What is the OKEI code in the delivery note and invoice?

Both in the invoice in the TORG-12 form and in the invoice there are special columns where the code of the unit of measurement of the shipped goods should be entered. The encoding of such a unit of measurement is taken from the All-Russian Classifier of Units of Measurement, designated OK 015-94 (MK 002-97) and approved by Decree of the State Standard of Russia dated December 26, 1994 No. 366. The latest changes to this classifier were made quite recently by order of Rosstandart dated June 1, 2018 No. 299-st.

NOTE! To make it easier to find the desired element, the classifier is divided into eight groups.

If the goods are shipped in kilograms, then in OKEI you need to contact the “Units of mass” group. The unit of measurement “kilograms” is encoded with the numbers 166. Also given here are the national and international symbols (kg and kg, respectively) and the national and international code symbols (KG and KGM, respectively).

The OKEI code in the invoice in the TORG-12 form is entered in column 5, and in the invoice - in column 2. In column 2a of the last of these documents the very name of the unit of measurement is given.

Units of measurement in an electronic invoice (ESI)

the wrong units are entered in an electronic invoice?

, which were expected, and this only becomes clear when viewing the document on the portal? Have you received ESF from suppliers with “strange” units of measurement? In this article we will try to figure out why this happens and how to avoid such mistakes.

The unit of measurement of the sold product/service is indicated in column 5 of section G

ESF.

When filling in the column on the portal, we see the clear name “Piece”, “Kilogram”, etc. Moreover, the required value is selected from the drop-down list, that is, it will not be possible to indicate a unit that is not in it

.

This happens because the ESF IS uses its own reference book of units of measurement, to which the taxpayer cannot add new values. The user may use only those units of measurement contained in this reference book.

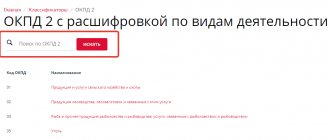

You can view the full list of its elements using the menu item Directories – Units of Measurement

.

This classifier combines data from the international classifier (MKEI) and the national classifier (OKEI). But, in addition to standard and well-known units, you can also find non-standard ones in it, which are not found in either MKEI or OKEI: “Page”, “One capsule”, etc.

It can be assumed that these elements were included in the general classifier of the ESF IS at the request of taxpayers. Therefore, if the reference book does not contain the unit you need, then you can try contacting the ESF IS support service with a request to add a new value and justify the need.

Pay attention to the column Unit code

(first column of the directory).

This is a three-digit unique digital code.

The source of the problem, described at the beginning of the article, is that the ESF document does not actually store the name of the unit, but its code

.

For example, if we export ESF from the ESF IS portal to a file and look at the contents of the file, we will not find any “pieces” or “tons” in it. The file (and the ESF IS database) stores unit codes. Important

That is, when viewing a document on the portal, the portal shows us the name of the unit of measurement according to the classifier, but in the database and in the ESF file it stores only the numeric code of the unit!

The problem arises when the supplier writes out the ESF from its accounting system, in which the unit of measure classifier is not configured or is configured incorrectly

.

For example, in the accounting system in the classifier for the unit of measurement “pieces”

001

was entered incorrectly .

The user writing out the ESF will think that he indicated “pieces” in the document (after all, in his accounting system 001 means pieces), but the portal will receive a document in “units of measurement with code 001”. The ESF IS will accept such a document and display to the recipient the name of the unit with code 001 according to its classifier

, and these will not be “pieces” at all, but in this case “nanometers” (because in the ESF IS classifier, code 001 corresponds to “nanometers”).

Therefore, if a problem arises, the buyer needs to contact the supplier with a request to correct the previously issued document by correctly filling in the unit codes

In 1C accounting systems, the code of the unit of measurement for IS ESF is specified in the classifier of units of measurement in the field dedicated for this Code (ESF)

.

The correct code value to indicate in this column can be found in the Units of Measurement

on the ESF IS portal.

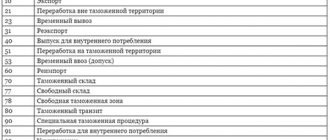

IS ESF codes of some standard units of measurement are given in the table.

| Code in IS ESF | Unit name measurements. | Short name |

| 796 | Thing | PC |

| 778 | Package | pack |

| 5114 | One service | |

| 356 | Hour | |

| 163 | Gram | G |

| 166 | Kilogram | kg |

| 168 | Ton Metric ton (1000 kg) | T |

| 112 | Liter Cubic decimeter | l dm3 |

| 113 | Cubic meter | m3 |

| 008 | Kilometer Thousand meters | km 1000 m |

| 006 | Meter | m |

| 18 | Linear meter | |

| 055 | Square meter | m2 |

| 059 | Hectare | ha |

| 061 | Square kilometer | km2 |

You can view a complete list of all unit codes in the ESF IS here.

For additional control, when issuing an electronic invoice in 1C, the user is shown both the numeric code of the unit of measurement and its name.

Keep in mind that the name of the unit in the accounting system is shown “for reference”, that is, there is no need to change or correct it (this will not affect anything). Attention must be paid to the numeric code

, especially if this is your first time writing out a document with such a unit of measurement.

What to do if the OKEI does not have a unit of measurement designation

Often, economic entities not only ship goods in pieces, kilograms, meters, etc., but also provide services, for example, transport goods along a certain route, thus performing a flight. What to indicate in this case in the corresponding columns of the documents?

Typically, when performing work or providing services, certificates of work completed/services provided are drawn up. There is no unified form of this document, therefore business entities have the right to independently determine it and not include such details as the OKEI code, because it is not mandatory according to Art. 9 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ. However, there is still space for the code on the invoice for services - what should I put there?

