Why do we need Incoterms?

The purpose of Incoterms 2000 is to provide a set of international rules for the interpretation of trade terms most commonly used in foreign trade.

In this way, the uncertainty of different interpretations of such terms in individual countries can be avoided, or at least significantly reduced. Often, parties to a contract are not familiar with the different trading practices in their respective countries. This can cause misunderstandings, disputes and litigation and waste time and money. To resolve these problems, the International Chamber of Commerce published in 1936 the first set of international rules for the interpretation of trade terms. These rules became known as Incoterms . Amendments and additions were later made in 1953, 1967, 1976, 1980, 1990, 2000 and now in 2010 to bring these rules into line with modern international trade practices.

Incoterms rules govern only the relationship between sellers and buyers under sales contracts. Incoterms deal with the seller's obligation to place the goods at the buyer's disposal, or to hand them over for carriage, or to deliver them to their destination, as well as the allocation of risk between the parties in these cases. They further define the responsibilities for completing customs formalities to clear for export and import, for packing the goods, the buyer's obligation to take delivery, as well as the obligation to provide evidence that the relevant obligations have been duly fulfilled.

What are Incoterms 2010

Incoterms (International commerce terms) is a trademark of the International Chamber of Commerce.

This is a set of rules with terms used in national and international trade. Incoterms 2010 (Incoterms 2010) is a collection of generally accepted international rules that are used for designation by government agencies, law firms and merchants around the world. The scope of the terms from the Incoterms 2010 collection concerns the rights and obligations of all parties involved entering into sales contracts. The new amended rules came into force on January 1, 2011.

How many trade terms are there in Incoterms?

The main purpose of Incoterms is to use terms for commercial purposes, choosing between:

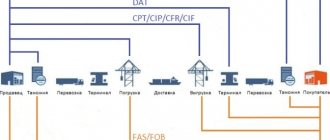

— minimum obligations of the seller to provide the buyer with goods on its premises (EXW); - broad responsibilities of the seller to transfer the goods to the carrier, which he chooses, pays for transportation (CFR, CPT) and carries out insurance against all possible risks (CIF), or for transportation to the carrier nominated by the buyer (FCA, FAS, FOB); — the maximum obligations of the seller to transfer the cargo at the point of destination (DAT, DAP, DDP). Incoterms are often criticized for having too many terms. Many are interested in the question: is it possible to reduce their number so that the parties can choose to transfer the goods at the buyer’s place or at the seller’s place. In commercial practice, there are several trading models for various cargoes. Commodities: grains, ores, coal or petroleum products are often transported on specially chartered ships that accept the goods for carriage only as a full load. In this case, the final buyer is generally unknown, since the goods can be resold during transportation. If the final buyer is still known, then he is not ready to take on all the costs and risks that may arise in the seller’s country. This explains the need for maritime terms that are still used in international trade. Incoterms 2010 maritime terms will not be appropriate for the supply of finished products. Many merchants are advised to use one of the Incoterms, which are intended for the transfer of goods at the buyer's location (DDP, DAP and DAT), or at the seller's premises (FCA or EXW). Often the transportation of finished products is entrusted to logistics providers, but in this case you will have to constantly communicate with the other party. It would then be impractical to use the terms CIP or CPT, under which the seller enters into the contract and leaves the rest to the buyer.

- What is Incoterms: how and where it is used

Structure of Incoterms 2000 rules

To facilitate understanding in the Incoterms rules, trade terms have been grouped into four categories that differ in substance: starting with the term according to which the seller only makes the goods available to the buyer on his premises (category “E” - EXW delivery term); Next comes the second group, according to which the seller is obliged to transfer the goods to the carrier specified by the buyer (category “F” - delivery terms FCA, FAS and FOB); further category “C”, according to which the seller is obliged to enter into a contract of carriage, but without assuming the risk of loss or damage to the goods or additional costs due to events occurring after shipment and dispatch (delivery terms CFR, CIF, CPT and CIP); and finally, category “D”, in which the seller must bear all costs and risks necessary to deliver the goods to the destination (DAF, DES, DEQ, DDU and DDP).

Price on FCA terms

When signing a bilateral contract for the supply of goods in the price on FCA terms, the seller includes the following costs:

- Actual cost of the goods;

- Expenses for export duties at customs;

- Costs for delivery of cargo to the place of transfer to the carrier.

