What does EXW, FCA, FAS, FOB, CFR, CIF, CIP, CPT, DAF, DES, DEQ, DDU, DPP mean?

To correctly draw up an application for the purchase of vacuum equipment, you may need information about abbreviated names of delivery conditions, the responsibilities of the seller and the buyer.

EXW (EX Works (...named place)) Ex-factory (...name of place)

The term "Ex Works" means that the seller is deemed to have fulfilled his obligation to deliver when he makes the goods available to the buyer at his place of business or at another named place (for example: plant, factory, warehouse, etc.). The seller is not responsible for loading the goods onto the vehicle, as well as for customs clearance of the goods for export.

FCA (Free Carrier (...named place))

The term "Free Carrier" means that the seller will deliver the goods, cleared by customs, to the carrier specified by the buyer to the named place. It should be noted that the choice of delivery location will affect the loading and unloading obligations at that location. If delivery is made at the seller's premises, the seller is responsible for shipment. If the delivery is carried out to another place, the seller is not responsible for the shipment of the goods. This term can be used for transportation by any type of transport, including multimodal transport.

FAS (Free Alongside Ship (... named port of shipment))

The term "Free Alongside the Ship" means that the seller delivers when the goods are placed along the side of the ship on the quay or lighters at the named port of shipment. This means that from that moment on, all costs and risks of loss or damage to the goods must be borne by the buyer. Under the terms of the FAS , the seller is responsible for clearing the goods through customs for export. THIS DIFFERS THIS EDITION FROM PREVIOUS EDITIONS OF INCOTERMS, IN WHICH THE RESPONSIBILITY FOR CUSTOMS CLEARANCE FOR EXPORT ASSIGNED WITH THE BUYER. However, if the parties wish the buyer to undertake customs clearance of goods for export, this should be clearly stated in the relevant addendum to the sales contract. This term can only be used when transporting goods by sea or inland waterway transport.

FOB (Free On Board (... named port of shipment))

The term "Free on board" means that the seller makes delivery when the goods pass the ship's rail at the named port of shipment. This means that from that moment on, all costs and risks of loss or damage to the goods must be borne by the buyer. Under the terms of the FOB , the seller is responsible for customs clearance of the goods for export. This term can only be used when transporting goods by sea or inland waterway transport. If the parties do not intend to deliver the goods over the ship's rail, the term FCA should be used.

CFR (Cost and Freight (... named port of destination))

The term "Cost and Freight" means that the seller makes delivery when the goods pass the ship's rail at the port of shipment. The seller must pay the costs and freight necessary to deliver the goods to the named port of destination, HOWEVER, the risk of loss or damage to the goods, as well as any additional costs incurred after the goods have been shipped, pass from the seller to the buyer. Under the terms of the CFR , the seller is responsible for clearing the goods for export. This term can only be used when transporting goods by sea or inland waterway transport. If the parties do not intend to deliver the goods over the ship's rail, the term CPT should be used.

CIF (Cost, Insurance and Freight (... named port of destination).) Cost, insurance and freight (... name of port of destination)

The term "Cost, Insurance and Freight" means that the seller has made delivery when the goods have passed the ship's rail at the port of shipment. The seller must pay the costs and freight necessary to deliver the goods to the named port of destination, BUT the risk of loss or damage to the goods, as well as any additional costs incurred after the goods have been shipped, pass from the seller to the buyer. CIF term, the seller is also obligated to purchase marine insurance in favor of the buyer against the risk of loss and damage to the goods during transportation. Consequently, the seller is obliged to conclude an insurance contract and pay insurance premiums. The buyer should note that under the terms of the CIF , the seller is required to provide insurance with only minimum coverage (See Introduction, paragraph 9.3). If the buyer wishes to have insurance with greater coverage, he must either specifically negotiate this with the seller, or take steps to obtain additional insurance himself. Under the terms of the CIF , the seller is responsible for clearing the goods through customs for export. This term can only be used when transporting goods by sea or inland waterway transport. If the parties do not intend to deliver the goods over the ship's rail, the term CIP should be used.

