To control the circulation of imported goods in Russia, from July 8, 2021, a national goods traceability system (NGTS) was introduced. All movement will be tracked from the moment of import into the territory of the Russian Federation until delivery to the final consumer. We tell you what awaits participants in the circulation of such goods in this regard. This may affect you even if you do not sell traceable products.

Which products are subject to traceability?

The list of traceable items may be updated, so please check for changes. To avoid double interpretation of names, the list contains EAEU and OKPD2 HS codes. Check on the Federal Tax Service website whether the product is subject to tracking.

As of June 2021, the list includes:

- household and industrial refrigerators, freezers;

- household and industrial washing machines;

- monitors, projectors, television receivers;

- prams;

- children's car seats;

- industrial heat pumps;

- forklifts, bulldozers, excavators, road rollers.

If there are difficulties with the classification of goods, use the HS code from the supplier’s invoice or check the data from the certificate of conformity.

If a traceable product was produced on the territory of the Russian Federation with full or partial use of imported spare parts, the created product is considered imported and is also subject to traceability. Exceptions:

- components are placed under the customs procedure of release for domestic consumption, that is, they have no restrictions on their use;

- Imported spare parts are placed under the customs procedure of a free customs zone, that is, they are processed by residents of such free economic zones as Alabuga, Titanium Valley, or under a similar customs procedure of a free warehouse.

You can determine the customs procedure using the customs declaration codes.

There is no need to report transactions with traceable goods if they involve state secrets, for example, the purchase of refrigerators as part of a defense contract. If the tracked product is intended for representative offices of international organizations, then it is also not included in the tracking system.

Postal smuggling

Every year, the international online trading market is gaining momentum, and international postal mail (IPO) is increasingly being used to purchase goods for personal use. The development of online commerce and postal services has made it possible for buyers to purchase goods from all over the world, and for sellers to enter the international market without opening branches in other countries. At the same time, the movement of goods across the customs border through IPOs is subject to customs regulation. With the rapid development of the international online trading market, the possibility of illegal movement of prohibited goods into international trade centers is also increasing.

Moving goods to MPO

Subclause 19, clause 1, art. 2 of the Customs Code of the Eurasian Economic Union (EAEU) defines IPO as parcels and items of written correspondence that are objects of postal exchange in accordance with the acts of the Universal Postal Union, accompanied by documents provided for by the acts of the Universal Postal Union, sent outside the customs territory of the Union from places (institutions) ) international postal exchange, either enter the customs territory of the Union at places (institutions) of international postal exchange, or transit through the customs territory of the Union.

The movement of goods in IPOs is regulated by the EAEU, documents of the Union, acts of the Universal Postal Union, laws of the Russian Federation, departmental orders of the Ministry of Finance, the Federal Customs Service of Russia and other legal acts.

Customs operations in relation to goods sent to IPOs are carried out by customs authorities at places (institutions) of international postal exchange. Places of international postal exchange, which are postal facilities on the territory of the Russian Federation, are established by the Ministry of Finance of Russia.

Thus, by order of the Ministry of Finance of Russia and the Ministry of Digital Development, Communications and Mass Communications of the Russian Federation dated December 18, 2021 No. 274n/715 “On determining the places of international postal exchange that are postal facilities on the territory of the Russian Federation and on declaring the order of the Ministry of Finance of Russia invalid and the Ministry of Telecom and Mass Communications of Russia dated March 31, 2021 N 54n/162” established places of international postal exchange in Moscow, St. Petersburg, Yekaterinburg, etc.

Order of the Federal Customs Service of Russia dated November 17, 2011 N 2350 “On establishing the competence of customs authorities to carry out customs operations in relation to goods sent across the customs border of the Customs Union in international mail” established a circle of specialized customs authorities for carrying out customs operations in relation to goods sent across the customs border of the Customs Union in the MPO.