When a contract for the international purchase and sale of goods is concluded, both parties to foreign economic activity must specify the terms of delivery as clearly and in detail as possible. Indicating the properties of the goods, designating the type of vehicle, volume of cargo and other data will allow you to avoid delays at customs and additional costs for export and import duties and fees.

Trade terms Incoterms 2000

Under category "E", the seller has minimal obligations: he must only make the goods available to the buyer at the agreed location - usually the seller's premises. On the other hand, as often happens in practice, the seller often assists the buyer in loading the goods onto a vehicle provided by the buyer. Although the term EXW would better reflect this if the seller's obligations were extended to include loading, it was decided to retain the traditional principle of the seller's minimum obligations under EXW terms of delivery so that it could be used for cases where the seller does not intend to make any obligations regarding loading of the goods. If the buyer wants the seller to do more, this should be clearly reflected in the purchase agreement.

Trade terms in category "F" require the seller to hand over the goods for carriage in accordance with the buyer's instructions. Due to the significant variety of circumstances that can occur in contracts, it was difficult to indicate the point at which the parties intend to transfer the goods according to the FCA delivery basis. In Incoterms 2000, the point of transfer of goods under FOB delivery terms, which coincides with CFR and CIF delivery terms, remained unchanged. Although the concept of “transfer of goods over board the vessel” fixed in the FOB delivery basis may in many cases be inappropriate, nevertheless, merchants understand and apply it taking into account the goods and available loading devices. An important change has been made to the FAS trade term in relation to the completion of the customs formalities required for the export of goods, since the most widely accepted practice is to place this responsibility on the seller rather than the buyer. To ensure that this significant change is highlighted in the preamble to the basic FAS term, it is highlighted in capital letters.

Trade terms of category "C" impose on the seller the obligation, at his own expense, to enter into a contract of carriage on normal terms. Therefore, after the corresponding delivery basis of group “C” there follows an indication of the point to which he is obliged to pay transport costs. According to the trade terms CIF and CIP, the seller's responsibilities also include the provision of insurance and payment of related expenses. Because the cost allocation point is in the country of destination, "C" delivery terms are often mistakenly considered arrival contracts, in which the seller bears all costs and risks until the goods actually arrive at the agreed point. Therefore, it should be emphasized that the basic terms of delivery of category “C” have the same legal nature as the trade terms of category “F”, i.e. The seller performs the contract in the country of shipment or dispatch.

Category “C” trade terms, unlike all other terms of delivery, contain two key clauses: one indicating the point up to which the seller undertakes to enter into a contract of carriage and pay the associated costs, and the second indicating the point of risk allocation. Therefore, extreme caution should be exercised when increasing the seller's obligations under the basic Group C terms of delivery. The essence of trade terms of category “C” is the release of the seller from additional risks and expenses after he has already properly fulfilled the contract of sale as a result of concluding a contract of carriage and transfer of goods to the carrier and has provided insurance in accordance with the basic terms CIF and CIP.

Category D terms of delivery are inherently different from Group "C" terms of delivery, since under category "D" terms of delivery the seller is responsible for the arrival of the goods at the agreed place or destination at the border or in the country of import. The seller bears all risks and costs of delivering the goods to the specified location. Therefore, category "D" trade terms refer to arrival contracts, and category "C" basic terms refer to shipping contracts. According to the basic terms of delivery of group “D”, with the exception of DDP, the seller’s obligations do not include the obligation to deliver the goods after the customs clearance required for their import in the country of destination.

Traditionally, DEQ trade term placed the onus on the seller to complete the customs formalities required for the importation of the goods since the goods were to be unloaded at the quay and were therefore entered into the country of import. But due to changes in the procedures for completing customs formalities in most countries, it is now more appropriate to assign the responsibility for completing the customs formalities necessary for the import of goods and paying taxes and other fees to the party domiciled in such a country. Therefore, the change in the DEQ delivery terms was made for the same reasons as the above change in the FAS basis term. Similar to the FAS supply basis, this change in the DEQ supply basis is highlighted in capital letters in the preamble.