CIP (Carriage and Insurance Paid To (... named place of destination)) Freight/carriage and insurance paid to (... name of destination)

The term "Freight/carriage and insurance paid to" means that the seller will deliver the goods to the carrier named by him. In addition, the seller is obliged to pay the costs associated with transporting the goods to the named destination. This means that the buyer assumes all risks and any additional costs until the goods are delivered in this manner. However, under the terms of CIP , the seller is also obliged to provide insurance against the risks of loss and damage to the goods during transport for the benefit of the buyer. Consequently, the seller enters into an insurance contract and pays the insurance premiums. The Buyer should note that the terms of the CIP require the Seller to provide minimum coverage insurance (see Introduction 9.3). If the buyer wishes to have insurance with greater coverage, he must either specifically negotiate this with the seller, or take steps to obtain additional insurance himself. The word “carrier” means any person who, on the basis of a contract of carriage, undertakes to provide or organize the transportation of goods by rail, road, air, sea and inland waterway transport or a combination of these modes of transport. In the case of transportation to a destination by several carriers, the transfer of risk will occur at the moment the goods are transferred to the care of the first carrier. Under the terms of the CIP , the seller is responsible for customs clearance of goods for export. This term can be used when transporting goods by any type of transport, including multimodal transport.

CPT (Carriage Paid To (... named place of destination))

The term "Freight/carriage paid to" means that the seller will deliver the goods to the carrier named by him. In addition, the seller is obliged to pay the costs associated with transporting the goods to the named destination. This means that the buyer assumes all risks of loss or damage to the goods, as well as other costs after the goods are handed over to the carrier. The word “carrier” means any person who, on the basis of a contract of carriage, undertakes to provide or organize the transportation of goods by rail, road, air, sea and inland waterway transport or a combination of these modes of transport. In the case of transport to the agreed destination by several carriers, the transfer of risk will occur at the moment the goods are transferred to the care of the first of them. Under the terms of the CPT , the seller is responsible for customs clearance of the goods for export. This term can be used when transporting goods by any type of transport, including multimodal transport.

DAF (Delivered At Frontier (... named place))

The term "Delivered before Frontier" means that the seller has made delivery when he places the unloaded goods, cleared for export but not yet for import, on an arriving means of transport at the disposal of the buyer at a named point or place at the frontier before the goods reach the customs frontier. neighboring country. The term “border” refers to any border, including the border of the country of export. Therefore, it is very important to accurately define the boundary by pointing to a specific point or place. However, if the parties wish the seller to assume responsibilities for unloading the goods from the arriving vehicle and bear all the risks and expenses for such unloading, then this should be clearly stated in the relevant addendum to the purchase and sale agreement (See Introduction, paragraph 11 ). This term can be used when transporting goods by any type of transport, when the goods are delivered to the land border. If the delivery will take place at the port of destination, on board a ship, or at a pier, the terms DES or DEQ should be used.

DES

Delivered Ex Ship (... named port of destination) Delivery from the vessel (... name of the port of destination)

The term "Delivered Ex Ship" means that the seller delivers when he places the goods, not cleared for import, at the disposal of the buyer on board the ship at the named port of destination. The seller must bear all costs and risks of bringing the goods to the named port of destination until they are unloaded. If the parties wish the seller to bear the costs and risks of unloading the goods, the term DEQ shall apply.

This term can only be used when transporting by sea or inland water transport or in multimodal transport, when the goods arrive at the port of destination on a ship.

DEQ (Delivered Ex Quay (... named port of destination))

The term "Delivered Ex-Wharf" means that the seller has fulfilled his obligations to deliver when the goods, not cleared for import, are placed at the disposal of the buyer on the wharf at the named port of destination. The seller must bear all costs and risks associated with transporting and unloading the goods at the pier. DEQ imposes on the buyer the responsibility for customs clearance for importation of goods, as well as payment of taxes, duties and other charges upon importation . However, if the parties wish the seller to bear all or part of the costs of importing the goods, then this must be clearly stated in the relevant addendum to the sales contract (See Introduction, paragraph 11). This term can only be used when transporting by sea or inland waterways or in multimodal transport, when the goods are unloaded from a ship onto a quay at the port of destination. However, if the parties wish to include in the seller's responsibilities the risks and costs associated with moving the goods from the quay to another location (warehouse, terminal, etc.) in the port or outside the port, the terms DDU and DDP should be used.