In accordance with Part 1 of Art. 286 of the EAEU Labor Code, upon arrival (departure) of an MPO, the carrier provides the customs authority with information about the names of places (institutions) of international postal exchange that are the sender and recipient of the MPO, gross weight, number of packages.

Information about the presence of goods in the international customs clearance, in respect of which prohibitions and restrictions are established, is submitted by the carrier to the customs authority if the carrier has such information.

Customs declaration

The general procedure for carrying out customs operations (including customs declaration) provided for participants in foreign economic activity applies to goods transported to international customs clearance centers that are not classified as goods for personal use.

The specifics of the procedure and conditions for moving goods for personal use across the customs border of the Union are established in Chapter. 37 EAEU Labor Code.

Goods for personal use are goods intended for personal, family, household and other needs of individuals not related to business activities.

The classification of goods as goods for personal use is carried out by the customs authority based on: the nature of the goods (the consumer properties of the goods, the traditional practice of their application and use in everyday life are taken into account); quantity of goods; Frequency of shipment of goods.

Some goods do not qualify as goods for personal use, regardless of their quantity (certain types of medical equipment, equipment for photo laboratories, etc.).

Documents provided for by the acts of the Universal Postal Union and accompanying the IPO can be used as a declaration of goods (DT) for the customs declaration of goods sent to the IPO, in accordance with the customs procedure for release for domestic consumption, if customs duties are not subject to payment in respect of such goods , taxes; There are no prohibitions or restrictions in relation to such goods, and no measures to protect the domestic market are applied.

Such documents include, for example, a CN 22 “Customs” label for small packages, a CN41 delivery note, etc.

IPOs are issued by the designated postal operator to their recipients, subject to the release of goods sent by international mail and payment of customs duties, special, anti-dumping, and countervailing duties.

Customs declaration and release of goods, with the exception of goods for personal use sent to MPOs, exported from the customs territory of the Union, are carried out before they are transferred to designated postal operators for dispatch.

Part 1 of Art. 285 of the EAEU Labor Code establishes a ban on sending to MPOs goods prohibited for shipment in accordance with the acts of the Universal Postal Union (drugs and psychotropic substances, counterfeit and pirated items, live animals, etc.) and the EEC (ozone-depleting substances, hazardous waste, pornographic materials and etc.).

Specific names of substances classified by the customs legislation of the Customs Union within the EurAsEC as weapons, narcotic drugs, psychotropic substances and their precursors, toxic substances, etc., are defined in the lists of the Decision of the Board of the Eurasian Economic Commission dated April 21, 2015 N 30 “On non-tariff regulation measures” .

Criminal liability for smuggling

Illegal shipment of MPO outside the EAEU, or entry of MPO into the customs territory of the EAEU may be a method of moving goods (items) for the purposes of Art. 226.1 and 229.1 of the Criminal Code of the Russian Federation.

Yes, Art. 226.1 of the Criminal Code of the Russian Federation establishes criminal liability for the illegal movement across the customs border of the Customs Union within the EurAsEC or the State border of the Russian Federation with member states of the Customs Union within the EurAsEC of potent, poisonous, poisonous, explosive, radioactive substances, radiation sources, nuclear materials, firearms , its main parts (barrel, bolt, drum, frame, receiver), explosive devices, ammunition, weapons of mass destruction, means of delivery, other weapons, other military equipment, as well as materials and equipment that can be used to create weapons mass destruction, means of its delivery, other weapons, other military equipment, as well as strategically important goods and resources or cultural values on a large scale or especially valuable wild animals and aquatic biological resources belonging to species listed in the Red Book of the Russian Federation and (or) protected by international treaties of the Russian Federation, their parts and derivatives (derivatives).