The trade term DDU was included in Incoterms 1990. It serves an important function when the seller intends to deliver the goods to the country of destination without completing the customs formalities necessary for its import and without paying the corresponding taxes.

| Seller's responsibilities | Buyer's responsibilities |

Transfer of ownership and risks

According to the terms of the DAP, the transfer of risk for the goods occurs upon arrival of the goods at the destination and their readiness for unloading. This is provided that the delivery is completed without delay, and both parties to foreign trade cooperation fulfill their obligations in full. If the buyer is late in accepting the goods and unloading them, then after the agreed date all risks also pass to him.

After the seller duly notifies the buyer of the arrival of the goods and the transfer of the cargo and documents for it, the exporter can be considered to have fulfilled his obligations.

The moment of transfer of ownership is of decisive importance if the exporter or importer is a Russian company. It should be specified separately in the contract, because Incotrems 2010 rules indicate only the moment of transfer of risks and costs. Otherwise, the transfer of ownership will be determined in accordance with the Civil Code of the Russian Federation, and the moment of its occurrence will be considered the moment of transfer of cargo from the seller to the buyer.

Define in a separate clause in the contract the conditions under which ownership rights are transferred from the exporter to the importer.

Are you sure that the DAP condition is right for you?

Fill out the form and we will select the most favorable conditions for you

Free consultation

You can also write to us by email or call our toll-free number:

8

Please help make this article better. Answer just 3 questions.

Table of differences between Incoterms 2000 terms

The main transportation is paid by the buyerThe main transportation is paid by the sellerDeliveryEXWFCAFASFOBCFRCIFCICPPTDAFDESDEQDDUDDPExport customs clearance of goodsLoading of goodsTransportation of goods to the port of shipmentLoading of goods onto a ship at the port of shipmentDelivery of goods to the border (any transport)BorderInsurance of goodsTransportation of goods on a ship to the port of destinationUnloading of goods from a ship at the port of destinationTransportation delivery of goods to their destination (any transport) Import customs clearance of goodsExplanation, translation, responsibilities and differences of Incoterms 2000 are indicated in the following table of Incoterms 2000 rules:

Additional terminology for FCA

The place of delivery designated in the contract delimits the obligations of the seller and the buyer for loading and unloading the goods. Thus, when delivering on the territory owned by the supplier, responsibility for loading and unloading operations falls on the seller, if in a different place, then on the buyer. The division of responsibilities occurs using additional terms. So, when you need to transport cargo, the volume of which completely occupies the entire space of a wagon, car, barge, or other vehicle, the contract states:

- FOT (free on truck) (when transporting a car).

- FIW (free in wagon) (railway transportation).

- FIB (free into barge).

When consolidation of cargo is required, it is possible to agree with the seller on the organization of delivery of goods to the terminal, warehouse, port, which is indicated by the seller. And then the following terminology applies:

- FT (free terminal) (terminal).

- FOR (free on rail) (departure station).

- FFB (free ferry berth).

Please help make this article better. Answer just 3 questions.