DDU (Delivered Duty Unpaid (... named place of destination)) Delivery without payment of duty (... named place of destination)

The term "Delivered Duty Free" means that the seller will place the goods at the disposal of the buyer, uncleared and unloaded from the arriving means of transport, at the named place of destination. The seller must bear all costs and risks associated with transporting the goods to that place, with the exception (if required) (See Introduction paragraph 14) of any duties collected for importation in the country of destination (the word "charges" here means the responsibility and risks for customs clearance, as well as for payment of customs formalities, customs duties, taxes and other fees). Such charges shall be the responsibility of the buyer, as well as other costs and risks incurred due to his failure to clear customs for import in a timely manner. However, if the parties wish the seller to assume the risks and costs of customs clearance, as well as part of the costs of importing the goods, then this should be clearly stated in the relevant addendum to the sales contract (See Introduction, paragraph 11). Responsibility, risks and costs for unloading and reloading of goods depend on who controls the selected delivery location. This term can be used regardless of the mode of transport, but when the delivery takes place on board a ship or at the quay at the port of destination, the terms DES or DEQ should be used.

DDP (Delivered Duty Paid (... named place of destination))

The term "Delivered Duty Paid" means that the seller will place the goods, cleared and unloaded from the arriving means of transport, at the disposal of the buyer at the named place of destination. The seller must bear all costs and risks associated with the transportation of the goods, including (where required) (See Introduction paragraph 14) any duties for import into the country of destination (the word “fees” here means the responsibility and risks for customs clearance, as well as for payment of customs formalities, customs duties, taxes and other fees).

While the EXW term imposes minimum responsibilities on the seller, the DDP imposes maximum responsibilities on the seller. The Union of Leak Testing Specialists, if desired by the customer, supplies leak detectors and other vacuum equipment under DDP terms. This term cannot be used if the seller directly or indirectly fails to obtain an import license. If the parties have agreed to exclude from the seller's obligations some of the costs payable upon import (such as value added tax - VAT), this should be clearly defined in the sales contract (See Introduction paragraph 11). If the parties wish the buyer to bear all risks and costs of importing the goods, the term DDU should be used. This term may be used regardless of the mode of transport, but when the delivery takes place on board a ship or at the quayside at the port of destination, the terms DES or DEQ should be used.

{jlcomments}

Incoterms 2000

In a foreign economic transaction, Incoterms 2000 is used in at least three documents, this is a foreign economic contract (agreement, contract); invoice (proforma invoice, invoice), also terms of delivery can be indicated in the CMR (international vehicle consignment note).

In foreign economic contracts (agreements, contracts), delivery conditions are indicated in the paragraph (or section) “Delivery conditions”.

The writing order is as follows, for example, when importing, cargo is imported into the country from Russia to Ukraine:

“FCA - Moscow, according to Incoterms 2000” (according to the rules, this condition means that the “Seller” fulfilled its obligations towards the “Buyer”, subject to the execution of a cargo customs declaration (CCD), cleared the cargo and transferred it to the “Carrier”, which will transport cargo to Ukraine),

where, FCA is the terms of delivery according to Incoterms 2000, Moscow is the geographical place of delivery of the goods (perhaps you have a question, how can this be? This means that the “Seller” of the goods fulfilled its obligations towards the “Buyer” by delivering the goods to the “Buyer” in the city of Moscow. Further delivery of goods to Ukraine lies with the “Buyer” of the goods).

In the invoice (proforma invoice, invoice, invoice) it is enough to indicate “FCA - Moscow”, this will mean that the price of the goods is calculated on the terms of “FCA - Moscow”, this means that the price of the goods includes the cost of the goods plus expenses for customs clearance of cargo plus the cost of loading the goods onto a vehicle.