Illegal movement across the customs border of the Customs Union within the EurAsEC or the State border of the Russian Federation with the member states of the Customs Union within the EurAsEC of narcotic drugs, psychotropic substances, their precursors or analogues, plants containing narcotic drugs, psychotropic substances or their precursors, or their parts, containing narcotic drugs, psychotropic substances or their precursors, instruments or equipment that are under special control and used for the manufacture of narcotic drugs or psychotropic substances, provides for criminal liability under Art. 229.1 of the Criminal Code of the Russian Federation.

Resolution of the Plenum of the Supreme Court of the Russian Federation dated April 27, 2021 No. 12 “On judicial practice in cases of smuggling” (hereinafter Resolution No. 12) identifies the following methods of committing smuggling:

- movement of goods or other items outside established places or during unspecified working hours of customs authorities in these places;

— with concealment from customs control;

— with false declaration or non-declaration of goods;

- using documents containing false information about goods or other items, and (or) using counterfeit means of identification or those related to other goods or other items.

Are all methods of smuggling typical for the movement of goods in MPOs?

In the vast majority of cases, the actual circumstances of moving items to MPO are the same, which is due to the standard algorithm of actions for purchasing goods through a foreign online store.

Since the transfer of goods (items) to MPO is carried out within the framework of customs legal relations, the possibility of their movement outside established places or during unspecified working hours of customs authorities is excluded.

Concealment from customs control is the performance of any actions aimed at making it difficult to detect such goods (items) or to conceal their true properties or quantity.

The method of concealment itself does not matter for qualification, but Resolution No. 12 highlights possible ways of moving goods (items) with concealment from customs control:

- giving some goods (items) the appearance of others, that is, a significant change in external characteristic features that allow them to be classified as goods of a different type (movement of potent substances in a toothpaste tube, etc.);

— the use of hiding places specially made or adapted for smuggling in MPO items. In the context of this norm, a cache should be understood as a place for secret storage, made for the purpose of illegally moving items across the customs border of the Customs Union or the state border of the Russian Federation. To make hiding places, a variety of material objects can be used, both the MPO packaging itself (for example, creating a double bottom in the package), and any objects moved in it (under the lining of clothing, etc.).

At the same time, judicial practice classifies as concealment from customs control any movement in international mail of goods prohibited for shipment, regardless of making some goods look like others or using hiding places.

Thus, in court verdicts one can find the wording: “illegal movement of a narcotic drug with concealment from customs control in an international postal item,” despite the absence of facts of making some items look like others or using hiding places.

Considering that almost all the items listed in the disposition of Art. 226.1 and 229.1 of the Criminal Code of the Russian Federation are prohibited for shipment in accordance with the acts of the Universal Postal Union (narcotic drugs, psychotropic substances, explosive devices, ammunition, etc.) and the Decision of the Customs Union Commission dated August 17, 2010 No. 338 “On the peculiarities of sending goods to international postal items” (firearms and their main parts, narcotic drugs, psychotropic and toxic substances, etc.), their very movement to the IPO across the customs border of the Customs Union or the State border of the Russian Federation with the member states of the Customs Union within the framework of the EurAsEC forms the objective side crimes under consideration, and this method is typical for the vast majority of crimes in the category under consideration.

The crime is considered completed from the moment the MPO is sent with the specified items contained in it, regardless of their receipt by the addressee. The objective side of the act consists only in sending the MPO, that is, in transferring the parcel to a postal organization for forwarding and delivery to the addressee.

The remaining methods of smuggling, outlined in Resolution No. 12, are not typical for smuggling in MPOs, but are theoretically possible for some types of goods.

Non-declaration as a method of committing smuggling consists in a person’s failure to comply with the requirements of Union law and the legislation of the Russian Federation on customs matters regarding the declaration of goods.

Customs declaration of goods is a statement to the customs authority by an authorized person in the prescribed form of information about the goods, the chosen customs procedure and (or) other information necessary for the release of goods. Customs declaration is carried out by the declarant or a customs representative in electronic or written form.