Responsibilities and differences in terms of delivery of Incoterms 2000

Category E term (shipment)EXWany types of transportEX Works (...named place) Ex-factory (...name of place) The Seller is obliged to: provide goods ready for shipment. The buyer is obliged to: complete export and import customs clearance and deliver the goods. Risks pass when the goods are transferred to the seller’s warehouse. The main difference is that the EXW delivery basis imposes minimal obligations on the seller. Category F terms (main freight not paid by the seller) FCAany types of transportFree Carrier (...named place) Free carrier (...name of place) The seller is obliged to: complete export customs clearance and ship the goods to the carrier appointed by the buyer. The buyer is obliged to: deliver the goods and perform import customs clearance. Risks pass at the moment of transfer to the carrier at the seller's warehouse. F.A.S.sea and inland water transportationFree Alongside Ship (... named port of shipment) Free along the side of the ship (... name of the port of shipment) The seller is obliged to: perform export customs clearance and place the goods at the port of shipment along the side of the ship specified by the buyer. The buyer is obliged to: load the goods onto the ship and deliver them to the port of unloading, as well as carry out import customs clearance. Risks pass at the port when the goods are placed along the side of the ship. FOBsea and inland water transportationFree On Board (... named port of shipment) Free On Board (... name of the port of shipment) The seller is obliged to: complete export customs clearance and place the goods at the port of shipment and load on board the vessel specified by the buyer. The buyer is obliged to: deliver the goods to the port of unloading, as well as perform import customs clearance. Risks pass at the port from the moment of full loading on board the vessel. Category C terms (main carriage paid by the seller) CFRsea and inland waterway transportationCost and Freight (... named port of destination) The seller is obliged to: complete export customs clearance, load the goods on board the vessel and deliver to the port of unloading. The buyer is obliged to: unload and accept the goods at the port of unloading, as well as perform import customs clearance. Risks pass at the port of shipment from the moment of full loading on board the vessel. CIFsea and inland water transportation Cost, Insurance and Freight (... named port of destination) The seller is obliged to: complete export customs clearance, insure, load the goods on board the vessel and deliver to the port of unloading. The buyer is obliged to: unload and accept the goods at the port of unloading, as well as perform import customs clearance. Risks pass at the port of shipment from the moment of full loading on board the vessel. C.I.P.any modes of transportCarriage and Insurance Paid To (...named place of destination) Freight/carriage and insurance paid to (...name of destination) The seller is obliged to: complete export customs clearance, insure and deliver the cargo to the agreed destination. The buyer is obliged to: accept the goods and perform import customs clearance. Risks pass at the moment of transfer to the carrier at the seller's warehouse. CPTany modes of transportCarriage Paid To (... named place of destination) The seller is obliged to: complete export customs clearance and deliver the cargo to the agreed destination. The buyer is obliged to: accept the goods and perform import customs clearance. Risks pass at the moment of transfer to the carrier at the seller's warehouse. Terms of category D (delivery) DAFany modes of transportDelivered At Frontier (... named place) Delivery to the border (... name of the place of delivery) The seller is obliged to: complete export customs clearance and deliver the cargo to the border. The buyer is obliged to: accept the goods and perform import customs clearance. Risks pass at the border. DESsea and inland water transportationDelivered Ex Ship (... named port of destination) Delivery from the vessel (... name of the port of destination) The seller is obliged to: complete export customs clearance, load the goods on board the ship and deliver to the port of unloading. The buyer is obliged to: unload and accept the goods at the port of unloading, as well as perform import customs clearance. Risks pass at the port of unloading until unloading from the vessel. DEQsea and inland water transportationDelivered Ex Quay (... named port of destination) Delivery from the pier (... named port of destination) The seller is obliged to: complete export customs clearance, load the goods on board the vessel, deliver to the port of unloading and unload. The buyer is obliged to: accept the goods at the port of unloading, as well as perform import customs clearance. Risks pass at the port of unloading from the moment of complete unloading from the vessel. DDUany modes of transportDelivered Duty Unpaid (... named place of destination) Delivery without payment of duty (... named place of destination) The seller is obliged to: complete export customs clearance and deliver the cargo to the agreed destination. The buyer is obliged to: accept the goods and perform import customs clearance. Risks pass at destination DDPany modes of transportDelivered Duty Paid (... named place of destination) The seller is obliged to: complete export customs clearance, deliver the goods to the agreed place of destination and perform import customs clearance with payment of duties. The buyer is obliged to: accept the goods. Risks pass at destination. The main difference is that the DDP delivery basis places maximum responsibilities on the seller.What does FCA mean: decoding

The term FCA is used in transportation and stands for Free Carrier. This phrase can literally be translated as “free” or “free” “carrier”. When drawing up a contract, the phrase “Free carrier” (... name of place) is used. In simple terms, the term means that the seller's obligations towards the goods last only until he delivers the goods to the carrier chosen by the buyer. The buyer's freedom to choose a logistics company is not limited in any way.

Franco is a place where responsibility for the safety and transportation of goods is completely transferred to the shoulders of the buyer.

The word “Carrier” can be understood as a person who, in accordance with a product supply agreement, will ensure the transportation of cargo using a type of vehicle or a combination thereof specified in the contract.

The conditions and procedure for the delivery of goods indicate that “delivery of goods under the contract is carried out on the terms of FCA - Free carrier / Free carrier - “Incoterms 2010”. The point of delivery of the goods is also indicated, for example, CHISTO LLC, when exporting detergents for coffee machines to China, could indicate: “FCA no. 31, st. Bestuzhev, Vladivostok, Primorsky Krai, Russian Federation, Incoterms 2010.”