Another example of writing delivery terms in accordance with Incoterms 2000 in a contract for the import of consumer goods from China.

As a rule, goods from China to Ukraine, and very often to Russia (Moscow, St. Petersburg) and other countries, sail in containers to Odessa or Illichevsk, and then are reloaded onto cars and then continue to their destination. In this case, when delivering goods to Ukraine, the conditions may be CIF Odessa or CIF Illichevsk. Which means that the Chinese “Seller” has fulfilled its obligations to the “Buyer” and will deliver the container with the goods to the Odessa sea trade port or Illichevsk sea trade port.

When transporting cargo by rail (railway), in mutual settlements between the parties for transportation, the parties use the delivery terms DAF - State border.

Example. If cargo from Russia is traveling to Ukraine, then the conditions may be DAF - Ukrainian border (instead of the words “Ukrainian border” you need to put a crossing point). It turns out that each party pays for transportation costs within its territory.

Example. The contract specifies the terms of delivery to FCA - St. Petersburg. In this case, the Seller, the Russian side, pays expenses within the territory of Russia and adds transportation costs to the price of the goods. The price of the goods was obtained on FCA terms - St. Petersburg. The Ukrainian side thus pays for the goods and transportation from the Seller to the Buyer

Incoterms 2000 is a set of documents that spell out and decipher the terms of delivery, for example, what the FCA delivery condition means, the obligations of the parties, the distribution of financial expenses, etc.

| Group E (departure) | EXW | Franco plant (place name) |

| Group F (main carriage not paid) | FCA | Free carrier (name of destination) |

| F.A.S. | Free along the side of the vessel (name of port of shipment) | |

| FOB | Free on board (name of port of shipment) | |

| Group C (main carriage paid) | CFR | Cost and freight (name of destination port) |

| CIF | Cost, insurance and freight (name of destination port) | |

| CPT | Freight/carriage paid to (name of destination) | |

| C.I.P. | Freight/carriage and insurance paid to (name of destination) | |

| Group D (arrival) | DAF | Delivery to the border (name of delivery place) |

| DES | Delivery from vessel (name of port of destination) | |

| DEQ | Delivery from wharf (name of port of destination) | |

| DDU | Delivered duty free (name of destination) | |

| DDP | Delivered Duty Paid (Name of Destination) |

Practical advice on using terms of delivery

When importing, try not to use EXW conditions, because... To determine the customs value, you need to show all expenses from the enterprise where you bought the goods to the border. And these are expenses, starting from customs clearance, plus all the costs of all permitting documents, loading onto a vehicle and then transportation to the border. A more correct condition would be the FCA condition, under which it is necessary to show only the costs of transporting the goods to the border (all other costs are already included in the price of the goods).

And when exporting goods, it is better to forget about the DDP condition, because they mean that you must not only bring the cargo to another country, but also carry out customs clearance of your cargo with payment of all expenses (it is very difficult to carry out these operations in another country). Classic, if there were delivery conditions DAF state border, but delivery conditions FCA are quite suitable, or delivery conditions CPT meaning that you must deliver the cargo to the destination of the Buyer of the cargo. If the cargo is very important, you can apply the CIP (cargo delivery and insurance) condition to the destination.

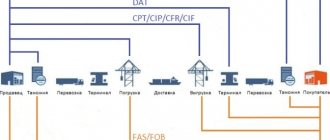

Incoterms 2000 terms of delivery by mode of transport

| Any type of transportation | ||

| Group E | EXW | Franco plant (place name) |

| Group F | FCA | Free carrier (shipment port name) |

| Group C | CPT | Freight/carriage paid to (name of destination) |

| C.I.P. | Freight/carriage and insurance paid to (name of destination) | |

| Group D | DAF | Delivery to the border (name of delivery place) |

| DDU | Delivered duty free (name of destination) | |

| DDP | Delivered Duty Paid (Name of Destination) | |

| Only sea and inland waterway transport | ||

| Group F | F.A.S. | Free along the side of the vessel (name of port of shipment) |