Non-declaration is possible by not declaring to the customs authority all or part of the goods (part of a homogeneous product is not declared, or when declaring a consignment consisting of several goods, information about only one product is reported in the customs declaration, or a product other than the one is presented to the customs authority information about which was declared in the customs declaration).

Some law enforcers classify the movement of goods (items) prohibited for transfer to MPO without making some goods look like others or using hiding places as non-declaration of goods (as indicated above, in general, judicial practice follows a different path), however, this opinion seems erroneous, since in principle there is no legal possibility of releasing certain types of goods (items) at the IPO, and accordingly there is no established procedure for declaring them for customs clearance.

If the declarant or customs representative in the customs declaration declares untrue (unreliable) information about the qualitative characteristics of the goods necessary for customs purposes (for example, information about the name, description, classification code according to the Unified Commodity Nomenclature for Foreign Economic Activity of the Union, about the country of origin, about the customs value), then these actions should be considered as an unreliable declaration of goods.

It should be taken into account that the information necessary for customs purposes is information submitted to the customs authorities for making a decision on the release of goods, placing them under the selected customs procedure, calculation and collection of customs duties, or information affecting the application of prohibitions or restrictions to goods .

Resolution No. 12 also noted that in case of smuggling committed through the use of documents containing false information about goods or other items, the customs authority as grounds or conditions for the movement (placement under the customs procedure) of goods or other items specified in Art. 226.1, 229.1 of the Criminal Code of the Russian Federation, documents may be submitted containing false information, in particular, about the name, description, classification code according to the unified Commodity Nomenclature for Foreign Economic Activity of the Eurasian Economic Union, about the country of origin, departure, customs value, description of packaging (quantity, type, marking and serial numbers).

In cases where smuggling involves methods of illegally moving goods or other items in the form of false declarations or the use of documents containing false information about goods or other items, smuggling is considered completed from the moment a customs declaration or other document is submitted to the customs authority that allows import into the customs territory. Union or export from this territory of goods or other items for the purpose of their illegal movement across the customs border.

Resolution No. 12 also paid attention directly to MPO: clause 15 states that the recipient of MPO containing contraband, if he, in particular, found, placed an order, paid, provided his personal data, address, provided methods of receipt and (or) concealment of the ordered goods is subject to liability as a smuggler.

If a smuggled item is moved into the customs territory under the guise of goods through a registered international trade union, the place of commission of such a crime is the place where operations related to its release are carried out with such goods (place of international postal exchange).

Conclusion

When sending goods and items to MPOs, you must carefully check whether they are prohibited for movement by this method, for which you should refer to the current information resources of customs authorities and postal services.

For purchasers of goods in foreign online stores, the difficulty lies in the fact that the procedure for moving goods using this method is regulated not only by the customs legislation of the EAEU, but also by acts of the Universal Postal Organization, and other international and Russian legislative acts.

This article discusses only the issues of smuggling as a criminal act, however, when sending and receiving international goods, other problems may arise related to customs clearance and payment of customs duties.

How NSPT works and who it concerns

The batch of goods is assigned a special number, which the participants in the turnover then indicate in all documents when reselling it. There is no need to put an identifier on the items themselves - this is one of the differences from the marking system. Participation in the traceability system is a separate responsibility not related to labeling; the product will not simultaneously participate in both control systems.

All participants in the circulation of traceable goods will report to the tax office on the movement of such goods. VAT payers will indicate information in an updated VAT return, and non-payers will indicate information in a special report.

You become a participant in the system if you perform any of these transactions with a traceable item:

- import;

- the presence as of 07/08/2021 of traceable goods remaining on the right of ownership, which are planned to be transferred in the future on one of the following grounds;

- purchase and sale in the Russian Federation from Russian counterparties;

- transfer of goods to a commission agent by the principal for the purpose of subsequent sale, if the agent acts on his own behalf;

- transfer or receipt of ownership rights free of charge;

- transfer and receipt of goods not related to sale (reorganization, contribution to the authorized capital, etc.);

- termination of traceability of goods (including sales to individuals for personal consumption, self-employed, transfer to production for the manufacture of new goods, disposal, loss and shortage);

- resumption of product traceability (including the return of previously sold goods from individuals and self-employed people, the return of unprocessed residues from production);

- export.