No designations are provided for the flight in the OKEI, so you can put dashes in columns 2 and 2a (subparagraph “b” of paragraph 2 of the Rules for filling out invoices, approved by Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137). And even choosing them incorrectly from the OKEI directory (for example, items with code 796) should not lead to negative consequences (letters of the Federal Tax Service dated July 18, 2012 No. ED-4-3/11915, Ministry of Finance dated March 26, 2012 No. 03-07-09/27 ). After all, the absence of values in these columns or their incorrect indication will not prevent tax authorities from identifying the seller, the buyer, the name of the goods (work, services, etc.), their cost, as well as the tax rate and amount.

FOR INFORMATION! We consider the negative consequences of the tax authorities’ refusal to deduct VAT on the invoice and the deduction of expenses based on the received transfer documents (invoices, acts, etc.).

It is also possible to indicate directly “flight” or “service” in column 2a, but without a digital code in column 2, since it is not provided for such values.

How are services measured?

There is no service unit code in the unit of measure classifier. Therefore, when providing services, many put down code 796, which refers to pieces.

But a service is an activity whose results do not have material expression (clause 5 of Article 38 of the Tax Code of the Russian Federation). Therefore, services are not measured in units.

At the same time, the UPD form serves, among other things, as the basis for customers to accept VAT amounts for deduction. Therefore, the UPD must indicate the quantity (volume) and unit of measurement of what is being sold, as well as the price (tariff) per unit of measurement (subclause 6, clause 5, article 169 of the Tax Code of the Russian Federation). But only if there is an opportunity for this.

If this is not possible, dashes must be placed in the “unit of measurement” and “quantity” columns (subparagraph “b”, paragraph 2 of the Rules for filling out an invoice, approved by Resolution No. 1137). The Ministry of Finance has repeatedly pointed this out (see, for example, letter dated June 5, 2015 No. 03-07-09/32579, etc.). The courts agree (see, for example, the resolution of the Administrative Court of the North Caucasus District dated March 18, 2021 No. F08-1159/2016). And the price (tariff) per unit of measurement is the price of the service provided according to the price list.

Therefore, there is no need to guess. If the goods (works, services) being sold are measured in units that are not specified in the Classifier of Units of Measurement, then dashes are placed in the corresponding columns of the invoice or UPD.

Results

OKEI will be needed to search for a digital code, as well as conventional and code designations of various units of measurement. The delivery note and invoice have special columns designed to indicate the digital code of the unit of measurement of the shipped goods. In cases where the required code is missing, the fields may not be filled in - dashes in them should not lead to claims from regulatory authorities.

The invoice unit code

is given in the main table of this document. Let's consider where it comes from and whether it is always necessary to indicate it.

What is it for and where to get the unit code

Indication of the unit of measurement code is required in column 2 of the main invoice table. For each line, this code correlates with its letter designation given in the adjacent column 2a.

In the specified units of measurement, column 3 shows the quantity of goods shipped (work performed, services), and column 4 shows the price of one unit. Accordingly, in column 5 (by multiplying the numbers contained in columns 3 and 4) the total cost of shipping one item is formed. The units of measurement may be different in different rows of the invoice table, but the principle of their use remains the same.

Indication of the unit of measurement code indicates that the unit was taken from a directory approved at the state level. The purpose of creating such a classifier was to unify the units of measurement used in the Russian Federation. For the user, its presence provides a certain convenience and eliminates the need to come up with your own units. This reference book was approved by Decree of the State Standard of the Russian Federation dated December 26, 1995 No. 366 and is officially called “OK 015-94 (MK 002-97). All-Russian classifier of units of measurement."

What to do if the unit of measurement is not in the classifier

If the unit of measurement used by the taxpayer is not in the reference book, then there are 3 possible ways:

- Try to choose a unit that fits the meaning. Most often, the one you are used to using is successfully replaced with a piece (code 796).

- Do not indicate the unit at all by putting a dash in columns 2, 2a and 3. This is allowed by subsection. “b” and “c” clause 2 of section 2 of appendix 1 to Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137 (see also letter of the Ministry of Finance of the Russian Federation dated February 10, 2012 No. 03-07-09/06).

- Specify your own unit.

How are the fields filled out?

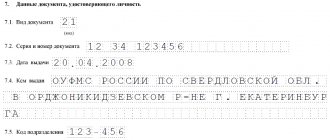

According to Appendix No. 1 to Decree of the Government of the Russian Federation No. 1137 dated December 26, 2011, the table of the invoice form contains the column “Unit of measurement”, which is divided into two columns 2 “code” and 2a “symbol (national)”. They must be filled out, if such a possibility exists (subclause 5, clause 5, article 169 of the Tax Code of the Russian Federation).

Reference. In column 2 you need to enter a code consisting of three digits, and in column 2a - the conventional name of the unit of measurement. When filling out these details, you should rely on the data from sections 1 and 2 of the OKEI directory.

How is the service assessed upon shipment?

A service or work can most often be priced in units. For example:

- the same type of repair of several products can be assessed by the number of these products;

- the work performed ultimately has some result that can be assessed quantitatively;

- the provision of rent of even several units under one contract can be considered one unit per month, provided that the number of objects leased remains unchanged;

- also, the number of services may correspond to the number of objects provided for rent, provided they are of the same cost.

If it is difficult to estimate the quantity of the service provided, you can take the opportunity not to indicate a unit for it at all by putting dashes in columns 2, 2a, 3, and in columns 4 and 5 - its price and total cost.