| FOB | Free on board (name of port of shipment) | |

| Group C | CFR | Cost and freight (name of destination port) |

| CIF | Insurance cost and freight (name of destination port) | |

| Group D | DES | Delivery from vessel (name of port of destination) |

| DEQ | Delivery from wharf (name of port of destination) | |

Recommendations for use

Traders continue to use the term FOB where it is completely inappropriate, while forcing the seller to bear the risk of transferring the goods to the carrier named by the buyer. FOB can only be used where the goods are intended to be delivered "over the ship's rail" or, in extreme cases, onto a ship, and not when the goods are handed over to a carrier for subsequent loading on a ship, for example, loaded into containers or loaded onto trucks or wagons in so-called “ro-ro” transport. Thus, in the introduction to the term FOB, a strong warning was given that the term should not be used when the parties do not intend to deliver the goods over the ship's rail.

It happens that parties mistakenly use terms also intended for the transport of goods by sea, when another mode of transport is intended. This may place the seller in a position where he cannot fulfill his obligation to provide the buyer with the relevant document (for example, a bill of lading, sea waybill or electronic equivalent).

DDP

Delivered Duty Paid (…named place of destination)

Delivered Duty Paid (...name of destination)

The term "Delivered Duty Paid" means that the seller will place the goods, cleared and unloaded from the arriving means of transport, at the disposal of the buyer at the named place of destination. The seller must bear all costs and risks associated with the transportation of the goods, including (where required) (See Introduction paragraph 14) any duties for import into the country of destination (the word “fees” here means the responsibility and risks for customs clearance, as well as for payment of customs formalities, customs duties, taxes and other fees).

While the EXW term imposes minimum responsibilities on the seller, the DDP term imposes maximum responsibilities on the seller.

This term cannot be used if the seller directly or indirectly fails to obtain an import license.

If the parties have agreed to exclude from the seller's obligations some of the costs payable upon import (such as value added tax - VAT), this should be clearly defined in the sales contract (See Introduction paragraph 11).

If the parties wish the buyer to bear all risks and costs of importing the goods, the term DDU should be used. This term may be used regardless of the mode of transport, but when the delivery takes place on board a ship or at the quayside at the port of destination, the terms DES or DEQ should be used.

| A. RESPONSIBILITIES OF THE SELLER | B. OBLIGATIONS OF THE BUYER |

| A.1. Provision of goods in accordance with the contract The Seller is obliged, in accordance with the purchase agreement, to provide the buyer with the goods, a commercial invoice or equivalent electronic communication, and any other evidence of compliance that may be required by the terms of the purchase agreement. | B.1. Payment of the price The Buyer is obliged to pay the price of the goods stipulated in the sales contract. |

| A.2. Licenses, certificates and other formalities The Seller must, at his own expense and risk, obtain any export or import license or other official certificate or other documents, and also carry out, if required (See Introduction paragraph 14), all customs formalities required for the export and import of goods and for their transit through third countries. | B.2. Licenses, certificates and other formalities The Buyer is obliged, at the request of the Seller, to provide the latter, at his expense and risk, with full assistance in obtaining, if required (See Introduction paragraph 14), any import license or other official certificate required for the import of goods. |

| A.3. Contracts of carriage and insurance a) Contract of carriage The seller is obliged to conclude at his own expense a contract for the carriage of goods to the named place of destination. If a special point is not agreed or determined by the practice of this type of delivery, the seller may choose the most suitable point for him at the named place of destination. b) Insurance contract No obligations (See Introduction, paragraph 10). | B.3. Contracts of carriage and insurance a) Contract of carriage No obligations (See Introduction, paragraph 10). b) Insurance contract No obligations (See Introduction, paragraph 10). |

| A.4. Delivery The seller must place the goods at the disposal of the buyer or another person nominated by the buyer, unloaded, on any arriving means of transport, at the named place of destination, on the agreed date or within the agreed period for delivery. | B.4. Acceptance of Delivery The Buyer is obliged to accept delivery of the goods when it is made in accordance with Article A.4. |