Thus, the obligation to participate in the traceability system may arise even if you are not engaged in foreign economic activity or trade in traceable goods. It is enough to simply purchase such a product for business purposes - and you are already required to report to the tax office. The obligation to participate in the process does not depend on the tax system and form of ownership.

Example.

An individual entrepreneur applying the patent taxation system purchased a Chinese monitor for office work after 07/08/2021 from M-Video LLC. Along with the monitor, the supplier provided the individual entrepreneur with an electronic invoice with the product identifier. The individual entrepreneur must accept the invoice through electronic document management channels, sign it with an electronic signature, and send a report on traceable goods to the tax office.

Without electronic document management, a store will not be able to sell a traceable product to an entrepreneur or company, and an individual entrepreneur or company will not be able to buy it. So any buyer from the business world, willy-nilly, becomes a participant in the system.

What is customs value adjustment and why is it needed?

Adjustment of customs duties is a procedure for changing the customs value of imported goods declared in the declaration, that is, its recalculation.

There may be several reasons for making corrections:

- the declarant did not justify the choice of the vehicle calculation method;

- the product costs less than the risk level established by customs;

- the cost of the product is less than the price of the components of which it consists;

- the cost of a unit of goods is higher than the risk level, but lower than what is usually indicated by other participants in foreign economic activity when importing similar products;

- a dependence was identified between the participants in the transaction in conjunction with a lower price of the goods than in the same transactions between independent participants in foreign trade activities;

- errors and clerical errors, discrepancy between the information in the declaration and the actual data;

- not including mandatory indicators in the calculation (for example, the amount of license fees, brokerage, commissions, forwarding services, etc.);

- other circumstances that cast doubt on the reliability of the vehicle.

Both the declarant himself and the customs authority can initiate changes at any stage of customs control.

We will adjust the customs value

Get a free design consultation

Call us on our toll-free number, or fill out the form and we will promptly contact you!

8 800 700 0952 Feedback

CTS before the release of goods

Adjustments to customs duties carried out before the goods are released into circulation are carried out on the basis of the requirements of the customs authority or at the request of the declarant himself.

If the customs office announced an adjustment, then the text of the document must indicate the reason why it considered the price information to be unreliable, describe how to correct it, and indicate the list of documents required for submission.

You can submit an appeal yourself, provided that customs officers have not yet sent requests for documentation or set a date for inspection, examination or examination.

The customs office issues the appropriate permit, after which the declarant makes changes to the DTS.

The number of days it will take for recalculation depends on the efficiency of the declarant. During the adjustment process, he will need to enter new data, calculate the vehicle using it and pay customs duties based on the obtained value.

Refusal to perform these actions will lead to a ban on the release of goods, the cargo will be placed in a temporary storage warehouse, which will lead to additional costs.

CTS after the release of goods

The CTS procedure after the release of goods by decision of customs officers is as follows:

- A desk audit is carried out, based on the results of which a report is drawn up.

- The previously calculated cost is canceled, and a note is placed on the declaration indicating the need to apply an adjustment.

- A decision is made to adjust the customs value of goods. It specifies the period during which you can receive additional advice and take the necessary actions. A copy is sent to the declarant.

- The declarant must inform in writing of his agreement with the decision made or refuse the proposed adjustment, indicating the reasons for disagreement. In the second case, the customs office will independently calculate the customs value and offer to voluntarily pay the additional assessed amount.

After the goods are released onto Russian territory, customs officers have three years (in some cases five years) to conduct CTS.

Adjustment at the initiative of the declarant is carried out with the permission of customs.

The declarant has the right to appeal to a higher authority or to the court the customs decision to adjust the vehicle within three months from the date of its receipt.

