, what are the main benefits of the manufacturer when selling his alcohol through Duty Free?

Oleg

Glazunov :

Premium vodka Russian Diamond will be sold in the global Duty Free network from the end of 2013. For us, this is brand recognition at the highest industry level.

The main benefit of being in Duty Free is

the high turnover of goods. Vodka has always been and continues to be one of the most popular alcoholic drinks around the world. And sales of vodka in global Duty Free channels confirm this: demand for the drink is growing dynamically. Compared to 2001, the increase in 2011 was more than 240% - $185.2 and $449.9 million, respectively (VODKA in Global Travel Retail Study, Generation Research).

But the main thing in Duty Free is not sales volumes, but the rapid growth of awareness and brand image. Duty Free is a global showcase and prestige. This will allow customers to get acquainted with the new product faster than with traditional promotion exclusively in retail chains. After all, the traveling public is the most active purchasing group, a consumer of premium products, including vodka. Therefore, the duty-free market is very important to us, despite its high entry barriers. The consumer traveler should encounter a brand as often as possible and if the brand is not in Duty Free, it cannot be global.

Retail . ru : How difficult is it to log into Duty Free? What is required from a brand to be represented in Duty Free?

Oleg

Glazunov :

It is difficult to enter the duty-free trade market; competition on it is very high. In addition to the actual high-quality product with an attractive positioning, the company’s reputation is important; recommendations and contacts are required. It’s difficult to surprise a sophisticated consumer, but we’ve managed to do it so far – Russian Diamond enjoyed extraordinary success at the IAADFS exhibition.

Retail . ru : What are the entry conditions? Is there a minimum sales requirement?

Oleg

Glazunov :

Of course. The logic is the same as in regular retail: no sales - no shelf. No one will keep a product that doesn't sell.

The Duty Free market is a kind of closed club for the elite, which is difficult to enter. Entry into this market is carried out, as a rule, through distributors. This requires an impeccable reputation of the brand and the manufacturing company for several years.

Retail . ru : What share of the brand's total sales will

Duty Free ?

Oleg

Glazunov :

It’s too early to assess now. It will take a year just to arrange it. But we expect that Russian Diamond will successfully compete with vodka brands from the top 10 sales in Duty Free, such as Absolut, Gray Goose, Smirnoff, Finlandia, Ciroc, Ketel, Russian Standard.

Retail . ru : Is there a connection between the start of sales of Belarus in Duty Free and the introduction of the brand to foreign markets?

Oleg

Glazunov :

Of course. There is no point in entering Duty Free without working in local markets. The US market is strategic for us. Now it is the No. 1 market in monetary terms. In the near future, we are planning the minimum necessary product support to enter retail chains in several states.

Retail . ru : Why did you go to Duty Free shelves with the Russian Diamond brand?

?

Oleg

Glazunov :

Russian Diamond has already gained recognition in the professional community, having received gold medals in the “Premium” category at two prestigious international competitions - the San Francisco World Spirits Competition in March of this year and the International Review of Spirits Competition, conducted by the international beverage testing institute “The Beverage” Testing Institute" in Chicago in 2012.

We believe that Russian Diamond carries a double meaning for foreign consumers: it directly states the country of origin and conveys the distinctive advantage common to premium vodka and diamonds - purity. We expect that the quality of Russian Diamond vodka will become a benchmark for the premium category vodka industry.

Retail.ru

How will lowering the duty-free threshold impact?

Experts from the Gaidar Institute, having studied the world and Russian practice of lowering the duty-free threshold for foreign online stores, came to the conclusion that there are no correlations in the world linking protective measures for the import of goods from other countries for individuals with the protection of local manufacturers. The most reasonable thing, the researchers believe, is to set such thresholds in relation to the cost of the goods themselves, as will be the case from 2021, and not to a time interval, as now.

Reducing the threshold for duty-free import of purchases from foreign online stores located outside the EAEU reduces the tax and business attractiveness of the country and at the same time increases the likelihood of an increase in gray and illegal imports, warns the Gaidar Institute. According to its experts, when the duty-free threshold is reduced, the cost of parcel administration increases: at the current level of collection and the threshold is reduced to €20, budget expenses will increase by 10.6 billion rubles.

In the event of a significant increase in the share of taxes in the cost of a parcel, for example VAT, the following scenario is possible, according to the Gaidar Institute: parcels will arrive in Russia through transit channels of the EAEU member countries, primarily Kazakhstan and Kyrgyzstan. Transparency Kazakhstan estimated the share of gray imports from China there in 2021 at 60 and 70%, respectively.

The decision to reduce the threshold for duty-free import of goods from January 1, 2020 to €200 was made at the supranational level by the Eurasian Economic Commission back in 2021, a representative of the Ministry of Finance reminded RBC. And the final decision on further reduction of duty-free import thresholds must be made in all EAEU countries. Therefore, any calculations of the effects of decisions, which have not yet even been formulated in final form, are very hypothetical in nature, a representative of the Ministry of Finance noted.

The department added that payment of customs duties through an authorized operator will not lead to an increase in budget expenditures for customs administration, nor to an additional burden on customs officials.

Andorra: duty-free paradise

One of the dwarf states of Europe, whose full name is the Principality of Andorra. Located in the Pyrenees between France and Spain, where the official language is Catalan.

The country's population is only 86,000 people, but the country is very popular among tourists. Every year, mainly in the winter season, it is visited by one and a half million mountain tourism lovers. There are two extensive ski areas: Grandvalira with its resorts Pas de la Casa, Grau Roig, Soldeu El Tarter and the Vallnord area, which includes the resorts of Pal Arinsal and Arcaliz.

The ski season in Andorra lasts from December to the end of April

However, the country is good for traveling all year round: in summer, Andorra becomes an excellent option for all lovers of mountain hiking. And all year round there are thermal centers, balneological sanatoriums and, of course, duty-free shopping. Also, to further attract tourists, the Andorran administration organizes performances of the Circus Dusoles completely free of charge several times a year. In 2017, for example, the circus performs the “Stelar” program.

There is also a Naturlandia park in Andorra. This is not an ordinary park in the usual sense. This is an adventure park that is located between 1600 and 2000 meters above sea level, in the La Rabassa area. The territory is surrounded by 800 hectares of forest. That’s why it gets its name: nature in its original form. Visitors to Naturlandia will be able to find various types of activities here: sports, educational, tourism. All conditions for relaxation and entertainment. For wildlife lovers, Naturlandia offers forest hikes. For gourmets - restaurants and cafes with a wide variety of cuisines from around the world.

More about shopping

Andorra is a duty-free zone, which means most goods are cheaper here than in neighboring countries (France and Spain). At the same time, here you can find shoes and clothing of famous brands, various industrial goods from world manufacturers, and one of the most popular goods that tourists bring from Andorra is tobacco.

At the same time, it is pleasantly surprising that most stores are open all week and until 20-21 hours. There are only 4 days off in shops a year: Christmas on December 25, January 1, Constitution Day on March 14 and the day of Our Lady of Meritxell, September 8, which is considered a National Holiday in Andorra.

There are no trains to Andorra and you can only get there by road: the one leading to the border with Spain (route CG-1, Farga de Moles) or the one that leads to the border with France through the Envalira tunnel, past the Pas de resort la Casa (CG-2).

You can also enter the country by helicopter to a commercial helipad.

At the border, everything is quite strict, they often ask to show documents, so when going shopping or visiting popular resorts, it is important to have all the documents in order and be sure to take them with you.