| A.5. Transfer of risks The Seller is obliged to deliver the goods subject to the provisions of Article B.5. and bear all risks of loss or damage to the goods until they are delivered in accordance with Article A.4. | B.5. Passing of risks The Buyer must bear all risks of loss or damage to the goods from the moment of delivery in accordance with Article A.4. The buyer is obliged - if he fails to fulfill his obligations in accordance with Article B.2. - bear all additional risks of loss and damage thereby caused to the goods. The buyer is obliged - if he fails to fulfill his obligation, to give notice in accordance with Article B.7. - bear all risks of loss or damage to the goods from the expiration of the agreed date or the end of the agreed delivery period. The condition, however, is that the goods comply properly with the contract. This means that the goods must be properly identified, that is, clearly separated or otherwise identified as the goods that are the subject of the contract. |

| A.6. Allocation of costs The Seller is obliged, subject to the provisions of Article B.6.: - in addition to the costs arising from Article A.3a), bear all costs associated with the goods until the moment when they are delivered in accordance with Article A.4., and - if required (See Introduction paragraph 14) - pay all costs associated with completing customs formalities for export and import, as well as other duties, taxes and other charges payable upon export and import of goods and their transit through third countries prior to delivery in accordance with Article A.4. | B.6. Allocation of costs The Buyer is obliged, in accordance with the provisions of Article A.3a): - to bear all costs associated with the goods from the moment of their delivery in accordance with Article A.4. - bear all additional costs if he fails to fulfill his obligations in accordance with Article B.2. or give notice in accordance with Article B.7. The condition, however, is that the goods comply properly with the contract. This means that the goods must be properly identified, that is, clearly separated or otherwise identified as the goods that are the subject of the contract. |

| A.7. Notice to the Buyer The Seller is obliged to duly notify the Buyer about the dispatch of the goods, as well as send the Buyer other notices required for him to take the usually necessary measures to accept delivery of the goods. | B.7. Notification to the seller The Buyer is obliged, if he has the right to determine the time within the stipulated period and/or the point of acceptance of delivery at the named destination, to duly notify the seller about this. |

| A.8. Proof of Delivery, Transport Documents or Equivalent Electronic Communications The Seller must provide the buyer at Seller's expense with a delivery order and/or conventional transport document (e.g., negotiable bill of lading, non-negotiable sea waybill, proof of inland waterway transport, air waybill, railway or road waybill or a multimodal transport bill of lading) which the buyer may require to accept delivery of the goods in accordance with Articles A.4./B.4. In the event that the seller and buyer have agreed to use electronic communications, the documents mentioned above may be replaced by equivalent electronic messages (EDI). | B.8. Proof of Delivery, Transport Documents or Equivalent Electronic Communications The Buyer must accept the required delivery order or transport document in accordance with Article A.8. |

| A.9. Inspection - Packaging - Labeling The seller is obliged to bear the costs associated with the inspection of the goods (for example, checking quality, dimensions, weight, quantity) necessary to deliver the goods in accordance with Article A.4. The seller is obliged to provide, at his own expense, the packaging (except in cases where it is customary in the trade to deliver the contracted goods without packaging) necessary for delivery of the goods. The packaging must be properly labeled. | B.9. Inspection of the Goods The Buyer must bear the costs associated with pre-shipment inspection of the goods unless such inspection is required by the authorities of the country of export. |

| A.10. Other obligations The Seller is obliged to bear all costs and pay fees associated with the receipt of documents or equivalent electronic messages, as provided in Article B.10., as well as to reimburse all expenses incurred by the buyer as a result of providing assistance to him. The seller is obliged to provide the buyer with all the information necessary to carry out insurance. | B.10. Other Obligations The Buyer shall, at the request of the Seller, render to the Seller, at his own expense and risk, his full cooperation in obtaining any documents or equivalent electronic communications issued or transmitted in the country of importation which the Seller may require for the purpose of making the goods so available to the Buyer. |

- INTRODUCTION

- "E" - term: EXW

- "F" - terms: FCA FAS FOB

- “C” - terms: CFR CIF CPT CIP

- "D" - terms: DAF DES DEQ DDU DDP