How to assign a registration number for a product batch

If the product is traceable, it is assigned a registration number (RNPT). It is created not for each unit of goods, but for the entire batch. RNPT must be indicated in universal transfer documents, invoices and tax reporting. The number is not physically applied to the product.

If the goods are imported from countries outside the EAEU, the number is assigned by the importer himself.

The number consists of blocks separated by a “/” sign. The first three blocks coincide with the number of the customs declaration in section A:

- customs code (section 29 of the customs declaration);

- date of registration of the customs declaration (section 54 of the customs declaration);

- serial number of the declaration.

The last block of RNPT numbers represents the serial number of the goods from section 32 of the customs declaration. If there are several parties in the customs declaration, then the RNPT is assigned to each of them.

Example.

A batch of 5 monitors was imported according to the customs declaration dated July 1, 2021 with the following data.

The registration number of the batch will be: 10129020/010721/0000123/001.

There is no need to notify the tax office about the assignment of a batch number, but it must be indicated in all shipping documents when moving goods from this batch.

If the goods are imported from the EAEU countries, the RNPT is assigned by the tax office.

To do this, submit an import notification to the tax office in the form KND 1169008 within 5 working days from the date of acceptance of the goods for registration. The Federal Tax Service will assign the RNPT within 24 hours and notify you.

If for any reason you return the imported goods to the supplier back to the EAEU, no later than the next business day after the return, submit an adjustment notification of import.

What to do with leftovers

If at the time of introducing traceability you have balances of such goods in your warehouse and they are intended for sale, submit a notification of balances to the tax office using the KND form 1169011 and receive RNPT from the Federal Tax Service. There is no specific deadline, the main thing is to obtain the number before the sale or disposal of the traceable product.

You will also have to submit a notice of balances and receive a RNPT if you decide to sell a traceable product that arrived to you in one of the following ways:

- purchase from individuals;

- purchasing from self-employed people;

- return to the seller by an individual or self-employed person of goods previously sold to him before 07/08/21;

- purchase of confiscated goods.

If you purchased a product and received an invoice before you can receive a deduction for it in the usual manner, despite the fact that they do not contain a RNPT number.

Document flow

All reporting and primary documents on traceable goods must be compiled and transmitted strictly electronically.

Exceptions:

- sales to individuals for their own needs, self-employed;

- import to the EAEU;

- export or re-export.

If the seller of traceable goods uses special regimes, he must also send the UTD to the buyer in electronic form.

Buyers are required to accept the electronic document and confirm with an electronic signature the fact of acceptance of the goods. From 01/01/2023, electronic document management operators will send electronic documents with traceable goods to the Federal Tax Service.

All participants in the circulation of traceable goods, including buyers (except individuals) must be connected to EDI. Without this, it will not be possible to sell or buy a traceable product.

From July 1, 2021, invoices must be drawn up using a new form. It was supplemented with fields for entering traceability details (RNPT, unit of measurement and quantity). You can include both traceable and non-traceable items on a single invoice. Read more about the features of filling out a new invoice in our article.

Errors in the RNPT number or its absence do not deprive the right to deduct VAT.

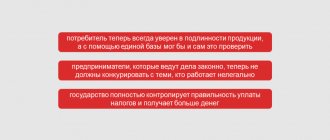

Principles and objectives of the product traceability system

The list of goods subject to traceability has already been approved. Goals of developing and implementing a traceability system:

- fulfillment of international obligations;

- confirmation of the legality of the circulation of goods in the Eurasian Economic Union;

- preventing the import of counterfeit products into the territory of the Russian Federation;

- increasing the competitiveness of domestic goods;

- ensuring the economic security of the country;

- reduction of gray imports.

In order to implement the Agreement, a national traceability system for goods released on the territory of the Russian Federation has been developed in accordance with the customs procedure for release for domestic consumption.

The creation, implementation and maintenance of a national goods traceability system is carried out by the operator of the national goods traceability system - the Federal Tax Service of Russia.

Principles of the national traceability system:

- eliminating duplication of business processes of taxpayers;

- the traceability identifier is formed using uniform rules;

- the system is based on the existing electronic document flow between taxpayers;

- the fact of transfer of ownership of a traceable product is recorded in available documents and does not require physical marking of the product;

- the requirements apply to all participants in the turnover.

Reporting

All transactions with traceable goods must be included in reporting and submitted to the tax office electronically, regardless of the tax system used. Recommended reporting forms are given in the letter of the Federal Tax Service dated April 14, 2021 No. EA-4-15 / [email protected] The composition of the reports for VAT payers and non-payers differs.

VAT payers

VAT payers submit a VAT return in the usual manner, simply using a new form, which is valid starting from reporting for the 3rd quarter of 2021. In section 8-11 of the declaration and in Appendix No. 1 to section 8-9, information about the purchase, sale, gratuitous transfer of traceable goods: RNPT, product unit code, quantity, cost. Products with different RNPT in each section are reflected on separate sheets.

There are situations when, in addition to the VAT declaration, you also need to submit a report on transactions with goods in the KND form 1169010:

- purchase, including through an agent, from VAT evaders;

- termination of traceability in the form of exclusion from the list of traceable goods, exports to the EAEU, sales to international representative offices, inventory shortages;

- renewal of traceability in the form of the return of unprocessed residues from production, identification of surpluses during inventory, previously recorded as shortages;

- a transfer of traceable goods has been made and it is not subject to VAT on the basis of the Tax Code of the Russian Federation.

The report is submitted electronically no later than the 25th day of the month following the reporting quarter.

VAT evaders

If you apply special tax regimes or take advantage of VAT exemption, you need to submit a transaction report to the tax office in the form KND 1169010 in the following situations:

- purchase or sale of traceable goods on the territory of the Russian Federation from Russian counterparties, including through agents;

- transfer and receipt of goods not related to sale (reorganization, contribution to the authorized capital, etc.);

- transfer or receipt of ownership rights free of charge;

- termination of traceability of goods (including sales to individuals for personal consumption, self-employed, transfer to production for the manufacture of new goods, disposal, loss and shortage);

- transfer or receipt of ownership rights free of charge;

- resumption of product traceability (including the return of previously sold goods from individuals and self-employed people, the return of unprocessed residues from production);

- import or export.

The report is submitted electronically no later than the 25th day of the month following the reporting quarter.

If you export goods to the EAEU , additionally submit to the Federal Tax Service a notification of the movement of goods in the KND form 1169009 within 5 working days from the date of shipment regardless of whether you are a VAT payer. If you previously exported goods to the EAEU and submitted a notification about the movement of goods, and then there was a full or partial return of this product, no later than the next business day from the date of return, send an adjustment notification about the movement of goods.

How to prepare to participate in the product traceability system

- Check if your products are traceable.

- Switch to electronic document management (EDF) with counterparties and enable the submission of reports to the tax office in electronic form. If you and your counterparty are served by different operators, contact your provider to activate roaming.

- Conduct an inventory of remaining items that are subject to traceability.

- Send a notification to the Federal Tax Service about the remaining traceable goods and receive the RNPT.

- Since RNPT is assigned to a separate batch of goods, organize batch accounting of goods and make changes to the accounting policy.

- Enter RNPT into the accounting program. To do this, the accounting system must be improved and updated.

- Organize a system for monitoring the correct formation of documents and reporting in the goods traceability system so that all traceable goods have a RNPT in the transfer documents. At the same time, not only the seller, but also the buyer must have EDI. Create internal regulations that eliminate omissions when entering RNPT into the accounting program. Make sure that transactions with traceable goods are reported on time and in full. For example, a report on transactions with traceable goods is submitted only if there are transactions, so you need to check quarterly whether the obligation to prepare such a report has arisen.

Procedure for adjusting customs value

Amendments to the vehicle can be initiated by customs or by the declarant himself (his representative). Adjustments are allowed before or after the product is released. The rules and deadlines for making changes are established by the Decision of the EEC Board of December 10, 2013 No. 289, as well as Art. 112 Labor Code of the EAEU.

Changing information about a vehicle at the initiative of customs before and after the release of goods

The need for CTS established by customs before the release of goods is formalized in the form of a requirement, which is handed to the declarant against signature or sent to his e-mail.

Within the period specified in the requirement, the declarant draws up the DTS in paper or electronic form and submits it to the customs authority. Correctly completed documents are registered in the information system. If the documents are filled out incorrectly, a refusal to register the changes will be issued.

Changes in the DTS after the release of goods at the initiative of customs occur on the basis of a decision made by it. The document is delivered against signature or by mail with acknowledgment of delivery. From the moment of receiving the decision, the declarant has 10 working days to change the vehicle.

In case of failure to submit the DTS within the prescribed period or if there are errors, the customs official independently fills out the declaration and sends it to the declarant.

Changing information about a vehicle at the initiative of the declarant

After the goods are released, the declarant can change the vehicle data. To do this, an application is submitted in any form, in which the reasons for the changes are given and supporting materials are attached.

Customs issues a CTS permit in the prescribed form within 30 days from the date of receipt of the application or sends a reasoned refusal. In some cases, the review period may be extended. Records of corrections are entered in the appropriate columns of the DT.

Customs officers are required to inform the applicant about any overpayment that has arisen in connection with the CTS.

What kind of violations will there be?

The penalties are still mild so that participants can adapt to the system. For example, if you purchased a traceable product, but the invoice does not have its identification number or it is indicated incorrectly, you retain the right to deduct VAT (clause 3 of article 2 of law No. 371-FZ).

The Federal Tax Service website states that liability measures will begin to apply from July 1, 2022. The authorities planned to supplement the Tax Code of the Russian Federation with articles 129.15-129.16 with fines for the absence of RNPT, errors in the number, lack of a report on traceable goods, but have not yet done this.

Currently, tax authorities can only request documents and explanations if they identify discrepancies between traceability system reports and other reports. For failure to provide documents upon such requests or failure to make corrections, standard fines are provided under clause 1 of Art. 126 of the Tax Code of the Russian Federation in the amount of 200 rubles for each document not provided and according to clause 1 of Article 129.1 of the Tax Code of the Russian Federation in the amount of 5,000 rubles.

Check whether you use traceable goods in your business activities. Prepare to implement a tracking system in your accounting and learn how to submit reports. And the “My Business Bureau” system will help you with this. This is a reference and legal system, consultations with lawyers, accountants and personnel officers, services for checking counterparties, assessing the likelihood of blocking a current account, a database of pre-filled forms and online calculators for calculating taxes, fees and payments to personnel.

Customs clearance

Any movement of goods and vehicles across the customs border of the Russian Federation entails the obligation to carry out procedures related to their customs clearance. Moreover, the import of goods and cars into the customs territory of the Russian Federation without the condition of its obligatory export is recognized as import, and, accordingly, the export of goods is recognized as export. In order to import or export goods, it is necessary to comply with established customs procedures related to its direct customs clearance and declaration. Without the skills and knowledge of customs legislation, carrying out such operations presents certain difficulties. Customs clearance and declaration of goods has the right to be carried out by both the declarant and a company that professionally carries out comprehensive customs clearance - a customs broker . In this case, the representative carries out all the necessary formalities on behalf of the declarant or other interested parties, on their instructions.

The stages of customs clearance of goods by the declarant involve the actual presentation of the goods being moved to the customs authority, their declaration and placement under the appropriate regime.

Customs clearance for imports includes comprehensive preparation of the necessary documentation and payment of customs duties, taxes and fees.